Forex Expert Advisor Generator is all you need as a trader

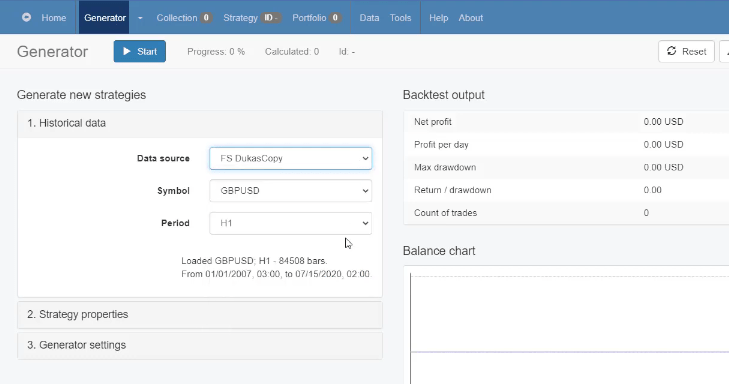

Hello traders, in this lecture, I will show you how we create strategies with EA Studio. There is the Forex Expert Advisor Generator which is the best thing in the software because based on the historical data that we have imported, we can create new strategies.

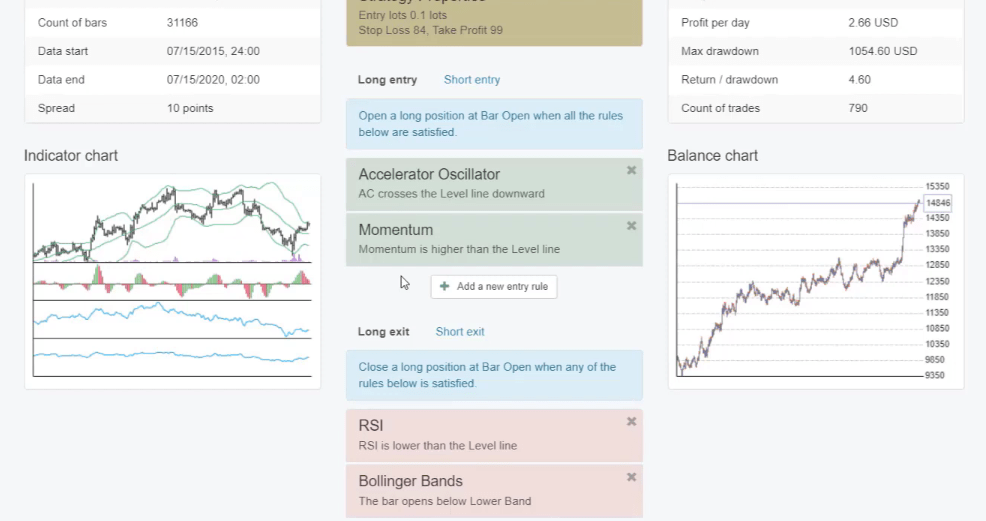

We select the symbol, the period, and then we have strategy properties.

