Home › Forums › Ready-to-use Robots › Prop Firm Robots › Which are the Best Pairs this Week?

Tagged: #Propfirmrobots #Propfirm, EA Trading academy, FTMO 6.0, FTMO Robot, Performance Issues, prop firm robots app, telegram, USDJPY EAs

- This topic has 269 replies, 1 voice, and was last updated 6 months, 1 week ago by

Anonymous.

-

AuthorPosts

-

-

August 25, 2023 at 9:09 #215448

Anonymous

InactiveI don’t have much data forward test for the last week, because it opened very less trades, only few. That’s why I can’t tell which pairs are the top performance at this moment, this current market. So anyone can share the top 3 please. Thank you very much

-

August 25, 2023 at 9:09 #193202

Anonymous

InactiveHi all,

Three days ago I installed the 7 FTMO EA’s and didn’t change the settings and the lot size has stayed the same which is 1. I have been losing (-700.00) with 0ne or two wins. I also had a -1,117 hit to my account because the EA opened GBPCAD and didn’t leave a stop lose so this trade is red. My question is: Should I stop using the EA’s, Should I make some changes, or Should I increase the lots size from 1 to ?. This is a prop account and I was positive before the EA’s, so I have some room to turn things around. Thanks for the help,

Chris

-

August 25, 2023 at 9:29 #193454

Anonymous

InactiveHey Chris,

Glad to hear from you.

1. I updated the FTMO Robot with 7 versions, but this does not mean you have to trade all of them in 1 account but select which one you want to use. For example, you can put them all in one trial and follow the results. Check which ones bring the most profits and use it on your Challange or Funded account.

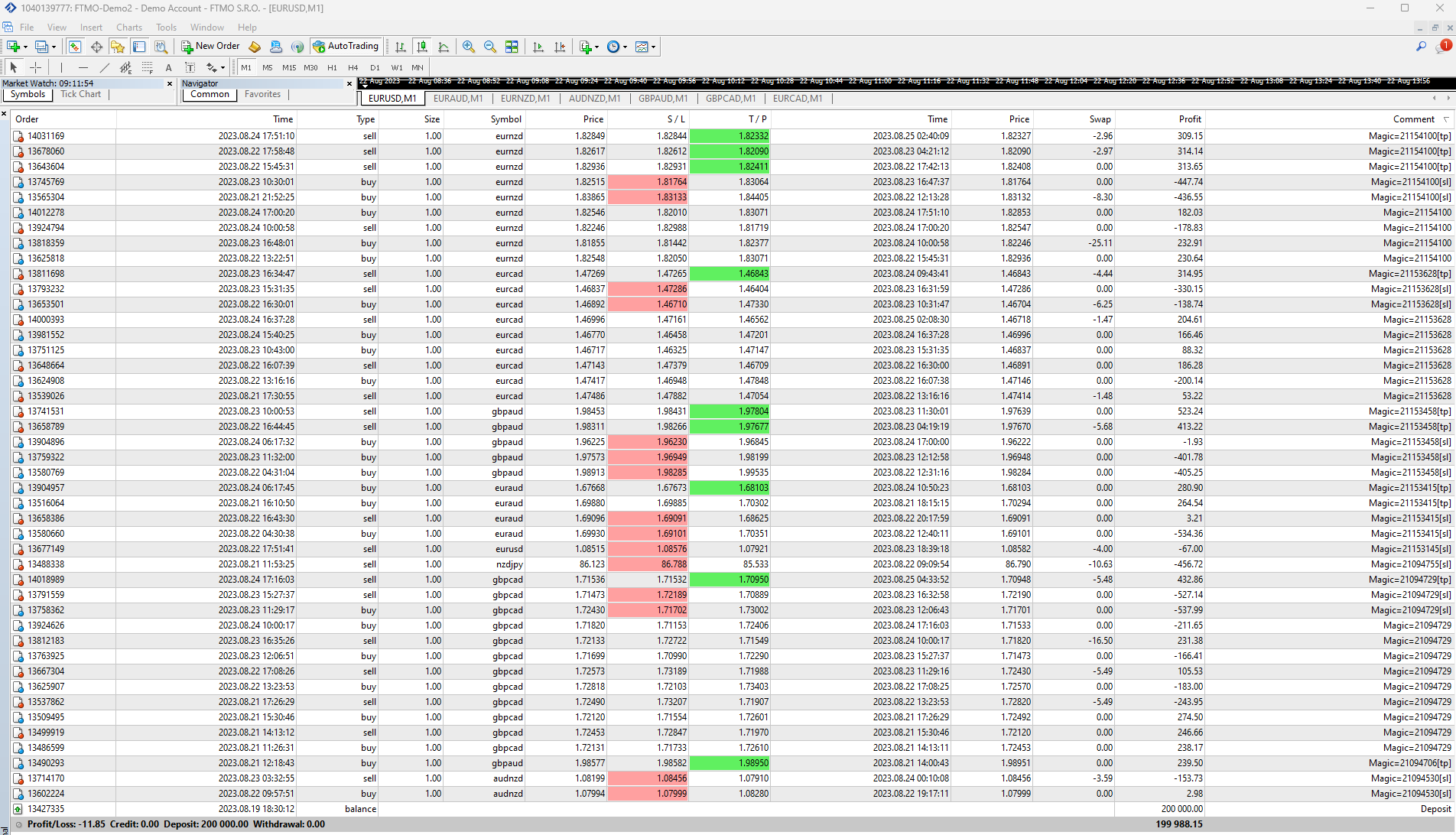

For example, here are all my recent trades where I am testing the 7 EAs (arranged by comments/magic numbers)

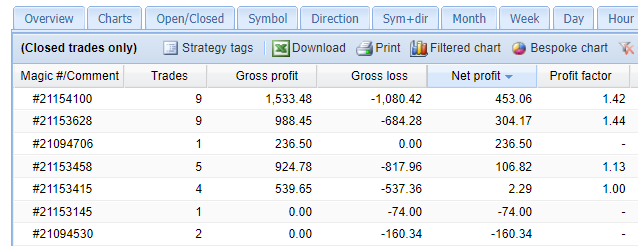

2. Then, what I would do is connect the account with FXBlue and see which EAs are most profitable:

In this case, I have 4 that bring profits in current market conditions. So I can pick 1 or 2 that I would trade on my challenge or FTMO-funded account.

At the moment the FTMO Robot for EURNZD is the top performer.

And I always combine with the scaling-up system I show in the FTMO Course.

3. All the EAs have SL, check the first screenshot.

But that is what I would do. It doesn’t mean you have to do it the same way. :)

-

August 31, 2023 at 22:24 #195152

Anonymous

InactiveHi,

Is the EURNZD still the best performer?

Thanks,

Janek -

September 2, 2023 at 8:05 #195460

Anonymous

InactiveHey Janek,

In the last few days of the week, it was the EURAUD. I recorded a video showing exactly how I manage it:

-

September 3, 2023 at 13:51 #195685

Anonymous

InactiveHi Petko,

Thank you for creating the video and answering here :)

-

September 16, 2023 at 11:05 #198885

Anonymous

InactiveHey Janek,

I appreciate it! I am going to add this video to the course since it turned out to be valuable indeed!

