Forum Replies Created

-

AuthorPosts

-

Marin StoyanovKeymaster

Marin StoyanovKeymasterTo further add to what Nikos said, the major thing you need to keep in mind is that the settings you can configure apply for every single EA. That being said, if you set the risk settings to high (2% per trade) and trade with 3 EAs at the same time, and they go on a loss, this would lead to 3*2%=6% loss of your account balance which eventually will lead to the challenge being lost due to drawdown. So keep in mind this when trading with multiple EAs.

For the second question, over the weekend the app uploads new strategies if if finds more profitable EAs than the current. So you might expect to see new EAs after the weekend. The stats in the app are auto updated every 30 minutes and at any time you can see which are the top performing EAs with the current market conditions.

Marin StoyanovKeymaster

Marin StoyanovKeymasterThe issue has been solved. Please follow this topic to solve it on your side. Then you will be able to download the EAs again. Sorry for inconvenience caused. Let me know if you still have issues.

Marin StoyanovKeymaster

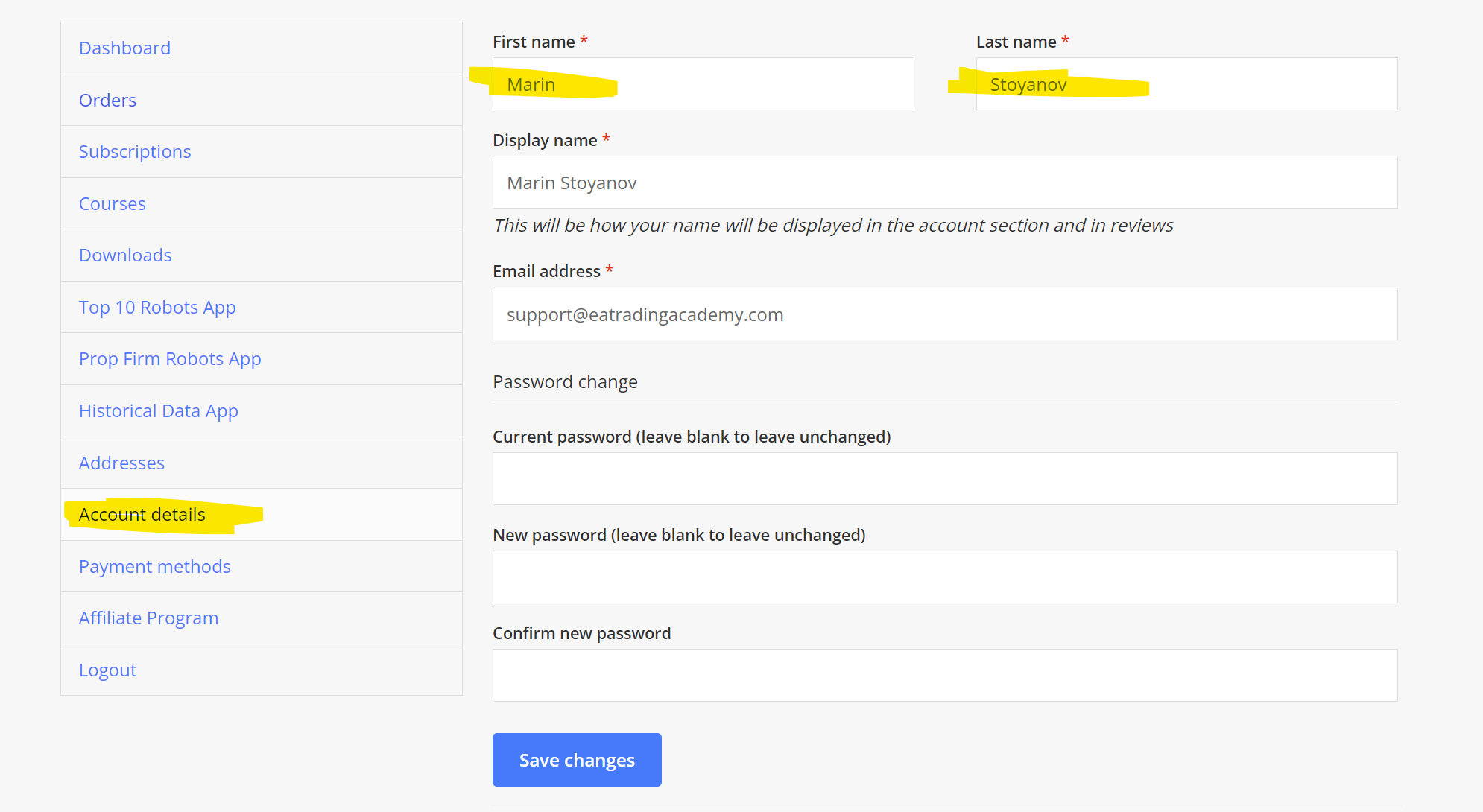

Marin StoyanovKeymasterHi all, the problem has been solved for anyone who wrote here in the topic. For anyone else, either DM us at Facebook or go to your Account details and verify that all the mandatory fields filled. This would solve the issue with your access. If you’re having a missing info for your account, then the apps won’t be able to properly display your names.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHello Devin, the problem seems to be that you have created 2 registrations on our platform. For the registration associated with your order the email is verified but the other registration that you have is not verified yet. Please write to [email protected] and let us know which email you want to keep using and we will merge your registrations into it.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey, Marin here from support team.

Looking at your profile I see that you have 1 year license for Top 10 BTCUSD EAs. The license will expire in July 2025. Once you go to the Top 10 Robots App, please switch to the pair you have a license for and try downloading the EAs then. If you can’t remember your password, please follow this link to reset it. In case you still have issues, please drop us an email at [email protected] and post some screenshots from the issue so we can assist you better.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi guys, I purchased the 10EAs App two weeks ago and I now notice that the App gives robots from the collection filtered by absolute Profit. It would be more beneficial for most traders to provide the top 10 EAs filtered by some measure of risk-adjusted returns, such as Return to DD, Sharpe Ratio, or similar. Most traders are focused on maximizing the return risk tradeoff.

