How does crypto staking work?

Instead of just keeping your cryptocurrencies in the wallets, you can earn rewards by staking these crypto coins. That’s right. After 2020, most of the crypto exchanges and wallets offer cryptocurrency staking. This is a super easy method to earn passive income from your cryptocurrencies. And this is what we show in our course about crypto staking.

Cryptocurrency staking is actually already quite popular, but there isn’t much educational content about it available. So I have decided to create this course so that everyone interested can learn how to do it with confidence. And I will demonstrate it step by step.

I have opened an account on one of the exchanges I use. I bought 3 different cryptocurrencies with a total current value above $5,000 just for this course to show you the whole process step by step.

By me saying the whole process, don’t think it is something complicated. It is a matter of just a few clicks and you do not need to have any experience in blockchain or anything related to cryptos. It really is very easy.

So let’s say you have $10,000 saved in your bank account, but instead of keeping it there, you can put that money to work and get up to 12% or even more on some of the exchanges per year. This is $1,200 without doing anything. Of course, if you have more then you could earn more. And if you have less, don’t worry, you will still earn over time because the amount will be compounding every month.

Staking demonstration

In the course, I explain what crypto staking is so you will know what you are doing. I will share with you which companies allow it and which ones I prefer to use. I will also teach you which are the safest wallets you can use to store your cryptocurrencies. And how I personally diversify the risk by keeping my crypto in different places.

Additionally, I will talk about money management and how much one should put into cryptos. Because I know many beginners that want to start investing in cryptos, are unsure which is the best asset to buy or worry that it’s too late. They wonder how much money they should invest and how long they should hold onto the asset.

I will try to answer all these questions. But what I will focus on is crypto staking because it allows you to earn extra passive income regardless of what the price of Bitcoin is or where the market goes.

I will demonstrate how to do the crypto staking right from my phone, sharing the screen of the phone with you. So if you decide to do it, you will know exactly what you need to do. I will share different strategies for crypto staking with you, which you can apply to your personal investment strategy. And it’s really great when you put your money to work for you because this way, you won’t lose the buying power of your money due to inflation. And crypto staking nowadays allows us to earn a respectable passive income.

What is crypto staking?

Let’s get straight to the point, what is crypto staking?

I will try to explain in simple words. Staking crypto is the process in which you will help or support the security and operations on the blockchain network and you get rewarded for that. If this still sounds complicated, we can say that staking is like locking cryptocurrencies to receive rewards.

So instead of just keeping your cryptocurrencies on the exchanges or on the wallets, you can stake them and you will earn a reward which is not bad at all.

And since 2020, and now in 2021, most of the popular cryptocurrency exchanges and wallets offer their clients to stake crypto. So these are platforms like Binance, Coinbase, Kucoin, Kraken, Poloniex, and etc.

The platform that I will use to demonstrate crypto staking in the course will be Crypto.com. And I don’t want to go into details what are the different crypto staking rewards in the different exchanges. Because they change them all the time. And if I tell you now the best conditions are on Binance, for example, next month it could be somewhere else.

When you decide if you should go for crypto staking, spend some time comparing several different crypto exchanges and crypto wallets to see which one will suit you best. And there are really many platforms and companies where you can earn interest as a reward from staking your cryptocurrencies.

The interest rates when staking crypto

So the ones that I have mentioned and most of the others work very similarly to how the banks work. So usually what happens with the banks is they get deposits and on the other side, they lend money to people who take credits.

And they get higher interest rates from the people that take loans. And give lower interest rates to the people that have deposits. So, for example, if I have a deposit in the bank, I would get, nowadays, about 1-2% maximum depending on the bank and the currency. But if I have a credit, I would be paying much more. 6-7, depends on what the interest rates are at the moment. So the exchanges and the wallets nowadays lend cryptocurrencies to the people that don’t have cryptocurrencies.

And, for example, I have cryptocurrencies, and I can lock them into my account so the exchange can lend them to other traders. And I get an interest rate out of that, the exchange gives me the majority of the interest rate and holds a portion from which they profit. The second way the exchanges and the crypto wallets work is they actually do staking on the blockchain using our cryptocurrencies. And of course, third, they can buy assets, invest in real estate just like the banks. Or they invest in stocks, it’s their business.

The thing is, when you choose your cryptocurrency exchange or wallet, you need to trust the company. Because they will be using your cryptocurrencies and you will be expecting them to pay rewards to you for that.

If you invest in something, you have to believe that you will profit out of it

And I know that many people are quite skeptical about cryptocurrencies. About staking, they start with, “Oh, my account will get hacked, I will lose the money, the price will go to zero“. Now, if you start with that thinking, you better not invest in cryptocurrencies.

Because if you invest in something, you have to believe that you will profit out of it. Or when we are talking about crypto staking, you need to prepare your mind that you will be having passive income from your cryptocurrencies no matter where the price is. Is it going up or is it going down? At the end of the period, you will have a passive income coming into your account.

Crypto coins Proof of Stake (PoS)

Now, I will buy some crypto coins from an exchange, I will put them in a hardware wallet and I will show you how easy it is to stake a pure Proof of Stake token.

Proof of Stake (PoS) is a mechanism used by the cryptocurrency blockchain to allow a person to mine or validate blockchain transactions depending on how many crypto coins he has. This means that the more Bitcoin or altcoin you own, the more mining power you have.

And before I show you the actual crypto staking, be sure to check our free lectures about the best crypto wallets and the top cryptocurrency exchanges to see what I use and found to be the safest. I’ll also look at the difference when you hold cryptocurrency on the exchange, on the wallet, and when you are actually staking them.

Staking crypto coins in a hardware wallet

Actually, by the time I’m writing this lecture, Algo is the easiest crypto for staking because all you need to do is to have it. And you will be getting crypto staking rewards.

Algo is the cryptocurrency of the blockchain called Algorand. The mission of this blockchain is to create an economy that is accessible for everyone with a digital currency that works fast and instantly. Like the fiat currencies but with the difference that it is digital. Algo or Algorand counts as a solution to 3 main problems of the blockchains today – decentralization, scalability, and security. The security in the Algo consensus algorithm is based on the honesty of the majority. The protocol is secured if 2/3 of the majority are honest.

