In today’s blog post, we’ll be diving into the world of Expert Advisors (EAs) with The Investment Innovator EA Review. Additionally, we’ll explore the workings of the MQL5 algorithm that determines the ranking of these EAs. As an experienced trader questioning some EAs like Bonnitta and Trade GPT, I’m excited to test the Investment Innovator EA and share my unbiased thoughts. Before we begin, let’s unravel the mystery behind the MQL5 algorithm and its impact on the top-ranked EAs.

Deciphering the MQL5 Algorithm

The MQL5 algorithm plays a crucial role in ranking Expert Advisors on the MQL5 Marketplace. While I’m uncertain about its exact workings, it’s clear that the algorithm’s ranking is not solely based on the number of demo downloads. It is a relief, as someone could easily manipulate such a metric. However, upon examining the current top-ranked EAs, it becomes evident that higher-rated EAs with better reviews and lower prices exist. This question arises: why do they give such prominence to the top three EAs?

The Investment Innovator EA Review: The Marketplace’s Perspective

One possible explanation for the ranking system is that the marketplace prioritizes profitability over quality. By featuring EAs with subpar performance at the top, potential buyers are forced to sift through a vast selection, increasing the chances of purchasing different EAs. This ultimately benefits the marketplace, as they earn commissions from each transaction. I’m eager to hear your thoughts on the MQL5 algorithm’s ranking system and its implications.

Investigation: The Investment Innovator EA

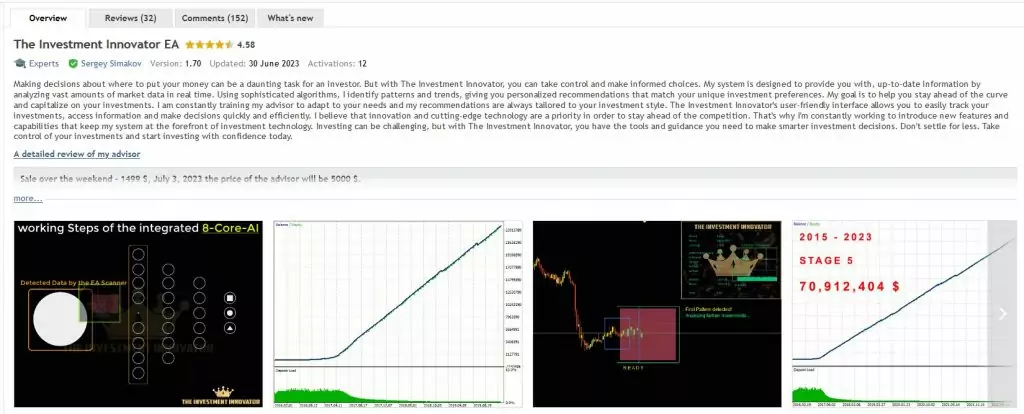

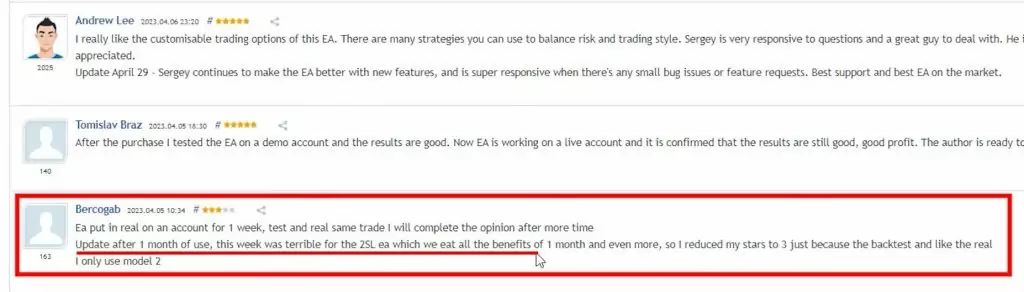

Now, let’s focus on the Investment Innovator EA, which I’ve chosen to review today. Its popularity, combined with positive reviews, caught my attention. While there is one 3-star review, I believe it’s important to consider all perspectives. The review states, “I tested this EA on a real account for one week, and I will provide an updated opinion after more time.” This user, like me, prefers to evaluate a product thoroughly before forming a final judgment.

The Investment Innovator EA Review: Update: A Challenging Week

After one month of use, the same user updated their review due to a challenging week for the Investment Innovator EA. They mentioned that two stop-loss events occurred, causing all the month’s profits to vanish. It appears that someone adjusted the user’s rating accordingly. While this feedback is crucial, it’s worth noting that every EA may experience occasional setbacks.

Examining Results and Signals

To gain further insights into the Investment Innovator EA, let’s explore its active signal accounts.It’s important to note that we have limited available data, which covers only two to three months. One signal account exhibited a substantial recent drawdown of nearly 30%, possibly aligning with the earlier mentioned three-star review. It’s essential to consider these results when evaluating the EA’s performance.

The Investment Innovator EA Review: Testing the EA on MetaTrader 5

For those using MetaTrader 5, the Investment Innovator EA is available for download. Users can access the EA from the market section and download a demo version for testing purposes. This provides an opportunity to explore the functionality and performance of the EA through backtesting. However, it’s crucial to note that live trading with the demo version is not possible.

Analyzing Backtesting Results

One notable aspect of the Investment Innovator EA is its impressive backtesting results. The EA’s historical performance showcases promising returns, indicating potential profitability. More on the backtesting a little later.

