FIFO trading is when you close positions in the same order in which they were originally opened. The FIFO rule is applicable on the US Forex trading market. It is so because the Forex FIFO rule is imposed to traders in US by the local brokers. This is requirement of the National Futures Association (NFA). In this article we will explain in detials what is FIFO rule in Forex, what are the FIFO requirements and how you can trade multiple strategies and multiple Expert Advisors in one account without breaking the first in first out rule.

Table Of Contents:

- What Is FIFO Rule In Forex Trading

- What Are the FIFO Requirements

- Is FIFO Rule Protecting Traders

- Does FIFO Apply to Open Trades of Different Sizes

- Which Brokers Apply FIFO Trading Rule

- How FIFO Trading Rules Affect Traders Who Use EAs

- FIFO Trading On MT5

- Check Your Broker’s Rules

- First In First Out SOLUTIONS For the US Traders

What Is FIFO Rule In Forex Trading?

The FIFO (First In, First Out) rule in forex trading refers to the practice of closing out open positions in the order they were originally opened. This means that when a trader has multiple positions in the same currency pair, the first position opened must be the first one to be closed.

The FIFO rule is enforced by some regulatory bodies, including the U.S. Commodity Futures Trading Commission (CFTC). The purpose of the FIFO rule is to prevent traders from engaging in certain types of hedging strategies. Traders should be aware of this rule and consider its implications when opening and managing multiple positions in their forex trading accounts.

Brokers apply this rule when you have several open positions on the same currency pair. The trades should also be the same size. So, the first trade that you entered must be the first one that you close.

So, suppose you open three different trades on three different days on the same currency pair and all of them are the same size. For example, you open trades on Euro/US dollar on Monday, Tuesday and Wednesday and all of them are the same size. You might decide that you want to close the one that you open on Tuesday. Your broker won’t allow you to do that because they have to follow the FIFO trading rules. You’ll have to close the trade that you opened on Monday first.

So what is FIFO rule in Forex ?

Very simply, this is when you are trading many strategies or you want to open multiple trades on one currency pair. You need to close the trade that you opened first. First in first out. The first trade you opened, you should close it first as well.

What Are the FIFO Requirements?

NFA Compliance Rule 2-43b is the rule that traders are speaking of whenever they refer to the Forex FIFO rule. It was implemented within the US Forex industry by the sector’s self-regulatory organization – the National Futures Association or NFA.

The main requirements of FIFO in forex trading include:

- Closing trades in the order they were opened: Traders must close their oldest open positions first when they have multiple trades in the same currency pair.

- Limited hedging strategies: The FIFO rule limits some hedging strategies as it requires closing out offsetting positions on a first-in, first-out basis.

- Compliance with regulations: Brokers and traders must comply with FIFO requirements set by regulatory authorities to avoid potential penalties or sanctions.

It’s important for forex traders to understand and comply with FIFO requirements to ensure they are operating within legal and regulatory guidelines while trading currencies.

FIFO trading rule doesn’t only apply to the Forex market. This rule is not specific to forex trading and applies to all types of trading, including stocks, commodities, and other financial instruments.

Is FIFO Rule Protecting Traders?

The FIFO rule also protects traders in another way. It blocks dealers from making price changes to orders. They can’t make price adjustments to an executed order. However, they can make an exception. In 2017, the NFA approved an amendment to Rule 2-43b. Dealers can change the price ONLY if that resolves a complaint in the client’s favor.

Traders can’t freely choose orders to close out. You can still place stop orders. Traders can also place limit orders. However, you can’t input those orders in the same way that you would prior to the change.

Dealers can change the price ONLY if that resolves a complaint in the client’s favor.

Does FIFO Apply to Open Trades of Different Sizes?

FIFO doesn’t technically apply with trades of different sizes. The open trades all have to be the same size. For example, all of your open trades will have to be 10,000 units for the FIFO rule to apply.

If you have three open trades and the first one is 10,000 units, the second one is 15,000 units and the third one is 10,000 units, you can’t close the third one before the first one. However, you could close the second one before the first manually. This would be so even if all three are for the same currency pair.

This is one way in which traders can work around the rule. For example they can make slight changes to the size of each trade that they have open. When they open positions with that in mind, they can manually close any one that they want to, without worrying about which one was opened first.