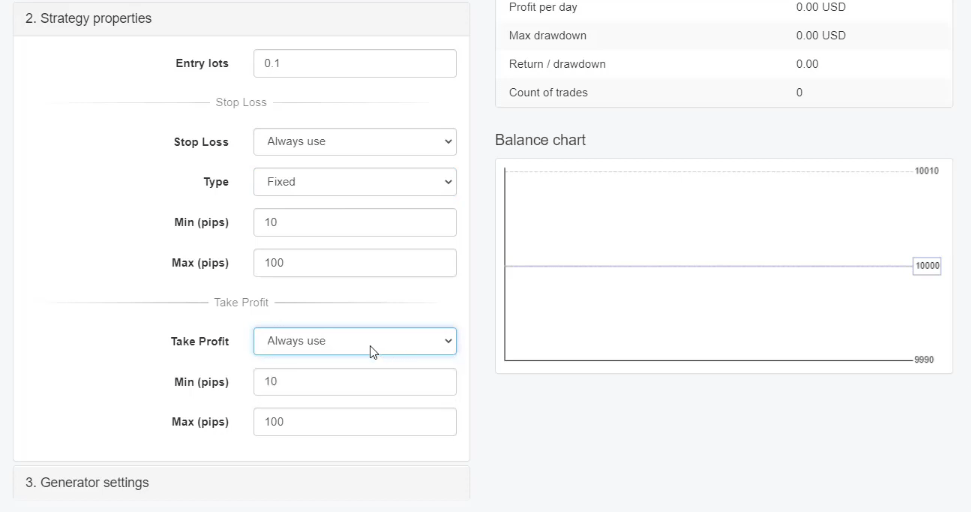

We can decide here with what lot we want to create the strategies. But later, when we put the Expert Advisors on Meta Trader, we can still change the lot. And I will stick to 0.1 lot. For Stop Loss and Take Profit, we have the option to select the range.

So if I keep it from 10 to 100, it means that all strategies will have Stop Loss and Take Profit somewhere between 10 and 100 pips. It’s up to you if you want to narrow the range. But I personally prefer to give the freedom of EA Studio to create the strategies with Stop Loss and Take Profit and to combine it with different indicators, and I keep it from 10 to 100.

For the Stop Loss, I will stick to Always use, so I will have always a Stop Loss for the strategies, and as well, I will stick to Fixed. There is the option to generate strategies with trailing Stop Loss but I stick to Fixed. And as well Take Profit, I always want to have one in my strategies.

Preset Indicators in the Forex Expert Advisor Generator

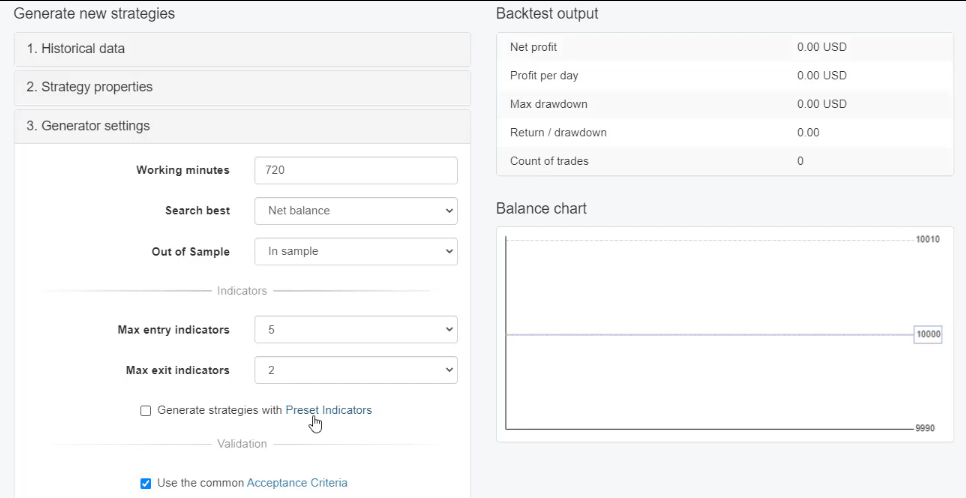

Now, in generator settings, we have the option to select how long we want the Generator to be working. Usually, I run it for 10 hours, which is 600 minutes. But let’s give it a little bit more this time, I will give it up to 720, which is 12 hours.

Now, it’s late in the evening and I will leave it working until tomorrow, and I will see what results I have. And usually, I use it this way. I leave it in the evening and in the morning I see the results. The rest, I will leave it this way. I want to search best by Net balance, meaning that on the top, I will see the strategies with most profit.

Out of Sample is a great tool that I will explain just in the next lectures. I will not use it now. I will leave it to In Sample. And we have the option to select how many entries and how many exits we would like to have. And by default, it was 4, but I just increased it a little bit to 5.

