Are you tired of analyzing charts all day long in search of profitable trades? Are you looking for a more efficient way to trade forex? Look no further, because we have an amazing MACD EA trading robot that will do all the hard work for you. Plus, you can download it for free! In this blog post, we will explain how the strategy behind the robot works so that you can understand when and why it will trade for you.

What is MACD Indicator and Why it Looks Different on Different Platforms?

First things first, let’s talk about the MACD indicator. MACD stands for Moving Average Convergence Divergence. It is a popular technical analysis tool that traders use to identify potential trend changes and market momentum. The MACD indicator is displayed differently on different trading platforms such as MetaTrader, TradingView, and others. But the underlying concept remains the same.

The MACD indicator consists of two lines and bars. The two lines are the MACD line and the signal line. The bars represent the difference between the two lines. When the MACD line crosses above the signal line, it is a bullish signal, and when it crosses below the signal line, it is a bearish signal.

On MetaTrader, the MACD indicator is displayed as bars and a single red line, which is the signal line. On TradingView, the MACD indicator is displayed with the MACD line as the blue line and the signal line as the orange line, with bars representing the difference between the two lines. It may look confusing at first, but once you understand the basic concept of the indicator, it’s not that complicated.

The MACD EA and Trading Strategy Explained

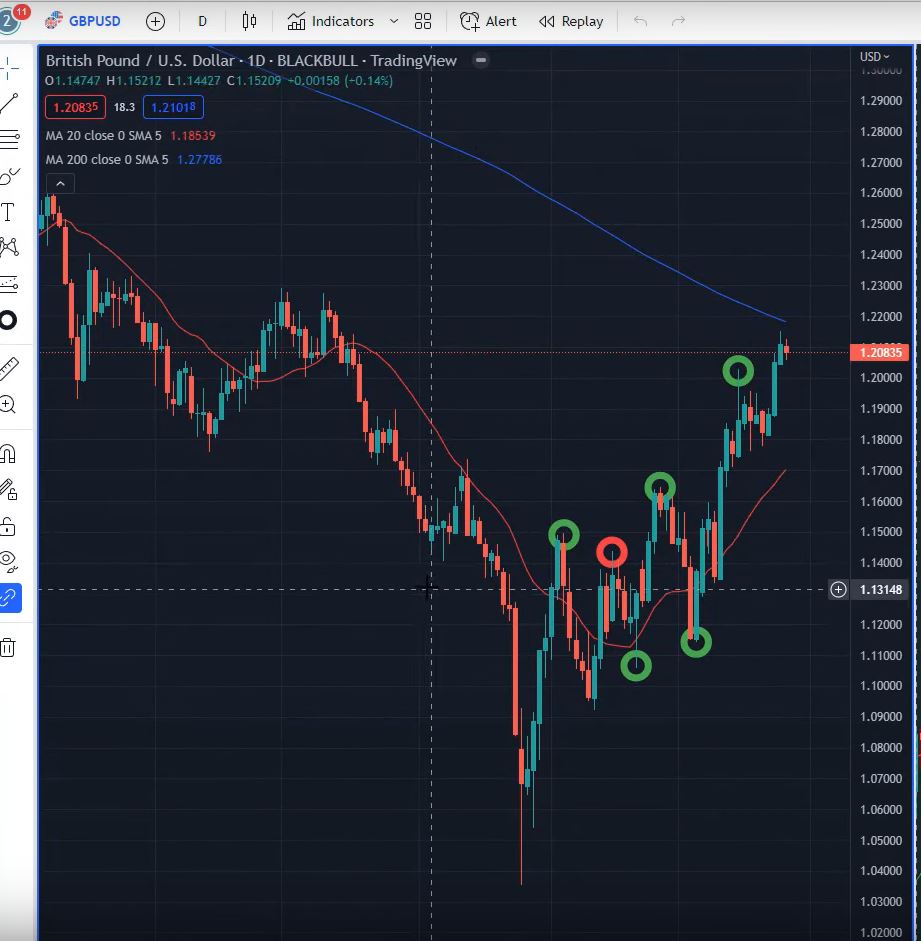

Now that you understand how the MACD indicator works, let’s dive into the strategy behind our MACD EA trading robot. This strategy uses the GBPUSD pair on the H1 chart, but you can use it manually on any platform or chart of your choice.

