Tagged: EA Studio Updates

- This topic has 184 replies, 1 voice, and was last updated 1 year, 1 month ago by

NIKOS KYRIAKOU.

-

AuthorPosts

-

-

January 16, 2019 at 23:34 #8521

Petko Aleksandrov

KeymasterHello traders,

Since 2019 has started with rapid development in EA Studio, I decided to open a new topic in the forum, where I will keep you updated with the new features and functions.

Also, I will record videos for each update, and I will explain it in details. This way you will be able to use the EA Studio software at its maximum!

-

January 16, 2019 at 23:45 #8523

Petko Aleksandrov

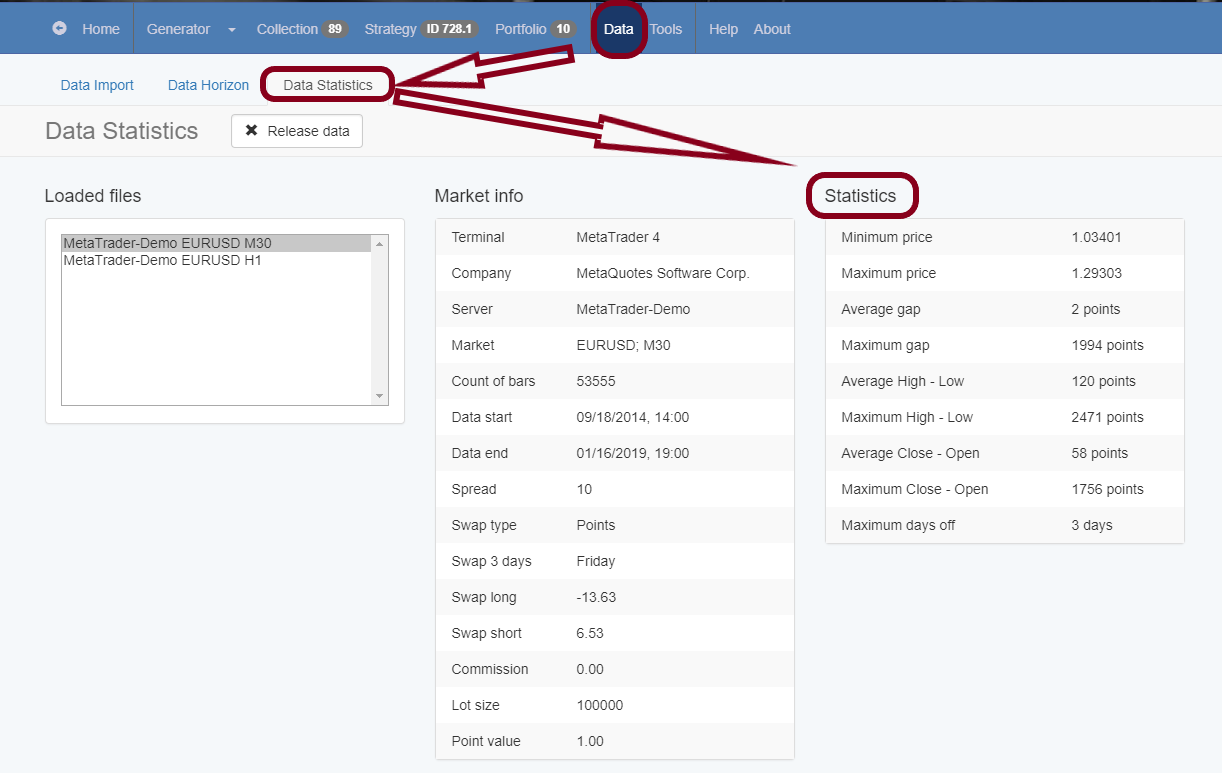

KeymasterThe First update is about the Forex Historical Data in EA Studio:

YouTube Video: EA Studio Updates: Forex data import

In the video, you will learn what is new with the Historical data in EA Studio.

There is the Data Statistic which allows us to evaluate the Historical data that we are using:

Also, for the licensed users, the max number of bars that we can use is increased to 500k.

Last, the Data is moved on the main bar, so it can be accessed easier and faster:

Let me know if you have any questions!

Petko A

-

January 17, 2019 at 1:54 #8526

jacpin2002

Participant@Petko-This is awesome! Thanks so much for posting this!

-

January 17, 2019 at 9:01 #8531

Petko Aleksandrov

KeymasterHey Jacpin,

I will do my best now to catch it up with the recent updates, as there are some very interesting ones. So I will record one video nearly everyday, and then I will continue recording when there are new updates.

Cheers,

-

January 17, 2019 at 9:45 #8532

Petko Aleksandrov

KeymasterHey Petko,

I have been away from trading for sometime as I was in the sea. Now I think to get back to EA Studio, and your old and new courses that I missed!

Hope you are doing fine, and the team.

Glad to see that there are so many people in the forum, in the beginning we were just few, good job!

-

January 18, 2019 at 0:06 #8555

Petko Aleksandrov

KeymasterHey George,

Glad to hear from you again. Thank you, I am doing fine. You have new courses and a lot in the forum to catch up with :)

-

January 18, 2019 at 0:26 #8557

Petko Aleksandrov

KeymasterThe second video for EA Studio updates is called:

Youtube Video: EA Studio updates: Backtesting trading strategies

In this video you will learn how to change the stats in Backtest Output.

As well, I will go over the New Backtest output called Backtest quality and Bars in trade.

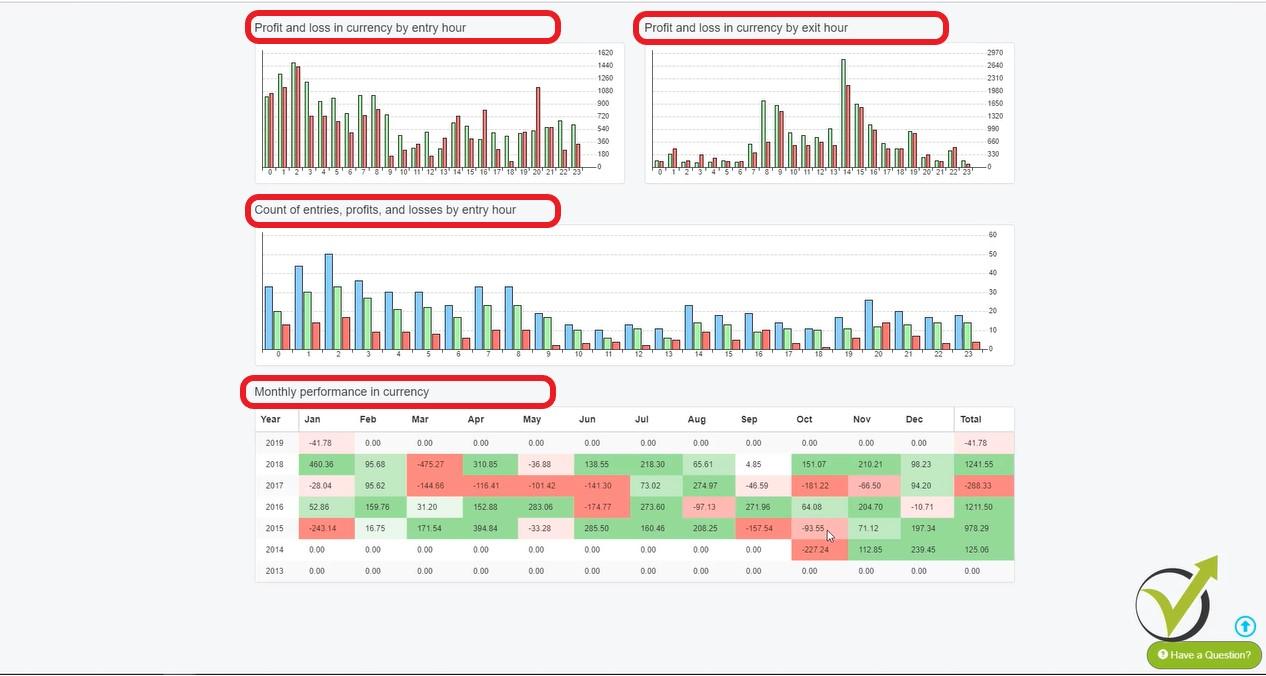

And I will go over the Count of entries by weekdays and Profit and loss in currency by weekdays:

More, I explain:

- Profit and loss in currency by entry hour

- Profit and loss in currency by exit hour

- Count of entries, profits, losses by entry hour

- Monthly performance in currency

Note* when you change the Session hours they will effect the entry and the exit of the positions. If there is a SL and TP the entry might happen outside the predefined trading hours. The broker is obliged to execute the SL and TP at any time.

-

January 18, 2019 at 9:45 #8573

Petko Aleksandrov

KeymasterWooow! So nice. I am using EA Studio everyday, everyday it is opened with me, but I did not see those improvements.

I think now I will need to review all of my EAs, so see if the are balanced.

Thanks so much Petko!

-

January 19, 2019 at 10:01 #8612

Petko Aleksandrov

KeymasterI like very much the new stats, they talk about the strategies. I think it will take some time to find the best way to read them..

Good to see that EA Studio is being improved so much!

-

January 19, 2019 at 19:11 #8632

Petko Aleksandrov

KeymasterYes, George, they are working a lot on it right now. It is getting better and better.

-

January 20, 2019 at 9:16 #8648

Petko Aleksandrov

KeymasterNice! I am sure the more it is improved, the better strategies we will have

-

January 20, 2019 at 22:44 #8663

Petko Aleksandrov

KeymasterHey Desita, well, with the new statistical graphs we have better view of the strategies. With those we need to focus on having more balanced strategies – that open trades all day long, take profits equally during the day and the week.

-

January 22, 2019 at 9:34 #8698

Petko Aleksandrov

KeymasterAre you going to record more videos with updates? I realize that I am not using EA Studio on its full capacity.

-

January 22, 2019 at 23:49 #8705

Petko Aleksandrov

KeymasterHey Desita,

Tomorrow I am planning to make another video about the EA Studio. Will let you know here in the forum.

Cheers,

-

January 23, 2019 at 23:01 #8729

Petko Aleksandrov

KeymasterThanks, Petko! I will be waiting for it, as I am waiting for every course you launch. :)

-

January 23, 2019 at 23:56 #8732

Petko Aleksandrov

KeymasterHello traders,

I have create a new video about the new criteria in EA Studio, called R – Squared. The video is called:

YouTube video: EA Studio updates: R – squared

In this video you will learn what R – squared is, and how useful it is in EA Studio.

R – squared statistically is regression line with many points around:

The value in EA Studio is from 0 to 100. The more points are on the line, the bigger number we have for R – squared.

Zero is when we do not have any points on the regression line, and 100 is when we have all the points on the line. In algorithmic trading this means that we would have only 2 orders, which will form the perfect line. In order to avoid that, we need to combine it with min count of trades.

If we use the R – squared in Search best, we can get strategies with great Equity lines. Specially if we combine it with Out Of Sample:

-

January 24, 2019 at 8:21 #8741

Petko Aleksandrov

KeymasterHey Petko,

Thank you for making it clear about the r- squared! It was a mistery for me, and now it is much clearer.

I played with it a lot last night, finally i left few generators working for EURUSD, GBPUSD, USDJPY, EUGBP and AUDNZD.

I was so so surprised to see the results in the morning! Fantastic equity lines! :)

I shared one of the strategies in the Forum, and i hope the others will test it.

Sure that this feature will improve the EAs a lot, and it will make our choice much easier, because while generating we get EAs with good equity lines, not too much to filter from there.

-

January 24, 2019 at 8:31 #8743

Petko Aleksandrov

KeymasterHi Petko,

Long time I did not look at the Forum, and I was so surprised to see so man new people and topics. This one is great. I like your videos, and I like that you make it clearer how to use the updates in EA Studio!

Keep up the good work!