And let’s get to the point, how Algo staking works? You just need to have Algo in your crypto wallet and you will be receiving staking rewards. There is no action you need to take to stake Algo, no need to delegate it to someone like with Tezos, for example.

If you want to learn how to stake Tezos on Ledger, don’t forget to have a look at our Crypto Staking course.

However, with Algo, you do not need to lock the crypto for a certain period. You just need to have Algo coins and you are already staking crypto. Even if you have 1 Algo token, which at the moment is around $1.25, you will be able to claim crypto staking rewards. And in the next lines, I will show you the whole process, step-by-step, using the Ledger Nano X hardware crypto wallet.

Purchase the crypto coins

And the first thing I will do is to buy some crypto coins. So I will open my Crypto.com mobile app and I will go to Track. There you can find all the assets that the Crypto.com exchange offers. I will scroll down and I will go to Algo.

You can see that at the moment, it sits at the price of $1.27. And actually, it did a nice break just a few hours ago. And this is one of the reasons I decided to writhe the article right now. So it broke an aggressive counter-trendline, which is my strategy for investing in the cryptocurrency market.

And at the same time, Bitcoin broke an aggressive counter-trendline, which is the signal for me when I want to buy cryptocurrencies.

And Algo reached $1.70 in February 2021, which makes me feel comfortable buying it at $1.27, $1.28. So let me buy so I will not miss the price and I will be buying 350 of Algo, which will cost me about $447 at the current moment. I will tap on Buy and I will buy with my card right now, as I want to do it instantly while I’m writing this article. This is why I will pay a 2.99% fee. Usually, I use wire transfers because this way I pay less in fees.

It takes a little while for the purchase to be confirmed and completed. And once it is completed, I will have 350 Algo coins in the Crypto.com app. If I go to Accounts, and let me see what I have in my crypto wallet, I have Crypto.com CRO coins, I have Cardano, and I have the Algorand.

And I tap on Algo, I can see details on the transaction below – at what price I have bought it, what is the fee, and what is my total cost.

And before I send the crypto to my Ledger hardware wallet, I want to show you how much you can earn from the Crypto.com app for comparison. So if I go to the Earn section in the Crypto.com app, I will see the crypto assets that I’m already staking. Bitcoin, Ethereum, CRO coin, and etc. I have total earnings of $16 since I started staking my crypto coins. And then if I go to Algo, you will see that on the 1 and 3-month term, I will earn respectively 1 and 2% annually, which is pretty low crypto staking reward. That’s why I prefer to stake my crypto on my Ledger wallet.

Install the Algo app on Ledger wallet

So the next thing I will do is to open the Ledger Live app on my phone and install the Algo app. My last transaction is the one where I showed how to stake Tezos coins on Ledger. And now I will go to Accounts and I will click on the plus button in the upper right corner, and I will tap on Add account, and then I will select Algo.

Algo app is ready, and the Ledger Live requests to “Allow Ledger Manager on your device”. Then in the app catalog, I will look for Algo again. And I will tap on Install, which will start the installation of the Algo app.

So for the people who have never used Ledger, this is a crypto wallet that is known to be one of the most secure since it is offline. It’s a hardware wallet. It’s not connected to the Internet. When I’m transferring cryptocurrencies, sending or receiving, all I need to do is to connect the Ledger with the Ledger Live app on my phone so I can do the transaction.

All the cryptocurrencies are stored in different accounts

The Algo app is already installed but if I go back to the accounts, I don’t see Algo. I will tap on the plus button and I will tap on Add account. Here I will search now for Algo and open the app of the Algorand one more time. And it says the application is ready. I will click on Continue and it says, “Accounts added successfully”. Now I have the Algorand in my accounts.

All the cryptocurrencies stored in the Ledger Live app are in different accounts. And each of the cryptocurrencies is called to be an app. First, you need to install it, and then you need to add the account.

Now I will go to Accounts. And if I scroll down, you will see on the bottom it says, Algorand 1, and I will tap on Receive and I will connect the Ledger Live with the Ledger hardware wallet again. I see the address on my Ledger Live app and on my wallet. And I just need to compare it. Usually, it’s enough to compare the first couple of letters or symbols and the last couple of letters and symbols.

And once I confirm that this is the address, I will just copy it and I will go back to Crypto.com app. And then I will go to my Algorand balance and I see that the price is already above $1.28. Hopefully, it will rise.

Withdraw crypto to Ledger wallet

Actually, they launched Algo on Coinbase Pro recently, so I guess this will help the price to gain some value. But what I will do right now, I will transfer the Algo coins to my Ledger wallet. I will tap on Withdraw because I will be sending it to external wallets. I will tap on that, Add wallet address. And right here, I will just paste the address from the Ledger wallet. It says Wallet Name, I can just call it Ledger X, for example. Pretty much that’s it. I will tap on Continue and it says, “Check your email to confirm your new wallet address.”.

And I need now to open my email where I have the confirmation from Crypto.com, I have the confirmation from my bank, and I have the withdrawal registration confirmation. And I need to confirm one more time the withdrawal address. So I tap on Confirm and it brings me back to Crypto.com. And you can see that the Ledger X address is already on the list. If I tap on Algo, and I have the option here to withdraw the amount, or I can select Max (350 Algo), and I will just tap on Withdraw. And that’s it.

You don’t need to do anything

The fee is 1 Algo and totally I will be transferring 350, so I’ll be sending 349 Algo. And I will tap on Confirm and it will take just a second. Tap anywhere to continue. So now the Algo will be gone out of my balance in Crypto.com app.

Let’s go back now to the Ledger Live app and see if we will have the Algo there immediately, usually should be almost immediately in there. I see that I have received 349 Algo.

So now if I go to Accounts and I scroll to the bottom, I will see the Algorand. I will tap on that. And if I scroll below, you will see that I don’t have any crypto staking rewards and I cannot claim rewards. But it will take a very short time. Probably by the end of this article, the crypto staking rewards will be there and I will just refresh the page a few times.

