Welcome back to my blog, where we explore the world of trading technology. Today, I will be reviewing one of the top Expert Advisors available on the MQL5 Marketplace—the Bonnitta EA MT5. Many of you have requested my thoughts on this Expert Advisor, and I’m here to provide an honest assessment. Join me as we delve into the details of this highly-priced EA and uncover its value.

Examining the Bonnitta EA

The Bonnitta EA has gained significant attention on the MQL5 Marketplace, with its price recently jumped up from $5000 to $5750. Such price adjustments are often made when there is high demand or to create a sense of scarcity, urging potential buyers to make quick decisions. However, let’s assess if this Expert Advisor truly offers value beyond its price tag.

Bonnitta EA Review: Strategy and Features

The Bonnitta EA is based on the Pending Position Strategy (PPS) and uses Custom Indicators, Trendline Support and Resistance Levels, and Price Action. It is worth noting that coding Price Action strategies is more challenging than integrating standard indicators into MetaTrader platforms. The developer claims to have conducted extensive testing, including stress tests with Slippage and Commission.

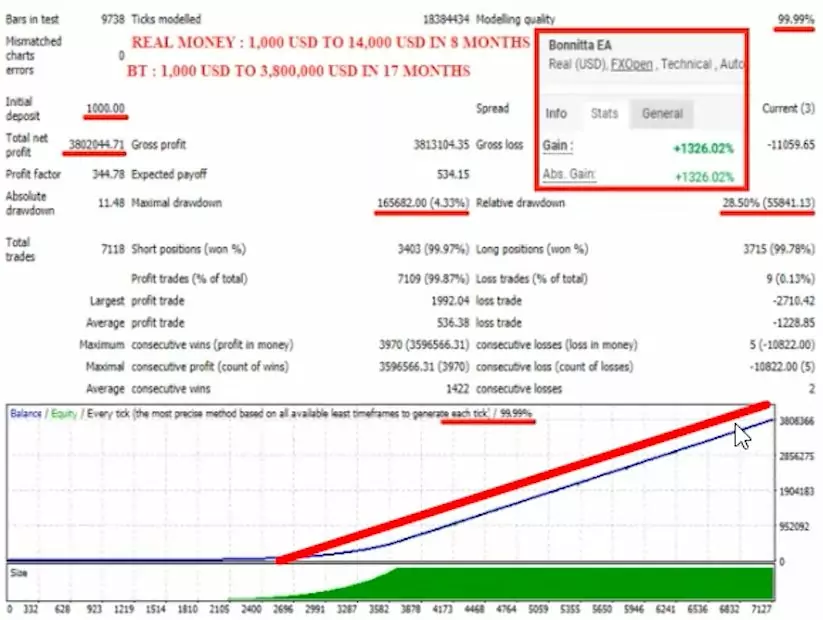

Backtest Results and Skepticism

While the Bonnitta EA boasts impressive backtest results, it’s important to approach such claims with caution. Skilled developers can create EAs with outstanding backtests, but real-time trading results often differ. Let’s examine the provided images showing the exceptional equity line. However, relying solely on descriptions and images is not enough—we need to test it ourselves.

Bonnitta EA Review: Personal Backtest and Findings

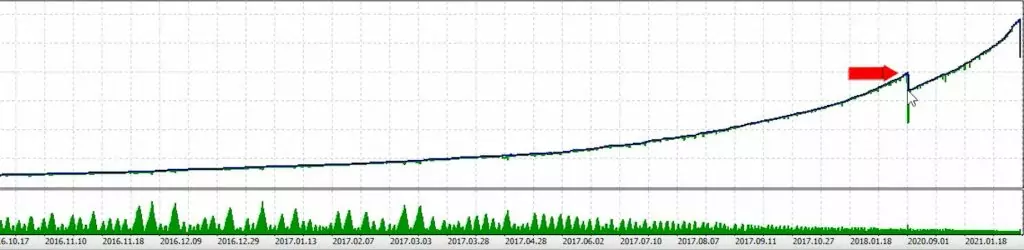

To gain personal experience, I downloaded the Bonnitta EA’s demo version and conducted a backtest. Testing it on the EURUSD pair with the H1 time frame, as suggested, I used the maximum available historical data from my MetaTrader terminal. Upon looking at the results, it became apparent that the backtest ended abruptly in 2021, raising questions about its completeness.