-

January 24, 2019 at 17:10 #8748

jacpin2002

Participant@Petko-OMG!!! After watching your video on the R-squared and running the generator on some more that I needed to create…wow! Just wow! The quality of the strategy went up significantly by having more count of trades, less stagnation, less drawdown, and reasonable increase in profit! Again, thank you and Miroslav for EA Studio. And thank you for taking the time to create these videos. I would have been so upset if I went on for months without adding the R-squared as part of my criteria in evaluating strategies.

-

January 24, 2019 at 21:44 #8752

Petko Aleksandrov

KeymasterHey Andi,

Glad to hear that I made it clearer with the r – squared. I had to test a lot before making this video, but it is really a huge thing with EA Studio.

Take your time to test more, and you will see even better results.

Happy to hear you shared a strategy! That is very generous in trading!

-

January 24, 2019 at 21:45 #8753

Petko Aleksandrov

KeymasterHello Rose,

Glad to see you back in the Forum. Yes, many students and traders joined the Forum, which makes me very happy.

I will keep you updated with the updates in EA Studio in this topic.

-

January 24, 2019 at 21:49 #8754

Petko Aleksandrov

KeymasterHey Jacpin,

Yes, the R-squared is WOW! But I tested it a lot before recording the video, because I wanted to show the best of it, and to demonstrate how to use it.

I am planning to include it in my generation permanently. Also, for the monthly updates of all courses. It really really improves the strategies.

I have prepared another video, which will surprise you even more. I will upload it tomorrow.

It is a method to generate the EAs using the trick with testing the recent data(avoiding Demo trading) and combination with the R-squared. Works brilliant!

-

January 24, 2019 at 22:06 #8759

Petko Aleksandrov

KeymasterHello Petko,

thanks so much for the video! I have some statistical skills but I did not imagine that r-squared could be implemented in EA Studio. It is really a top product in algorithmic trading.

So as far as I get it, the points around the regression lines are the results of the trades, right?

-

January 25, 2019 at 9:47 #8768

Petko Aleksandrov

KeymasterHello Desita,

Yes, we can say they are the results of the trades, but added to the equity. Not alone.

Simply, when we use R – squared in the generator, it founds such strategies that the equity line is closer the the regression line.

Kind regards,

-

January 25, 2019 at 9:54 #8770

Petko Aleksandrov

KeymasterHi Petko,

very nice topic here, we can learn more from the free videos you upload in Youtube.

Thank you for your hard work!

-

January 26, 2019 at 12:17 #8786

Petko Aleksandrov

KeymasterHello traders,

I have uploaded a new video with another updated in EA Studio regarding the Out of Sample.

So far I was not a fan of using the OOS, but with this update the things changed a lot!

Please, find the YouTube video here: EA Studio Updates: Out Of Sample monitor and acceptance criteria

There are two major improvements with Out Of Sample in EA Studio.

First, we have a change in the Acceptance criteria:

Now we have the chance to generate the strategies with different acceptance criteria for the Complete backtest, for the In Sample Part, and for the Out Of Sample part.

This way we can use for example, 70% of our Historical data to generate strategies with predefined acceptance criteria. And with the rest 30% we will see simulated trading from EA Studio, as it was actually trading. NOW, here is the thing: We want to see only the strategies that actually profited in these 30%. So we can place precise criteria in the Out of Sample part.

In one of my courses I showed a trick how to avoid Demo testing, but we had to change the data range, than filter the EAs manually. Now it is possible to do it all automatically.

Second we have the Out of Sample monitor:

Here you will see detailed statistic for the complete backtest, the In Sample part, and in the Out Of Sample part.

In green you will see the same criteria that you have set in the Acceptance criteria. This shows that this is validated criteria. If it is in red, this means that the criteria was not validated with the minimum you have set in the acceptance criteria.

At the end of the video I show an example method how to generate trading strategies using the OOS in the acceptance criteria but in the Optimizer, not in the Generator. Combined with the r-squared new criteria, you will see great trading strategies.

-

January 26, 2019 at 22:55 #8801

Petko Aleksandrov

KeymasterAnother very interesting video, Petko! I had to watch it few times as I am still new with EA Studio, but at the end I got it how you generate such EAs!

Thanks a lot!

-

January 27, 2019 at 10:32 #8813

Petko Aleksandrov

KeymasterWow! I missed to see this topic, and not watched the 4 videos in a raw! Very nice! I liked the last one the most. Interesting approach, Petko!

Thanks for the work to share what is new with EA Studio, this way we will use it properly.

-

January 28, 2019 at 14:53 #8849

Petko Aleksandrov

KeymasterChingi,

take your time to learn how to use it. i know some thing might be a bit more complicated, but I am sure after you go over all of the courses, all will become clear to you.

Cheers,

-

January 28, 2019 at 14:54 #8850

Petko Aleksandrov

KeymasterHey Chris,

Glad to hear from you again. Yes, I will do my best to keep you all updated with the new features in EA Studio, because some of them are very useful!

-

January 28, 2019 at 16:17 #8858

edu

ParticipantHello petko,

i try this new method and one of the strategies with 0,01 is this

<script async src=”//s.imgur.com/min/embed.js” charset=”utf-8″></script>

It seems to good to be true and infact it has only 103 orders from 2/8/2016 to now

what do you think they are too poor data? If yes why we put 100 in the optimizer?

thank you

-

January 29, 2019 at 0:07 #8869

Petko Aleksandrov

KeymasterHello Edu,

yes, 100 bars is small, in the video I give just an example method, but you should definitely look for stricter acceptance criteria.

The minimum I use is 300 count of trades, and depending on the time frame I am looking for 500 or 800 as min for count of trades.

-

January 29, 2019 at 9:59 #8884

Petko Aleksandrov

KeymasterEdu, what Petko does in this videos is to show the updates in the functions of EA Studio.

Each one of us should fine the most strict criteria according to the Historical data each one has.

If he shows the stricter he uses(he has a lot of data) and we test with such criteria, we would not see any strategies.

-

January 30, 2019 at 0:13 #8892

Petko Aleksandrov

KeymasterActually the idea here is to test the strategy with not all of the data. OOS helps to test the EAs as they were on Demo.

Also, when we optimize the EA, it is good to use the OOS, because this way we will see if it was over-optimized.

Now with the new updates in EA Studio, we can filter the results very well by setting the criteria, but for sure, use stricter criteria as much as possible.

-

January 30, 2019 at 9:56 #8923

Petko Aleksandrov

KeymasterHello Petko,

I used this method with 250 trade, generated 10 EAs in total for 10 different currency pairs and placed on Demo. The first trades are all on profit.

Will see ow it goes. Thanks a lot for the awesome videos you are doing!

-

January 31, 2019 at 9:35 #8943

Petko Aleksandrov

KeymasterYou are welcome, Chingi!

If you use 10 different currency pairs, you should make sure that you place equal exposure to the different currencies.

Do not place only USD pairs for example, because this might bring huge risk to your portfolio if there are some unexpected moves with the USD.

Hope that makes sense.

-

January 31, 2019 at 18:39 #8948

edu

ParticipantHello Petko,

today i was creating some EAs and i generated this. It seems too strange to be good even if there are a lot of orders opened (more than 300). Shouldn’t this method generate only not over-optimized strategies? (just a question)

<script async src=”//s.imgur.com/min/embed.js” charset=”utf-8″></script>

-

February 1, 2019 at 1:09 #8952

Petko Aleksandrov

KeymasterWow, Edu! How did you come up with such an equity line?

Did you use optimization in In Sample part only?

Also, how did you generate the strategy?

-

February 1, 2019 at 1:36 #8955

edu

ParticipantHi Petko

I used the exact procedure you used in your video.

I imposted out of sample 30% and r-squared in optimization.

I used the reactor as you teach in the video.

-

February 1, 2019 at 11:06 #8962

Petko Aleksandrov

KeymasterHello Edu,

really hard to say just from looking at the picture. It looks really too good to be true.

If you want me to have a deeper look at the EA, you can drop it in the e-mail to Marin, and I will have a look at it during the weekend.

Cheers,

-

February 1, 2019 at 14:36 #8965

edu

Participanti tried the montecarlo test and it resulted over optimized so i don’t want make you lose time

-

February 1, 2019 at 16:37 #8968

Petko Aleksandrov

KeymasterYes, it looks like over-optimized strategy. However, the idea of these tools as Monte Carlo, and OOS, and Multi Markets is to recognize these strategies and eliminate them.

-

February 1, 2019 at 23:49 #8988

edu

ParticipantIt happened again but this time on another cross. The others strategies look normal but this 8000 trades? What??

I did again the montecarlo test and it resulted over optimized

<script async src=”//s.imgur.com/min/embed.js” charset=”utf-8″></script>

-

February 2, 2019 at 0:32 #8991

jacpin2002

Participant@edu-I am totally going to need a video as to how in the world you are coming up with these strategies, even if they are over optimized. Those results are crazy!

-

February 2, 2019 at 10:07 #8994

Petko Aleksandrov

KeymasterJacpin, is right, I was wondering as well how you succeeded with this result. Did you get few of these strategies or just one?

If you got few in the way I showed, I would suggest you to drop them in on Demo account and see what happens, even you saw the bad results in Monte Carlo. If it is just one, than I would say it it some good work of EA Studio to find such a “fantastic” strategy.

-

February 2, 2019 at 15:53 #9032

edu

ParticipantYes only the two i posted. The others are good and “normal”. This week i will the test them and i will keep you updated when i have 10 orders closed

-

February 2, 2019 at 19:31 #9038

Petko Aleksandrov

KeymasterAll right, Edu.

Let me know if you have any other questions.

Cheers,

-

February 5, 2019 at 12:41 #9229

Petko Aleksandrov

KeymasterHello Petko,

I am Jordan, very new to trading and to Forex Academy.

I wanted to ask if these videos are part of any course, or they are just separately free resources?

-

February 6, 2019 at 19:03 #9397

Petko Aleksandrov

KeymasterHello Jordan,

I just completed all the 20 courses, and I think I did not meet the videos anywhere, so they are just additional info about the EA Studio updates!

It is great that Petko recorded those, so we know how to use all features in EA Studio.

-

February 8, 2019 at 9:58 #9460

Petko Aleksandrov

KeymasterHello Jordan,

Yes, so far the videos are not included in any course, but I think to include them in the Forex strategy course: Portfolio trading with 12 Robots

Anyway, even I decide to include them, I will still post them here in the Forum.

Kind regards,

Petko A

-

February 9, 2019 at 10:11 #9510

Petko Aleksandrov

KeymasterHey Petko,

I am testing a lot the r – squared, but when I combine it with the other criteria as Profit Factor, Win/Loss ratio, I hardly get strategies.

So I need to go down to r-squared like 55-65. Is this normal?

-

February 9, 2019 at 15:35 #9522

edu

ParticipantHi Petko,

i am trying the crazy EA. It is working well. 4 orders opened 4 tp

What you think should i wait 10 orders?

-

February 9, 2019 at 23:59 #9529

Petko Aleksandrov

KeymasterHello Stephen,

Glad to hear you are testing the new feature r-squared with EA Studio.

Yes, my testing shows as well that if you combine the r-squared with other criteria you will need to lower it.

But even you go down to 50 as r-squared you will still see nice equity lines.

Kind regards,

-

February 10, 2019 at 0:02 #9530

Petko Aleksandrov

KeymasterHello Edu,

Glad to hear the EA keeps on great profit. You have your mystery there how you created such an EA :)

I am interested to know what is the r-squared with the strategy. I believe it is between 90 and 100!

It is up to you how long time you will test it. How does it go over the Monte Carlo?