The work around only functions as you want it if you close the trades manually. If you set up Expert Advisors with MetaTrader, or you have a market order in place, the first position is always the oldest position. This will block you from closing some of your positions automatically, once you’re using a broker that uses FIFO trading rules.

Which Brokers Apply FIFO Trading Rule?

Rule 2-43b was implemented in 2009. Brokers that facilitate FIFO trading have matching features on their platforms. So, all platforms that existed before 2009 were adjusted so that they met the requirements of rule 2-43b. The top three brokers in the US follow the FIFO rule. Traders in the United States should also follow this rule. Traders who aren’t in the US don’t need to follow the rule. That’s because they’re outside the NFA’s jurisdiction.

The National Futures Association NFA requires all Forex brokers to follow this rule. If a broker doesn’t follow this rule, they could end up in problems with the NFA. US brokers don’t want that. They want to be in good standing, so they follow the rule.

The FIFO rule helps traders. It protects their capital. However, traders who like to hedge with opposing positions find it difficult to trade with this rule in place. Despite that, there are a few minor adjustments that you can make to stick to the rules and benefit from your strategy.

If your broker is in the United States, they probably use FIFO. The FIFO rule applies to all Forex brokers in the United States.

How FIFO Trading Rules Affect Traders Who Use EAs?

Many traders use Expert Advisors to save time. Some use more than one expert Advisor at a time. In fact, when they become comfortable with using them, they may use as many as 10 Expert Advisors simultaneously.

If you’re using Expert Advisors with MetaTrader, you should be careful about the lot size. If you have open trades with multiple Expert Advisors and they all have the same lot size, the rule will apply. That is, the first trade that you opened must be closed first. Traders can’t close any other positions first.

If you’ve gotten accustomed to trading with a particular lot size, it may be hard for you to change. For example, all of your trading strategies may work best with a particular lot size. In addition, some brokers don’t allow you to have nano lots.

Some traders are very particular about their Expert Advisors. It’s not simple to change the lot size on that type of strategy. In that case, you won’t want to make any changes to that. A size change could decrease your profits.

If you’re using Expert Advisors, you can trade different currency pairs so that you don’t break the FIFO rule. Trading different currency pairs helps you to meet the requirements of trading. It helps you to manage your risk.

Are you struggling with the FIFO rule in forex trading? Discover a seamless solution with the Top 10 Robots app! These Expert Advisors allow you to trade multiple currency pairs effortlessly, helping you comply with regulations while optimizing your trading strategy.

FIFO doesn’t stop you from benefiting by using portfolio trading. However, you should plan your portfolio of Expert Advisors carefully. Despite that, trading with a portfolio is harder than trading with a single Expert Advisor because of FIFO.

Traders should implement their strategies as safely they can. If you’re using a broker that only allows FIFO trading, and you want to use a portfolio of strategies, you may need to look at trading different currency pairs.

FIFO Trading On MT5

Several Forex brokers offer MT4 or MT5. Some of these brokers are based in the US, so they only allow FIFO trading. In that case, if you’re using the MT5 platform and you try to close another position before the first one, you will get an error message. This says that the FIFO rule prohibits the action you want to take. When you get that message, you need to sort your positions according to the time that you opened them. When you find the oldest position, you should close it first.

You usually get that problem with MT5. MT4 is the platform that was developed before the FIFO rule. That is, it was not required for Forex brokers to close the oldest trade first when MT4 was the only product available from MetaTrader.

The new feature on MT5 has made it unpopular among retail traders. For this reason, some brokers only offer MT4. If you’re using MT5 you can’t hedge on the same pair. You can open positions on different currency pairs.

MT5 has a few features with make it hard to work around the FIFO rule with the same account. However, there are some brokers that will allow you to open more than one trading account and use MT5. In this way, you can have opposing positions with the same currency pair.

You’ll meet up on a few blocks if you only have one account and you try to open multiple positions on the same currency pair. Your orders will merge automatically. So, MT5 will put all your positions into one order. That satisfies both the FIFO rule and the rules that prevent hedging in Forex.

Check Your Broker’s Rules

All brokers have different rules. This means that the workarounds that are good for one won’t be of much benefit with another broker. Similarly, sometimes what works on a demo account, won’t work when you’re trading Forex with real cash.

