Home › Forums › Ready-to-use Robots › Prop Firm Robots › Prop Firm Robots: Suggestions and Ideas

- This topic has 185 replies, 6 voices, and was last updated 7 months, 3 weeks ago by

V10n31ZZ.

-

AuthorPosts

-

-

August 10, 2023 at 20:53 #190306

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey traders,

Many of you have been trading the FTMO robot since I created the very first version. Based on your feedback, emails, replaies in the Forum I greatly improved it! Thank you for that!

So in this Forum Topic, I would be happy to hear more suggestions and ideas.

So far, what I have collected from e-mails and replies in the Forum is as follows:

- Take Profit for the Account (close all trades and stop trading if the challenge target is reached)

- Use on different currency pairs

- Set files for the lot size of the different accounts

Looking forward to your ideas!

-

August 10, 2023 at 23:57 #190267

Brian Watson

Participantis there a way add automatic Trailing Stop to each trade after the trade is in profit

-

December 1, 2023 at 7:32 #217675

Nicholas Grobler

Participant+1 On this, I wanted to ask for this exactly. Some of the trades in V5 was nicely in profit, I was using AUDUSD, they did not hit TP and reversed to close in negative. So a trailing stop would be awesome.

-

-

August 10, 2023 at 23:58 #190309

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterThat is a good idea! I will check the possibilities and if that will bring better or worse results.

-

August 11, 2023 at 13:02 #190393

Marin Stoyanov

KeymasterHi Petko,

I have an idea, instead of using lot sizes, would it be possible to change it so you have the following options:

— Risk Mode: Percent or Lot SizePercent: Based on the account size, automatically calculate the position so it will use X% of the account’s equity (This would allow compounding)

Lot Size: The setting we have now to manually set the specific lot size.Kind regards

-

August 11, 2023 at 13:06 #190409

Alan Northam

ParticipantEAs usually work best when they are updated once every month or two. It is easy to adjust the lot size at these times.

-

-

August 17, 2023 at 12:40 #191762

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterAlso, if you use % and not lots, it’s hard to compare a few EAs in the account. And this is what we do – we trade many EAs and we trade them with the same lot so we can see which ones are the top performers.

-

October 26, 2023 at 4:16 #207222

0xBitpool

ParticipantOnce we get funded with FTMO, we’re not allowed to keep the trades opened overnight.

I imagine this is the reason why we have the “Entry time” settings in the EA

I have 2 questions:

1) Should we change these settings based on FTMO timezone? (in case they use different timezones depending on your region for example)

2) I’m not sure I understand correctly “keep the trades overnight”. I understand we have to close them before the night. Are these settings covering this case? Or is it just for the entry time but not the exit?

-

October 26, 2023 at 4:18 #207223

0xBitpool

ParticipantHere is the link to FTMO FAQ for this: https://ftmo.com/en/faq/do-i-have-to-close-my-positions-overnight/

-

October 26, 2023 at 7:41 #207252

aaronpriest

ParticipantThis would only apply to weekends for Forex pairs because overnight rollover is minutes and not 2hrs, however for indices it might be nightly, I’m not sure. I use the swing account with FTMO for just this reason so I don’t have to worry about closing for news or weekends.

-

October 26, 2023 at 7:49 #207254

0xBitpool

ParticipantYes I was thinking of trying the challenge for a swing account for the extra safety. I must admit not looking for the news is a big plus.

A 1:30 leverage should be fine but if the robot is able to address the overnight / weekend stuff, I’d be happy to keep an eye on the important news to get access to a 1:100 leverage

This raises another question: does the calculation of the min position changes if the leverage is 1:30? As it’s less risky, one would maybe be tempted to multiply the lot size by 3 😏

-

October 26, 2023 at 9:11 #207271

Dygon Linux

ParticipantPlease help me to have the best setup for the 80000€ challenge and the 10000€. I want to have all Ea that works in the challenges.Thank you very much!!

-

October 26, 2023 at 14:26 #207347

Alan Northam

ParticipantHi Dygon,

For the 80000 euro challenge set the EA properties as follows. This will limit risk to 1%.

Amount for a new lot = 2.4

Maximum position amount = 2.4

Amount to add on addition = 0.0

Amount to close on reduction = 0.0For the 10000 euro challenge set the EA properties as follows. This will limit risk to 1%.

Amount for a new lot = 0.3

Maximum position amount = 0.3

Amount to add on addition = 0.0

Amount to close on reduction = 0.0To determine which EAs are working the best in the current trading environment add all EAs to a demo account and watch them for one to two weeks. Then pick the EAs performing the best and add to your FTMO challenge.

-

November 4, 2023 at 14:11 #209658

dusktrader

ParticipantHello, just a wishlist item… in a future update to this bot, can you offer an option to base the risk on % of equity? That way over time it will take advantage of compounding in the account.

So, for example, I’d like to be able to enter 1% as the equity risk, and the bot would calculate this dynamic for each trade.

Thank you for considering!

-

November 5, 2023 at 16:29 #209968

dusktrader

ParticipantHello, can you please give your thoughts on trading through holidays and/or month of December? I noticed one of Petko’s videos was demonstrating a bot in Dec 2022 I think.

Have you by chance been able to backtest this through holiday/December months?

I’ve been advised that manual trading is a bad idea in December, but I’m curious your thoughts. Also, maybe this doesn’t apply to bots in general.

Thanks

-

November 5, 2023 at 19:19 #210017

dusktrader

ParticipantAhh! I see Petko already answered this question. Just watched this video: https://www.youtube.com/watch?v=QCNWanYW9Do

Spoiler: he doesn’t risk real money during December for manual or bot trading (at least per this video)

-

November 5, 2023 at 23:47 #210080

Alan Northam

ParticipantPetko was testing a new EA and it happened to be December when the new EA was created so he tested it during December. All newly created EAs should always be tested using a demo account. This is why he used a demo account during December. It was not about not risking real money during December it was about testing a new EA using a demo account before deciding to move the EA to a live account.

Alan,

-

-

November 6, 2023 at 4:03 #210127

dusktrader

ParticipantThanks Alan. Are you saying that it is “okay” to pursue bot trading in December as well?

-

November 23, 2023 at 9:05 #215359

Arik Shahar

ParticipantHi,

I’m about to start a 100K challenge now

My question is can I use multiple profitable FTMO robots in the same account. I had 3 forex pairs with nice profits and I’m considering whether to trade with the three robots or with one of them each time.Thanks.

Eric

-

November 23, 2023 at 13:42 #215411

Ilan Vardy

KeymasterHey Eric,

Yes, you can. You can use as many as you’re comfortable using, based on the criteria who select (profitable trades, profit factor, etc.). Just make sure you adjust the entry lots and risk settings to match the account size and number of EAs, so you don’t risk too much.

Cheers,

Ilan

-

November 28, 2023 at 13:00 #216635

Brian Pelton

ParticipantI haven’t purchased the FTMO Bot yet but how about this approach?

Start off with all 8. Lower the lots accordingly. Divide 1% by 8.

Then monitor the performance. After you have a pair that has losses after 5 trades remove it.

Now let’s say you remove 2. Now adjust your lots to accommodate those removals.

This will let you stay low risk but instead of just using the top performers you slowly remove the losers just like what

is taught in the courses but on a smaller scale instead. Thoughts? Has anyone tried this?

-

November 28, 2023 at 13:32 #216646

Alan Northam

ParticipantHi Brian,

Good to see you are thinging about risk management. This is a good low risk approach. Good idea! Keep thinking about ways to manage your account. Good to see you are thinking individually instead of just following others advise. This is the way to learn and to become a successful trader.

Alan,

-

November 30, 2023 at 22:04 #217558

Luce

ParticipantI have an Deposit of 10k on an demo account and the balance is currently at 10.148,13

That should be a gain of 1,48%. But MyFxBook shows a gain of 0,41%:

does somebody now why?

-

December 1, 2023 at 8:37 #217688

Alan Northam

ParticipantGo to Metatrader Account History below the chart and make sure you are showing all history.

