Home › Forums › Live Trading Results › Challenges › Ongoing Challenge: 10 EAs from EA Studio

- This topic has 20 replies, 1 voice, and was last updated 11 months, 4 weeks ago by

Alan Northam.

-

AuthorPosts

-

-

March 3, 2024 at 1:12 #239385

Alan Northam

ParticipantDear Traders,

This was a low risk challenge with average weekly risk less than 2%. Challenge was completed in 12 weeks.

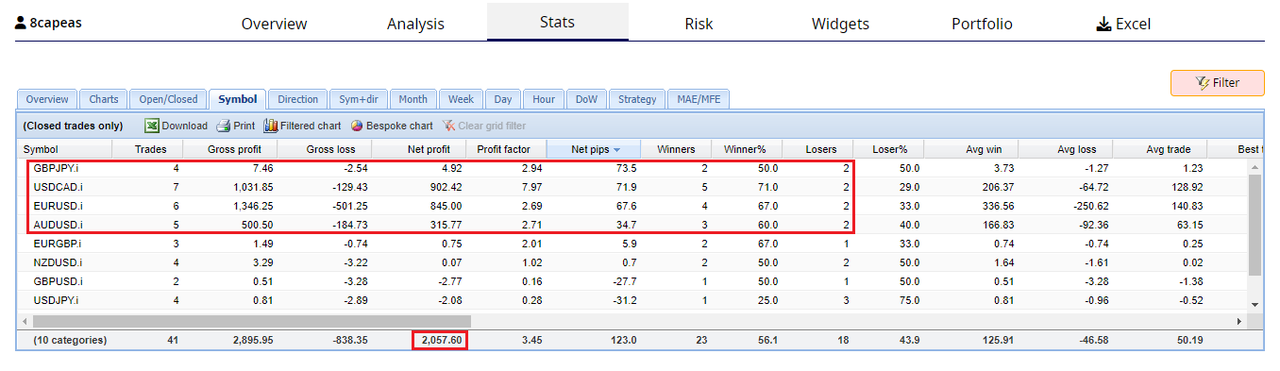

On the weekend of February 17, 2024 I created 10 Expert Advisors using EA Studio. I then installed them on my second Infinity Forex Funds (IFF) 100K Algo Evaluation account. I changed the lot size to 0.01 so I could evaluate how my Expert Advisors would work on the IFF account. On the following weekend of February 24, 2024 I analyzed the results on the following FXblue account. The following table shows the results. As can be seen EURUSD, USDCAD, and AUDUSD were the top 3 performers. I then increased the lot size to represent a 0.5% risk to my account balance.

This weekend of March 2, 2024 the table below shows the trading results. I sorted the table by the pips gained and lost during this last week of trading. The results of USDCAD, EURUSD, and AUDUSD show a nice profit for the week. Also notice the Top performer was GBPJPY. However GBPJPY was not chosen to trade as it was not in the top 3 chosen to trade the week before. As a result it traded this week with a lot size of 0.01 lots. Hence the reason for the very small profit. Note also this Expert Advisor gained the most pips for the week. As a result I will now add it to my trading list of EAs. I have increased the lots size this weekend to the lot size representing a 0.5% risk to my account. All together, I will be trading 4 Expert Advisors this next week, GBPJPY, USDCAD, EURUSD, and AUDUSD all with a 0.5% risk to my account for a total account risk of 2%.

Alan,

-

March 5, 2024 at 7:08 #239811

Petko Aleksandrov

KeymasterHey Alan,

You did a great job here! Congratulations!

Thanks for sharing the account and the results with the others.

Please share more about how you generated the EAs with EA Studio. This will be useful for all licensed EA Studio users.

-

March 10, 2024 at 15:37 #240778

Alan Northam

ParticipantHi Traders,

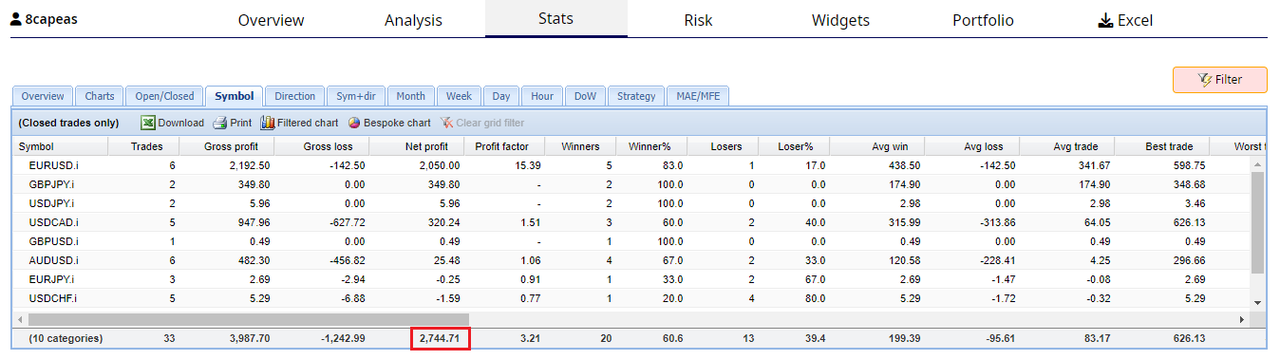

Week of March 3, 2024 through March 9, 2024. The following are the third week results of trading the 10 Expert Advisors (EA), I created using EA Studio, on my second Infinity Forex Fund (IFF) 100K Algo Evaluation account. To analyze the results of trading my EAs this past week I used FXblue and sorted the list by the “Net Pips” column from maximum pips to minimum pips. I then reviewed the Symbols column for the following results:

<b>EURUSD:</b> EURUSD was the top performer this week with a nice profit of $2050.00. I will continue trading this EA next week.

<b>GBPJPY:</b> GBPJPY was the second top performer this week with a nice profit of $349.80. Last week this EA was the top performer posting a small profit with a 0.01 lot size. I then reinstalled this EA with the normal lot size for an account risk of 0.5% adding it to my list of trading EAs.

<b>USDJPY:</b> USDJPY was the third top performer this week. The reason the profit was so small this week was because the lot size was only 0.01 lots. Although the lot size was so small it had the third largest pips for the week and is the reason why it came in third place. The reason why the lot size was so small is because I have been testing this EA over the last three weeks. I will now reinstall this EA so it will have the proper lot size for an account risk of 0.5%. I will trade this EA next week.

<b>USDCAD:</b> USDCAD came in fourth place this week with a nice profit of $320.24. I will continue to trade this EA next week.

<b>GBPUSD:</b> GBPUSD came in fifth place with a very small profit. The reason it came in fifth place was because it had the fifth largest gain in pips for the week. The reason for the small profit is because I have been testing it with 0.01 lot size. Because of the very small profit this last week I will not add it to my list of trading EAs.

<b>AUDUSD:</b> AUDUSD came in sixth place with a small gain for the month. This EA has a 0.91 lot size for an account risk of 0.5%. I will continue to trade this EA next week.The last 4 EAs remain in losing positions and will continue to be tested with a lot size of 0.01 lots.

<b>ROBOTS TRADING NEXT WEEK:</b> EURUSD, GBPJPY, USDJPY, USDCAD, AUDUSD.

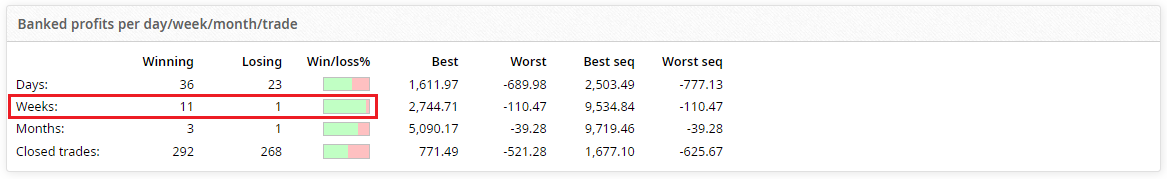

<b>TOTAL ACCOUNT PROFIT:</b> The total profit for this account last week was $2744.71. The total profit for this account since I have been trading it is $4805.76. This account is now half way to reaching its target price to pass the Evaluation!

<b>TOTAL ACCOUNT RISK:</b> The total account risk for trading this next week will be 2.5%.

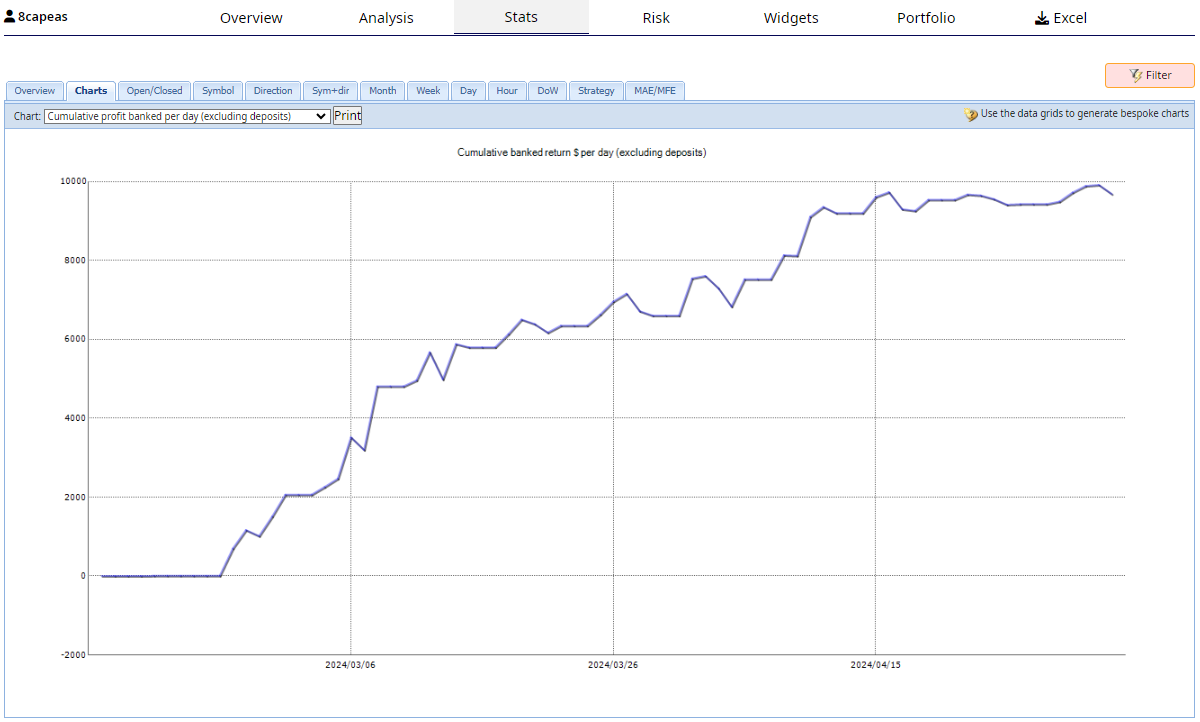

The following is the account stats from the beginning when I first started trading this account on February 17,2024.