-

February 10, 2019 at 15:31 #9546

Petko Aleksandrov

KeymasterHey Petko,

do we expect more improvements with EA Studio? So far it is fantastic program for every trader, but I will be happy for more :)

-

February 10, 2019 at 16:27 #9548

edu

Participant -

February 10, 2019 at 22:54 #9552

Petko Aleksandrov

KeymasterHeu Edu,

it is quite interesting what you did. The results with Monte Carlo are not crucially bad. I see that half of them fail, and the others are keeping the same good equity line.

I think you should not look at the randomly skip positions because if your Expert Advisor works all the time, there should be no problem with the entries.

However, test it more on a demo, if it keeps profiting you can give it a try.

Anyway, if at one moment it starts to lose and the equity line goes down, you can always remove it.

-

February 11, 2019 at 0:44 #9557

donaldmoore

ParticipantPetko: I have been moving through the courses to gain understanding of techniques. I do not find the links on the courses where you show the latest updates for the EA’s you generate/test/compare each month. Where or how do I find the links?

Also if a EA Studio generated strategy uses “Volume” as part of the selection criteria should we automatically eliminate it from consideration or accept the results as is? -

February 11, 2019 at 10:03 #9560

Petko Aleksandrov

KeymasterHello Donald,

the Volume indicators in Forex are calculated a bit different, not like in stocks. Simple they do not show the real volume on the global market(it is not possible) but with formulas behind, they get an interpretation of it. However, I am using the volume indicators. If they showed good profit why not to test them?

Cheers, -

February 11, 2019 at 22:38 #9576

Petko Aleksandrov

KeymasterHey Donald,

Can you please make it clear which links are you talking about?

If you are talking about the updates with the Expert Advisors themselves, I always place them in the same place where the original ones were.

They are displayed below the video. In most of the courses, they are with the video where I show how to place the Expert Advisors on Meta Trader. In few is where I filtered and selected the EAs.

Let me know if you can not find any, but let me know the name of the course, so I can tell you the exact lecture.

Kind regards,

-

February 11, 2019 at 22:38 #9577

Petko Aleksandrov

KeymasterHey Donald,

Can you please make it clear which links are you talking about?

If you are talking about the updates with the Expert Advisors themselves, I always place them in the same place where the original ones were.

They are displayed below the video. In most of the courses, they are with the video where I show how to place the Expert Advisors on Meta Trader. In few is where I filtered and selected the EAs.

Let me know if you can not find any, but let me know the name of the course, so I can tell you the exact lecture.

Kind regards,

-

February 12, 2019 at 13:52 #9595

edu

ParticipantHello Petko,

have you seen the data that i have posted?

Sorry for the message

-

February 13, 2019 at 4:43 #9608

donaldmoore

ParticipantPetko: I have gone through Basic Algo Trading Course + 3 Robots and London, NY & Tokyo Algo Trading but I cannot find the links for the updates.

-

February 13, 2019 at 7:54 #9609

Petko Aleksandrov

KeymasterHello Edu,

Yes, I saw it.Let me know what exactly is the questions, or you are just sharing it?

-

February 13, 2019 at 7:59 #9610

Petko Aleksandrov

KeymasterHello Donald,

For the Basic algorithmic trading course, you can find the EAs as attached file in the lecture called How to place the Experts on the Meta Trader for trading. When I make an update, I will attach the updated EAs again there.

The London, NY & Tokyo algo trading course is the only algorithmic trading course where I did not include EAs because of the different time zones. If I create such EAs, they would work only for the same time zone.

For all of the rest algo trading courses, you will find the EAs attached below the videos where I show how to place them on Meta Trader, and when I launch un update, they will appear there.

You can follow all the updates normally at the beginning of each month(1st week): Updates in the courses

-

February 14, 2019 at 12:46 #9636

Petko Aleksandrov

KeymasterHey Petko,

the last update in the Acceptance criteria really changed it all. Having the solution for In Sample and Out of Sample is really fantastic!

I have been testing it for 2 weeks now, and the results are just amazing!

-

February 15, 2019 at 9:29 #9658

Petko Aleksandrov

KeymasterMe too, it was great to see the updates in Petko’s videos and apply. Very happy he did those videos!

-

February 16, 2019 at 15:34 #9690

Petko Aleksandrov

KeymasterHey guys,

I am very happy to hear that the videos are useful. I am going to record more. I wish the day was 36 hours at least so I can have the time to record videos for everything :)

-

February 24, 2019 at 11:45 #9996

Petko Aleksandrov

KeymasterHey Petko,

I wish the day was 36 hours too! :)

This way we would have time for all, or maybe then we would like it to be 48 :)

Your updates are awesome! I loved the new course as well!

-

February 26, 2019 at 8:13 #10065

Petko Aleksandrov

KeymasterI’m in the new course too. Yes, EA Studio updates all the time, and I was very happy when Petko started with these videos because this way we can catch it up.

-

February 27, 2019 at 11:15 #10086

Petko Aleksandrov

KeymasterHey Desita,

I actually realized that I need to record these updates because sometimes I was not familiar with the new features in a studio and I had to follow there film. That is why I said to myself if I am not following systematically the updates of a studio probably my students are not following them as well.

So the best thing would be to record videos with the new updates and explain them after I have tested. Also, as traders we are focused on generating strategies, managing the trading accounts with many expert advisors, calculating the risk management in our account, deciding which expert advises to place on a live account, and which one to remove back to the demo account.

That is why I think it is very very important for me to record these videos so all of my students will follow along old updates and will use EA studio with its full capacity.

-

March 1, 2019 at 23:35 #10166

Petko Aleksandrov

KeymasterHey Petko,

your videos for the updates are really nice, I went over them once again, and I will dedicate the weekend to generate some new EAs using your new methods.

It is really admirable that you test new systems, methods, and you share them all with us! Thank you for your work!

-

March 2, 2019 at 8:15 #10182

Petko Aleksandrov

KeymasterYou are very welcome, Jordan!

Try to put the generation in your daily routine. Just start it in the morning or in the evening, and let it go while you work, trade or you are out. This way you will build it as a daily habit, which will bring you many profitable EAs.

-

March 2, 2019 at 23:18 #10277

Petko Aleksandrov

KeymasterPetko gave me the same advice some time ago and it was hard to get used to that but once I started to run the generator in the morning and evening, and it all changed. Every day I have profitable strategies and robust strategies because I run the generator for 12 hours. I found very strict criteria for myself so at the end, I have 5 to 10 strategy in the collection.

Also, I used now the OOS more, and I don’t spend so much time for Demo trading.

-

March 3, 2019 at 22:52 #10310

Petko Aleksandrov

KeymasterGlad to hear you took the advice, Haliffa!

Having 5-10 strategies ready for trading daily is a treasure. Imagine such an EA is a couple of 100s dollars on the market, and with EA Studio and FSB Pro we generate them daily.

-

March 8, 2019 at 9:55 #10402

gowiso

ParticipantHi Petko,

Many thanks for the good work.

In regards to the EAs you are updating every 2 – 3 months (on Udemy), according to your experience in the markets

1. What would be the appropriate period to test them on my platform demo account before porting to live in view of the ever changing markets ?.

2. Is there any further need to optimize them on the EA studio ?

Kind Regards

Owiso G.

-

March 8, 2019 at 11:00 #10403

Petko Aleksandrov

KeymasterHello Owiso,

Welcome to the forum! You have two options here.

1. You can test the EAs that Petko provides and you can select the EAs that perform well with your broker.

2. You can optimize the EAs with EA Studio according to your historical data. This brings the risk of over-optimization.

Actually, the best is to generate your own Expert Advisors with EA Studio, following the steps from Petko.

Regarding the testing, it is up to you how long to test the EAs…. I wait for 10 trades and 150 pips profit.

-

March 8, 2019 at 11:10 #10405

gowiso

ParticipantHi Bob,

Many thanks

As a newbie on the algo trading front, I will initially stick with Petko’s EAs until am very comfortable at generating my own strategies , I really appreciate the baseline of 10 succesful trades however, how long does one keep trading the selected EAs. I notice the market is now most volatile than ever.From your experience, How many EAs would be appropriate to trade in USD 500 account and at which lotsizes.

Kind Regards

Owiso G.

-

March 8, 2019 at 11:14 #10406

Petko Aleksandrov

KeymasterHey Gowiso,

You are welcome, here we are happy to share the experience because this way better results come for everyone.

If you want to start with 500 USD I would suggest you to go for 0.01 lot and max with 10 EAs.

Now, once the EAs are on live, you should monitor their performance and have a different filter there. For example, I keep looking at the last 10 trade for Profit Factor 1.2, and just recently I added the R – squared above 60. So if it falls below that, I remove the EA from the live back to Demo for further tests.

So in the live account, you should keep only the EAs that profit.

-

March 8, 2019 at 12:04 #10411

gowiso

ParticipantHi Bob,

Many thanks Bob, just for clarification,

1. the different EAs must have separate magic numbers ?

2.Can I open say 5 EG charts and trade the same EA ( with the same magic number) or in such a situation i would have to trade it on one chart but upscale the lot size.

Regards

Owiso G.

-

March 8, 2019 at 23:18 #10418

Petko Aleksandrov

KeymasterHello Gowiso,

Glad to hear you in the forum. Bob gave you a great answer, cheers, Bob!

Yes, the different EAs you should trade with different Magic Numbers so you can follow their performance.

If you open different charts with one EA, when the entry conditions are there it will open trades on all charts. So if you selected to trade with 0.01, you will have 5 positions with 0.01. This would be useful if you take your profits on different levels, anyway it is useless.

Let me know if there is something else.

Cheers,

-

March 9, 2019 at 22:21 #10431

gowiso

ParticipantHi Petko,

I am trying to import back the UJ EAs into the studio unfortunately its giving me an error “cannot import strategy; something is wrong with the file”

What could be the problem

Kind Regards

Owiso

-

March 10, 2019 at 10:08 #10432

Deniza

ParticipantHello Gowiso,

What is UJ EAs?

Let me know so I can assist you.

-

March 10, 2019 at 10:50 #10437

gowiso

ParticipantHello Petko,

Hope you are keeping well.

Apologies UJ is abbreviation for USD/JPY pair.

Am referring to the top 10 EAs you uploaded on Udemy USD/JPYfor MarchKind Regards

Owiso

-

March 10, 2019 at 17:17 #10441

Deniza

ParticipantHello Gowiso,

I just watch the USDJPY course and the EAs are created with FSB Pro, not with EA Studio. That is why you can not import them back in the EA Studio.

Cheers,

-

March 10, 2019 at 18:56 #10443

gowiso

ParticipantHi Deniza,

Ouch !!!

Many thanks for the enlightenment so in essence we have to touch base with both engines ?By the way you may just call me Owiso, the G is for my baptismal name – Gaetano

Kind Regards

Owiso

-

March 11, 2019 at 8:57 #10454

Andi

MemberHey Owiso,

you got the right answer, the Top 10 USDJPY are generated with FSB Pro. We expect updates in FSB Pro this year, and one of them is to accept the EAs from EA Studio. For the moment, you can just transfer some EAs from one to the other by building the strategies from the Strategy Editor.

-

March 15, 2019 at 11:19 #10566

Petko Aleksandrov

KeymasterHey Petko,

any idea about the future updates in EA Studio? What we can expect more?

-

March 16, 2019 at 14:21 #10597

Petko Aleksandrov

KeymasterHey Bob,

as far as I know, they are improving now the Walk Forward validation. I have included the Walk Forward in the new course that is coming up this week, and I will update it later with the improvements.

-

March 23, 2019 at 21:24 #10721

Petko Aleksandrov

KeymasterPetko, I went over the videos for the EA Studio updates once again, so useful! Thanks a lot!

-

March 28, 2019 at 7:01 #10846

Petko Aleksandrov

KeymasterYes, I watch them periodically as well, same as most of the courses :)

-

March 29, 2019 at 19:54 #10919

Petko Aleksandrov

KeymasterGlad to hear that, Sisi!

