Home › Forums › Ready-to-use Robots › Prop Firm Robots › Passed Challanges with the FTMO/Prop Firm Robots

- This topic has 90 replies, 1 voice, and was last updated 4 months, 1 week ago by

Anonymous.

-

AuthorPosts

-

-

October 26, 2023 at 11:14 #207295

Anonymous

InactiveHey Traders,

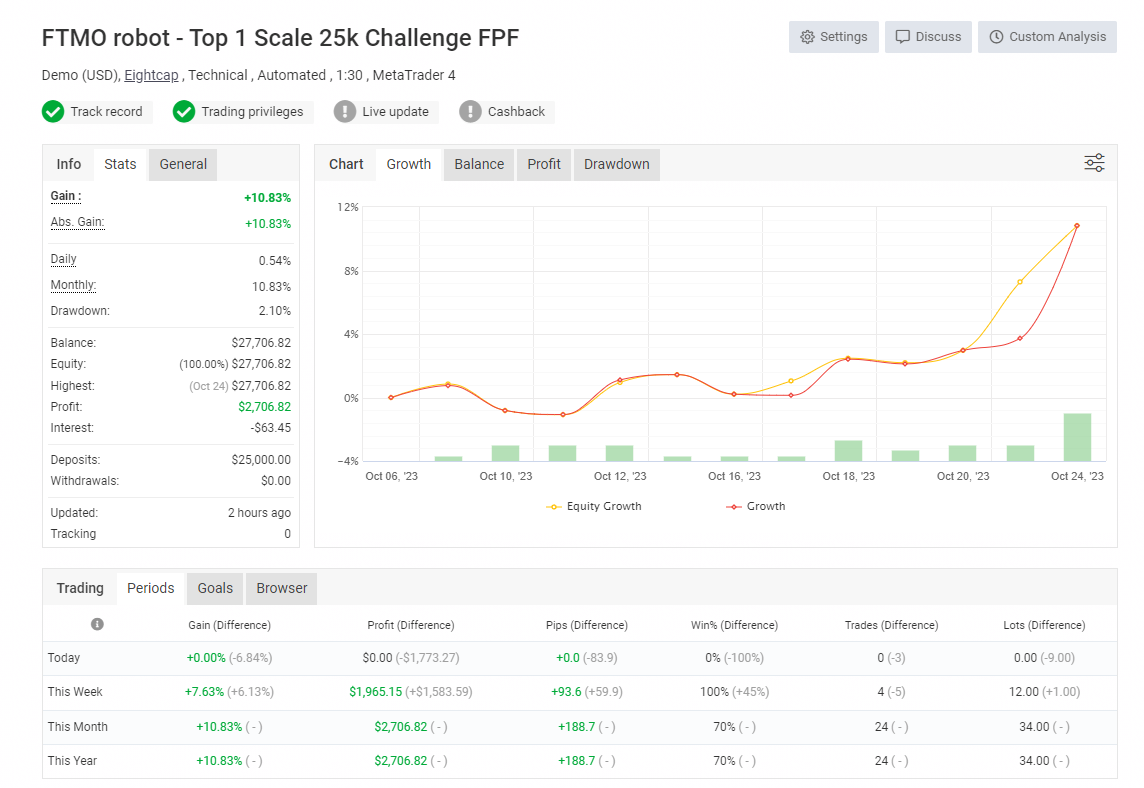

I’m happy to share with you that I passed 2 Prop Firm challenges with the FTMO Robot in the last 2 weeks!

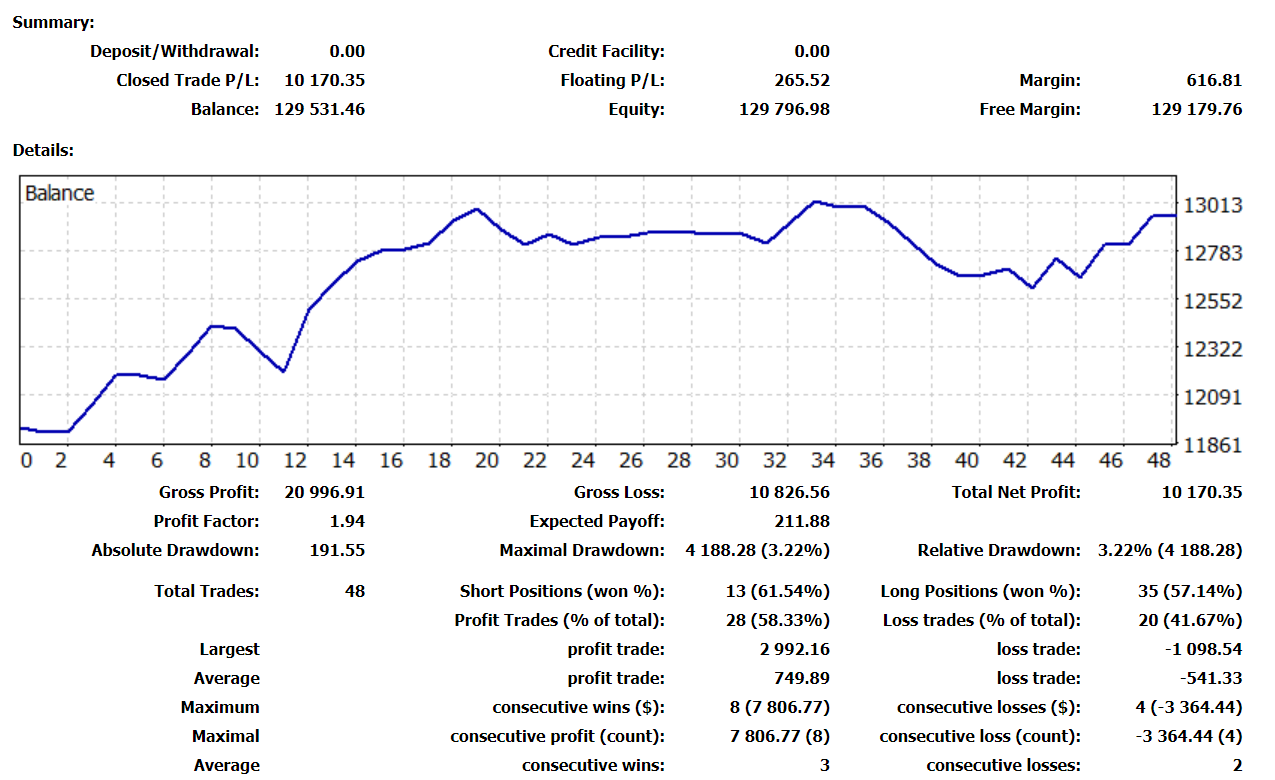

In the first challenge, I used the Top Performer from the 7 FTMO Robots. Once I reached 2%, I increased the entry lots to 3. You can see the statistics for all trades in the account.