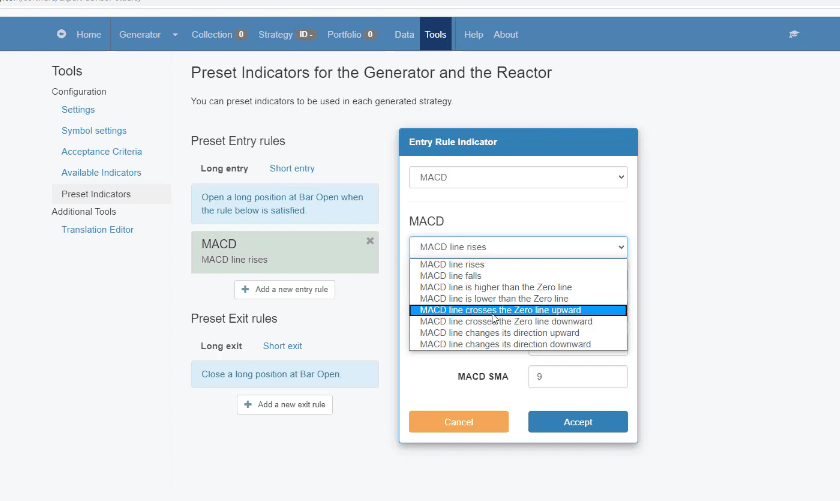

You have the option to use preset indicators, which means that if you have a favorite indicator, let’s say MACD indicator, you can select it and add it or you can find it as well in Tools, Preset Indicators.

And if you add any of the indicators, for example, MACD, the Forex Expert Advisor Generator will always be part of your strategy and in every strategy you will have that indicator with that rule.

Acceptance criteria is how you will get only the best Expert Advisors

It could be a different rule, MACD line crosses the zero line upward, for example. And this indicator with this rule, with these parameters that you have set, will be always in your strategies. It will be in all the strategies that the Forex Expert Advisor Generator will create.

So basically, the generator will use this indicator and will add some more, will add the Stop Loss and the Take Profit to build the strategy for you. Really cool thing but I’m not going to use it in this course and in this example of generating strategies.

So this is what the generator is about. It creates strategies based on the historical data that we have imported for the symbol, for the timeframe we want. We have the range for the Stop Loss and the Take Profit and we decide if we want to use some preset indicators or not.

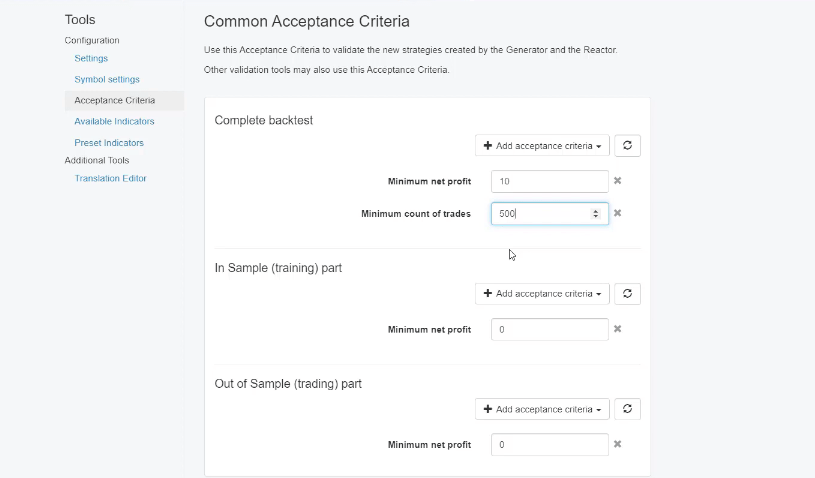

And very important, at the end is the Acceptance criteria, which allows us to set some rules for the strategies or to filter the strategies that the Forex Expert Advisor Generator will show at the end in the Collection. Usually, I go with Minimum count of trades. Every time, minimum of 300 or even more, I go to 500.

Profit factor is a must in the Acceptance criteria

What I said in the previous lecture is that the more count of trades we have, the more robust strategy it will be. Because if we have the event of entry rule and exit rule, many times, like 500 times for these 5 years of historical data, it means that this strategy executed many trades and it’s a strategy that we can rely on.

If we have a strategy that executed just 10, 20, 50 trades for 5 years, well, we don’t really know if this will continue to repeat in the future. So the more count of trades we have, the more robust strategies we get from the Generator. And, one more time, having fewer bars with more count of trades allows us to have more active strategies.