So that’s it, guys. I don’t need to do anything. I don’t need to delegate it as I did with Tezos. So I don’t need to send delegation rights to any Baker or something like that. This is for the Tezos. For the Algo, all you need to do is to have Algo in your Ledger wallet. And from there you do nothing. Actually, I already have a reward of 0.00349 of Algo.

Claiming the crypto staking rewards

And I can claim it, but it’s already added to my account. So if I tap on Claim, it says, “Congratulations, you earned 0.00349 Algo. Continue to claim your rewards.”. But below, it says, “The rewards are smaller than the estimated fees to claim them.”. Whenever I have some more crypto staking rewards, I can claim them and they will be added to my account. But now, actually, they are added to my account.

I just need to claim them but because there is some fee, I will wait. And keep in mind that approximately every 20 minutes you will receive crypto staking rewards. So staking Algo coins in Ledger is that simple. You just need to have the coins in your wallet. And you saw that I didn’t do anything, and it started adding rewards to my account. Obviously, the more coins you have, the more crypto staking rewards you will get.

By the time I’m writing this lecture, the rewards are approximately about 6% annually. This is much better compared to the 2% that I showed to you in the Crypto.com app. So it is up to you where you want to stake your crypto coins, where you feel comfortable keeping your assets, your Algo in this case.

But the best thing and the thing I like the most with the Algo coin, and that’s why I wanted to have it in my portfolio, is the fact that it is a pure Proof of Stake. You don’t need to delegate it. You don’t need to lock it for months. It’s just that simple to do it.

Staking Cryptocurrencies on Mobile Apps

I will start with the mobile apps because most of the exchanges, most of the wallets have really friendly and very easy-to-use mobile apps. And as I said, there are different wallets, there are different exchanges. I don’t want to go through all of them because next month the app could look in a different way, or their conditions, fees, or the staking itself could be totally different from what it is right now with one exchange and what it will be by the time you’re reading this lecture.

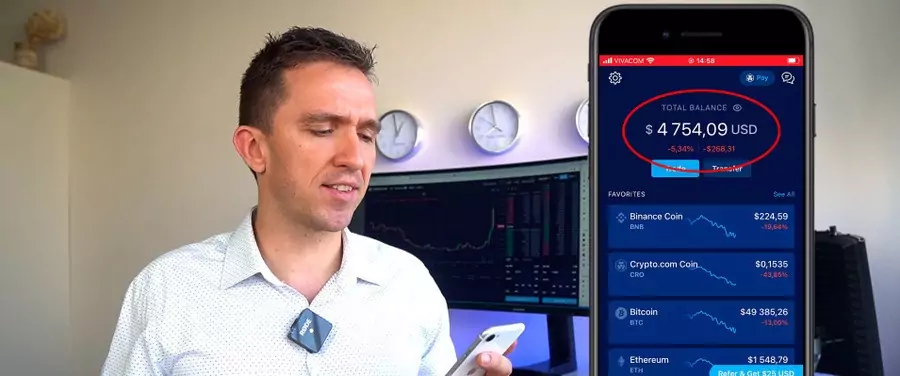

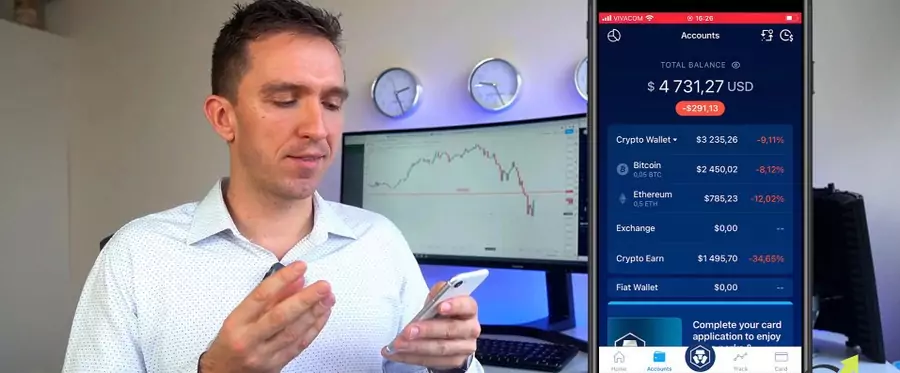

So, as I said, for the purpose of our cryptocurrency staking course, I have selected to use Crypto.com because their app is super easy to use and at the same time, they have many assets which you can use for staking. And now if I open my app for Crypto.com, you will see that what I have is the total balance on the top and right now it’s at $4,754.

And yesterday I was recording the previous lectures from the course, my balance was $5,800 and something. So it dropped like $1,000.

But the market has been very negative today. The Bitcoin dropped below $50,000, the CRO coin yesterday reached above 27 cents and today it dropped back to 14 because they launched the official date for the main net blockchain that Crypto.com has tested and is launching next month. So that news was accepted very well by the community and the CRO coin just skyrocketed to 27 cents, and today it dropped to 13-14 at the moment.

Cryptocurrencies are volatile assests

And what I have as well, a very negative Bitcoin with 13%, Ethereum as well with 18%. So if you already have Cryptocurrencies, you will know that the balance of your account can vary a lot from day to day. And that is very normal because the Cryptocurrencies are volatile assets. And when I’m investing in Cryptocurrencies, I don’t pay attention to such ups and downs.

Of course, when I’m trading, so daily I’m buying and selling, I don’t allow myself such drawdowns. I usually take quick profits and buy on the cheaper price and then again, when there is a movement up, I sell, I buy at a cheaper price. But that’s the trading. Now, when it comes to staking, the idea is that we keep the Cryptocurrencies for a longer time. And we lock them in our accounts so we can get rewarded for it.