-

October 2, 2023 at 22:09 #202784

Anonymous

InactiveHi all,

These 7 bots have different Risk to Reward Ratios. Is that correct? The default EA’s when loaded?

AUDNZD 1 to 0.5

EURAUD 1 to 0.56

EURCAD 1 to 0.41

EURNZD 1 to 1.5

GBPAUD 1 to 1.85

GBPCAD 1 to 0.83

NZDJPY 1 to 0.44

Or do I need to change the RR to a 1 to 2 or 1 to 3?

Thanks

-

October 2, 2023 at 22:26 #202788

Anonymous

InactiveSorry to add, I’d these RR’s are correct I would need to modify my Lot sizes so that the max lot size is 1%?

-

October 3, 2023 at 11:30 #202856

Anonymous

InactiveI think what you are wanting to do is to limit the risk of account loss to 1%. This is done by a calculation based upon the account size, risk in percent, and the Stop Loss. All the EAs have their individual SL set to the required number of pips to equal an account loss of 1% so you do not need to change anything. All you need to do is set the lot size based upon your account size as follows:

200K Account: Amount for new position = 6.0 / Maximum position amount = 6.0

100K Account: Amount for new position = 3.0 / Maximum position amount = 3.0

50K Account: Amount for new position = 1.5 / Maximum position amount = 1.5

25K Account: Amount for new position = 0.75 / Maximum position amount = 0.75

10K Account: Amount for new position = 0.30 / Maximum position amount = 0.30

-

-

November 11, 2023 at 15:32 #211578

Anonymous

InactiveHi all,

starting a thread to discus which EAs we plan to use for the week. Please make sure you put what version and a quick reason why

-

November 11, 2023 at 15:34 #211579

Anonymous

Inactivepersonally I’m using

10k funded

v4.3 – EURAUD, EURUSD and GBPCAD. Overall last week made me 3% so hoping this carries on.

20k funded

V5 – EURUSD, EURAUD and USDCHF. Overall the backtesting results look very good so putting them on at reduced risk.

-

November 11, 2023 at 21:49 #211653

Anonymous

InactiveAwesome results, thank you for sharing… do you scale up the lots?

-

November 11, 2023 at 22:02 #211657

Anonymous

InactiveYeah so I scaled up but not as aggressively as recommended in case of risk

-

-

November 14, 2023 at 9:59 #212411

Anonymous

InactiveNice one Luke.

I am still testing V5. It is 50 50 my end. Still running on a 200k demo.We should set up a Discord Group.

Maybe share additional info etc.

-

-

November 11, 2023 at 16:40 #211598

Anonymous

InactiveI tend to agree for v4.3, although EURUSD drove most of the profit. I’m still testing v5.

-

November 11, 2023 at 17:23 #211608

Anonymous

InactiveThis is a great thread thanks for starting it.

I’m going to use 4.3v EURUSD not had enough trades on the v5s yet. I then will review it again Wednesday and hopefully chuck a v5 on to my 10k challenge.

Luke did you pass the funded challenges woth these robots ?

-

November 11, 2023 at 22:42 #211671

Anonymous

InactiveYeah passed phase one and now 1% up on phase 2 using the bots

-

-

November 11, 2023 at 20:58 #211637

Anonymous

InactiveWe need a telegram group be so much easier to discuss the robots etc …..

-

November 11, 2023 at 21:13 #211644

Anonymous

InactiveThe week ahead looks like it’s going to be very volatile due to lots of high-impact news… Do you guys trade during the news or not?

-

November 11, 2023 at 22:06 #211659

Anonymous

InactiveI am starting an FTMO 10K challenge on Monday using USDCHF and GBPAUD V5 with 1% risk for each asset. Will consider scaling up when account reaches 2% profit.

Alan,

-

November 11, 2023 at 22:11 #211661

Anonymous

InactiveI can put up a telegram group for us guys. Real small to start with, but I’d probably want to get prior authorization from Petko or Alan

-

November 11, 2023 at 23:15 #211680

Anonymous

InactiveI’ve joined lukes link above.

-

November 14, 2023 at 3:07 #212360

Anonymous

Inactivefor the version 4.3, it is strange that now the open trades have no SL. It was normal last week.

-

November 14, 2023 at 3:16 #212361

Anonymous

InactiveHi guys I just joined and set up the FTMO ea’s with the set files. Wondering if anyone has updated results; which pair/s are performing for you?

-

November 14, 2023 at 3:59 #212363

Anonymous

InactiveI just start V.5 this week, it is opening 3 trades now.

-

-

November 14, 2023 at 11:30 #212433

Anonymous

InactiveHello Team FTMO :)

I think a Telegram group is a great idea. We can continuously share best results. I recently joined, on the 9th of November. I have been running V5 on a VPS since then. Just makes sense to me to have a VPS, running my own PC all the time is not feasible, also execution times on the VPS are MUCH faster.

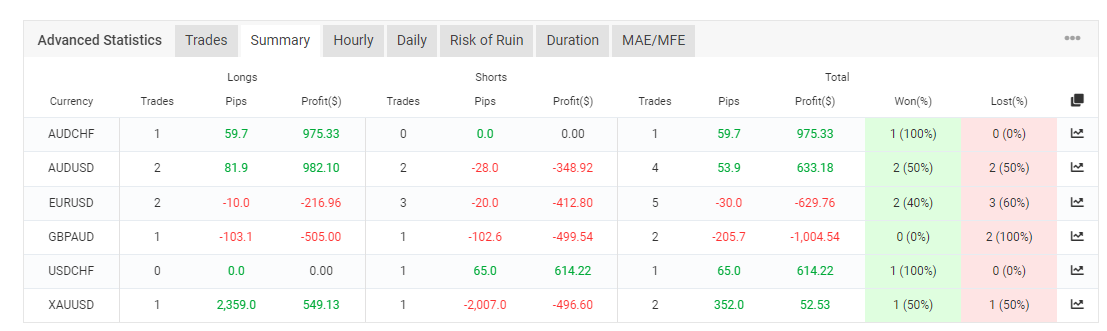

Since I activated the EA, V5, my results have been as follows:

Three closed trades:

EURUSD x 2: Both in profit

AUDUSD x 1: loss

Six open trades:

AUDCHF: in profit

AUDUSD: in small loss

EURUSD: currently in a big loss

GBPAUD: strong profit

USDCHF: strong profit

XAUUSD: strong profit

Planning on running the EA’s for the prescribed 10 days and then putting the most profitable ones on my current 10K account to test things out. Hopefully all goes well.

-

November 14, 2023 at 11:39 #212436

Anonymous

InactiveHas everyone just literally plugged V5 in and run with it? Just to test?

Or have people been back testing and amending?

I am not sure if we should make any amendments as the EA Trading Team have done all the hard work and supplied the set files.

I assume this is correct all?Thank you.

-

November 14, 2023 at 22:49 #212575

Anonymous

InactiveAny updates on todays trading?

-

November 15, 2023 at 11:11 #212698

Anonymous

InactiveI do nothing but use the set file.

