Forum Replies Created

-

AuthorPosts

-

Alan Northam

ParticipantHi Traders,

Beginning traders believe all they need to do is to purchase an Expert Advisor, otherwise known as a robot or bot, add it to a trading chart and the profits will follow. This is not reality! In the forum I have seen traders take the Prop Firm robots and trade them successfully and end up with funded prop firm accounts. I have also seen traders take the Prop Firm robots and trade them unsuccessfully and blame the losses on the robots. While using robots that has been proven to be profitable is part of the equation, a traders strategy on how they trade the robots is just as important if not more important to successful traders. I have been trading since 1985, and many years ago I learned that every trader must develop their own trading strategy. Think about this; if there was one successful strategy for trading everyone would purchase it, use it, and get rich. This is not the case. What works for one trader does not always work for other traders. Every trader must develop a trading strategy that works for them. Developing a strategy that works takes time, patience, practice, and determination. There is an old saying: “If at first you don’t succeed, try, try, again”. This is definitely true when it comes to learning how to become a successful trader.

Alan,

Alan Northam

ParticipantHi Chandan,

All robots will have profits and losses. So there is no such thing as a perfect robot that does not make any loses.

How can I help you get started on the right track to being a successful trader?

What robots do you have?

What is your account size?

Is your account a prop firm account or a brokerage account?

Alan,

Alan Northam

ParticipantI wanted to wait for several weeks before responding to Petko’s request to share my workflow as I did not want traders to think it was just luck as to the progress made after just a week or two. I wanted traders to be able to see it in action over several weeks in order to give my workflow credibility.

My favorite time frame is M15. I used the last one year of historical data from Infinity Forex Funds. I also used the default Monte Carlo for my robustness test. The Acceptance Criteria was profit factor 1.2, count of trades 100. I did not use Out of Sample testing as I do this in real time on the actual brokerage server I use. From the collection I chose the strategies with a balance line that looks as close as possible to a straight upward sloping line.

While the above process of creating strategies has some importance, I do not believe it is the only thing of importance. I believe the most important part of trading the Expert Advisors is how you trade them. I have seen many traders take high quality Expert Advisors and try to trade with them and end up losing, and then blaming the EA. Beginning traders think all they have to do is purchase an EA slap it on a chart and the profits will come. I do not believe in this principle. I believe the trader has to properly apply a trading strategy in using the EAs to be successful. By following through my weekly reports I believe you will learn my workflow on how I am successful in trading Expert Advisors. I believe you can take this workflow and apply to any well created Expert Advisor and be successful at trading. However, I do not believe my workflow is the only workflow their is to being a successful trader as all successful traders have developed their own successful workflow. This is just simply the workflow I have developed to be successful at trading Expert Advisors. With practice and determination, you too, can develop your own workflow that makes you a successful trader.

