Introduction

In the realm of gold trading, the right tools can make all the difference. On a recent Sunday morning, I made a discovery that’s worth sharing: the Free Gold Expert Advisor.

Free Gold Expert Advisor: A Sunday Morning Discovery

Sundays are often for relaxation. But for me? It was about finding the perfect gold robot. After sifting through numerous robots I crafted with EA Studio, one stood out.

Why This Robot?

It wasn’t just its impressive performance that caught my eye. It was the logic behind its strategy. I always aim for a clear, logical trading strategy in the robots I design. This ensures precise trade openings and closings. And here’s some exciting news: I’m sharing this robot for free!

Diving into the Strategy

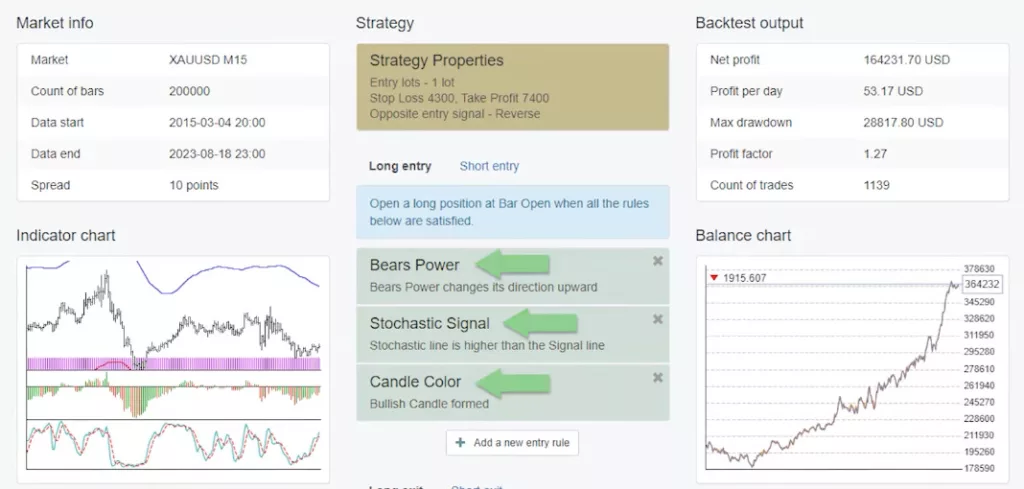

This robot uses a blend of indicators to make its decisions:

- Bears Power Indicator: This is our main entry point. Displayed as green and red bars below the chart, it signals when to enter a trade. We look for a shift from downward to upward movement.

- Stochastic Line: Our secondary indicator. It needs to be above the signal line. Specifically, we’re observing K period 14, D period 4, and slowing 2.

- Candle Color Patterns: The final piece of the puzzle. We’re on the lookout for three consecutive candlesticks, each with a body height of at least 18 pips.

Free Gold Expert Advisor: A Real-World Example

Imagine you’re considering a long trade. Here’s the checklist:

- The Bears Power indicator shows an upward shift.

- The Stochastic line is above the signal line.

- There are three or more consecutive bullish bars.

When these stars align, it’s time to open the trade. In one test, this setup led to a profitable outcome!

The Art of Reversing Trades

But what if the market suggests a different direction? The expert advisor has a plan. If the indicators hint at a short trade while we’re in a long one, the advisor acts. It closes the long trade, whether it’s profitable or not. Then, it opens a short trade. This ensures we’re always in sync with the market’s rhythm.

In the world of gold trading, having a logical and efficient expert advisor is invaluable. The Free Gold Expert Advisor offers just that, making trading both logical and profitable.