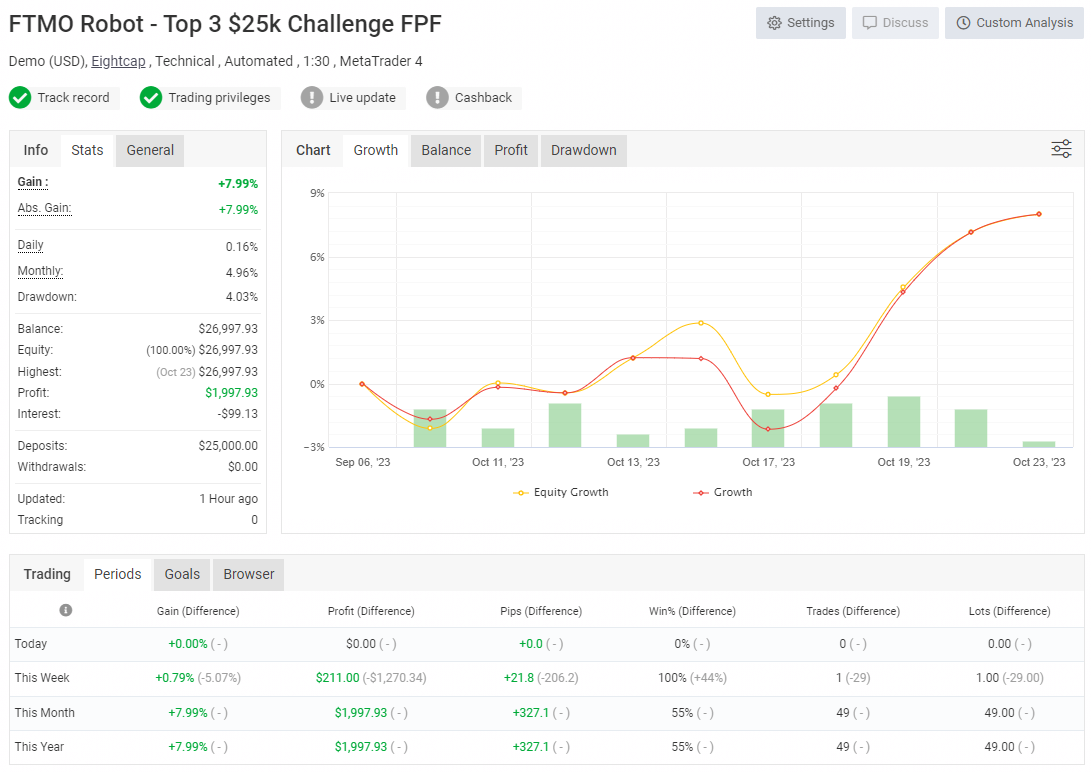

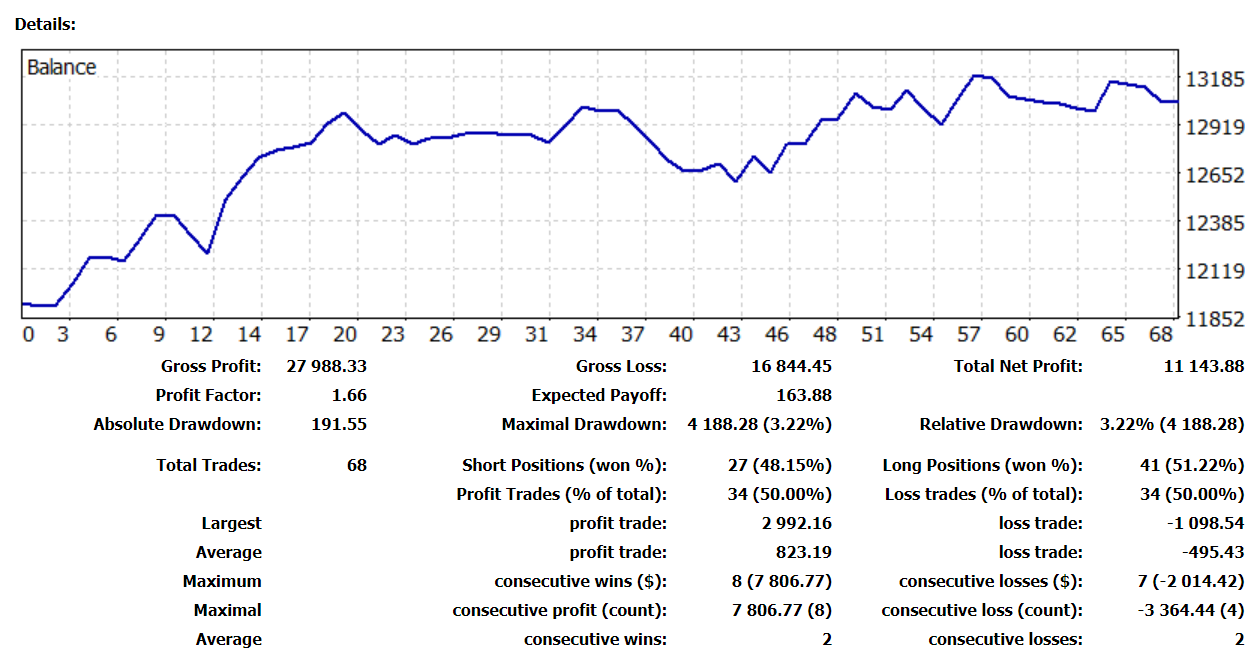

I used the Top 3 EAs in the second challenge without changing the lot size. Have a look at the statistics from the account.

The second account is with time limit so the target is 8%. Surprisingly the Prop Firm marked it as Passed at 7.99%! :)

I also recorded a video about it, and it will be published tomorrow – Friday the 26th of October.

Cheers,

-

October 26, 2023 at 11:49 #207299

Anonymous

InactiveWow congratulations! Can I ask you about the time settings of the bots? 1-23 by default? Or did you modify them?

-

October 28, 2023 at 14:08 #207946

Anonymous

InactiveYes, I use the default settings. I did not change anything.

-

-

October 26, 2023 at 17:16 #207380

Anonymous

InactiveLeverage 1:30, meaning you opted for FTMO Swing accounts?

-

October 28, 2023 at 2:12 #207838

Anonymous

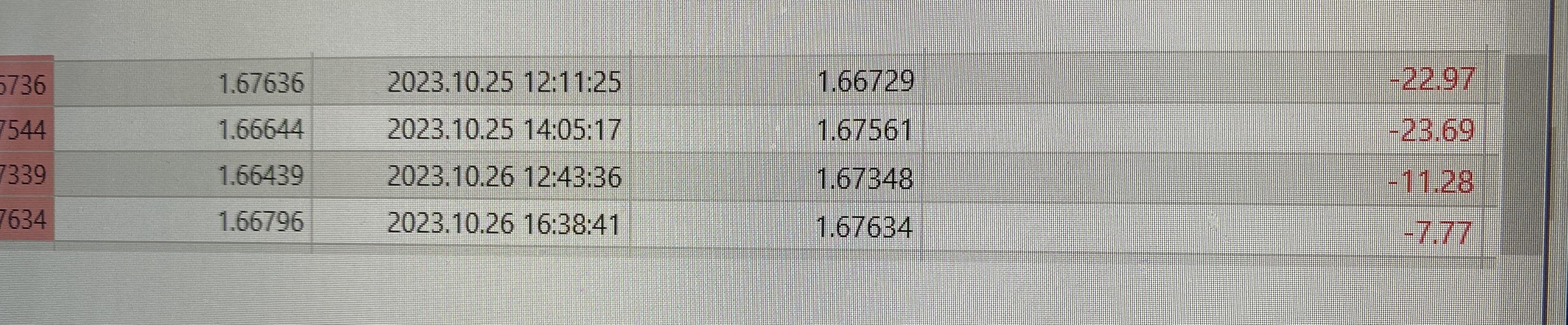

InactiveGreat job! I was running the GBPCAD also and it was losing multiple trades, so I shut it down. I’m using the V4.3 on 1M

I would love to get it working like yours. Any help is greatly appreciated.

-

October 28, 2023 at 2:14 #207839

Anonymous

Inactive -

October 28, 2023 at 17:11 #207989

Anonymous

InactiveIf you check the trades in the reports, you will see that I traded the GBPCAD at the beginning of the week. At the end of the week, the AUDNZD was the profitable one.

So you need to track the 7 EAs and see which is the best one at any moment.

-

October 28, 2023 at 17:44 #208000

Anonymous

InactiveGlad to hear there was profitability on your side this week, unfortunately I have only radio silence with these EA’s for some reason. I’d love to rectify that.

-

October 28, 2023 at 18:23 #208010

Anonymous

InactiveI have a few of ideas. 1. In the EA properties box reduce all four of the first four lines from 1.0 to 0.01 to see if you now start to get trades. 2. Start a 200K FTMO demo swing trade account and add all 7 EAs. I know the EAs will work there. This way you can start tracking which EAs are performing the best in the current market environment while you continue to resolve the issues with the other brokers. 3. Contact each broker and make sure they allow EAs. 4. Give me access to your computer so I can make sure everything is setup properly.

Alan,

-

October 28, 2023 at 19:41 #208026

Anonymous

InactiveHello Alan, I had already tried 0.01 lot size on one of the other accounts I was tracking, but still there were no entries.