Alan,

-

-

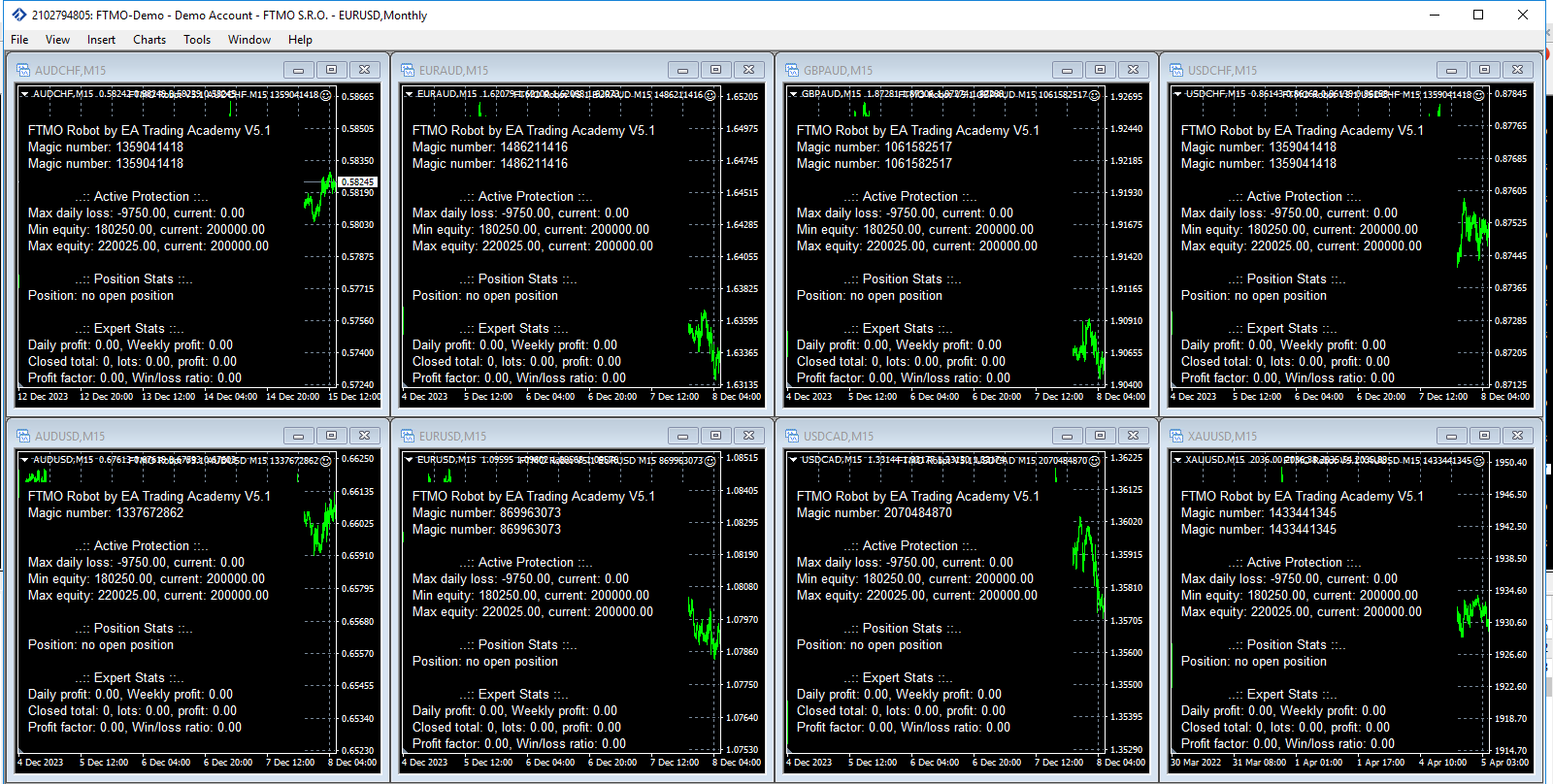

December 1, 2023 at 20:47 #217937

Carlos Benavides

ParticipantI suggest that you keep the 8 bots running inhouse and share the details for my fxbook with us so we can check for the top 3 profitable for the last 5 days I got a VPS for 15usd per month and the resources are already full with just running the test bot on 8 charts I don’t think it can handle another mt5 account to trade the top 3…. This will really help us a lot to cut costs on a VPS. Ram is already at 90% and CPU usage at 60% to 80%

-

December 2, 2023 at 7:42 #218096

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterWith the new Version 5 we have included set files that risk exactly 1% from the Account size.

However, I guess you request is to use % instead of Lots, which is something we have been considering.

We will also leave that topic so nay other ideas how to improve the FTMO Robot will be taken into consideration!

-

December 6, 2023 at 23:14 #219413

Alan Northam

ParticipantHow To Trade the FTMO Robots

===========================Petko does not recommend trading all 8 robots in an FTMO Challenge. He recommends trading just 1 to 3 robots.

To determine which robots to trade in an FTMO Challenge the robots should be tested in the FTMO Free demo account for a minimum of one to two weeks.

After testing the robots in a Free FTMO demo account the demo account should be linked to FXblue or MyFxbook. You will then be able to review the most profitable robots. You can then select the top 1 to 3 top robots with a minimum of 3 to 5 closed trades. If none of the top 3 robots have closed at least 3 to 5 trades continue testing.

Once you have determined the top 1 to 3 robots you can now add them to an FTMO Challenge.

Continue to monitor all 8 robots in the Free FTMO demo account on a weekly basis with FXblue or MyFxbook. If different robots become the top 1 to 3 performers move these to your FTMO Challenge and replace the old robots with the new ones. Once the 14 day Free FTMO demo account has expired, create a new one, and link to FXblue or MyFxbook. Continue monitoring the robots on a weekly basis to continue updating the FTMO Challenge with the newer 1 to 3 top performers.

Note1: It is not recommended to trade all 8 robots in an FTMO Challenge at one time. The reason for this is they will all generate profits at different times. The strategy is to determine which of the 8 robots are currently in profit and trade those in the FTMO Challenge while the robots that are performing poorly are kept in the demo account.

Note2: Each robot has an account risk of 1%. Trading 3 robots will result in an account risk of 3%. It is not recommended to allow an account risk of more than 3%.

Note3: While it is not recommended to trade more than 3 robots in the FTMO Challenge at the same time if you chose to trade more than 3 robots in an FTMO Challenge then the lot size of each robot should be reduced to keep the account risk at a maximum of 3%.

I also suggest the review Petko’s video on how to install and trade the FTMO v5.1 robots:

https://eatradingacademy.com/forums/topic/is-the-robot-available-for-multiple-funded-accounts/#post-219126Alan,

-

December 8, 2023 at 6:49 #219630

Carlos Benavides

ParticipantI would like to request to add 3 or more pairs so we always have something to choose from specially on slow months like this.

-

December 8, 2023 at 10:29 #219643

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterGreat! And I have something more to add: If the traders follow these instructions, THEY WILL NOT FAIL A CHALLENGE. So far I never lost a challenge if I was trading the Top 1 Expert Advisor out of the 8. It might take longer to pass, but it won’t fail!

And so far, we don’t have a trader who reported or shared stats of losing a challenge if one was trading, just the Top 1 CURRENT winner. Most traders that failed just placed all of them on a challenge and did not follow the instructions.

-

December 14, 2023 at 13:31 #220706

Sammy Trader

ParticipantSo, the safest and low risk strategy is to use the Top 1 from 8 EAs to pass FTMO. It would of course take longer. For step 1 of the challenge where are suppose to get 10% of the profit, any idea roughly how long will it take to achieve it ? 1 month, 2 months or 3 months? For a newbie, with the Top1 EA , shall I stick to a $25k challenge or can go for $100k , I don’t really care if it takes longer to beat Step 1 challenge. My priority is to be on safe side first and then gradually start doing medium risk trading after passing the challenge.

Also, Can we just use EA for FTMO with the given set file without changing any parameters in it?

Thanks

-

December 14, 2023 at 15:52 #220727

Alan Northam

ParticipantThe lowest risk is to use the Top 1 EA. As to how long it will take to pass the challenge depends upon the volatility of the market. There are certain days, weeks, and months that are more volatile than others.

For a newbie, I would recommend using a 10K challenge. This way if you fail the challenge you can use the same money you would have used on the 25K or 100K challenge to try the 10K over again until you pass then challenge. Then once you pass the challenge you can use profits from it to use higher level challenges.

Alan,

-

December 25, 2023 at 18:58 #222481

Sammy Trader

Participant@Alan – So from Petko’s comment above. If I stick to the no.1 top performing EA of the last 2 weeks (out of all FTMO robots) and just use it with given set file/settings without changing any parameters in it, would that be enough to pass a challenge? I am going to buy a limitless option of the challenge where I can take as much as time I need, as long as I do not violate the rule of drawdown.

-

December 25, 2023 at 23:03 #222515

Alan Northam

Participant“@Alan – So from Petko’s comment above. If I stick to the no.1 top performing EA of the last 2 weeks (out of all FTMO robots) and just use it with given set file/settings without changing any parameters in it, would that be enough to pass a challenge?”

If you follow the instructions it is all you need to do to pass the challenge. It doesn’t mean you will pass the challenge on your first challenge. Petko has failed challenges but by retaking the challenge and following the instructions he has eventually passed the challenge. The instructions tell you what to do, the instructions do not guarantee you will pass the challenge everytime you take the challenge. However, if you take the challenge multiple times you should pass the challenge the majority of the time.

In trading there are no guarantees of winning everytime you place a trade. If there were guarantees we would all be rich. The phase I use is “In trading there is no guarantees of success, only probabilities!” By following the instructions we increase the probability of success.

Alan,

-

December 26, 2023 at 9:42 #222576

Sammy Trader

ParticipantThank you so much for the reply. All clear now :-)

-

-

-

-

-

December 8, 2023 at 19:58 #219751

Tanyeem gazi

Participanthey petko can you put an entry delay feature for more easy uniqueness of the robot

-

December 9, 2023 at 18:55 #219858

eliav dror

Participanthi i just wanna know if i activate the all robots in challange is safe to not reach 5% daily?

-

December 9, 2023 at 20:05 #219863

eliav dror

Participantand also why in all the setting of diffrent pairs its not fix at 1:2 rr ?

-

December 10, 2023 at 12:46 #219936

Alan Northam

ParticipantHi eliav dror,

Your answer to your question about not hitting 5% can be found in the following link:

https://eatradingacademy.com/forums/topic/how-to-trade-the-ftmo-v5-1-robots/#post-219413

The answer to your question about 1:2 rr is that the robots are created to trade profitably the majority of the time with the RR set for each robot. To change this value to a 1:2 rr would result in the robots losing the majority of times. Why is this? This is because sometimes the robots will move against the trade for a short period of time before becoming profitable. So if the stop loss was set to close to the opening price the trade could be closed with a loss before it had a chance to move into profitability. The robots are therefore created for best performance.