Inconsistencies and Further Evaluation

As I continued looking into the backtest, I encountered more inconsistencies. Attempting to test specific time frames, such as the last one year or one month, the backtest failed to provide reliable results. Such behavior is highly unusual, especially considering the price tag associated with this Expert Advisor.

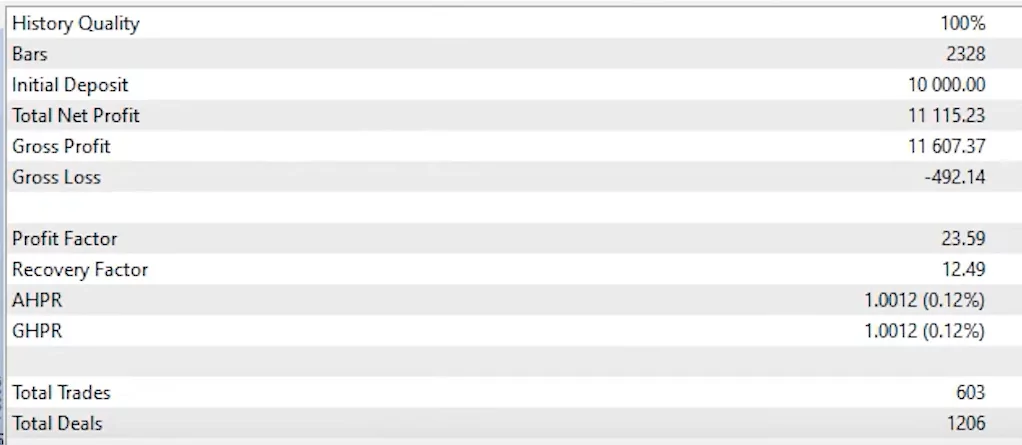

Bonnitta EA Review: Analyzing the Backtest

To begin our evaluation, let’s revisit the previous backtest we conducted. As we delve into the results, we can draw some initial conclusions about this EA’s performance. The backtest reveals an impressive net profit of over $11,000, showcasing a remarkable return of more than 100% within a one-year period.