The 3 brokers I have tried definitely allow EA’s because I use them regularly to trade many different EA’s on all my accounts, (demo & live).

Always I have other EA’s along side Petkos FTMO bot, (to verify MT4 functionality) and they trigger entries as normal.

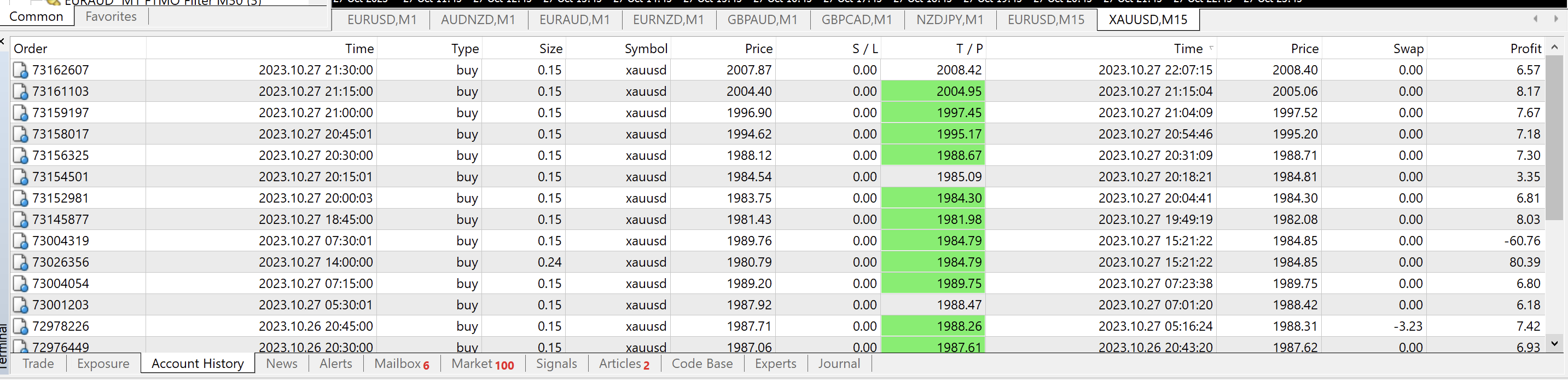

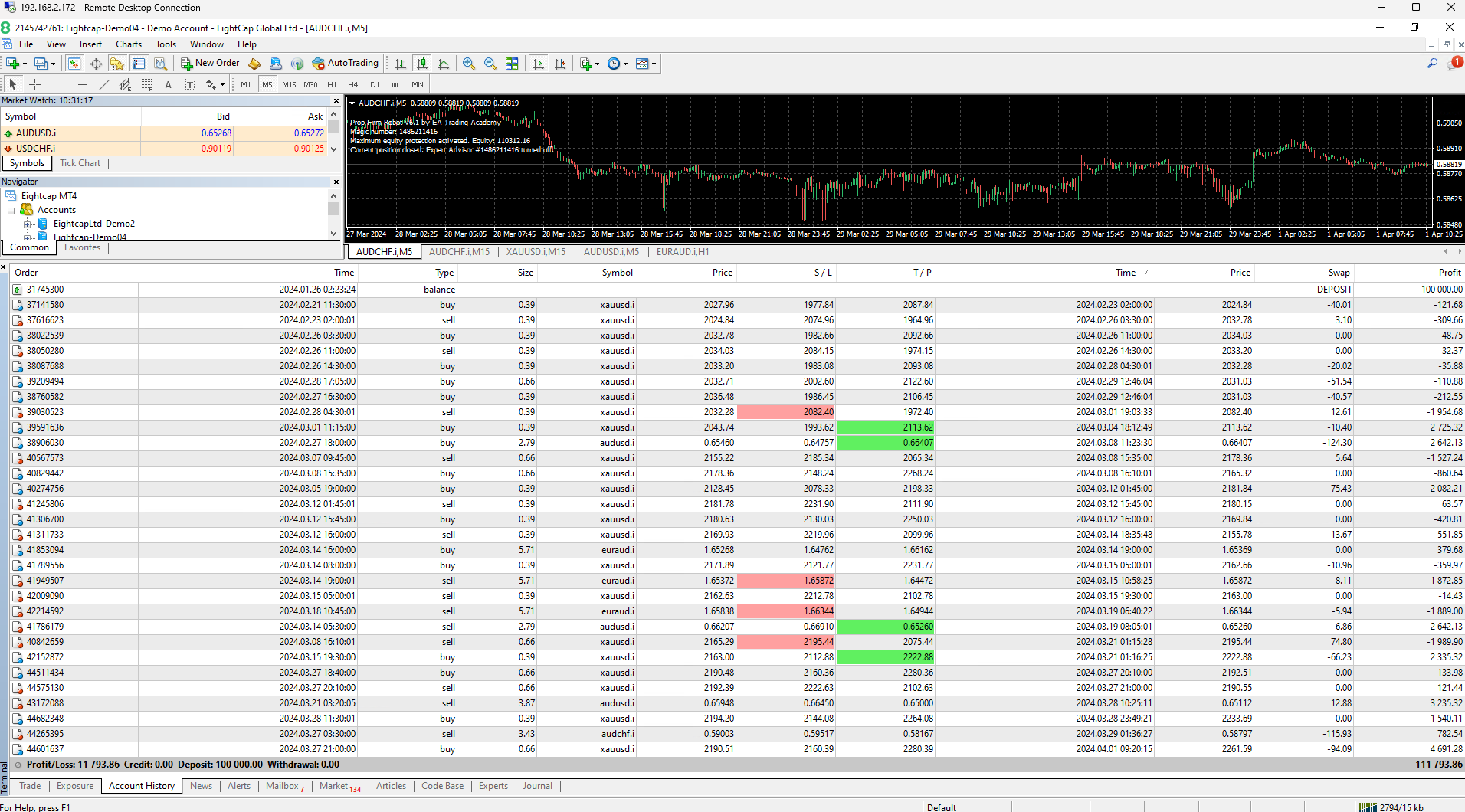

For example this last week on the same account, I put an EA trading XAU/USD along with it, and as you can see that one made many entries;

Im not sure what else I can try, last week I deleted all my other MT4 terminals except this current EightCap one, to make sure there was no issues with conflicting terminals.

This next trading week I will reinstall the separate terminals again with different brokers and test them with smaller lot sizes only.

Very confusing why it doesn’t work for me.

-

October 28, 2023 at 19:48 #208028

Anonymous

InactiveRe: suggestion 4.

If someone can email me through EA Trading Academy, I can give you temporary access to my VPS where you can asess the situation.

-

-

-

-

October 29, 2023 at 3:07 #208109

Anonymous

InactiveDear Petko,

Before I ask my question, I want to thank you. In demo mode, the 7 EA’s have performed so well since October 11 that is up 12.5%. That is 17 days.

Before I start the FTMO evaluation, I have a question.

Once I ran all 7 bots, how many days going backwards do I use to identify the top performer? 2 days, 1 week, 2 weeks?

My biggest fear is for the currency pair to start having a red streak after 12 trades with an 80-90% win rate. Any light you could shed on this would be of great help as I know you have come across this concern in the past.

Thank you Petko.

Ling

-

October 29, 2023 at 11:36 #208171

Anonymous

InactiveI would wait 1 week to identify the top performer. You can change the amount of time to see what works best for you.

There will always be periods of profits and periods of losses. There are many strategies that can be used to minimize losses so that over the long term the account will be profitable. One strategy is to have several Expert Advisors trading. When one EA is going through a period of drawdown the other EAs may be going through periods of profits. Another strategy is to have a demo account of the 7 EAs and only move the Top performer to a live account or maybe the top 3 performers. Then once each week (you can change this time to see what works best for you) review the demo account and move the top performers to the live account.

Hope this helps!

Alan,

-

October 30, 2023 at 17:32 #208472

Anonymous

InactiveThank you Alan, much appreciated!

Ling

-

-

-

October 29, 2023 at 3:13 #208106

Anonymous

InactiveI just purchased the bot.

Is the 30 TF the best one to use?

Well done on passing the challenges.