The updates were useful to me as well, that is why I decided to create these videos. If all is applied properly, your strategies and Expert Advisors will improve their performance.

-

April 6, 2019 at 12:17 #11061

Haliffa

ParticipantHi Petko! My new EAs using the OOS are much better – less drawdowns and better profit factor. Also, before I kept the EAs on live account about 2-3 weeks, now I have some EAs on live for over 45 days and they are still with profit factor above 1.2.

-

April 13, 2019 at 9:40 #11172

Petko Aleksandrov

KeymasterHello Haliffa,

I am glad to hear that the updates are useful! This is the idea of all updates at EA Studio, to improve the EAs and the strategies.

-

April 13, 2019 at 9:43 #11173

Petko Aleksandrov

KeymasterHello all,

I do not know if you have noticed the educational cap on the blue bar of EA Studio:

When you click on it, it shows brief information for each feature in EA Studio.

When you change the tab, it will show automatically the information for the feature:

Also, I am glad to say that I was invited from Forex Software company to record short videos for each feature.

We will do our best to record those till the end of 2019. This will make the usage of EA Studio easier and faster for everyone.

-

April 25, 2019 at 7:27 #11534

Petko Aleksandrov

KeymasterHello Petko,

Hope you are doing well! I did not notice that educational small cap. I think it will be great to have more information about each feature.

I will be looking for videos from you!

-

May 1, 2019 at 18:39 #11716

jacpin2002

ParticipantHi Petko!

I just saw that EA Studio updated again. Can you maybe help explain what is going with the new way that strategies are being generated in the reactor. Here is a screenshot of my reactor running as of today:

Before the update, the generated strategies and the passed validation numbers were the same. I thought that this is because I am not using the Common Acceptance Criteria in the Generator settings. After the update, I am still not using the Common Acceptance Criteria in the generator settings, but now the numbers between the generated strategies and passed validation are different. I’m curious as to what validation is being used on these strategies. Can you shed some light on this?

Also, I see that the Optimization has been updated to Full Data Optimization. This is where I keep the R-squared and % OOS optimzation to take place and it looks like it is working the same way. Will you be doing a video explaining this section in more detail?

Thanks so much.

-

May 2, 2019 at 8:35 #11762

Petko Aleksandrov

KeymasterHi, Jacpin, I noticed that as well but did not have time to experiment with it! I am waiting for video too. It will be useful as always because Petko brings the best of each feature.

-

May 2, 2019 at 23:50 #11826

Petko Aleksandrov

KeymasterHi Jacpin,

Yes, there is a great update with EA Studio again. I am out of town this week, but as soon as I am back next week I will record a video.

Safe trading!

-

May 4, 2019 at 11:41 #11873

Petko Aleksandrov

KeymasterLooking for these videos! I do not want to use it in a wrong way :)

-

May 5, 2019 at 4:13 #11922

jacpin2002

ParticipantYou can find the videos on Petko’s YouTube channel-EA Forex Academy. It’s a great channel to subscribe to and get more information on ways to use the software and create strategies.

-

May 5, 2019 at 9:17 #11927

Petko Aleksandrov

KeymasterYes, it is! I really liked the recent video about Why Forex traders lose money:

-

May 9, 2019 at 8:41 #12206

Petko Aleksandrov

KeymasterHey Andi,

actually, there are many other reasons why people lose, but I have tried to cover the most important ones.

-

May 12, 2019 at 9:20 #12340

Petko Aleksandrov

KeymasterHello Petko! Great video! I see myself there when I was scammed. Now I am on my feet in trading with you and the strategy builders.

When can we expect the video update for Walk Forward optimization?

-

May 13, 2019 at 19:00 #12363

Petko Aleksandrov

KeymasterDear traders,

I have uploaded a new video about the Walk Forward Optimization.

Here it is in YouTube: EA Studio updates:Walk Forward optimization

In the video, you will learn what is the newest in EA Studio and how useful it could be to find even better strategies for trading.

Now we see the parameters in the different segments and a complete backtest with the last parameters:

We say that a strategy has passed the walk forward optimization if:

- all segments are validated

- the complete backtest with the last parameters is validated with the common acceptance criteria

- the new strategy is better than the original one

If you have questions, do not hesitate to ask me.

Cheers,

-

May 14, 2019 at 7:49 #12372

Petko Aleksandrov

KeymasterHi Petko, thanks for the video. I have watched it, but to be honest it is quite advanced for me. I will need to watch it again. I did not use the Walk Forward so far. You said you demonstrate it in Top 10 USDCAD course. Maybe I will have a look at this course first and then this lecture will make more sense to me.

-

May 15, 2019 at 20:12 #12401

Violet

ParticipantPetko, thank you so much for your work! I would not understand how the new features work if it is not your work! I really appreciate it!

The WFO looks really interesting and it gives weight to the recent period plus having the complete backtest validated is just fantastic!

-

May 16, 2019 at 18:16 #12417

Petko Aleksandrov

KeymasterHello Deniza,

Glad to hear from you. I am planning to record series of videos for EA Studio and FSB Pro that will be in help of the traders how to use the programs from A to Z. Similar to these videos but starting from the zero.

And yes, the WFO is quite interesting. I am still testing it a lot but got some decent strategies that are already on a live.

-

May 17, 2019 at 10:34 #12418

Petko Aleksandrov

KeymasterHey Petko, such videos will be very useful! Even I am already familiar with EA Studio I would be interested to have such videos just to be sure I am not missing anything. Also, it will be helpful for the new traders.

I really like the Walk Forward Optimization. I think the idea is great and I will test it out as well!

-

May 18, 2019 at 14:01 #12476

Petko Aleksandrov

KeymasterHey Van,

I am sure the videos will be very helpful to everyone. I will do my best to record those next month.

-

May 21, 2019 at 22:53 #12528

Deniza

ParticipantReally liked the last video for the Walk Forward Optmization. I did not imagine such analysis are possible.

-

May 22, 2019 at 22:12 #12545

Deniza

ParticipantHello Bob,

actually, the Walk Forward is a pretty old method. I am happy now it is in EA Studio and actually it was included in a great way.

-

May 29, 2019 at 11:01 #12669

Andi

MemberIt is great to have it now. I retested all of my EAs and removed 20% of them. Now I will need to catch it up with the number, but I always use it in the Reactor as you showed Petko!

-

June 3, 2019 at 7:44 #12942

Petko Aleksandrov

KeymasterHey Andi,

try not to “catch it up with the number” of EAs. This way you are forcing yourself to trade EAs that are not within your acceptance criteria or risk tolerance. You better trade with fewer EAs, but the right ones.

-

June 6, 2019 at 9:46 #13079

Petko Aleksandrov

KeymasterHello Petko,

Thank you for the advice, I get your point. I know that, but somehow I really force my self-trading with more EAs. This time I think to listen to you from the beginning, not after mistaken :)

-

June 11, 2019 at 10:08 #13377

Petko Aleksandrov

KeymasterHey Andi, you do not really need to listen to me. You have to trade the way you feel comfortable and convinced. I just share the mistakes I did in the beginning, and I hope others will not repeat them, ot at least minimize them :)

-

June 21, 2019 at 16:48 #14265

halvard

ParticipantHei Petko,

Is there a reason why you are using different settings on EURUSD / GBPUSD / USDCAD? Or is it just to show how to use the

different settings is EA Studio?

I have bought the courses for the different pairs, but got a little confused :).

Best regards

Halvard

-

June 22, 2019 at 8:18 #14304

Haliffa

ParticipantYes, I think Petko shows different ways to use the generator and the reactor in EA Studio. This way different strategies are created and better risk diversification is achieved.

I have all of his courses, and I am amazed by how he creates different EAs all the time. I know EA Studio and FSB are great pieces of software, I have been using them for over a year now, but it is important to use them the proper way. The programs just teach you how to trade as well…

-

June 22, 2019 at 11:45 #14319

halvard

ParticipantThank you :)

-

June 23, 2019 at 11:16 #14374

Haliffa

ParticipantHi Halvard,

yes, Haliffa gave you a nice answer. Creating strategies using different criteria will give you better diversification. For example, if you have strategies with smaller TP and SL, they will be more active and open and close a bigger number of trades. And having with a bigger range, the trades will last longer. Also, having strategies on different time frames is a great way to a wider risk-diversification.

-

July 10, 2019 at 8:24 #15788

Petko Aleksandrov

KeymasterHey Petko,

I got your courses 2 months ago, I watched nearly all of them, and just now I saw that topic…stupid mistake from me.

I will know to follow the updates at the beginning of the month.

-

July 11, 2019 at 21:46 #15884

Petko Aleksandrov

KeymasterHello Deenslavi,

here you can follow the updates of EA Studio as a software. Every new feature, change in some of the inputs, I normally do a video and post it here.

There is another topic with the Updates of the courses.

Cheers,

-

August 23, 2019 at 16:43 #18578

Petko Aleksandrov

KeymasterHey Petko,

Hope you and your team are fine! I was wondering if there will be an update with the EA Studio regarding the new changes on the Acceptance criteria in OOS and the Walk forward. I see that when I run OOS with the Walk Forward I do not get the green line as in the courses. I guess this is because of an update.

Appreciate your work!

Regards,

-

August 25, 2019 at 14:05 #18679

Petko Aleksandrov

KeymasterHello Andi,

yes, I will be recording such a video in the next days. Many of the users and students asked me about it, so the best will be to have a video. I will do my best to record it in the next 2-3 days.

Cheers,

-

August 27, 2019 at 9:16 #18899

Petko Aleksandrov

KeymasterHello traders,

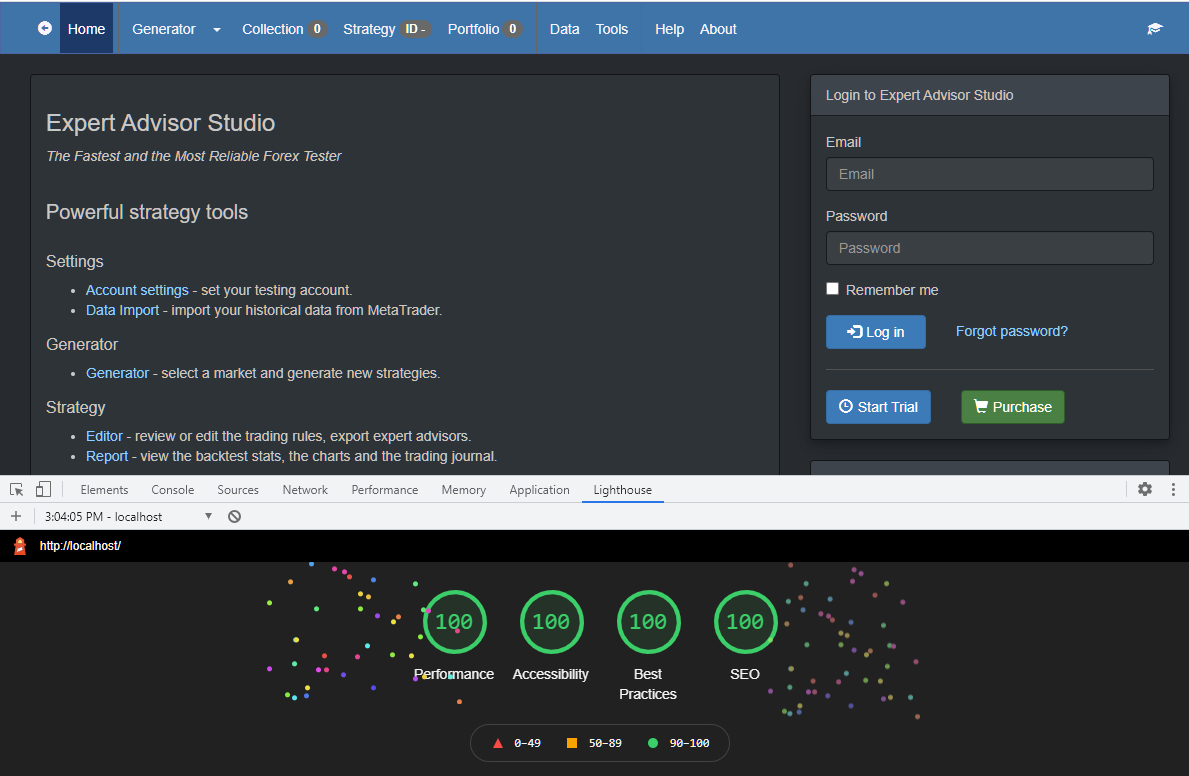

maybe some of you have noticed that there are new videos on the Landing page on EA Studio:

I decided to make a free start-up course about EA Studio which will help all traders that test the trial period. If you have already experience with EA Studio, I am sure there might be something new to learn.