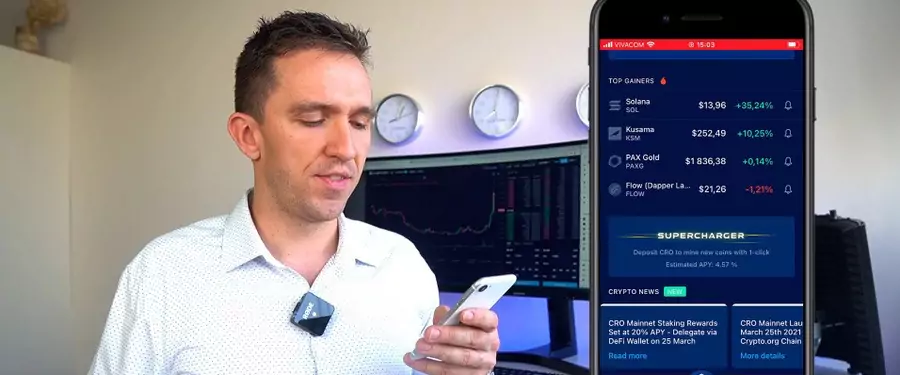

So it really doesn’t matter if the market will go up or it will go down in a day or two. We care that at the end of the period we have selected for the staking, we are getting a reward. So right now I will go through the Crypto.com app and most of the exchanges have very similar apps. So on the Home page, I can see my total balance. I see some favorite assets, how they’re doing, very negative today.

Crypto news

Then below, we have the top gainers. So these are the assets that gained the most during the last 24 hours. And then below we have some Crypto news.

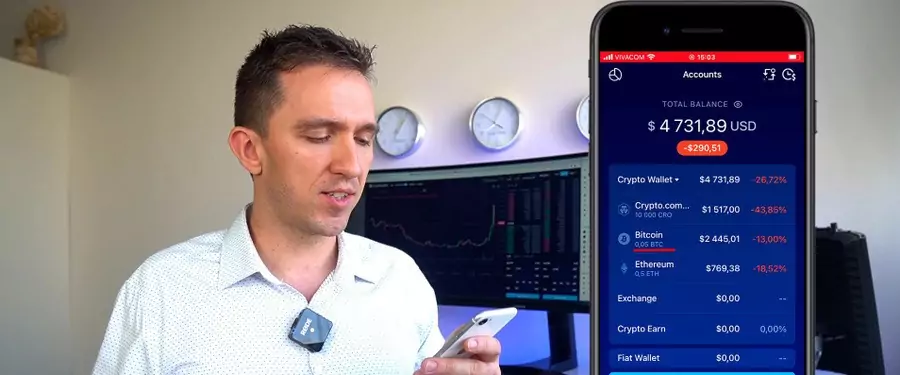

So right now the news about Crypto.com is around the main net launching on March 25th as I’ve said. And then I have Accounts. I have my Crypto wallet, I have Exchange, and I have Crypto Earn.

So Exchange and Crypto Earn show 0 because I didn’t do anything. I wanted to do it while I’m recording the course. And then we have Fiat Wallet which is if I have actual USD or EUR into my account. And if I click on Crypto Wallet, you will see what I have.

I have 10,000 CRO coins, I have Bitcoin 0.05, and I have Ethereum 0.5. So if I click, for example, on the Bitcoin, it’s negative today as I said, fell below 50,000.

But if I scroll down, I see the history, that I bought the Bitcoin at the price of 52,682 Bulgarian levs, which is about $32,000. So when I was preparing the course, I bought some Cryptocurrencies to have in a brand new account to show you the staking. And at that moment, the Bitcoin was at 32,000, today it’s near 50,000, yesterday it was 55,000. So I already did a profit because the Bitcoin increased its value.

Dollar Cost Average strategy

Same with the Ethereum because I bought it at the end of January as I believe, yes, 27th of January. Then in the menu down, we have this circle with the lion.

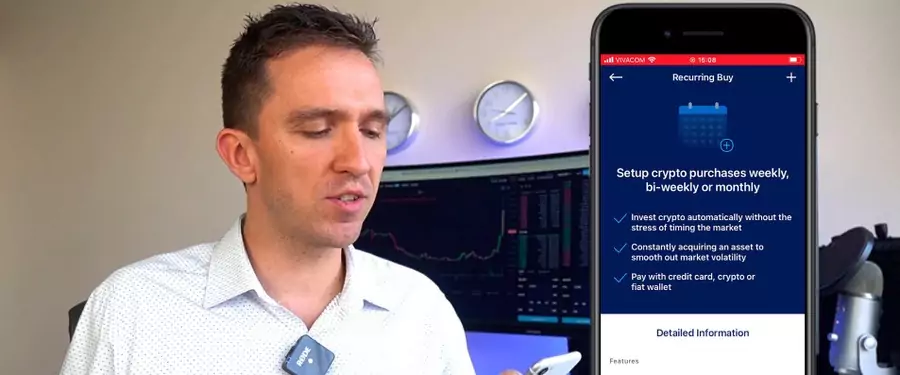

If I click on it, you will see that there is the Crypto Wallet, Track, Fiat Wallet, Recurring Buy.

So Recurring Buy is available on most of the exchanges and they allow you to regularly buy Cryptocurrencies.

For example, if I click on it, you will see that I have the option to invest Crypto automatically without the stress of timing the market.

And this basically means that I can set it, for example, every week or every month to buy, let’s say, Bitcoin for $100. So it doesn’t matter where the price of Bitcoin goes, I can set recurring buy. So every Monday, for example, I will be buying Bitcoin for 100 EUR.

And no matter where the price goes, I will be buying every month 100 EUR, next Monday 100 EUR, and so on. And this is called Dollar Cost Average strategy, which is not a bad strategy by the way. No matter where the price goes, you are buying every week or every month. I can see the accepted Cryptocurrencies. So Crypto.com offers weekly, biweekly which means every 2 weeks, and monthly.

Earn option

And you can have maximum 5 active recurring purchases, the minimum amount is $50 for each purchase. And then we have spent the option if you want to pay, Crypto.com offers different Visa cards. Depends on how much you have into your portfolio, how much you’re staking. And then in Finance, we have the Supercharger and we have the Earn option.

