Forum Replies Created

-

AuthorPosts

-

January 18, 2019 at 18:05 in reply to: Fixed stoploss, "may use" or "none" when creating strategies? #8600

dommech

ParticipantInteresting @Jacpin, thx!

January 18, 2019 at 15:40 in reply to: Fixed stoploss, "may use" or "none" when creating strategies? #8586dommech

Participantdommech

ParticipantI did not notice that, was to tierd yesterday. :) Yes when I loaded my VPS the first day I saw that when I left metatrader on with the EA’s they both were taking trades (VPS EA’s+Metatrader EA’s) so I closed them manually when I saw it, that of course makes the stats harder to trust. But still, it is an extremely big profit difference between the two accounts

dommech

ParticipantHi Thx for the feedback!

I got off a bumpy start when the GBPJPY went in to a range for the past 2 weeks, so I’m a bit down on the account. I’v been trading live now for 2 weeks now.

But just wanted to show a perfect example of that a past profitable strategy does not need to be a future profitable one.

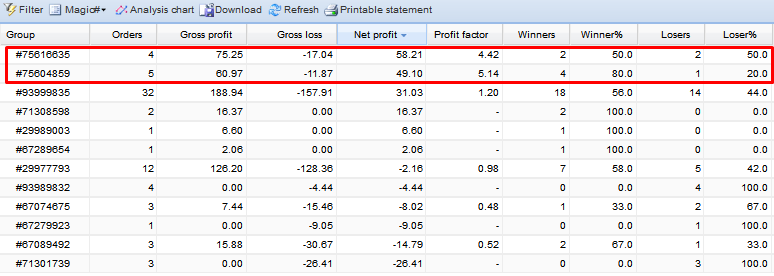

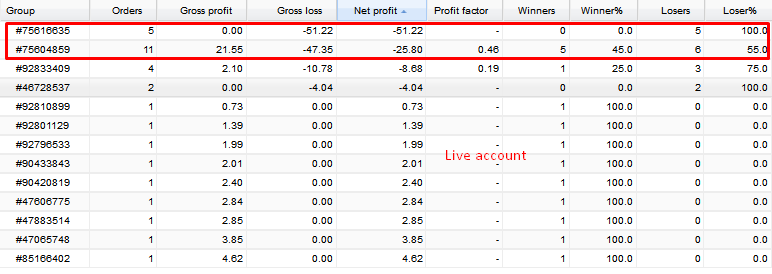

First one is a Demo account and second one is Live, same settings different outcomes.

January 11, 2019 at 9:43 in reply to: Forex strategy, Forex ea or cryptocurrency ea – share with everyone #8366January 10, 2019 at 15:33 in reply to: How satisfied are you with the automated trading software EA Studio? #8354dommech

ParticipantHi Chingi Welcome to the family!

I’m with Andi, go thru the courses from Petko and take notes or Favorite mark the things you would like to go thru again, this will save you a lot of time (and probably money) test all the platforms on Demo and when you feel conforteble go live with a very small amount just to test everything out.

I’ve been in the EA community for about 1 year now and EA Studio is my final destination, will not look anywhere elsefor Algo setups.

But I’m very new with EA Studio (14 days)

I use to test and optimize 1 EA (Ichumoko) for usually about a week, and when building a portfolio and going thru FX pairs + non correlation that are profitble enough to fit my system it usually took me 2-3 months before I was completely done. With EA Studio it took me less than 48h to find a much more profitble setup than the portfolio I’ve been working on for months.

With EA studio I can create multiple non correlatet strategies extremely easy so I can focus 90% on Money Management, Risk and new strategies (Markets, timeframes, assets) instead of putting in weeks of testing.

Ask a lot of questings and read and study Petko’s (resourse) material with has helped me a lot on my jurney!

dommech

ParticipantI will use Demo as well but I will not Demo test my strategies before going live, I will still continue to demo test “backup strategies” if I need to switch out some of the ones. Testing this way on “Out-Data” work as well as demo testing. Markets change anyway so it’s not a guarantee that the strategy will work live if it did on demo.