Some robots in the current app, such as EURJPY M15 #749235461, currently in position 9, have better Return to DD and lower absolute Drawdown than most of the other EAs in their categories. For instance, rather than providing the top 10 by absolute Return, you could provide: top 3 by Return + top 3 by Return to DD + top 3 by Drawdown.

Another suggestion is to provide the data for each EA in a table format with EAs as rows and in the columns showing: 1d, 1w, 1M, 1Y, 5Y, Profit Factor, Drawdown and Return to DD. Whilst also keeping the current “chart with data underneath” presentation.

Thanks,

David

Marin StoyanovKeymaster

Marin StoyanovKeymasterSorry, can check the bot keep losing day by day, how should I handle it else I might lose the challenge, should I hold but when I will know when to resume the same approach ?

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi Nikos,

I am still having issues with the bot I decided to increase my VPS slices and retest I went to Blackbull markets and reset both demos to $200k but on one of my accounts I see this loss protection is activated. So I dont know if this is a glitch or what?? my daily loss is $7800 My account was at $216k and has $16 in profit not sure why this $214,941 loss protection ( see highlighted) is activated did not reset the bots when I rest my balance back to 200k or something? PLease let me know ewhen you are available to look over the accounts. As there is still the issue of the accounts not trading the same

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Satish, Marin here from the Customer Support team. You can contact us via the forum or support email and we will connect you with Petko to schedule the session. Consider this done. Bear in mind that due to his availability, the earliest possible date when you can book a session is 2 weeks from now. Petko will get in touch with you to agree on time that would suit you both.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Nikos check this out I saved the logs for trades made on 07/30/24 as this date I noticed many more trades for USDJPY on one account vs the other and much more profitable. I use chatgpt to analyse the logs and this is what chatgpt is saying between the two accounts that day.