Alan,

-

December 12, 2023 at 13:01 #220322

Tanyeem gazi

ParticipantHey, I am confused about something. for this week I took three robots for 3currencies. Now as this is my first week trading a challenge account, I divided 1% risk of the account within the three best performing robots making it 0.3% risk each and reduced the lot sizes. Is this the right way? If not, what should I do my account size is 50k.

-

December 12, 2023 at 14:16 #220334

Alan Northam

ParticipantHi Tanyeemgazi,

When taking the FTMO Challenge you need to keep your account from losing more than 5% of your account balance in one day. To do this you need to set the risk of each robot you are trading so this does not occur. It is recommended to keep the total account balance risk below 3%. So, if you are trading 3 robots then each robot can be set to have a risk of 1%. To do this you need to set the lot size properly. Since you are using just 3 robots you can set each robot to the lot size recommended in the setfiles.

By dividing the lot size by three for each robot you have limited your daily account loss to 1%. This is fine, however it will take much longer to pass then challenge.

Here is the thing about passing the challenge. The larger the risk the sooner you could possibly pass the challenge, however the risk is increased of failing the maximum daily drawdown of 5% or falling below the total account loss of 10%. The lower the risk the longer it will take to pass the challenge but the risk of losing your account is lowered. Each trader must decide how much risk to take as each traders risk tolerance is different.

Alan,

-

-

December 12, 2023 at 19:14 #220380

gabiscriba

ParticipantHi Alan.

I have a big request, which will definitely be helpful to all users of this robot.

You will definitely test these 8 robots permanently and you always know which is the top of the robots that perform the best.

Please post this ranking periodically, it would help us a lot.

Especially when this ranking changes.

We thank you a lot.

For example, the ranking after my tests is EURAUD, USDCHF, XAUUSD.

I don’t know if the other users have the same ranking.

I started using these 3 robots, with the mention that EURAUD opens very few trades.-

December 12, 2023 at 20:59 #220393

Alan Northam

ParticipantHi gabiscriba,

How would this be better than each trader testing the robots?

Alan,

-

-

December 12, 2023 at 21:10 #220396

gabiscriba

ParticipantI think it is the best. You know how to test robots the most correctly. Many of us do not know or fail to test them correctly.

My question is: how anybody would test better than you?

I think many would appreciate this help. Of course, if you want to offer it. -

December 14, 2023 at 12:59 #220699

riccardo moschino

Participant<p style=”text-align: center;”>Secondo i miei test il più performante è EURUSD e EURAUD 🙄</p>

-

December 14, 2023 at 13:08 #220702

riccardo moschino

ParticipantPerché quando si avvia il bot non vedo alcun indicatore sul grafico? Non ce nemmeno l’intup true or false

-

December 14, 2023 at 15:35 #220723

Alan Northam

ParticipantWhen using MT4 you will not see indicators!

Alan,

-

-

December 14, 2023 at 22:19 #220778

PrimalSci

ParticipantMy bot has been trading the latest release (all 8 bots) and is in profit, albeit a little, but still profit.

I will be looking at the summery and taking the best 2 or 3 bots and test them.

-

December 15, 2023 at 3:22 #220809

seanetics

ParticipantHi Alan,

Please can you provide me with the line(s) of code that needs to be changed or commented out to Disable Hedging and Effectively only Enable Netting?

Thanks, Ri.

-

December 15, 2023 at 6:44 #220813

Alan Northam

ParticipantI don’t use MT5. Contact [email protected]

Alan,

-

-

December 18, 2023 at 9:51 #221283

JordyTr971

ParticipantHi, how much time it take to you to pass challenge with only TOP 1 ea?

The ea’s do not seem much active I did not have a single trade since 3 days

I still prefer precise entry trade that a bunch of bad trade :)

-

December 18, 2023 at 10:24 #221289

Alan Northam

ParticipantHi Jordy,

Petko’s video should answer your question.

Alan,

-

-

December 18, 2023 at 22:29 #221383

Robby Mesenberg

ParticipantHey there,

I‘m currently Trading ftmo bot v5.0 and v5.1

isnt it Useful to Trade the New and the old ones? I don’t use Myfxbook or fxblue, they don’t Note every Trade thats opened in my accounts, so my Trust is Little Bit low. But Great Platforms, love them.

Im testing around very much every day and i noticed nice Profits the last two weeks with EURUSD V5.0, XAUUSD v5.0 and USDCHF v5.1.The other v5.1 Werent that good the Last Week, Hope to see them profiting. Big changes in Relation to v5.0. Very interesting.

should i only Trade the new ones or is it a Great tactic to test around, Write them down and use the best of all the Versions?

another question would be:

how do you decide if an ea is the „Top Performer“ and how Long it is one?

good Profits the Last Weeks? The last month(s)? The last days? The Last Hours?

how do i know if a profitable run is Over? After 1 loss or how?i watched every Video 10 times at least and im looking Hours in Forum every day But it seems im the only one who asks this. ;D

maybe there is a problem in my Head :)

hope u r Fine, Great work for low prices, thank you for your help and a wonderful Christmas Week my G‘s!

-

December 18, 2023 at 23:52 #221397

Alan Northam

ParticipantQuestion 1: “should i only Trade the new ones or is it a Great tactic to test around, Write them down and use the best of all the Versions?”

Answer 1: Petko recommends trading the TOP 1 to TOP 3 Expert Advisors. Since you are testing both V5.0 and V5.1 you could combine V5.0 and V5.1 and trade just the TOP 1 EA or the TOP 3. There is no right or wrong method.

Question 2: “how do you decide if an ea is the “Top Performer“ and how Long it is one?”

Answer 2: To determine top performers use only the closed trades. I personally use FXblue to sort the performance of all the EAs from top performers to bottom performers. From this sorting it is easy to pick the top performers. To determine how long an EA will remain the top performer I check FXblue every few days to see if the top performers have changed. As long as the EA I am trading remains in the top performer position when sorting the EAs I continue to trade it. Once it falls out of the top performance position I stop trading it and start trading the new top performer.

I hope this answers your questions. If not, then please let me know what I am not explaining. I am here to help!

Alan,

-

December 19, 2023 at 18:05 #221501

Sammy Trader

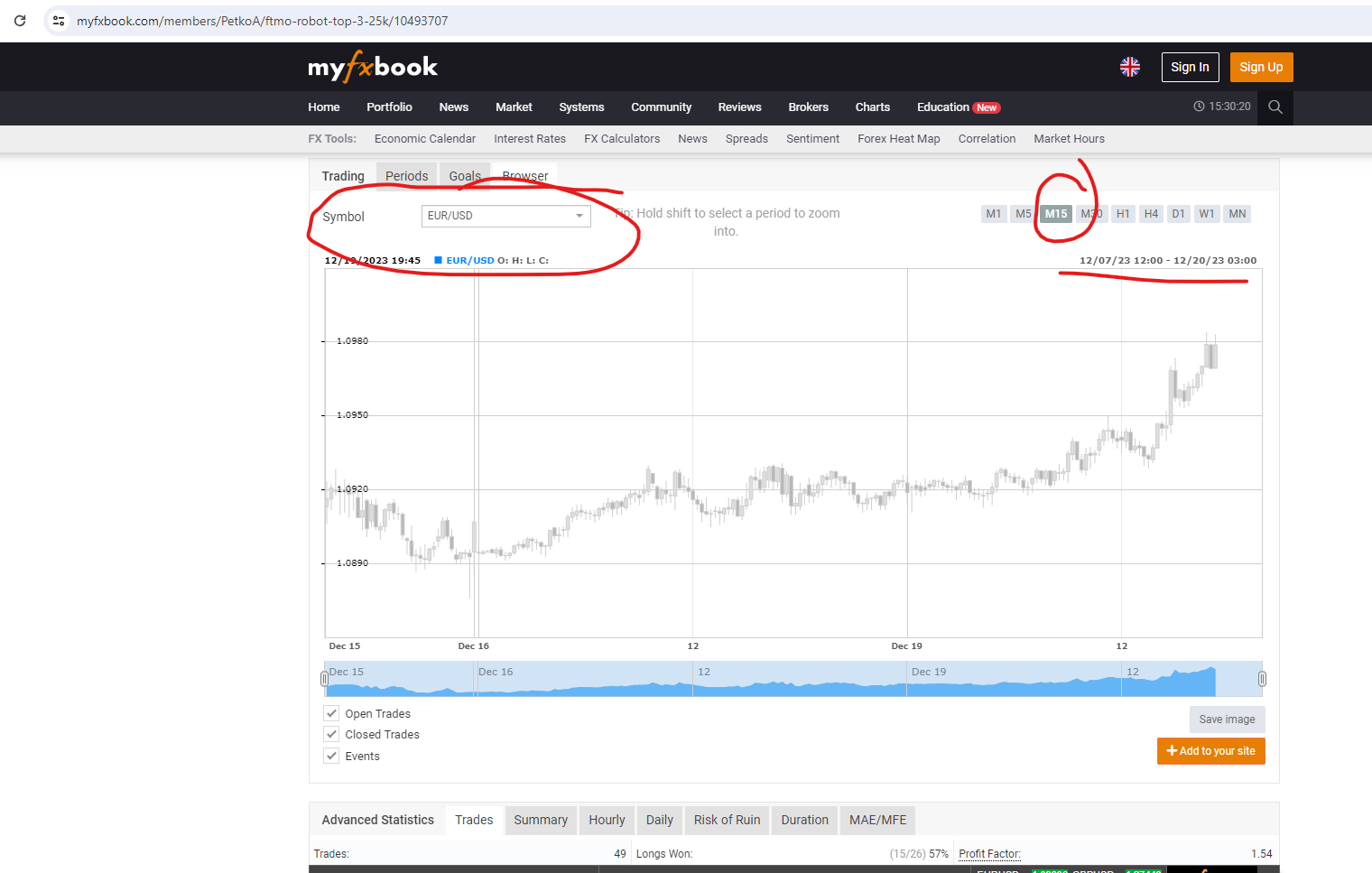

ParticipantHi, one question please : why do we need a long term testing through FXBlue ?

