Forum Replies Created

-

AuthorPosts

-

Alan Northam

ParticipantHi Paul4x,

After you add the EAs to Metatrader close Metatrader and then re-0pen it. You should now see the EAs in the Navigator window. Once you see the EAs in the Navigator window you can then install them onto the trading chart.

Alan,

Alan Northam

ParticipantHi Konstantino,

If you see a smiley face or a blue hat in the upper right corner of the trading chart then the EAs are installed properly and you just need to give the EAs more time to take trades.

Alan,

Alan Northam

ParticipantHi Stewart,

You need to log into your account before you can download the robots.

Alan,

Alan Northam

ParticipantFXIFY is the only prop firm that I know of that allows traders in the United States. Here, Nicholas has started his first FXIFY Challenge. In this link Nicholas shares his first experiences with this prop firm.

https://eatradingacademy.com/forums/topic/ftmo-robot-app-v6-0-new-features-released/#post-249312

Thank you Nicholas for sharing,

Alan,

Alan Northam

ParticipantSure, yes I’ll let you know how it turns out! So far I have had 2 trades with the EAs, one closed for a small profit, and one is still open.

Totally happy to share:

I am in the US, and it took some research but I found that FXIFY ( https://www.fxify.com/ ) accepts US Traders and allows the use of EAs. So that’s a good option. I had to get the EAs approved before use though – all you do is email their support team, and they will ask you to tell them a short description of what the EA does (i just typed about 2 sentences describing what it does, based off Petko’s videos) and also provide a screen recording of the EA running for 3 minutes. They approved it in under 24 hours. Great support team and it’s so far been a good experience with FXIFY. Purchased my first FXIFY challenge, installed the robots and I’m on my way! I’m starting with a 10K Challenge, to make sure I understand how to properly use the EAs, but they offer challenge accounts all the way up to $400K. and a VERY good scaling plan! I highly encourage you to check them out.

After I pass the $10K challenge, I’ll purchase a $400K challenge.

Will keep everyone updated on my progress!

Cheers,

NicoAlan Northam

ParticipantHi Nicholas,

Great! Keep us informed as to how your trading goes. Can you share in one response what country you are in, what prop firm you are using, account size, what EAs you are using, did you have to get approval to use EAs, what you did to get the EA approved? I know you have shared some of this in the above responses but it would be helpful to other traders to be able to review all this information in one response. I would like to use your experience to share with others.

Thanks!

Alan,

Alan Northam

ParticipantThank you Alan! I appreciate your help! For the “all-in” or “raw” spreads, I’m seeing it on the FXIFY site> https://www.fxify.com/

I researched it and I didn’t think it would make much of a significant difference, so I just picked one and went with it.

I’ve just started my first challenge with the EAs, so I’m excited! And thank you for your guidance about the risk, it’s noted!

Cheers,

NicoAlan Northam

ParticipantHi Nicholas,

That scaling plan was based upon the robots that had a 1:2 RR. For other robots just wait until the account reaches half profit target and then increase risk. Beware however, increasing risk can also increase draw down!

Alan,

Alan Northam

ParticipantHi Nicholas,

That scaling plan was based upon the robots that had a 1:2 RR. For other robots just wait until the account reaches half profit target and then increase risk. Beware however, increasing risk can also increase draw down!

Alan,

Alan Northam

ParticipantHi Nicholas,

Answer 1: Leverage does not matter when using the Prop firm with the three levels of risk.

Answer 2: I am not sure if all-in or raw spreads is better. Can you tell me what prop firm or brokerage is using these two so I can research them to see which is better.

Answer 3: I would not do any scaling until you have half your profit target. Personally, I do not use it. It is a way to get funded quicker, it is also a risk of a large draw down of your account. Personally, I prefer to just let the account take a little longer to reach the profit target, but then again I am a conservative trader.

Alan,

Alan Northam

ParticipantHi Raymond,

That makes more sense!

The following are good choices:Alan,

Alan Northam

ParticipantHi Raymond,

If you installed the 200K robots and have not made any changes to the lot sizes then the robots are working properly based upon the risk you selected. The reason for the lot profits at the moment may be because of the market environment. I would give it more time to see if the profits increase in the weeks ahead.

Alan,

Alan Northam

ParticipantHi Raymond,

For an account size of $200, if you are getting profits of $60-$80 dollars you are doing quite well as that is a 30% to 40% return.

Alan,

Alan Northam

ParticipantHi Francesco,

In the upper left corner of your trading chart it shows the Minimum Equity protection has activated. This stops your account from trading. This happened because the Prop Firm robots you installed on your trading chart is for a 100K account, whereas, your account size is $50,000. You need to download the 50K robot and install it in your trading chart.