-

November 19, 2023 at 22:18 #214483

Anonymous

InactiveHELLO EVERYONE. IM JUST WONDERING IF IS GOOD OR NOT TO RUN THE 8 ROBOTS AT SAME TIME TO START A 10K CHALLENGE. IM SCARED THAT MORE THAN ONE LOSE AND ACHIEVE THE DAILY DRAWDOWN. MAYBE THE EXPERIENCE OF SOMEONE ELSE CAN HELP ME

-

November 20, 2023 at 7:11 #214565

Anonymous

InactiveHello all

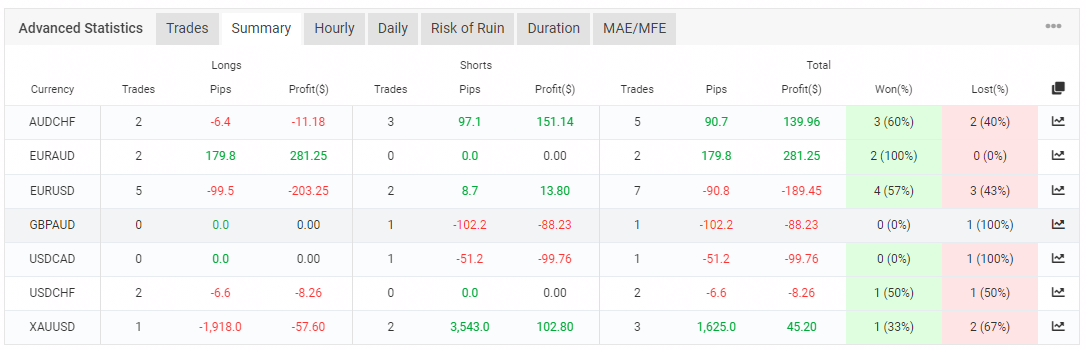

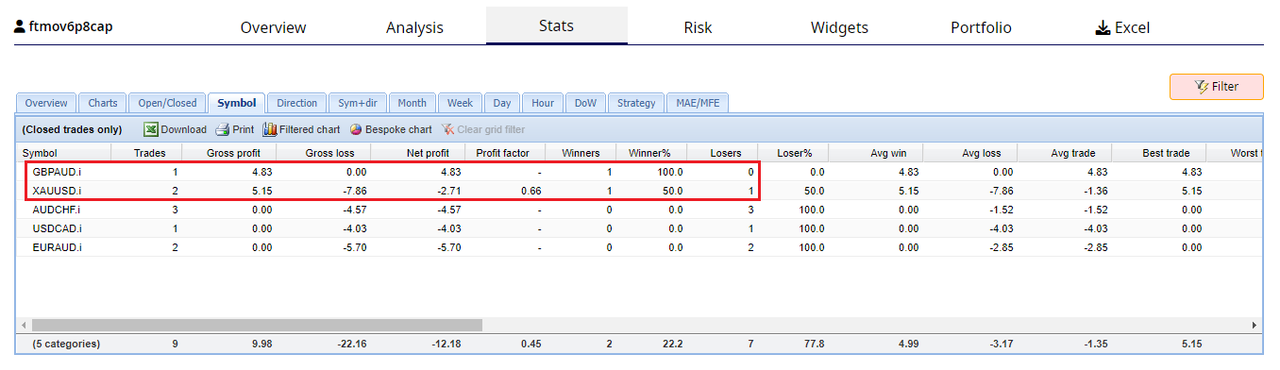

I asked this in another thread, but wanted to get the groups feedback. I have not moved any EA onto my live account. Been running on a test account for two weeks now. The EA’s started off performing great, but they have not been doing so great the past week. I am now unsure which one to use. For those running on version 5, what does your reults say, here is mine:

-

November 20, 2023 at 8:26 #214580

Anonymous

InactiveI have tested running 7 robots (except gold) on a demo account for 2 weeks with losing results.

However if I selected the 3 best pairs it give positive returns.I recommend to run them on demo first and test for yourself.

-

November 20, 2023 at 10:29 #214598

Anonymous

InactiveThank you I appreciate it. What are the 3 best pairs? And the ones to avoid ?

-

November 20, 2023 at 11:41 #214616

Anonymous

InactiveRun all 8 for two weeks. Then pick the top three most profitable. That is the process basically. Petko mentioned he now runs them on a three day period then picks the best ones. I do not see this working simply because the EA’s do not open a lot of trades. Either way. Activate all eight on your TEST account, NOT live account. Then pick the top ones for Live account.

-

November 21, 2023 at 0:48 #214781

Anonymous

InactiveOk and once you select three pair what is the surety they will work next week? So its mean we have to keep running 8 pairs forever on demo and keep switching according to the market situation. Thats my opinion. Appreciate if someone can correct me

-

November 21, 2023 at 11:24 #214875

Anonymous

InactiveYour results show that AUDCHF made the most profit but only with 1 trade. So you might want to give it a bit more time.

Also, the AUDUSD performed well with 4 trades.

Remember that these EAs are based on non-martingale systems, so there will always be stagnation periods.

As I’ve mentioned in another thread, if the EAs are in a losing phase, I don’t put anything on the challenges but wait for the next profitable run.

Cheers,

-

November 21, 2023 at 21:40 #215024

Anonymous

InactiveHey, what are the top 3 best performing bots for this week to turn on since I bought the bot a couple of days ago?

-

November 22, 2023 at 15:12 #215177

Anonymous

InactiveHi Malik,

There is no guarantee that if an EA is profitable today, it will be profitable tomorrow. It is determined entirely by the market. As Nicholas has said, and you mentioned too, you should keep all 8 on a demo account, link your demo account to a website like MyFXBook (Check out this video: https://youtu.be/H19yWrotTVg), and monitor the performance, even daily, putting only currently profitable EAs onto your challenge account.

Cheers,

Ilan

-

November 22, 2023 at 17:35 #215211

Anonymous

InactiveYes, I wanna know as well.

-

November 22, 2023 at 17:46 #215212

Anonymous

InactiveHe guys,

I have some question before I turn on Algo Trading with the EA’s. Hopefully you can answer them.

1) First question is: what are the top 3 best performing pairs right know. I installed the EA’s on a demo, but since Monday so I don’t have enough results, but I would like to start with my 100K Funding Pips account (challenge).

2) If I trade the best 3 performing pairs, is it necessary to decrease the risk, or are the normal setfiles enough for the top 3? So let’s say the top 3 are: Gold (o,49 lots), EUR/USD (3,87 lots) and USD/CHF (1,78 lots). Can I just rely on these setfiles given lot sizes, or do I have to decrease them since I’m using 3 of them?

3) When there is news, especially red USD folder news, do I always have to close all positions? And when im not at home, it’s difficult to turn off Algo trading. Does the EA’s have a setting it won’t place any trades in the radius of like 30 minutes around news, or is the Algo trading turn off a must?

Thanks in advance!

-

November 22, 2023 at 17:58 #215215

Anonymous

InactiveEurusd for me

-

November 23, 2023 at 0:33 #215289

Anonymous

InactiveYou have to test the 7 EAs+Gold EAs and see which one performs best currently, we can’t say which is the top performer because tomorrow it may not be.

-

November 23, 2023 at 7:33 #215348

Anonymous

InactiveThis is such a crappy answer…my goodness. So we switch on a robot that was a top performer for the past two weeks. BUT tomorrow it may not be. This is ridiculous…

-

-

November 23, 2023 at 0:43 #215291

Anonymous

InactiveHello Lucas, straight to your questions.