We already have Petko’s profile where we can see the long term testing of – https://www.myfxbook.com/members/PetkoAor

https://www.myfxbook.com/members/PetkoA/ftmo-robot-top-3-25k/10493707

Can’t we pickup form here

-

December 19, 2023 at 18:06 #221507

Alan Northam

ParticipantIf Petko’s results were from the most recent week you could certainly use them. However, the top performing robots can change every week as market conditions are continuously in a state of change. So, if Petko’s results were from several weeks ago then the top performers have most likely changed. To keep up with which robots are currently the top performers it is necessary to check them every week.

Alan,

-

December 19, 2023 at 18:48 #221512

jovyishere

ParticipantSo wouldnt it make sense to maintain this profile weekly? We then can choose what bots we want to run. We dont need to have 100 people testing the same 8 bots. You guys make this harder than it needs to be.

-

December 19, 2023 at 19:07 #221519

gabiscriba

ParticipantYou are right. I have the same proposal and request that I had before. To post here weekly the ranking of the most profitable robots.

Thank you very much. -

December 19, 2023 at 19:24 #221522

Alan Northam

ParticipantPlease contact [email protected] and request this feature.

Alan,

-

December 19, 2023 at 20:58 #221531

Sammy Trader

ParticipantIsn’t anyone from Support team here who monitors this chat and pass the suggestions from members to higher ups? This will only improve the process and product usage. It should be better in EAtrading’s own interest rather than we all firing multiple same emails to support@

-

December 19, 2023 at 23:43 #221552

Alan Northam

ParticipantThe forum moderators monitor the forum and helps traders with the issues they are having. This free’s up the support team to deal with support issues. What you are requesting is not a problem you are having but a request which falls under support. Having said that sometimes support or Petko may pop into the forum and answer a question or two but this does not occur often. The best way to ask for a feature request is to contact support.

Alan,

-

December 19, 2023 at 20:40 #221527

Sammy Trader

ParticipantVery wise remark @Jovishere, imagine paying for all that VPS for demo account to test for months before we actually go and take the challenge.

-

December 19, 2023 at 23:46 #221553

Alan Northam

ParticipantWhen demo testing I do not use my VPS. I only use my VPS for live trading.

Alan,

-

-

-

-

-

December 18, 2023 at 22:35 #221384

gabiscriba

ParticipantHi Robby.

You are not the only one asking questions, it’s just that they appear on several topics.

I am also waiting for the answers to your questions, especially the one about Top Performers. -

December 20, 2023 at 1:28 #221572

MUSTAFA SAMEH

ParticipantI would prefer that there be a test by the academy on what are the best currencies for this week

-

December 20, 2023 at 10:03 #221675

gabiscriba

Participant@mustafa sameh, I would prefer this too.

-

December 20, 2023 at 11:57 #221688

Sammy Trader

Participant@mustafa sameh, I would prefer this too. This will help the Petko FTMO community a lot.

-

-

December 20, 2023 at 1:43 #221575

jovyishere

ParticipantI have 3 different demos going. 2 on mt4 and 1 on mt5. same broker. only the mt5 is trading the others are not. I have selected the same pairs and same set files to start. any reason why the other 2 may not be trading?

-

December 20, 2023 at 5:30 #221590

Alan Northam

ParticipantAre you using the same broker for all 3 demos?

-

-

December 20, 2023 at 9:12 #221662

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterThere is already a topic about that: https://eatradingacademy.com/forums/topic/recommended-forex-pairs/#post-220142

You can check the best pairs from this morning.

-

December 20, 2023 at 9:53 #221671

Tanyeem gazi

Participanthey, I had a question about risk management. today is Wednesday and I reached 2% of my account. Should I continue trading for the rest of the two days? or should I trade in the next week by increasing the risk times 3 according to the pdf provided?

-

December 20, 2023 at 21:43 #221759

Alan Northam

ParticipantToday I start a FREE FTMO V5.1 demo Challenge. I will now wait until the end of the end of the year to determine the top EAs.

Alan,

-

December 20, 2023 at 22:00 #221762

gabiscriba

ParticipantGreat! Let us know too.

-

-

December 21, 2023 at 14:56 #221904

store634

ParticipantHi guys,

I recently purchased the FTMO v5.1 robots. I put them on a FTMO demo account to monitor the top performers. They actually running great and the account is up 1.5% in 3 days. Opening already over 10 trades.

Now I took the top robot and put it on my SurgeTrader 25k challenge. But nothing. No trades opened. I added 2 more of the top 3 but still not opening any trades. Just wondering if they are not working on SurgeTrader? They EA’s though.

Does anybody experienced anything like that?

Thank you,

Alex

-

December 21, 2023 at 15:35 #221907

Sammy Trader

ParticipantIt’s Festive holidays all over the world, trading volume will be less in this week and next week. You need to monitor the Top performing 1st EA for at least a month. I would recommend to pause your challenge until 2nd January (Ideally until Late January if you want to play low-risk). I hope you opted for unlimited time to pass. Keep us informed

-

December 21, 2023 at 15:40 #221908

Alan Northam

ParticipantHi Alex,

Unfortunately, the historical data for FTMO and Surge Trader are not the same. Therefore, the top performers may be different between these two prop firms. Having said that the Expert Advisors should still work. I would give it another day to two. If you don’t see any trades then contact Surge Trader support.

Alan,

-

-

December 21, 2023 at 16:44 #221920

Nautilus Entertainment

ParticipantHello,

I installed FTMO V5.1 with the Pair AUD CHF , AUD USD with the set files. Is there anything else I need to do?

-

December 21, 2023 at 16:57 #221921

Brian Pelton

ParticipantYou should put all of them on a demo to test them for awhile then take top 1-3 performers and try a challenge.

-

-

December 21, 2023 at 16:58 #221922

Nautilus Entertainment

ParticipantWhy I need to try first I thought it works? I’m confused

-

December 21, 2023 at 17:23 #221927

Sammy Trader

ParticipantAt this moment, we have to test ourself by paying on a VPS server $25 per month. Hopefully EATrAdingAcademy will change something in future where they would be testing their EA in a VPS and we can see the results of Live Demo in a Trader’s profile.

So, test in demo and don’t take a risk by jumping straight into a challenge.

-

December 21, 2023 at 18:34 #221940

Alan Northam

ParticipantI do not use my VPS to test Expert Advisors. I have an old pc I use for this purpose which I leave running 24/7. If my power goes out or the internet is down, which does not happen often, I just take note and continue on with my testing as a few yours when the power is down or the internet is down is a small period of time compared to testing for a week or more. A few hours when the internet is down does not affect the overall testing results.

Alan,

-

December 22, 2023 at 8:57 #222035

Sammy Trader

ParticipantSo, you mean would rely in your Home PC 24/7, running it on your own electricity and reliable internet without any latency to get the results from EA. How much would that cost for a month in total ? Wouln’t paying for a VPS server $25/per months be cheaper and reliabale ?

Honestly, I wish EA trading academy do this job for its members and only members can see the live result somewhere without going through all that testing ourselves, so we jump straight into the Challenge with best performing EA.

-

-

-

December 21, 2023 at 18:22 #221938

Alan Northam

ParticipantThanks for your question!

The reason we are given 8 Expert Advisors to trade is because they do not all trade at the same period of time. If they did all trade at during the same period of time we would not need 8 Expert Advisors as only 1 would do. For this reason we need to test the Expert Advisors to determine which of them are trading more profitable in the current market environment.

As an example, there are times when a certain Expert Advisor will be in a losing position for a several weeks or even several months while other Expert Advisors are profitable. It is therefore necessary for us to determine which Expert Advisors are currently being profitable.

Alan,

-

-

December 21, 2023 at 17:25 #221928

Nautilus Entertainment

ParticipantThis make no sense. For what exactly I’m paying?

I can test thinks myself without buying any EA 😅

-

December 24, 2023 at 9:43 #222310

Sammy Trader

ParticipantFirst you buy a $25 per month VPS to test EAs on a Demo account. After a month, whatever is the 1st Top EA performed, stick to it while testing others on a demo account as things will change again after Holidays when market gets more volatile.

-

December 26, 2023 at 13:49 #222647

riccardo moschino

ParticipantHo provato a mettere 2 grafici. In uno ho installato FTMO con posizioni BUY, nell altro ho posizionato il FTMO, cambiando numero magic e mettenndolo in SELL. che dite?