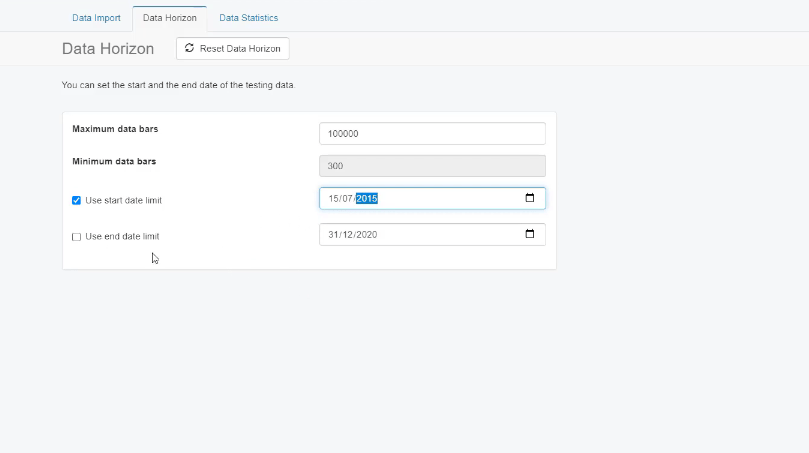

And because I have refreshed the page from the previous lecture, I will go to Data, and Data Horizon, and I will check Use start date limit, one more time, from 15th of July, 2015. And today we are on the 15th of July, 2020. So 5 years, and this is about 31,000 bars.

Now, the other thing I put in the Acceptance criteria is the Profit factor. Profit factor is very simple and it filters the strategies very well according to me. And it’s calculated by the Net profits divided by the Net losses. Strategies with Profit factor above 1.2 are really good.

The Reactor is the next level after Forex Expert Advisor Generator

And basically, everything we have above 1 shows that the strategy is profitable. We will have more Net profit than Net losses. However, 1.2 works great for me. Now, if I press on Start, the Generator will start calculating strategies.

However, I want to add something more, and this is the Monte Carlo which is a robust tool that we have for each strategy. And before, we were doing it manually. After we have some strategies in the Collection, we were running Monte Carlo, Multi Market, or any other robust tool.

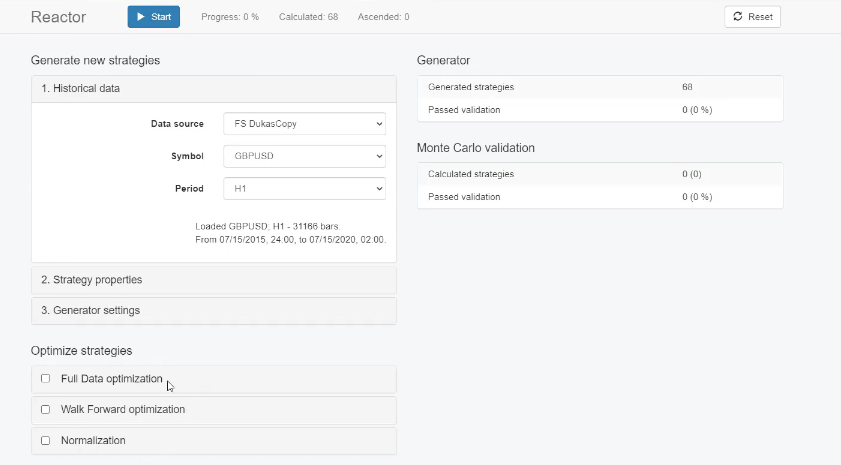

But now we have the Reactor which allows us to do the whole process automatically. So the Reactor is the Generator plus optimization and robustness options.

So we can optimize all the strategies that are generated with full data optimization, very similar to Meta Trader optimizer but this one works much faster.

And then we have the Walk Forward optimization, a little bit more advanced tool, I’m not going into details about it. We have a lot of free videos on YouTube about this optimization. And then we have the normalization, and robustness testing is what I focus on.