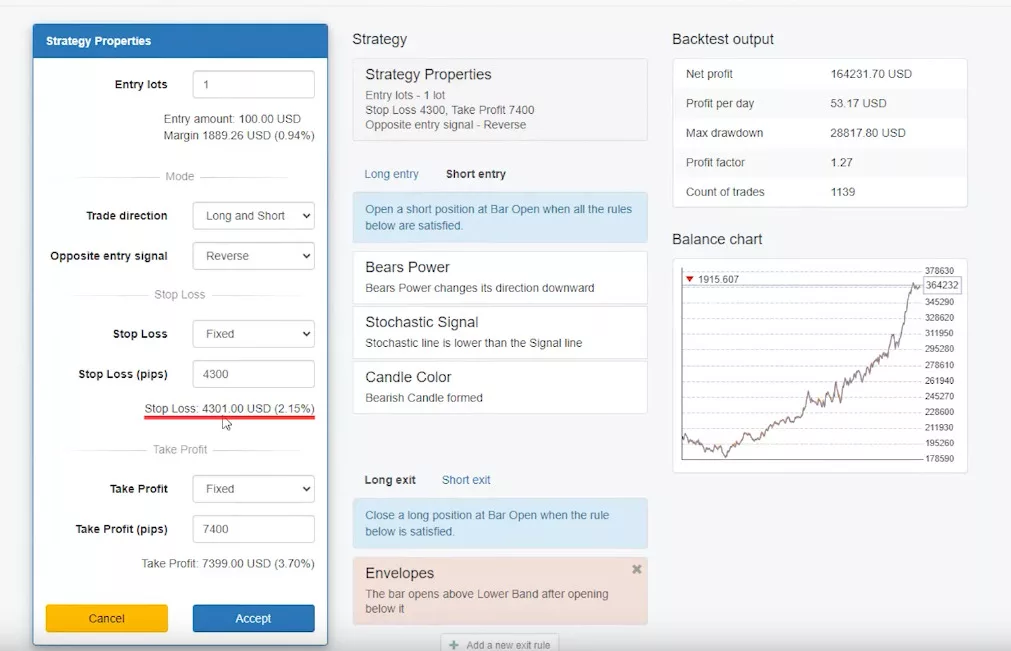

Free Gold Expert Advisor: Setting Up Stop Loss and Take Profit

In trading, it’s essential to manage risks. With this robot, I’ve set a stop loss of 4,300 pips. This means if things don’t go as planned, the maximum I’d lose is 4,300. On the flip side, the take profit is set at 7,400 pips. But remember, these figures are based on trading one lot in a 200,000 account, as configured in the EA Studio.

Adjusting for Smaller Accounts

Not everyone starts with a large account, and that’s okay. If you’re beginning with, say, a $1,000 account, you can adjust the entry to 0.01. While this means potentially smaller profits, it’s all about scaling to what you’re comfortable with. Always remember, the key is to start somewhere and grow from there.

Free Gold Expert Advisor: Testing Before Diving In

Before committing real money, I always recommend testing on a demo account. I’ve set up a demo with FXView, and I’ll guide you on how to get the robot running.

Installing the Robot on MetaTrader

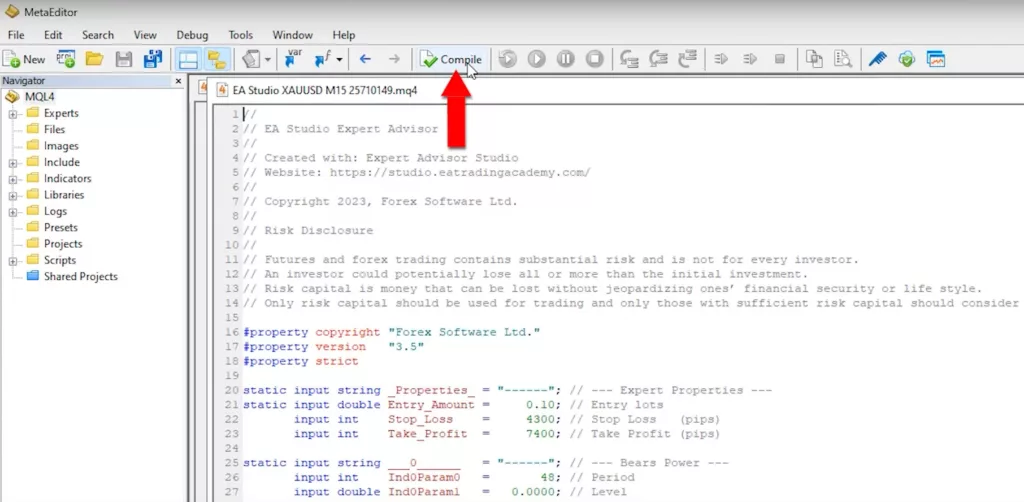

Firstly, you’ll find links for both MetaTrader 4 and MetaTrader 5 in the link below. Once you’ve downloaded and extracted the files:

- Copy the Robot: Ensure you’ve selected the correct file for the platform you’ll be using. MQL4 for Metatrader4, MQL5 for Metatrader5

- Access the Data Folder: In MetaTrader, go to File > Open Data Folder.

- Navigate to the Experts Folder: Click on MQL4, then Experts. For Metatrader 5, click on MQL5.

- Paste the Expert Advisor: This is where you’ll place the robot’s code.

- For Metatrader 5: Open in MetaEditor: Clicking on the pasted file will open MetaEditor, letting you view the code. The best part? I’ve kept nothing hidden. If you’re keen on learning, this code can be a great starting point to enhance your programming skills. If programming isn’t your thing, no worries. Just hit ‘compile’, and the expert advisor will be ready in the experts tab. For MetaTrader 4 users, a simple refresh in the Navigator window on the right will do the trick.

Bringing the Robot to Life

Now, open a new gold chart and switch to M15. Drag and drop the expert advisor onto the chart. You’ll then see various inputs: stop loss, take profit, lot size, and the indicators. After adjusting these to your preference and clicking ‘OK’, a smiley face will appear. This indicates the robot is active and ready. However, since today’s Sunday, trading won’t commence just yet.

