Forum Replies Created

-

AuthorPosts

-

November 2, 2021 at 21:29 in reply to: What should I aim for in terms of returns? Setting Expectations #100336

Petko Aleksandrov

KeymasterHey Ivone,

You are doing quite well!

With Crypto I did more…but the market is just insane with some coins :) I can call it more of luck sometimes :)

Petko Aleksandrov

KeymasterHey mate,

It looks like you had only 2 trades…are you sure you implemented the strategy as it is shown in the video?

Which video are you looking at?

Did you try to see the results with the Premium Data?

Petko Aleksandrov

KeymasterHey traders,

Please, find attached in the course the new USDCAD EAs for November.

If you have any questions, do let me know.

Kind regards,

Petko A

Petko Aleksandrov

KeymasterHey guys,

I also updated the NFT course with another two sections that will help you understand better the Gas Fees, and you will learn how to find NFT Projects early.

Thank you for all the questions. It helped me improve the course!

I hope you will learn more in the two sections ( 9 lectures) added.

Petko Aleksandrov

KeymasterHello all,

The Chia forks are here, and I just updated the Crypto Farming course with four exciting lectures:

26. Chia Forks are here!

27. Why there are forks

28. How to compare the Chia Forks

29. Chia Forks calculator

It’s pretty exciting that there are Chia forks already, and I was sure this time would come! :)Enjoy the lectures, and let me know which Chia fork you liked the most?!

Petko A

Petko Aleksandrov

KeymasterHey mate,

I shared with you what I think, it is up to you if you want to take the advice or not :)

Petko Aleksandrov

KeymasterHey traders,

The October EAs are uploaded to the courses.

I always remind that but I guess I will keep doing it, just because it is SUPER important! (smiley)

Safe trading!

Petko A

Petko Aleksandrov

KeymasterHey guys,

Here are some of the recent EA Studio Updates:

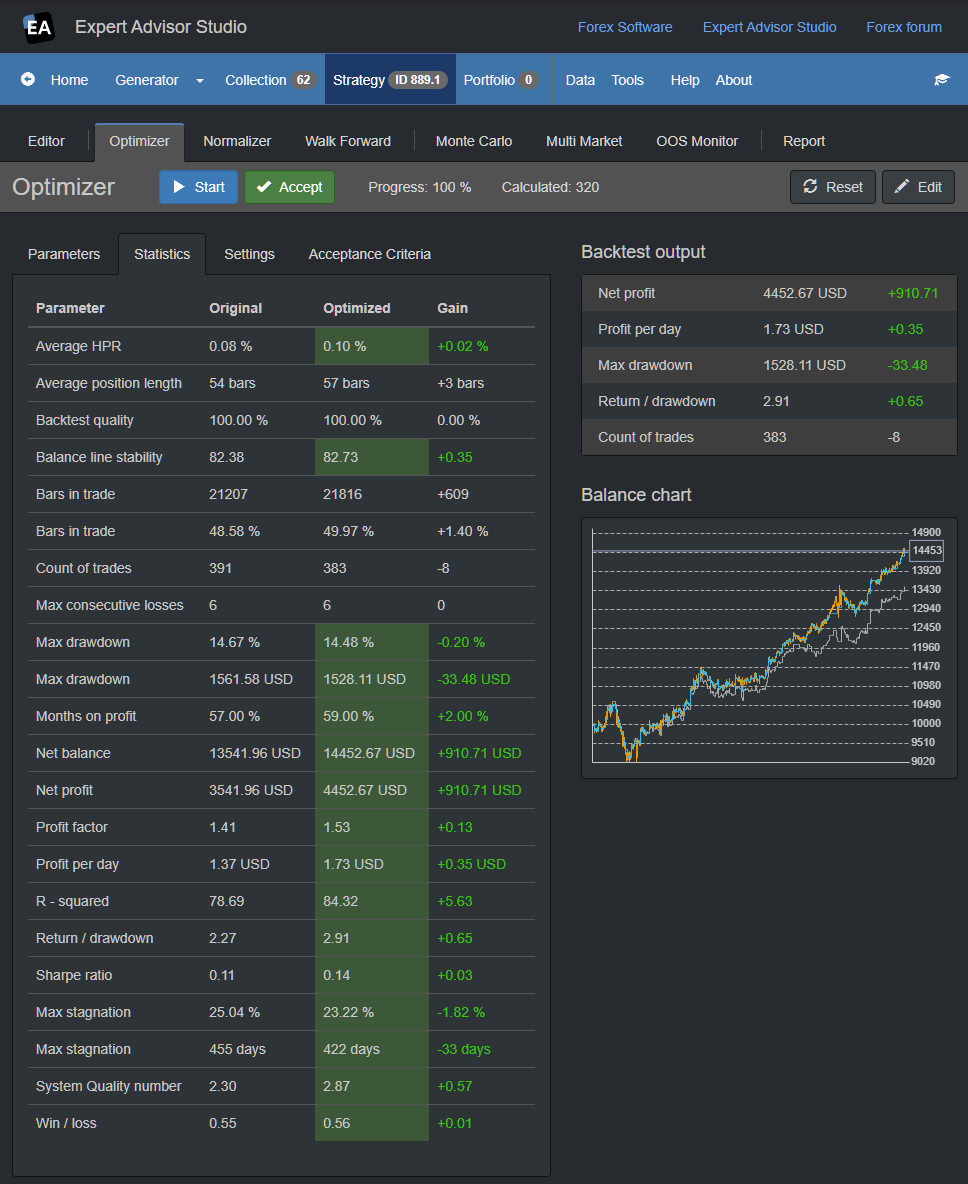

1. We see Statistics now when Optimizing or Normalizing the strategies:

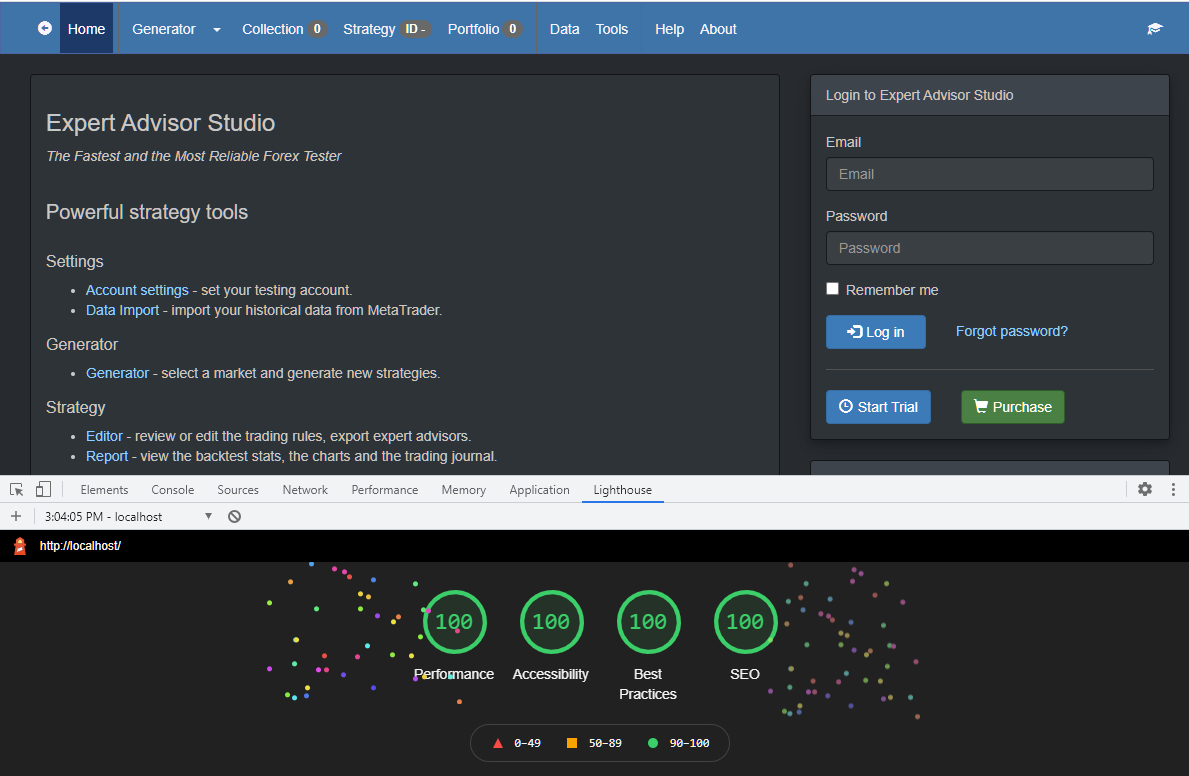

2. A better User Interface. Now the program loads faster because the source code got 30$ shorter. This is because it uses no more bootstrap.js and jQuery.js. I have no idea that that is but that is the reason :)