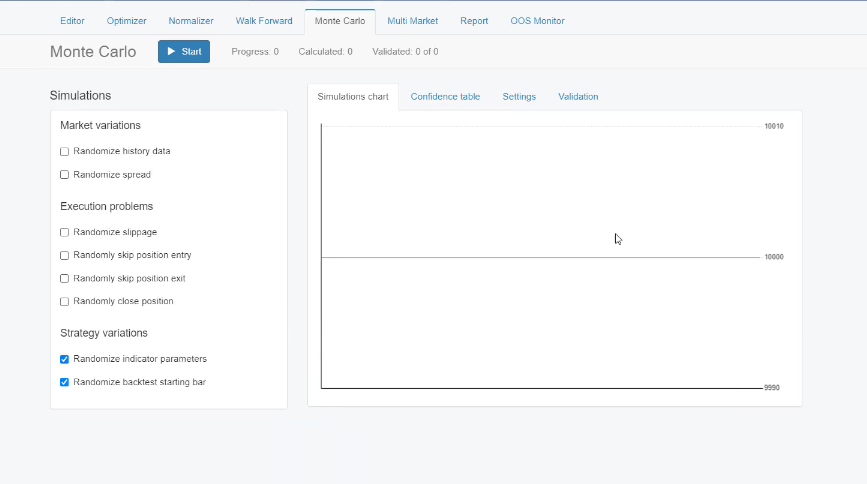

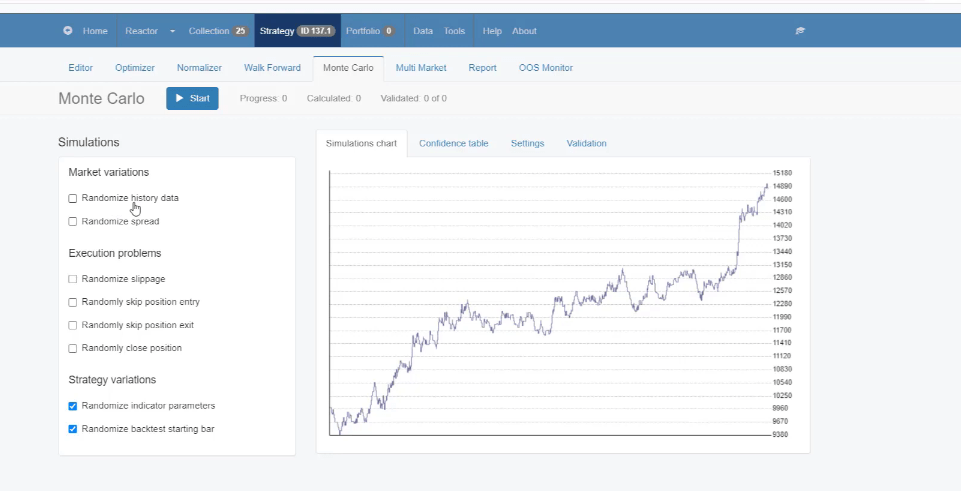

Monte Carlo

And I always use the Monte Carlo. What Monte Carlo does, in simple words, it performs a variety of tests.

So it’s a backtest but it backtests the strategies with Randomize indicator parameters. So, for example, if we have MACD 12:26:9, it will check with 13:26:9, 14:26:9, or 12:27:9, or 12:26:10.

Basically, it will change the parameters, it will try to break the strategy. And if the strategy is still robust, it will perform well and we will see all the results here. I will show you that later when we have some strategies ready. But for the moment, I will leave it like that. Forex Expert Advisor Generator plus Monte Carlo.

And if I click on Start, you will see how it goes. All the strategies are being calculated, and those that pass the Acceptance criteria will go through the Monte Carlo. If they pass Monte Carlo, I will see them in the Collection. automatically.

This is how the Reactor works, really great because it does everything

Now, as I already said, the best thing with EA Studio is that we can run a couple of Reactors simultaneously. I will simply duplicate the top. But make sure to keep it in a separate browser so it will work faster. And if you keep it active, it will be even better.

Data Horizon

Now, I will go for EURUSD on H1 chart. And I will change the Data Horizon quickly, we set 15th of July, 2015 and it will be until today if I don’t check on Use end date limit.

Going back to the Reactor, what we have – strategy properties is the same.

Let’s have a look at the Acceptance criteria. Working minutes, 720 and Acceptance criteria, it has saved. Going back to the Reactor, Monte Carlo is checked, and that’s it. I’m ready to run the EURUSD. Press on Start and it starts calculating for EURUSD.