And exactly the Earn option is where we will be staking and I will show you that in the next lectures.

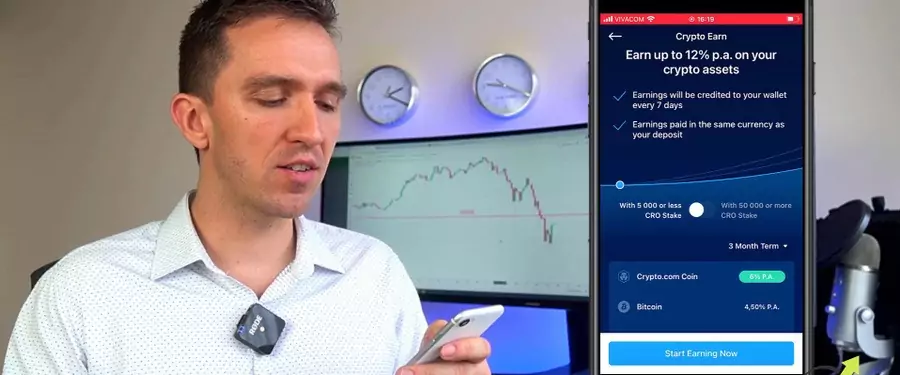

So as you can see, on the top, it says ‘Earn up to 12% annually on your Crypto assets’. I will show you the different assets, different time periods, what’s the difference so you can have an idea of what you are doing before actual Crypto staking. And I will show you step by step how you can do it from this app of Crypto.com and as I said, most of the apps work in a very similar way. They look very similar.

And most of the exchanges and wallets have a desktop app as well so you can do it from your computer. Now, personally, when I do trading, technical analysis, and I draw some patterns, lines, I always do it from the computer. But I often buy and sell Cryptocurrency from my phone. If I am out, if I see the price at which I am ready to buy, I can do it immediately from the phone, from the street, from the restaurant, wherever I am.

Have both desktop and app versions

I would suggest you have both, have a desktop version where I actually follow the prices and I see clearly the chart and I have as well the apps from the different Cryptocurrency exchanges that I use. So if I want to do it at any moment and I am not in front of the computer, I can do that easily. So let’s get into the staking itself and I will show you the different options that we have.