1) You have to test the 7 EAs+Gold EAs and see which one performs best currently, we can’t say which is the top performer because tomorrow it may not be.

2) If you use the default set files then it’s okay to trade with 3 EAs. The set files will allow a maximum daily drawdown of 1% per robot. If you want to be on the safe side, you can additioanly decrease the lots. For example if you want to have no more that 1% daily drawdown then you would need to divide every lot by 3 becuase you have 3 EAs running.

3) It is a personal choice if one will close trades manually. But personally we do not close trades during news. We are working on implementing the news into the EA.

Kind regards,

Marin @ Customer Support team

-

November 23, 2023 at 7:55 #215353

Anonymous

InactiveYou wont get assistance on this. I have asked. I keep on getting responses basically sating I have to keep on testing someone elses robot until I get a “winner” and even then I am told, this might not work. As per the response from Marin.

-

November 23, 2023 at 16:15 #215456

Anonymous

InactiveWe all have the same problem…I have been running a an FTMO test for 3 weeks, no clear winners and very few trades opened. Hopefully I will get somewhere soon with this. The only answer you will get from the team here is that “you need to test” they do not seem to be willing to help us with the top EA’s on a weekly basis.

-

November 23, 2023 at 17:22 #215483

Anonymous

Inactivethat is not good at all

-

-

November 23, 2023 at 17:30 #215485

Anonymous

Inactivedo i have to change the top performers every week or every monday? and i think their should even more detailed video of this robot, a lot of key pieces are missing

-

November 24, 2023 at 9:41 #215668

Anonymous

Inactiveanyone pass FTMO with the previous version?

-

November 24, 2023 at 22:31 #215832

Anonymous

InactiveHe,

I am running the EA’s on a demoaccount, and now it’s Friday. So im wondering do we have to close the trade(s) before the weekend, or if the EA have an open trade, let it stand over the weekend, and wait for it to close itself the next week?

Thanks in advance

-

November 25, 2023 at 10:01 #215902

Anonymous

InactiveHi,

I’ve just left mine open, did the same last week.

Cheers,

Anthony

-

November 25, 2023 at 11:23 #215910

Anonymous

InactiveHey guys i am after a few opinions here, particularly from anyone has been algo trading for some time, do you believe it is better to move the stop loss? so far i have been waiting for clear structure on the 1 hr timeframe and moving my stoploss a few pips above or below the structure and I have been profitable 2 weeks in a row with v5 robot and my win loss is better then backtested results however i am concerned that i am basically running a different strategy to the backtest. How have you guys been managing your stops and or early closes?

-

November 26, 2023 at 12:02 #216133

Anonymous

InactiveClosing EA’s on Friday is a personal choice. What I do is as follows: If my EA’s are in profit and heading upward towards TP, I will leave them open over the weekend. However, if my EA’s are in losing positions and heading downward towards SL I will close the positions and let them start new trades the following week.

Alan,

-

November 26, 2023 at 15:37 #216171

Anonymous

InactiveEA’s created by EA Studio, FSBpro, or ExpressGenerator, place the SL and TP at particular price levels because in their backtesting these are the price levels where the EA generate the most profit over the backtesting time frame. It is therefore my opinion that SL and or TP should not be moved.

Alan,

-

November 26, 2023 at 16:47 #216190

Anonymous

InactiveHello,

if you choose for example just 1 pair to trade on the FTMO account, do reccomend to increase the lot size or leave it like in the set files, so a losing trade would make -1% of the account?

BR Luce

-

November 26, 2023 at 23:02 #216265

Anonymous

InactiveYou could increase the lot size to 2%. I my opinion, 3% or more would incur too much risk!

Alan,

-

December 5, 2023 at 15:19 #219138

Anonymous

InactiveHello everyone,

I just wanted to recommend 2 forex pairs that made a big profit this week. AUDCHF and EURAUD

I used the built-in settings on a 100K account

Good luck to everyone! -

December 7, 2023 at 10:46 #219471

Anonymous

InactiveHello,

I’m having issues with the installation of the ver5.1 on mt5, every time I load the robot on the 4th chart it will automatically remove the robot on the 3 chart that were the robot was loaded. it will keep removing other charts with the robot. Any help is highly appreciated.

Thanks

-

December 7, 2023 at 12:51 #219484

Anonymous

InactivePetko just published a video on how to install FTMO V5.1 robots and how to use them. Here is the link address:

Alan,

-

-

December 8, 2023 at 10:35 #219644

Anonymous

InactiveI like that topic. Everyone can share which assets are most profitable daily or weekly!

-

December 8, 2023 at 19:48 #219750

Anonymous

InactiveNice topic. My demo didn’t work this week for some reason. So what are some of your thoughts on pairs to turn on for next week?

-

December 11, 2023 at 10:33 #220142

Anonymous

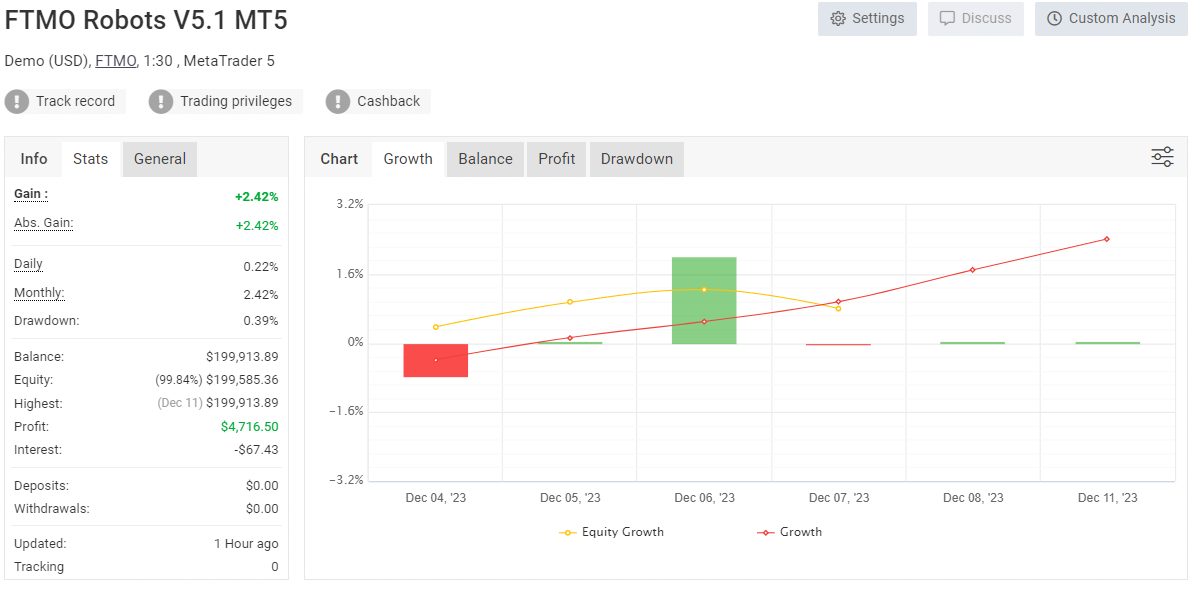

InactiveWEEK 2 – DEC – 2023

Good morning, traders!