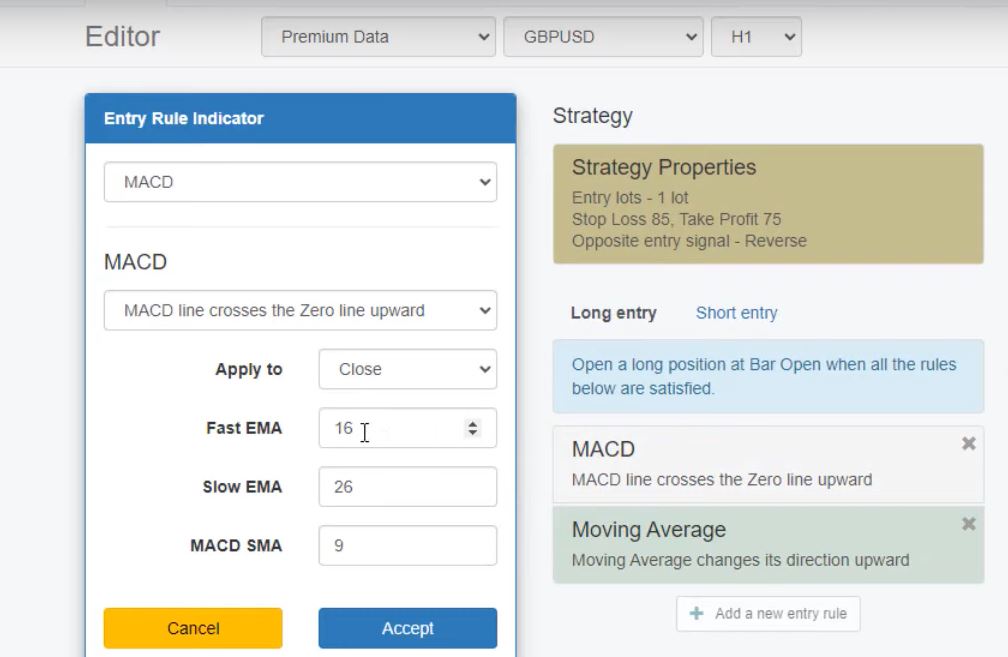

The MACD EA trading robot uses the following settings:

- Fast EMA: 16

- Slow EMA: default

- Signal smoothing: period of 9 (default)

The strategy uses the signal line crossing the 0 line upward to generate a long signal and crossing downward to generate a short signal. So, when the bars cross the 0 line upward, it’s a buy signal, and when the bars cross the 0 line downward, it’s a sell signal.

The MACD EA trading robot has shown consistent profits since 2007, which means it has a stable balance chart over the years. But don’t take our word for it. You can test it yourself on a demo account to see how it performs in different market conditions.

Indicators in the MACD EA

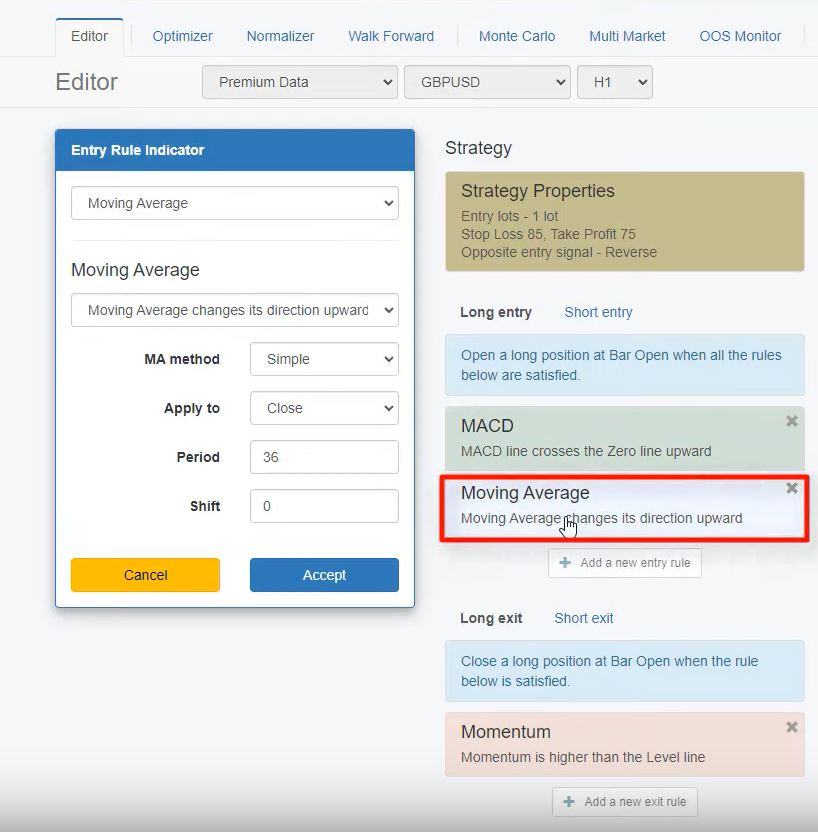

The MACD EA strategy is based on two indicators: Moving Average Convergence Divergence (MACD) and Moving Average. The MACD is the line that connects the tops and bottoms of the gray bars. The entry rule for the MACD Robot is when the MACD line crosses the 0 line upward with a fast EMA 16. The Moving Average changes its direction upward, with a period of 36. We need to see both happening at the same time to confirm a buy or sell signal.