-

January 12, 2024 at 9:26 #226403

Hiu Kin Yeung

ParticipantMy account is down 7% on a 100K challenge, I got $93700

Now I’m planning to switch to using the FTMO bot, want to have it run on low risk ,let it grind back to $97500 , then i wanna scale it up

Is there any setting I can twerk ?

Would the bot counter any problem while i start it off with just $93700 ?

-

January 12, 2024 at 9:46 #226408

Alan Northam

ParticipantThis is exactly why demo testing is important. You can follow the guidelines for demo testing from the following link:

The link shows how to trade the FTMO 5.1 robots but it applies to all FTMO robots as well.

To change the account risk from 1% to 0.5% (low risk) all you need to do is to cut the lot size in half.

Alan,

-

January 18, 2024 at 15:46 #227677

Abhishek Chib

ParticipantWhy asking for new feature. Live example : USDCAD was in profit and small New reverse the market. If we have Tailing SL or Slab wise TP then we will in profit. See screen shot.

-

January 22, 2024 at 10:27 #228801

Robert Forbes

ParticipantWould it be possible to expand the range of trading accounts, or to allow us to put in a custom amount that automatically works out the setting?

For example, FXIFY is offering substantial discounts for challenges, and they have a $15000 account, and up to $400000. Also, Surgetrader has a $250000 account. It would be great to get settings for these account sizes.Thanks!

-

January 22, 2024 at 11:28 #228815

Alan Northam

Participant

-

-

January 22, 2024 at 10:59 #228808

heroking82

Participanthello.

i would like to turn off a FTMO robot instead of removing it from charts…

is it possible to do the slash (//) technique with FTMO robots?

if so which line. cheers

-

January 22, 2024 at 11:26 #228814

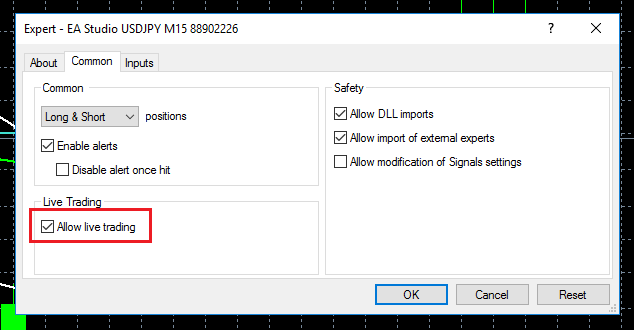

Alan Northam

ParticipantHi heroking82,

Go to the Expert Advisor properties box and uncheck the following:

Alan,

-

January 22, 2024 at 15:44 #228861

heroking82

Participantlegend. cheers

-

-

January 23, 2024 at 21:03 #229168

Robby Mesenberg

ParticipantHey there!

as we got the backtest Feature, is it clever to Trade them on funded Accounts?

Does anyone have experience on that?

-

January 24, 2024 at 10:17 #229280

Alan Northam

ParticipantHi Robby,

The FTMO app does the backtest so traders do not have to spend time backtesting the Expert Advisors. I take the top 1 to top 3 Expert Advisors from the FTMO app and apply them to an FTMO Challenge.

Alan,

-

January 24, 2024 at 13:07 #229330

Robby Mesenberg

ParticipantThanks for your answer alan. I meant trading them on funded. Not Challenge. Do you have experience with that?

-

January 24, 2024 at 19:22 #229398

Alan Northam

ParticipantHi Robby,

Yes you can use the FTMO robots from the FTMO app on a funded account. The only difference is that the robot will automatically close the robot when the account reaches 10% profit. To keep this from happening you can turn this feature off in the robots properties dialog box. The other thing is you don’t want the robot to drawdown very much so you really need to protect the account from hitting the max daily loss limit and the max account loss limit. So I would suggest tightening these up as well. I would also suggest not risking more than 0.5% of account balance until after you have made 1 or 2% profit. Again this is to protect the account from drawing down. All these changes can be made in the robots properties dialog box. Since you have gone through the process of passing the challenge and the verification stages you do not want to loss your account once it is funded. So slow and easy to start until you get some profit, then you can increase the risk.

Alan,

-

-

January 24, 2024 at 18:55 #229390

Gilles Ruelens

ParticipantAlan

The top 1 -> top 3 is it from the weekly, daily, monthly?

thx in advance

-

January 24, 2024 at 19:25 #229400

Alan Northam

ParticipantHi Gilles,

I use the weekly time period to select the top 3. I did this at the beginning of the week. Right now my account is up about 1.6%.

Alan,

-

-

January 25, 2024 at 3:10 #229467

Trader 27

ParticipantHere’s a feedback and improvement suggestion after running ftmo robot on live funded account. During New York Close, brokers tends to widen the spread, yes entry protection is in place for the EA, however, an opened trade that’s still running will be stopped out prematurely by the broker. Hence is there a way to improve the robot to prevent such losses.

Thanks in advance.

-

January 28, 2024 at 11:59 #230113

MUSTAFA SAMEH

ParticipantHello

I have a suggestion regarding the filter for the previous period, whether a day, a week, or a month

Is it possible to add a date from to to so that we can, for example, know the profits and losses for two weeks, not just one week? -

January 28, 2024 at 23:39 #230250

MUSTAFA SAMEH

ParticipantHello

I have a suggestion regarding the filter for the previous period, whether a day, a week, or a month

Is it possible to add a date from to to so that we can, for example, know the profits and losses for two weeks, not just one week?-

January 31, 2024 at 12:46 #230995

vinnysvinyl

ParticipantYes! I second this. A month is a little too long, a week a bit too short. Being able to manually select a range would allow us to hone in on the Goldilocks zone ; )

-

-

February 19, 2024 at 19:29 #236158

Patrick Verlee

ParticipantHi There,

Starting out here. I was wondering if you also have setfiles for EURO SWING accounts. That would be great for us, European traders unless there’s a reason for only using USD accounts.

Let me know. Thanks

Patrick

-

February 19, 2024 at 20:27 #236174

Alan Northam

ParticipantHi Patrick,

The same setfiles will work for both USD and the EURO. However, with the new FTMO app you do not get a setfile as the downloaded robots will have the correct settings.

Alan,

-

-

February 21, 2024 at 0:40 #236642

Perry Chan

Participant“Continue to monitor all 8 robots in the Free FTMO demo account on a weekly basis with FXblue or MyFxbook. If different robots become the top 1 to 3 performers move these to your FTMO Challenge and replace the old robots with the new ones. Once the 14 day Free FTMO demo account has expired, create a new one, and link to FXblue or MyFxbook. Continue monitoring the robots on a weekly basis to continue updating the FTMO Challenge with the newer 1 to 3 top performers.”

Dear Alan,

I have a question about that, if the first FTMO demo account expired after 14 days, I open another one, and I have to wait for an week to see which EAs are the top performer. So I can only trade for 2 weeks per month isn’t it?

Because:1st week: FTMO demo account test

2nd week: Keep tracking the performance of the demo account and can place the top performer on live account

3rd week: Open a new demo account start testing and live account closes all trades until new demo open trades and show which EAs are the top performers.

4th week: Keep tracking the performance of the demo account and can place the top performer on live account

-

February 21, 2024 at 9:50 #236721

Alan Northam

ParticipantHi Perry,

The top 1 to 3 robots would be added to the MT4/MT5 terminal and would then continue to trade for 2 weeks or longer. Once the new demo account has determined new top 1 to top 3 robots then they would replace the old ones.

Having said this I can no longer use the FREE FTMO demo account nor can I purchase new Challenges as FTMO no longer offers them to traders in the United States. As a result I am now using Infinity Forex Funds Algo Evaluation account as IFF does not offer a demo account. So I use the Algo account to test my robots with a 0.01 lot size which is not limited to 14 days but the time frame is unlimited. Other than that I still use the plan above.

You have the same option. If you don’t want to be limited by the 14 day demo account you can purchase a 10K Challenge and use it as your test account.

Alan,

-

-

March 6, 2024 at 19:06 #240104

fabber tender

ParticipantHi everyone, @Alan

I wanted to ask for clarification.

I understood how to test the robots, the problem is that if last week (for example) the best robots were xauusd m4 eurusd m30 and EURAUD M15, the following week I put them on my account but none of these open operations… then they I go again to exchange with the best ones from the previous week and again no one opens operations… so a month has passed and I haven’t opened any operations… what am I wrong? @alannI also didn’t understand one thing, for each robot there are different time frames, for example XAUUSD there is m5/m15/m30 which should I test on the demo account? all pairs with m5? all pairs with m30? so you can’t get out of it anymore

-

March 6, 2024 at 22:12 #240134

Alan Northam

ParticipantHi fabber,

I know this can get quite confusing. I trade the Prop Firm app robots a little differently. I put all 14 robots on my trading account. I set the lot size to 0.01 lots and trade all of them for one week. I then pick the top performers and then change the lot size back to what it was when I downloaded the robots. The following links should give you an idea on how I trade the robots:

https://eatradingacademy.com/forums/topic/recommended-forex-pairs/#post-236573

https://eatradingacademy.com/forums/topic/recommended-forex-pairs/#post-239251

Also, there are three versions of XAUUSD. There is XAUUSD M5, There is XAUUSD M15, and there is XAUUSD M30. The XAUUSD M5 goes on the five minute chart, the XAUUSD M15 goes on the fifteen minute chart, and the XAUUSD M30 goes on the thirty minute chart.

