Ethereum Classic price prediction

In today’s price prediction article, I’ll be talking about the Ethereum Classic. I will tell you what are the realistic price predictions from that moment after the price did an amazing move from around $30 up to $180 early in May. And I will share with you the recent investment that brought me over 184% of a profit with the Ethereum classic.

What is Ethereum Classic?

So for beginner traders and investors, the Ethereum Classic is the continuation of the unaltered history of the original Ethereum chain.

It preserves the principle of Code is Law. And on my Patreon page where I share my investments immediately as soon as I purchase an asset, I give a crypto buy alert, or when I sell, I send a crypto sale alert to my followers.

You can see that on the 17th of April, I bought 11 Ethereum Classic tokens at the price of $47, and then a little bit later I added another 15. If I have to be precise, that was at the price of $35.10, which gave me an average price of $40.46, a total investment of $1,051. And I have sold it at $115, profit of nearly $2,000 or that was 184.23% as a profit.

Why Fibonacci for the Ethereum Classic price prediction

So now I will share with you why I have sold it and I will share with you what are the next realistic price targets. And what is the realistic price prediction for Ethereum Classic that everyone is looking for?

I’m using the Fibonacci as you already may have seen in some of my other lectures. But for the purpose of this lecture, I will delete everything I have on the chart because I want to make it really simple and clear for you.

So you will know exactly what I’m looking at and how I succeed in taking such profits in a relatively short time.

So one more time, if you look at my spreadsheet which you can find on my Patreon’s page, you will see that this was a short-term investment. I have assets with long-term purposes, I have assets that are staking but the Ethereum Classic was with a short-term purpose.

And about two weeks were needed to get this percentage of 184%. So what do we have over the chart? Back in October, the price was sitting at $4, $5. So if you bought it at that time that would be an amazing investment, if you haven’t, no worries.

CoinGecko

The crypto market always brings us new opportunities. So how do I draw these Fibonaccis that show me a realistic Ethereum Classic price prediction? This is what I will show you right now.

I will grab a Fibonacci. I’m on CoinGecko right now which is a great website, not promoting it or anything. This is where I follow the cryptocurrencies, they have a trading view which makes it super easy for drawing purposes.

So right now I’m on the daily chart and you can see that back in 2020 in May, July, September, and November, the price was just going sideways. Somewhere in the range between $4 and $8.

And then it did the first move in January 2021. So I’m taking the first positive move which is this one over here and I’m drawing a Fibonacci the other way around so from the top to the bottom.

And if you’re not familiar with Fibonacci, it uses retracement levels of 23.6%, 38.2, 50, and 61.8. And with simple words, when we have a move, after that we can use these levels as retracement levels and we can buy the dips and take a better average price.

Price Retracement

But what I’m using with the Fibonaccis are actually the targets. As you can see, on the top of that drawing we have 4 targets. One sits at 161.8, 261.8, 361.8, 423.6. What I’m using is the second target of 261.8. So after the price reaches the target, I’m taking a new Fibonacci, I’m drawing it from the top.

So the price broke over here this target and when I see the top, I draw a new one going to the lowest point of the retracement. Which, in this case, was that point over here.

Then we have a new target and in this case, it sits at $40.23 and you can see that it worked really nice. The price reached and then it did a retracement.

So let’s see, I’m taking a new Fibonacci from the top right over here drawing it to the lowest point. Now, of course, I need to zoom a little bit to see exactly where it is, not making it like 100% but try to make it as close to the level as possible.

And then here is the top and you see that the retracement of 38.2 worked really well.

Counter-trendline

And this is the moment where I was purchasing, I used a counter-trendline right over here and I do that on the lower timeframe on the hourly chart.

Let me just do it precisely, here is one and then I took one more aggressive I believe it was that one right over here. So I had 2 entries.

If I confirm on my Patreon’s spreadsheet, yes, 2 entries.

And then let’s see where were the new targets. I will not show you what happened after that, I just wanted to show you what I was looking at, $115.85. This was the target and this is why I have sold at $115. Now let’s go slowly and see what the price did, you can see it went sideways, and then boom!

Here it is. And at this moment, I saw the Ethereum Classic price reaching $115, it reached it right over here. So I took my profit, 184% is not a bad profit and I don’t regret taking it. Even after that, the price reached $180 almost to the fourth target. But this is exceptional. What I mean is this is rare, such a move is rare.

