In this lecture, I will talk about how you can earn passive income from your crypto coins and I will share with you a simple crypto passive income strategy.

It’s a fact that everyone wants to earn passive income, nobody wants to work 40-50 years. Everyone wants to get retired much faster to enjoy grandchildren (I’m not sure if everyone wants grandchildren actually).

What is passive income?

So let’s go to the point, what is passive income? Passive income means that I will relax back and I will scroll all day long on Facebook and the money will just flow in, they will just flow in.

Unfortunately, before you start earning passive income, you need to do some work done unless your parents did give you 100 Bitcoins as a birthday present.

And true, crypto is one of the easiest ways nowadays to earn passive income. But of course, you need cryptocurrencies in the wallet, so you can do it easily from the wallet apps right from your phone. So what is passive income? This means that you are getting rewards for an asset that you own.

Staking Cryptocurrencies on the blockchain

For example, me recording this video right now won’t bring me any profits unless one day I decide to use YouTube and put ads in front of the video. Maybe by the time you are watching that video, this will happen. So at that moment, I will have passive income from YouTube because I have recorded that video long ago and I own this video.

And I receive rewards from YouTube because there are ads before the video, during the video, I don’t know maybe it will change with time. Same thing when you build a house or you buy an apartment. At the moment you build it you’re not getting anything. Actually, you’re spending money but when you start lending it to people, then you will get passive income.

It is the same thing with cryptocurrencies, no matter if you are mining it or you’re buying it from the exchanges. If you stake your cryptocurrencies on the blockchain, you can receive rewards for that.

So there are 2 options to earn passive income from crypto. One is to stake them, the other option is to lend them. And I’ve recorded many lectures on staking cryptocurrencies, it is possible on different wallets.

I personally like to use Ledger which is a hardware wallet. And, for example, there if I want to stake Tezos, I need to delegate the right to a baker, this is how it’s called in there. And I will put the video below so you can have a look at it.

Or with simple words, I give my cryptocurrencies to the blockchain to make it more secured, more decentralized to secure the network. And because of that, I receive rewards annually.

Lending the cryptocurrencies

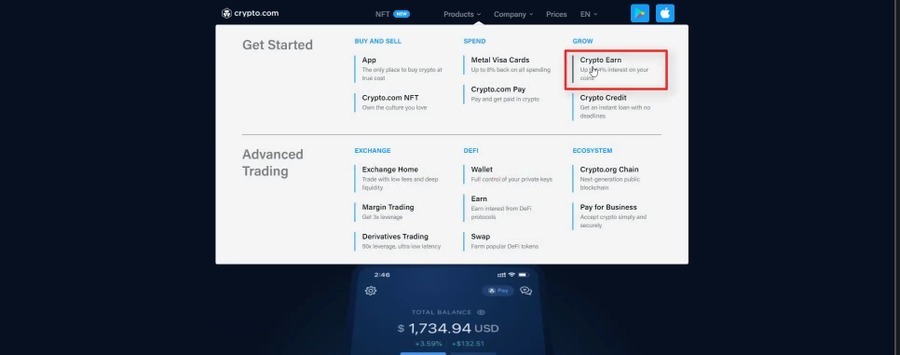

The other option to earn passive income from crypto is to lend your cryptocurrencies and this is possible with most of the exchanges nowadays. As well, Crypto.com is the one I like the most because there is the Earn option.

And there, you can earn passive income for lending almost all the cryptocurrencies that are available.

For example, with this option on Crypto.com, I earn passive income from crypto coins like Bitcoin and Ethereum. They are is available for stake on the Ledger because it is Proof-of-Work and not Proof-of-Stake. And one interesting thing to mention here is that on Crypto.com you can stake the CRO coin, which is the coin of the exchange for a Visa card.

Cashback

So at the current moment, they have different options but if you stake a certain amount of cryptocurrencies, they send you a Visa card. And when you pay after that with this Visa card and you use it everywhere you get cashback.

This is kind of a passive income again because we are spending daily but while we are spending we get some cashback into our cryptocurrency wallet, which I personally find pretty cool. I will put a link with the Crypto.com staking options, so we both can get a bonus if you decide to use it.

