Home › Forums › Ready-to-use Robots › Top 10 EAs › Top 10 Robots App vs Prop Firm Robots App

- This topic has 103 replies, 2 voices, and was last updated 10 months, 1 week ago by

[email protected].

-

AuthorPosts

-

-

April 12, 2024 at 6:46 #250803

Marin StoyanovKeymaster

Marin StoyanovKeymasterDive into a detailed comparison between the Top 10 Robots App and Prop Firm Robots App. This discussion aims to explore the key differences in features, user interface, and etc. Share your experiences, ask questions, and gain insights on which app suits your trading needs best. Whether you’re deciding which app to use or just curious about the nuances between them, this is the place for you.

-

April 12, 2024 at 6:46 #248143

ec_2008

ParticipantI had bought the prop firm robots last year. Saw through email that you guys are launching top 10 robots app. Can I know what’s the difference between top 10 robots app and prop firm robots app?

-

April 12, 2024 at 12:51 #248207

Alan Northam

ParticipantHi ec,

The Top 10 robots app will have many more robots to chose from and will also contain a couple of crypto robots.

Alan,

-

April 12, 2024 at 15:19 #248238

ec_2008

ParticipantHi Alan,

Thank you. I will be waiting for the launch.

-

April 12, 2024 at 17:36 #248272

Craig

ParticipantIs it going to be included for those who already own the current robot app?

-

April 15, 2024 at 16:50 #248897

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Craig,

You must have received an email that gives you access if you have purchased any of the Top 10 Robots!

Hope this helps!

Kind Regards,

Nikos

-

-

April 15, 2024 at 12:43 #248786

stewart

ParticipantHi

What’s the difference between the top 10 robot app and the followings EA ?

Stewart

-

April 15, 2024 at 15:27 #248869

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Stewart,

The difference of the Top 10 Robots to the Expert Advisor packages is that on the Top 10 Robots app, is that on the packages you get more robots than on the Top 10 Robots App.

On the Top 10 Robots App, you get the Top 10 performing robots on the available pairs so that you do not need to search on which are they as they are displayed on the App and you can get them faster.

In case you want more options though, the Expert Advisors packages is worth it!

If you have any more questions, let me know!

Kind Regards,

Nikos

-

-

April 16, 2024 at 23:48 #249293

paul4x

Participantwhats going on here? i purchased a membership for 190 back in december and i was able to gain access to the trading pairs that we were using.

now when i login to download the best performing pairs for last week, it says i have to purchase a plan? what was the 190 i paid for back in december for?

feeling a bit ripped off here.

-

April 17, 2024 at 9:53 #249294

Craig

ParticipantI had this worry but realised the “Top 10” robots is a totally separate thing to the Prop Firm robots

-

April 17, 2024 at 9:55 #249358

Marin StoyanovKeymaster

Marin StoyanovKeymasterHello Paul, as Craig pointed out, the Top 10 Robots app is a different app. Your existing purchase gives you access for 6 months to the Prop Firm Robots app.

Regards, Marin

-

-

April 17, 2024 at 8:13 #249341

stewart

ParticipantHi

already paid Euro 995, still got the following message when downloading:

To access and download the Top 10 Robots, you need to be a registered user and have an active plan with us.

Please log in to download the Expert Advisors. If you haven’t purchased a plan yet, you can select one that suits your needs here.Stewart

-

April 17, 2024 at 10:40 #249365

Alan Northam

ParticipantHi Stewart,

You need to log into your account before you can download the robots.

Alan,

-

-

April 17, 2024 at 12:22 #249389

Markus Woitok

Participantjust to be sure to select the right plan for the App, this one is without Gold and Crypto?

-

April 17, 2024 at 12:24 #249390

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Markus,

Yes, this is only Forex robots, no gold or crypto!

Kind Regards,

Nikos

-

-

April 20, 2024 at 22:20 #250158

Boyan Todorov

ParticipantHello,

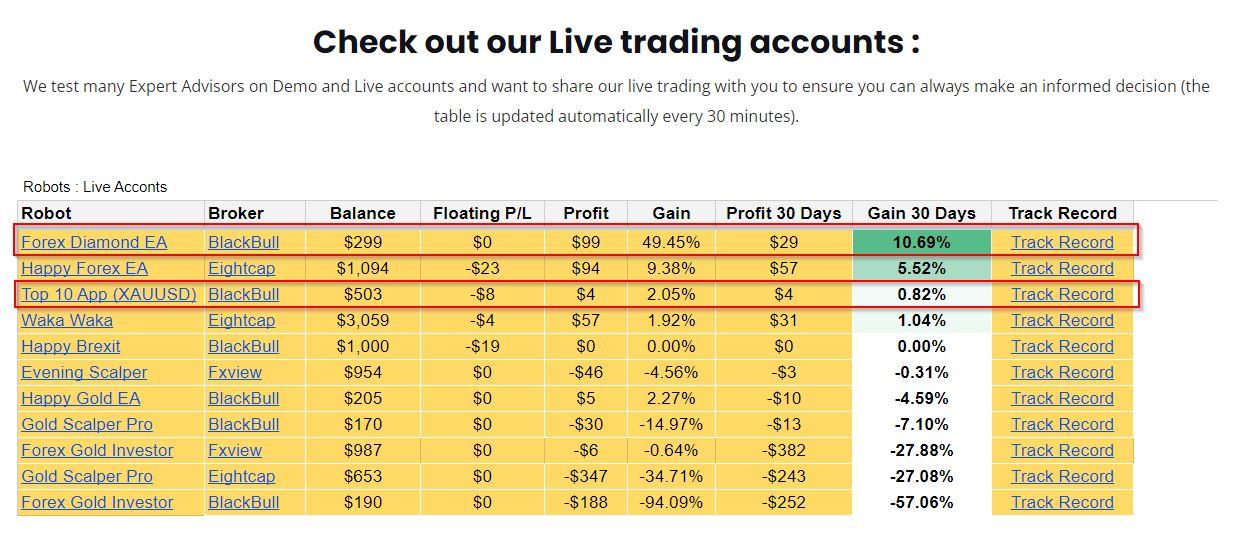

after the fail of the Forex Gold Investor on last Friday, I stopped using it for a while and I am looking for a new EA , because I want to continue trading my darwinex zero account and also my brand new FX2 Funding challenge which I also have to start trading within 30 days. According to the current trading results you post the two candidates would be the Forex Diamond EA and the Top 10 App Robots and I have some questions about those.

– Firstly why does the Forex Diamond EA performs differently in the last 30 days on the live account results and on the challenges results(find the screenshots in the attachments)?

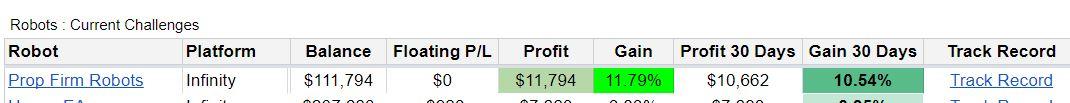

– secondly you have in the results on the live account the Top 10 App(XAUUSD) and on the challenges the Prop Firm Robots which is performing a lot better during the last 30 days. What is the difference between these two?

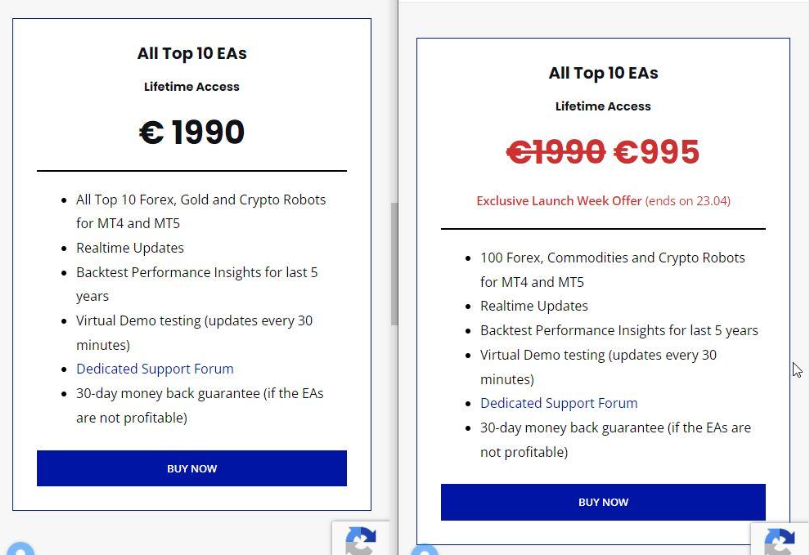

– and last but not least – when I click on Top 10 App(XAUUSD) in the Live acoount results table and on the Prop Firm Robots in the challenges resukts table I get different offers to purchase – see the screenshot comparison in the attachment. I thought there is a 50% discound this week on all plans of the Top 10 robots can you please explain? And I also do not understand the difference of the offers on the left and on the right side – the first two columns on the left are included only10 Gold Robots – what about the first two columns on the right side – what is here included? And also the third column – on the left it is 100 EAs and on the right side only 10 although double the price?

Please get back with me soon as I want to make up my mind anf take advantage of the discount. Thanks a lot!

best regards

Boyan -

April 22, 2024 at 0:51 #250399

Boyan Todorov

ParticipantHello,

I am trying to figure out what are the differences between the Prop Firm robots an the Top 10 EAs and which ones are more suitable for passing a challenge. So far I figured out, that the Prop Firm robots contain 14 EAs, each trading different instruments, while the Top 10 EAs contain up to 100 EAs – 10 instruments with 10 strategies each – is that correct? I took a look at the results and I see that the Prop firms robots performed a lot better in the challenges than the Top 10 EAs in the live accounts – but as far as I see in the track record the Top 10 EAs have been running only for a week or so, so they cannot rally be compared. So I am not sure which one is my better choice, please get back with me soon, so I can possibly take advantage of the 50% discount if I decide to get the Top 10 EAs. Thanks!

Boyan

-

April 22, 2024 at 12:04 #250461

Boyan Todorov

ParticipantHi,

refering to the user guide of the Top 10 EAs U have a couple of questions. Is the app actually ranking Top 10 EAs out of many more per pair? Could you please explain one more time how you activate only certain EAs from the portfolio to trade on the live account? Petko said that in the demo account all the EAs in the portfilio are enabled and trading while testing. Then he removes the slashes of two of them in the code and they become active, but what about the other ones? Thanks!

https://www.youtube.com/watch?v=aW9WHQRh2LM

Boyan

-

April 22, 2024 at 12:05 #250486

Alan Northam

ParticipantHi Boyan,

Actually you have things kind of backwards. To start with none of the strategies in the Portfolio have slashes in front of them. This allows them to trade. This is why they were trading in the demo account. Then in the live account to STOP certain strategies from trading slashes are put in front of them in the source code of the Portfolio. After the slashes are placed then the source code needs to be compiled. Now, the strategies with the slashes placed in the source code will become INACTIVE. All other strategies will continue to trade.

Alan,

-

April 22, 2024 at 12:28 #250492

Boyan Todorov

ParticipantHi Alan,

thank you for the clarification. What about the other question – is the Top 10 EAs app ranking the top 10 out of many more? And do you know what the difference between these two offers is?

Thans!

Boyan

-

April 22, 2024 at 12:48 #250496

Alan Northam

ParticipantHi Boyan,

I can see from the chart your confusion. There are ten different assets, EURUSD, GBPUSD, USDCHF, EURGBP, EURJPY, USDJPY, XAUUSD, XAGUSD, BTCUSD, and ETHUSD. Each asset has 10 Expert Advisors. This makes a total of 100 Expert Advisors. The forex Expert Advisors are: EURUSD, GBPUSD, USDCHF, EURGBP, EURJPY, USDJPY. The Commodity Expert Advisors are: XAUUSD, XAGUSD. The Crypto Expert Advisors are: BTCUSD, and ETHUSD.

The two images above are really the same except for price. At the moment you can get a great discount on the Launch price. This price is only offered during the launch week and ends on April 23, 2024.