Alan,

Alan Northam

ParticipantHi Traders,

WEEKLY REPORT

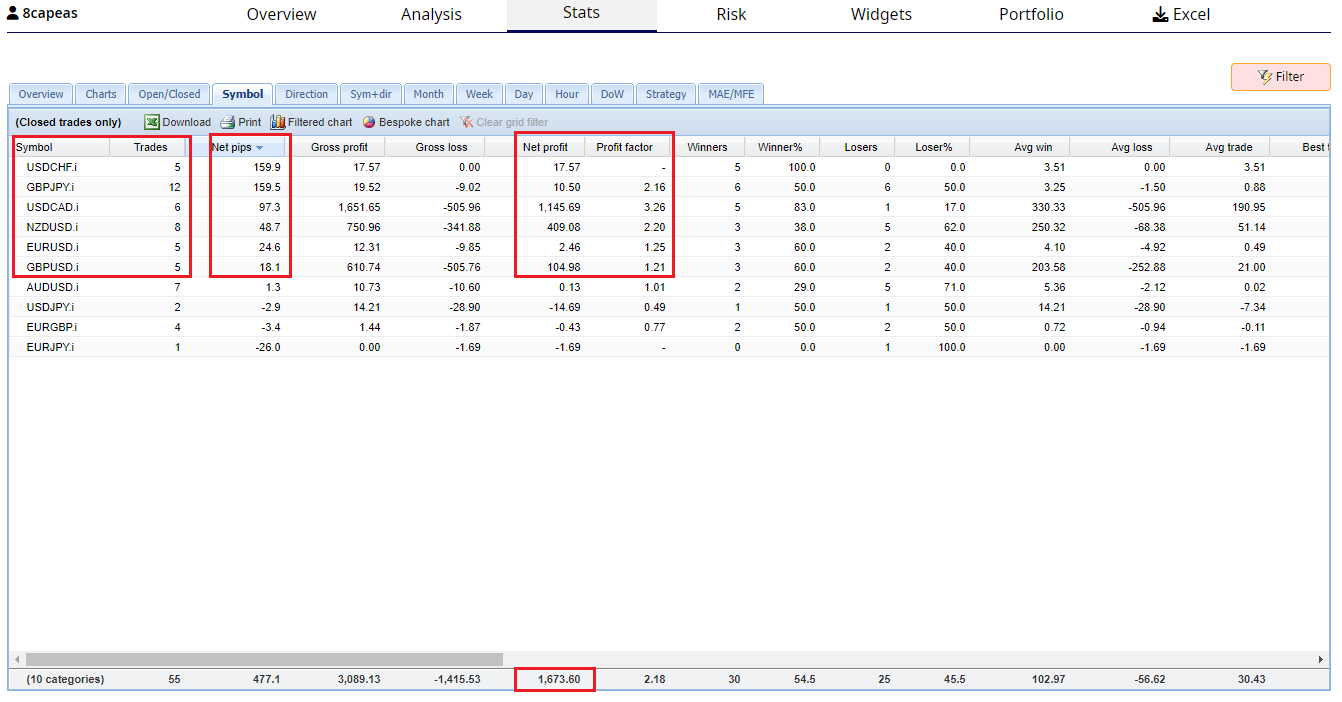

Week of April 7, 2024 through April 13, 2024. The following are the eighth week results of trading 10 Expert Advisors (EA) I created using EA Studio. These Expert Advisors where then traded on my Infinity Forex Fund (IFF) 100K Algo One Step Evaluation account. I analyzed the results this week using FXblue where I sorted this past weeks trading results by the “Net pips” column from most pips gained to most pips lost this past week. I then looked at the Net Profit column to determine profits and losses for the week. The following are the results along with the changes made for trading next week:

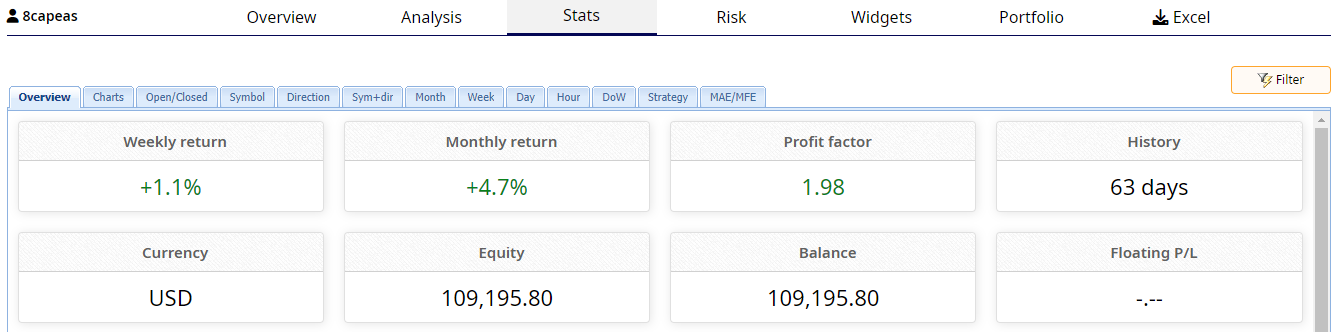

This past week ended with an $109,195.80 account balance. The price target to become a funded account is $110,000. To reduce risk of this next week of significantly drawing down this account I am going to limit the risk to the account to 1%.