This is what I see today:

And the top FTMO Assets during the last one week:

-

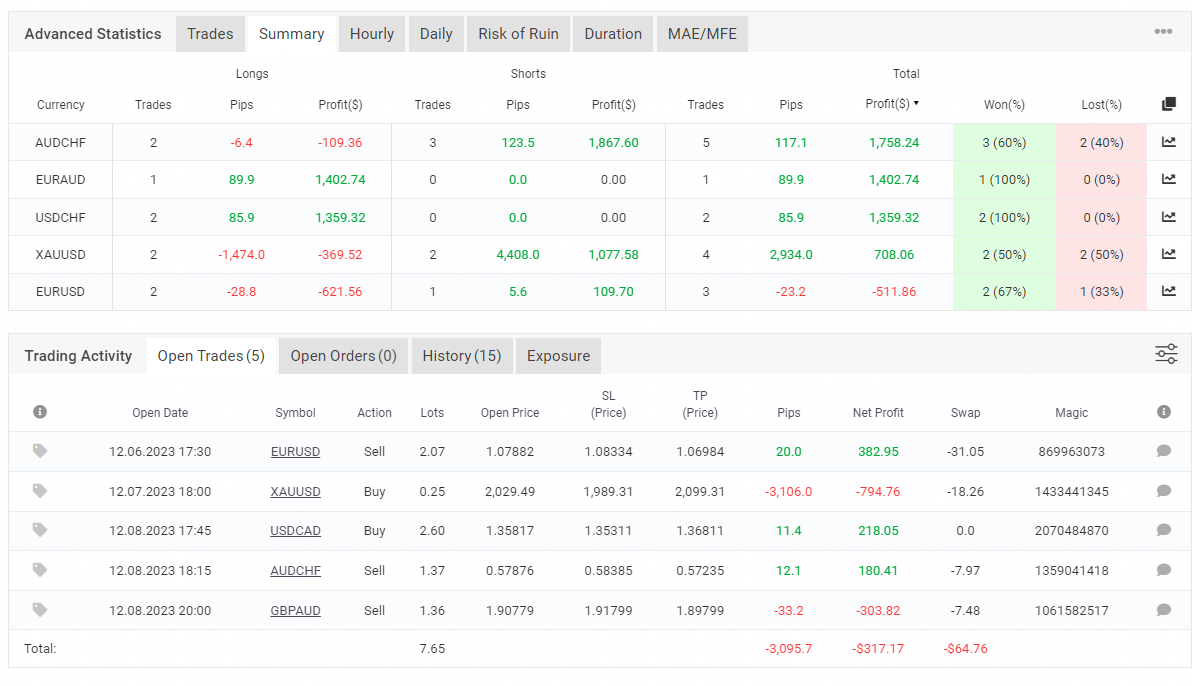

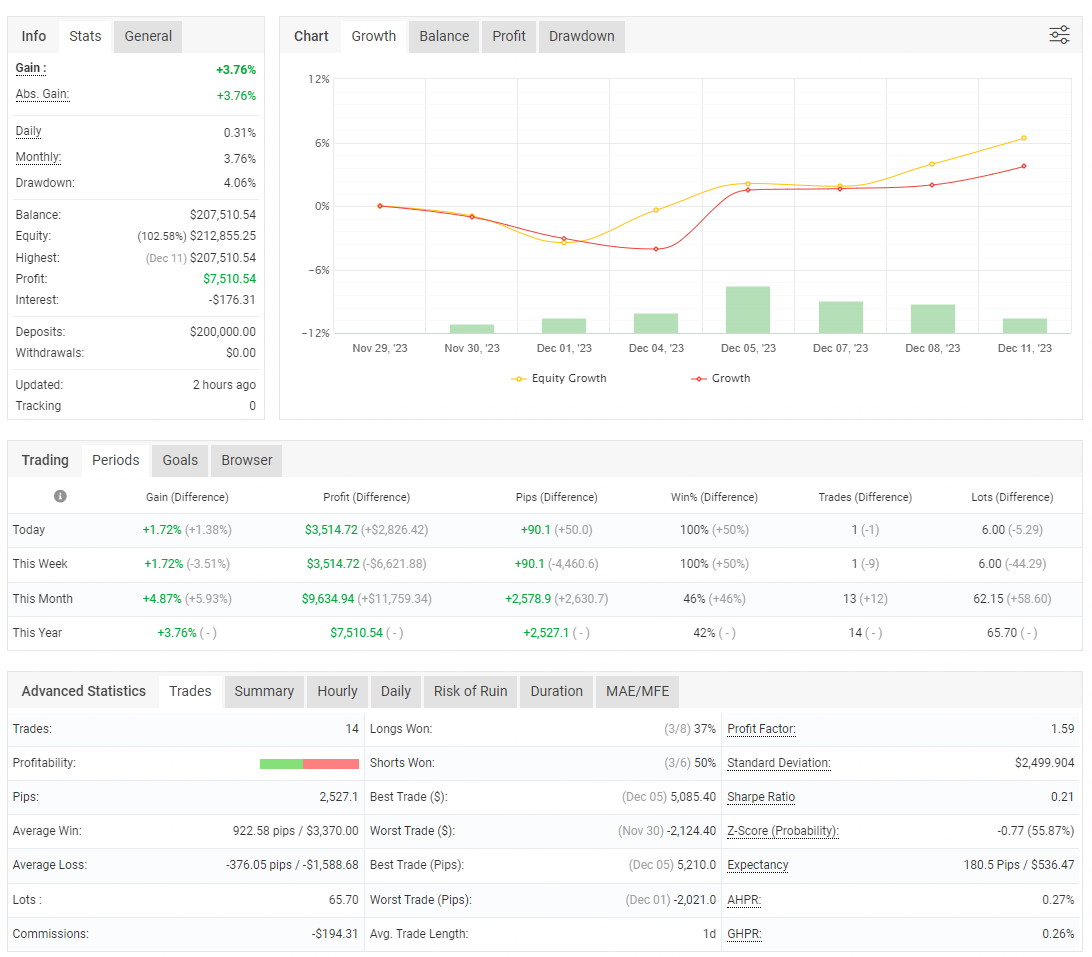

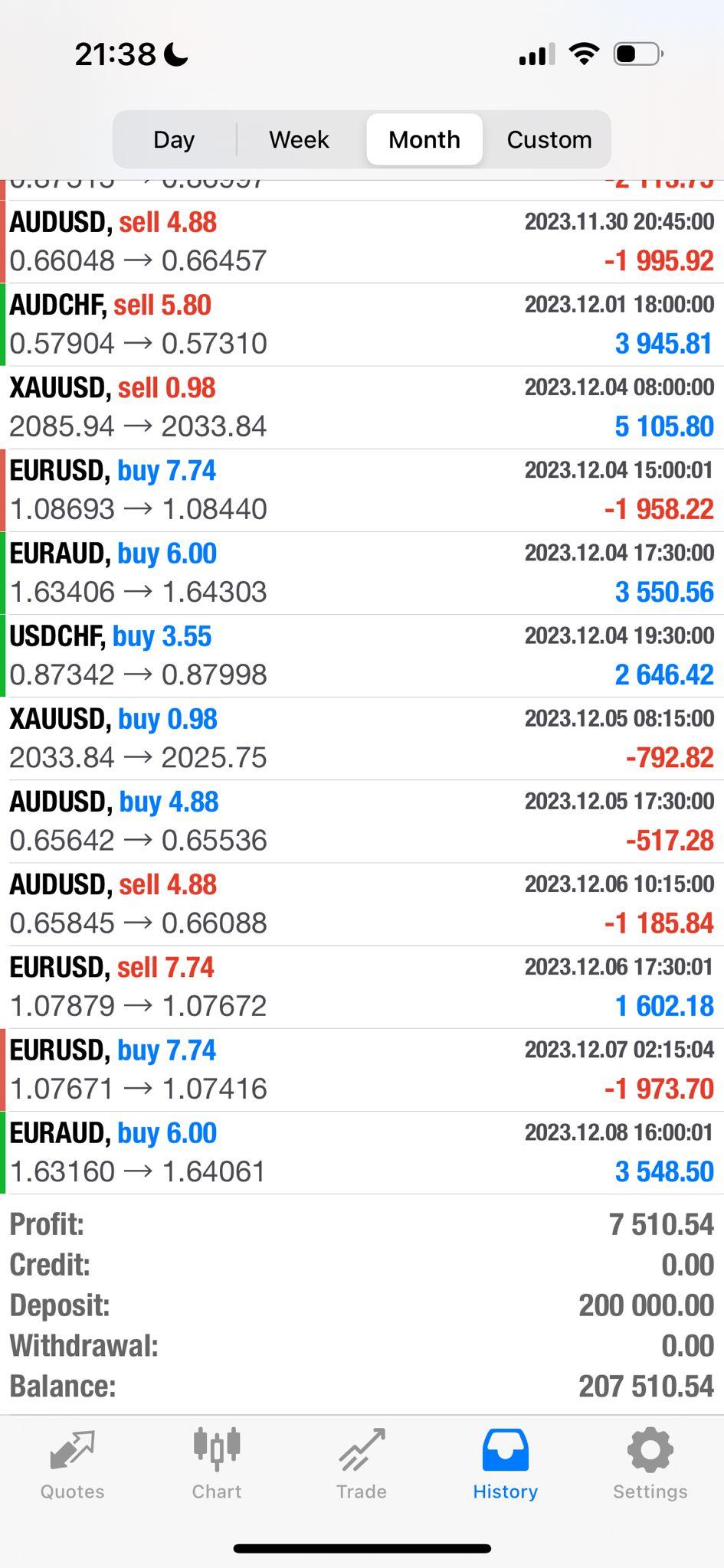

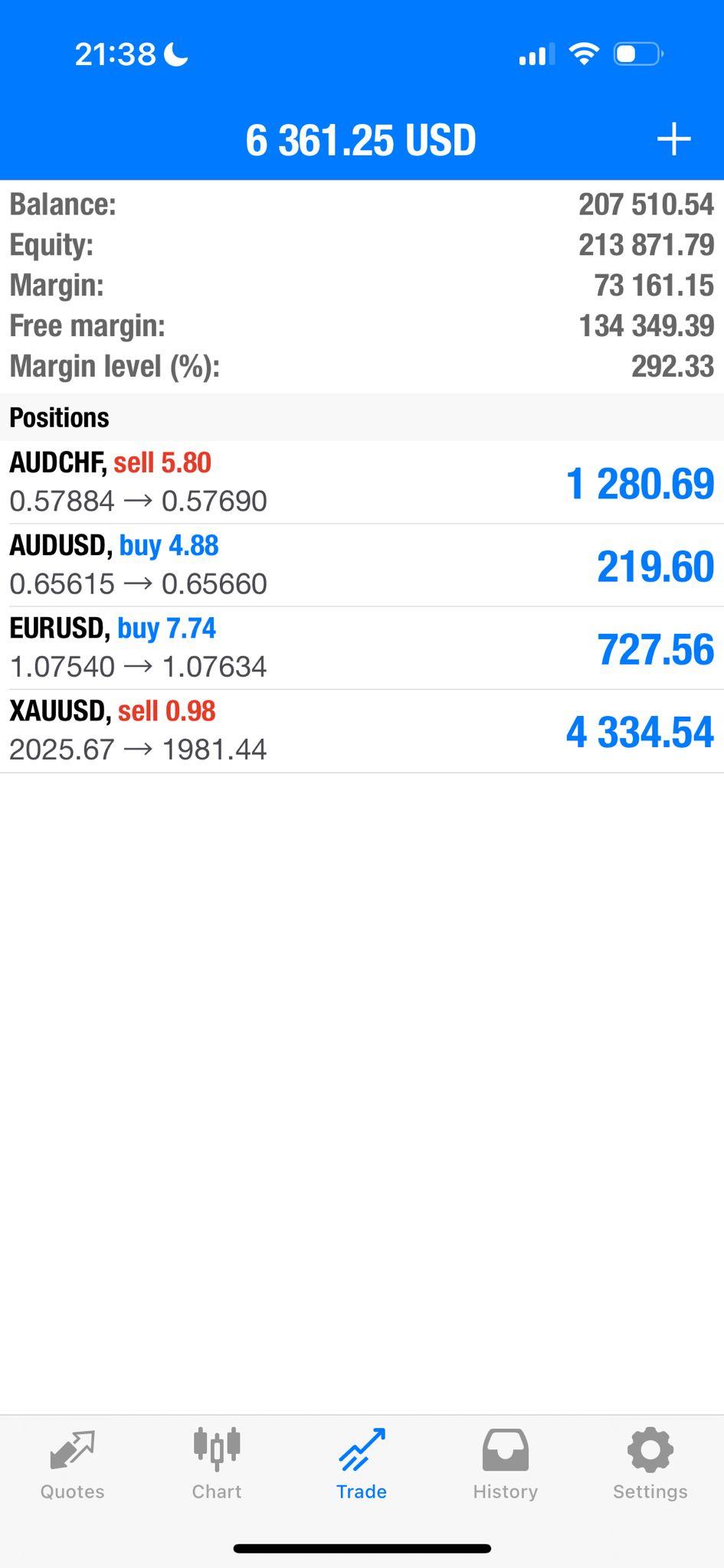

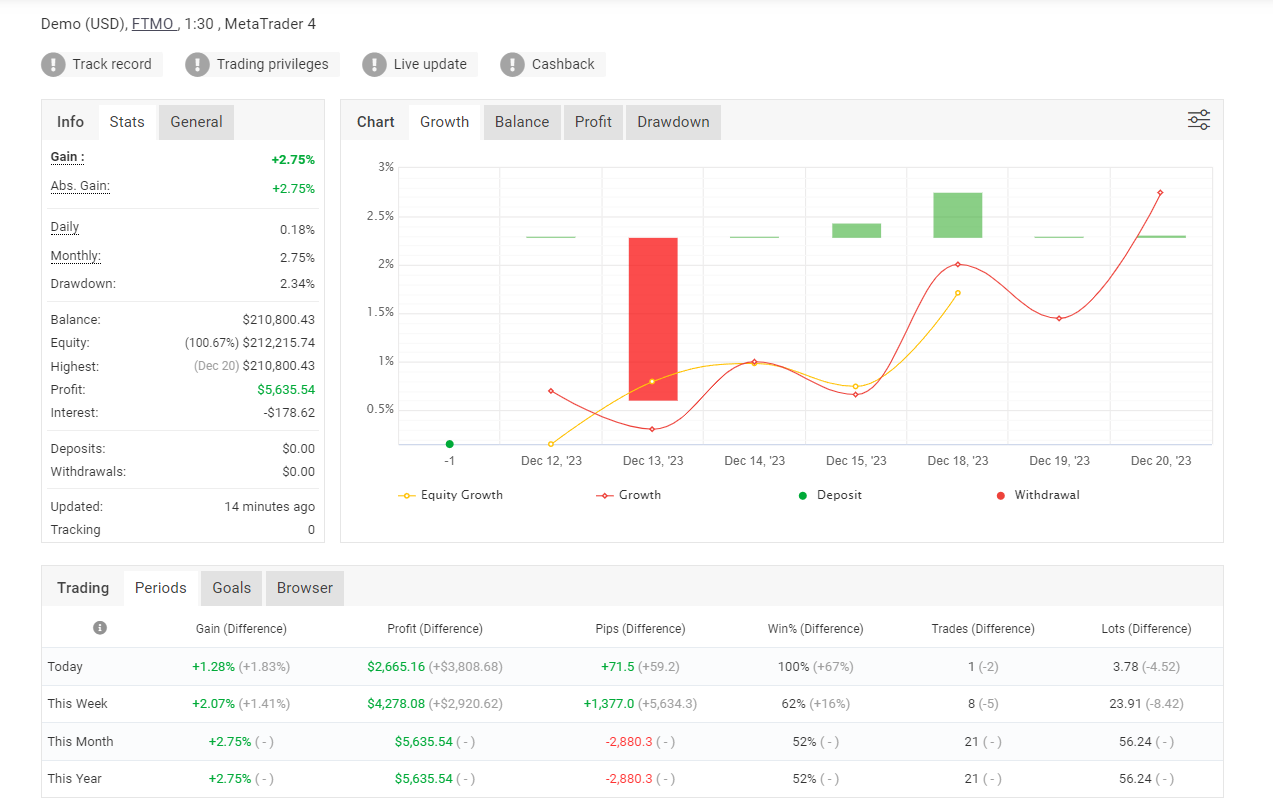

December 11, 2023 at 22:37 #220244

Anonymous

InactiveHi all,

Im a very satisfied with the performance of the V5 EA. I am running al 7 pairs + gold on a 200k demo account. And the equity is 213k at the moment. I did not change any settings, just loaded the 200k settings etc and let it run on a VPS.

At first it got a drawdown but now it is going good. I am going to transfer it on a 20k live account. I will run all pairs and I dont mind if I lose the account, but I personally do not think the EA will lose the challenge. I am going to try to finish the first FTMO challenge on a Live 20k account. Will keep u guys updated.

See screenshot for the results.

-

December 11, 2023 at 22:40 #220245

Anonymous

InactiveHere a some more screenshots of the account right now.

-

December 11, 2023 at 22:40 #220246

Anonymous

InactiveLast screen

-

December 12, 2023 at 8:17 #220287

Anonymous

InactiveRunning 5.1 for 11 days now on testing, these are the results:

-

December 17, 2023 at 18:55 #221192

Anonymous

InactiveNicola – How are the results so far for 5.1? It must have been 20 days now. Aer you putting the EA in live account ?

-

-

December 13, 2023 at 21:54 #220590

Anonymous