My intention is to start low, $10k on the Funded Trader perhaps, and work my way up.Thanks.

-

October 30, 2023 at 4:16 #208359

Anonymous

InactiveGonna start the challenge on a 25K Swing account tomorrow! I’m excited

-

October 30, 2023 at 23:50 #208551

Anonymous

InactiveGood luck!!

I have started testing on a 200k demo account (Alpha Capital Group). So far, hardly any draw-down and 3k up.

Day one.

Impressive.I will give it a week and then test on a 1ok account and may go for a 10k funded account with The Funded Trader.

Slow and steady wins the race.-

October 31, 2023 at 1:25 #208566

Anonymous

InactiveThank you! Good luck to you too!!

Meanwhile, you can check how it’s going here: https://www.myfxbook.com/members/0xBitpool/ftmo-challenge-25k-top-3/10505789

-

November 1, 2023 at 22:07 #209054

Anonymous

InactiveLooking good! Can you share your setting? I was looking at your trades and they are taking trades differently than mine.

Thanks for your time.

-

November 1, 2023 at 22:16 #209058

Anonymous

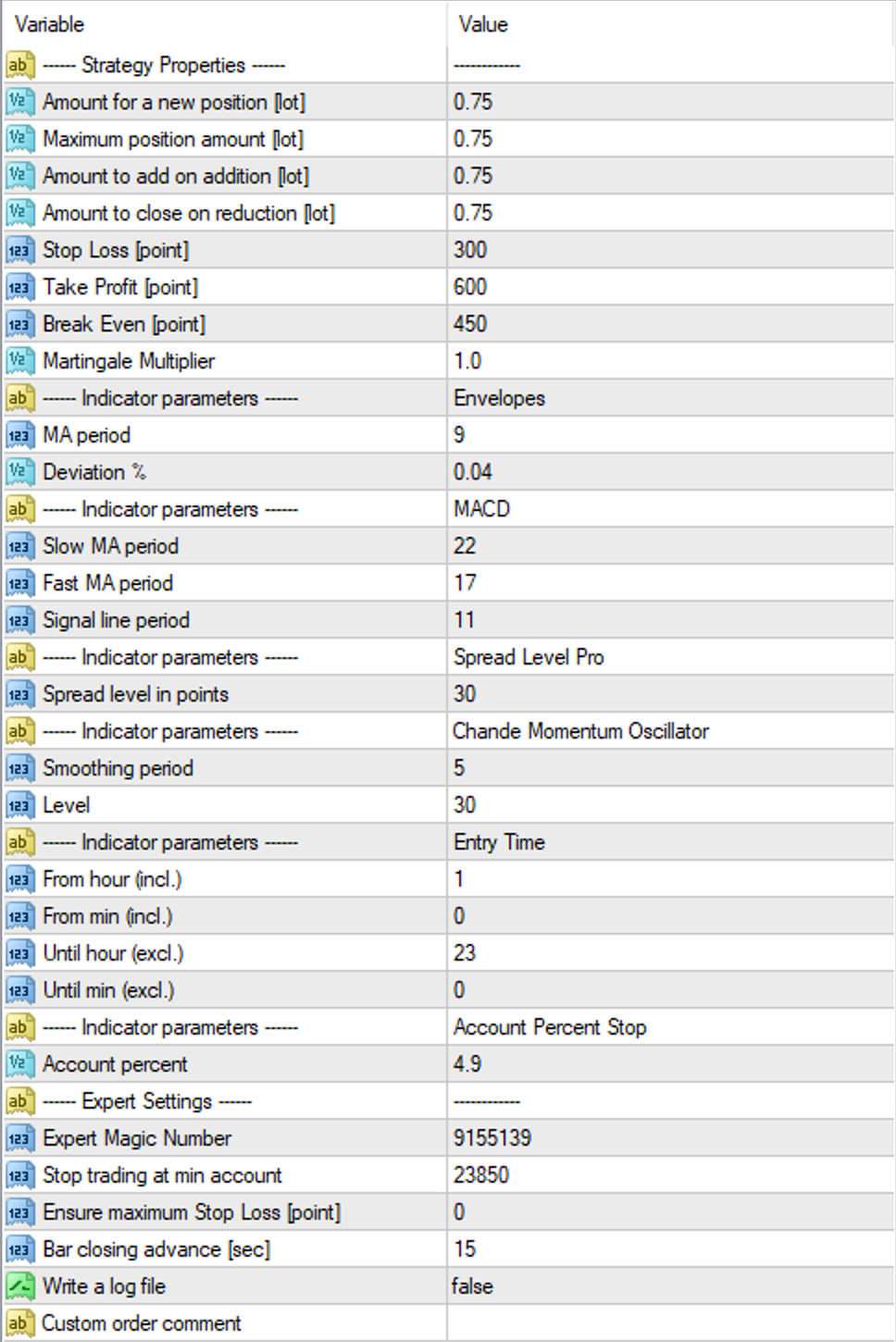

InactiveSo for FTMO, 25K on a swing account, here are my settings (example for EURUSD)

-

-

January 18, 2024 at 22:02 #227766

Anonymous

Inactivehi,

just checked your stats, around $400 profit since last october? not the best results so far.

-

-

-

-

October 31, 2023 at 22:47 #208788

Anonymous

InactiveHi Petko/Alan

I purchased the FTMO robots a month ago and it passed the FTMO 50k DEMO challenge with all 7 EAs. Now I am enrolled in 100k real challenge and in last 12 days, it is up by 1.1 %. I still have my demo accounts to monitor which are the top EAs in last one week and based on that I am using top 3 EAs GBPCAD, EURUSD and AUDNZD in my real FTMO challenge:

My questions:

1) In 100k challenge, I am trading 3 pairs with 1 lot size , it that okay or should I change any settings/lot size? I am trading EA as is.

2)If I manually close any trade or manually open any trade, does it affect the EA settings or how EA trade?

3) Sometimes I see trade reverse and I tend to manually change it, should I do it or leave the EA as is? Of course that going in contrast of automatic trading. In long term, I want to trust the EA and trade automatically.

4) How to calculate the % of account size with lot size? How much account size I am risking per lot?

thanks,

Parveen

-

November 1, 2023 at 22:50 #209069

Anonymous

InactiveAnswer 1) Trading 3 pairs with 1 lot for each pair yields an account risk of 2%. This is OK.

Answer 2) Manually closing a trade does not affect the EA. It will continue to function normally.

Answer 3) If you are going to trade with EA’s then you need to have faith in them and not be changing their parameters or manually close the trades. Having said that I will manually close a trade if it is close to the TP and I see it is starting to reverse directions. This is the only time I will close a trade.

Answer 4) Use a calculator to set lot size, etc. https://www.babypips.com/tools/position-size-calculator

Alan,

-

-

November 2, 2023 at 1:12 #209084

Anonymous

InactiveIs there anything that I need to do before attaching the FTMO bot on to its required pairs in MT5?

I noted that Alan said to download previous data prior to attaching? I think I have done this correctly.Any additional advice would be great.

Thanks.

-

November 2, 2023 at 11:53 #209181

Anonymous

InactiveHi PrimalSci,

Good luck with your challenge, and just be aware of your risk! Keep us posted as to how it goes.

Alan,

-

November 15, 2023 at 6:53 #212640

Anonymous

InactiveHey,

What do you mean by previous data? I have not heard about it and I am curious

Thanks

-

-

November 2, 2023 at 13:04 #209192

Anonymous

InactiveThanks Alan.

Not going so good at the moment unfortunately but it is early days and need to give it a chance. Trading is difficult and will always fluctuate up and down. It is what it is.

Is the bot purely a plug and play bot?

Thank you.

-

November 2, 2023 at 15:09 #209222

Anonymous

InactiveHi PrimalSci,

The only thing you need to change would be the first four lines in the EA Properties box based upon your account size.

The following is the recommended lot sizes based upon a 10K account which limits risk to 1%:

Amount for a new position = 0.3 lots

Maximum position amount = 0.3 lots

Amount to add on addition = 0.3 lots

Amount to close on reduction = 0.3 lots* For larger accounts simply scale the lot sizes.