Free Gold Expert Advisor: Introduction to Backtesting

In the world of trading, backtesting is a crucial step that allows traders to evaluate the potential and reliability of a trading strategy or robot. By simulating trades based on historical data, backtesting provides insights into how a strategy would have performed in the past. With the Free Gold Expert Advisor in focus, let’s delve into the backtesting process and understand its nuances.

Step-by-Step Backtest Process

Backtesting might seem like a daunting task, but with the right steps, it becomes straightforward:

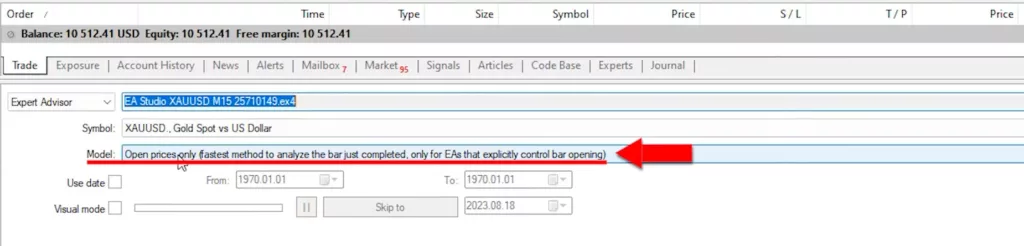

- Initiating the Backtest: First, within the MetaTrader platform, right-click and navigate to the expert advisors section. Here, you’ll find the option for ‘strategy tests’.

- Choosing the Right Model: It’s essential to select the ‘open prices only’ model. This is a vital step because all Expert Advisors (EAs) from EA Studio initiate trades at the beginning of a new bar, ensuring accuracy in the backtest.

- Launching the Test: With everything set, click ‘start’. As the backtest runs, you’ll witness a visual representation of how the robot would have traded based on historical data.

Dissecting the Differences: MetaTrader vs. EA Studio

Upon running the backtest, seasoned traders might observe a difference between the graphs displayed in MetaTrader and EA Studio. This discrepancy, while initially puzzling, has a logical explanation.

The Significance of Choosing the Right Broker

Every trader knows that the choice of broker can make or break their trading experience. The robots I meticulously design and share with the community are optimized for brokers that offer minimal spreads.

But what exactly is a spread? In simple terms, the spread is the difference between the buying (ask) and selling (bid) price of an asset. A smaller spread means reduced trading costs, which can significantly impact profitability in the long run.

Selecting the right broker isn’t just about competitive spreads. Commitment to transparency and trader security is crucial. With the right broker, traders can rest easy knowing their funds are protected. Some brokers roll out enticing incentives for traders, such as free VPS services and a generous 100% welcome bonus for those registering under their global entity. But the single most important aspect when selecting a broker to use, is to ensure they are well-regulated.

Free Gold Expert Advisor: Unraveling the Mystery Behind Backtest Discrepancies

When comparing backtest results, the difference between MetaTrader and EA Studio becomes evident. In MetaTrader, the data chart typically starts from the end of January of the current year. On the other hand, EA Studio, with its premium data offering, provides a backtest that stretches back to 2015. This extended data range in EA Studio offers a broader view of potential trading outcomes, explaining the variance in backtest results.

However, it’s crucial to note that the accuracy of backtesting also hinges on the symbol settings used for different assets. When utilizing EA Studio for backtesting, traders must ensure they apply the appropriate symbol settings for each asset to get accurate results.

Free Gold Expert Advisor: The Power and Potential of EA Studio

For traders looking to elevate their trading game, EA Studio emerges as a potent tool. It’s not just a platform for backtesting; it’s a comprehensive environment where traders can generate or automate trading strategies, transforming them into expert advisors. The platform’s user-friendly interface ensures even those new to trading can navigate with ease.

Equipped with the right tools and a reliable broker, traders are poised to navigate the tumultuous waters of the trading world with confidence. For a more in-depth guide on harnessing the power of EA Studio, do check out the video on my YouTube channel. Remember, in trading, knowledge is power. Stay informed, trade wisely, and I eagerly await our next interaction in my upcoming posts.

One of the standout features of EA Studio is its ability to export trading strategies as expert advisors with just a single click. This seamless integration ensures traders can swiftly move from strategy creation to live trading. And for those curious, I’ve included a link to the expert advisor I crafted on that memorable Sunday morning in the description.

Wrapping Up: The Journey of Trading and Backtesting

In conclusion, the realm of trading is vast and ever-evolving. Backtesting stands as a beacon, guiding traders by offering a glimpse into potential future performance based on past data. While discrepancies in backtesting results across platforms like MetaTrader and EA Studio can arise, understanding the reasons behind them demystifies the process.

Can be used in live trading??

It’s a personal choose. This free EA is created for educational purposes and we don’t update it. On our live trading page you can see which EAs we’re using at the moment. This is not a financial advice, it’s just what we do. You need to make your own due diligence before picking an EA to trade with.