On the right side, you can see each lecture, and you can click on it if you want to see specifically this video.

Also, we have already captions available in English, Portuguese(Brazil) and Japanese. There are some more languages coming up. If anyone likes to contribute to different languages, please let us know. :)

-

August 28, 2019 at 13:12 #19037

Petko Aleksandrov

KeymasterDear traders,

I have recorded and uploaded update video for the Walk Forward Optimization in the Reactor.

This video will be an update as well in the course Walk Forward optimization: Forex trading with Portfolio EAs

If you have any questions, let me know.

Regards,

-

August 28, 2019 at 23:58 #19126

Petko Aleksandrov

KeymasterThank you, Petko for the video! It makes a lot of sense now!

I couldn’t figure out why I do not see the green part in the strategies when following your method from the Walk Forward Optimization course.

Thanks for making these videos :)

-

August 29, 2019 at 18:53 #19170

Petko Aleksandrov

KeymasterThanks for the video, Petko!

Appreciate your work!

I have a question. I generated some EAs the way you show, but when I click on each one and perform the Walk Forward Optimization the strategy that shows up is not better than the original one? Why the Reactor lets it go in the collection?

Maybe I miss something?

-

September 7, 2019 at 8:06 #20692

Andi

MemberHello Mery, well if you have used the Walk Forward Optimization and you get any of the strategies from the collection, it means that the strategy already passed the Walk Forward Optimization. And you are doing WF optimization on the one that is already optimized.

This is why you do not see a better strategy because you are trying to optimize with WF the one that is already optimized. It is not the original one that you are having in the collection. We do not see the original because it was changed from the WF optimizer.

Hope that helps.

-

September 9, 2019 at 15:24 #20971

Thapelo

ParticipantO man, I tried as well the walk forward Optimization after having it in the Reactor. Andi is correct. We do not see the original strategy but the one that already passed the walk Forward Optimization.

-

September 10, 2019 at 15:56 #21041

fxtalant

ParticipantI see that there new EA Studio updates all the time. That is great. It is nice to have a software that is being developed.

-

September 13, 2019 at 17:15 #21372

Petko Aleksandrov

KeymasterHey Mery, Andy gave you a great answer.

When the strategy goes over the Walk Forward Optimization in the Reactor, it is being changed and you see the optimized new version. If you run it again you will most probably see worse strategy as in your picture.

No worries, it took me some time as well to understand the Walk Forward Optimization process.

-

September 24, 2019 at 22:45 #22292

Petko Aleksandrov

KeymasterHey Petko!

Very nice last video about the walk forward optimization! It has been a pain using it, just because I was not sure if I use it properly.

Now after watching that video it is much clearer for sure.

Thanks!

PS: Good point here Andi!

-

September 27, 2019 at 12:05 #22477

Petko Aleksandrov

KeymasterPetko’s videos are always helpful. I always watch some courses from time to time and I find always something I have missed.

Especially, the walk forward optimization course, I have watched it over 5 times…

-

September 28, 2019 at 10:33 #22537

Petko Aleksandrov

KeymasterHello traders,

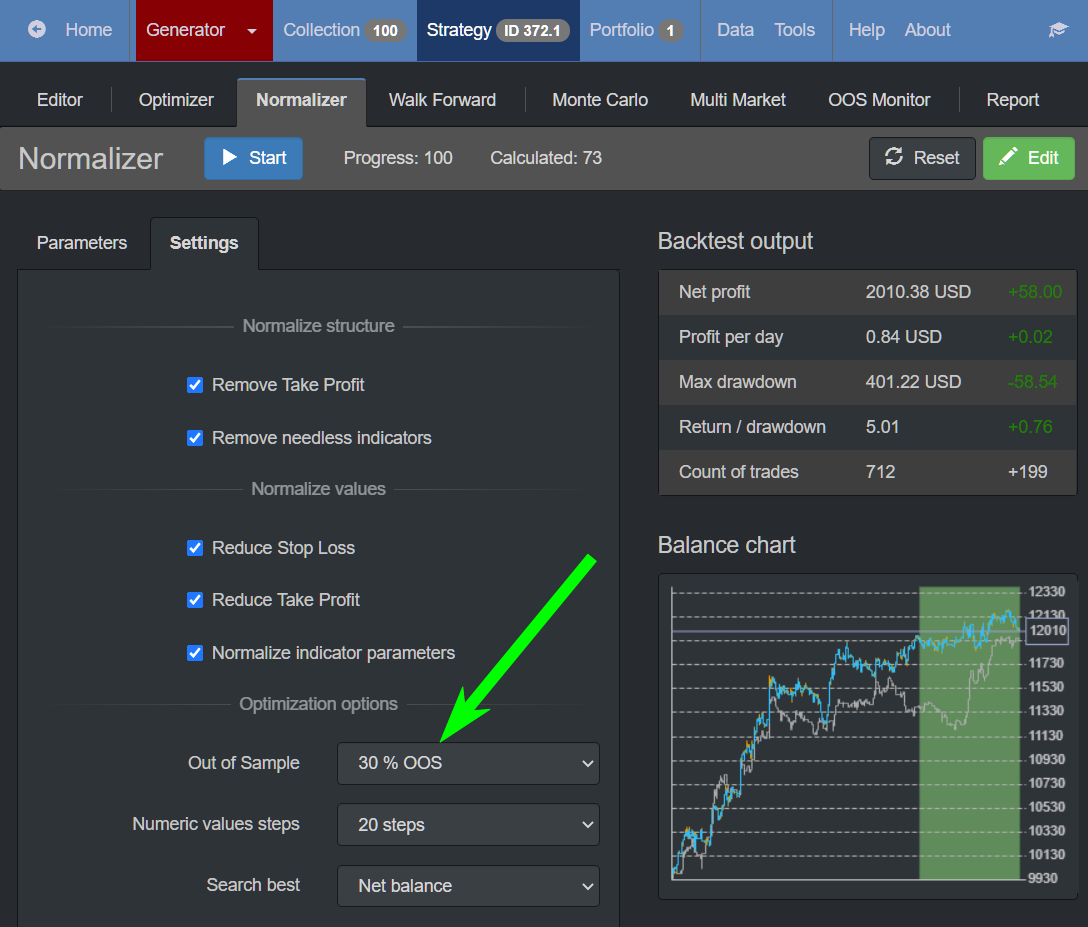

We have a great new feature in EA Studio since yesterday. It is called Normalizer:

You will find it right between the Optimizer and the Walk Forward Optimization. Actually it is something similar to the Optimizer but the idea is to improve the strategy by:

- Remove Take Profit

- Remove needless indicators

- Reduce Stop Loss

- Reduce Take Profit

- Normalize indicator parameters

The function will be integrated into the Reactor as well, and once it is, I will record a video about it.

Safe trading!

-

October 11, 2019 at 8:46 #23671

Thapelo

ParticipantHey Petko,

I really like the new feature Normalizer.

it took me some times to understand it, but after I did, I think it is amazing!

every option is very logical.

how ever I will be looking for a video which will be very useful for me.

-

October 14, 2019 at 13:01 #23823

Petko Aleksandrov

KeymasterHello Petko,

I am also looking forward the video for the normalizer. I find it very useful but before actually using it, it will be great to see your point of you.

Kind regards,

James

-

October 24, 2019 at 16:19 #24680

Petko Aleksandrov

KeymasterHello traders,

Sorry for the delay with this update, but here it is:

It turned out that the Normalizer is an excellent tool, and I will be using it more often.

I will implement it in the upcoming monthly updates for the courses.

Let me know if you have any questions.

Kind regards,

Petko A

-

November 3, 2019 at 6:27 #25866

forexmaniac

ParticipantHey Petko, thanks for the update. After going through the video I’m also of the same opinion. I think the Normalizer is a very effective tool. The videos you create are very helpful even to the beginner traders like myself, I must commend you on that.

Are there any updates we should expect in the near future? Please let us know.

-

November 4, 2019 at 20:22 #25992

james.makunike

ParticipantGood evening. I am new to EA studio so in case i enquire about a feature that already exist do forgive me. The EAs that you share with us monthly in some of the courses i would love an opportunity to bring back the EAs that i would have selected into EA studio so that i can further refine them

-

November 6, 2019 at 9:12 #26157

Petko Aleksandrov

KeymasterHello James,

yes, you can upload an Expert Advisor back if you go to the strategy editor, and after that, you click that arrow down on the left side of the Data resource:

Also, if you want to import not just one but whole portfolio or let’s say the 10 EAs from any of my courses, you can use the Validator.

Drop them there, filter if you wish with acceptance criteria and Monte Carlo and press Start. The EAs that go trough will show in the collection.

-

November 29, 2019 at 14:23 #28482

Jay-r Yuzon

ParticipantGood day Petko,

Regarding portfolio EA’s, you taught us in your courses how to edit the code of the portfolio EA especially on how to disable the trading of a particular EA within the portfolio. However, can you tell us how to adjust the position size as well? Where do we go in the code to do that, and what to do thereafter?

Cheers,

Jay-R

-

November 29, 2019 at 14:41 #28484

Petko Aleksandrov

KeymasterHi Jay-R,

the position size you can select it when you drag the EA over the chart. If you want to change it at one moment, just drag the EA again over the chart and select the new size. If you have already removed some of the strategies they will not apply because you would be using the new compiled Portfolio EA.

-

November 29, 2019 at 15:57 #28494

Jay-r Yuzon

ParticipantThanks Thapelo.

Yes, that would definitely be the method to be done if I want to change all of the position sizes for all of the strategies that are enabled to be traded within the portfolio ea.

I’m sorry for not being specific with my question, I meant suppose I would want to only change the position sizes of SOME of the strategies found within the portfolio but NOT ALL.

I’m assuming that it has something to do with altering the code itself?

Cheers,

-

December 2, 2019 at 10:18 #28789

Petko Aleksandrov

KeymasterHey Jay-R,

as far as I know, you can not do that. The size is one for all of the strategies in the portfolio. If it was possible it would be in the input menu. I am sure they can add that, it is an idea, but that will bring you far away from the diversification.

Because if you increase the lot of one strategy it is the same as trading one expert advisor with higher lots in the account. But if that one starts to lose, it will bring you more losses and the others won’t be able to compensate because they are trading with smaller lots.

The idea of trading portfolio experts or many experts in the account is to have equal lots so there will be risk-diversification.

-

December 3, 2019 at 4:37 #28917

Jay-r Yuzon

ParticipantNoted Bart. Thanks.

Yes, what I’m trying to do would definitely be contrary to the concept of diversification.

Currently, however, I’m using portfolio EA’s not for the purpose of diversification but simply to save space in my MT4 terminal while testing a number of strategies per currency pair.

Also, I’m still quite new in trading algos, and to be honest, I’m still not used to seeing a lot of magic numbers that’s why opted to test different strategies through portfolio EA’s to make things simpler initially.

I’ll get better through time =)

Cheers,

-

December 4, 2019 at 9:18 #28991

Bart Meijrink

ParticipantHey Jay-R,

Your idea is great! What you said that we could use Portfolio EAs to test the individual EAs, is a great idea! I never thought about it.