I will need to open now one more Reactor for EURGBP, but I make sure to use DukasCopy data that I have imported, and I will go for EURGBP on H1 chart. Going quickly through the Data Horizon and I will use start date limit, 15th of July, 2015.

Reactor, I just check the strategy properties, Generator settings, the Acceptance criteria. Usually it saves, but I always make one more check and then I am ready to go. Click on Start and I see it.

Run many Forex Expert Advisor Generators depending on the computer you use

Now, what I have is 3 Reactors running simultaneously. If you are doing that, make sure to follow the speed. You can see that because I have opened 3, it gets a little bit slower. But this is because I have too many tabs and browsers opened on this computer. I will make sure to close them to increase the speed.

But if it gets slower, what you can do is just to stop one of them and continue with the other 2. You can see the speed increases. Or if I stop that one as well, I will push it just on the first one. So it depends on the computer you are using. And keep in mind that EA Studio works in the browser.

So give it a try, see how it goes with 3-4. It depends again on what else you have opened on the computer. But if it gets really slow, you can just run one, and then another one, and then another one. It depends really on what machine you are using.

Now I will leave it generating strategies for 12 hours. And once I have the results, I will continue and I will share with you some more tricks about how I test the Expert Advisors before doing real trading with them.

My strategies do not perform by luck

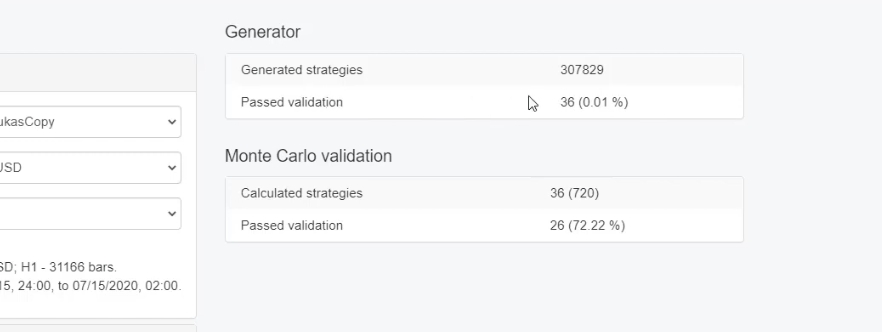

I continue now 12 hours later with the results from the reactor in EA Studio and I have the GBPUSD as seen below. So what I have is 307,829 strategies generated. From those, just 36 passed the Acceptance criteria.

Now, this is not by luck. I have tested it so many times to figure out that this Acceptance criteria that I have set of 500 count of trades as a minimum and 1.2 Profit factor works great.

And it brings me at the end nice strategies with very good equity lines and backtest statistics.

So I run the Forex Expert Advisor Generator for 10-12 hours and in the end, I have not a huge number like hundreds of strategies but I have a decent number which I would like to test.

From these 36, 26 passed the Monte Carlo validation. And for the beginners, I will quickly show what is the Monte Carlo. I will click on any of the strategies and go to Monte Carlo. You can see it below. You have different simulations for Randomize history data.

We have done here the best thing we can do with history data so I’m not testing it there. Then we have Randomize spread. As we said, I’m always putting a little bit higher spread to be more pessimistic in the backtest so I don’t need to test for Randomize spread as well.

Randomize backtest starting bar

And then, execution problems, this is only if you have some execution problems with your broker. But if you have such problems, you better change the broker because executing the trade when we do algorithmic trading is essentially important. So if you notice any problems with the execution, just look for another broker.

On the bottom is what’s most important for me, strategy variations. Randomize indicator parameters – this means that we will have different backtests. For example, this strategy has Accelerator Oscillator and Momentum. And the Oscillator doesn’t have any parameters but the Momentum has a period of 43.

So the Monte Carlo will test with period of 44, 45, different parameters. Same with the exit conditions that we have below and it will try to break the strategy.

If it succeeds, the strategy will not go into the collection. So let me click on Start and you will see the results that we will have.

And one last thing, here we have Randomize backtest starting bar – this means that we will do a backtest on different starting bar which is very logical since we will be trading this strategy in the future. And we want to make sure that whenever we place it on the chart, it will be profitable.