Alan,

Alan Northam

ParticipantHi Traders,

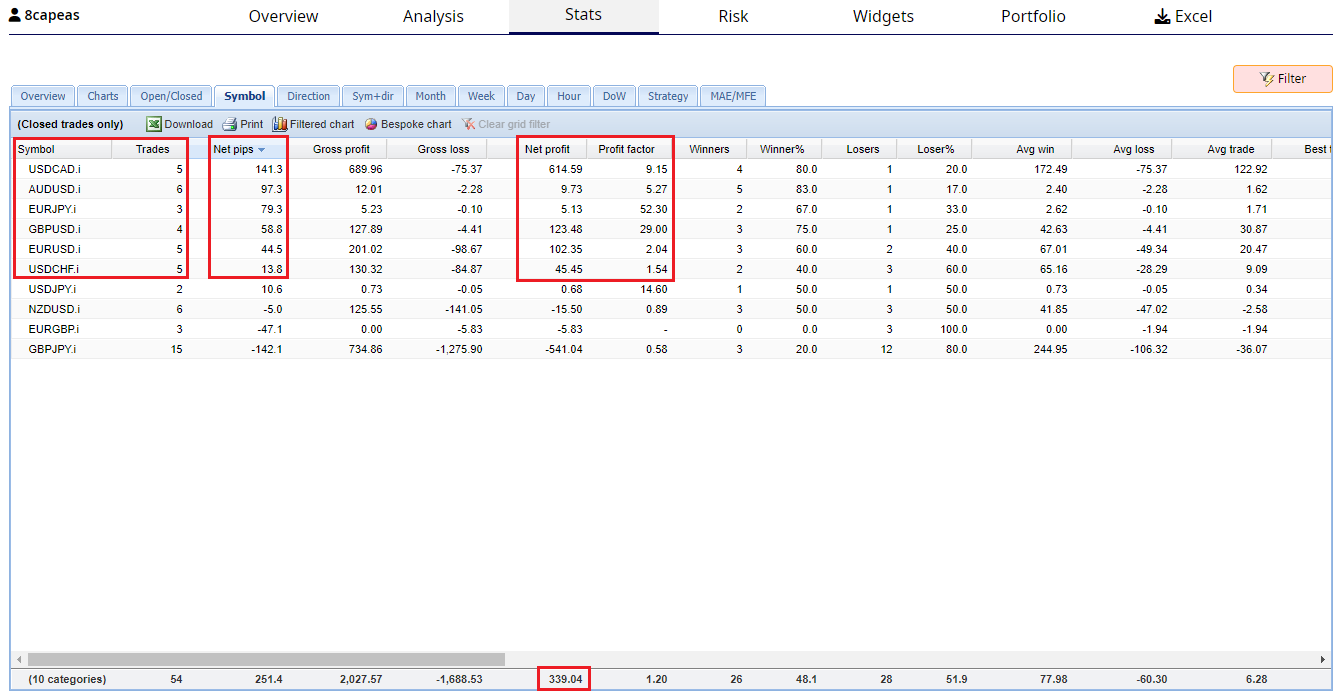

WEEKLY REPORT

Week of April 13, 2024 through April 20, 2024. The following are the nineth week results of trading 10 Expert Advisors (EA) I created using EA Studio. These Expert Advisors where then traded on my Infinity Forex Fund (IFF) 100K Algo One Step Evaluation account. I analyzed the results this week using FXblue where I sorted this past weeks trading results by the “Net pips” column from most pips gained to most pips lost this past week. I then looked at the Net Profit column to determine profits and losses for the week. The following are the results along with the changes made for trading next week:

This past week ended with a profit of $339.04 and an account balance of $109,534.84. The price target to become a funded account is $110,000. To reduce risk of this next week of significantly drawing down this account, since it is so close to hitting the price target and becoming funded, I am going to limit the risk to the account to 1%.

The top seven currency pairs this past week had a profit factor of 1.2 or greater. Of those top seven pairs I will trade the top 6 as the seventh pair (USDJPY) only had a profit of $0.68. I will adjust the lot size of these six currency pairs to have a 0.16% account risk each for a total account risk of 1%. The other four currency pairs will have their lot size adjusted to 0.01 lots.

USDCAD(+4.25%): 0.60 Lot size

EURUSD(+2.02%): 0.23 Lot size

AUDUSD(+1.31%): 0.33 Lot size

GBPUSD(+0.35%): 0.21 Lot size

EURJPY(+0.29%): 0.28 Lot size

USDCHF(+0.21%): 0.30 Lot sizeUSDJPY(+0.60%): 0.01 Lot size

NZDUSD(+0.37%): 0.01 Lot size

EURGBP(-0.02%): 0.01 Lot size

GBPJPY(-0.16%): 0.01 Lot sizeThis first chart shows the trading results for this past week:

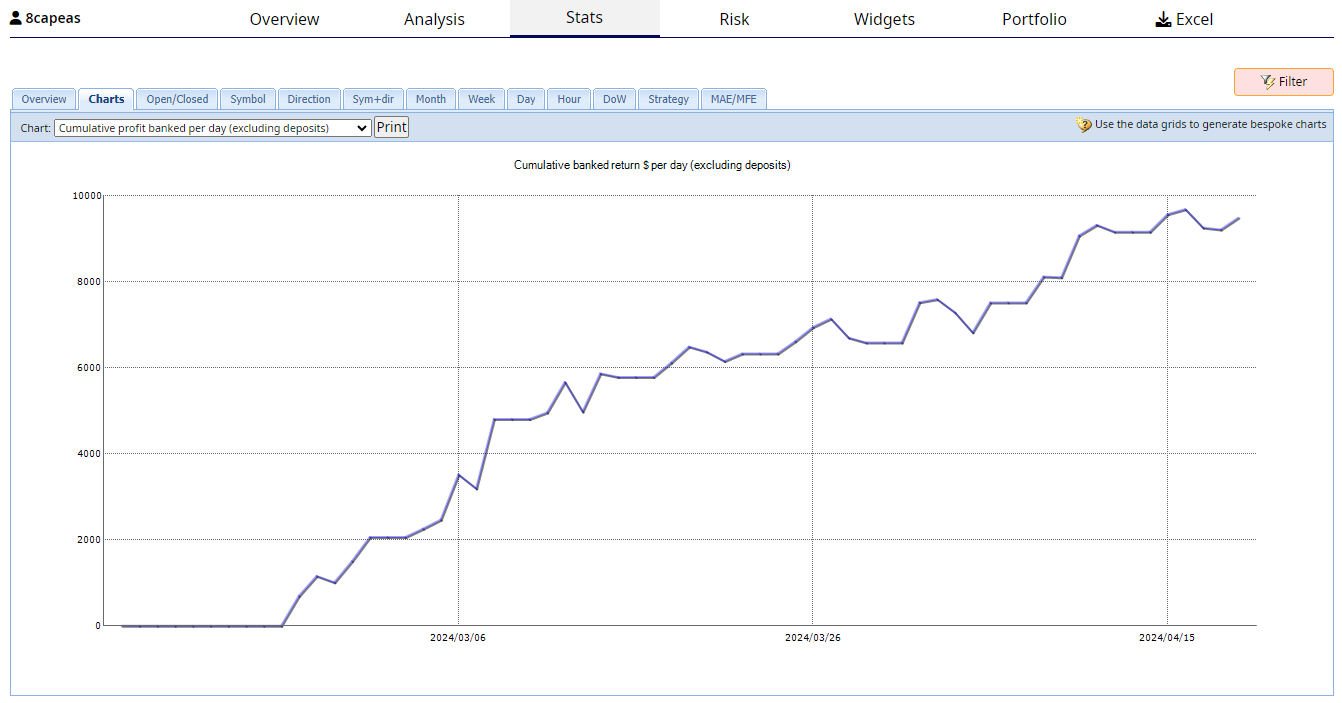

This chart shows trend line of the cumulative profit this week:

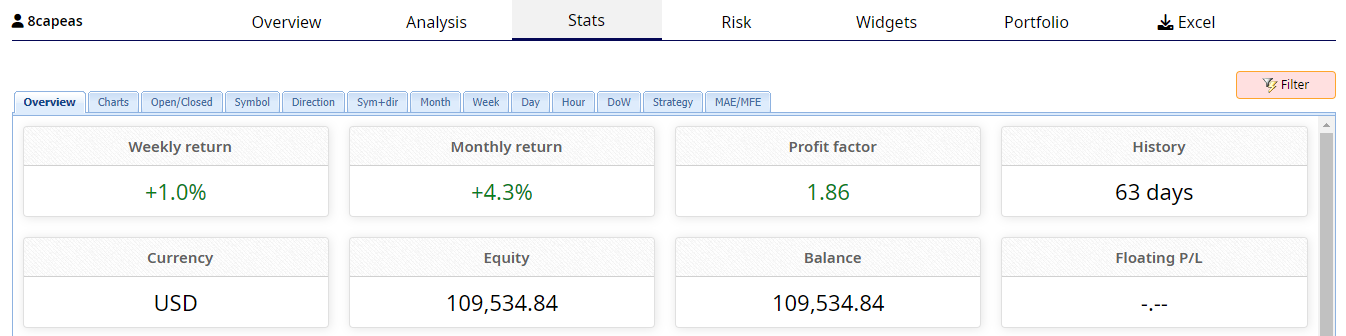

This chart shows the statistics of this account since inception:

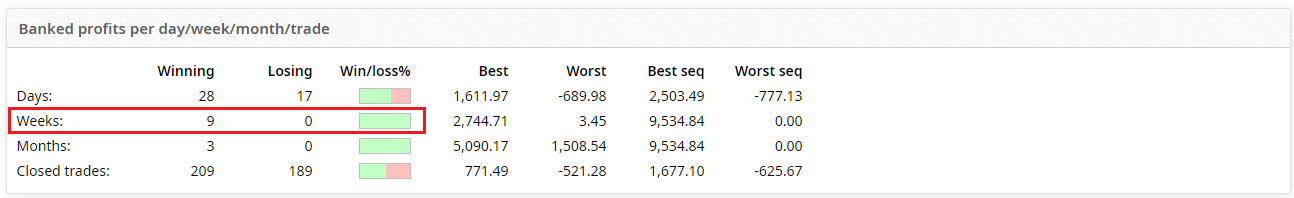

This chart shows all 9 weeks of this Evaluation has been profitable:

Alan,

Alan Northam

ParticipantHi Boyan,

Yes they are different apps. They have different strategies. The Prop Firm robots are best for using with prop firms. The Top 10 EAs are best used with brokerage accounts and are tested using the brokerage accounts listed. I would recommend using the same brokerage accounts.

https://eatradingacademy.com/premium-robots/prop-firm-robots/

https://eatradingacademy.com/premium-robots/top-10-forex-robots/

Alan,

Alan Northam

ParticipantHi Boyan,

I approved it so you can see it now. However, I do not cover those particular EAs so one of the other moderators will have to reply to your questions and concerns.

Alan,

Alan Northam

ParticipantHi Gregor,

I reviewed your FXblue results. I suggest keeping AUDCHF.pro and USDCHF.pro with current lot sizes. Change other lots sizes to 0.01. Each weekend sort by Net pips, largest to smallest. Then look at Symbols. Pick the ones that are in profit with profit factor greater than 1.2 and increase their lot size to the risk level you are willing to accept. Move all other assets to 0.01 lots. repeat each weekend. This is how I do it. I do not expose my account to more than 3%. For example, if I find 4 assets that have profit for last week and profit factor greater than 1.2 I set each of their lot sizes to represent 0.75% of account balance.

You can follow my topic from start to current status to get an idea of how I trade the robots. The robots I trade are my own but the workflow is the same:

Hope this will help get you going!

Alan,

Alan Northam

ParticipantHi erlas,

I can understand your frustration about not having success with trading. Losses happens to all of us. However, success comes from being persistent, and when we lose we try again. Trading the Prop Firm robots is no exception. Petko and other traders end up with funded prop firm accounts because when they lose the try again and again until they succeed with funded accounts. The Prop Firm robots can be used to achieve funded accounts. The Prop Firm robots have been backtested and forward tested and shown to be profitable. The following graphics show the latest published results of getting funded using the Prop Firm robots. I wanted to share these with you so you can see they are profitable.