The Investment Innovator EA Review: Analyzing Chart Analysis and Broker Choice

To begin, let’s examine the chart analysis capabilities of The Investment Innovator EA. By opening a new chart window for Gold and switching to the M30 timeframe, users can easily drag and drop the EA to view its endpoints. It’s crucial to choose a trusted and regulated broker to ensure the reliability of backtesting results and live trading.

Understanding Broker Regulation and Safety

Regulation is a vital aspect to consider when you select your broker. Always choose a broker regulated by several authorities, such as the Financial Conduct Authority (FCA) in the UK, which is one of the most well-known and reputable ones. The FCA monitors broker transactions to ensure the safety of clients’ funds. Before making any decisions, it’s crucial to research and choose a well-regulated broker to ensure the security of your investments.

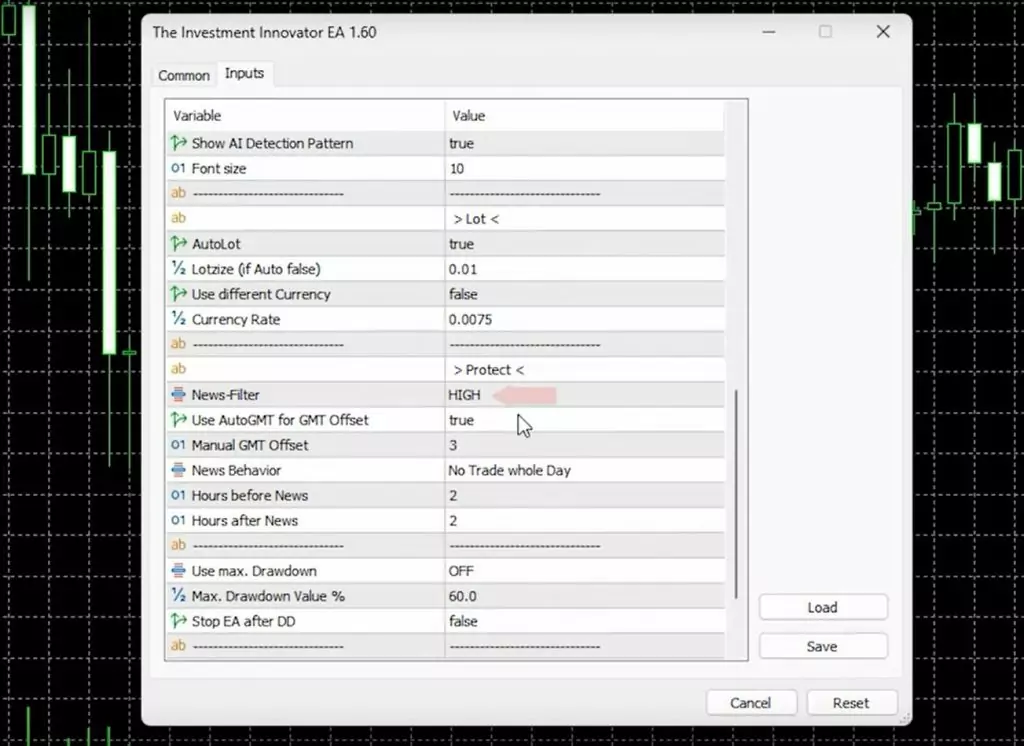

The Investment Innovator EA Review: Exploring EA Inputs and Customization

The Investment Innovator EA offers various models and stages, giving users the ability to customize their trading experience. The default settings include options for trailing start, trailing stop, take profit, and stop loss, which are set at 150 pips for Gold. Additionally, users can adjust the lot size, activate news protection, and utilize the Max Drawdown feature, particularly useful for those doing the FTMO or other proprietary firm challenges.

Performing Backtests and Assessing Results

Backtesting is a valuable tool for testing an EA’s past performance. By doing backtests in MetaTrader using The Investment Innovator EA, users can assess its potential profit over different time periods. Initial backtests for one month showed a 40% net profit, while longer backtests covering the entire year showed impressive gains of $320,000. However, it’s important to note that significant drawdowns were seen during these periods.

The Investment Innovator EA Review: Addressing User Reviews and Stop Loss Claims

In user reviews, one trader mentioned the presence of two stop losses, which were not visible during backtesting. It’s essential to consider that the EA’s performance may vary based on the chosen inputs, including the selected model and stage. While the purchase of the EA may provide a guide or PDF explaining these differences, skepticism remains regarding the accuracy and viability of the backtesting results.

The Importance of Live Account Testing

Although the backtesting results may appear positive, caution should be taken when moving over to a live trading account. Backtests can sometimes be overly optimized, resulting in unrealistic profitability. It is advisable to test the EA on a demo account first to gain a better understanding of its strategy and performance. Real experiences on live accounts can provide a more accurate assessment of the EA’s effectiveness.

The Investment Innovator EA Review: Conclusion

In this review of The Investment Innovator EA, we’ve explored its features, backtesting results, and user reviews. We’ve discussed the importance of selecting a regulated broker that ensures the safety of your funds. Customization options, including various models and stages, allow for personalized trading experiences. However, skepticism surrounds the backtesting results, highlighting the need for cautious interpretation. Testing the EA on a demo account before moving over to live trading is recommended.

Check out as well one of the EAs we trade on a few live accounts.

Please note that this blog post is for informational purposes only and should not be considered as financial or investment advice. Trading and investing involve risks, and it’s important to conduct thorough research and consider your individual circumstances before making any financial decisions.