Alan,

-

November 2, 2023 at 15:34 #209231

Anonymous

InactiveSuperstar.

Thanks Alan!!Will keep you updated on how it goes!

-

-

-

November 2, 2023 at 13:05 #209194

Anonymous

InactiveHey, I just wanted to start my first ftmo challenge with this bot. I have 2 questions:

1. I live in germany, with eur as currency. Do I have to choose EUR or USD as currency when I want to start ftmo?

2. I have to take the swing account, Right?Thanks Guys!

-

November 2, 2023 at 16:12 #209245

Anonymous

InactiveHi Rick,

Answer 1) It is up to you as to whether you should choose EUR or USD. However, since you are in Germany EUR might be your better choice.

Answer 2) Yes, use the swing account!

Alan,

-

-

November 4, 2023 at 5:52 #209584

Anonymous

InactiveIn my opinion both of your strategies is dangerous. The scale up one is dangerous if you don’t monitor it all the time if consecutive loss happened, it will violate 5% daily limit. The three top performers EA will be dangerous too, your DD is close to 5%, and it’s just lucky not violate it.

-

November 4, 2023 at 15:58 #209691

Anonymous

InactiveHey Joko,

I appreciate your feedback!

True, but one should not use the scaling-up method if one can’t monitor the trades. I decided to use the scaling-up system only when I am around the monitor.

About the second one, it depends on your risk tolerance. It’s not luck. I’ve done plenty of tests with the EAs and the lot size to calculate that the chances of passing the challenge and not violating the rules are huge. If that ”risk” is too much for one one, it’s just a matter of lowering the lots.

-

November 6, 2023 at 17:40 #210269

Anonymous

InactiveHello!

Thank you for all that you guys do.

I have 3 questions.

1. If I am closely following EURUSD and have decided to use it for an evaluation, how do you decide when is the best moment to begin using the scaling plan? After seeing 1, 2 or 3 red trades or is it based on a different criteria?

2. I would like to ask if soon there will be a way to create a script to automatically trade with the same number of lots if the current trade is a loser, but if the current trade is a winner, to automatically add “X” number of lots before placing the next trade.

3. I am considering purchasing the TOP 10 Forex robots and would like to confirm if they are all a 1:2 loss/win ratio to use the scaling plan to pass a challenge.

Thank you,

Ling

-

November 6, 2023 at 20:55 #210319

Anonymous

Inactiveanswer 1: This is explained in the cheat sheet you can download from the FTMO course, However, I will explain how I would use the scaling plan for a 10K account. When I would start the challenge I would start with a lot size of 9.3 lots. Once I have $300 profit I would increase the lot size to 0.9 so that the next time the EA entered a trade it would trade with a lot size of 0.9 lots. Then once the account reached a profit of $900 I could increase the lot size to 2.7 lots. The idea about how much to scale up is so that if the EA hit the SL the account would be reduced to would not exceed the daily amount of 5%.

answer 2: This IS done by how you set up the first 4 lines in the FTMO EA properties.

answer 3: The TOP 10 Forex robots do not adhere to the 1:2 loss/win ratio.

Alan,

-

November 7, 2023 at 16:14 #210490

Anonymous

InactiveThank you Alan, your answers are very helpful and much appreciated.

Ling

-

-

-

November 7, 2023 at 3:52 #210386

Anonymous

InactiveDear Petko,

In one of your account you use Forexpropfirm and its leverage is 1:30. In your opinion for the one shoot/entry not martingle, is it always enough?

-

November 7, 2023 at 11:40 #210449

Anonymous

InactiveHi joko,

Leverage of 1:30 is sufficient to pass the FTMO challenge.