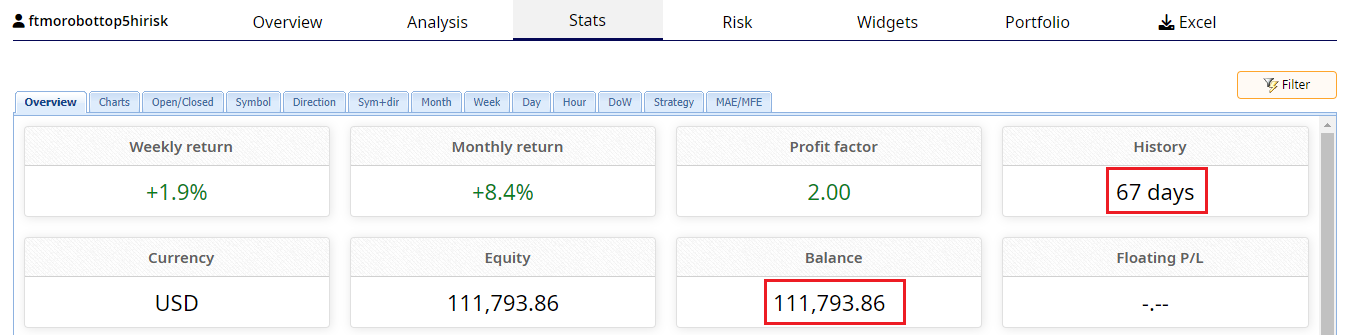

This first chart shows it too 67 days to become funded

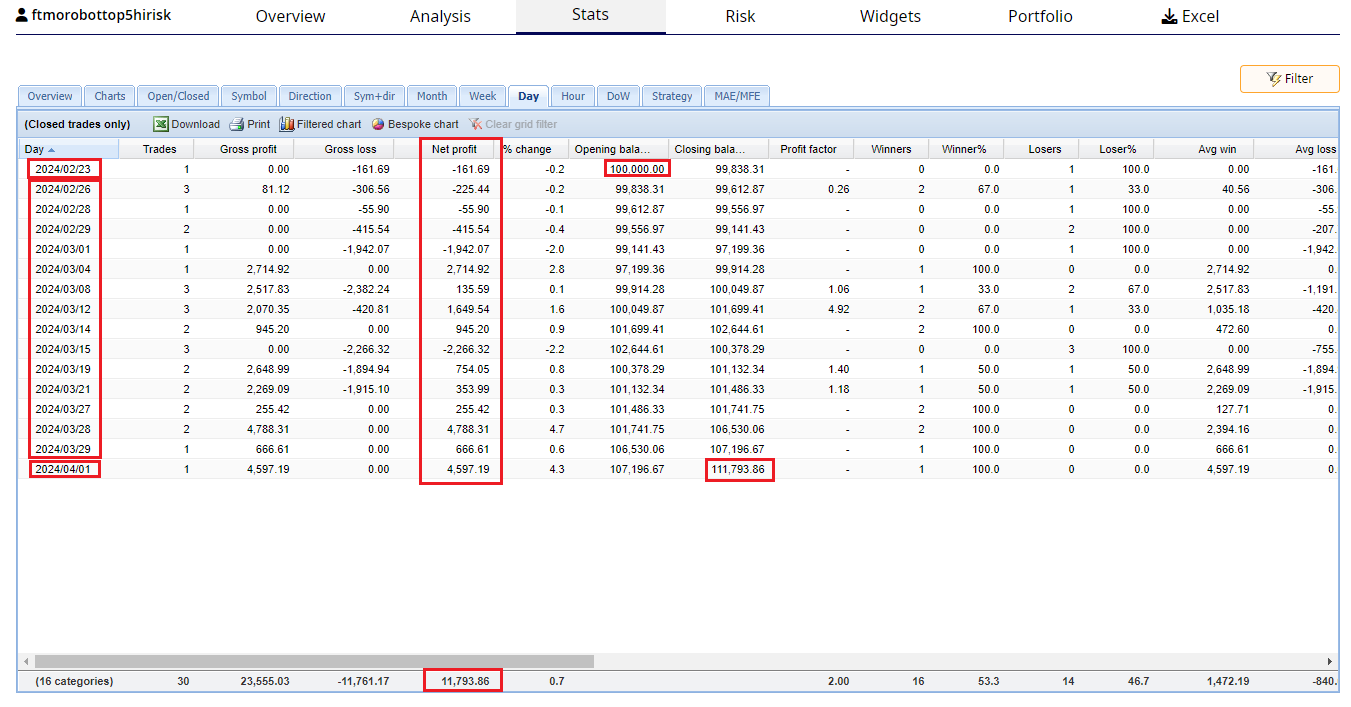

This chart shows the profit and loss of each trading day

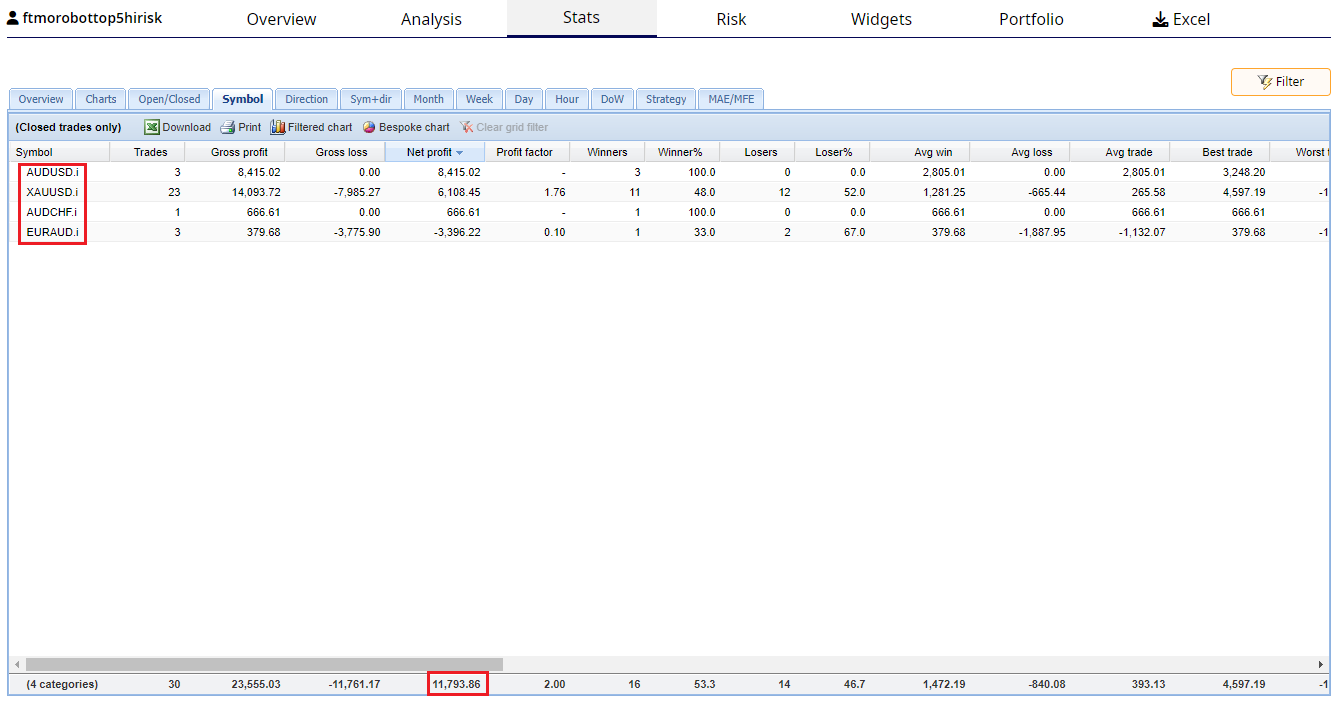

This chart shows which robots were chosen to trade from the weekly robots

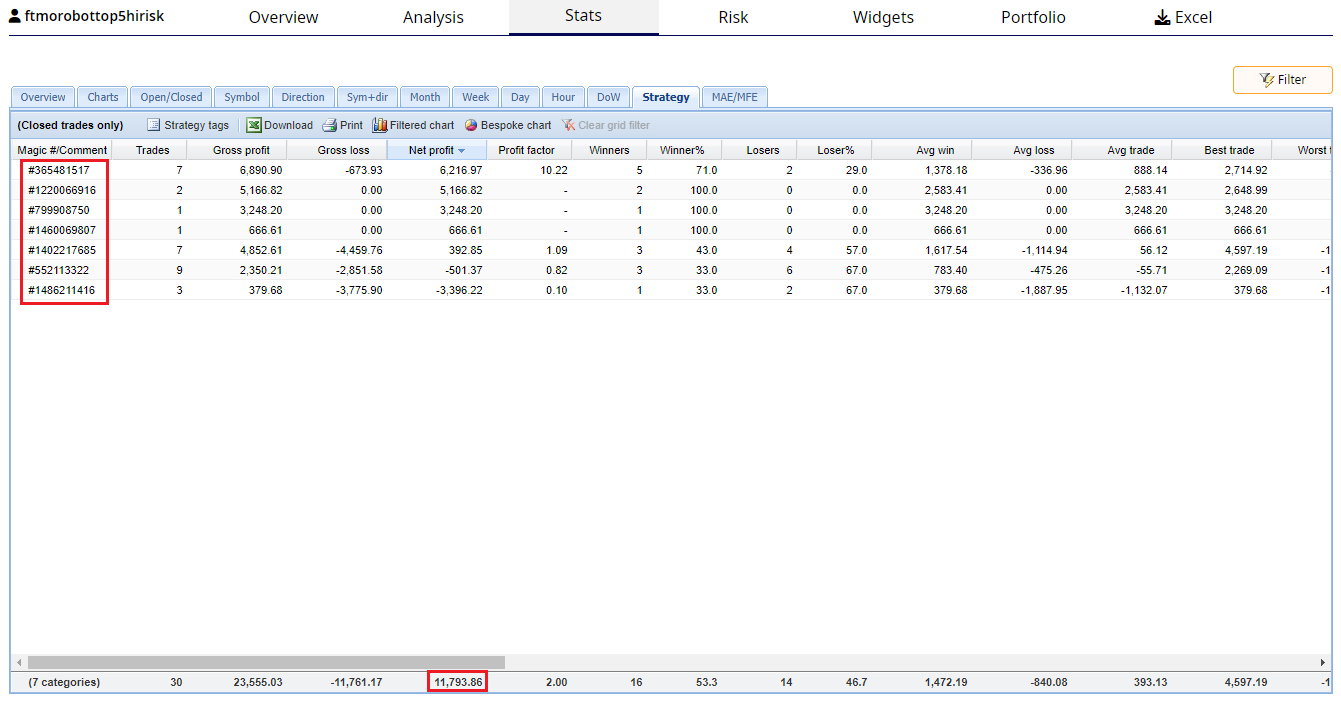

This final chart shows the magic numbers and also indicates 7 robots were chosen to trade

As you can see it is possible to become profitable with the Prop Firm Robots.

Here is the link to FXblue where I retrieved these charts:

https://www.fxblue.com/users/ftmorobottop5hirisk/statsAlso, the following link shows how I trade my robots. The robots were created by me but you can follow the same workflow with prop firm robots. Hope this helps!

https://eatradingacademy.com/forums/topic/ongoing-challenge-10-eas-from-ea-studio/Alan,

Alan Northam

ParticipantHi Andy,

This is why it is always recommended to test the Expert Advisors on a demo account until you feel comfortable they can be profitable.

Alan,

Alan Northam

ParticipantPlease do not use profanity!

Alan Northam

ParticipantHi Paul4x

This happens because the robots you downloaded do not match the account size so the robots turned themselves off to protect your account. For example, if you have a $10,000 account then you need to download the robots for a $10,000 account. Which robots did you install? Can you show a screenshot?

Alan,

Alan Northam

ParticipantHi Charles,

I will send this to support!

Alan,

Alan Northam

ParticipantHi Charles,

Did you make sure you were logged into your account?

Alan,

Alan Northam

ParticipantHi Ridwan,

When using M1 time period the length of time the out of sample time frame in which the EA will continue to work properly is usually from 10% to 30% of the historical data time frame. The yellow circled area looks to be within this 10% to 30% range.

Alan,

Alan Northam

ParticipantHi Chandan,

I can help you with filling in those values but I need to know the requirements from the prop firm. What prop firm are you using and what option from the prop firm did you choose?

Alan,

-

AuthorPosts