Alan,

-

April 22, 2024 at 22:42 #250802

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi Boyan, these packages represent the same thing. I’m sorry for the misunderstanding. If you click on the buy button on both, you will get the same discount as the product is the same. I suppose the left package was visible on the prop firms page which was not correct and we removed it from there earlier today. Just a reminder that tomorrow is the final day of our Top 10 app launch 50% discount. As Alan explained, the robots in the Top 10 Robots App and the Prop Firm Robots App are completely different and the strategies are different.

This is how the Top 10 Robots App works. On powerful servers we use the Express Generator which generates over 8000 new strategies per market every day. Then we pass them via Acceptance Criteria and Monte Carlo. We merge them to our running collections (up to 100 strategies per market). On the weekend, we choose the best 30 for a market and upload them to the Top 10 Robots server. The strategies are kept in Top 10 until they perform well on virtual trading environment. We have strategies staying in Top 10 for more than a few months. All EAs here work on M15.

The EAs from the Prop Firm Robots App follow the its own strategy and are created in a way to satisfy prop firms requirements. They work on different timeframes. Hope this makes sense and gives some clarity on the differences between the two web applications.

-

-

April 22, 2024 at 13:13 #250515

Boyan Todorov

ParticipantHi Alan,

thank you, this is what I thought – the offers look preety much the same. The question for me is if those are the EAs that achieved the results in the table under challenges results, becuase it says Prop Firm Robots there?

As to the EAs – what would be the use of the Top 10 EAs app since Petko ist trading all of the strategies in a portfolio and then he just picks only the profitable for the live account? Thank you und sorry if I aks too many questions, just trying to figure out what is most suitable for my prop challenges.

Boyan

-

April 22, 2024 at 13:27 #250521

Alan Northam

ParticipantHi Boyan,

Don’t feel bad about asking questions, this is what we are here for!

The Top 10 EA app and the Prop Firm Robot app are two different apps with different strategies.

The Prop Firm Robot app is used for trading Expert Advisors with prop firms. The Top 10 app is created more for trading on live accounts. However, you can use them on Prop Firms but you will need to set up the account protections manually.

Alan,

-

April 22, 2024 at 13:47 #250529

Boyan Todorov

ParticipantHi Alan,

I thought it was clear, but now I am even more confused. I thought the strategies are anchored in the single EAs. Now you tell me, that the apps have different strategies? The two offers about the 100 EAs, that you told me are the same, are listed once under Prop Firm Robots(the left one) and once under Top 10 Forex Robots(on the right with the discount). However if I get the discounted EAs I would be able to extract them only from the Top 10 EAs app, and the results from the screenshot are fromm the Prop Firms App. So could you please explain if I get the discounted EAs will they be suitable for passing a challenge? Thanks!

Boyan

-

April 22, 2024 at 13:56 #250533

Alan Northam

ParticipantHi Boyan,

These two are the Top 10 EA app:

This is the Prop Firm Robot app which is different from those above:

Alan,

-

April 22, 2024 at 14:35 #250544

Boyan Todorov

ParticipantHi Alan,

so these are the Prop Firm robots, correct?

So these are 14 Prop Firm Robots for 14 different assets, which I would be able to export from the Prop Firm Robots App. This is my first option.

And these are 100 EAs wich I would be able to export from the Top 10 EAs app, right? This would be my option 2.

Since the Top 10 EAs have not been trading for a month yet, the results for the last 30 days cannot be really compared to the Prop Firm Robots. And since the Top 10 EAs are more recently developed, which one do you suggest is better for passing a challenge and trading on a funded account? Just your opinion, not a financial advice of course, thanks!

Boyan

-

April 22, 2024 at 15:26 #250566

Alan Northam

ParticipantHi Boyan,

You are correct! Your number 1 is the Prop firm Robot app. Your number 2 is the Top 10 EA app.

Now about the Top 10 EA app: The Top 10 EA app has been trading for more than one month but was not made public until now when it was decided to launch this app. So the 30 day performance is accurate!

The Prop Firm robots are created to be used in passing prop firm challenges. These robots have account protections built into them so they will protect the trader from losing the account.

The Top 10 EA app was created more for trading brokerage accounts which do not have the stringent draw down limits. However, the account protections are still built into the EAs but are just not being used. Knowing this you can use the Top 10 EAs to pass a challenge but you need to manually set up the account protections.

So, either app can be used to pass a challenge. The Prop Firm robot app is a little easier to use as you can select the account size, the Max daily drawdown, the Max drawdown, and the profit target based upon the limits set forth by the prop firm you chose to use.

Now for using EAs on a funded account: Here is where a problem exits. The problem is that most prop firms do not allow using third party EAs. However, most prop firms do not apply their rule with challenge accounts but only on funded accounts. The Prop Firm robot app is advertised to help you pass a challenge and is not advertised to be used with funded accounts.

Alan,

-

-

April 22, 2024 at 16:30 #250593

Boyan Todorov

ParticipantHi Alan,

thanks for the detailed informations. I have a darwinex zero account in the training phase where I was trading the Forex Gold Investor. After the big DD on the 12th of April when it lost 12% of the account I stopped it. I have also another brand new 25k challenge with FX2 Funding, that I have to start trading soon. I would then rather get the Prop Firm Robots to pass this challenge, but what would happen if I use it on the Darwinex account? And also if I pass the FX Funding challenge – is there a posibility to make the trades look unique – maybe change magic number, comment or something? After all the benfeit of passing a challenge is to trade the account. I see in the results that you have funded account trading with EAs, the Forex Gold Investor is not the best one at the moment though, which one would you use? Thanks!

Boyan

-

April 24, 2024 at 4:40 #251180

Matt

ParticipantHello Boyan. Great points.

Forex Gold Investor has had a protection upgrade since the 12th of april to help protect the account. It’s version 1.94. So check that out, do some testing with it and see how it goes. I hope it helps with your challenges and funded accounts.

On the top of making the account unique, you could simply run a different EA on the account with small risk, small SLs, so there are a number of trades that don’t come from the first EA. Then it will show that your account is operating in it’s own parameters, making unique trades and not copy trading.

As for the best EA that we’re trading atm, you can see up-to-date figures on our website:

https://eatradingacademy.com/live-trading/

https://eatradingacademy.com/premium-robots/ftmo-robot/

https://eatradingacademy.com/funded-accounts/I hope that helps. Let me know if you have any other questions.

Warmly

Matt

-

-

April 22, 2024 at 16:49 #250602

Boyan Todorov

ParticipantThank you so much Alan, hope to hear back from your colleague soon!

Boyan

-

April 26, 2024 at 12:57 #251728

Boyan Todorov

ParticipantHello Alan and Martin,

I got the Top 10 EAs during the discount period and I have all 10 Portfolios with 10 EAs each running on a demo. My strategy would be to monitor the weekly performance and put the Top 2-3 EAs on a live account or/and challenge. I have some questions though. Firstly how often do the strategies in the app get updated? Martin wrote in a reply to me in this thread, that on the weekend 30 strategies get added to the app – does that mean that every weekend 30 EAs get updated in the app? If so how do I know which ones changed? I mean at the end of the first week of monitoring I will put the best EAs to work on real money and I will start the testing on demo for the next week along. For this purpose do I have to download all portfolios new from the app? I watched the tutorial and the video in the course about managing the portfolio EA. It shows how to evaluate the performance using FX blue and how to disable the non profitable EAs in the portfolio. However when I move to a live account I would like to put the top performers as single EAs and not as a portfolio, because I have more setting concerning the account protection. Is there a way, as soon as I identify the EAs I want to trade live to find and download only these from the app? Or maybe it is better to do this at the very beginning, just in case that the EAs in the app get updated in the meanwhile? If I have them downloaded at the start, how can I identify which files to put on the live account? Thank you!

Boyan

-

April 30, 2024 at 11:49 #252465

Boyan Todorov

ParticipantCould please someone of the moderators get back to me reagrding my last post? I would greatly appreciate it. Thank you!

Boyan

-

May 1, 2024 at 11:07 #252643

Marin StoyanovKeymaster

Marin StoyanovKeymasterHello Boyan,

Apologies for the late reply.

So, you can see which strategies changed by clicking on the latest button on the top right corner of the app which says latest and you can see what are the new strategies. To see which are changed, you need to check the magic number of each EA.