InactiveBonjour, j’aurais aimé savoir comment choisir la meilleure paire chaque semaine ou toutes les deux semaines avec le robot ftmo V5.1, car il ne prend pas beaucoup de positions et parfois, la paire gagnante change et je fais plus de profit avec toute les paires que juste choisir la meilleure paire comment faire alors pour diminuer le risque et réaliser un bon défi.

-

December 13, 2023 at 21:54 #220592

Anonymous

InactiveHello, I would like to know how to choose the best pair every week or every two weeks with the ftmo V5.1 robot, because it doesn’t take many positions and sometimes the winning pair changes and I make more profit with all the pairs than just choosing the best pair how to do then to decrease the risk and achieve a good challenge.

-

December 13, 2023 at 23:33 #220600

Anonymous

Inactive<p style=”text-align: left;”>Good evening everyone, how can we deal with the robot during these days when many reports are issued and influence the robot to enter into more profitable deals? Because I noticed last week, through my experience with the robot, that it was giving me good profits compared to this week, in which it seemed that it was no longer able to identify profitable trades, to the point that almost all trades consisted of losers.</p>

<p style=”text-align: center;”>Is there any solution I can do to avoid losing trades?</p> -

December 17, 2023 at 12:36 #221138

Anonymous

InactiveHello together,

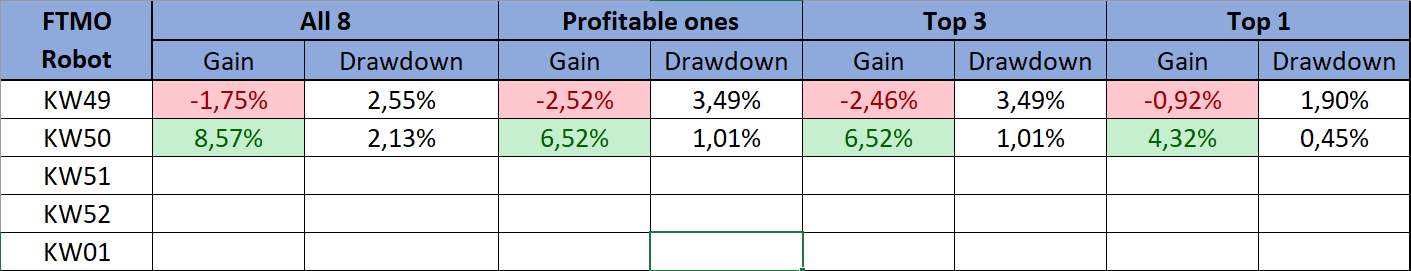