Let’s say we have 50 strategies, and instead of testing individually, we can test in 1 portfolio. Saving the collection will give us the idea after that of which strategies performed the best, or which ones are ot the top.

If the strategy ending on 005 makes the most profit, that would be the 5th strategy in the collection.

I will implement that from that week :)

Thanks, Jay-R!

-

December 5, 2019 at 11:47 #29064

Jay-r Yuzon

ParticipantHey Bart,

Glad to know that method of testing helped out =)

I hope it aids you to bank more pips.

Cheers,

-

December 5, 2019 at 21:08 #29086

Petko Aleksandrov

KeymasterHey guys,

that is quite an interesting discussion that you had right here :) Good job! This is how everyone progresses faster. Nice idea, Jay-R!

-

February 13, 2020 at 15:32 #37857

Petko Aleksandrov

KeymasterI really like these videos for EA Studio Updates. Petko explains very detailedly about every new feature.

I will be watching for your new videos.

Cheers

-

June 1, 2020 at 15:33 #50008

Petko Aleksandrov

KeymasterHello traders,

Last days I have recorded a video showing how to download Historical data from the Forex Historical Data App we have and how to make it work for any other broker’s data.

This is a great solution if you have a small number of bars, and you want to have more.

-

July 27, 2020 at 3:47 #55373

fxtadeusz

MemberHello

What is the difference between

free and paid EA Studio. -

July 27, 2020 at 8:38 #55377

Petko Aleksandrov

KeymasterHi there!

The free EA Studio allows you to use all the features – generator, optimizer, robustness tools, Historical data, etc. The thing you can not do with it is to export Expert Advisors (Robots).

But you can test it for 15 days with the free trial. You can export as many EAs as you wish. There is no limitation.

The only difference better the EA Studio license and the trial is that you can not export Portfolio EAs with the trial.

-

July 28, 2020 at 22:33 #55454

fxtadeusz

MemberThanks for the answer

this is what I ment. -

August 4, 2020 at 17:50 #55964

Petko Aleksandrov

KeymasterHey traders,

I have recorded a short video with some of the updates we have in EA Studio:

The generator is just the same, but it has a visual presentation of how every new and better strategy is performing compared to the previous one.

Also, you will see that we can limit now the number of Entry and Exit conditions.

Have a look at the video to make sure you are taking the most out of the software.

I will keep you updated with the recent improvements.

-

August 12, 2020 at 12:44 #56889

Petko Aleksandrov

KeymasterHello traders!

Here is another video with more updated on EA Studio:

-

December 1, 2020 at 15:27 #68128

[email protected]

MemberHi there,

I have been trying to upload my own EA (MQL4 and EX4 files) but it will not allow me to do so.

can you assist me with this as i try to drag and drop the files as well but I cant get anywhere!

Thanks!

Anthony

-

December 3, 2020 at 16:23 #68739

Akwin

MemberEmpowering us with such meaningful EA studio updates knowledge is a plus, it helps us to have a clearer picture for strategies.

-

December 6, 2020 at 9:42 #69102

Petko Aleksandrov

KeymasterHey Anthony,

Glad to hear from you.

You can not actually import external EA. What you can do is to build it using the editor. Use the User Guide for more info:

-

December 29, 2020 at 8:56 #70574

Omosisko

MemberPls is any subscription for 1month in fsb or Ea studio

-

January 4, 2021 at 15:12 #71077

Petko Aleksandrov

KeymasterHello Omosisko,

Welcome to the Forum!

FSB Pro comes only with a lifetime license. EA Studio has 3 months as a lowest plan.

Cheers,

-

January 5, 2021 at 18:30 #71467

Omosisko

Member- How much is each studio for 3month

-

January 6, 2021 at 8:09 #71640

Ilan Vardy

KeymasterHi Omosisko,

You can have a look at pricing for all plans using the link below:

Thanks,

Ilan

-

January 8, 2021 at 13:11 #71798

Nitin Rana

ParticipantIs there a way for the forum to show most recent updates on Page 1 rather than showing oldest post on page 1?

Thank you, Nitin

-

January 8, 2021 at 13:24 #71799

Nitin Rana

ParticipantHi Anthony,

You cant upload your own EA. However, since you have the code for the strategy, one think you can do is to create a strategy with and enter your criteria as an entry and exit condition and see how to match it closely to your EA and use EA Studio robustness tool to see how you can tweak it there. Another thing is if you think your strategy is good then you can backtest in MT4 directly also and see if that helps.

Hope this helps. Nitin

-

January 17, 2021 at 14:45 #73432

Petko Aleksandrov

KeymasterHey Natin,

That is not a bad idea, I will discuss it with the team.

Cheers,

-

April 5, 2021 at 9:52 #82351

Petko Aleksandrov

KeymasterHello traders,

EA Studio was updated multiple times during the last month, and here is the most important:

- Symbols settings were moved to Data.

- We have the option to set “Digit” in the Symbol settings page which solves the issue for the Historical data from brokers with different number digits

- The Volume indicators are marked as not recommended

- You can import up to 1 000 000 bars as a Historical data

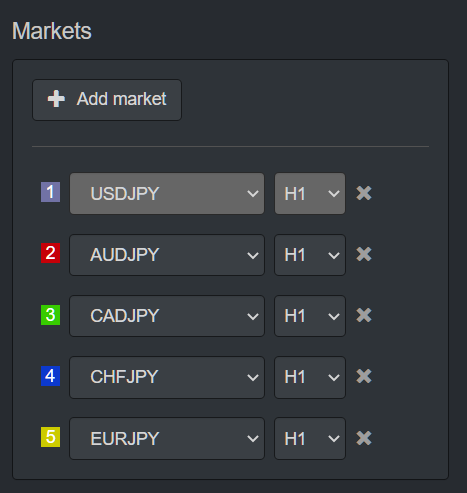

- Multi-Market adds relevant markets:

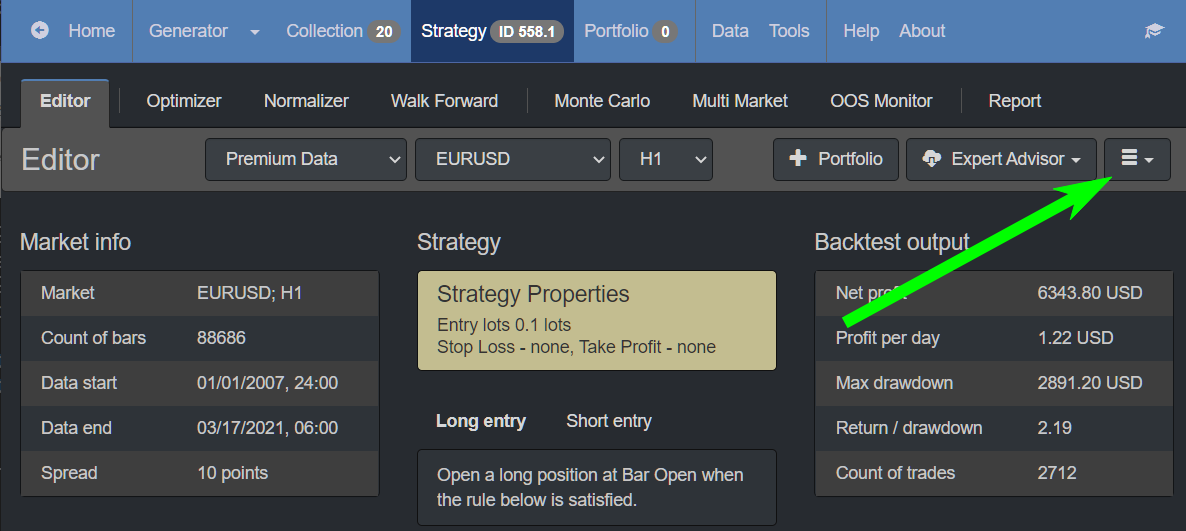

Also, the editor button is now on the right side:

OOS is now available in the Validator and the Reactor:

I am glad that Mr. Popov from Forex Software is working on the software and improving it all the time.

-

September 29, 2021 at 15:48 #96809

Manish Sharma

ParticipantHi,

I like the software. There are few suggestions that may already be in consideration or might be new:

– A complete portfolio backtesting with different time frames, different portfolio advisors, and instruments would add a massive value. Everything is there in terms of data, custom parameters but we still have to export the portfolios and test the cumulative drawdowns/margin required on demo account.

– % size lots rather than fixed will make the software scalable.

-

September 30, 2021 at 8:31 #98373

Petko Aleksandrov

KeymasterHey Manish,

Glad to hear you liked the video.

Yes, many people asked for the % size lots, but there are many concerns about it. If you trade many EAs in the account, each trade will open different sizes, and it will be hard to compare the EAs and decide which one had the best performance.

Also, deciding how much to trade is simple math, and actually, it is the professional approach to trade with fixed lots.

Regarding the complete Portfolio Backtesting, keep in mind that the EA Studio is limited with MetaTrader on the other end. And on MetaTrader, the EAs work on separate charts. The portfolio EAs work on a one-time frame and one asset. So even having a mixed portfolio in EA Studio would be useless because MetaTrader wouldn’t allow it.

Let me know if there is anything else. There have been many updates recently in the EA Studio, and I will drop them a bit later on this topic.

-

September 30, 2021 at 10:10 #98375

Petko Aleksandrov

KeymasterHey guys,

Here are some of the recent EA Studio Updates:

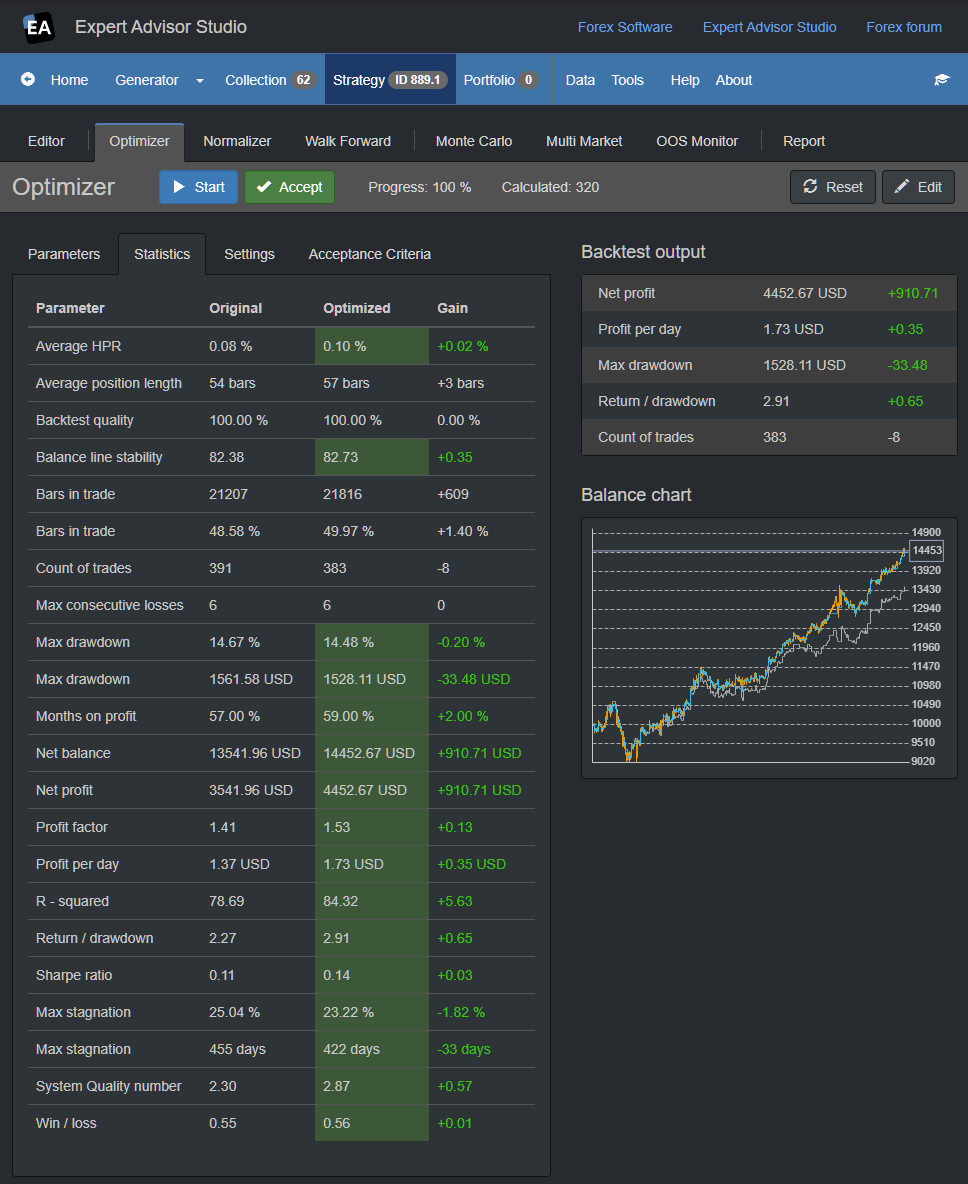

1. We see Statistics now when Optimizing or Normalizing the strategies:

2. A better User Interface. Now the program loads faster because the source code got 30$ shorter. This is because it uses no more bootstrap.js and jQuery.js. I have no idea that that is but that is the reason :)