Alan,

-

-

April 17, 2024 at 14:28 #249418

Konstantinos Borsis

ParticipantDo we need to allow for the indicators to show on screen for the EA to take trades or this is not affecting trading?

I have added 3 top performers from the app for the last 2 days have not opened any trades yet. Please advise.

-

April 21, 2024 at 22:31 #250380

Konstantinos Borsis

ParticipantHello everyone. 2 questions :

1. do we “mess” at all with the entry protections or leave them all to zero?

2. Could we add a trailing (indicator calculated or fixed points) for longer trades to have the EA monitor any significant profits rally so it can protect some profits in case things start to go the other way?

Cheers :-)

-

April 21, 2024 at 23:24 #250387

Alan Northam

ParticipantHi Konstantino,

Answer 1: If you are using the Expert Advisor to trade with a Prop Firm then I would highly recommend setting up protections to keep from the possibility of losing your account. However, if you are using the Expert Advisors with a demo or live account with your forex broker then the decision of using protection is up to you.

Answer 2: After years of creating Expert Advisors Petko has learned there is no advantage of using trailing stops, in fact, it can actually cause the trader to lose more trades. Here is the reason: In the majority of trades the market will draw down by a percent or two before trading in the positive direction. With trailing stops this could cause your trade to stop out with a loss instead of going on and becoming profitable.

Alan,

-

April 23, 2024 at 22:06 #251127

Konstantinos Borsis

ParticipantHey Alan, quick one if you know: is the entry time schedule and the zero entry protections part of the optimisation as well? So we could either adjust only lot size and maybe spread max or we can leave it as is since it has been optimised in the Robot app?

-

-

-

April 22, 2024 at 7:08 #250438

Konstantinos Borsis

ParticipantThank you Alan. Regarding entry settings, I was wondering why by default these are all zero although if you set them up you would get safer trades but also much less activity. The bot is set not own many trades at the same time anyway, and the schedule and news and equity protection filters that are on by default can offer significant protection I believe. This is why max spread, max open positions and max lot can be both good and bad. Also, I usually cut the lot size suggested by 40-50% to make things even safer. So was wondering maybe the entry protection is a bit overkill if the activity of the bot would be further restricted as from monthly to daily sets the amount of trades fall to 1 trade (month-week-day) although usually the DD is much lower than Y1 or Y5 which offer more possibilities of trading due to larger history data with also better correlated balance-equity graphs.

So I would usually select 1-3 top performers tbh either M or Y1 and avoid W or D most of the times and use them only for confirmation and verification for my selection of the top performers. I would also avoid putting more than 3 bots on same account at the same time and avoid increasing lots at least until I hit a minimum of 3 consecutive wins which then go and scale a bit higher.

Now regarding trailing I do agree that usually will eat to your profits but at least it won’t run you to SL or bigger losses if set correctly. In general manual setting of the SL when the trade is going good is better as well as maybe adding the MT trail after your position is at least 1/3 in profits run.

-

April 22, 2024 at 15:07 #250561

rasa

ParticipantI may have found a bug in the prop robot app: when selecting a different amount for trading capital one would assume that the oder of the robots do not change while in the same timeframe … that is true for all amounts but the $10K: the best robot stays the same but from then on the order is different from all the other amounts … please look into that … thank you!

-

April 22, 2024 at 16:10 #250581

Alan Northam

ParticipantHi rasa,

This is not a bug but how the prop firm robot app works. As you change the account size the profit in “dollars” changes and this then can change the order of the robots from most profitable to least profitable.

Alan,

-

April 22, 2024 at 17:15 #250614

rasa

Participantthank you … it seems to be the cause of rounding …

-

April 23, 2024 at 17:41 #251049

Konstantinos Borsis

ParticipantHello Guys. Do you adjust entry time or entry protections at all? I am trying to research and monitor spread behaviour and best entry time settings for XAUUSD, EURUSD and EURAUD. Any thoughts ideas much appreciated :-)

-

April 24, 2024 at 12:33 #251232

Konstantinos Borsis

ParticipantHello guys,

trying to get some insight on these:

1. I understand that optimisation in the app is providing best trade settings per TF and historical data chosen per account size. So besides, lot size do I need to adjust entry protections (spread, max positions max lot) or for example the entry time/schedule? What would you suggest please?

2. I check for 1-3 top performers looking for smoother graph line and lower DD version and use only these. Any suggestions here as well please?

-

-

April 30, 2024 at 12:59 #252475

Konstantinos Borsis

ParticipantHello everyone. After studying the EAs and testing a bit further my idea on how to use the prop app and EAs is: choose the top 4-5 Y1 performers DD<5 lowest peak above your starting balance, half the starting lot 50%, adjust before/after news according to your prop, don’t change anything else and just give it time to do its thing, scale up as you go. Monitor every Friday after marker close and keep a log/journal of performance. If trades hold in profit more than a day, possibly add manual trail at 1/3 of TP or close manually at 3/4 of TP just to make sure youare bringing any some profit. Check Prop App every Sunday afternoon for any major changes based on your account and make any needed adjustments before market open Monday. Any ideas/suggestions please let me know.

-

April 30, 2024 at 19:46 #252543

Craig

ParticipantHi All,

Is there a way to download all the V6.1 on their own?

At the moment is have to flick through Daily, Weekly and Monthly to make sure I have them all and download separately.

What I’d like it a button to download all V6.1 or V6.0 not matter what the performance.

I want to run them all at 0.01 Lot on a challenge and do my own top performer analysis. Using the App does not seem to work for me choosing the weekly Top 1 or 3 so must be a broker difference or backtest vs live difference

Thanks

-

May 23, 2024 at 17:39 #256652

Konstantinos Borsis

ParticipantHello everyone. I hope this weeks trading is treating you all good. I know trailing stop is not Petko’s trading style, but it would be a great help for those that would occasionally use it as profit protection with positions that either are on strong trend our way and/or have a big SL/TP setting, like XAU.

I hope you can consider this if possible.

Thanx.

-

May 30, 2024 at 9:05 #258357

NIKOS KYRIAKOU

ParticipantHey Konstantinos,

Thank you for your suggestion.

I will forward this to the team!

Kind Regards,

Nikos

-

-

May 23, 2024 at 21:59 #256683

Richard Lawrie

ParticipantGood day EA Trading academy Team

I trust you are doing well.

I have noticed that there has been a big change in the pairs of the Prop firm app. Completely different to the pairs that were on the App for quite some time.

I am still running 6 of the top pairs from the older pairs that are now no longer visible on the app. I have also added a number of the new pairs and adjusted my risk settings accordingly.

I have not seen any announcements of these changes tthough. What is the reason for the change? Are we able to make use of the new pairs? & are you still able to keep the older pairs on?

Thank you

-

May 27, 2024 at 17:43 #257443

KazGwada

ParticipantGood morning

I think we should keep all the bots visible on the dashboard, even those that you no longer think are performing. This would allow us to monitor the real performance of the bots over a real long period without any update (2 years)…. Because unfortunately as soon as ‘ a boot seems less efficient, replace it with a new one which has been optimized and not really tested. KEEP THE MAXIMUM BOT IN THE DASHBOARD

It would also be necessary to put the 3 month timeframe

THANKS -

May 30, 2024 at 9:25 #258360

NIKOS KYRIAKOU

ParticipantHey Richard,

The reason for the change is because we wanted the app to provide more profitable strategies so that there are plenty to trade with.

You can of course use the new and old pairs if you wish!!

Hope this helps!

Kind Regards,

Nikos -

May 30, 2024 at 9:54 #258367

NIKOS KYRIAKOU

ParticipantHey KazGwada,

Thank you for your suggestion!

I will forward this to the team!

Kind Regards,

Nikos -

May 30, 2024 at 18:08 #258504

Konstantinos Borsis

ParticipantHas anyone had TP hit on any pair EA of the Prop Firm Robots in the past 14 days at all? If so can you please share result and/or settings and which pair and TF you used?

-

May 30, 2024 at 18:10 #258509

Konstantinos Borsis

ParticipantHas anyone had TP hit on any pair EA of the Prop Firm Robots in the past 14 days at all? If so can you please share result and/or settings and which pair and TF you used?

-

May 30, 2024 at 18:10 #258510

Richard Lawrie

ParticipantGood day Nikos

How do I access the older pairs.

I can only see the current pairs on the FTMO app.Not the older one’s that I installed on my account a few weeks back.

-

May 31, 2024 at 10:56 #258681

NIKOS KYRIAKOU

ParticipantHey Richard,

The only way is if the old robots are profitable currently, then they will show in the app and you can download them. Most of the time, the new ones will show up as they are more profitable than the old ones.

Hope this helps!

Kind Regards,

Nikos

-

-

May 30, 2024 at 20:22 #258551

Shekeb Khatibi

ParticipantHello everyone,

I’ve been using the Prop Firm Robots for Forex trading, specifically the top 5 robots, but this past week all my positions closed in loss. Despite following the system, my trades weren’t successful.

### My Issue:

Despite using the top 5 robots, my trades have been unsuccessful this week. Has anyone else experienced this or have any suggestions to improve performance?