Alan,

-

-

December 21, 2023 at 11:02 #221845

Anonymous

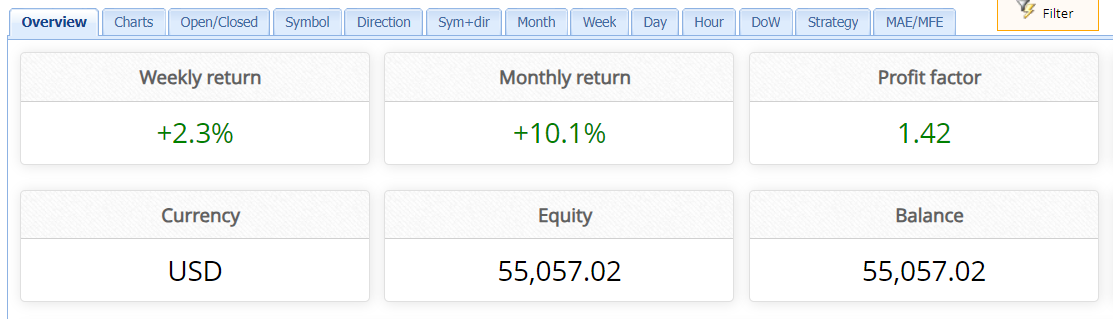

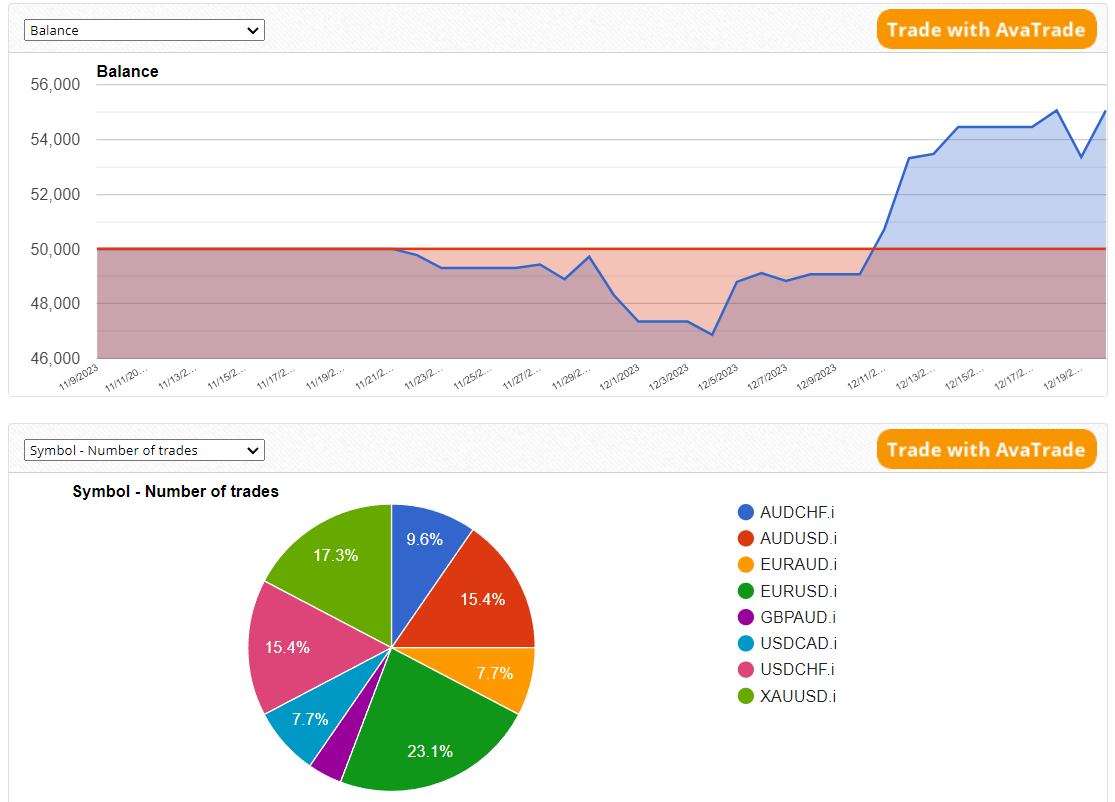

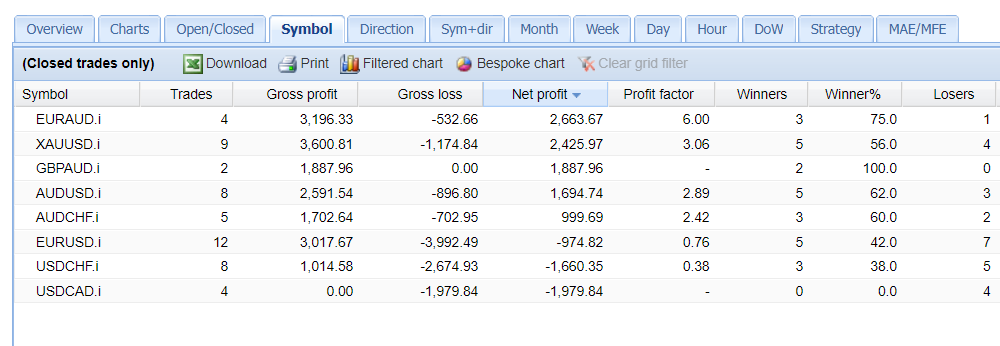

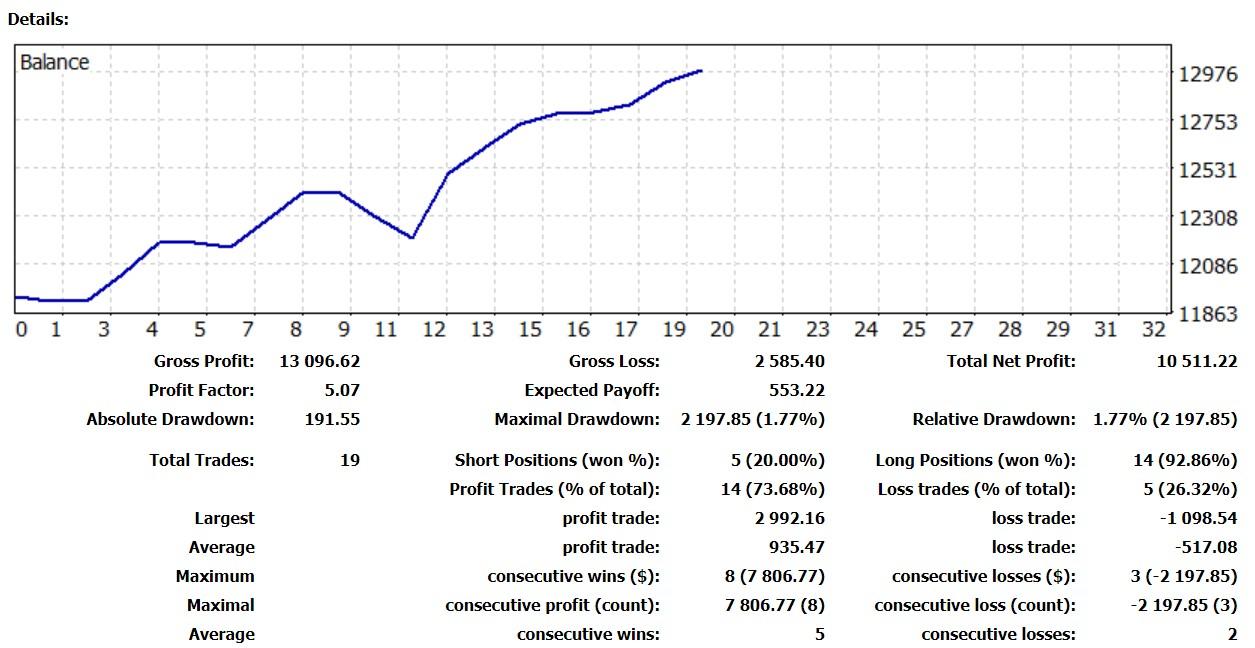

InactiveThe FTMO Robot has passed another challenge! This time it was the Infinity Forex Funds 50k account.

I used all the robots trading simultaneously with 1% (normal) risk per trade. Once the account reached 5% profit, I doubled the entry lot (keeping it at 5% max Daily Loss). This is a variation of the scaling-up system I teach in the FTMO Course.

Once the equity reached $55,050, the trades were closed automatically using the integrated target protection settings in V5.1.

It took about 30 days for the FTMO Robots to pass the challenge. EURAUD and GOLD were the most profitable pairs. You can have a look at all of the stats here.

At the beginning of the challenge, I had the FTMO Robots V5.0, and then I replaced them with the Robots from V5.1 (that is why there are double magic numbers). I also doubled the lots according to the V5.1 values.

Scaling up works great for me! And I don’t find it as risky as the Martingale approach because we reinvest the profits in the account.

We plan to integrate the scaling-up method in the inputs of the EAs so that when one wants to double (any multiplier), the lots can do that automatically at a certain point.

In this example, it was just one one-time manual intervention but it would have been great to set this from the beginning:

– increase 2 x lots once the account reaches $52500 (5%).

We will work on that, and as soon as we develop it, we will add it as an option in the EAs.

-

December 21, 2023 at 14:44 #221895

Anonymous

InactiveNice! I will start a 50K Evaluation using v5.1 robots.

Alan,

-

-

December 28, 2023 at 1:52 #223102

Anonymous

InactiveI’ve passed FTMO with earlier version but I adjusted the strategy slightly so it worked for me. Using latest version on my 2 funded accounts now and it’s doing well

-

January 5, 2024 at 10:40 #224808

Anonymous

InactiveDear Fellow Traders,

I’m genuinely thrilled to share a major milestone in my trading journey – the FTMO Robot has successfully navigated and conquered my 1 Phase 15k Challenge! 🎉

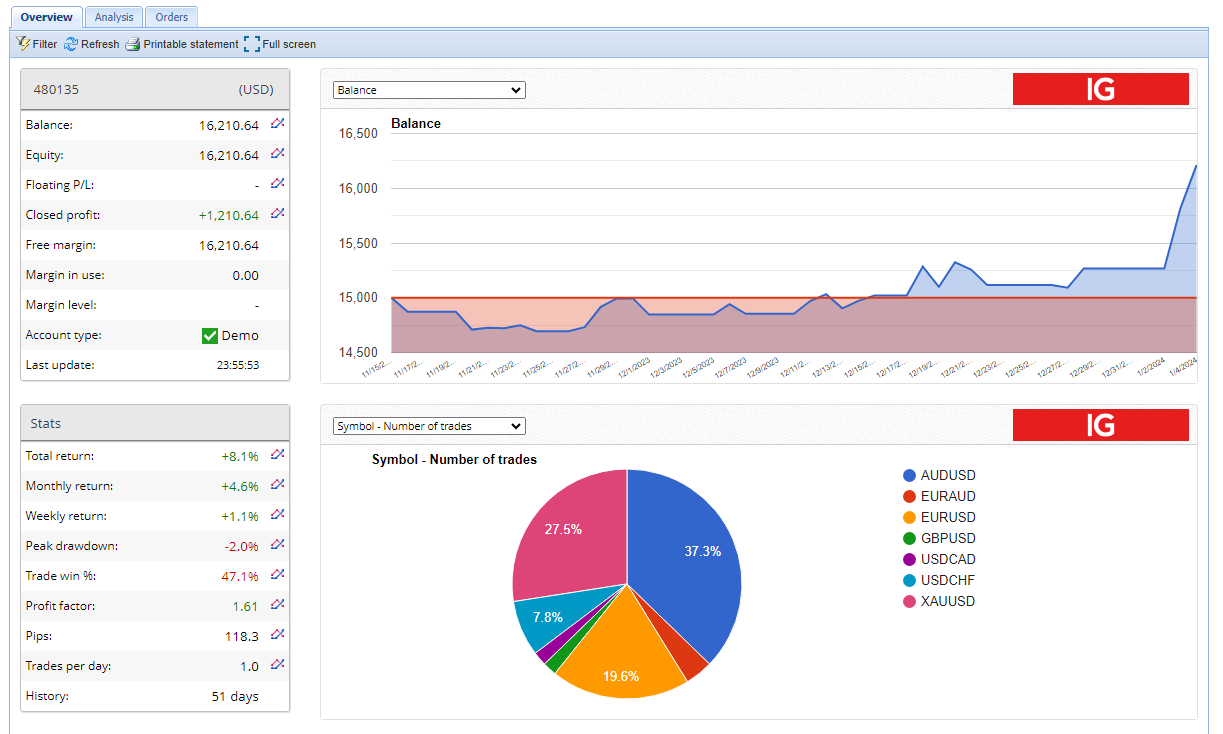

I initially kicked off with V5.0, diligently trading for a month with the Top 3 performers. However, in the pursuit of optimizing results, I decided to make a strategic move. I upgraded to V5.1, tweaking the lot size to be twice the default for the top performer, USDCHF. The outcome? It delivered the maximum profit during this trading.