Visualizing the Backtest

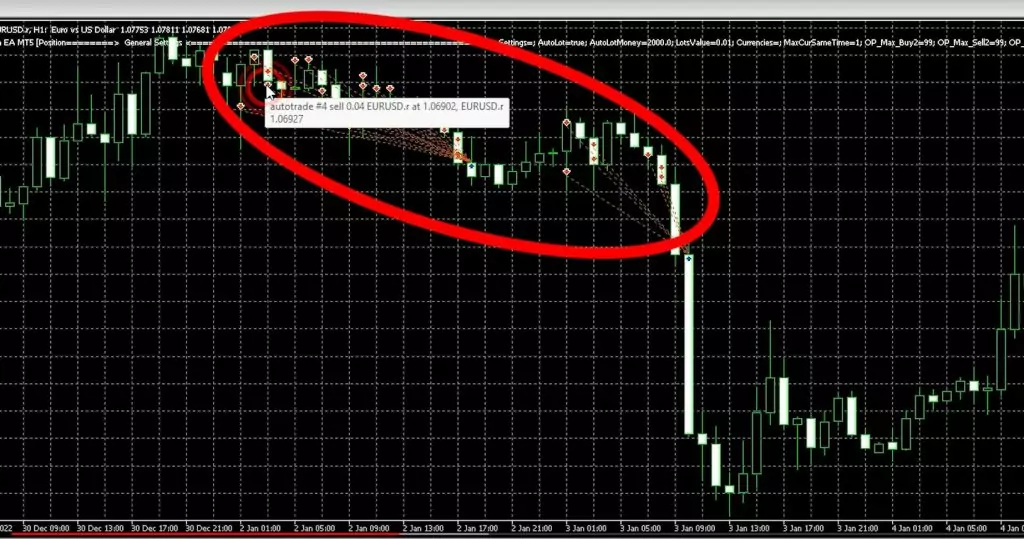

To gain a better understanding of the Bonnitta EA’s performance, let’s explore the visual representation of the backtest. Observing the chart, we can identify multiple trades being opened and closed, indicated by the appearance of candlesticks. Notably, there are instances where two trades are opened and subsequently closed within a short time frame.

Bonnitta EA Review: Analyzing Trade Patterns

Upon closer examination, we notice that during upward market movements, the Bonnitta EA tends to open more long trades. Conversely, during downtrends, it favors short trades. This suggests that the EA could utilizes a trend-following indicator to guide its trading decisions. However, the limited information available on the chart hinders our ability to understand the strategy in greater detail.

The Trust Factor

As traders, we often find ourselves in a position of trust when evaluating Expert Advisors. The Bonnitta EA is no exception. With minimal insights gleaned from the chart and the description section provided, we are compelled to rely on the seller’s claims. This reliance on trust can sometimes be challenging, as it leaves us craving more transparency and a deeper understanding of the EA’s underlying mechanisms.

Bonnitta EA Review: Real Account Track Record

To gain further confidence in the Bonnitta EA’s performance, let’s explore its real account track record. Examining the MQL5 Marketplace, we can assess the EA’s proven track record and verify its historical results. This information can provide additional assurance regarding the reliability of this trading tool.

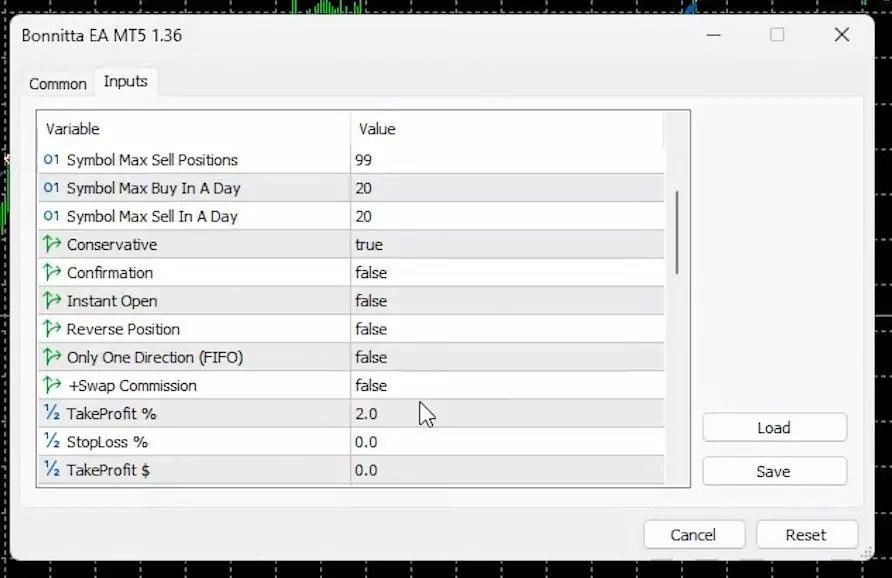

Understanding the Inputs

Let’s take a closer look at the inputs of the Bonnitta EA. By simply dragging the Expert Advisor onto the chart, we can access its settings. Notably, we find parameters such as Symbol Max for buy positions, which is set to 99, and Symbol Max for buy and sell positions in a day, set to 20. These values appear quite high, raising questions about their effectiveness.

Bonnitta EA Review: Digging Deeper into Functionality

Upon examining the inputs, we realize that understanding how this Expert Advisor works and the indicators behind it becomes a challenging task. Despite the option to check news for various currencies, which is crucial in a high-priced EA like this, the lack of transparency regarding its functionality and code accessibility raises concerns. Trading Expert Advisors without code access can be highly risky, necessitating further investigation.