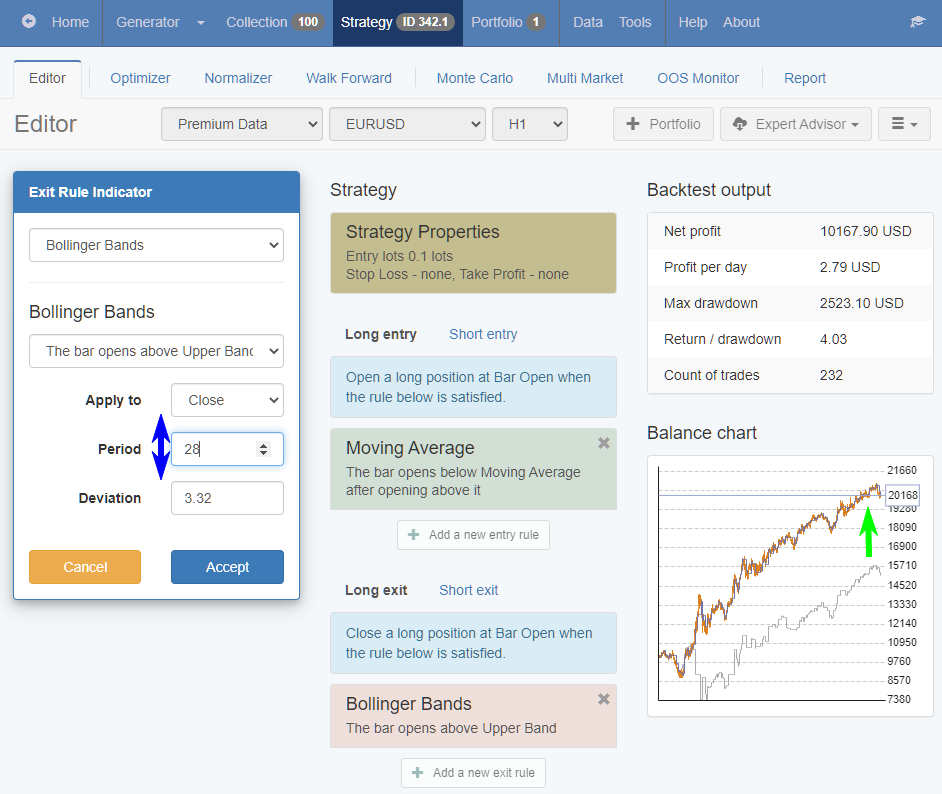

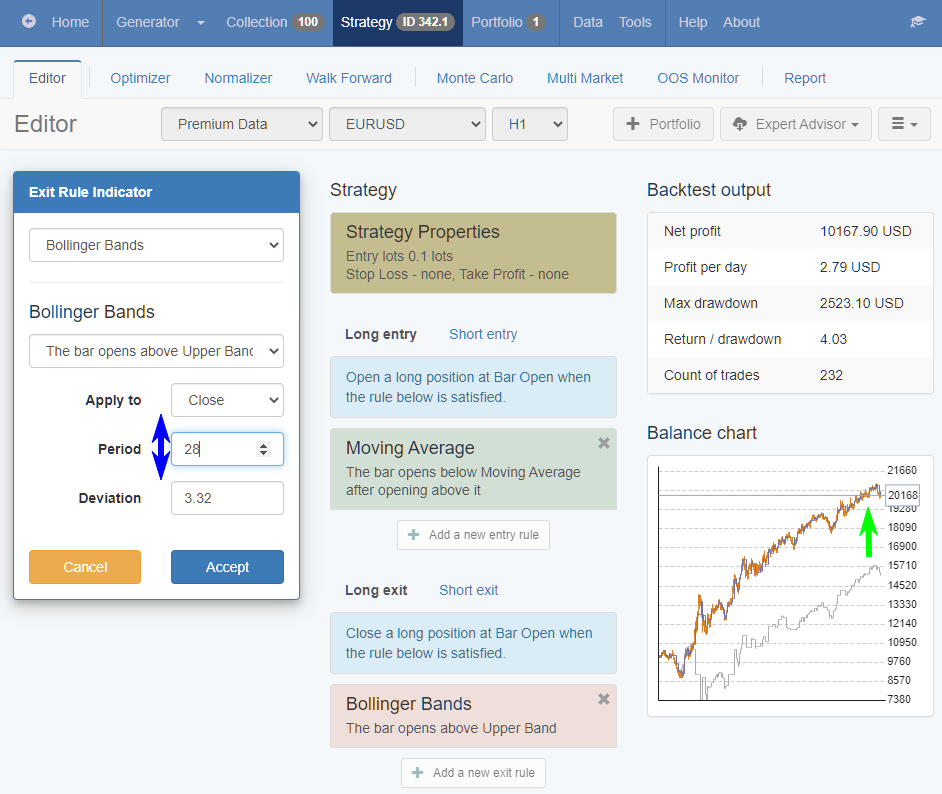

3. In the Editor we can change the values in the Indicators and the Editor will calculate the backtest in real-time:

4. Accept button added to the Optimizer and Normalizer. So if you decide to ”accept” the new values, you do not need to click on Edit as it was until the moment, but just click on Accept.

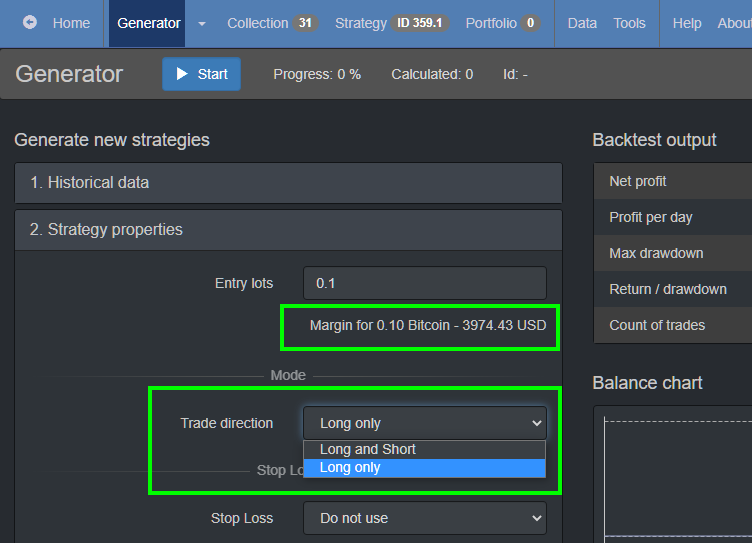

5. Margin requirements added in the Generator. This way you will know how much you need in order to use the strategies.

-

December 2, 2021 at 20:35 #102492

Petko Aleksandrov

KeymasterHey traders,

Two major updates in EA Studio:

1. Portfolio Expert Advisors are now available for MetaTrader 5.

2. You can download all the strategies from the Collection with one click as a zipped file. This saves a lot of time.

Cheers,

-

January 31, 2022 at 8:45 #103686

Katia Zaoe

ParticipantIs this trading robot still profitable?

Do you have a sample account that uses this trading robot for 2 years or more? -

January 31, 2022 at 8:46 #107963

Petko Aleksandrov

KeymasterHello Katia,

EA Studio is not a robot. It is software that generates, analyses, and backtests robots.

Please, have a look at the free course so you can learn more about it:

https://eatradingacademy.com/courses/algorithmic-trading/online-trading-course-ea-studio-start-up/

-

January 16, 2023 at 2:36 #140897

Alan Northam

ParticipantAdd Stop Loss in percent to individual strategy Report and and Portfolio Stats. Risk management suggests that each asset traded should not be greater than 2% of account balance. In the case of a portfolio containing multiple strategies it would be nice to know what the total risk is in percent. Knowing what the risk (SL) is in percent is crucial to proper risk management and should be included in EA Studio.

-

January 16, 2023 at 3:00 #140902

Alan Northam

ParticipantAlso, add Stop Loss as a filter to generator, reactor, and validator.

-

February 5, 2023 at 10:31 #143312

Petko Aleksandrov

KeymasterHey Alan,

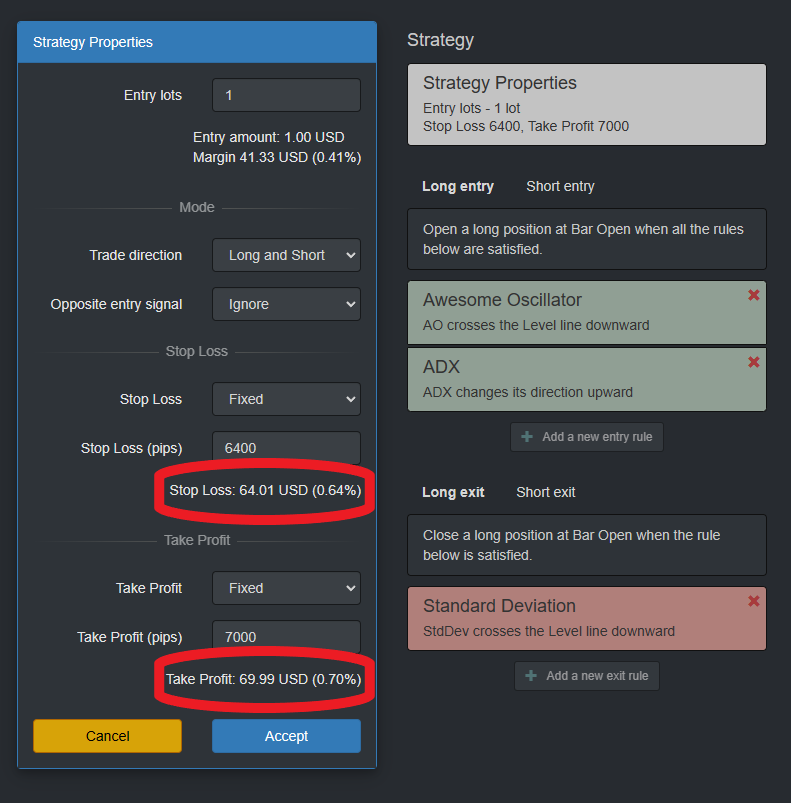

Such an update was recently launched. You can see what percentage is the SL or the TP.