Next update March 16, 2024

Alan

-

March 13, 2024 at 0:17 #241204

Angelo

ParticipantHello Alan,

great results and thanks for sharing, it would be great as Petko asked if you could share the EA creations process of thes 10 EAs.

Timeframe, data period, robustness test… any info is appreciated.

Happy challenge!

Angelo

-

April 21, 2024 at 12:28 #250250

Alan Northam

ParticipantI wanted to wait for several weeks before responding to Petko’s request to share my workflow as I did not want traders to think it was just luck as to the progress made after just a week or two. I wanted traders to be able to see it in action over several weeks in order to give my workflow credibility.

My favorite time frame is M15. I used the last one year of historical data from Infinity Forex Funds. I also used the default Monte Carlo for my robustness test. The Acceptance Criteria was profit factor 1.2, count of trades 100. I did not use Out of Sample testing as I do this in real time on the actual brokerage server I use. From the collection I chose the strategies with a balance line that looks as close as possible to a straight upward sloping line.

While the above process of creating strategies has some importance, I do not believe it is the only thing of importance. I believe the most important part of trading the Expert Advisors is how you trade them. I have seen many traders take high quality Expert Advisors and try to trade with them and end up losing, and then blaming the EA. Beginning traders think all they have to do is purchase an EA slap it on a chart and the profits will come. I do not believe in this principle. I believe the trader has to properly apply a trading strategy in using the EAs to be successful. By following through my weekly reports I believe you will learn my workflow on how I am successful in trading Expert Advisors. I believe you can take this workflow and apply to any well created Expert Advisor and be successful at trading. However, I do not believe my workflow is the only workflow their is to being a successful trader as all successful traders have developed their own successful workflow. This is just simply the workflow I have developed to be successful at trading Expert Advisors. With practice and determination, you too, can develop your own workflow that makes you a successful trader.

Alan,

-

-

March 16, 2024 at 16:21 #241895

Alan Northam

ParticipantHi Traders,

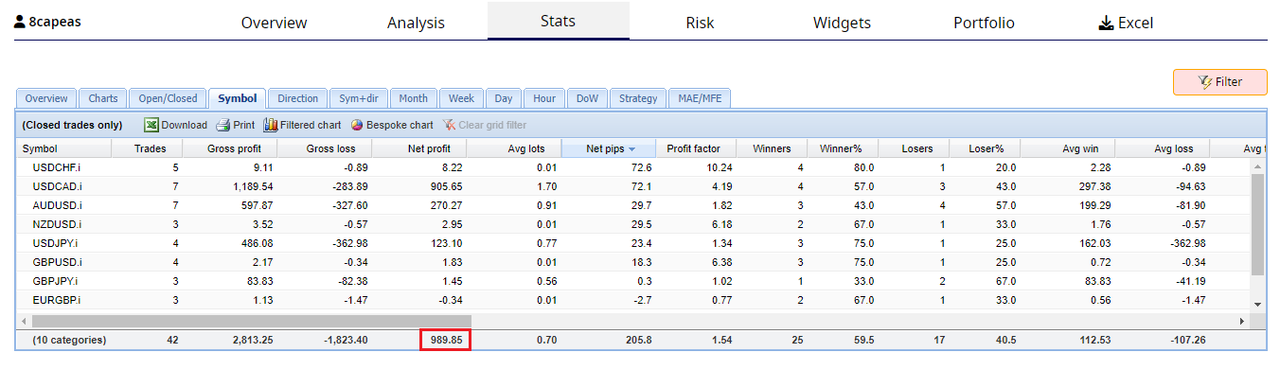

Week of March 10, 2024 through March 16, 2024. The following are the fourth week results of trading the 10 Expert Advisors (EA) I created using EA Studio. These Expert Advisors where then traded on my second Infinity Forex Fund (IFF) 100K Algo Evaluation account. To analyze the results of trading these EAs I used FXblue and sorted the list by the “Net Pips” column from maximum to the minimum. The reason I am sorting the list by “Net Pips” and not by “Profit” is because the lot sizes are not the same. I then reviewed thr results of the EAs by using the Symbols column. The following are the results along with the changes made for trading next week:

USDCHF: USDCHF was the top performer this week. The reason the profit was so small this week was because the lot size was only 0.01 lots as I have been testing this EA over the last four weeks. This is the first week this EA has risen among the top performing EAs. I will now reinstall this EA so it will have the proper lot size for an account risk of 0.5%. I will trade this EA next week.

USDCAD: USDCAD came in second place this week with a nice profit of $905.65. I will continue to trade this EA next week.

AUDUSD: AUDUSD came in third place this week with a nice profit of $270.27. I will continue to trade this EA next week. Last week this EA came in fifth place. I decided to continue to trade this EA as all EAs can go through a short period of drawdown. However, if this EA would have produced as loss this past week I would consider the trend has changed and would be reducing the lot size back down to 0.01 lots.

NZDUSD: NZDUSD came in fourth place this week. The reason the profit was so small this week was because the lot size was only 0.01 lots as I have been testing this EA over the last four weeks. I will now reinstall this EA so it will have the proper lot size for an account risk of 0.5%. I will trade this EA next week.

USDJPY: USDJPY came in fifth place this week with a nice profit of $123.10. This EA was first week this EA was traded with a 0.77 lot size representing 0.5% account risk. I will continue to trade this EA next week.

GBPUSD: GBPUSD came in sixth place this week. The reason the profit was so small this week was because the lot size was only 0.01 lots as I have been testing this EA over the last four weeks. I will now reinstall this EA so it will have the proper lot size for an account risk of 0.5%. I will trade this EA next week.NOTE 1: My account has now reached a maximum of 3% risk to my account. All other Expert Advisors will continue to be tested with a lot size of 0.01 lots.

ROBOTS TRADING NEXT WEEK: USDCHF, USDCAD, AUDUSD, NZDUSD, USDJPY, GBPUSD.

TOTAL ACCOUNT PROFIT: The total profit for this account last week was $989.85. The total profit for this account since I have been trading it is $5795.61. The profit target to complete the Evaluation phase is $8000. This account is now 72% of the way to reaching its target price to pass the Evaluation. This account could potentially hit its profit target of $8000 within the next 10 days!

TOTAL ACCOUNT RISK: The total account risk for trading this next week will be 3%. This account will not increase risk beyond 3%.

NOTE 2: This account has slowly increased risk each week as the account has been slowly becoming more profitable. Strategy: “Increase risk on strength. Decrease risk on weakness”.

The following is the account stats from the beginning when I first started trading this account on February 17,2024.

Next update March 23, 2024

Alan

-

March 23, 2024 at 13:03 #243574

Alan Northam

ParticipantHi Traders,

Week of March 16, 2024 through March 23, 2024. The following are the fifth week results of trading the 10 Expert Advisors (EA) I created using EA Studio. These Expert Advisors where then traded on my second Infinity Forex Fund (IFF) 100K Algo Evaluation account. I analyzed the results this week by two different methods using FXblue. First, now that I have good history on the performance of each EA I analyzed each EA by looking at their “Cumulative pips banked per day chart” over the last five weeks. I then chose the 6 best performing EAs. Second, I sorted this past weeks trading results by the “Net pips” column to determine profits and losses for the week. The following are the results along with the changes made for trading next week:

USDJPY: USDJPY moved from fifth place last week to first place this past week, based upon the number of pips made, with a nice profit of $528.79. It also had a nice “Cumulative pips banked per day chart” pattern. I will continue to trade this EA next week.

AUDUSD: AUDUSD moved from third place last week to second place this past week, based upon the number of pips made, with a nice profit of $914.55. It also had a nice “Cumulative pips banked per day chart” pattern. I will continue to trade this EA next week.

USDCHF: USDCHF moved from first place a week ago to third place this past week, based upon the number of pips made, with a nice profit of $605.00. It also had a nice “Cumulative pips banked per day chart” pattern. I will continue to trade this EA next week.

EURJPY: EURJPY came in fourth this past week, based upon the number of pips made, with a small profit of $55.86. This EA was not selected to trade this past week as it was not among the top six best performers. I will increase the lot size from 0.21 lots to 0.76 lots representing a 0.5% risk to my account balance. It also had a nice “Cumulative pips banked per day chart” pattern. I will trade this EA next week.

EURGBP: EURGBP came in fifth this past week, based upon the number of pips made, with a small profit of $1.63. This EA was not selected to trade this past week as it was not among the top six best performers. I will increase the lot size from 0.01 lots to 0.49 lots representing a 0.5% risk to my account balance. It also had a nice “Cumulative pips banked per day chart” pattern. I will trade this EA next week.

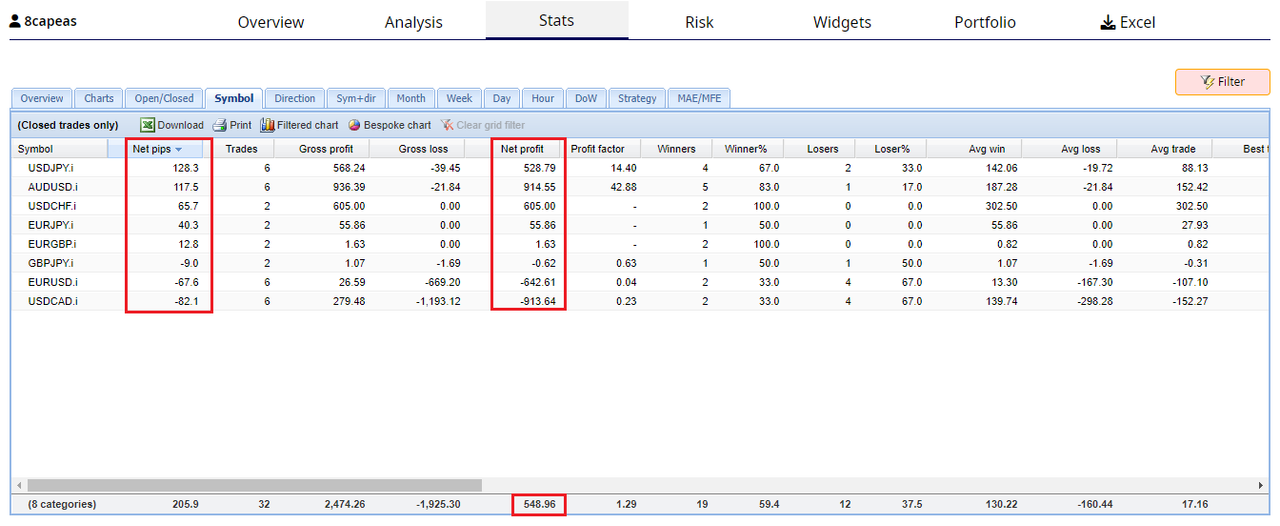

NOTE 1: EURUSD USDCAD and GBPJPY did not perform well this past week. Also GBPUSD and NZDUSD were not traded this week. These five EAs will be removed and replaced with new EAs. The new EAs will start with a lot size of 0.01 and forward tested this next week. If any of these five new EAs move into the top six best performing EAs this next week they will be chosen for trading the following week.