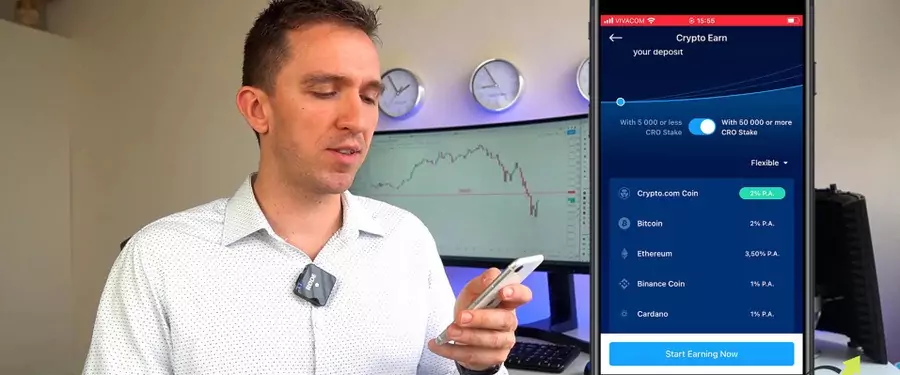

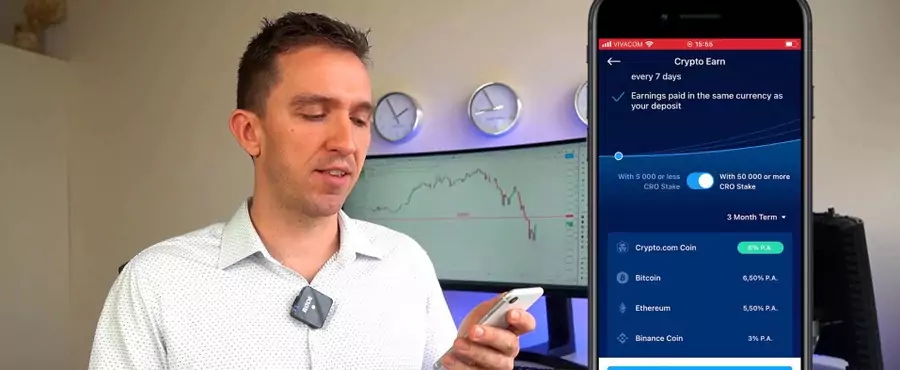

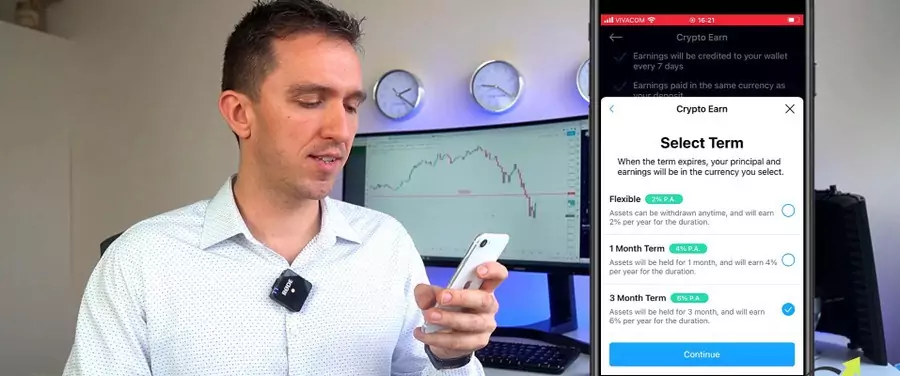

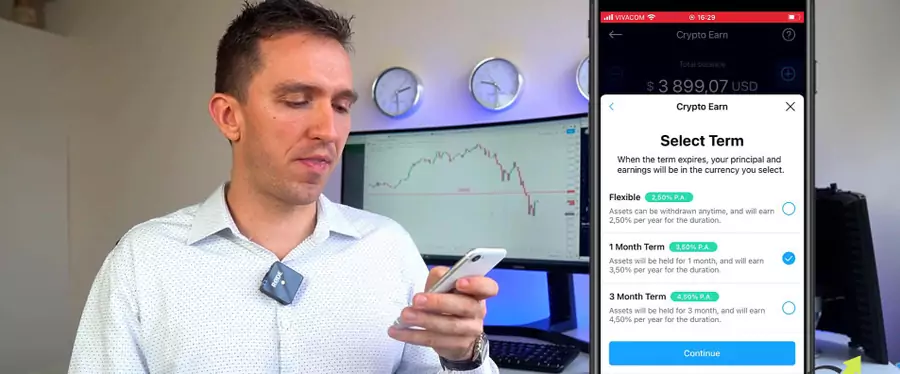

Now I will explain what are the different time periods and what you need to keep in mind before you decide for how long you want to stake your Cryptocurrency. So if I open the Crypto.com app again and I click on the lion icon and then I tap on Finance Earn, I will get to the staking section. And we have 3 options; we have staking for a 3-month term, we have a 1-month term, and we have the Flexible option.

The flexible option

So with the Flexible option, we have access to our Cryptocurrency all the time, but we have lower rates. So, for example, I will have 2% on the CRO coin, I will have 2% on Bitcoin, and I will have 3.5% on the Ethereum.

If I increase it to 1 Month Term, you will see that for the CRO coin I have 4%, for Bitcoin I have 4.5%, and for Ethereum I have 4.5%.

And then if I take the maximum of 3 Month Term, I will have 6% for CRO coin, 6.5% for Bitcoin, and 5.5% for Ethereum.

And keep in mind that this percentage is on a yearly basis. So it is a personal choice how much time you want to be staking your Cryptocurrencies. An interesting strategy that I’ve been using and I will demonstrate a little bit later is that you can select different periods for the different assets you have. So this way, you will have constant access to some of your Cryptocurrencies.

Staking period

As well, if you have, for example, only Bitcoin in your account, let’s say you have 3 Bitcoins in your account, you can set 1 coin for 1 month, another coin for 3 months, and the third coin for flexible options so you’ll have access to your 1 Bitcoin at any moment if you want to purchase something or if you want to sell it, if you want to exchange it. Or if you want to use the 3-month term for all of them, you can start on a different date.

For example, if you start at the beginning of January, let’s say, and you select the 3-month option, you will be staking it January, February, and March. The second Bitcoin, you can start in February. So you will be staking in February, March, and April. And the third one, you can start in March. So it will be March, April, and May.

Every month, 1 staking period will be over and you will have access to your 1 Bitcoin and then you will decide if you want to start a new staking period or if you want to sell it, exchange it, or whatever you want to do with your Cryptocurrency. So you don’t necessarily need to put all of your Crypto for 1 period and wait for 3 months and have no access to any of your Cryptocurrencies for 3 months.

Setting stakes

So think about how you will feel comfortable and if you feel OK if you lock all of your Cryptos for 3 months. Because the market could turn very negative and you want to sell it but you cannot because you’re staking it, then you’d better go for the flexible option which will be more suitable in this case for you. But if you are the kind of person that says, ‘Alright, I don’t care where the Bitcoin will be in 3 months time.

I want to get some reward of having it into my wallet or my exchange. I will set it for 3 months and in 3 months time I will get the rewards from the staking and then I will see what I will do.’ But again, if you want to take the maximum periods, I would suggest you divide your Cryptocurrencies and start on different date.So all the time, one staking period will be over, another one will start, another one will be over, another one will start.

Then you will have access constantly to your Cryptocurrencies. So before I show you step by step how to set up the staking, I will explain what is the difference if you are staking Cryptocurrencies such as the Bitcoin, the Ethereum, the other volatile assets, and if you are staking the USD coin which is pegged to the American dollar.

The main difference

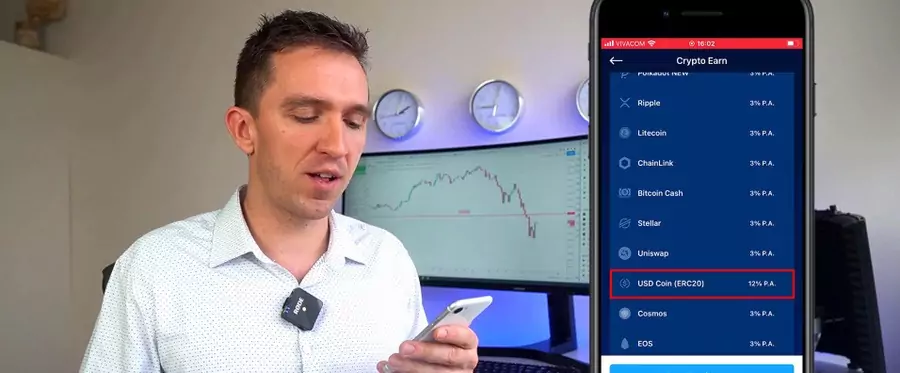

So what is the difference if you want to stake the USD coin or if you want to stake Bitcoin, Ethereum, CRO coin, or any other volatile coin? The difference is that with the USD coin, we have the highest percentage. If I scroll down, you will see that on Crypto.com, for the moment, I have 12% annually staking the USD coin, which is ERC 20 coin and it’s a much higher percentage compared to the rest.

As well, I have with the Tether which is again back to the American dollar. But the main difference for me is not that much the percentage you get as a reward at the end of the staking period, but the fact that the USD coin is pegged to the American dollar. So it doesn’t matter where the Bitcoin goes, is it going up? Is the market bullish? Is the market bearish? At the end of your staking period, you will have your same USD coins, the same value, but you will have a bigger reward.

In other words, you are not taking the risk that in 3 months time your Cryptocurrency value will be lower or it will be higher. So, for example, if I stake Bitcoin right now, and in 3 months time I don’t know where it will be, it could be much lower than the 50,000 where it is right now, but it could be 100,000. We don’t know that. But if it is the USD coin in 3 months time, it will be a very similar value to what I have right now because it is pegged to the American dollar.