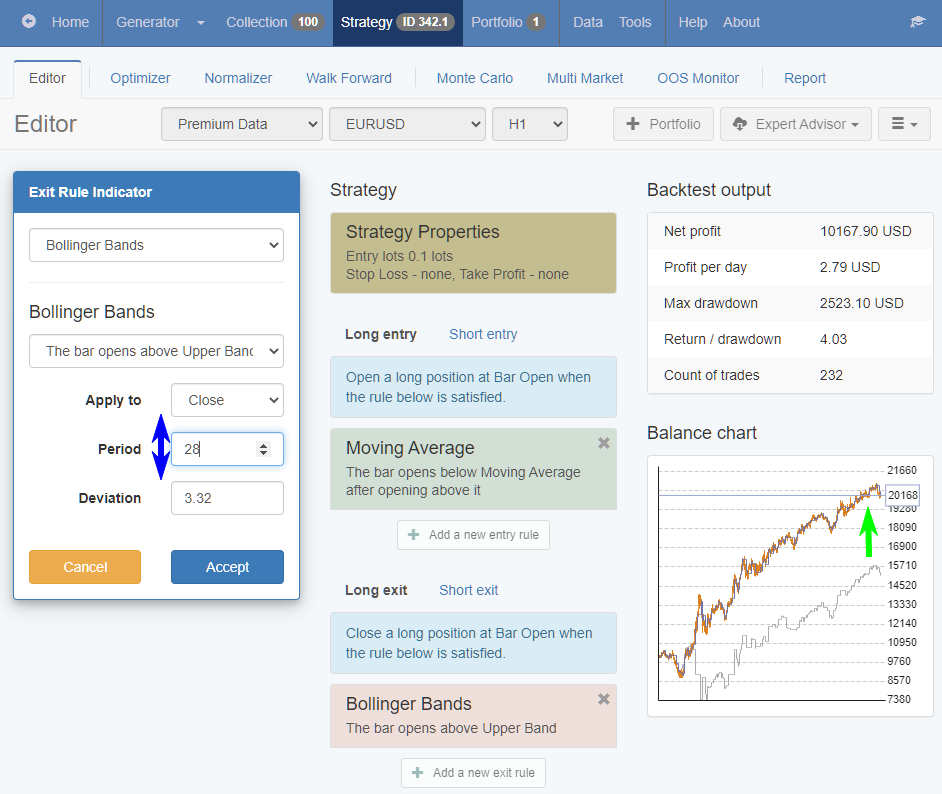

3. In the Editor we can change the values in the Indicators and the Editor will calculate the backtest in real-time:

4. Accept button added to the Optimizer and Normalizer. So if you decide to ”accept” the new values, you do not need to click on Edit as it was until the moment, but just click on Accept.

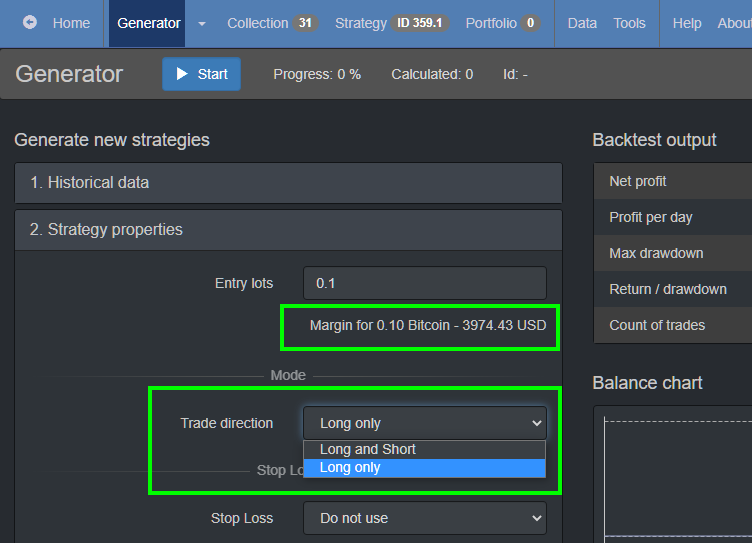

5. Margin requirements added in the Generator. This way you will know how much you need in order to use the strategies.

Petko Aleksandrov

KeymasterHey Manish,

Glad to hear you liked the video.