I used V5.0 initially but it was cost to cost even after 1-month trading with Top 3 performer later I replaced all the robots with V5.1 with Top 3 performers but this time 2x the lot size of default for the top 1 performer ( USDCHF). It gave me the maximum profit in the meantime.

The journey took me a solid 34 calendar days, during which USDCHF and EURAUD emerged as the most profitable pairs for me.

For those keen on the nitty-gritty details and statistics, feel free to check out the comprehensive breakdown on my FX Blue profile:- https://www.fxblue.com/users/480135

Happy and genuine trading vibes to all!

-

January 5, 2024 at 22:20 #224960

Anonymous

InactiveSo did you just keep using the same top 3 performers from your test time? I have been trialling the 8 bots as suggested for to see what are top performers

-

-

February 19, 2024 at 17:16 #236117

Anonymous

InactiveHello Allan,

Thanks for this.

Sorry if you’ve already answered this but just to double check that your original post in this thread refers to the performance of the FTMO EA straight out of the box with the original settings and no modifications? This was a month ago so is there an update on the performance since then? I ask because I see some people on other threads complaining of slow activity.

-

February 19, 2024 at 17:36 #236121

Anonymous

InactiveHi David,

Sorry, I am not sure what original post you are referring too. Anyway, being in the United States I can no longer trade the FTMO robots on the FTMO challenge as it is not allowed by FTMO. What I can tell you is when I was trading the FTMO robots on an FTMO challenge they were not modified!

Alan,

-

-

February 21, 2024 at 15:51 #236808

Anonymous

InactiveHi there,

Is there anything in particular we need to watch out for when purchasing a challenge from a prop firm. Here is an example from a prop firm EA limitations.

Yes, we allow the use of any risk management EA or Trading Bot as long as they are not used in the following ways:

Martingale

Tick scalping

Reverse arbitrage trading

Latency arbitrage trading

Hedge arbitrage trading

HFT (High Frequency Trading), Grid TradingSo would the FTMO Robot be allowed in the above case ? Not sure how the EA FTMO robot functions to be sure on what to look out for.

thanks in advance

Patrick

-

February 21, 2024 at 16:25 #236820

Anonymous

InactiveHi Patrick,

Yes you can use the FTMO robots as they do not trade under any of the conditions you noted above.

Alan,

-

-

February 28, 2024 at 13:09 #238592

Anonymous

InactiveHello Traders!

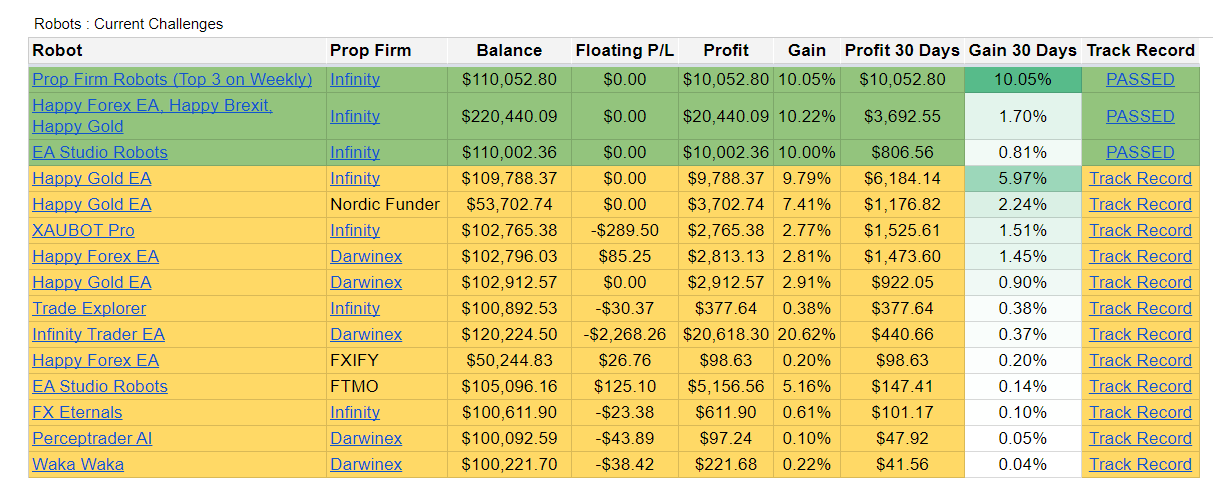

We have taken the next step in our transparency efforts with our students by making the results from our challenges public:

On the new page, you will find all the accounts we trade – challenges and funded accounts!

You can track how the Robots are performing at any given moment with live records! This page aims to test all the robots for you, so you can easily decide which ones you want to trade!

Note: Please do not consider any information on that page as financial advice! Choosing which robot to trade with on which prop firm is a personal decision!

Cheers,

Petko A

PS: We have also changed the name of the FTMO robot app to Prop Firms Robot because we don’t want to be associated with FTMO or any other Prop Firm.

-

April 1, 2024 at 16:29 #245816

Anonymous

InactiveHello traders,

I’ve got really good news to share!

The Prop Firm Robots (or FTMO ROBOT) have successfully passed yet another challenge! This time, it was on a $100k challenge account with Infinity Forex Funds. I relied on the Top 5 EAs from the Prop Firms App on the weekly timeframe. I took a bit of a risk by doubling the lots once the account hit 5%. It took the Prop EAs a solid 40 days to pass the challenge, and what’s even more impressive is that they managed to gain a whopping 15% in just the last 30 days, which is awesome to see!

Here is an image of some of the stats:

Kind Regards,

Nikos -

April 5, 2024 at 9:01 #246710

Anonymous

InactiveWow, thanks for posting Nikos that’s really encouraging. I’m new to this and I just purchased those bots last night. Just waiting to receive them now.

-

April 5, 2024 at 10:29 #246727

Anonymous

InactiveHey Pete,

Thank you very much and of course if you have any questions, let me know and I will assist you!!

Thank you!

Kind Regards,

Nikos -

April 5, 2024 at 10:44 #246732

Anonymous

InactiveHi Nikos,

You’re welcome! Thanks so much and yeah, I’ll definitely hit you up for any advice moving forward. Nice to have a ‘big brother’ out there who’s already been ‘through the trenches’.

I wish you success and happy trading,

Pete

-

April 5, 2024 at 10:49 #246734

Anonymous

InactiveHey Pete,

Thank you so much and I wish you happy trading and success as well!

As mentioned, I am here whenever you have a question, just let me know!

Kind Regards,

Nikos -

April 8, 2024 at 12:34 #247283

Anonymous

InactiveHello traders,

Here is the video about this challenge. I hope it will be useful to you to know how exactly I passed the challenge with the Prop Firm Robots:

-

April 8, 2024 at 13:44 #247292

Anonymous

InactiveJust to clarify, did you check the top weekly performers every day? and adjust the loaded Robots based on this?

-

-

April 9, 2024 at 0:01 #247422

Anonymous

InactiveGood question because I loaded up the XAUUSD M5 bot and by the time it entered a trade I see now that it’s not even on the list and drawing down now.

Seems we have to be pretty vigilant with it. Should be look at the weekly and only seek out the monthly for confirmation or?

-

April 17, 2024 at 14:28 #249417

Anonymous

InactiveDo we need to allow for the indicators to show on screen for the EA to take trades or this is not affecting trading?

I have added 3 top performers from the app for the last 2 days have not opened any trades yet. Please advise.

-

April 18, 2024 at 11:28 #249635

Anonymous

InactiveGood day EA Trading academy members

Been a great couple of days with the FTMO Robot’s…

Trusting that it will continue.