And I don’t want to go into details about the earnings and the annual rewards on the different exchanges because they change all the time. So before you decide to stake cryptocurrencies or to earn passive income from crypto, make your research. Because by the time you’re reading this lecture, the conditions on the exchanges might be totally different.

Crypto passive income strategy

Now, for my passive income strategy, I use the Ledger wallet, which is a hardware wallet and I keep there most of my cryptocurrencies. At the same time, I stake some of the cryptos there and I use Crypto.com for the Earn option where I can earn passive income from all the currencies that are available. Keep in mind that one of the best rewards comes with stable coins such as the USD coin.

If you want to see my crypto passive income strategy in action, follow me on Patreon and get notified every time I buy, sell or stake. As well you will get access to my cryptocurrency portfolio spreadsheet which you can copy and use for yourself.

So, with Crypto.com, for example, at the moment the reward I think is 12%. So if I had $100,000 to invest, I’d definitely like to put them into USD coins on Crypto.com and earn 12%. This is $12,000 a year, which makes it $1,000 a month and the good thing is that with time the rewards compound.

So, for example, if you have $100,000 to stake into USD coin or to earn passive income from Crypto.com, for example, at the end of the year you will have $12,000. Which you can add to a new staking period and from there, you can start a new period and you will be starting with $112,000, and earn another 12% for the year on these 112,000.

I hope this brings you a realistic idea of how much passive income you can earn from staking crypto.

Cryptocurrency Staking vs. Real Estate vs. Dividend Strategy

Now, let’s make some comparisons, Cryptocurrency staking versus real estate versus dividend strategy.

Passive Income from Cryptocurrency Staking

So with cryptocurrencies, as I said, you can earn between 5-6 up to 12% on your cryptocurrencies a year. And if we take the example of $100,000, we said that at the end of the year, we can earn $12,000.

Passive Income from Real Estates

Now, for example, in my country Bulgaria, if you want to buy apartments in the capital Sofia, for that money, you can buy a one-bedroom apartment. A bedroom and a living room. And if you lend it, then you can earn no more than $300 to $400 maximum a month. Which makes it somewhere around $5,000 a year. So this is 50% less compared to how much you would earn from cryptocurrencies, which makes it about 5% from the initial investment.

Passive Income from Stock Dividends

And now if we compare it with the stock dividend strategy, I know many people are using that. Especially in the United States, it’s super popular.

I really like it, it’s just not my type of investment but if you invest $100,000 into stocks, you need to invest them in stable companies. These are companies that are long-established on the market, they will offer at least 5-6% on annual basis. And at the end of the year, you will still have about $5,000 to $6,000 roughly. But here is the kicker, cryptocurrencies increase their value much more than real estate and stocks.

Tesla and some other stocks did a fantastic growth in 2020 but they don’t give dividends. So for me personally, having the opportunity to earn between 5% and 12% in crypto staking as a passive income and at the same time having the opportunity to have a fantastic growth by the price increasing in value makes the cryptocurrency the perfect asset for a passive income in the long-term.

Dollar-Cost Averaging

When you develop your crypto passive income strategy, Dollar-Cost Averaging is something that you might want to consider.

Dollar-Cost Averaging is when you buy cryptocurrencies on a regular basis. For example, every first day of the month or every Monday and you buy regularly the same amount.

And if you don’t have an idea on how to use this strategy to earn passive income in crypto, you can check out some of our trading & investing courses.

Conclusion

And I can tell you that I have a lot of students that did that starting back from 2016, 2017, and now in 2021, they have a sustainable amount of cryptocurrencies. But most importantly, they have a better average price when Bitcoin reaches record highs. So Dollar-Cost Averaging strategy is super suitable for beginners and advanced traders.

I personally buy cryptocurrencies regularly, I aim to buy the dips, but that’s not always possible, of course.

Thank you guys for reading. I’ll be happy to hear your thoughts about crypto passive income in the comments below. Take care and I will see you in another lecture.

thanks for the wonderfull lecture, it was so helpfull to both the newbies and experienced traders

Hey Ssentamu, we are glad that you found it useful. We will do our best to keep it that way!

hello, how can i solve this problem with this page showing? eyeg