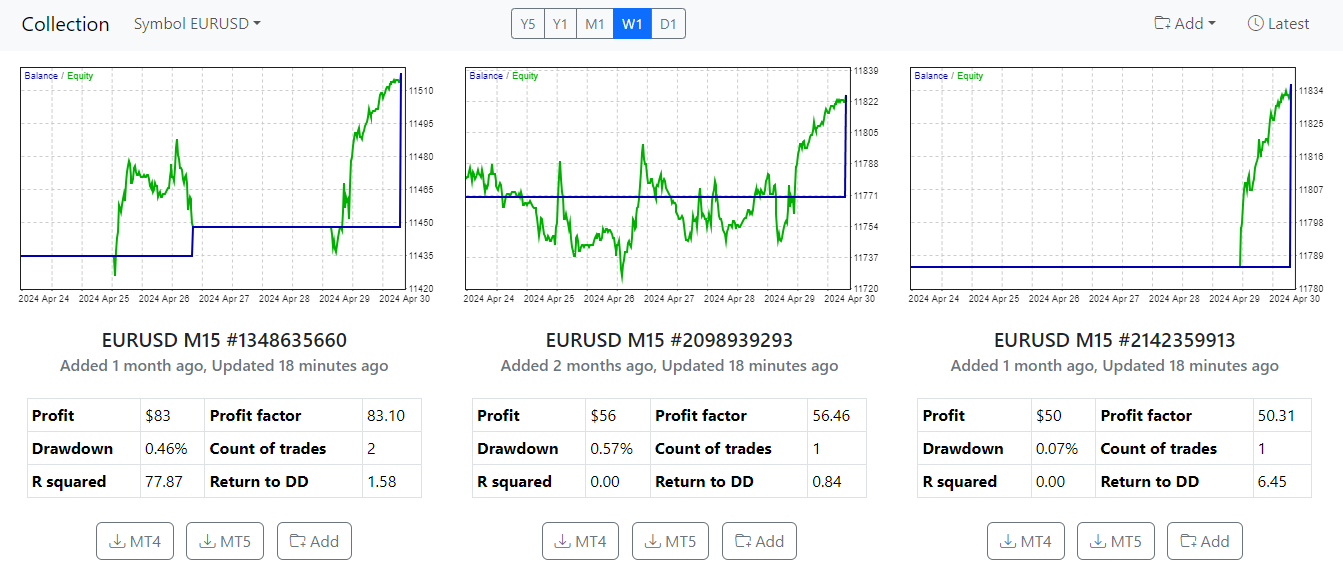

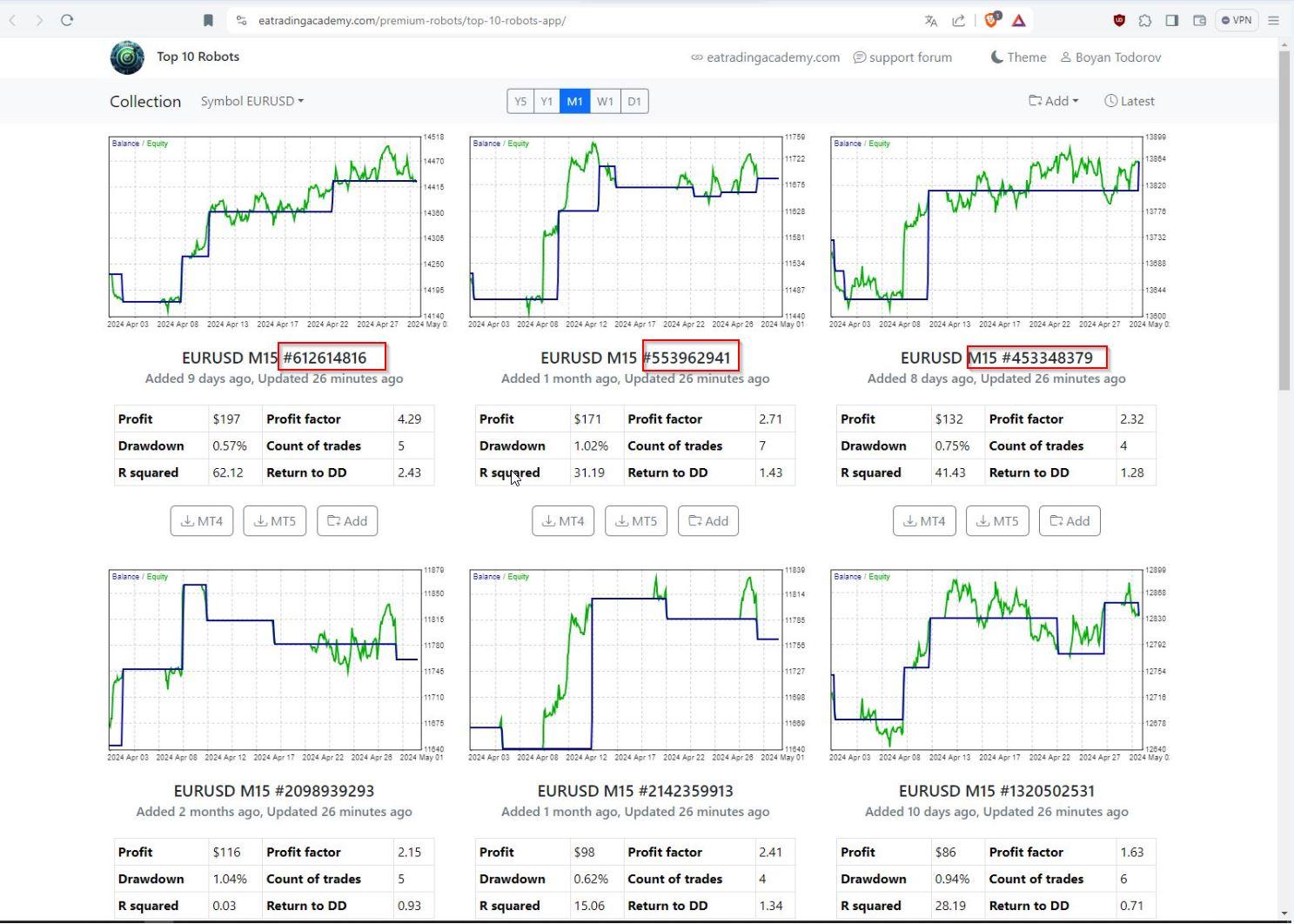

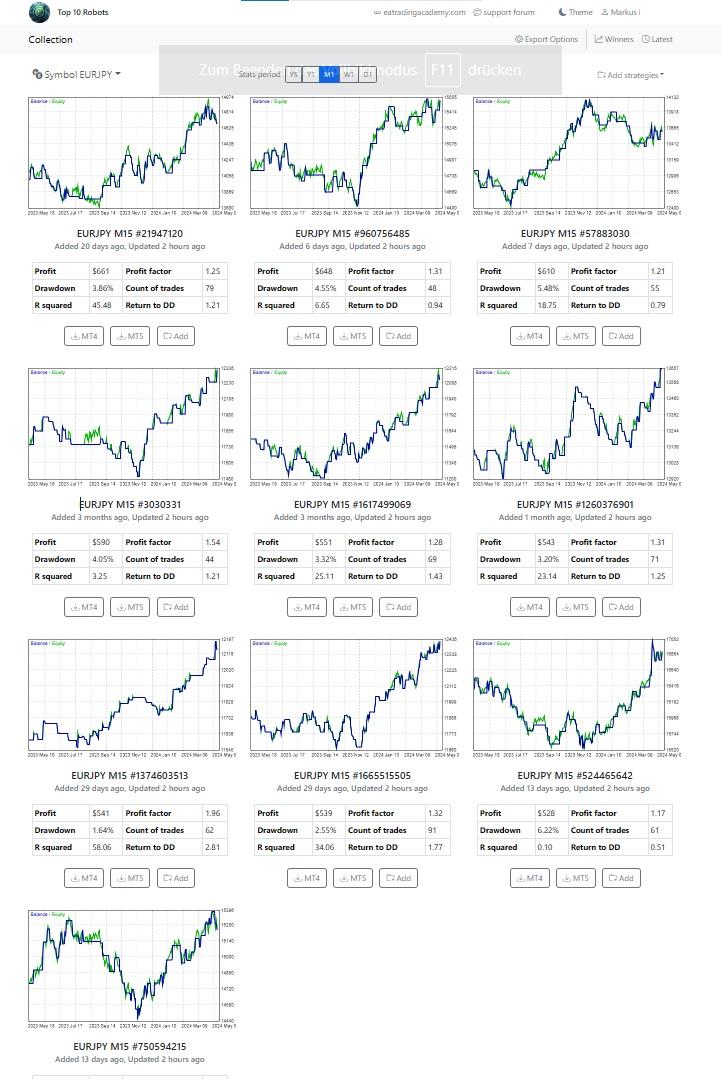

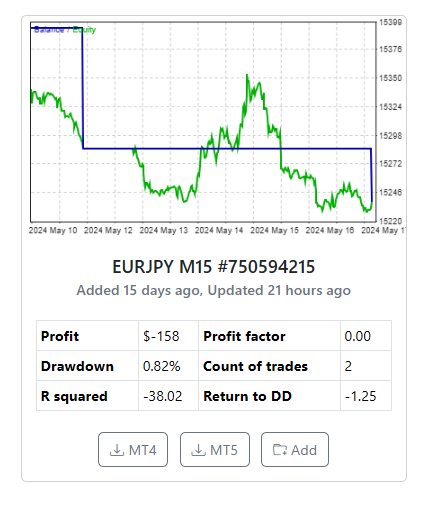

For example, you can see the Top 3 Robots here:

In each EA, you can see a number next to the pair and timeframe and example to that is EURUSD M15 #1348635660. This number #1348635660 is the number you need to look to see which EA is which.

Also, in the screenshot above, on the top right corner, there is the Latest button which if you click it, a window will appear that shows the latest strategies that were added and how much time ago:

This is how it looks when you click the Latest button. Keep in mind that it shows the latest strategies from all pairs.

In order to identify which EA is which, you can just check the magic number as mentioned above and change them accordingly in your account.

Hope this helps!

If you have any more questions, let us know!

Kind Regards,

Nikos

-

-

May 2, 2024 at 21:34 #252993

Boyan Todorov

ParticipantHi Nikos,

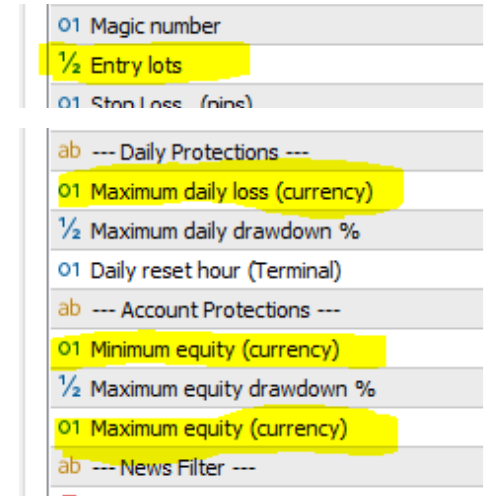

thanks for your input. I’ve been trading the 10 Portfolios of the Top 10 EAs app for a bit more than a week on a 100k demo account with the standard settings. I will choose the Top 3 best performing strategies and I will put them on a 25k FX2 Funding challenge and I want to make sure I have the right settings. I am allowed to have a max. DD on the account of 6% or $ 1500 and a max. daily DD of 4% or $1000. Considering spreads, swaps, comissions and slippage I will set max. daily loss at 3% to make sure I don’t get below the 4%. The min. equity I will set to $23700 with a buffer of $200. The max. equity I will set to 27 050 to be on the safe side. Since I don’t have a setting for the risk in the app(like in the Prop Firms App) I am not sure what to put into the lot size, the max. open positions and max. open lot? I want to trade with medium risk of 1% per trade, but can you please help me calculate these parameters to get the best out of it? I would definitely chose a max spread of 30 points. Is it reasonable to have the news filter switched on, or this will result in a poor performance? Thanks a lot!

Boyan

-

May 3, 2024 at 0:42 #253015

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

So, in order to calculate the risk per trade and to make it be 1% per trade, you can try this link:

https://www.babypips.com/tools/position-size-calculator

It will help you calculate the risk per trade for the pairs that you wish to trade. I know that you said it’s portfolio but you can just see what pairs you have chosen and depending on that, you can write the correct information in the link that I provided so that you can see what would be the lots size.

Also, regarding the news filter, I suggest that you have it on, especially in a challenge!

Hope this helps!

If you have any more questions, let me know!

Kind Regards,

Nikos

-

-

May 3, 2024 at 1:43 #253023

Boyan Todorov

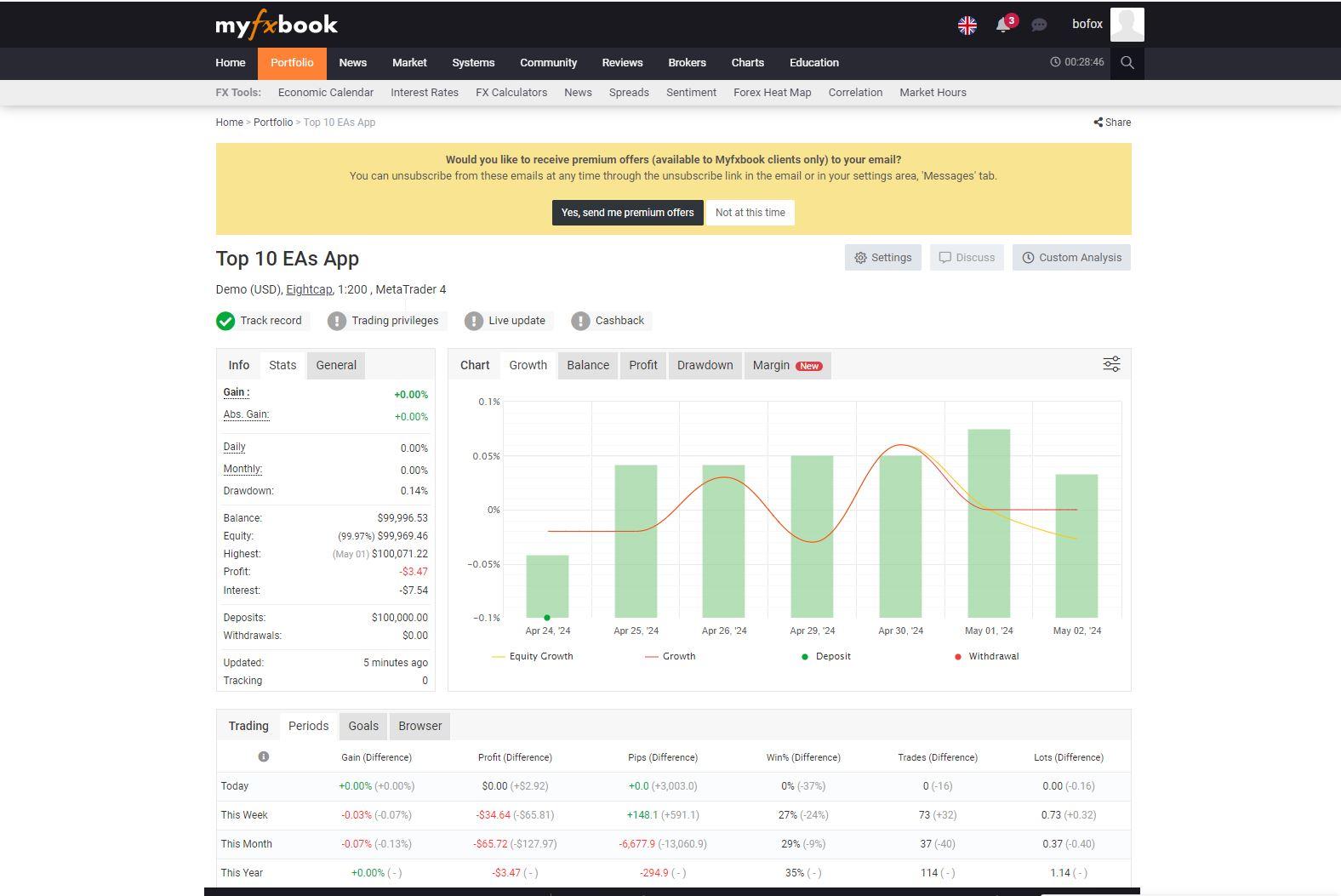

ParticipantThank you Nikos helps a lot. I connected my demo account with myfxbook to check the profitable strategies, but I cannot finde dem like in the Complete Guide video from Petko(second screenshot). Can you tell me what I am doing wrong? Thanks!