Thank you,

-

May 31, 2024 at 9:37 #258672

NIKOS KYRIAKOU

ParticipantHey Shekeb,

I believe it is a losing period for the robots. Try again next week and see if there are any differences in the results.

Kind Regards,

Nikos-

May 31, 2024 at 23:20 #258833

Shekeb Khatibi

ParticipantDear Nikos,

Ok,we will see next week and thanks for reply.

-

June 2, 2024 at 21:55 #259183

Shekeb Khatibi

ParticipantDear Nikos,

I hope you are well. I recently purchased your forex robot and I have a concern regarding its use with prop firms.

Prop firms often have strict rules and monitor trading patterns closely. They might suspend accounts if they detect similar trading strategies or patterns from multiple traders using the same robot. Given this, I have a few questions:

1. Does using your robot risk account suspension by prop firms?

2. If the risk exists, what steps can I take to avoid this issue?

3. Are there specific configurations or customizations you recommend to ensure my trading activities remain unique and compliant with prop firm rules?

Your advice and any additional recommendations would be greatly appreciated.

Thank you for your support.

Best regards

-

June 3, 2024 at 10:48 #259272

NIKOS KYRIAKOU

ParticipantHey Shekeb,

I understand your concern but you can use our prop firm robots in many prop firms without issues.

1. As far as I am aware, the strategies used in the prop firm EAs, do not violate the rules for most prop firms.

2. To make sure that everything is fine, ask the prop firm if they accept EAs first and what kind of EAs.

3. The configurations are set in a way to be compliant with the prop firm rules but if you still have doubts, you can ask them about the rules so that you can see analytically by them what are they rules and be more sure if everything is correct!Hope this helps!

If you have any more questions, let me know!

Kind Regards,

Nikos

-

-

-

-

May 30, 2024 at 20:53 #258562

Pat Savard

ParticipantWhy the hell you decided to update the wole thing withour any prior advice?

-

May 31, 2024 at 17:28 #258759

Pat Savard

ParticipantNikos, it’s nout about the EA as it’s normal to see loosing trades. The problem is that you updated the app ( that obviously come from forexsb.com) with new EA. I was using the 6.0 and 6.1 FTMO EA and suddenly the web app dont show anymore theses EA. Whos is responsible for the web app? EAtradingAcademy or forexsb.com.

I feel like I have been left behind with my 60 and 6.1 EAs. Please correct me if I’m wrong and I should have seen an annoucement about all theses new features

@Petko could reply?A filter on the web app to see EA versions would habe been a smart idea!

I see no accnoucement on Petko Youtube challen and I dont think I received an email about this update.

-

May 31, 2024 at 23:45 #258840

Shekeb Khatibi

ParticipantDear Petko,

I hope you are well. I recently purchased your forex robot and I have a concern regarding its use with prop firms.

Prop firms often have strict rules and monitor trading patterns closely. They might suspend accounts if they detect similar trading strategies or patterns from multiple traders using the same robot. Given this, I have a few questions:

1. Does using your robot risk account suspension by prop firms?

2. If the risk exists, what steps can I take to avoid this issue?

3. Are there specific configurations or customizations you recommend to ensure my trading activities remain unique and compliant with prop firm rules?Your advice and any additional recommendations would be greatly appreciated.

Thank you for your support.

Best regards,

-

June 3, 2024 at 10:49 #259273

NIKOS KYRIAKOU

ParticipantHey Shekeb,

I have answered to your questions above!

Kind Regards,

Nikos

-

-

June 4, 2024 at 2:01 #259424

Derek Fitzgerald-Poe

ParticipantHello I am new and just bought the bot but one thing I noticed is that the Prop Firm Robot App only goes to 200k can you increase to $1 million once you have data. Some Prop Firms goes to $1 million challenge and so all the numbers are off for DD and Target when we can only select up to 200k

-

June 4, 2024 at 21:20 #259571

NIKOS KYRIAKOU

ParticipantHey Derek,

The reason the App has until 200k is because most of the prop firms offer 200k challenges. Based on that, we have just set it up until 200k.

Hope this helps!

Kind Regards,

Nikos

-

-

June 20, 2024 at 18:53 #262195

WASIM

Participantcan you please add a function to close the trade before high-impact news?

-

June 21, 2024 at 11:00 #262281

NIKOS KYRIAKOU

ParticipantHey WASIM,

There should already such function. In case it does not work, try to add the robot again to the chart.

Kind Regards,

Nikos

-

-

June 20, 2024 at 21:12 #262225

Shekeb Khatibi

Participant<p style=”text-align: left;”>Dear Nikos,</p>

<p style=”text-align: left;”>Since installing the new update for the Prop Firm Robot on MetaTrader 5 yesterday, it has not opened any positions. I have checked the settings and permissions, but the issue persists.Could you please assist me in resolving this?Thank you.</p>-

June 21, 2024 at 11:07 #262282

NIKOS KYRIAKOU

ParticipantHey Shekeb,

Can you please send me a screenshot of the settings of the robots and also the platform?

Thank you!

Kind Regards,

Nikos

-

-

June 21, 2024 at 15:36 #262310

Shekeb Khatibi

ParticipantDear Nikos,

I wanted to inform you that the issue I was experiencing with the Prop Firm Robot not opening positions has been resolved. After 24 hours, the robot has started functioning correctly and is now opening positions as expected.Thank you for your support.

-

July 2, 2024 at 19:03 #267014

Marin Stoyanov

KeymasterHi Nikos or Petko,

I noticed that not all EAs have a trailing stop loss. Is there a possibility to add such functionality in all? For example USDJPY M15 #2013751115 doesn’t have a trailing stop loss

-

July 4, 2024 at 0:10 #267670

NIKOS KYRIAKOU

ParticipantHello Aphrodite,

So, each strategy is different which means that trailing stop loss for example for the EA you mentioned, might not be a good option.

Hope this helps!

Kind Regards,

Nikos

-

-

July 3, 2024 at 18:24 #267601

Shekeb Khatibi

ParticipantDear Nikos,

How to configure the EA for 6k challenge with 5% daily loss and 8% target, because for this amount of challenge there is no any setting in prop firm app.

-

July 4, 2024 at 0:12 #267672

NIKOS KYRIAKOU

ParticipantHey Shekeb,

You can still use the 10k amount in the App for the EA you want to download and you just have to manually adjust the amount of the profit target and the daily loss according to challenge that you have.

Hope this helps!

If you have any more questions, let me know!

Kind Regards,

Nikos

-

-

July 4, 2024 at 16:20 #267833

Marin Stoyanov

KeymasterDo you change EAs before the start of Sydney session? Or just when your day starts depending on which country you stay in

-

July 4, 2024 at 16:51 #267844

NIKOS KYRIAKOU

ParticipantWe just change the EAs when the day starts if there is any change that needs to be made!

Kind Regards,

Nikos

-

-

July 4, 2024 at 16:20 #267834

Shekeb Khatibi

ParticipantDear Nikos,

Thanks for your info and support.

-

July 4, 2024 at 16:52 #267845

NIKOS KYRIAKOU

ParticipantHey Shekeb,

You are welcome!

Kind Regards,

Nikos

-

-

July 5, 2024 at 6:58 #267950

Marin Stoyanov

KeymasterAnyone else seeing huge losses from these prop robots this week? I went from $200k account up to $215k ($15k in profit in 2 weeks) then this week I am down to $205,500, Huge losses! Seems like Robots are very up and down. My strategy is to go in once per week and see which robots performed best for the prior week then the top 3-5 bots I add to my prop challenge for the following week trading. First two weeks of using the robots gains were amazing now the third week this week I am seeing huge losses especially today on USDJPY I lost like $3500 and in a $1600 floating loss overall. I am focused on a few pairs that seemed to perform well on the prior weeks. USDJPY, USDCHF, EURJPY, and XAUUSD. I have a number of USDJPY bots trading 1553814431, 538832091, 2013751115, 2067664102. Any Thoughts?

-

July 5, 2024 at 10:15 #267977

NIKOS KYRIAKOU

ParticipantHey Derek,

What you can do is to keep checking everyday and see if there is any change in the profitable robots. Here is a trader who has reached 10% using this method:

Just scroll to the latest message!

Kind Regards,

Nikos -

July 5, 2024 at 10:56 #267983

Marin Stoyanov

KeymasterSo what are you saying I should instead of seeing which bots performed well over a week period to check every single day by checking in prop robot app and switch to daily instead of weekly to see which bots have the highest profit factor and just add those bots and cut any loser bots that are in a loss? Let me know if this is correct? In the course it talks more about checking weekly to see which bots performed best but if you are saying I need to add winning bots for each day to trade the following day. Also do you recommend I add these top winning bots after daily close or before daily open and look at bots that performed well the previous day?

-

July 5, 2024 at 11:15 #267986

Marin Stoyanov

KeymasterI have noticed that after a winning EURJPY trade the EA automatically entered a EURJPY trade again but this time at a loss. The next day the Set file had changed. Please add option to each set file to close EA automatically. This would prevent the EA opening trades in the same direction after a win because the trend could have changed.

-

July 5, 2024 at 20:33 #268183

Marin Stoyanov

KeymasterNw this bot has nearly blew my account not using more than medium risk and I started out at low risk in 2 weeks I was at $215k almost $216k now I am down to $204k in a 2 day period! wiyth $2700 in floating loss!