Evaluating Performance

Next, let’s evaluate the performance of the Bonnitta EA. Starting from 2019, we can see some signals but a noticeable absence of reviews, which is a concerning aspect. However, an in-depth analysis reveals impressive yearly profits, especially in 2022, with returns exceeding 100%. These results are confirmed by conducting backtests on MetaTrader. Nonetheless, the absence of reviews raises suspicions and warrants a closer look at user experiences.

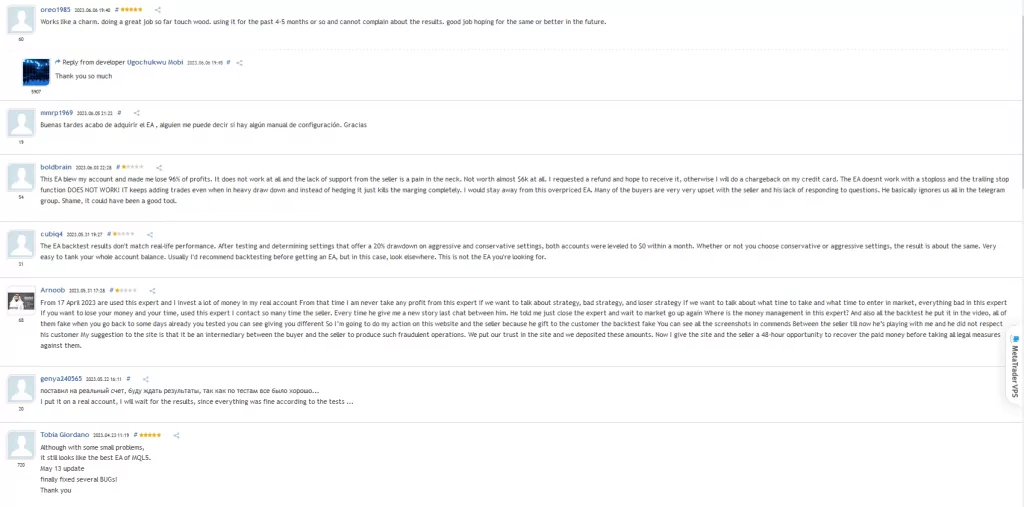

Bonnitta EA Review: User Reviews – A Mixed Bag

Turning our attention to user reviews, we find a majority of positive feedback, indicating satisfaction with the Bonnitta EA. However, one review stands out with a rating of 1 star. Delving into the details, the reviewer claims that the author released new versions, leading to a conclusion that it is a scam. The reviewer mentions bugs in version 1.3 and their subsequent correction in version 1.36, which only magnified the deceit. Allegedly, the EA opens 15 times the number of real trades, allowing it to achieve impressive backtest results. This revelation, coupled with the absence of a Stop Loss, raises concerns about account safety.

The Developer’s Strategies and Backtest Dilemmas

Upon reconsidering the review, it is plausible to assume that the Bonnitta EA’s developer updates the robot with settings that ensure favorable backtest results. Such tactics make it difficult to replicate the same success in live trading. This raises doubts about the effectiveness of the Expert Advisor and the reliability of its backtest results. It is crucial to keep this in mind and approach the Bonnitta EA with skepticism.

Bonnitta EA Review: Personal Perspective and Conclusion

As an experienced trader and reviewer, I remain skeptical of this high-priced EA available on the MQL5 Marketplace. Personally, I find the $5000 price tag exorbitant, especially considering the absence of comprehensive user reviews and the potential risks associated with limited code accessibility. I encourage you, the readers, to share your thoughts and experiences with the Bonnitta EA in the comments section. Your insights will undoubtedly be invaluable to others interested in exploring this Expert Advisor.

In the meantime, feel free to check out my review of other Expert Advisosr from the MQL5 Marketplace on my YouTube Channel and Blog Together, let’s navigate the complex world of trading software and make informed decisions to enhance our trading journey.