BoyanPS. I am sending this message for the third time. The first two times it had 2 screenshots, but it does not work with them, or at least I don’t see it.

-

May 3, 2024 at 10:48 #253077

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

Can you please provide a screenshot for this as I cannot see any screenshot if you have provided any.

Thank you!

Kind Regards,

Nikos

-

-

May 3, 2024 at 2:32 #253028

Boyan Todorov

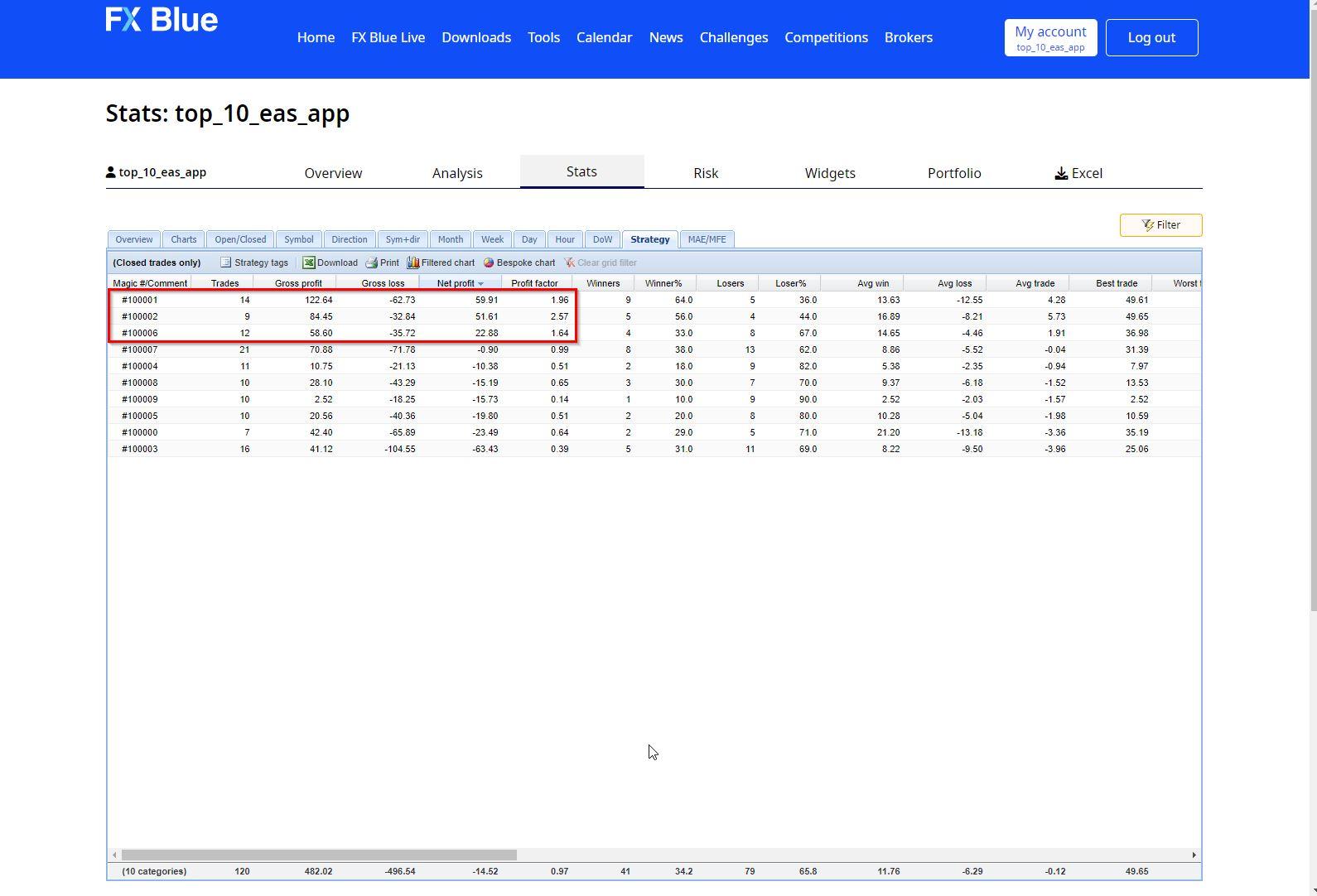

ParticipantHi Nikos,

I registered now the account also with FX Blue and in the stats in the colimn net profit the best performing magic numbers are 100001, 100002 and 100006. The issue is I turned on the comments in mt4 and I see that the number 100001 ist having both eurgbp and xagusd trades, the number 100002 xagusd and eurusd and the number 100006 eurogbp and eurgbp. This is pretty confusing. And when I go to the App I see totally different numbers. Please help!

Boyan

-

May 3, 2024 at 10:45 #253076

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

I see that you are confused with the magic numbers. Probably the reason there are 2 pairs in one magic number is due to portfolio robot.

Just so that I can understand more on where you are looking exactly, can you please provide a screenshot so that I can help you more?

Thank you!

Kind Regards,

Nikos

-

-

May 3, 2024 at 12:53 #253018

Boyan Todorov

ParticipantThanks Nikos, helps a lot. I guess for the SL in pips for the calculator I just have to take from the EA settings right? One more thing – I connected my demo account to myfxbook to check the profitable strategies like in the Complete Guide video from Petko(second screenshot), but I cannnot find them, can you tell me what I am doing wrong? Thank you!

Boyan

-

May 3, 2024 at 13:39 #253109

Boyan Todorov

ParticipantHey Nikos,

I just replied with 4 screenshots, but the reply does not appear again. Is there another way to contact you where I can also send the screenshots? Thanks.

Boyan

-

May 3, 2024 at 13:54 #253113

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

I was able to see 2 of the screenshots which makes me understand what you are talking about and I can assist you.

Before going to it though, for the risk calculator, you need to see the settings from the robot.

So, about the myfxbook, have the EAs made any trades in the account yet?

Kind Regards,

Nikos

-

-

May 3, 2024 at 14:05 #253114

Boyan Todorov

ParticipantHey Nikos,

the Portfolios had many trades since the 23rd of april. I assume you saw the two screenshots of the myfxbook and of the Petkos’s video. I don’t see the 4 screenshot regarding the migic numbers though, I have no I idea why a reply with screenshots does not appear. The posting with the two screenshot was made last night and it took hours to appear. I don’t know what to do. Do you have an email?