Yes, many people asked for the % size lots, but there are many concerns about it. If you trade many EAs in the account, each trade will open different sizes, and it will be hard to compare the EAs and decide which one had the best performance.

Also, deciding how much to trade is simple math, and actually, it is the professional approach to trade with fixed lots.

Regarding the complete Portfolio Backtesting, keep in mind that the EA Studio is limited with MetaTrader on the other end. And on MetaTrader, the EAs work on separate charts. The portfolio EAs work on a one-time frame and one asset. So even having a mixed portfolio in EA Studio would be useless because MetaTrader wouldn’t allow it.

Let me know if there is anything else. There have been many updates recently in the EA Studio, and I will drop them a bit later on this topic.

Petko Aleksandrov

KeymasterHey mate,

You are missing the main issue. It is with the digits of your broker. I will try to explain it simply. Stay with me.

This strategy has a Stop Loss of $1220. But this is for the regular brokers that have two digits after the decimal comma.

They would display the price, for example, $41500.00. And there we might have the $1220 SL. But when your broker offers the price without the cents then the SL is not actually $1220. I guess it is just $12.20. The EAs read the digits, this is programming. So when the number of digits is different then the SL and the TP will be different. It’s not about how high the price of Bitcoin is compared to the cents.

When you make the backtest, check the orders and see the result when the SL is hit. Is it $1220? This is why your backtest has more number of trades, because the orders are closed much faster because of the smaller SL and TP (because the digits are less).

Hope that makes sense.

Petko Aleksandrov

KeymasterHey Daniel,

Sorry for the late reply. We are moving the office and the new studio of mine where I will be recording, and we couldn’t answer on time on all channels.

I will ask my team to help you out.

Petko Aleksandrov

KeymasterHey Stefanos,

Reading your other posts I do not think you need anyone mentoring you. ;) You have a great idea of what you are doing, just keep practicing until you find your own system.

The EA Studio software is just the tool we use to generate and automate strategies. From there it is our job to figure out which is the best method for managing the EAs. Just like when you buy a nice car, it’s only you who will be driving it, not the manufacturer. Unfortunately, there is always the chance for a crash, that is why good money management is needed.

Petko Aleksandrov

KeymasterHey Stefanos,

the Portfolio EAs are only available for MetaTrader 4. Try dropping it to the validator and you will see the strategies in the collection.

September 29, 2021 at 9:52 in reply to: Consecutive losses waiting for big win and splitting the risk #98353Petko Aleksandrov

KeymasterGreat to see exciting ideas in the Forum :)

I like the one where you would wait for the consecutive losses to use the strategies and target the profitable trades.

Three things here:

1. it might take a long time before it happens

2. it might happen, then you might see just one positive trade, and again the consecutive losses

3. as you said, it is a lot of manual work

I will think over everything you said and give you some tips. But I like the idea.

Moreover, the markets always go up and down. Just like with crypto nowadays. What goes up goes down. This is why I am recently always buying the dips(because the negative move is made). I see it more and more with the EAs.

After they make the losses, it is time for profits. But keep in mind that we need to automate it. If you have an idea, we might suggest it as an update in the software.

September 29, 2021 at 9:51 in reply to: Consecutive losses waiting for big win and splitting the risk #98351Petko Aleksandrov

KeymasterGreat to see exciting ideas in the Forum :)

I like the one where you would wait for the consecutive losses to use the strategies and target the profitable trades.

Three things here:

- it might take a long time before it happens

- it might happen, then you might see just one positive trade, and again the consecutive losses

- as you said, it is a lot of manual work

I will think over everything you said and give you some tips. But I like the idea.

Moreover, the markets always go up and down. Just like with crypto nowadays. What goes up goes down. This is why I am recently always buying the dips(because the negative move is made). I see it more and more with the EAs.

After they make the losses, it is time for profits. But keep in mind that we need to automate it. If you have an idea, we might suggest it as an update in the software.

-

AuthorPosts