USD coin suitability

So the value of the USD coin will be the same as the value of the American dollar at that time. So it’s a stable coin, it’s backed by the US bank and some huge companies. I guess USD coin’s more suitable for the people that are not huge believers of the Cryptocurrencies and they have some saved money. Let’s say you have $100,000 saved and instead of just keeping them, you can put them to work for you. You can buy USD coins from Crypto.com or any other exchange. And at the end of the year, you’ll have 12%, which will be $1,200, not bad.

That’s $1,000 a month without doing anything. And I really don’t like to say without doing anything because obviously you did something to earn that much money. Luckily, with staking, there’s a chance to get much more at the end of the year. Or at the end of the 3 month period compared to what the bank will give you. And something important here, when you look at the percentages, some might think that this is for the lockup period, for example, for the 3-month term. No, it’s annual. So if you decide to stake, for example, the USD coin 12%, this isn’t for the 3 months.

If you are staking $100,000, you’re not getting $12,000 after 3 months but after 1 year. After 3 months, you’re getting 3%. Which makes it 1% a month. So all of the percentages you see on the app are annual. And this is something you need to bear in mind before you decide for how long you want to stake the Cryptocurrencies. Which Cryptocurrencies you want to stake, and how you want to manage your account. And I’ll share with you what’s my strategy when I’m staking Cryptocurrencies.

Staking Cryptocurrency on Crypto.com app

I will now show you how you can stake your Cryptocurrency on the Crypto.com app that I have selected for the purpose of the course and you will see how you can earn income from your Cryptocurrencies. So if I open the app and I tap on the lion roundish icon in the bottom and then I tap on Earn in Finance, I will get to the Earn section where I have the option to select different period of time. And below I can select the asset I want to stake.

So on the top, I have 2 options; With 50,000 or more CRO stake or With 5,000 or less CRO stake.

So no matter which one I select, the CRO coin staking does not change. At the moment it is fixed to 6%. But if I change, one more time, for the Bitcoin and the Ethereum, the percentage lowers. So as I said, for the purpose of this course, I have opened a brand new account, bought some Cryptocurrencies, CRO coin, Bitcoin, and Ethereum to show you how it works.

And I didn’t stake any Cryptocurrency with this account. So simply I will show how I would do it if I were you. This means that I need to stick to with 5,000 or less CRO stake. So let me start with the Crypto.com coin, and for 3 months I have 6%. Let me lower it to 1 month, it drops to 4%. And if I change to Flexible, it will decrease to 2%.

The CRO coin

So for the CRO coin, I will definitely go for the 3-month term. I am OK to keep CRO coin for a longer period of time. And then I will just click on Start Earning Now and I will select the CRO coin. I will select right here 3 months and I will click on Continue.

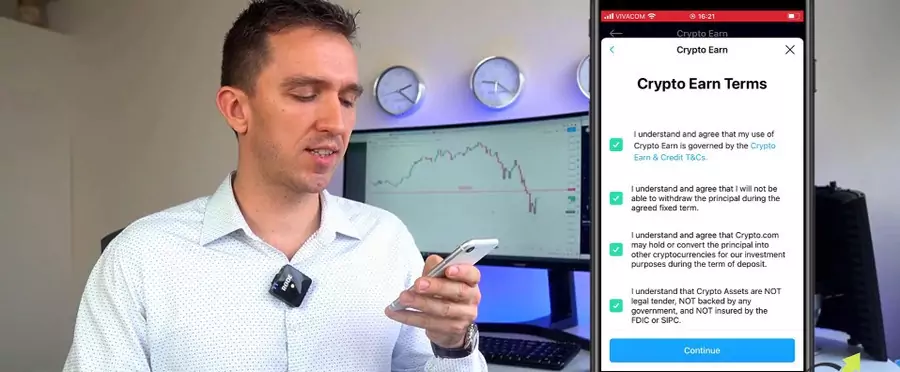

Then here are the terms and conditions which I would suggest you have a look at.

But right now I will just click on all of them and I will tap on Continue.

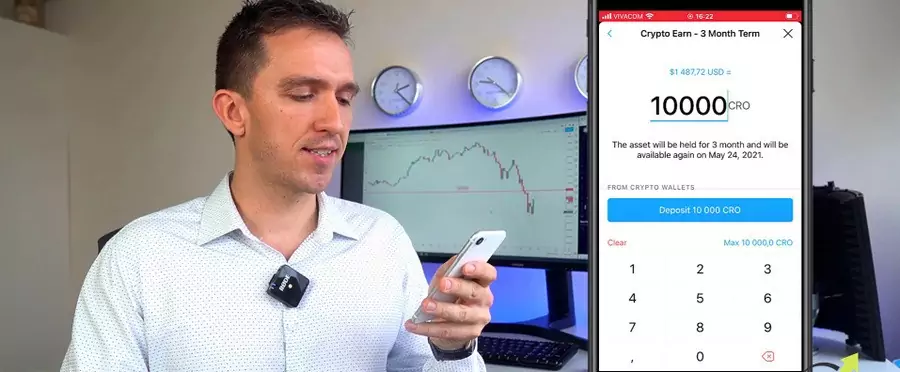

I have the warning that the asset will be held for 3 months. And will be available again on May 24th, 2021. And I have the option to select how many of my CRO coins I want to stake. It gives me 5,000 by default but I have 10,000 in the account. So I will take all of it and I will tap on Deposit.

So it’s depositing from my CRO Wallet and I see the summary. Confirm, and it needs my passcode.