Anyone else been making some good profits.

I have setup a nice portfolio and I am hoping it will pay off.

I will leave the robots to run now and see what happens. -

June 18, 2024 at 16:46 #261805

Anonymous

InactiveDear traders,

We are really happy to announce that we passed a 100k challenge with Infinity Forex Funds using the Top 3 Robots from the Prop Firm Robots App on the weekly timeframe!

It took about 2 weeks for the EAs to pass the challenge and today was the day that it was passed!

You can also see here the results:

As you can see it is the first on the list and they passed with 10.05% profit gain!

You can access this table from this link below:

Kind Regards,

Nikos -

June 19, 2024 at 11:01 #261917

Anonymous

InactiveHi Nikos,

How did you go about choosing the EAs to use to pass this challenge? Did you choose the top three EAs from the previous week going into a new week or did you change the EAs every day based on what was top 3 at the time?

Many thanks,

George.

-

June 19, 2024 at 11:25 #261926

Anonymous

InactiveHey George,

I was checking every day to see if there is any EA that is more profitable than the ones I was already trading with!

Kind Regards,

Nikos-

June 19, 2024 at 11:28 #261927

Anonymous

InactiveI see, so, would you check at the end of each day for the following morning or at the beginning of the day ready for the day?

Many thanks!

George.

-

June 20, 2024 at 13:14 #262117

Anonymous

InactiveHey George,

I am sorry for the late reply.

I look at every start of the day to see if there is any more profitable robot.

Kind Regards,

Nikos

-

-

-

-

June 19, 2024 at 12:32 #261956

Anonymous

Inactive@Nikos I think what would be beneficial to all is setting a daily routine and checklist for us if possible?

For example:

- Do you check the top 3 each morning, evening etc

- Do you close positions for weekends?

- If an EA has dropped off the top 3 but has an open position do you leave it or close it?

- Are there any conditions that require manual intervention such as closing all for NFP/CPI/FOMC?

Thanks

Craig

-

June 20, 2024 at 13:17 #262118

Anonymous

InactiveHey Craig,

I am sorry for the late reply.

So, these are the answers to your questions:

1. I check every start of the day or morning for more profitable robots

2. I do not close the positions

3. I close the position if I have to change the robot

4. I believe that before the news, the robots close the trades automatically but in case it does not happen you can close them manuallyHope this helps!

Kind Regards,

Nikos-

June 20, 2024 at 13:37 #262133

Anonymous

InactiveThanks Nikos! I like to have a structure to work to. By doing it this way it fits nicely to my trading routine. Will see how the demo goes next few weeks

Craig

-

June 25, 2024 at 7:50 #263007

Anonymous

InactiveHey Craig,

It’s always good to have a structure and sure let me know how it goes!

Kind Regards,

Nikos

-

-

June 24, 2024 at 18:20 #262848

Anonymous

Inactivehow long before the news should I close the trade?

-

June 25, 2024 at 7:51 #263008

Anonymous

InactiveIf it does not work automatically, it’s good to turn it off about 15-30 minutes before the news!

Kind Regards,

Nikos

-

-

-

June 20, 2024 at 19:06 #262197

Anonymous

InactiveEJ and UJ weekly EAs for 50k 1%, closed after 24 hours with total profit 850$ hitting a manually moved SL, close to hitting TP but price reversed. Yesterday, UJ and UCHF weekly closed hitting SL at 677$ total loss. Replaced the UCHF with EJ. Working on demo, if EJ and UJ repeat the wins 2-3 times more I ll try them on one of my challenges.

-

June 27, 2024 at 14:31 #263436

Anonymous

InactiveSo Far so good, this is the best attempt I have had to date. Up 5.8% using 1% Risk and setting the Top 3 Weekly EA’s every morning. BTC took a chunk but paid it back the next day. Only Issue I have is the contract sizing on XAG, I needed to up the lots by a factor of 10 on RoboForex

-

June 28, 2024 at 9:24 #263601

Anonymous

InactiveHey Craig,

It’s great that you are having good results, thanks for sharing!

Kind Regards,

Nikos -

July 1, 2024 at 14:27 #265623

Anonymous

InactiveHey Craig, quick question: When you say you set them up every morning, do you mean that you turn them off and on again in the morning or do you download new weekly EA`S every day?

thank you!

-

July 1, 2024 at 14:31 #265626

Anonymous

InactiveHi Andre,

I don’t turn them off and on, I just look at the app each morning and see what are the top three on the 1 Week setting.

I just make sure each day I have those top 3 running

-

-

-

July 1, 2024 at 19:58 #265999

Anonymous

InactiveHi ive just seen the video on youtube and that you can download the top 3 for free. However i have logged in and it wont let me download them as it keeps saying im not logged in when i go to the page, any help on this?

-

July 1, 2024 at 20:13 #266009

Anonymous

InactiveHello, the download link is available in the video description. For convenience I’m sending it here as well.

-

-

July 3, 2024 at 10:36 #267436

Anonymous

InactiveHi All,

Hit 10% Target this morning. Will keep testing a few more weeks. Will start fresh again today. If I can keep this sort of consistency I will put on a real challenge

-

July 18, 2024 at 10:58 #270884

Anonymous

InactiveLittle Update, After hitting 10% I have kept the process going.

It has had a bit of a flat spot and back to 10% gain but main thing for me is Daily DD not been touched and the balance has recovered. Lets see what the next week hold… roll on 20%

-

July 18, 2024 at 13:50 #270945

Anonymous

InactiveHey Craig,

Thank you for sharing your results and we are happy to know that our robots are doing well!

Keep updating us with the performance and results!

Thank you!

Kind Regards,

Nikos

-

-

July 31, 2024 at 19:04 #273322

Ron Lee

ParticipantHi,

can check if using the top 5 weekly will get positive result ? cause after 1 weeks I still in the negative -2.5% ?

Or should I switch to top 3 weekly instead?-

July 31, 2024 at 19:08 #273323

Anonymous

InactiveI can’t say about the top 5 but the Top 3 Has been working for me, however last few weeks have been flat-ish (See Image) Hovering between 12,652 – 13,185

But this seems to be more to do with the market Phase as My other EA’s are underperforming too.

-

-

August 1, 2024 at 2:25 #273359

Ron Lee

Participantshould I change or stick to top 5 ?

-

August 2, 2024 at 3:51 #273615

Anonymous

InactiveHello everyone on the forum. I am using the prop firm FXIFY. I started a $100k challenge with FTMO prop firm bots. So far, I am at -2.5%. I am using the 5 best bots on a monthly frame. After 2 weeks, I left 3 bots that were profitable. Is this approach correct? Is there any documentation with a description of how to use these bots? (I’ve already watched the video)

-

August 2, 2024 at 11:08 #273692

Anonymous

InactiveHey Konrad,

Actually, the best approach is to first test on a demo and when you are comfortable enough, you can just go ahead and trade them on a challenge.

What we are basically doing also is that we check in the app to see if there is any more profitable robot than the ones we are trading currently. For example, let’s say that we have a USDJPY EA but on the first robots in the App, we see a different or one of the same pair but with different magic number, we just change the robot that is trading with the one that is on the top 3 or 5.

Hope this helps!

Let me know if you have any questions!

Kind Regards,

Nikos

-

-

August 8, 2024 at 2:33 #278054

Ron Lee

ParticipantHi can check for the infinity challenge I notice cannot use crypto so for the top 5 robot approach should I just ignore the crypto bot or I just include top 5 non crypto ea instead ?

-

August 8, 2024 at 9:56 #278086

Anonymous

InactiveHey Ron,

Indeed Infinity does not offer crypto assets so you cannot set the crypto EAs. You just need to ignore it and just get the next one if it is a metals or forex pair.

Kind Regards,

Nikos-

August 8, 2024 at 12:58 #278102

Anonymous

InactiveSorry, can check the bot keep losing day by day, how should I handle it else I might lose the challenge, should I hold but when I will know when to resume the same approach ?

-

-

-

-

AuthorPosts

- You must be logged in to reply to this topic.