It seems that both files are not being read correctly, possibly due to encoding issues or file formatting. I will attempt to read the raw content of the files to better understand their structure and find a suitable way to process them.

The files are encoded in a format that includes a byte order mark (BOM) indicating UTF-16 encoding, which is why there are issues reading them directly. I will reprocess these files using UTF-16 encoding to extract and analyze the data correctly.

Both logs appear to have a non-standard structure with columns that are not clearly named. The data contains technical information about the trading environment, but it seems the log messages are mixed with system and expert advisor details.I will attempt to clean the data and isolate relevant entries related to trades on the USDJPY pair from both accounts to identify the discrepancies.

The filtered logs indicate entries related to trades on the USDJPY pair for both accounts. Here’s a summary of what was found:565 Account: It has multiple entries for USDJPY trades including market sells and buys with specific volumes (e.g., 3.02 lots, 4.03 lots). These trades are detailed with timestamps and order acceptance confirmations.

363 Account: This log also contains entries for USDJPY trades, but it appears to have fewer trades compared to the 565 account. The volumes and timestamps are also different.

Key Observations:

Trade Volumes: The 565 account has executed more trades with varying volumes compared to the 363 account.

Timestamps: The trades in the 565 account seem to have been executed at different times than those in the 363 account, which could indicate differences in the bot’s trading strategy execution or conditions met during the trades.

Trade Count: The 565 account has more recorded trades for USDJPY, which might explain its higher profitability on the given date.

Possible Reasons for Discrepancies:

Different Trade Triggers: The bots may have different parameters or have encountered different market conditions, leading to a different number of trade executions.

Execution Environment: Differences in latency or execution speed due to the environment (e.g., VPS vs. local machine) might have affected the trade timing.

Configuration Differences: The bots might not have identical configurations, leading to discrepancies in trade behavior.

To further diagnose the issue, it would be useful to compare the specific configurations of both bots and consider any differences in their operating environments. If needed, I can help you analyze further based on more details. Marin StoyanovKeymaster

Marin StoyanovKeymaster1)FTMO Challenge strategy: every morning at 10:00 am update robots, close all positions that exist and are open from previous robots, replace with new top five on weekly charts. Ιs the change right at this time or is a specific time recomended? On weekends if we have open positions do we keep them until Monday morning or close them, on Friday night?

2) When we have upcoming news red flag USD we pause the robots one hour before and one hour after news (although your instructions are for 2 mins). Would you recommend less (I ask because disruption starts roughly at that timeframe).

3) On the weekend when the market is closed expect for crypto, should we pause robots that include crypto pairs, if they are in the weekly top 5 list? Marin StoyanovKeymaster

Marin StoyanovKeymasterHello, you can import the EA in Forex Strategy Builder Professional and use the software user interface to create a martingale strategy.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Michael, glad to hear about your success with the challenge.

For your funded account, sadly when the market is against us there is not much we can do. We have other users who also reported that the last few days are not good for them after a great start. This is just another market cycle that eventually will end.

What I would do in such a situation is just to pause trading for a while until the market goes in my favor again. I still trade on my demo accounts with the best performing EAs from the Prop Firm Robots app and/or the Top 10 Robots app to keep an eye on the market and when I notice that it’s being stable I start trading again.

P.S. By the way, this is a great topic and it would be great to hear how other traders approach this situation, so moved it into the main Prop Firm Robots app forum as a separate topic. This will give it more exposure and hopefully others will share their thoughts.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHello, the EAs from the Top 10 Robots app are different and use different parameters during the generation process. The app is a completely separate product. You can learn more about it here.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHello everyone on the forum. I am using the prop firm FXIFY. I started a $100k challenge with FTMO prop firm bots. So far, I am at -2.5%. I am using the 5 best bots on a monthly frame. After 2 weeks, I left 3 bots that were profitable. Is this approach correct? Is there any documentation with a description of how to use these bots? (I’ve already watched the video)

-

AuthorPosts