regards

Boyan

-

May 3, 2024 at 14:26 #253106

Boyan Todorov

ParticipantHey Nikos,

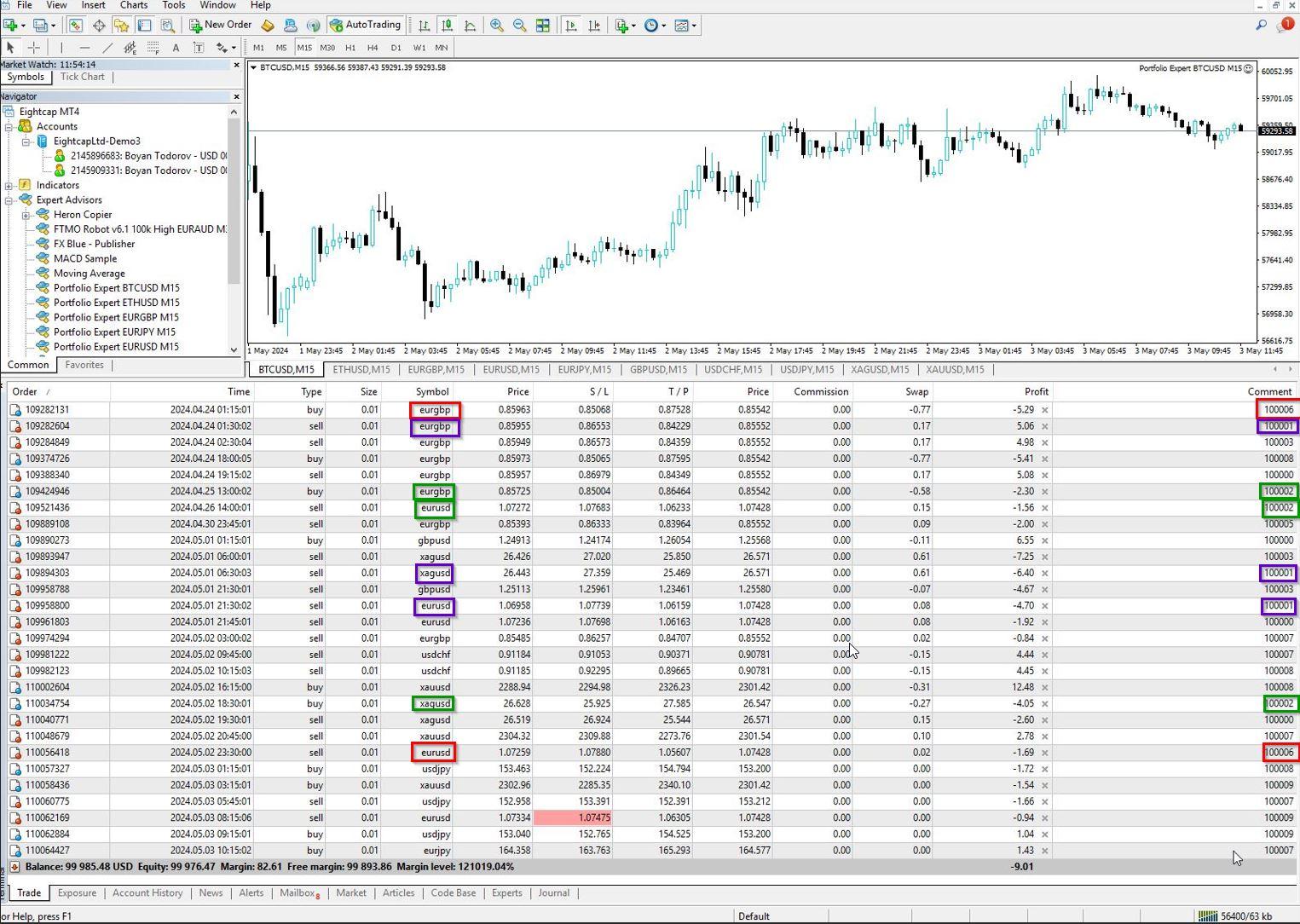

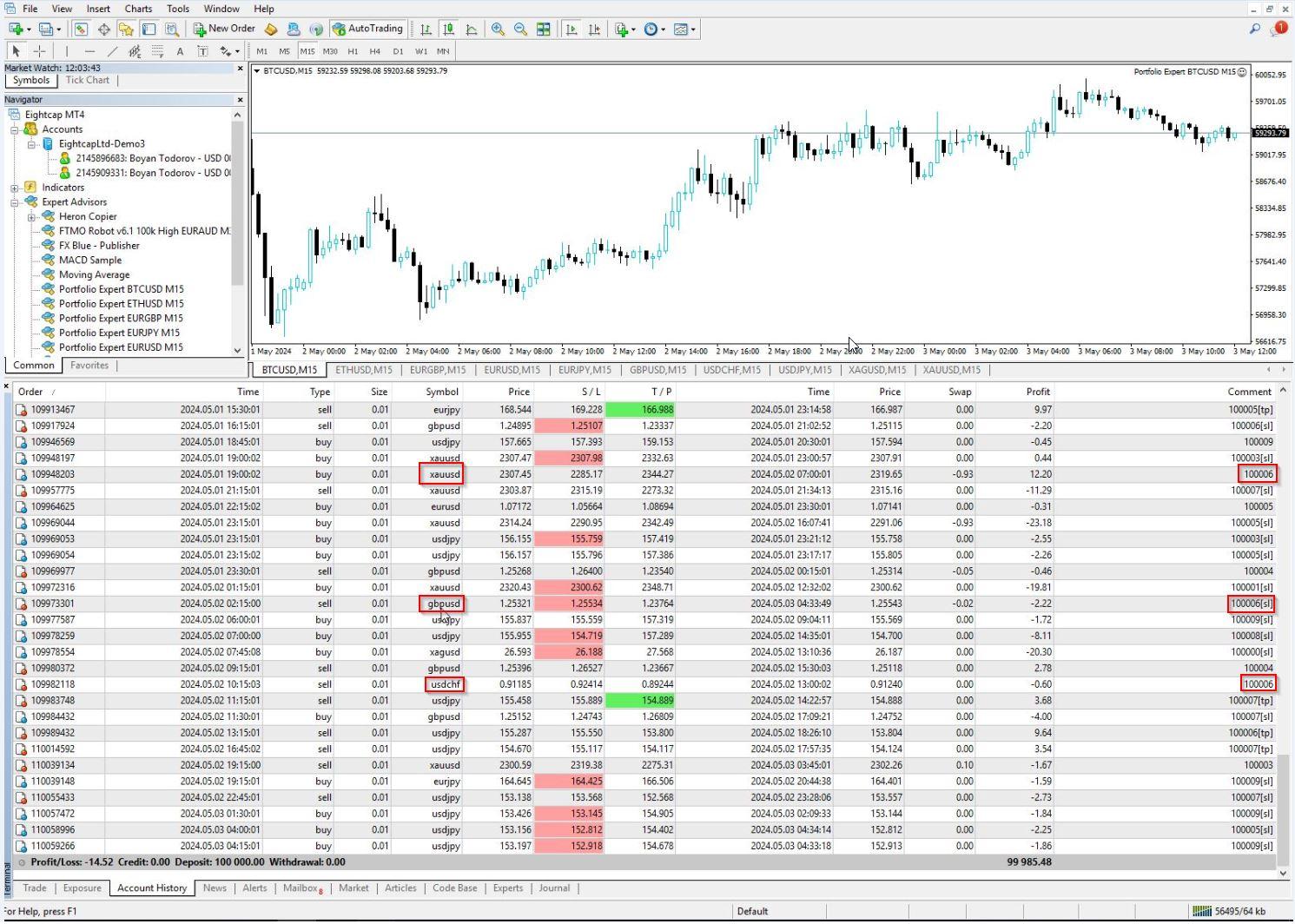

I see now that the screenshots from myfxbook showed up, so naow you can see what I mean – where do I have to go to see the lines of the single portfolios?

As tot he magic numbers – here I send you the screenshots, I hope they show up. The first one is from FX Blue, where I sorted in the strategies tab the EAs and marked the 3 ones on the top, that I want to trade – 100001, 100002 and 100006. I also send screenshots from mt4 from my demo account where I attached all the 10 Portfolios with 10 EAs each. As you can see there are trades with these magic numbers 100001, 100002 and 100006 and there are different symbols with the same number. So how do I find the 3 most profitable EAs from the FX Blue stats to put them on the challenge? I started trading the 10 portfolios on the 23rd of April. Unfortunately I downloaded only the portfolios and not the single EAs. The magic numbers in the App(see screenshot) have totaly different pattern than 100001, 100002 and so on. I hope there is a way to identify the EAs. Please take a look and give me a feedback, since I have a deadline to start trading the cahllenge which is soon. Thanks a lot!

Boyan

Boyan

-

May 3, 2024 at 14:42 #253121

Boyan Todorov

ParticipantHey Nikos,

I saw the posting with the screenshots went now through, please give me a feedback, thanks!

regards

Boyan

-

May 3, 2024 at 16:57 #253134

Boyan Todorov

ParticipantApparently Nikos is not here, can someone from the other mods please help me out? Thanks!

Boyan

-

May 3, 2024 at 18:52 #253153

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

I am so sorry for the late reply.

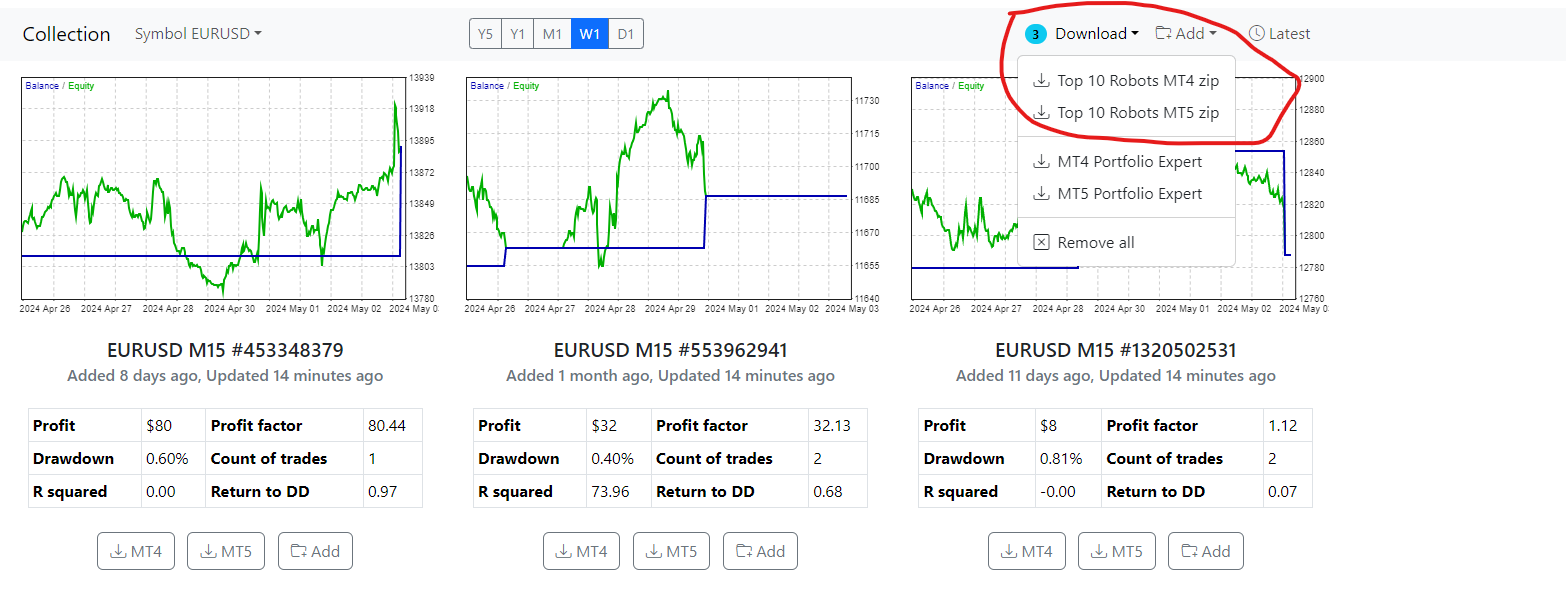

So, in order to find out what strategies are being traded, the only way to do it basically is before you download the portfolio robot, you need to also choose the top 10, top 5 or top 3 whatever you want to trade in the app from where it says add and see what robots will be inside of the portfolio before you download it.

That is the solution I have for that. Another way is to check the strategies via the code but you still cannot see the magic number, so it’s not possible to see the individual EA magic number and identify which one is it.

Hope this helps.

If you have any more questions, let me know!

Kind Regards,

Nikos

-

-

May 3, 2024 at 19:08 #253154

Boyan Todorov

ParticipantHello Nikos,

thanks for the reply, sorry for being impatient, I just want to get this clear before the weekend so I can run the EAs right on Monday, so I would appreciate if we can get done today with the issue.

So for the future I will adopt the workflow you suggest – at the point of downloading the portfolio EA I will also download the seperate EAs. However there will be 10 EAs in each portfolio. The Portfolios have magic numbers like 10000… something, and the single EAs have totally different ones. So still remains the question how to identify the top 3 strategies?

At the current point I have to start trading and I will do it like in the Complete Guide from Petko – I will open the code and leave only the profitable strategies active. What is still confusing me is that for example with the same Portfolio magic number I have trades with different symbols. And the Portfolio normally trades 10 different strategies but the same symbol – so how is this possible? You see the results in the stats from FX Blue – I really need a step by step guide how to identify the Top 3?

Hope you can help with this, thanks!

best regards

Boyan

-

May 3, 2024 at 19:28 #253157

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

No need to be sorry, I completely understand!

So, if you choose for example Top 3 from the add button in the app, it will have 3 strategies inside the portfolio robot. You can also check from the code after you download it.

And with that, you can click on the add as mentioned and also download the robots individually and you will see what magic numbers will be inside the portfolio robot.

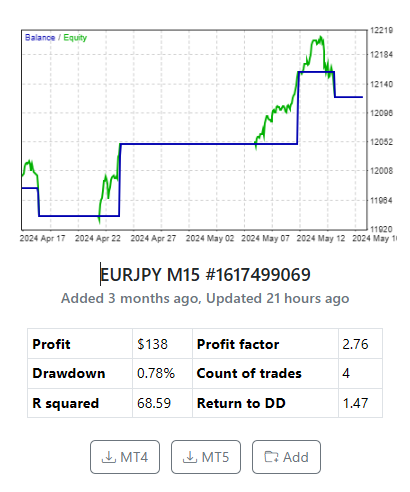

You can see more in the screenshot below:

What I did here for example is that I chose the Top 3 strategies of EURUSD pair and they are ready to download either as a portfolio or individually.Here you can also see that if you click one of the buttons in the circle, you can download them individually:

You probably can see it says Top 10 but if you download them, you can see that there are 3 robots if you have chosen Top 3.So, if you also download the portfolio, you will know that inside of it, there will be the strategies that you see in the individual robots.

You can identify the Top 3 as we mentioned by the magic number which you will see in the individual robots you will download.

That is the way it’s possible to be done!

Hope this helps!

If you have any other questions, let me know!

Kind Regards,

Nikos

-

-

May 3, 2024 at 19:44 #253165

Boyan Todorov

ParticipantThanks Nikos, this was the part that I understand. Lets stay with the Top 3 exapmle(I assume if I download all 10 of them it is the same). When I open the portfolio EA in the meta editor the strategies are numbered like 10001, 100002, 100003 and so on. And when I download the individual robots they have random numbers. How do I know which robot corresponds to what number in the meta editor?

Secondly, the other very important thing that bothers me now is the issue with same number different symbol. Like you can see in my screenshot, the best performing strategy is 100001. One can assume it is the first one from the portfolio with magic number 100. However it trades different pairs – EURGBP, XAGUSD, EURUSD – so this is confusing me. It is alywas one symbol per portfolio isn’t it? So what is going on here?

Thanks a lot!

Boyan

-

May 3, 2024 at 20:27 #253172

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

So, I understand what you are talking about. A way for this is to either compare the robots by placing the individual ones in a demo account and the portfolio ones in another demo account and compare the trades of each robot by seeing what time they were opened for example.

Another way is by seeing the code which might be a little bit more complicated but you can see what are the properties of each individual robot and also see what are the properties of the strategies in the portfolio robot.

About the issue with the different symbol, I saw that on the screenshots you sent and I am not sure what the issue is on that. I would suggest here to try and download a new portfolio robot and see if that happens again.

Hope this helps!

If there is anything else I can assist you with, let me know!

Kind Regards,

Nikos -

May 3, 2024 at 20:50 #253174

Boyan Todorov

ParticipantHi Nikos,

not really what I wanted to hear.

As to the first issue – trading parallel the individual EAs is not an option, because if I start doing this why do I need the portfolio at all? My goal is not to have to put 100 EAs on 100 charts. So I will try to look at the code, but since I am not a developer I am not sure what to look at, can you hive me a hint?