The top six currency pairs this past week had a profit factor of 1.2 or greater. I will adjust the lot size of these six currency pairs to have a 0.16% account risk each. The other four currency pairs will have their lot size adjusted to 0.01 lots.

USDCHF: 0.30 Lot size

GBPJPY: 0.59 Lot size

USDCAD: 0.60 Lot size

NZDUSD: 0.31 Lot size

EURUSD: 0.23 Lot size

GBPUSD: 0.21 Lot size

AUDUSD: 0.01 Lot size

USDJPY: 0.01 Lot size

EURGBP: 0.01 Lot size

EURJPY: 0.01 Lot sizeNOTE 2: The profit to the account this week was $1673.60. The total profit for this account to date is $109,195.80 and must reach $110,0000 to pass the one step Evaluation and become funded.

NOTE 3: The total account risk for trading this next week will be 1.0% to reduce chance of significant drawdown.

This first chart shows the trading results for this past week:

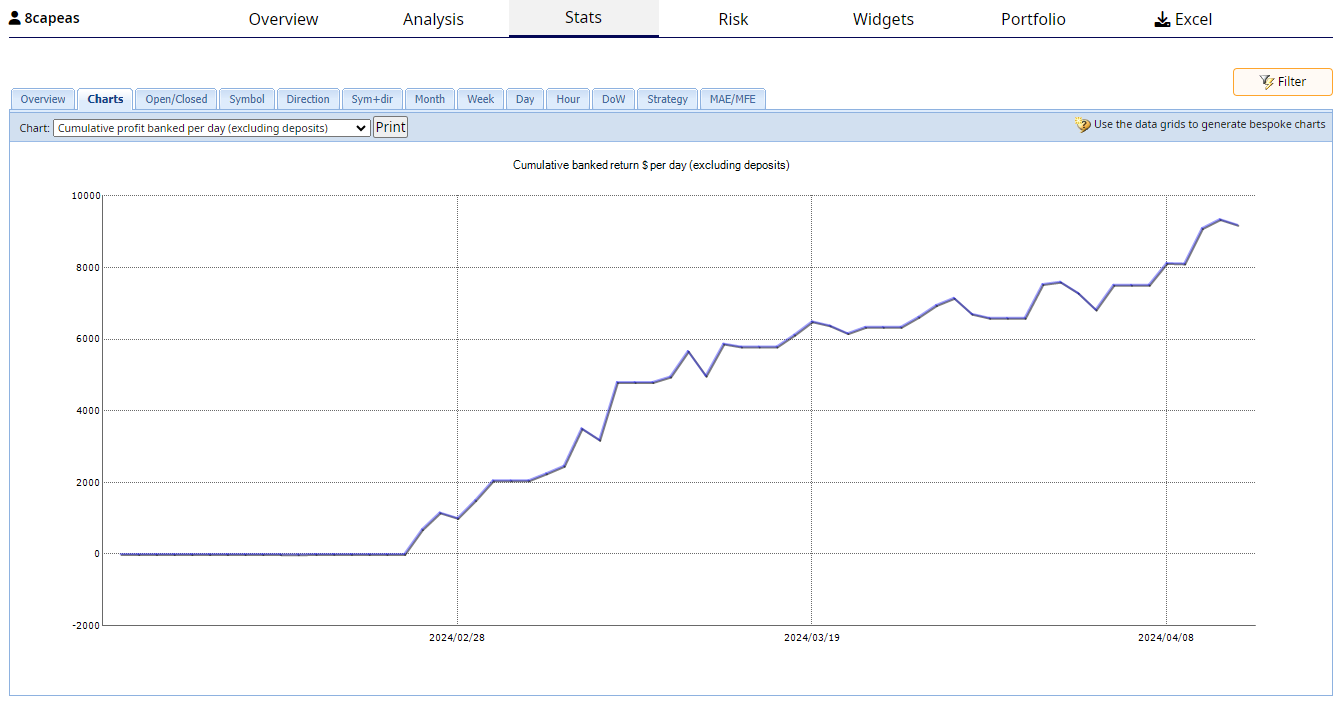

This chart shows trend line of the cumulative profit this week:

This chart shows the statistics of this account since inception:

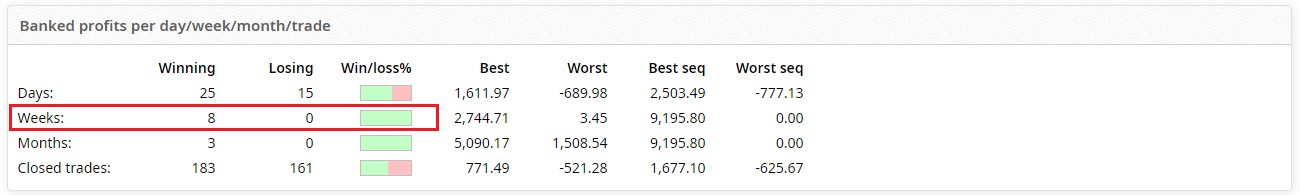

This chart shows all 8 weeks of this Evaluation has been profitable:

Alan,

-

AuthorPosts