ROBOTS TRADING NEXT WEEK: USDJPY, AUDUSD, USDCHF, EURJPY, EURGBP.

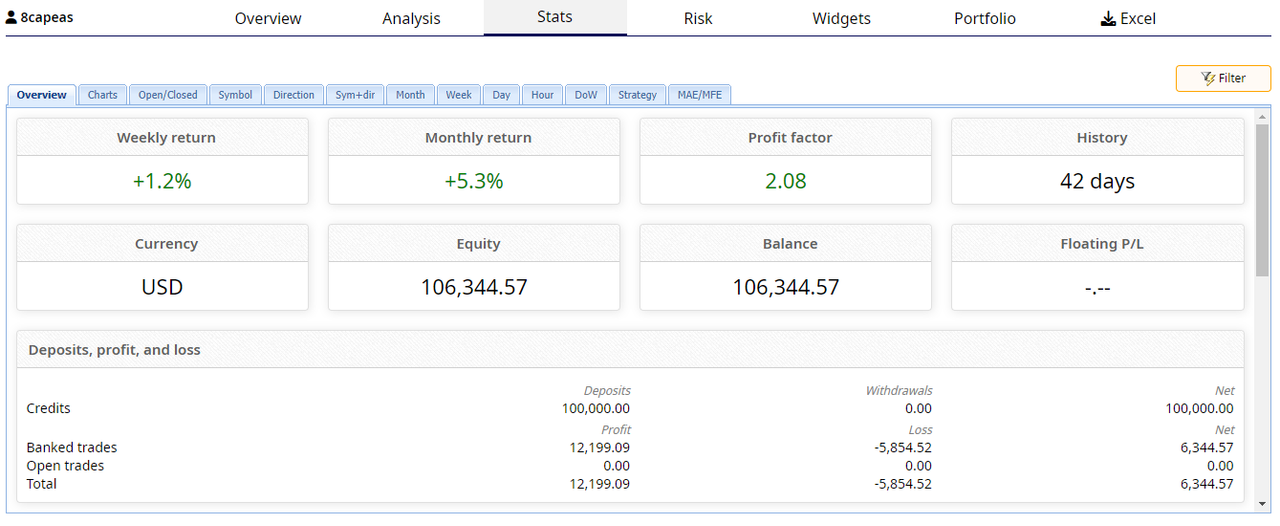

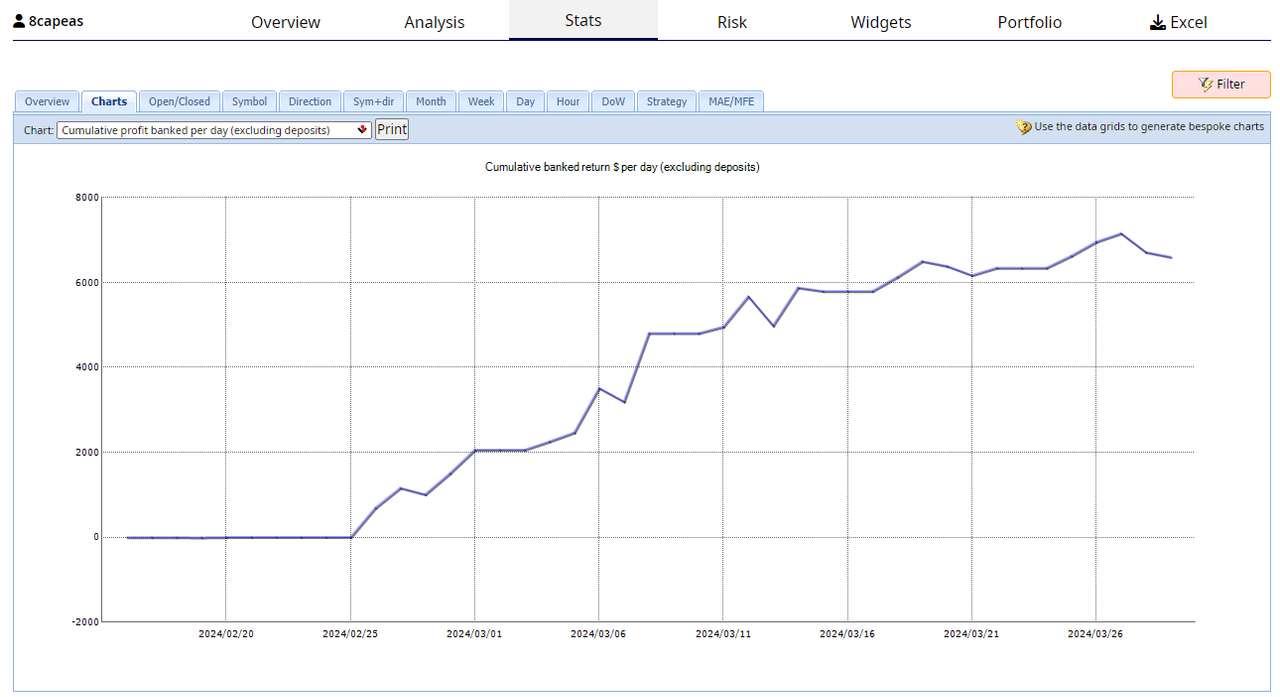

TOTAL ACCOUNT PROFIT: The total profit for this account last week was $548.96. The total profit for this account since I have been trading it is $6344.57. The profit target to complete the Evaluation phase and become funded is $8000. This account is now 79% of the way to reaching its target price to pass the Evaluation. This account could potentially hit its profit target of $8000 within the next 10 days!

TOTAL ACCOUNT RISK: The total account risk for trading this next week will be reduced to 2.5%. This account will not increase risk beyond 3%.

This first chart shows the trading results for this past week:

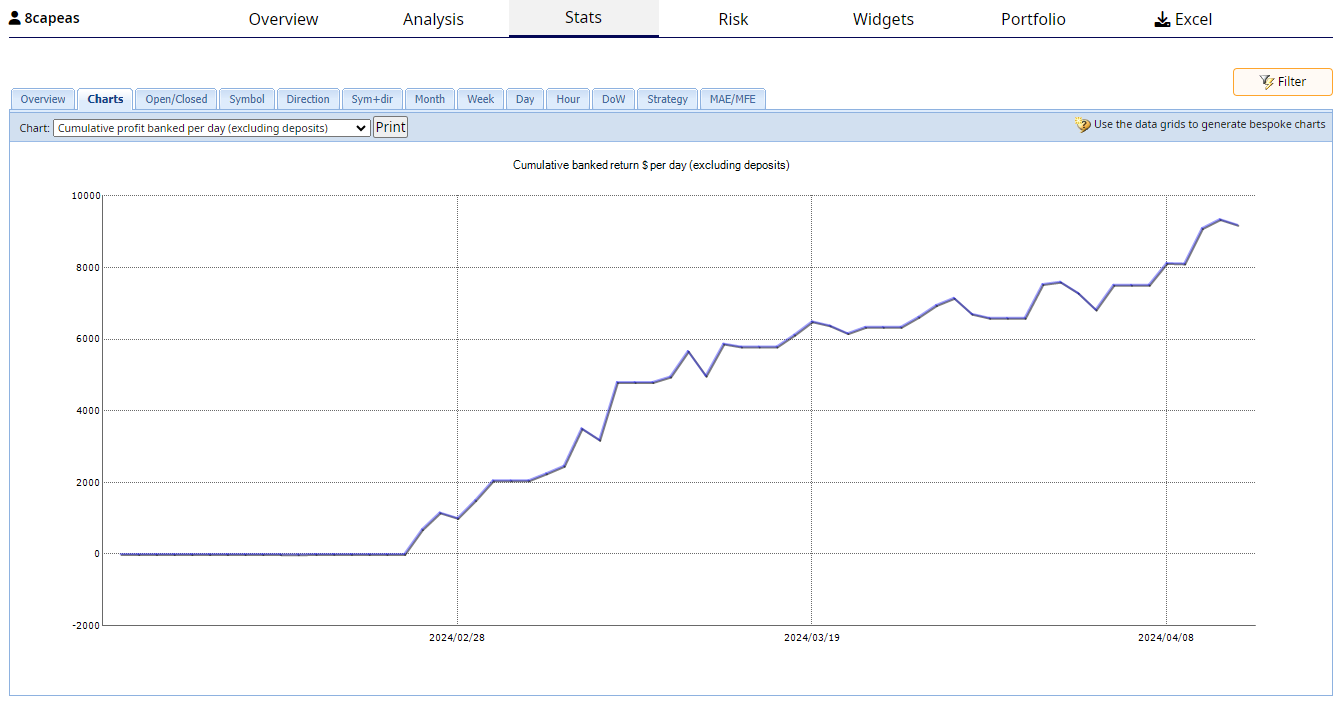

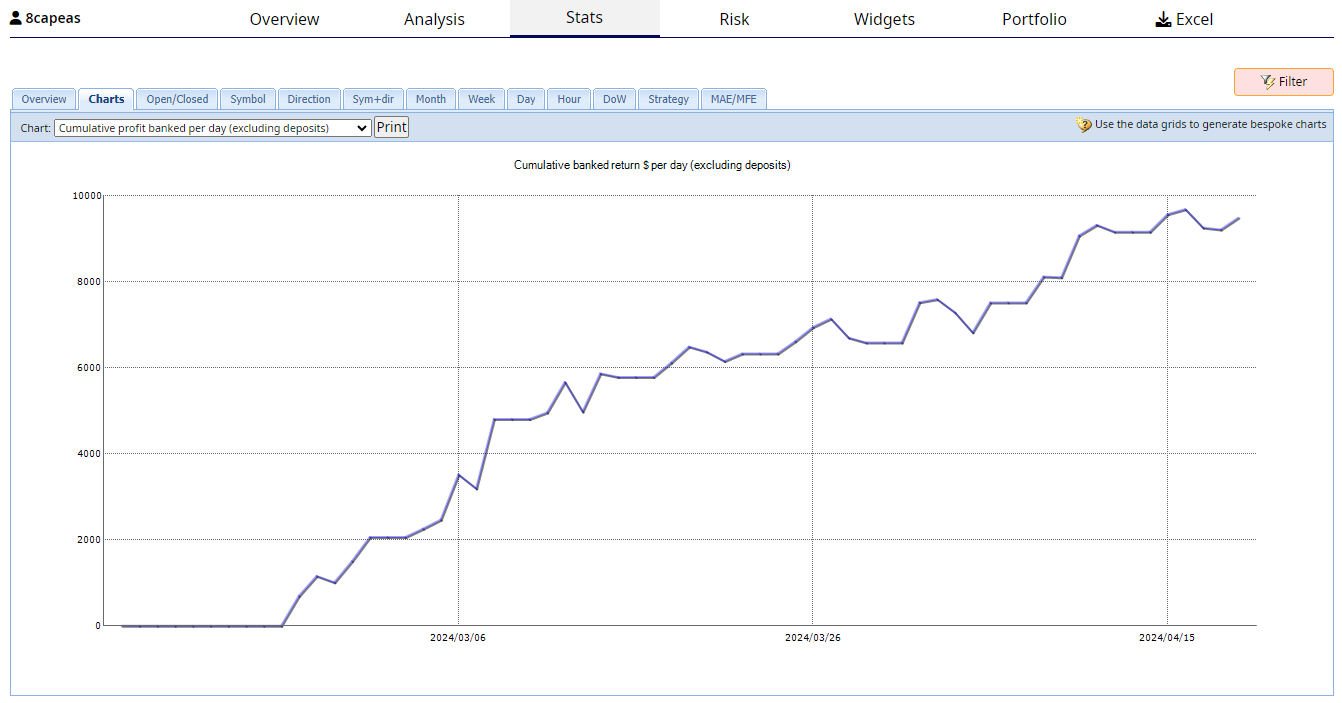

This chart shows trend line of the cumulative profit this week:

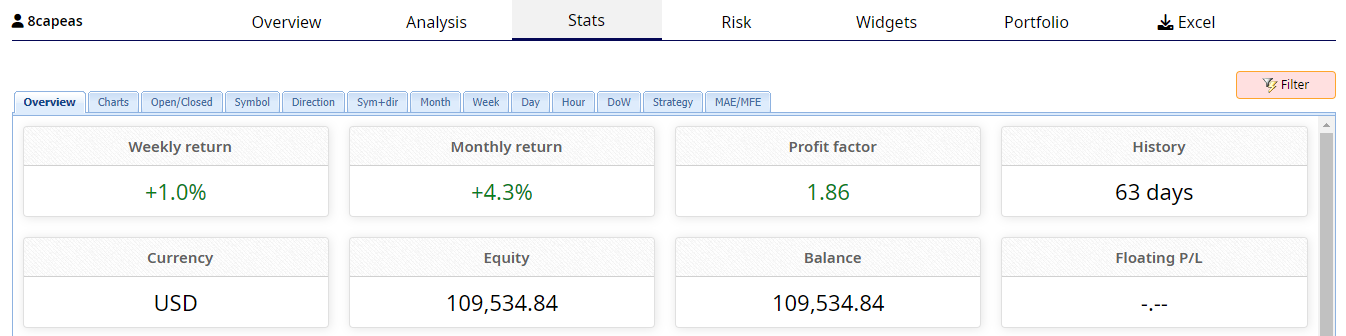

This chart shows the statistics of this account since inception:

Alan,

-

March 31, 2024 at 15:51 #245635

Alan Northam

ParticipantHi Traders,

Week of March 24, 2024 through March 30, 2024. The following are the sixth week results of trading 10 Expert Advisors (EA) I created using EA Studio. These Expert Advisors where then traded on my second Infinity Forex Fund (IFF) 100K Algo Evaluation account. I analyzed the results this week using FXblue where I sorted this past weeks trading results by the “Net pips” column from most pips gained this past week to most pips lost. I then looked at the Net Profit column to determine profits and losses for the week. The following are the results along with the changes made for trading next week:

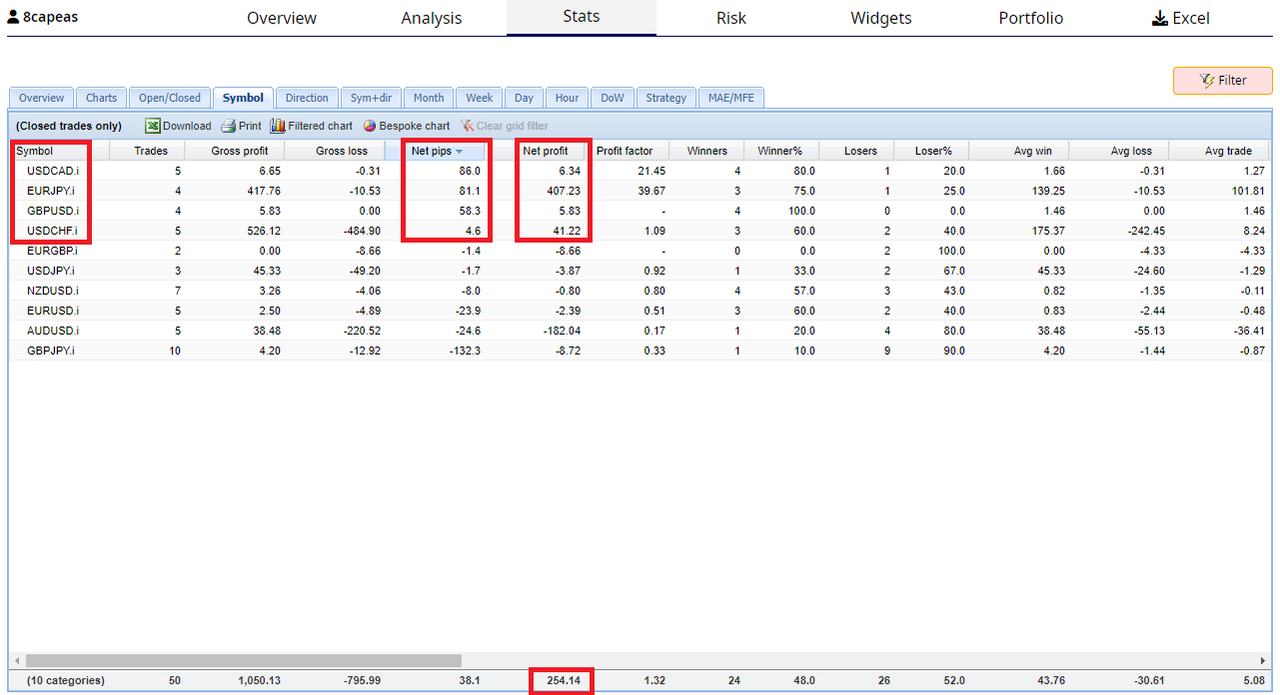

USDCAD: USDCAD was the top performer this past week. I have increased its lot size from 0.01 to 1.6 lots and will trade it this next week.

EURJPY: EURJPY Moved into second place this past week. I will continue to trade it next week.

GBPUSD: GBPUSD Came in third place this past week. I have increased its lot size from 0.01 to 0.56 lots and will trade it this next week.

USDCHF: USDCHF Moved into fourth place this past week with a small profit. Even though this Expert Advisor posted a small profit this last week it also had big losses and will have its lot size reduced to 0.01 lots to reduce risk of additional losses this next week.

NOTE 1: AUDUSD, NZDUSD, EURUSD, GBPJPY, EURGBP, USDJPY all had losses this past week. They will all have lot sizes reduced to 0.01 lots and will continue to be traded this next week.

NOTE 2: In the past weekly reports I was thinking this was a two phase challenge to get funded. Under that assumption I would have only needed to have a profit of $8000 to move to the second phase of the challenge. However, this challenge is actually a one step challenge to get funded. This means I must reach a $10,000 profit to get funded. Sorry for the error on my part!

TOTAL ACCOUNT RISK: The total account risk for trading this next week will be 2.0% to reduce chance of drawdown due to the majority of Expert Advisors not being profitable at the moment. This account will not increase risk beyond 3%.

This first chart shows the trading results for this past week:

This chart shows trend line of the cumulative profit this week:

This chart shows the statistics of this account since inception:

Alan,

-

April 6, 2024 at 14:06 #246950

Alan Northam

ParticipantHi Traders,

Week of March 31, 2024 through April 5, 2024. The following are the seventh week results of trading 10 Expert Advisors (EA) I created using EA Studio. These Expert Advisors where then traded on my second Infinity Forex Fund (IFF) 100K Algo Evaluation account. I analyzed the results this week using FXblue where I sorted this past weeks trading results by the “Net pips” column from most pips gained to most pips lost this week. I then looked at the Net Profit column to determine profits and losses for the week. The following are the results along with the changes made for trading next week:

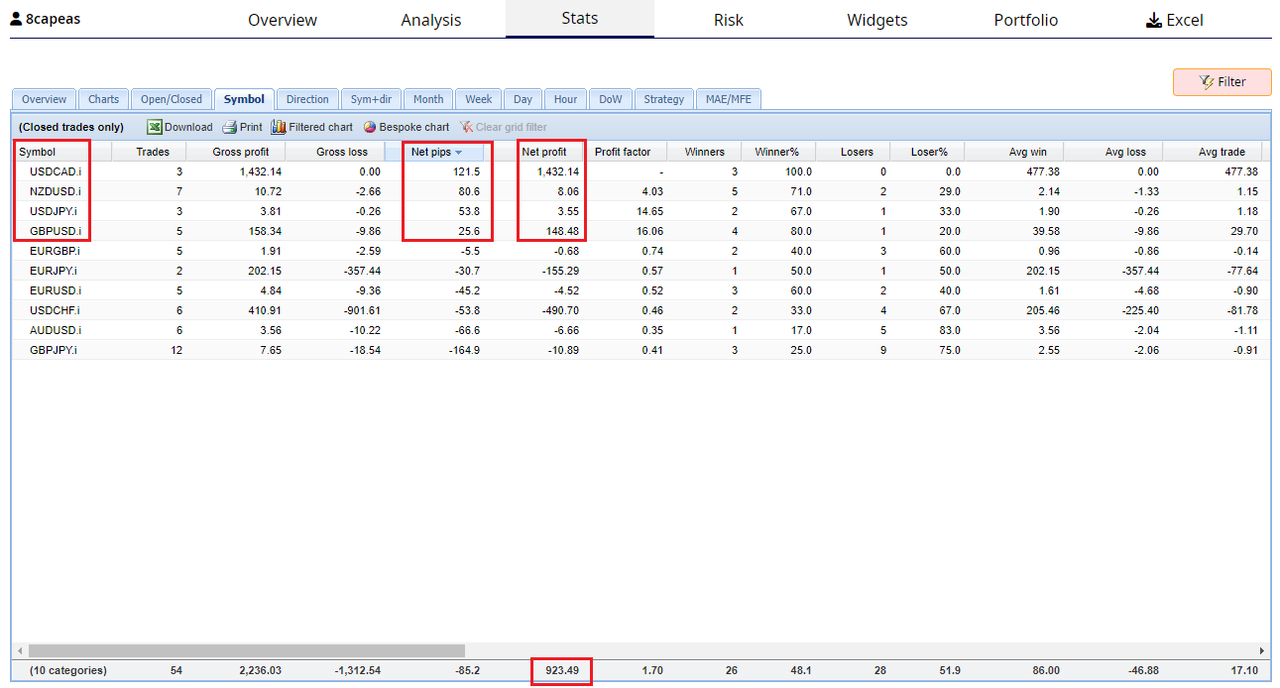

USDCAD: USDCAD was the top performer this past week with a net profit of $1432.14. I will continue to trade this asset next week.