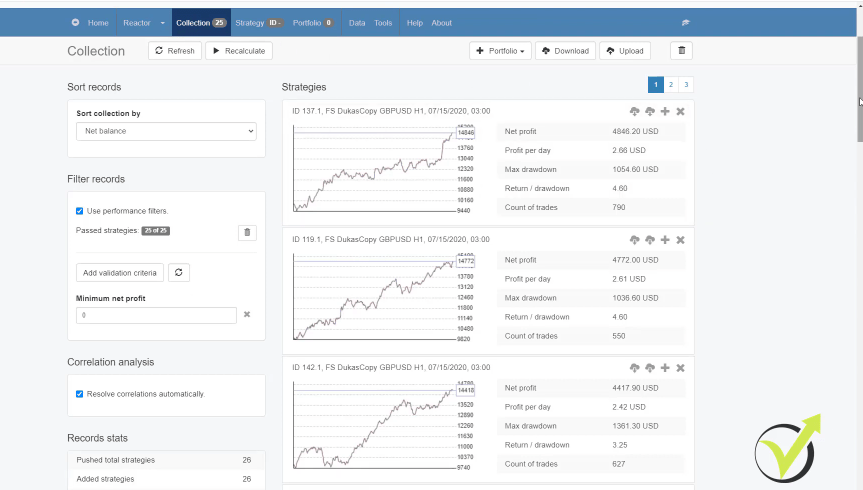

The resolved correlations

And you can see that we have 18 out of 20 validated tests. And as validation, here we have just Minimum count of trades of 100. I keep it at the default, you really don’t need to make it any more complicated. So this is what the Monte Carlo does.

It runs variety of backtests according to the simulations we have set. So, one more time, from the 300,000 strategies, just 36 passed the Acceptance criteria of minimum 500 count of trades and 1.2 Profit factor. And then from these 36, 26 passed the Monte Carlo meaning that 10 strategies failed the Monte Carlo.

And finally, I have 25 strategies in the collection. Where is this one strategy? It was a resolved correlation. If I scroll a little bit lower, you will see Resolved correlations – 1. And again, for the beginners, the resolved correlations means that there was a strategy which was very similar to any of the other.

Either the equity line was very similar or it had similar entry or exit rules so it was removed. This way, we have 25 different strategies. Absolutely different from each other. And this is how we achieve risk diversification because we trade one asset but we trade with different strategies. We don’t expose the risk on one single strategy.

EA Studio: The fastest Forex Expert Advisor Generator

Now, let me scroll lower to show you all the strategies. They all look really good. Even if I go to the second page, it’s right here, and I go down. You will see that all of the equity lines are really nice. I will go through the third one as well, here it is.

All of the strategies are nice. And something very important, I really don’t go through each strategy to check what are the entry and exit conditions, to check the indicator chart. Of course, you can do that but with time I saw that it’s not really needed.

EA Studio has a really good Forex Expert Advisor generator and I don’t need to spend time looking into each strategy.

Now, what I need to do, I will just leave it doing nothing. As I said, for one month, I will not do anything with these collections. I will just download it.

And I have the very similar results actually for EURUSD, I have about 30 strategies there. And for EURGBP, I have about 25 I think, it’s just on my other screen. So I will download these collections and I will wait for 1 month to have the new data from the market.

EA Studio free trial: Generate as many EAs as you wish for 15 days

So what I usually do after tha, I will download it again from the Forex Historical Data App and I will recalculate the strategies to see which of these strategies performed best during this 1 month.

This is how I test the strategies recently and it works really nice. So this is how we use EA Studio to have many great strategies at the end of the collection. And don’t hesitate to give it a try. It’s absolutely free to test EA Studio. There is a free trial that you can use for 15 days and all the strategies that you export during this time are working for a lifetime.

So there is nothing to lose, there is nothing engaging. Just give it a try. It’s a great experience for every trader to practice Expert Advisors and I’m pretty sure you will like it more than manual trading because it’s less work, better results.

Thank you for watching and don’t forget to have a look at our free course as well which is available on our website at EA Forex Academy. The Forex Expert Advisor Generator might sound unbelievable, but it is very real.

That is a free lecture from the course Forex Trading with Expert Advisors + 30 best Strategies (Every Month), so if you want to get the EAs that I use, you can have them monthly with the course.