The target

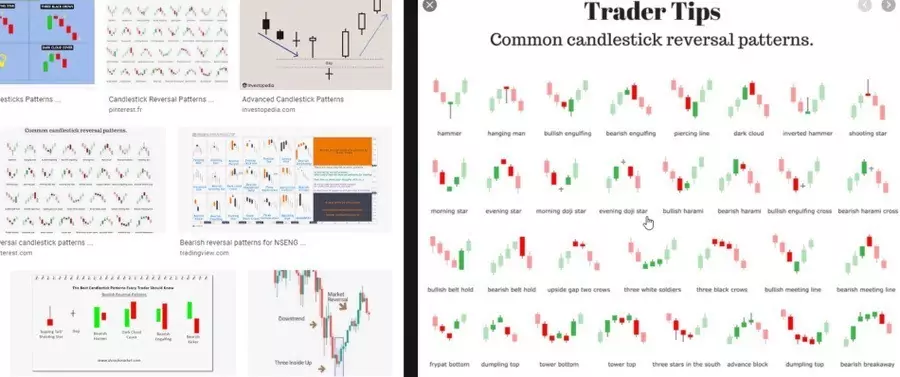

And from my experience, I’m using the second target because it works best for most cases. And the other thing I could have done is probably to wait and see a reversal pattern on the hourly chart like what we have over here with this candlestick. This is a reversal pattern right over here and it’s a great place to take your profit.

So if I kept it, I would have gained quite more exit at $142 but in this case, I decided to use the second target of the Fibonacci which was at $115. So when I decide that this is my target, doesn’t matter what’s going on, how pumped the price is or is it on all exchanges, a top gainer and everybody’s jumping in.

I don’t care. If I said that this is my target, then I will take my profit there and I will just sell everything. And if I’m not using the Fibonaccis, I’m usually waiting for a reversal pattern on the hourly chart, it could be a doji, it could be a gravestone doji. I mean there are a lot of reversal patterns, I’m not going to talk about that in this Ethereum Classic price prediciton.

Current investment

You can google them so you will see how they look. But simply, they show us when the price might reverse or where is the top but not every time.

It’s not a guarantee that there will be a reversal pattern at all. So this is why I personally prefer to use the second target of Fibonacci. It worked great for me until the moment from 2020, 2021, until now May.

What is the next target or the next price prediction for Ethereum Classic?

I’m taking quite nice profits on my investments and I always use the second target on the Fibonacci. And I know you’re waiting for the answer to the question, what is the next target or the next price prediction for Ethereum Classic?

So what I will do, I will grab a new Fibonacci and this is the new top and I will draw it to the lowest retracement.

So let me do it precisely, I want to give you a precise number and this will be the one that I’ll be looking for as well.

And I don’t have currently any investments. And I’m just waiting for a bigger retracement over here, I will show you right now what I’m looking at.

Buying opportunities

So I want to draw it precisely, yes, here it is, that’s the level. So this is my new Fibonacci and I’ll be super happy buying the Ethereum Classic at this zone. Let me grab a rectangle, for example, and I’ll be super happy buying the Ethereum Classic below the $100 somewhere in this box. Somewhere between the $23.6 and the $38.2 Fibonacci retracement level. So if the price drops over here, I’ll be buying it again.

And my next target would be $430.85. This is my next target for the Ethereum Classic.

One more time, I don’t have any at the moment, I have sold them all. I’ll be looking for a bigger retracement down to this box. I always want to buy the dips and sell the record highs.

And as well, when I was selling at $115 these were new highs. And then I have a new Fibonacci looking for the retracement which is somewhere between $60 and $85. So I’ll be looking for buying opportunities right over here. Of course, if the price drops in there it might never go in there, right? It might just continue higher. Which is fine.

Taking the profit

I took my profit, never regret taking your profits. Especially if you do over 100% of a profit, never regret and say, ‘oh why didn’t I wait? The price reached new record highs. I sold it too early.‘ If you did over 100% this is amazing, you have doubled your investment so do not regret it.

Learn to follow the exact system, exact targets, and this way you will avoid emotions. So at that moment, there were no emotions with me. I saw the target reached, I sold the tokens, and I took my profits and reinvested them into another asset that is already on a profit. So this way, I keep the emotions away, if the target is reached I take the profit.

If the price drops to these levels I will buy again and I will be looking for my next target. And I will take the profits here even if the price reaches $1,000, after that, I won’t regret because I will still have a great profit. This is the mindset you need to have so you’ll be profitable on the market.

What is your prediction about Ethereum Classic price?

If you have any questions let me know in the comments below. Check out one more time my Patreon’s page where I share all my investments when I am buying, when I’m selling, always selling on a profit. If an asset goes on a loss, I’m patient, I buy again at a cheaper price to have a better average price. And at the end of the day, I sell on for a profit.

Thank you, guys, for reading this Ethereum Classic price prediction. I would be happy to see what is your Ethereum Classic price prediction in the comments below. And I will see you in another lecture.