I asked Mr. Popov about it sometimes, and he fulfilled the wish. But it’s not all the time. :)

-

February 6, 2023 at 19:05 #143551

Alan Northam

ParticipantYes if did finally see that after posting my request. However, I don’t see where it would add up all the SL and TP for a portfolio of strategies. Also would like to see this added to EA Studio!

-

-

February 28, 2023 at 10:53 #146098

Petko Aleksandrov

KeymasterHey Alan,

I have missed your answer here. I can’t understand what you mean. Do you mean to put SL and TP the same for all the strategies in a portfolio?

The portfolio is a collection of different strategies. So if you wish to have SL of 30 pips and TP of 60 pips, for example, you would need to generate such strategies with fixed SL and TP. Then when you add them to portfolio EA they would all have the same SL and TP.

Let me know if that is what you wanted to say.

-

March 1, 2023 at 18:59 #146247

Alan Northam

ParticipantDisregard! The Portfolio Stats, Max DD, answers my question. I think I must have been asleep when I asked the question :o)

-

-

March 1, 2023 at 22:22 #146262

Alan Northam

ParticipantPetko – I have taken another look at my original question and it now looks like the Portfolio Stats Drawdown does not answer my question. When I add up all the SL of all the strategies within my portfolio the total, in dollars, does not equal the Portfolio Stats Drawdown in dollars, infact, they are quite different. So, evidently the Portfolio Drawdown is calculated differently. So, what I have been doing is taking all the SL from each strategy within the portfolio, as you have shown in your earlier post above, and adding them up manually to determine my Portfolio Risk in Dollars and in Percent. The result is quite different than the Max Drawdown shown in the Portfolio Stats! It would be nice not to have to do this manually but to have the Risk added to the Portfolio Stats.

-

April 24, 2023 at 11:11 #154724

Petko Aleksandrov

KeymasterHey traders,

Here are the recent updated with EA Studio.

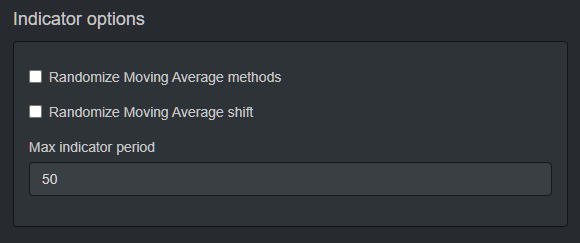

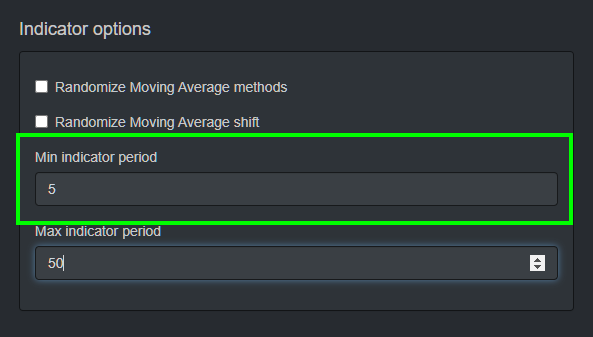

1. Indicator Options added in tools:

The max period for the indicators in the Editor is 1000.

Also, we have a min Indicator period that the traders can set:

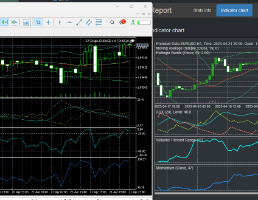

2. When we place the EAs on MetaTrader 5, the indicators will load automatically:

This is very useful to traders who want to improve the strategies behind the Robots.

-

August 16, 2023 at 16:02 #191585

Alan Northam

ParticipantPlease refresh EA Studio with Ctrl+F5 to be sure you have the latest version. It must be v23.8.16.

-

March 29, 2024 at 15:50 #245200

Marin Stoyanov

KeymasterHello dear traders,

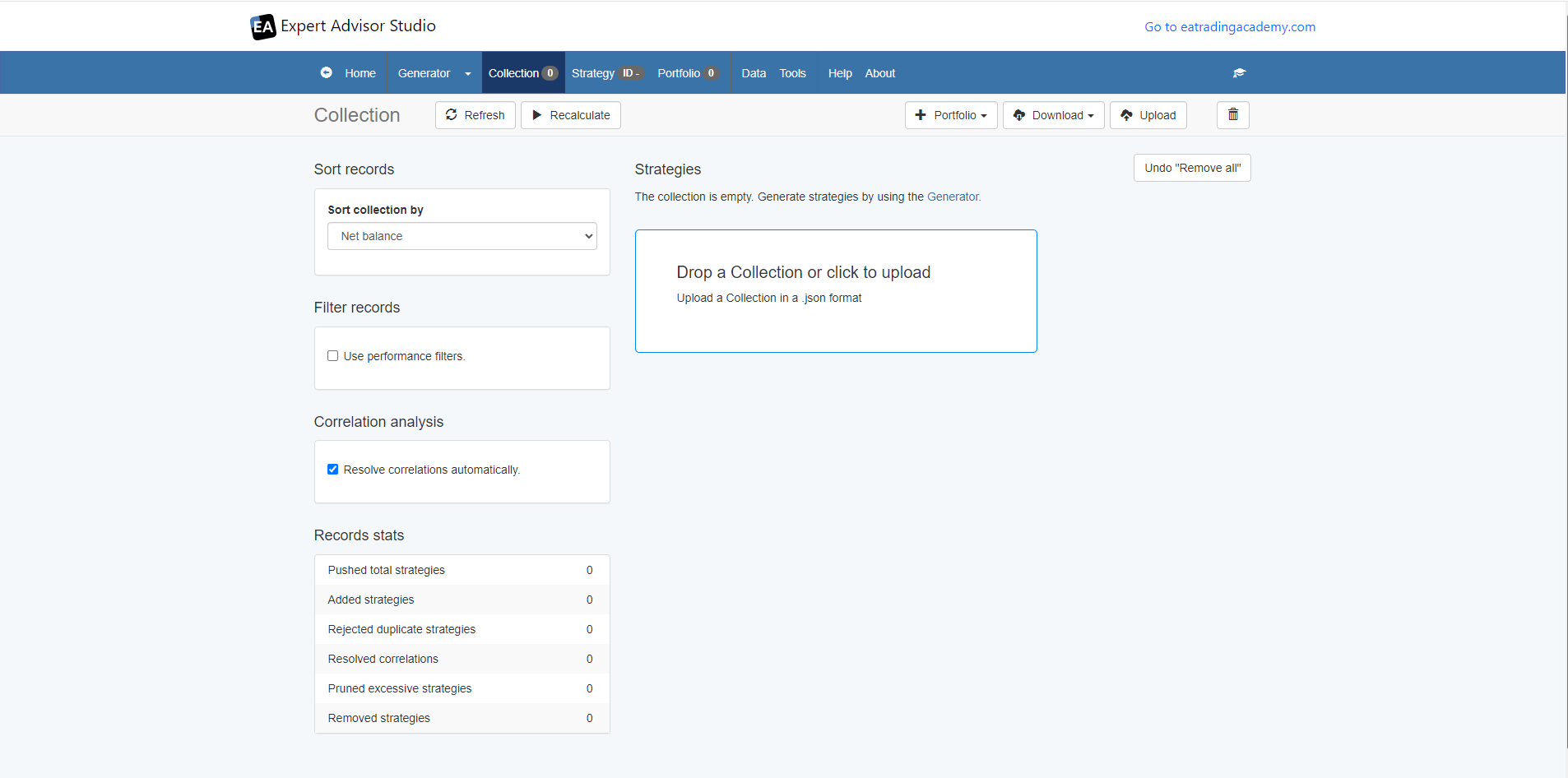

We are glad to tell you that there is a new update in EA Studio which can be helpful. This is what changed:

1. The Last Open Position stats from the Collection page and from the Balance chart is now removed.

2. You can now drag and drop your collections in the collections page if they you have a .json file of the collections.You can see in the image below how it looks:

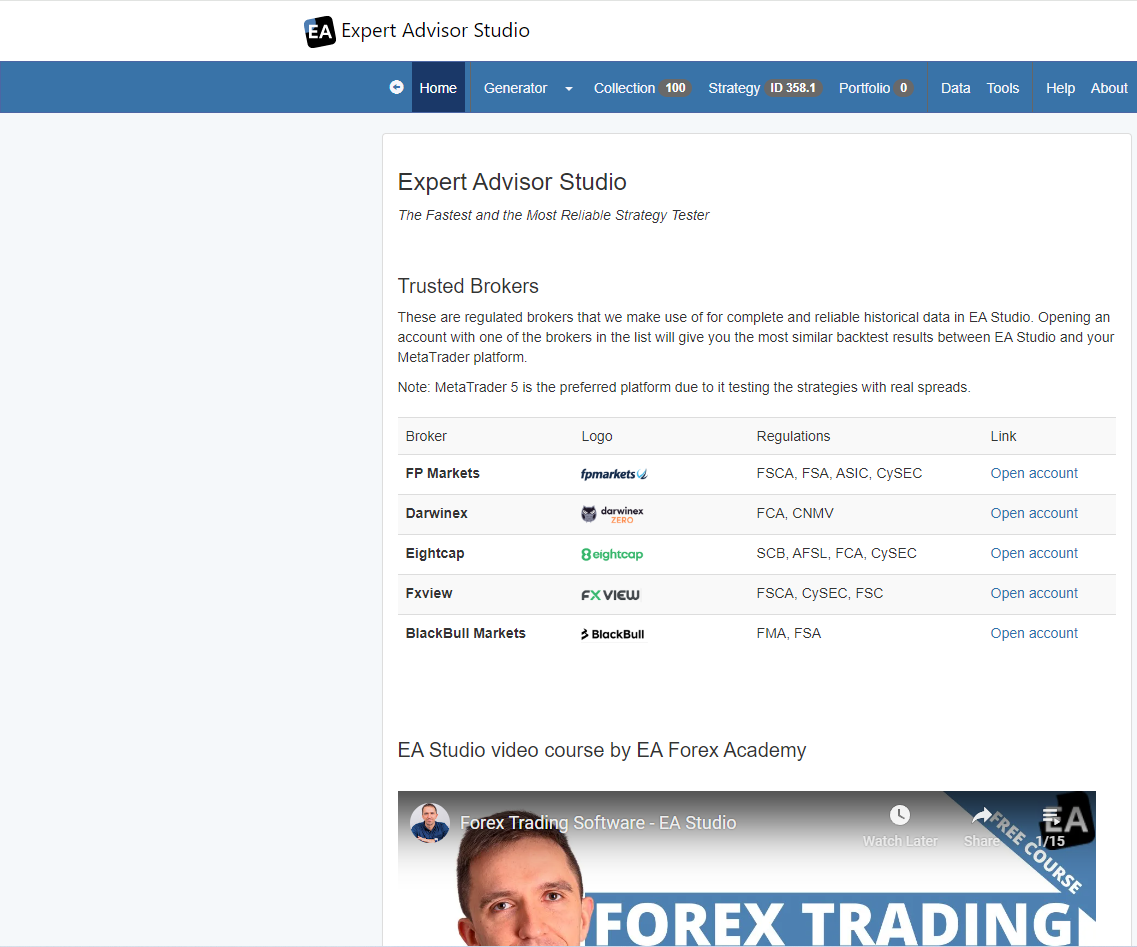

Also, another thing that changed is that now you can see all the trusted brokers that we have tested and the ones that work best with EA Studio in the landing page of EA Studio.

Let me know if you have any questions!

Kind Regards,

Nikos -

June 12, 2024 at 7:21 #260831

Zomclubnet

ParticipantThank you

-

June 12, 2024 at 10:30 #260846

NIKOS KYRIAKOU

ParticipantYou are welcome!

Kind Regards,

Nikos

-

-

-

AuthorPosts

- You must be logged in to reply to this topic.