NZDUSD: NZDUSD came in second place this past week. This asset was not in the top ranking last week so it traded with a 0.01 lot size and had a profit of $8.06. I have increased its lot size from 0.01 to 0.84 lots. I will trade this asset next week.

USDJPY: USDJPY came in third place this past week. This asset was not in the top ranking last week so it traded with a 0.01 lot size and had a profit of $3.55. I have increased its lot size from 0.01 to 0.77 lots. I will trade this asset next week.

GBPUSD: GBPUSD came in fourth this past week with a net profit of $148.48. I will continue to trade this asset next week.

NOTE 1: EURGBP, EURJPY, EURUSD, USDCHF, AUDUSD, GBPJPY all had losses this past week. They will all have lot sizes reduced to 0.01 lots and will continue to be traded this next week.

NOTE 2: The profit to the account this week was $923.49. The total profit for this account to date is $107,522.20 and must reach $10,0000 to pass the one step Evaluation and become funded. Based upon the current weekly return of 1.0% I calculate it could take three weeks to become funded.

NOTE 3: The total account risk for trading this next week will be 2.0% to reduce chance of drawdown due to the majority of Expert Advisors not being profitable at the moment. This account will not increase risk beyond 3%.

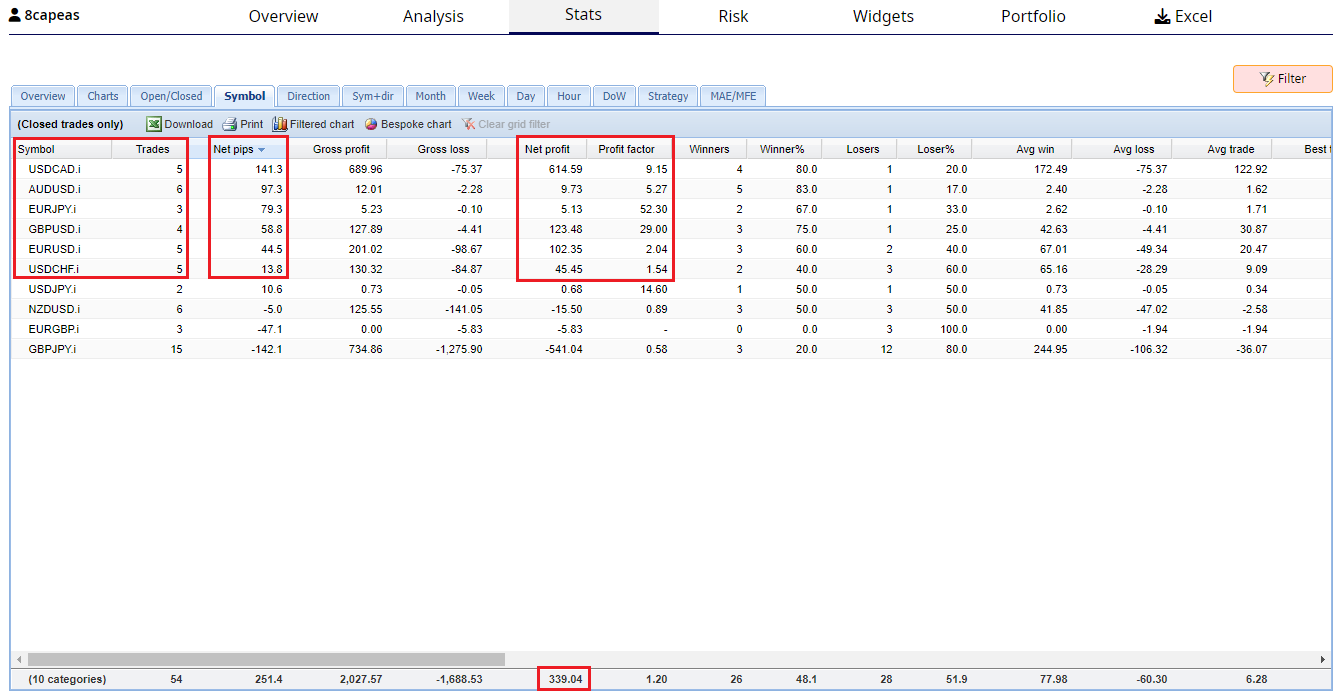

This first chart shows the trading results for this past week:

This chart shows trend line of the cumulative profit this week:

This chart shows the statistics of this account since inception:

Alan,

-

April 14, 2024 at 22:24 #248698

Alan Northam

ParticipantHi Traders,

WEEKLY REPORT

Week of April 7, 2024 through April 13, 2024. The following are the eighth week results of trading 10 Expert Advisors (EA) I created using EA Studio. These Expert Advisors where then traded on my Infinity Forex Fund (IFF) 100K Algo One Step Evaluation account. I analyzed the results this week using FXblue where I sorted this past weeks trading results by the “Net pips” column from most pips gained to most pips lost this past week. I then looked at the Net Profit column to determine profits and losses for the week. The following are the results along with the changes made for trading next week:

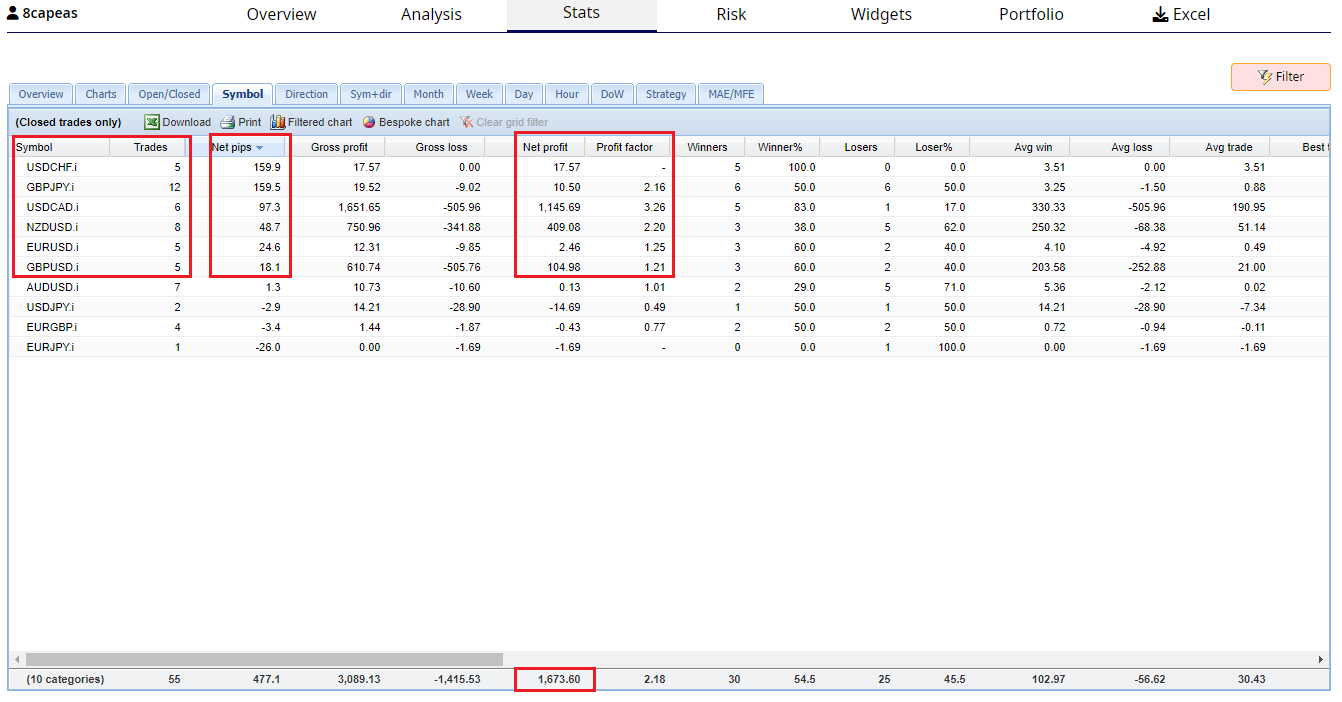

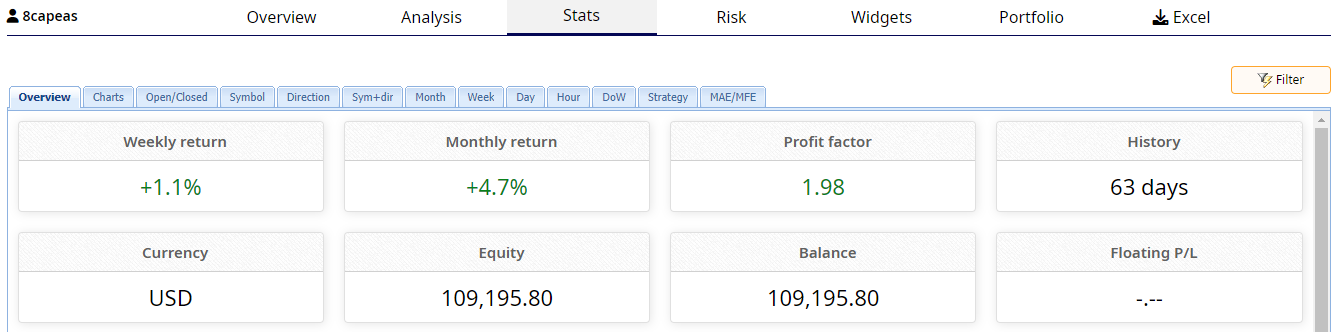

This past week ended with an $109,195.80 account balance. The price target to become a funded account is $110,000. To reduce risk of this next week of significantly drawing down this account I am going to limit the risk to the account to 1%.

