Today I’ll be talking about margin crypto trading, and I will talk about the pros and the cons.

What is Crypto Margin Trading?

So what is the Margin Cryptocurrency Trading? This is the option that we have from some of the exchanges to trade with more money from what we have into the account.

For example, if I fund an account on Coinbase, which is one of the most popular exchanges out there, with $100,000 or let’s say with $10,000 and I want to buy cryptos, I have actually $10,000. But with some of the exchanges like Kraken, Binance, Crypto.com, offer that and it’s called Loan-to-Value. You can actually purchase more cryptocurrencies from what you have into the accounts.

You will be able to purchase, for example, for $20,000 or even $30,000. How that works? The exchange will actually loan money to you. You will borrow from the exchange money to purchase a bigger amount of Cryptocurrencies. Of course, as you can guess, that is risky and it’s costly. How come? There is an interest rate.

The interest rates

They will not just give you money so you will be richer faster. They will borrow money but you will have to pay for that.

And pay attention here, some of the interest rates are relatively high, jumping up to 20% or even 30% a year.

And this is, of course, useful if you catch the very right moment on the market, you borrow the funds, you make quick profits, you sell it, and you’re good to go.

For example, if you have done that when the Bitcoin price broke $20,000 and it reached $40,000 shortly, then you will be doing great.

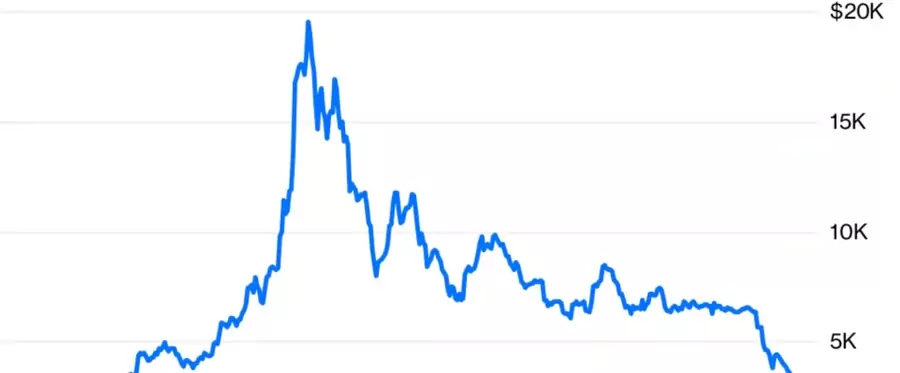

But if you have done that in January 2018 and after that the price crashed from $20,000 down to $3,000 and something, well what happens?

You will be holding borrowed money from the exchange and you will be paying interest rates.

So if you have bought Bitcoin at, let’s say, $19,000 in 2017, but you didn’t buy 1, you bought 2 more. For example, on Binance, you borrowed 2 from them but you had only 1. And then you hold these 3 Bitcoins for a few years and you just pay interest rates. Well, I’m not sure that you would still hold any Bitcoins.

My money management technique

Because you borrow the money but when the price drops, you will be losing actually 3 times more than what you would have lost if you had just your Bitcoin. So cryptocurrency margin trading is quite useful. If you want to get some quick profits, that’s where it’s risky.

Remember that on the market, anything that is risky will bring you more profits and everything that is less risky will stay longer on the market.

That’s why if you are planning to buy cryptocurrencies as an investment and hold them for years, you better not use margin crypto trading. Because this might bring you into losses much faster than you were expecting. But usually, people get greedy when they get into the cryptocurrency market because they wish they bought more and so they can make bigger profits.

Of course, I wish I bought more but I bought exactly with the amount I have decided. I have good money management that I stick to. For example, I never go above 20% of all my capital for cryptocurrencies, that’s the rule I follow. It doesn’t mean you have to do it but it’s good to have rules. And of course, I wish I bought it earlier at a better price but that’s the market, there are always possibilities.

Don’t get greedy

If you have bought at one price, it means that this was the price at which you were ready to buy. On the market, there is no expensive and there is no cheap price. It’s always the current price that matters and that’s what I explain always in my courses. Because many of my students ask me, ‘OK, isn’t it too late to buy Cryptocurrencies in 2021?‘

Well, it was late when the Bitcoin was $1,000 because many people said, ‘Oh, why didn’t I buy it at $5, why didn’t I buy it at $10?’ And when the price reached $50,000, the mass of people say, ‘Oh, it’s too late to buy cryptocurrencies.‘ But what if next year the price is over $100,000? Is $50,000 still going to be too expensive? So there is no expensive price, especially for Bitcoin.

It’s always the current price that matters. So don’t get greedy to borrow a lot of money from the exchanges because you might lose much faster. The margin trading with crypto is great when there is huge volatility. Just like what happened after the price broke the $20,000, reached to $30,000, to $40,000 very quickly.

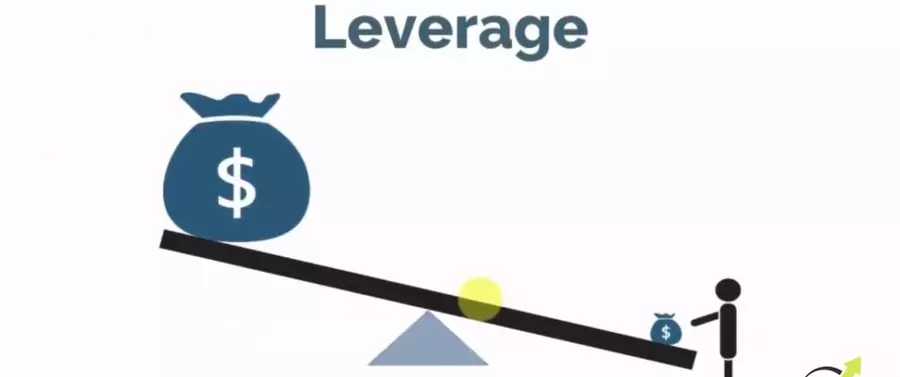

Leveraged trading

And you can use that time or such a period of volatility, so you can trade with some borrowed money from exchanges and brokers and get some quick profits but not for holding cryptos for years because you will be paying a lot of interest rates. And just to make it clear, at the end of the lecture, the margin crypto trading actually comes from the Forex brokers, which have named it leveraged trading.

And they have invented that much before even Bitcoin was created. So when you have a Forex trading account, you can use leverage much higher than 1 to 2 or 1 to 3.

There are leveraged accounts 1 to 100 or 1 to 500. What that means, is that if I have $1,000 of an account, I can open positions 500 times more.

Obviously, that’s super risky and you can blow your account for less than a minute. So the right turn to go is actually leverage. But the crypto exchanges just twisted it and called it margin crypto trading, but it is leveraged trading. Or with simple words, it is borrowed money that we use from the exchanges, from the broker, to open bigger positions. But you have to be very careful with that one more time.

Thank you guys for reading this lecture. If you have found it useful, please share your thoughts about crypto margin trading in the comments below.