these are my results so far with the FTMO Robot V5:

(always taking the results of the last week as suggested)

BR Luce

-

December 17, 2023 at 13:02 #221145

Anonymous

InactiveHi Luce,

Nice!

Are you demo testing on FTMO demo account?

Is this V5.0 or V5.1?Alan,

-

December 17, 2023 at 16:04 #221171

Anonymous

InactiveHello Alan,

i am testing it on an demo account on an VPS with the FXView broker.

Its V5.0

BR Luce

-

December 17, 2023 at 17:00 #221179

Anonymous

InactiveThanks!

Please keep us informed of your results as I think traders would find it of value. It also shows that not all weeks will be profitable, however over time the majority of weeks should show profitability. :o)

Alan,

-

December 17, 2023 at 17:23 #221182

Anonymous

InactiveHello Alan,

i will try to post the weekly results every weekend.

BR Luce

-

December 17, 2023 at 17:29 #221183

Anonymous

InactiveHi BR Luce,

One more thing I forgot to suggest. If you are going to eventually open an FTMO Challenge you should also test on the FTMO demo account so you can compare the results between your brokers server results and the FTMO server results. Sometimes I see significant difference when demo testing on one server and live trading on another. I have even experienced different results when demo testing on a broker and then live trading with the same broker using the same EAs.

Alan,

-

December 17, 2023 at 20:44 #221216

Anonymous

InactiveHello Alan,

isnt the FTMO Demo just aviable for a few days?