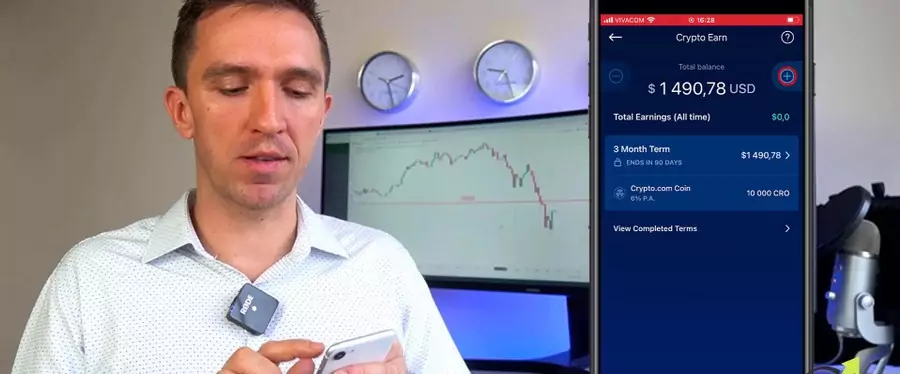

You deposited 10,000 CRO. Tap anywhere to continue. It’s loading but I am referred to the Crypto Earn section where I have my total earnings, 0. Because as I said, I opened a brand new account for the purpose of the course. So you see that my balance is there and my Crypto Wallet is just Bitcoin and Ethereum right now.

And my CRO coin moved to Crypto Earn.

Difference between clicking on the lion and clicking on the Earn

So it’s not anymore into my Crypto Wallet. And now I want to show you the difference that if I click on the lion and I click on the Earn. It brings me to my Crypto Earn section and not the page where I was before. Now I need to tap on the + button.

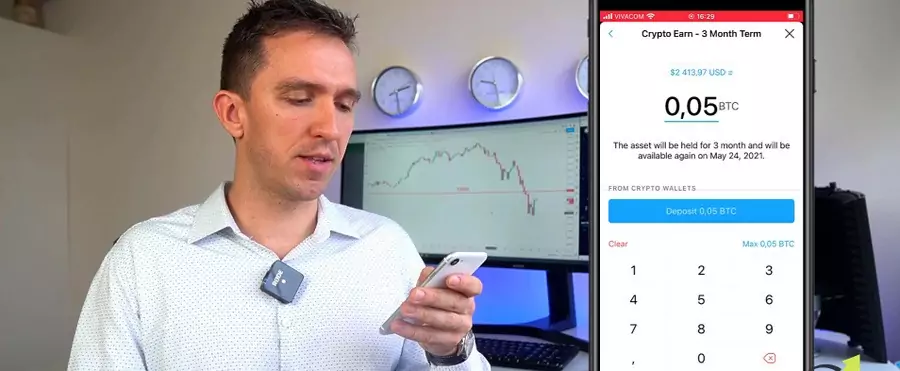

So I will be selecting more Cryptocurrencies for staking and then I will click on Bitcoin. And now I have again the option to choose. Thus I will go again for the 3-month period, I click on Continue.

I will accept the terms and conditions. Then I tap on Continue. And now I will select to use all of the Bitcoin that I have into my account, 0.05, I will deposit it.

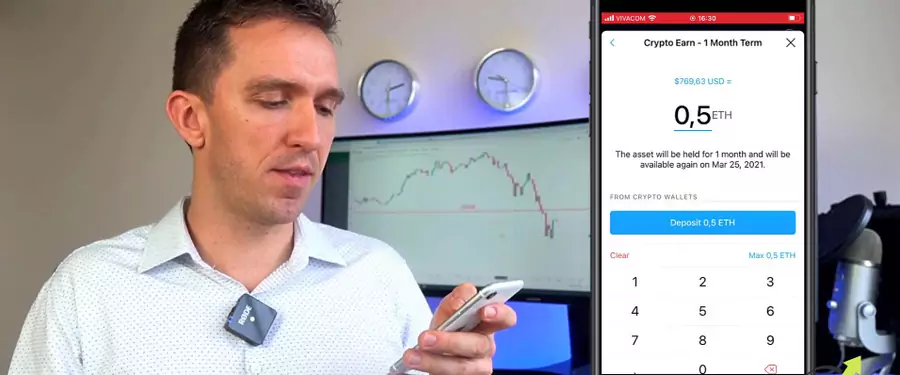

So on the 24th of May, again, the staking period will be over. And I confirm it, it requires the passcode. I have deposited the Bitcoin as well. So let me show you very quickly again for the Ethereum where I will select just a shorter period for the purpose of this lecture.

I will tap on the plus, Ethereum. And here I will go for the 1 Month Term.

So we can see at the end what will be the difference between staking 1 month or 3 months. I will hit on Continue. I will accept all of the terms and conditions, Continue. And I have half Ethereum right over here,

and I hit on Deposit and I will simply confirm it. The passcode is required again and I enter it.

Preferability in staking in different periods of time

I deposit as well the Ethereum. Tap anywhere to continue. And all of my Cryptocurrency now is into the Earn section and not anymore into my Wallet. So I don’t usually do it that way. I just wanted to show it in one lecture. I would prefer to start my staking in different periods of time. So all the time I will have access to some of my Crypto and not having it blocked for 3 months.

But that account with this Crypto, I have bought it just for the purpose of the course. And I wanted to show you how you can select different Cryptocurrencies. For different periods of time so you can see what is the difference. So leave now the Cryptocurrency staking and it is that simple, actually, to do it.

Conclusion

Thank you very much for reading this lecture. I hope you have understood how you can buy cryptocurrencies, send them to a crypto wallet, and then start receiving rewards from staking them. And the easiest way for the moment is Algo indeed when we are talking about the type of cryptocurrencies.

But always make sure to check out the different crypto exchanges, the different wallets, what percentages they offer for rewards. For me personally, anything above 4-5% annually is good enough to have my cryptocurrency staking. And I prefer Algo in this case because I’m not locking it, just what I showed already in Crypto.com. But all I need to do is just to keep it in my wallet.

And as you saw, for example, with the Bitcoin and Ethereum, I had to lock it in the Earn section on Crypto.com. But because Bitcoin and Ethereum are Proof of Work and not Proof of Stake coins, I cannot stake them on the Ledger or on the other wallets. So I use the Earn option on Crypto.com. Thank you for reading and I will see you in the next lecture.