About the second issue – of course I can start over, but I have a challenge that I have not started yet and that expires on the 10th of May next Friday if it stays inactive. I am trading the 10 portfolios since the 23rd of April and I wanted to start using the Top 3 performers on the challenge now. So what would do if you put yourself in my shoes? Is there a chance to get in contact with the developer who developed the app, maybe he can tell us something more about this issue?

Thanks!

Boyan

-

May 6, 2024 at 13:25 #253531

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

About the code, just leave this part as there is a lot to look into.

Regarding the the second issue, the only solution I can provide is to compare from your portfolio EA and another platform of metatrader with the individual EAs in it, compare which are the EAs by the trade time and find the magic number that way so that you can also identify the strategy.

Hope this helps!

Kind Regards,

Nikos

-

-

May 3, 2024 at 20:52 #253175

Boyan Todorov

ParticipantAnd one more thing Nikos about myfxbook – you saw the two screenshots. Why does my chart look differently from the chart in Petkos video – I see the account growth, but not the lines of the portfilios – anything about this?

Thanks!

Boyan

-

May 6, 2024 at 13:21 #253530

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

About the MyFxBook, you can just click on Custom Analysis and then find the magic number tab so that you can check the boxes of which magic numbers you want to be shown.

Hope this helps!

Kind Regards,

Nikos

-

-

May 6, 2024 at 16:45 #253572

Boyan Todorov

ParticipantHi Nikos,

like I said, the edge of trading Portfolio EA is, that it saves time letting you put only 10 EAs in the charts and not 100. At the point, where you have to trade simultaneously the individual EAs on a seperate account and have to compare trades and time stamps to figure out which one is which, or to figure out why the same Portfolio EA magic number trades different symbols, the usage of the Portfolio EA becomes pointless, which is very disappointing. So all the testing of the 10 portfolio EAs that I have been doing since the 23rd of April was for the birds, because I cannot really evaluate the results. Yesterday I did the hard work and put the Top 5 on the yearly from all symbols as individual EAs on single charts – 48 piece total(because BTC had only 3). It is the most safe way to keep a track, but really time consuming, especially if I have to do it on a weekly basis. Is there a chance to optimize this process? Maybe run a script on the mt4 or something?

Another thing – I followed a thread in the formu called ‘Prop Firm Robots: Errors and Solutions’ where I read, that the Prop firm robot is not taking new trades 15 min. before the market closes and 15 min. after ist starts again to avoid huge spreads. When is this time window exactly – is it only during weekends or are the markets closing also during business days? Is there such a setting also in the Top 10 EAs?

Thanks!

best regards

Boyan

-

May 7, 2024 at 14:41 #253740

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

I understand your point and I do not have any other solution unfortunately.

About optimizing the process, I do not think it is possible.

Also, about the Prop Firm Robots not taking trades in the mentioned times, it depends on the daily time reset that you have set in the robot settings. And markets do close on weekends so the robots do not trade on the weekends except bitcoin or crypto in general.

Hope this helps!

Kind Regards,

Nikos

-

-

May 8, 2024 at 0:01 #253856

Boyan Todorov

ParticipantHey Nikos,

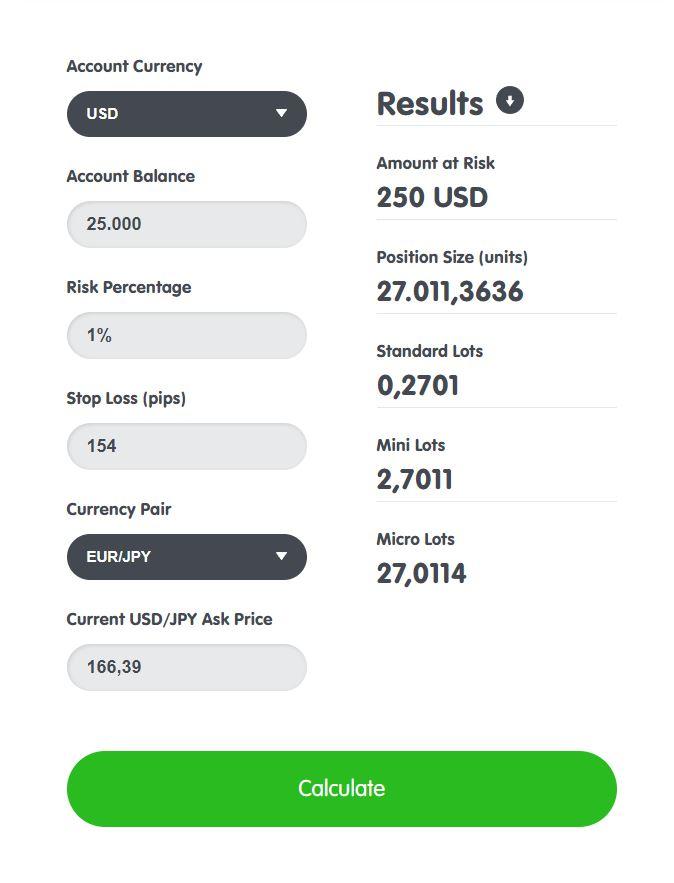

I checked the risk calculator, that you sent me. I put in the parameters of the exapmle EUR/JPY(see screenshot). Do you know why, although I selected EUR/JPY as a currency pair, at the bottom it says ‘Current USD/JPY Ask Price’? And also this calculator is missing the commodities like XAUUSD, can I load them somewhere? In the setting ‘Entry lots’ I assume is meant standard lots, so according to the calculator everything smaller or equal 0,2701 puts 1% or less of the account per trade at risk, is that correct?

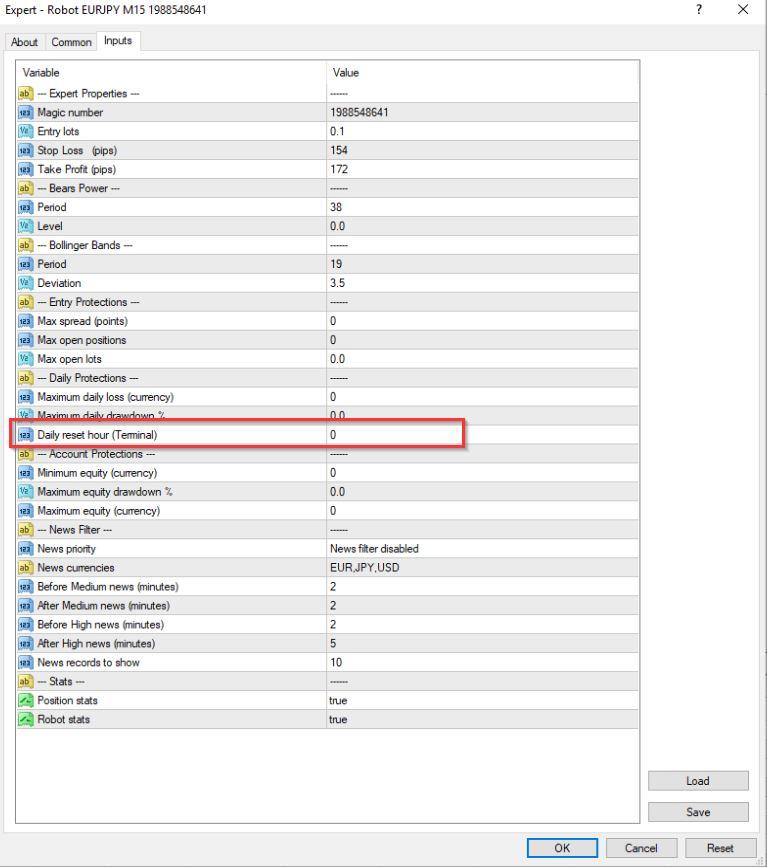

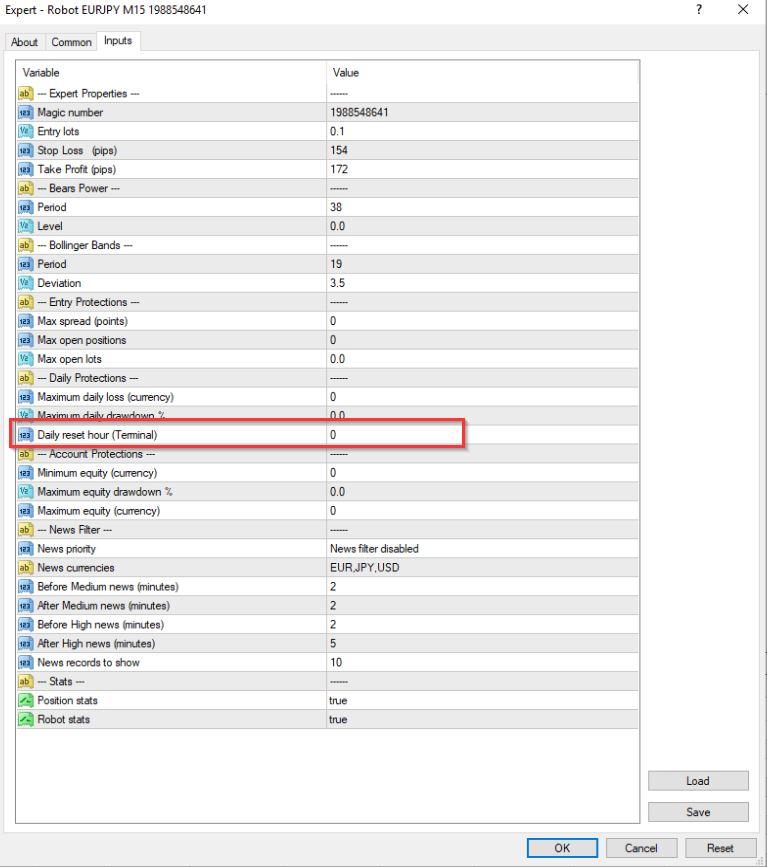

As to the daily time reset, I guess you mean the setting ‘Daily reset hour(Terminal)’ – see screenshot. What hour should I put there?

Thanks!

best regards

Boyan

-

May 8, 2024 at 0:13 #253862

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

So, this risk calculator is mostly for forex pairs not commodities. Also the reason probably it says Current USD/JPY Ask price instead of EUR/JPY is that it just needs the page to be refreshed.

Also about the risk that you mentioned, yes it is correct that it will be 1% risk.

About the daily reset hour which is indeed what I meant, you just need to check with the broker or prop firm that you are using in what time zone the platform operates on and you need to set it at 00:00 at that time zone.

Hope this helps!

Kind Regards,

Nikos

-

-

May 8, 2024 at 1:05 #253871

Boyan Todorov

ParticipantHey Nikos,

do you see my screenshots at all? Because I don’t. I tried several times to load them, it simply does not work. Anyway, refreshing the page did not do it, it starts from scratch afterwards. And since I am trading EURJPY I am not sure if I get the right risk calculation putting in the ask price for USDJPY ? Is there maybe another online calculator with more options that also covers the commodities?

Here is my risk calculation:

Inputs:

Account Balance 25.000 USD

Risk Percentage 1%

Stop Loss(pips) 154

Currency Pair EUR/JPY

Current USD/JPY Ask Price 166,319

Oitputs:

Amonut at risk 250 USD

Position Size(units) 26.999,8377

Standard Lots 0,37

Mini Lozs 2,7

Micro Lots 26,9998

Does this look plausible to you? I also noticed, that when I calculate the risk for the currency pair EUR/USD, which is the default setting when you open the calculator, it calculates the risk without asking for the Current Ask Price – what is your comment on this?

How is the daily reset hour setting working after all? What happens when I put a time there?

Thanks!

Boyan

-

May 8, 2024 at 12:38 #253965

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

Actually, you are right, by refreshing the page, it indeed does not work so I am sorry for that.

A solution to that is to change the currency from USD to EUR and try again.

Also, I cannot see the screenshots but if the issue was that, you probably can solve it by just converting the currency.

About another position calculator, you can also use MyFxBook calculator here: https://www.myfxbook.com/forex-calculators/position-size/XAUUSD

That one covers commodities too.