For example, on a demo account you might use a wider range of lot sizes than you would with real cash. You shouldn’t do that. Test your strategy on the platform in the demo version, just as you would in the live version.

If you plan to stick to a specific lot size with real capital, that’s the lot size you should use with your demo account. If you do that, you’ll be notified right away if you’re violating the FIFO rule with your demo account. That way, you’ll know immediately if the broker only allows FIFO trading.

First In First Out SOLUTIONS For the US Traders

First option is to trade on many accounts. You can install multiple MetaTrader accounts on your platform. And we have a topic in the forum on how you can do that. But having many MetaTrader platforms installed on the computer is pretty heavy. It’s also a lot of work.

So how can you do it on one account?

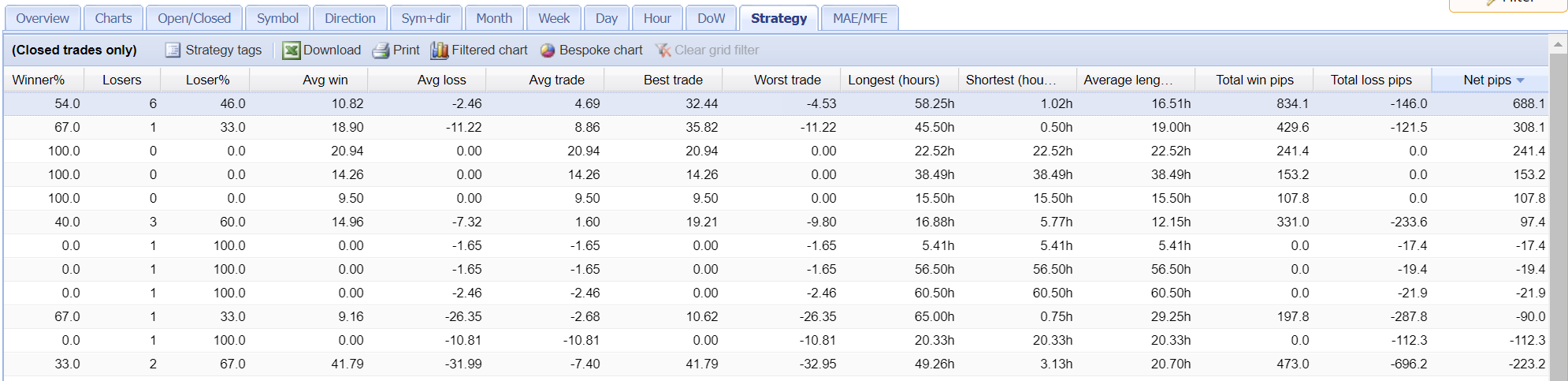

You can open a Demo account and put each Expert Advisor with a different lot. So the first Expert Advisor, the first strategy, you can put with 0.01, then with 0.02, and so on. Obviously, you have a lot to go. And when you follow the strategies’ performance in FX Blue, you should be looking not at the Net profit but at the Net pips. Just arrange the Expert Advisors according to their performance, and scroll to the right to find the column with the pips.

This is because when you’re trading with different lots, the performance in pips is the same. This doesn’t break the first in first out rule. You will be able to trade many Expert Advisors in the account this way. From there, you can see which are the Expert Advisors that bring you most profit on a Demo account and you can put them into the live account.

So this is really a great trick for the US traders.

Check out this insightful forum post by a fellow US trader who documented an experiment with the FIFO rule and Forex.com.

Now, the other issue is that US traders cannot find brokers which allow hedging. One broker is FXChoice which we have listed in our trusted brokers‘ page exactly for the reason that they allow US traders.

Keep in mind that there are no brokers in US that will break the First In FIrst Out rule. If they do – they are 99.9% scammers.

Conclusion

Some traders try to work around the rule by opening two accounts at the same broker. They always go long on one account. However, they make sure that they always go short on the other account. They also transfer funds from one account to the other.

That strategy only works at some brokers. Some brokers don’t allow you to have more than one account some brokers also don’t allow you to transfer funds between multiple accounts.

Earlier in this article you learned that it’s sometimes possible to work around the FIFO rule by opening trades of different lot sizes. That workaround doesn’t function as you might want it to at all brokers. That’s because some brokers will merge your orders. When they do that, they calculate the average price for the entire lot.