To illustrate this strategy, let’s take a look at some examples. In the first example, the MACD line crosses the 0 line upwards, and at the same time, the Moving Average starts to climb. This is our confirmation to enter a long position. In this case, the take profit was hit, and the stop loss was below. In the second example, the MACD line crosses the 0 line upwards, and the Moving Average changes its direction upward. However, the price reverses downwards and hits the stop loss.

The strategy has an exit condition, and the momentum needs to be higher than the level line for the trade to close. The exit condition is momentum above the 185 line, with a period of 51, level 100.85. The strategy also includes a stop loss of 85 pips and a take profit of 75 pips.

Selecting the Right Broker to use your MACD EA on

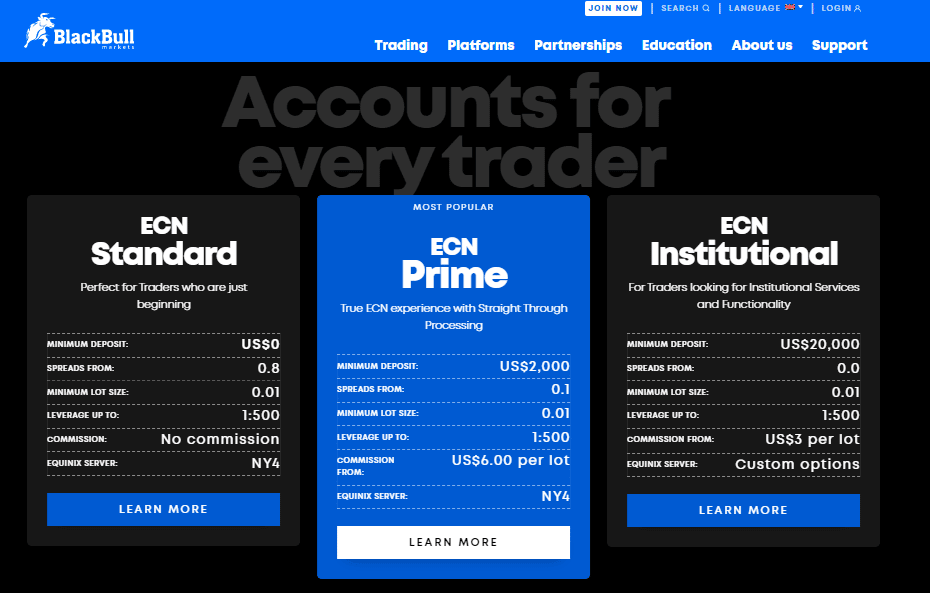

BlackBull Markets is a regulated ECN broker that offers over 26,000 tradable instruments, and traders can leverage up to 1 to 500, which means they can trade with much larger amounts than what they have in their accounts. BlackBull Markets offers different types of accounts, including ECN Standard, ECN Prime, and ECN Institutional accounts.

With the ECN standard account, traders can enjoy spreads from 0.8 pips without any commission. On the other hand, with the ECN Prime account, spreads start from 0.1, with a commission of $6 per lot traded. However, the minimum deposit for the ECN Prime account is $2000. BlackBull Markets offers the MetaTrader and TradingView platforms. To connect with BlackBull Markets on TradingView, traders need to click on the CO Brokers option in the Trading panel and select BlackBull Markets. Once connected, they can trade straight away on the TradingView platform.

MetaTrader is a popular platform for algorithmic trading, and this is what we use for our MACD Robot strategy. Traders can easily grab the Robot from today’s video and backtest it on MetaTrader with BlackBull Markets using a demo or live account. Additionally, BlackBull Markets offers a free subscription to TradingView Pro if traders open a live account with them.

Risk-Reward Ratio

With algorithmic trading, we do not follow the 1 to 2, 1 to 3 risk-reward ratio rule from manual trading. In algorithmic trading, the closer you put your stop loss to your entry, the bigger chance you have to hit it before the take profit. Therefore, don’t panic if your stop loss is bigger than the take profit.

Download MACD EA Trading Robot for Free

As promised, you can download the MACD EA trading robot for free. Just visit our website and follow the instructions. It’s easy to install and use, even if you are a beginner in forex trading.

Conclusion

In conclusion, the MACD EA trading robot is a great tool for traders who want to automate their trading and save time. The MACD indicator is a powerful technical analysis tool that can help you identify potential trend changes and market momentum. Our MACD EA trading robot uses a simple but effective strategy that has shown consistent profits over the years. Don’t hesitate to try it yourself and see how it performs in different market conditions. Remember to always test any trading strategy on a demo account before using it on a live account. Happy trading!