Regarding the settings which you do not get the current ask price it’s because you need to convert the currency to EUR.

The daily reset hour setting is for example on the prop firms, when you have a loss during the day, you know that if make a 5% loss, you lose the account but the total loss of the account can be about 10% or 6% or depending on the prop firm. So, this setting allows to reset the daily loss. It means that when this hour that you have set passes, it will not be for example a 2% loss, it will be at 0%. And for the robot, it also resets it so it is to protect the account from being breached.

Hope this helps!

If you have any other questions, let me know!

Kind Regards,

Nikos -

May 8, 2024 at 12:45 #253857

Boyan Todorov

Participant -

May 8, 2024 at 12:45 #253858

Boyan Todorov

Participant -

May 8, 2024 at 12:53 #253855

Boyan Todorov

ParticipantHey Nikos,

I checked the risk calculator, that you sent me. I put in the parameters of the exapmle EUR/JPY(see screenshot). Do you know why, although I selected EUR/JPY as a currency pair, at the bottom it says ‘Current USD/JPY Ask Price’? And also this calculator is missing the commodities like XAUUSD, can I load them somewhere? In the setting ‘Entry lots’ I assume is meant standard lots, so according to the calculator everything smaller or equal 0,2701 puts 1% or less of the account per trade at risk, is that correct?

As to the daily time reset, I guess you mean the setting ‘Daily reset hour(Terminal)’ – see screenshot. What hour should I put there?

Thanks!

best regards

Boyan

-

May 8, 2024 at 13:07 #253981

Boyan Todorov

ParticipantHey Nikos,

in the meanwhile the screenshots are visible – why does it take that long for them to show up?

I’ve just checked the myfxbook Position Size Calculator. Apparently there is a difference between the Position size and the Trade Size. What I need to know is what to put in the Entry lots field of the EA, so as not to risk more than 1% of the accoint per trade. The myfxbook calculator has a prompt saying Trading Size(Lots) – what do I have to put here? This is actually what I need to know? And when I change the account currency from USD to EUR in the babypips calculator I do get the prompt Current EUR/JPY Ask Price but how does this affect the calculation, because when I do this I am risking 250 Euro which is more than 250 USD hence more than 1% of the account? I am getting confused, how to do it right.

As to the daily reset hour – lets say I have set max. 3% daily loss and the day closes with 2% daily loss and open trades. After the daily loss gets reset it means that I am allowed to have another 3% daily loss for the next day on the rest of the equity, is that correct?

Thank you!

Kind regards

Boyan

-

May 9, 2024 at 10:33 #254133

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

I am not too sure of what happened with the screenshots.

About the Trading Size (Lots) in myfxbook position size calculator, you can just leave it to 1 lot.

Regarding babypips, you just need to calculate the difference. You can do so by seeing how much is 250$ in Euros and just insert that Euro amount instead. For example, I see after doing the conversion today from USD to Euro, the price is 232 Euros. So, instead of 250 Euros, you insert 232 and calculate it that way.

About the daily reset hour, it’s actually like that!

Hope this helps!

Kind Regards,

Nikos -

May 9, 2024 at 12:39 #254152

Boyan Todorov

ParticipantHey Nikos,

as to the screemshots, these got posted several times, because I tried to load them several times. It is not the first time I have this issue. It looks likes to me that I cannot load screenshots instantly, but they have to be approved first by someone from the TA, could that be the case?

As to the risk calculation – I am not sure if I got you right – where do I put the 232 Euros?

Anyway I did the calculation one more time with both calculators with the following inputs: Currency Pair EURJPY, Account Currency USD, Account Size 25.000, Risk Ratio 1%, Stop-Loss(Pips) 154 -according to the EA I am going to use and I put 1 in the ‘Trade Size(Lots)’ field in myfxbook calculator. It shows automatically USDJPY 155,81100 there. This value I put in the field Current USDJPY Ask Price in the babypips calculator. I get pretty much the same results from both calculators – Sizing according myfxbook is 0,25 lots and Standard Lots according to babypips is 0,2529. So that means, that when I put 0,25 in the field Entry lots of the EA I will be risking 1% from the 25k account per trade, correct? In the Complete Guide video Petko used 0,1 but this is myabe because he was trading 10K account right? So this would be risk medium according to the Prop Firm Robots App, and if i want to trade low risk I should put 0,125 in my case right?

Could you please explain what the correlation between the entry lots and the SL exactly is?

Thnaks!

kind regards

Boyan

-

May 10, 2024 at 12:52 #254338

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

Actually this is the case about the screenshots!

Regarding the risk calculation, I was just referring to the part you said that you are risking $250 but in myfxbook position size calculator where it says Risk Ratio, there is a button which says swap with money. With that instead of just writing the percentage you want to risk, you write the amount of money you want to risk per trade.

So, to get the correct calculations, you need to import in the Account Currency EUR instead of USD as you want to trade EURJPY.

What do you mean about the correlation between the entry lots and the SL?

Thank you!

Kind Regards,

Nikos

-

-

May 9, 2024 at 12:42 #254154

Boyan Todorov

ParticipantPS: And one more thing I forgot – in the Top 10 EAs there is also crypto BTC and ETH, but I do not find them in myfxbook calculator, how can I calculate the risk there? Just to my understanding – I will not be trading the coins directly but some other instrument like inex or contract or something right?

Thanks!

-

May 10, 2024 at 12:53 #254339

Marin StoyanovKeymaster

Marin StoyanovKeymasterThere are no crypto pairs in these calculators.

-

-

May 9, 2024 at 22:33 #254233

Boyan Todorov

ParticipantHey Nikos,

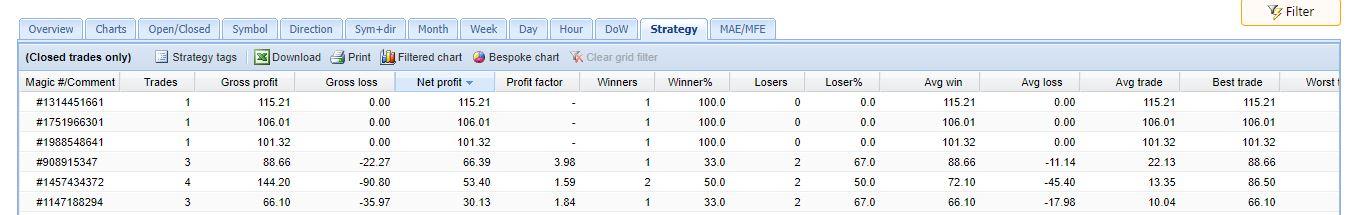

I just chekced the results of the Top 5 EAs, that I put as individual EAs in the charts on Sunday. As of today I have hard times picking 3 of them to trade on a challenge next week. The top 3 performers took only one trade and therefore no profit factor and 100% winners. The fourth one has a profit factor of 3,98, it took 3 trades and has 1 winner and 2 losers – how does the profit factor get calculated? The fifth one took 4 trades so far and has a profit factor of 1,59 – 2 winners and 2 losers. And sixth one took 3 trades and has a profit factor of 1,84 – again 1 winner and 2 losers. All the rest were not profitable at all. So considering these results which 2 or 3 out of these 6 would you pick out for the live trading? I’m sending a screenshot for known reasons in a seperate posting following. Thank you!

kind regards

Boyan

-

May 10, 2024 at 13:01 #254340

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

So the trading factor is calculated based on winning and lost trades. So, in your case where you see no profit factor as shown in the screenshot it is because there are no losses which is of course good!

Regarding the results, please know that every strategy has a losing period as well as winning period. Which means that not every strategy can be profitable even it is the best one. Definitely results cannot be guaranteed but by testing the best strategies first before setting them in a real account or challenge, it’s always the best practice to see at least the direction it can go.

Hope this helps!

Kind Regards,

Nikos

-

-

May 9, 2024 at 22:34 #254234

Boyan Todorov

Participant -

May 10, 2024 at 14:31 #254351

Boyan Todorov

ParticipantHey Nikos,

the more I ask question the more confused I get.

As to the risk calculation – you say when I trade the pair EURJPY I have to put EUR in the field Account Currency. But my account is in USD, what if I trade something else? Do I have to do it every time like this – convert the account balance from USD to the first currency of the trading pair? That would be very disrupting.

About the correlation entry lots – SL – why does the calculator needs the SL in pips to calculate the entry lots?

About the crypto pairs – which calculator do I use for those? And you did not tell me – when I trade this crypto pairs – I am not trading the coins, since I am not trading on a crypto exchange, what instrument am I trading CFD?

About the results in FX Blue – thank you fort he info, this is also what I am aware of. You still did not tell me which 2 or 3 out of these on the screenshot would you chosse if you were me?

I would appreciate if you answer today, because I want to put the strategies to trade on the weekend. Thank you!

Kind regards

Boyan

-

May 10, 2024 at 14:55 #254357

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

I am sorry if I am confusing you, I am trying my best to explain everything!

Regarding the risk calculation, I just mentioned changing the currency as you was getting the USD/JPY asking price. You can keep it in USD if this is your account currency.

About the SL, it is needed in pips as this is the way the SL can be better calculated. Also, it is needed as this is how the risk is calculated in case the trade goes in the opposite direction.

I am not really aware of risk calculators for crypto.

I am sorry I think I must have missed the questions of choosing from the screenshot. I would pick the one with profit factor 1.84 and 3.98 and the reason is because they seem to have a good potential since the losses that really big. I would avoid the ones without profit factor as with just 1 trade, you cannot really tell if it is going to be profitable in the end.

Hope this helps!

If you have any more questions, let me know!

Kind Regards,

Nikos

-

-

May 10, 2024 at 15:19 #254361

Boyan Todorov

ParticipantHey Nikos,

thanks for the quick responce.

So to sum up and finalize the topic risk caluclation – I would keep the account in USD. This is what I posted yesterday maybe you missed it:

‘Anyway I did the calculation one more time with both calculators with the following inputs: Currency Pair EURJPY, Account Currency USD, Account Size 25.000, Risk Ratio 1%, Stop-Loss(Pips) 154 (according to the EA I am going to use) and I put 1 in the ‘Trade Size(Lots)’ field in myfxbook calculator. It shows automatically USDJPY 155,81100 there. This value I put in the field Current USDJPY Ask Price in the babypips calculator. I get pretty much the same results from both calculators – Sizing according myfxbook is 0,25 lots and Standard Lots according to babypips is 0,2529. So that means, that when I put 0,25 in the field Entry lots of the EA I will be risking 1% from the 25k account per trade, correct? In the Complete Guide video Petko used 0,1 but this is myabe because he was trading 10K account right? So this would be risk medium according to the Prop Firm Robots App, and if i want to trade low risk I should put 0,125 in my case right?

Just tell me if I got everything right, tnanks!

As to the cryptos – if you tell me what instrument is being traded I will do my own research on the calculator.

Thanks for your opinion on the choice of the EAs, what do you mean by this – ‘they seem to have a good potential since the losses that really big’ ?

Thanks

Kind regards

Boyan

-

May 10, 2024 at 17:01 #254385

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

Yes, I read it but I might still missed something. Anyways, you got it correct!

So, about crypto, since it is in a broker and not a crypto exchange, it is a CFD asset as mostly brokers offer CFD assets to trade.

I meant to say they seem to have a good potential since the losses are not that really big which makes it a good robot to trade with.

Hope this helps!

If you have any more questions, let me know!

Kind Regards,

Nikos -

May 10, 2024 at 17:14 #254387

Boyan Todorov

ParticipantHey Nikos,

this is what I also thought, just wanted to make sure I got everything straight. Thank you and have a great weekend!

kind regards

Boyan

-

May 10, 2024 at 20:49 #254424

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

Sure. If at any time you have any other questions, let me know!

Thank you and you have a great weekend too!

Kind Regards,

Nikos -

May 13, 2024 at 11:51 #254771

Boyan Todorov

ParticipantHey Nikos,

I need you support again please. I put yesterday 4 EAs to trade on a 25k demo account to test the account protection settings. I tried to fill the Daily rest hour(terminal) in the settings, but I dont know how exactly to put it. I need to put 17:00 EST there? Another thing is the news filter – what is the difference between Medium and High news filter? I have both set now. What are the recommended before and after settings in minutes? I have now for both Medium and High news 60 minutes for before and after.