I go with enough history data to feel confident + 80-90% Monte Carlo + the last step is the one month of “Out data” I don’t feel that I need more confirmations than that, this way really saves Weeks or even months so I’m willing to take the risks.

Hey, I’m compounding profits so lets start to compound time ;-)

dommech

Participant@jacpin thx sounds good, I go usually for M15 H1 and sometimes H4 but not lower

Will change to 5 years as well :-)

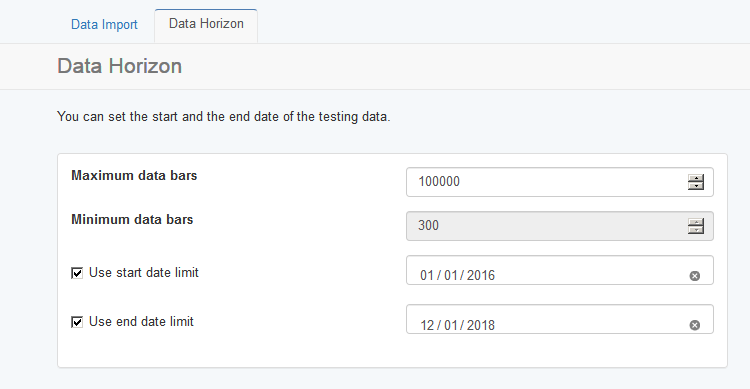

I recently heard in one of Petko’s courses that instead of demo testing the files you could (optional!) Change the data horizon and leave 1 month out of the generator and later recalculate. this gives me even more confidence that the strategy is robust. I still put many EA’s on demo so exchange the bad ones

dommech

ParticipantThx for the answers guys!

Some strategies with especially extremely low DD (0.5-2%) I’ve found that they are extremely rare.

My Backtesting data is over 3 years, always when using FX I’m thinking of adding it to 5 years, my thoughts are that market behavior changes and 3-5 years is enough? Or how do you guys think?

Usually I get 200 trades/strategy but if I set it higher I might miss the rare ones with the low DD

I understand that this affects the robustness of the strategy if it’s only 50 trades but the low DD makes me want to take the risk

Off Topic, but:

How far back do you guys go with FX, how many years or bars do you use to get enough statistic data?

dommech

ParticipantI use :-)

Maximum equity drawdown %: 10-15% (Depends on FX 10% or Crypto 15%)

Minumum Trades: 50

and Sometimes:

Maximum stagnation %: 30%

Minimum return / drawdown: 3

dommech

ParticipantWhat do you men with “smart lot traded? :-) I Use 0.01 lots

By Break even I mean If i start up with a 200usd account and at 400usd I would withdraw 200 to make it Break even (Risk free) Later I would withdraw 50% monthly from that account

dommech

ParticipantThank you for the information Petko! My thoughts were to withdraw 50% of the monthly profits from every account that is break even (100%ROI)

I will start a Journal here very soon on my findings and so other people can pick what they want to use or add to so we can make it even better.

Overall I think my money works harder when using 1:500 leverage and multiple accounts

Cheers!

dommech

ParticipantNice Petko, a bit off topic but what are your intentions with multiple accounts?

Mine is mostly spreading the risk over a couple of accounts and as soon as they are 100% ROI i will Compound the returns with another small account and more EA’s and let the old one run as printing machines until they self destruct (or I change EA’s)

This way I can have a Portfolio spread over multiple accounts, It is all about ROI anyway. :-)

I thought that running 10EA’s on a 1:500 200usd account would be too much but it looks good so far.

I’m Testing this theory now on Demo and it looks promising.

dommech

ParticipantI’m using 1:500 with multiple 200-500 accounts

dommech

ParticipantI’ve had som sucess with GBPJPY not tried any other pair

-

AuthorPosts