The top six currency pairs this past week had a profit factor of 1.2 or greater. I will adjust the lot size of these six currency pairs to have a 0.16% account risk each. The other four currency pairs will have their lot size adjusted to 0.01 lots.

USDCHF: 0.30 Lot size

GBPJPY: 0.59 Lot size

USDCAD: 0.60 Lot size

NZDUSD: 0.31 Lot size

EURUSD: 0.23 Lot size

GBPUSD: 0.21 Lot size

AUDUSD: 0.01 Lot size

USDJPY: 0.01 Lot size

EURGBP: 0.01 Lot size

EURJPY: 0.01 Lot sizeNOTE 2: The profit to the account this week was $1673.60. The total profit for this account to date is $109,195.80 and must reach $110,0000 to pass the one step Evaluation and become funded.

NOTE 3: The total account risk for trading this next week will be 1.0% to reduce chance of significant drawdown.

This first chart shows the trading results for this past week:

This chart shows trend line of the cumulative profit this week:

This chart shows the statistics of this account since inception:

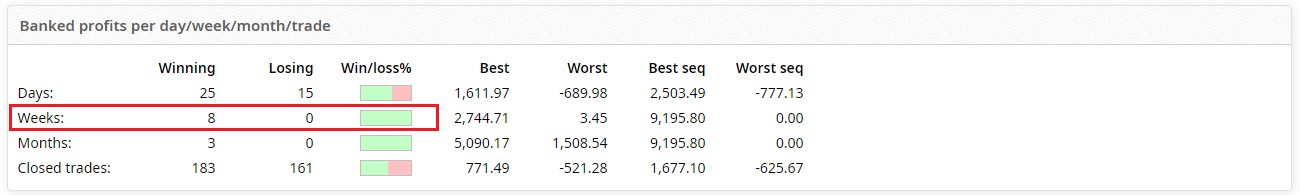

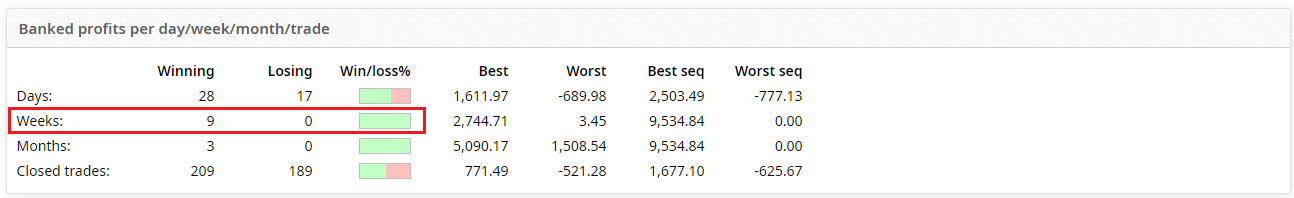

This chart shows all 8 weeks of this Evaluation has been profitable:

Alan,

-

April 21, 2024 at 11:53 #250230

Alan Northam

ParticipantHi Traders,

WEEKLY REPORT

Week of April 13, 2024 through April 20, 2024. The following are the nineth week results of trading 10 Expert Advisors (EA) I created using EA Studio. These Expert Advisors where then traded on my Infinity Forex Fund (IFF) 100K Algo One Step Evaluation account. I analyzed the results this week using FXblue where I sorted this past weeks trading results by the “Net pips” column from most pips gained to most pips lost this past week. I then looked at the Net Profit column to determine profits and losses for the week. The following are the results along with the changes made for trading next week:

This past week ended with a profit of $339.04 and an account balance of $109,534.84. The price target to become a funded account is $110,000. To reduce risk of this next week of significantly drawing down this account, since it is so close to hitting the price target and becoming funded, I am going to limit the risk to the account to 1%.

The top seven currency pairs this past week had a profit factor of 1.2 or greater. Of those top seven pairs I will trade the top 6 as the seventh pair (USDJPY) only had a profit of $0.68. I will adjust the lot size of these six currency pairs to have a 0.16% account risk each for a total account risk of 1%. The other four currency pairs will have their lot size adjusted to 0.01 lots.

USDCAD(+4.25%): 0.60 Lot size

EURUSD(+2.02%): 0.23 Lot size

AUDUSD(+1.31%): 0.33 Lot size

GBPUSD(+0.35%): 0.21 Lot size

EURJPY(+0.29%): 0.28 Lot size

USDCHF(+0.21%): 0.30 Lot sizeUSDJPY(+0.60%): 0.01 Lot size

NZDUSD(+0.37%): 0.01 Lot size

EURGBP(-0.02%): 0.01 Lot size

GBPJPY(-0.16%): 0.01 Lot sizeThis first chart shows the trading results for this past week:

This chart shows trend line of the cumulative profit this week:

This chart shows the statistics of this account since inception:

This chart shows all 9 weeks of this Evaluation has been profitable:

Alan,

-

April 22, 2024 at 6:20 #250428

George Pit

ParticipantHi Alan, I find your workflow very interesting. I’m going to adopt it to see what results I get. Could you explain how you calculate lot sizes and risk percentages for each currency pair? What formula do you use? I’m new to this, but I learn quickly.

I’m starting with a $1000 USD account with 1:500 leverage.

-

-

April 22, 2024 at 6:32 #250431

Alan Northam

ParticipantHi George,

I use a pip calculator. Here is the link;

https://www.babypips.com/tools/position-size-calculator

Risk is calculated as a percentage of the account balance. For example, $1000 account with a 1% risk would mean you would risk $10.00. So if you are trading 2 Expert Advisors set the risk for each EA at $5.00 or 0.5%.

Alan,

-

April 27, 2024 at 21:03 #251990

Alan Northam

ParticipantHi Traders,

WEEKLY REPORT

Week of April 21, 2024 through April 28, 2024. The following are the tenth week results of trading 10 Expert Advisors (EA) I created using EA Studio. These Expert Advisors are being traded on my Infinity Forex Fund (IFF) 100K Algo One Step Evaluation account. I analyzed the results this week using FXblue where I sorted this past one week trading results by sorting the “Net pips” column from most pips gained to most pips lost this past week. I then looked at the Net Profit column to determine profits and losses for the week. The following are the results along with the changes made for trading next week:

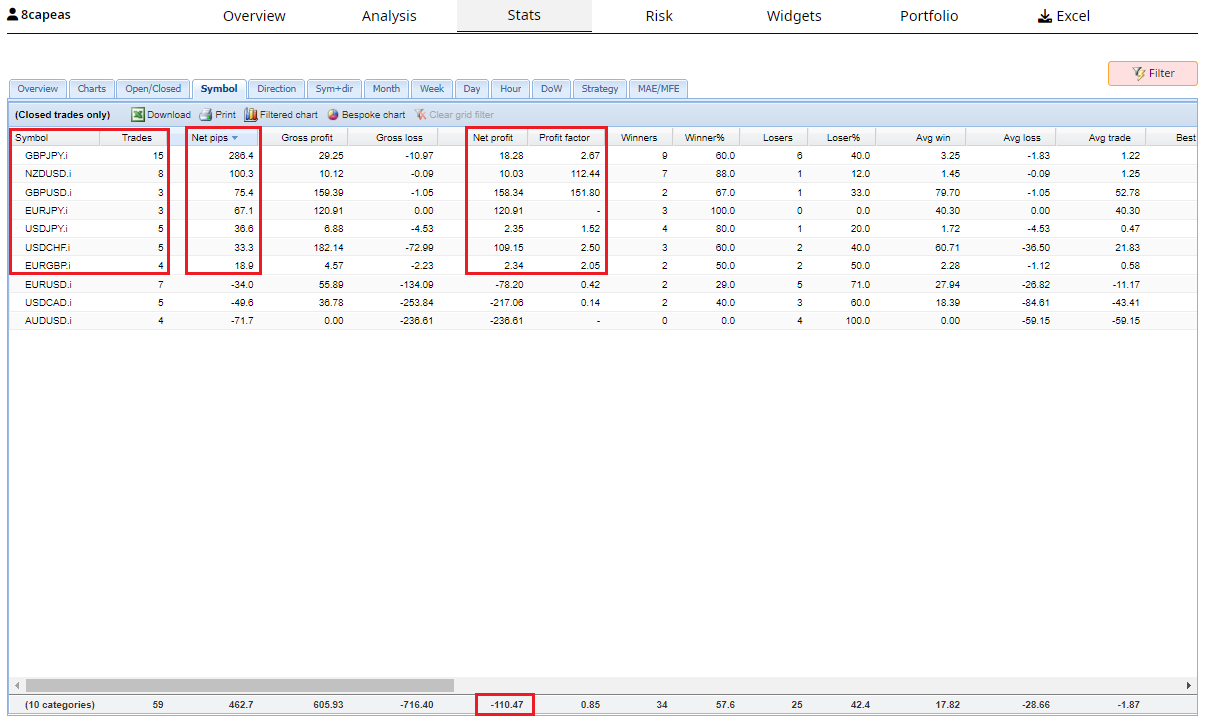

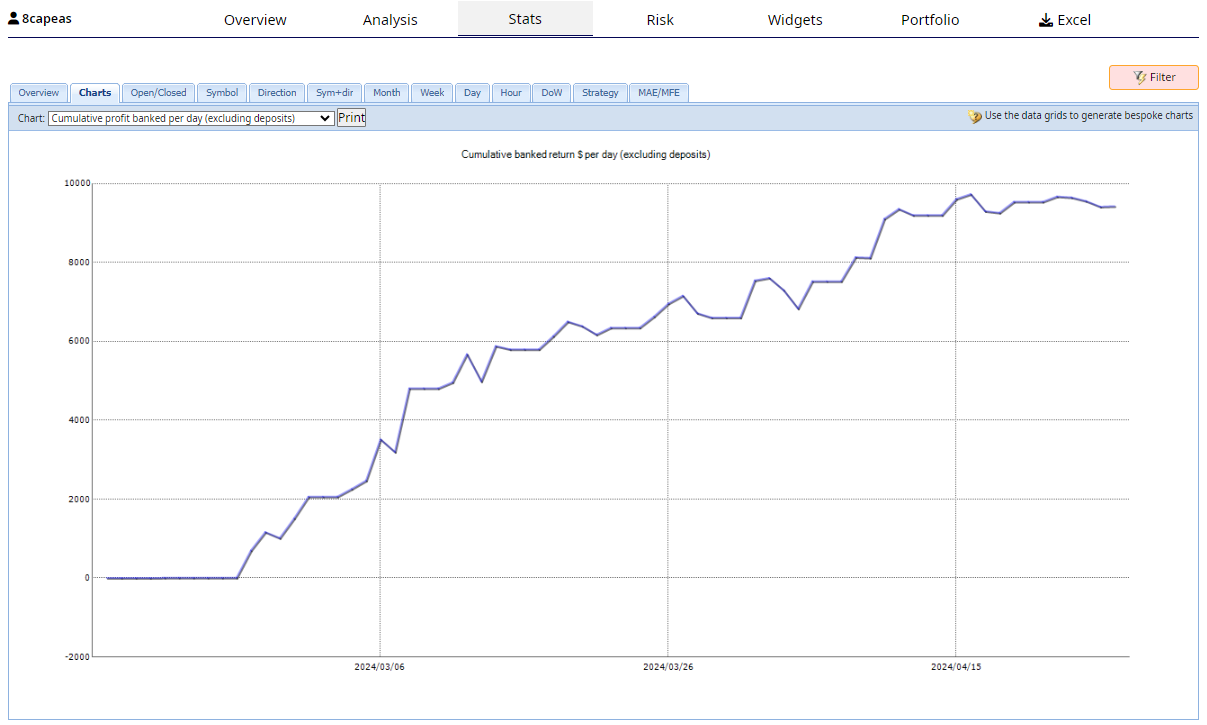

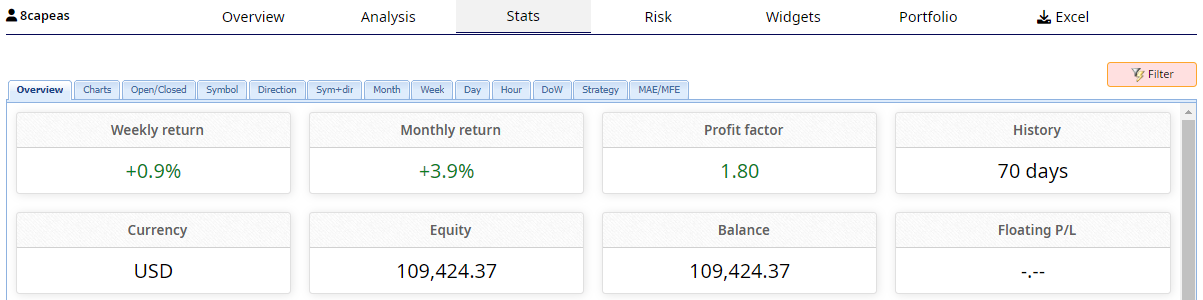

This past week ended with a small loss of $110.47 and an account balance of $109,424.37. The price target to become a funded account is $110,000. This was the first losing week out of the ten weeks this account has been trading. To reduce risk of this next week of significantly drawing down this account, since it is so close to hitting the price target and becoming funded, I am going to continue to limit the risk to the account to 1%.

There were seven top currency pairs this past week having a profit factor of 1.2 or greater. However, two of the pairs, GBPJPY and EURGBP, will not be traded this next week because over the last ten weeks they produced an overall loss of -0.14% and -0.01% respectively. I will adjust the lot size of each of the five currency pairs I will be trading this next week to have an account risk 0.20% for a total account risk of 1%. The other five currency pairs will have their lot size adjusted to 0.01 lots.

USDJPY(+0.61%): 0.33 Lot size

GBPUSD(+0.50%): 0.25 Lot size

EURJPY(+0.40%): 0.33 Lot size

NZDUSD(+0.38%): 0.36 Lot size

USDCHF(+0.35%): 0.30 Lot sizeUSDCAD(+4.04%): 0.01 Lot size

EURUSD(+1.94%): 0.01 Lot size

AUDUSD(+1.09%): 0.01 Lot size

EURGBP(-0.01%): 0.01 Lot size

GBPJPY(-0.14%): 0.01 Lot sizeThis first table shows the trading results for this past week:

This chart shows trend line of the cumulative profit since inception:

This table shows the statistics of this account since inception:

This table shows all 9 of the last 10 weeks of this Evaluation have been profitable:

Alan,

-

April 29, 2024 at 16:56 #252298

Mr Stols

ParticipantHello Alan,

It seems you are doing really well in this challenge with the EA Studio bots.

Personally I’m trying to do something similar, for 2 months now, but my results in my live-account are going, slowly, down.

So hopefully you can help me to get my campaign going.What am I doing?

Using the last year of the premium data

Default Monte Carlo

profit factor 1.5

count of trades 100

Petko’s system: selecting bots after 5 trades, now using 7 trades

checking performance every week and remove losers completelySo I have a few questions and hopefully you can help me out here.

Question 1)

Are you using 1 ea per forexpair or a portfolio?Question 2 On which day of the week are you changing the lotsizes? )

Question 3)

When creating the EA bots which settings are you using?using SL?

if so, which value?using TP?

if so, which value?Question 4)

Any other settings or tips?Thanks,

John

-

April 29, 2024 at 17:32 #252303

Alan Northam

ParticipantHi John,

I use last one year of historical data from the broker/prop firm I will be trading with.

Default Monte CarloAnswer 1: I use individual EAs not portfolio

Answer 2: I make lot size changes on the weekend

Answer 3: I actually have 5 trading accounts working and each one uses different settings and they all work. When I create a strategy using premium data, for example, and then change the historical data to something else, for example, Blackbull, I get different results. In some cases when I create a nice looking strategy with premium data and then change the historical data the result shows strategy losses. I think this is what is happening to you. So each brokers historical data is different. As a result the secret is not the settings used in creating the strategy but using the same historical data you are going to use when trading.I do not use portfolio EA.

I let EA Studio choose SL and TP.

Answer 4: I do my final filtering in collections.

Alan,

-

-

May 4, 2024 at 19:47 #253293

Alan Northam

ParticipantHi Traders,

WEEKLY REPORT

Week of April 28, 2024 through May 3, 2024. The following are the eleventh week results of trading 10 Expert Advisors (EA) I created using EA Studio. These Expert Advisors are the same Expert Advisors I have been trading for the last eleven weeks without any upgrades or optimizations. The only thing I changed with these Expert Advisors is the lot size each week. These Expert Advisors are being traded on my Infinity Forex Fund (IFF) 100K Algo One Step Evaluation account. I analyzed the results this week using FXblue where I sorted this past one week trading results by sorting the “Net pips” column from most pips gained to most pips lost this past week. I then looked at the Net Profit column to determine profits and losses for the week. The following are the results along with the changes made for trading next week:

This past week ended with a profit of $253.90 and an account balance of $109,678.27. The price target to become a funded account is $110,000. To reduce risk of this next week of significantly drawing down this account, since it is so close to hitting the price target and becoming funded, I am going to continue to limit the risk to the account to 1%.

There were six profitable currency pairs this past week having a profit factor of 1.2 or greater. However, two of the pairs, GBPJPY and EURGBP, will not be traded this next week because over the last ten weeks they produced an overall loss of -0.14% and -0.01% respectively. I will adjust the lot size of each of the four currency pairs I will be trading this next week to have an account risk 0.25% for a total account risk of 1%. The other six currency pairs will have their lot size adjusted to 0.01 lots.

Note: The percentages in parenthesis show the percent gain of each currency pair over the last 11 weeks.

AUDUSD(+1.09%): 0.46 Lot size

USDJPY(+0.90%): 0.39 Lot size

USDCHF(+0.78%): 0.41 Lot size

GBPUSD(+0.55%): 0.29 Lot sizeUSDCAD(+4.03%): 0.01 Lot size

EURUSD(+1.93%): 0.01 Lot size

GBPJPY(-0.13%): 0.01 Lot size

EURJPY(+0.29%): 0.01 Lot size

NZDUSD(-0.08%): 0.01 Lot size

EURGBP(-0.01%): 0.01 Lot sizeThis first chart shows the trading results for this past week:

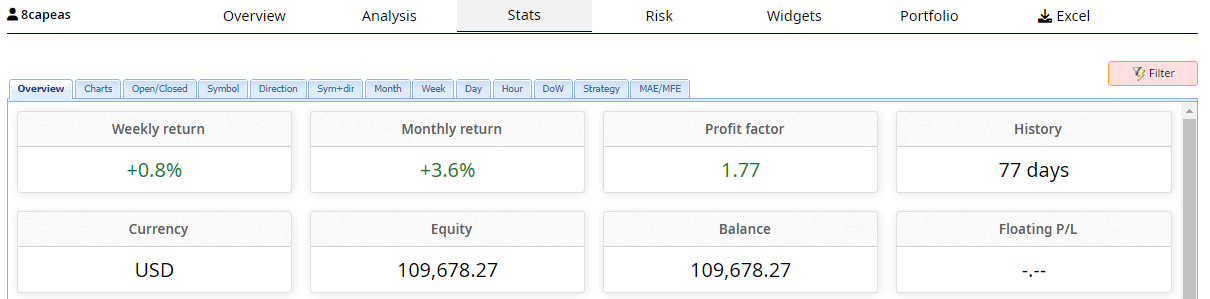

This chart shows trend line of the cumulative profit since inception:

This chart shows the statistics of this account since inception:

This chart shows 10 of the last 11 weeks of this Evaluation have been profitable:

Alan,

-

May 11, 2024 at 15:02 #254524

Alan Northam

ParticipantHi Traders,

WEEKLY REPORT

Week of May 5, 2024 through May 11, 2024. The following are the twelfth week results of trading 10 Expert Advisors (EA) I created using EA Studio. These Expert Advisors are being traded on my Infinity Forex Fund (IFF) 100K Algo One Step Evaluation account. I analyzed the results this week using FXblue where I sorted this past one week trading results by sorting the “Net pips” column from most pips gained to most pips lost this past week. I then looked at the Net Profit column to determine profits and losses for the week. The following are the results along with the changes made for trading next week:

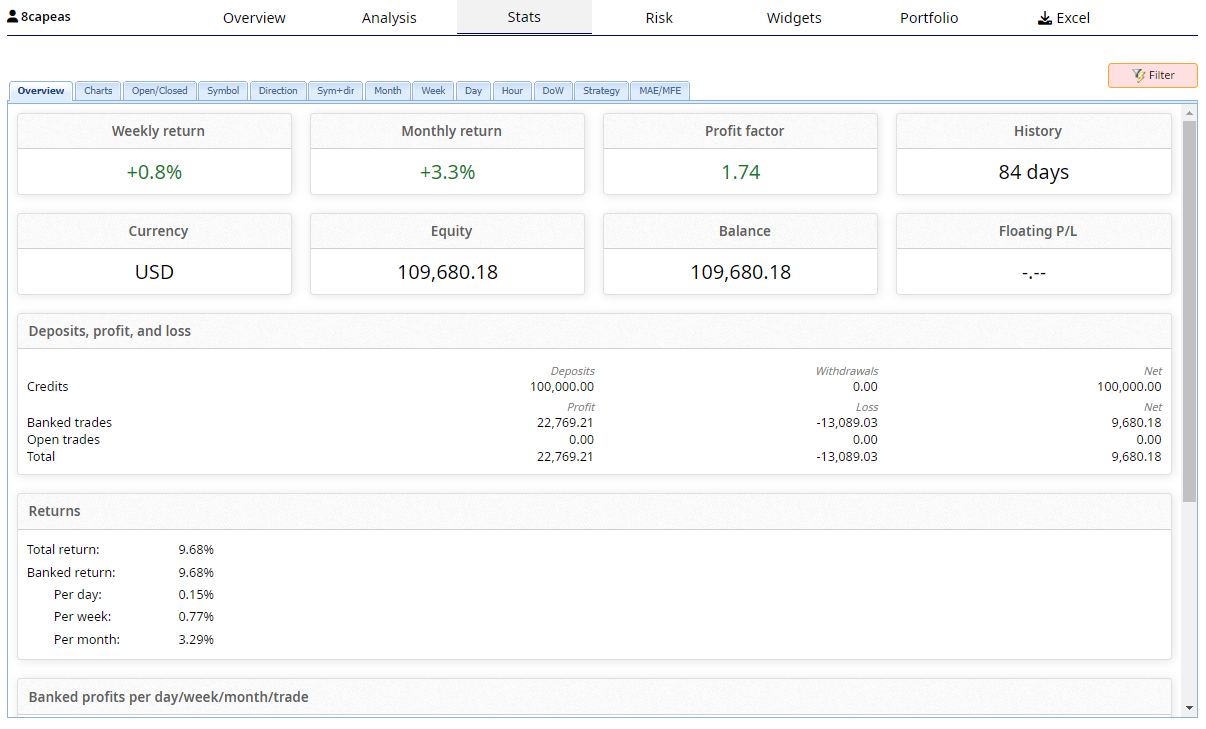

This past week ended with a profit of $1.91 and an account balance of $109,680.18. The price target to become a funded account is $110,000. To reduce risk of this next week of significantly drawing down this account, since it is so close to hitting the price target and becoming funded, I am going to continue to limit the risk to the account to 1%.

There were six profitable currency pairs this past week having a profit factor of 1.2 or greater. However, two of the pairs, NZDUSD and EURGBP, will not be traded this next week because over the last twelve weeks they produced an overall loss of -0.08% and -0.01% respectively. I will adjust the lot size of each of the four currency pairs I will be trading this next week to have an account risk 0.25% for a total account risk of 1%. The other six currency pairs will have their lot size adjusted to 0.01 lots.

USDCAD(+4.04%): 0.80 Lot size

USDJPY(+1.020%): 0.39 Lot size

EURUSD(+1.94%): 0.32 Lot size

USDCHF(+0.85%): 0.41 Lot sizeAUDUSD(+0.93%): 0.01 Lot size

GBPUSD(+0.52%): 0.01 Lot size

EURJPY(+0.28%): 0.01 Lot size

EURGBP(-0.01%): 0.01 Lot size

NZDUSD(-0.08%): 0.01 Lot size

GBPJPY(-0.14%): 0.01 Lot sizeNote: The percentages in parenthesis show the percent gain of each currency pair over the last 12 weeks.

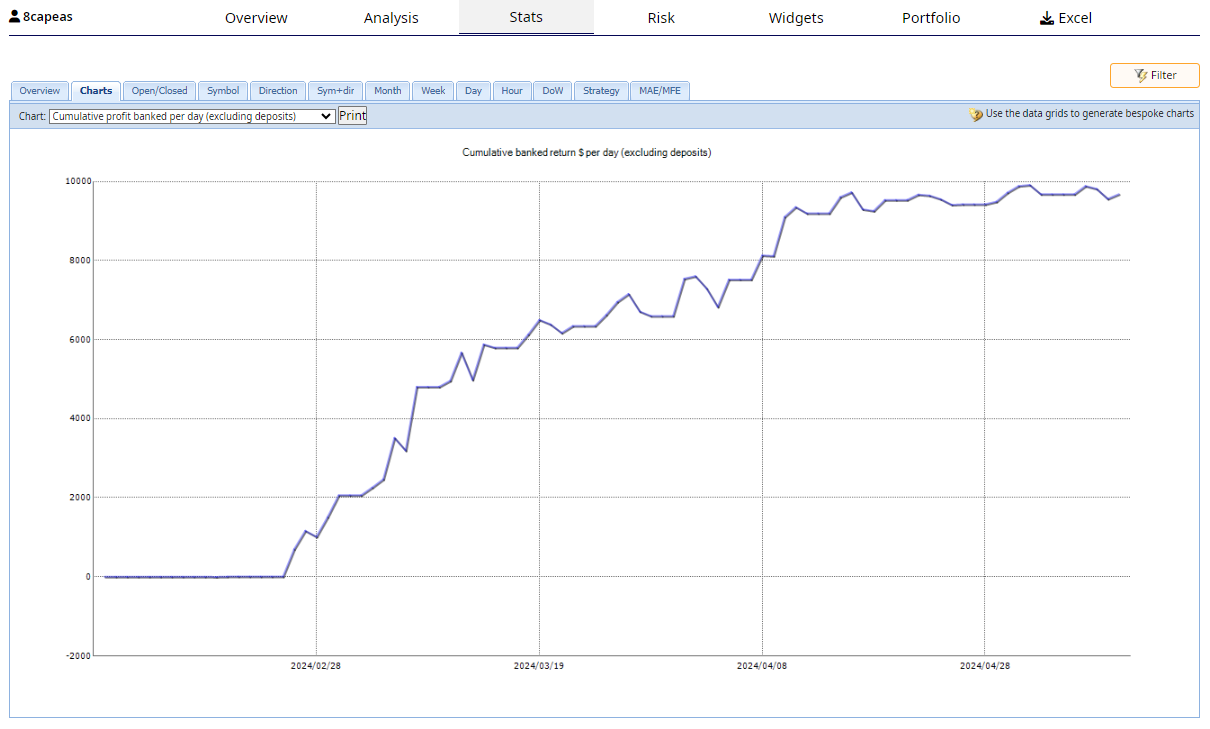

This first chart shows the trading results for this past week:

This chart shows trend line of the cumulative profit since inception:

This chart shows the statistics of this account since inception:

This chart shows 11 of the last 12 weeks of this Evaluation have been profitable:

Alan,

-

May 15, 2024 at 3:45 #255078

Alan Northam

ParticipantHi Traders,

WEEKLY REPORT

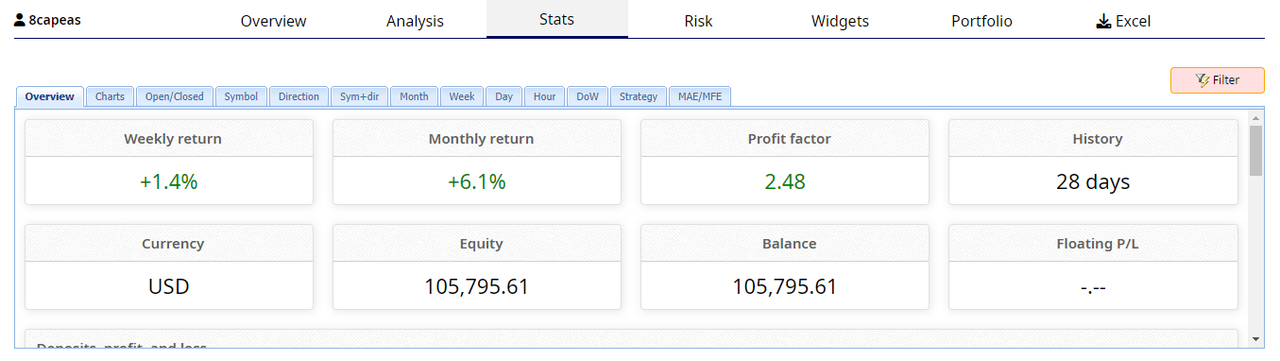

On Tuesday 05/14/2024 this Infinity Forex Fund One Step Evaluation hit the profit target of $110,000. As a result, this account is now FUNDED! The previous twelve weekly reports in this Ongoing Challenge outlines the process I went through to achieve this goal.

Statistics:

Profit = $10,002.36

Gain = 10.00%

Average 30 Day Profit = 3,158.64

Average 30 Day Profit (%) = 3.3%The Expert Advisors used to pass this Evaluation and obtain a FUNDED account I created using EA Studio. These Expert Advisors are the same Expert Advisors I have been using for the last twelve weeks without any upgrades or optimizations. The only thing I changed over the last twelve weeks were the lot size.

This chart shows the statistics of this account since inception:

This chart shows balance line of the cumulative profit since inception:

The following the the Certificate of Acheivement:

Alan,

-

July 11, 2024 at 15:42 #269662

Alan Northam

ParticipantHave you been looking for a profitable method of trading Expert Advisors? If so, then I recommend following the method I used in trading Expert Advisors that lead to a funded Infinity Forex Fund account.

Also, have you been wondering if EA Studio is worth the investment. In my opinion YES! I used EA Studio to create the Expert Advisors used in the Infinity Forex Fund Challenge that lead to a funded account.

Did you know you do not need to purchase EA Studio before you learn how to use it? I have devised a step by step teaching method in learning how to use EA Studio. In this teaching method you will learn in detail how to use EA Studio, you will also be able to create some Expert Advisors and test them in a demo account, all before you purchase EA Studio. Once you have learned how to use EA Studio and have created some Expert Advisors and tested them in a demo account then you can decide if EA Studio is for you. To follow my step by step method in learning EA Studio, creating Expert Advisors and testing them in a demo account click on the this link: EA Studio How To

Alan,

-

July 11, 2024 at 18:20 #269692

Alan Northam

ParticipantNote: Do not start the free trial of EA Studio until you have followed the step by step teaching method of “EA Studio How To”.

Alan,

-

-

-

AuthorPosts

- You must be logged in to reply to this topic.