Another thing is the risk calculation again. I am trading the following EAs with the following Stop Losses and calculated Entry lots for 1% risk on the account:

XAUUSD – SL 3306 pips, Entry lots 0 according to myfxbook

XAUUSD – SL 3246 pips, Entry lots 0 according to myfxbook

USDJPY – SL 29 pips, Entry lots 1,34 according to myfxbook

USDJPY – SL 16 pips, Entry lots 2,43 according to myfxbook

I find these results unusual. When I calculated the pair EURJPY with 154 pips SL for the same conditions I got as a result for the Entry lots 0,25 lots. Why do I get a 0 for the Entry lots on the XAUUSD? Also when I calculate the XAUUSD in myfxbook I don’t have the XAUUSD Ask price displaed like in the pair USDJPY – why? Is there something I am missing?

And finally I downloaded yesterday the current 100 robots from the app and put them individually on a demo account. However I was able to put only 99 EAs on the same account in mt4. Is there a limitation ad if so, how can I solve this?

Thanks!

kind regards

Boyan

-

May 13, 2024 at 12:47 #254779

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

So, about the daily reset hour, you need to ask your broker or prop firm whatever you are using, what timezone their platform is based on and just set it to be at the end of the day of that timezone.

About medium and high impact news, the difference is that medium is less volatile and high impact news are very volatile which means that the price moves extremely fast and it can be dangerous to trade at that time.

Regarding the minutes, we have it at about 2-3 minutes before but you can set it at even 5-10 minutes before. Though, 60 minutes is also really good as you are way more safe!

So, USDJPY and EURJPY, are different pairs which means the prices are also different and that is why you do not see the same lot size.

The reason you see 0 entry lots on XAUUSD is because the risk is very low. You will need to set it 50 pips or less to see what lot size you need to use. Also, about the ask price, I am not too sure about that, I would say it is because it is commodity but yea, I am not too sure.

Did you receive any error while trying importing them?

Thank you!

Kind Regards,

Nikos

-

-

May 13, 2024 at 13:03 #254782

Boyan Todorov

ParticipantHey Nikos,

I already asked the prop firm, it is like I said 17:00 EST, my question was regarding the time format I have to use, can I put it in exactly like this?

About the news – I guess the EA is obtaining information about news events online, ist hat right? And how does it behave when I have set times for before and after – it does not open trades in this time, or it also enforces to close open trades before the event?

About the risk on the XAUUSD – I thought the greater the pips set in the SL oft he EA, the bigger the risk? Or maybe I misunderstood something? So the SL is set in the EA to more than 3000 pips and if I change it to 50 won’t it affect the results oft he EA?

About the charts in mt4 – I did not get any error, I was just not able to creat a new chart after the number reached 99, no error, just nothing happens.

Thank you!

Kind regards

Boyan

-

May 13, 2024 at 14:00 #254788

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

So, regarding the format, yes, it has to be exactly like that, without the EST just the numbers.

About the news, indeed the EA gets information online for the news. The way it behaves it is exactly as you said, it will not open trades during these times and also it will close trades if there are any open before the news.

Regarding the risk for XAUUSD, yes that is exactly as you said but since it is only 1% risk, you can place a bigger SL than 50 pips because the risk is low and because XAUUSD price is a lot different than forex pairs. If you set the risk higher, you can also set the pips higher or if you have a account with a bigger amount, I guess you can do 1% risk and have also greater pips in SL.

I see, probably there is a limitations.

Hope this helps!

If you have any more questions, let me know!

Kind Regards,

Nikos -

May 13, 2024 at 14:25 #254793

Boyan Todorov

ParticipantHey Nikos,

about the rest hour – if I put in only 17:00 how does the EA know which time zone?

Reagrding XAUUSD – I thought the pips are predetermined in the EA and if I have a profitable strategy with 3306 pips of SL and I want to keep it profitable I am not allowed to change the SL? What would you do in this specific case when I have once XAUUSD with 3306 pips SL and once XAUUSD with 3246 pips SL? We are talking all the time about the same account – 25k and may risk tolerance is 1%.

About mt4 – seems like you also weren’t aware oft this limitation.

Thanks!

Kind regards

Boyan

-

May 13, 2024 at 14:40 #254797

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

So, the EA is actually taking the date from the platform so this is how it knows the time zone.

You can of course change the SL but it will be greater than 1% risk. In this case, I would increase the risk a little to get the SL in the point I want or I would just keep the risk the same for example in your case 1% and just set the pips to whatever is required for the trade to be executed correctly.

About the limitation, of course I was aware and something I forgot to mention is that there is a 99 chart limitation. A solution to this would be to set the robots in a portfolio.

Hope this helps!

Kind Regards,

Nikos -

May 13, 2024 at 14:44 #254798

Boyan Todorov

ParticipantHey Nikos,

so if I keep the risk at 1%, your suggestion would be to chnage the pips so far, that I get an Entry lots value different than 0, is that what you mean?

Thanks!

kind regards

Boyan

-

May 13, 2024 at 14:47 #254799

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

Yes, this what I meant!

Kind Regards,

Nikos -

May 13, 2024 at 14:58 #254801

Boyan Todorov

ParticipantOk, I will have to cjeck on this, right now I have these XAUUSD EAs running with 3306 and 3246 pips and Entry lots 0,01, which would mean I have higher risk than 1%, right?

Thnaks Nikos!

kind regards

Boyan

-

May 14, 2024 at 10:58 #254931

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Boyan,

Sorry for the late reply.

Actually yea, the risk is now higher than 1%.

Kind Regards,

Nikos -

May 17, 2024 at 12:56 #255476

Markus Broschwitz

ParticipantHi

My question is, for which broker are the both (Prop Firm and TOP10 EA Forex) EAs created and supposed to use?

Also, I am wondering, why the Sets for the EURJPY pair from the TOP 10 ROBOT APP

are not the same (by magic no.) like in the last video shown with live results:

best wishes

Markus

-

May 17, 2024 at 13:27 #255486

Alan Northam

ParticipantHi Markus,

The robots are created using blackbull historical data. However, you don’t need to just use the blackbull broker as you can also use other brokers / prop firms. Recently one of our traders picked the top 5 robots, placed them on an Infinity Forex Fund challenge, and got funded within a few months.

I, on the other hand, use a different approach. When I use robots with a different broker / prop firm I forward test them with a small lot size like 0.01 for a week or two. I then select the best performing robot to trade with a normal lot size.

As to the magic numbers not being the same. When the robots are updated with EA Studio they will automatically be given a new magic number.

Alan,

-

-

May 19, 2024 at 11:22 #255729

Markus Broschwitz

ParticipantI understand now, why the sets disappear from the App list whit time.

Now, I check the list on fxblue (closed trades) with them in the App. And they don’t fit. Do you understand, why it´s so?

https://www.fxblue.com/users/top3eurjpy200livefor example:

buy trade on 14th May was a WIN in FXBlue

Magic No.:1617499069and there was no Win trade in the App on 14th May

next on:Buy, 16th May with Magic No 750594215

on the App, there was no win trade

Thank you in advance for your answer, it`s very appreaciated.Best wishes

Markus-

May 19, 2024 at 11:23 #255741

Alan Northam

ParticipantHi Markus,

Different broker, different results!

Alan,

-

-

May 22, 2024 at 1:30 #256317

paul4x

Participantcam i ask why as a paid member for the prop firm robots that we are not given the same service as the top 10 robots app subscribers are given? on the top 10 they have a winners section and a latest trade section, wheras prop firm robots have neither of these extra options.

Why is that?

-

May 22, 2024 at 10:01 #256368

Marin StoyanovKeymaster

Marin StoyanovKeymasterHello Paul4x, let me explain this.

Although they look similar, these are 2 different webapps that suite different needs.

The robots in the Prop Firm Robots App are fewer compared to the prop firm robots app and currently there is no point to have the Winners and Latest sections in this app. If there is a new strategy added it will replace one of the existing worst performing strategies. The number of strategies is much smaller and it’s easier to see when the strategy was added and updated in a single screen. On the other hand, this app has build-in settings for challenge targets, protections and etc. which are not present in the other app.

The Top 10 Robots App works differently. Currently there are 100 strategies in total in the app. New strategies are being added every weekend and some of the existing once which are not perfuming well are being dropped. This makes it very difficult to see when a new strategy is added and also to arrange the strategies by different criteria, as in the app each pair has it’s own view.

We’re working on exciting updates in the Prop Firm Robots app that will be released in the next 1-2 weeks. We will post an update in the relevant forum and send emails to the users who have the app so you will receive a notification once this happens.

Regards,

Marin @ Customer Support

-

-

July 2, 2024 at 9:25 #266213

Marin StoyanovKeymaster

Marin StoyanovKeymasterhi Marin.

Is it ok to use Prop firm EAs on my 10K live account, if i cannot afford to get the top 10 app yet. This can get me going in the meantime.

If so, which settings would i have to adjust.

Regards,

Tsholo

-

July 2, 2024 at 11:46 #266424

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi Tsholo, practically you can, as long as you’re using the appropriate EAs for your account, but you might face several challenges with the live account.

First, if you plan to use the EAs from the Prop Firm Robots app on a live account, you need to download the EAs for the appropriate account size, e.g. if you’re planning to use them on a $10k live account, then you would need to download EAs for $10k challenge.

Another thing is that the EAs from the Prop Firm Robots app come with several protections that you preset prior to downloading the EAs. Those reflect most prop firm challenges requirements. You can modify them after downloading the EAs. Those are the Daily Protections and Account Protections. While these are good when participating in prop challenges, they might limit the trading in the live account. On the other hand, they can help to protect the account from huge losses in case market goes downside. So it’s a personal choice if you’re going to change them or not.

Another difference is that each individual EA in the Top 10 App by default is preset to 0.1 lots per trade. In the Prop Firm Robots app the each EA has its own individual lots, and the lot size differs from the risk settings – low (0.5% of the account per EA), medium (1% per trade per EA) or high (2% per trade per EA).

Always start with a demo account with the same size you plan to have on the live account and test different setups to see what works for you and if you’re satisfied.

-

-

July 2, 2024 at 13:08 #266468

Marin StoyanovKeymaster

Marin StoyanovKeymasterThank you Marin for a great response.

just as a follow up, if i trade a $10K account, with the applicable EAs from the prop firm app, on moderate risk, what would be the advisable settings for entry lots, maximum daily loss, maximum daily drawdown, minimum equity and maximum equity

Regards,

-

July 3, 2024 at 9:31 #267400

Marin StoyanovKeymaster

Marin StoyanovKeymasterIt’s a personal choice how much you will be risking. As I mentioned above, by default the EAs from the Prop Firm Robots app come with a pre-set lot based on the settings you choose. The lot is different for each pair and for each strategy. We don’t use the Prop Firm Robots on live accounts and we don’t have insights on this. On our live accounts we use EAs from the Top 10 Robots app.

-

-

July 3, 2024 at 10:06 #267428

Marin StoyanovKeymaster

Marin StoyanovKeymasterOk, thank you.

-

August 1, 2024 at 20:11 #273565

Marin StoyanovKeymaster

Marin StoyanovKeymasterThe top 10 Prop Firm EA have safety measures built in in hopes to prevent you from failing the challenges due to daily or total draw down? Do the top 10 EA’s have any safety measures built into them? If you are running the top three EA’s at once on the challenge, do you need to reduce the safety messures to a 3rd on each or do the EA’s somehow work together to see total drawdown between all three?

When it comes to all the Top 10 EA’s access do you have an annual subscription available? Id prefer to do an annual subscription rather than a lifetime.

Thank you,

-

-

August 26, 2024 at 15:30 #302741

[email protected]

ParticipantIf i get the course , i get also the EA related to the funded accounts and does these robots ensure passing the challenge?

-

-

AuthorPosts

- You must be logged in to reply to this topic.