-

July 5, 2024 at 20:41 #268186

Marin Stoyanov

KeymasterHi Derek

I don’t know if this is because of NFP week but the drawdowns were for sure huge. And the bots kept opening trades at premium prices even after hitting TPs

Nikos, maybe could you adjust the EAs so that if the price has reached all time high it shouldn’t keep buying at that premium price and also recognize when there’s a reversal?

-

July 5, 2024 at 20:51 #268189

Marin Stoyanov

Keymastershould I check the prop robot add daily instead of setting on Weekly and going in once a week to add top performers to my chart? This is how I did it for the last 2 weeks and like I said I started at $200k on low risk settings and added just the top 3-5 robots that had the highest profit factor from the prior weeks and in a 2 week period I was right on the edge of passing phase 1 of my challenge and was amazed by the bot! Everything was going smoothkly! Then this week everything was wiped away I actually lost one prop challenge becuase of this but I was taking two $200k challenges and one of them thankfully I am still active but almost blew the 2nd account today! The good news is at least I can rebuild as long as I didnt blow the account. So should I select Daily on the prop robot app now and see which bots performed well each day and switch bots out daily OR should I still only go in once per week and see which bot performed well the prior week?

-

July 5, 2024 at 20:54 #268190

Marin Stoyanov

KeymasterBy the way I wss using these pairs USDJPY, USDCHF, EURJPY, and XAUUSD for the week not sue if NFP effected these pairs but according to last week the Profit factors were very high on these pairs so I added a number of bots from these pairs I had a few versions of the USDJPY which took the biggest losses.

-

July 5, 2024 at 22:33 #268212

Marin Stoyanov

KeymasterOne pair USDCHF I am looking at daily chart to see more of a birds eye view on how the bot is trading and it put in a buy order near the top of the price move as price was rallying for several candles then price reversed a couple candles later and now the bot is in a $1000 drawdown. So something is off almost every trade is a loss its making careless buy trades near tops of rallys instead of buying in demand zones and selling near supply zones. Also on USDJPY I am wathcing the trades and every trade is careless its making completely the wrong trades selling into demand zone and closing after price rallys in a loss. Seems like every trade is the opposite of what it should be doing

-

-

July 5, 2024 at 20:44 #268187

Marin Stoyanov

KeymasterNow this bot has nearly blew my account not using more than medium risk and I started out at low risk in 2 weeks I was at $215k almost $216k now I am down to $204k in a 2 day period! wiyth $2700 in floating loss!

-

July 5, 2024 at 22:37 #268214

Marin Stoyanov

KeymasterWhat’s steps are you taking each day?

I am in profit and have surpassed the 10% gain in the last few weeks. What I am doing is as Nikos did to pass, Every morning I open the app and set it to weekly 1% risk. I then set the top 3 EAs on my account. Some days there is no change so no need to do anything.

So again, every morning, open app, set to weekly and make sure all top 3 are running on your account

-

July 6, 2024 at 0:12 #268228

Marin Stoyanov

KeymasterHi Craig what I am doing is on Sundays before the market opens I select weekly plug in my prop firm details as far as target and daily and max loss then I see the top 3-5 and I add those to MT5 and use a trade copier to copy trades over to my prop account. So what you are saying is what I should be doing is checking not once a week on the weekly but checking every single day on the weekly not daily but weekly correct? Then if new bots are showing and I dont have those I add them to my chart? What about the ones the day before if they are not showing would you remove those and just have the new ones that you added from seeing which top bots are showing on the weekly?

-

-

-

July 17, 2024 at 5:15 #270666

Thomas Hunter

ParticipantHi, I’m new to using the bots. I’ve won only 2 trades out of seven trades so far. Guess I’m still learning the bot. Should I adjust stop loss to avoid losing the trade?

-

July 17, 2024 at 14:11 #270731

Ryan Sloan

ParticipantI’m going to suggest this once again but can we have an account size drop down where you can put your own figure in and it auto calculates the rest for the bots. It shouldn’t be that hard to do….I don’t use FTMO – I use a completely different prop firm that works on scaling up each successful round by a % and so fixed numbers like 10k 25k etc are useless to me except for the challenge phase.

-

July 19, 2024 at 12:40 #271275

Michael Jonsson

Participant1. Daily target, close all ongoing trade if the daily target equity is hit and don’t open any new trade until next day.

2. Close all ongoing trade X minutes before high news.

3. Portfolio mode, check if other trade is ongoing, don’t open more then X trade if we running multi EA’s on the same account. -

July 19, 2024 at 12:43 #271276

Marin Stoyanov

KeymasterExcellent and essential for prop firm trading.

-

July 22, 2024 at 12:07 #271831

Marin Stoyanov

KeymasterA way to set a delay for trade entry and exit so that you are not taking exactly the same trades as other people using the same ea on any particular platform.

-

July 22, 2024 at 12:09 #271833

Michael Jonsson

ParticipantGreat idea.

-

-

July 22, 2024 at 12:10 #271834

Marin Stoyanov

KeymasterAgreed. Without a delay, we will always get flagged for copying. Excellent idea.

-

July 22, 2024 at 12:14 #271835

Michael Jonsson

ParticipantIt should be an automatic random number from an interval of number like, (1-5000 ms).

-

-

July 23, 2024 at 9:08 #271936

NIKOS KYRIAKOU

ParticipantHello traders,

Thank you for your suggestions!!

Kind Regards,

Nikos -

August 2, 2024 at 20:30 #273785

Marin Stoyanov

Keymaster1)FTMO Challenge strategy: every morning at 10:00 am update robots, close all positions that exist and are open from previous robots, replace with new top five on weekly charts. Ιs the change right at this time or is a specific time recomended? On weekends if we have open positions do we keep them until Monday morning or close them, on Friday night?

2) When we have upcoming news red flag USD we pause the robots one hour before and one hour after news (although your instructions are for 2 mins). Would you recommend less (I ask because disruption starts roughly at that timeframe).

3) On the weekend when the market is closed expect for crypto, should we pause robots that include crypto pairs, if they are in the weekly top 5 list? -

September 17, 2024 at 14:44 #310168

sulaiman altahhan

ParticipantHi team, I would suggest that the EA’s should have trailing stop loss where we can protect the profit properly. for example yesterday the EA USDJPY M15 #1599046594, TP set as 90 pips however the price reached around 85 and returned back so in such of cases the trailing stop loss it is so useful.

-

September 17, 2024 at 19:58 #310220

Alan Northam

ParticipantHi Sulaiman,

The other side of your argument goes like this: Suppose price moved to half of the take profit target, reversed back in a downward direction, hit the trailing stop for a profit, and then price moved back upward and continued on to surpass the original take profit price. What happened in this hypothetical example is that the trader would have received half the profit instead of the full profit. This hypothetical example can happen in reality because all EA’s will go through drawdowns, and if the trailing stop is set too tight then the positions would be closed during a drawdown instead of allowing price to complete the drawdown and then continue in the profitable direction and hit the price target. If the trailing stop is set too loose so as to not close out a position during a drawdown then perhaps the trailing stop is of no value. When the EA’s are created the take profit and stop loss price points are determined to allow for the optimum profit and minimum losses based upon the historical data. As a result, statistically, over the long term, it is more profitable to allow trades to complete their drawdowns and continue on to hit their profit targets while occasionally taking a loss.

Alan,

-

September 18, 2024 at 0:10 #310296

Konstantinos Borsis

ParticipantI agree with Alan 100%. I have been a trailing stop advocate for very long time until recently. And yes it is far better to allow the trade play out completely. Yes some of the trades will be lost but overall you would be more profitable. What you can do in case you get nervous, is set up an alert on a specific profit level and if hit check manually to decide if you want to close the position there or keep an eye and close it later. Personally if the price is above 80% I would close the trade manually and live to fight another day. 😊

-

September 18, 2024 at 0:10 #310297

Konstantinos Borsis

ParticipantI agree with Alan 100%. I have been a trailing stop advocate for very long time until recently. And yes it is far better to allow the trade play out completely. Yes some of the trades will be lost but overall you would be more profitable. What you can do in case you get nervous, is set up an alert on a specific profit level and if hit check manually to decide if you want to close the position there or keep an eye and close it later. Personally if the price is above 80% I would close the trade manually and live to fight another day. 😊

-

September 18, 2024 at 0:10 #310298

Konstantinos Borsis

ParticipantI agree with Alan 100%. I have been a trailing stop advocate for very long time until recently. And yes it is far better to allow the trade play out completely. Yes some of the trades will be lost but overall you would be more profitable. What you can do in case you get nervous, is set up an alert on a specific profit level and if hit check manually to decide if you want to close the position there or keep an eye and close it later. Personally if the price is above 80% I would close the trade manually and live to fight another day. 😊

-

November 22, 2024 at 14:09 #379744

V10n31ZZ

ParticipantHi,can you guys want to implement in the robots more protections like;to select witch day to trade and the hours

I think this things can help a lot with winrate.ex. i want to trade USDJPY robot only in NY session from 15:00 to 19:00

-

November 22, 2024 at 14:17 #379749

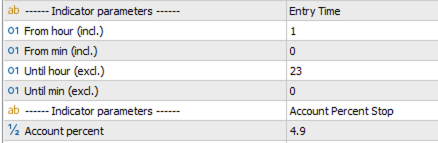

V10n31ZZ

Participant

-

-

AuthorPosts

- You must be logged in to reply to this topic.