Luce

-

December 17, 2023 at 20:49 #221217

Anonymous

InactiveThe FTMO demo is good for 14 days. So you could get 2 one week results. Then you can start a new FTMO demo account and repeat.

Alan,

-

-

-

-

-

December 18, 2023 at 0:07 #221255

Anonymous

InactiveFrom the results, it shows that running on all 8 gets better gains compared to running on selected top performers for both weeks. This is a bit surprising as we are taught to pick the top 3 or top 1 performers to run the EA.

I am not sure if I am mistaken or missing something here.

-

December 18, 2023 at 0:24 #221257

Anonymous

InactiveIts not always the case. The chart above is only the results of two week testing using only one broker. What you need to base the trading decisions on is many weeks, months, years of testing with many different brokers, then you can determine the best way to trade. Thus the teaching of Petko is based upon years of trading. By choosing the top 1 to 3 EAs will provide the best results over the long term.

Alan,

-

December 19, 2023 at 23:20 #221549

Anonymous

Inactive<p style=”text-align: left;”>Thanks Alan, I appreciate the clarification and tips. Cheers.</p>

-

-

-

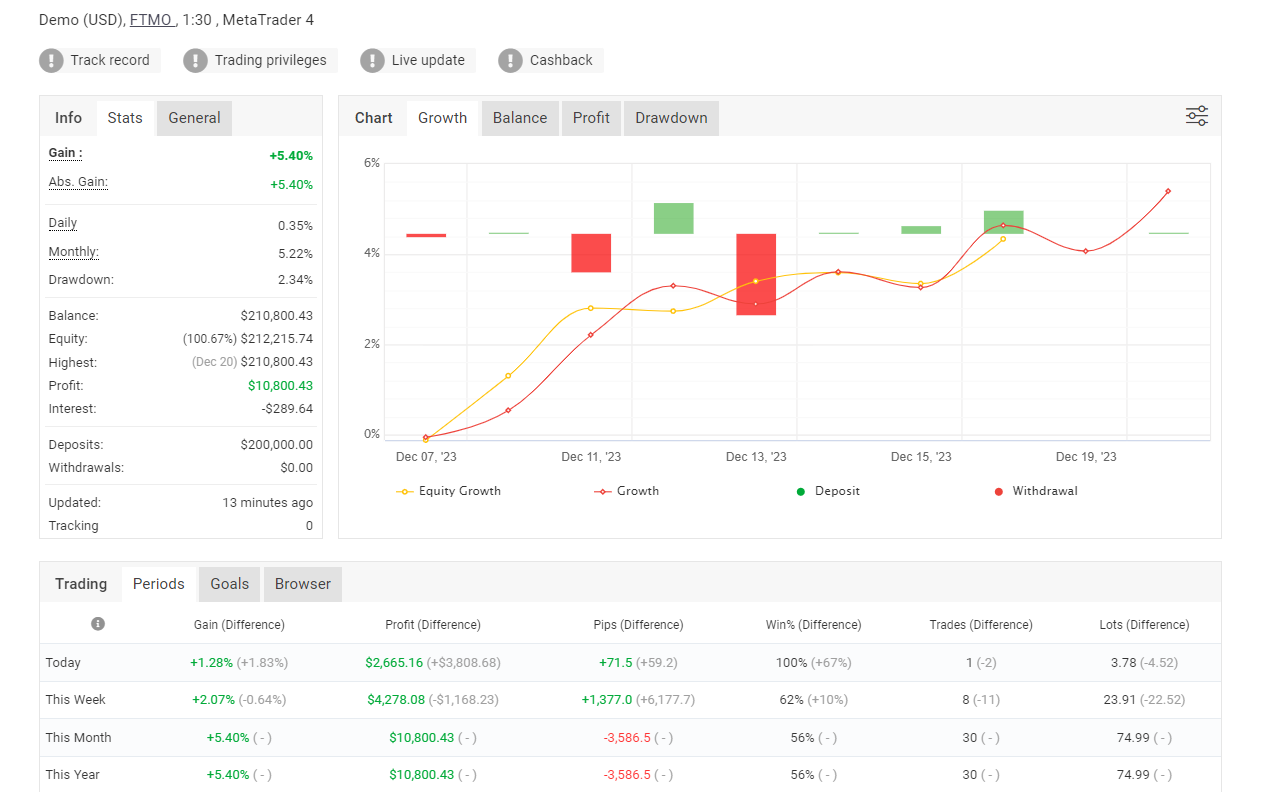

December 20, 2023 at 9:06 #221658

Anonymous

InactiveWEEK 3 – DEC – 2023

Here are the results I saw this morning:

The trial account passed (it reached 5%):

Here are the performances for the last 1 week:

And here are the results for the last 2 weeks:

I would probably trade until the end of this week, and I will pause trading between the holidays (but that’s me).

I know many of you want us to provide the link to the testing account and save you the testing, but there are a few problems:

1. Once the trial passes, we must start a new account – we need one week to collect data in the new account. Traders who started in this period won’t have data to use.

2. It turns out that the results are different for the different prop firms. We tested the FTMO Robots on 5 different prop firms, and surprisingly, the prop firms offer very different quotes, which leads to different trades. This is why if you follow our FTMO Trial results but apply the best performers on Infinity, for example, you will not achieve optimal results.

3. Using myfxbook will always lead to some delay.

So what is the solution?

We are working on updating the FTMO Robots so the results will be displayed on the chart. This means that once you put the EAs on MetaTrader, it will start collecting the statistics.

We will also be able to select the period in days. For example, we will see the results for the last 1 week or any predefined period.

And this will be on the chart itself (where the stats are currently with V5.1).

But I can’t promise when this update will be ready because it requires much work.

However, the January update is ready! Which is huge! :)

Cheers,

Petko A

-

December 20, 2023 at 10:29 #221676

Anonymous

InactiveThat’s great!

-

-

December 29, 2023 at 0:46 #223305

Anonymous

Inactive<p style=”text-align: left;”>Certainly not the eurusd anyway this week, 500 loss so far in just 2 days on test account, gold at 250 loss and gbpaud up 250 so far. But demo account down 500 in total over 2 days</p>

-

January 12, 2024 at 16:46 #226504

Anonymous

InactiveHi Guys,

I just started using the FTMO robot this past week. The number of trades I got is much lower than what I expected based on the youtube videos so I am here to check if you guys also got so few trades this past week as me or maybe something is wrong with my settings. I understand different market conditions may play a role in the number of trades but still I would like to double check because my results are suspiciously low.

So far this week I had the following trades:

XAUUSD 2 trades, losers

GBPAUD 1 trade, loser

EURAUD 1 trade, winner

USDCHF 1 trade, loser

USDCAD 1 trade, loser

Currently open: AUDCHF, USDCAD, XAUUSD

Please let me know if you guys have similar results or not. Any troubleshooting ideas are welcome but I checked the timeframes and other settings multiple times.

Kind Regards,

Bence

-

January 12, 2024 at 17:05 #226511

Anonymous

InactiveHi Bence,

This is also what I am getting.

Alan,

-

January 12, 2024 at 17:24 #226519

Anonymous

InactiveHi Alan,

Thank you for the response. Much appreciated.

Is this number considered normal/average or are we in a relatively slow period right now?

Bence

-

January 12, 2024 at 18:31 #226526

Anonymous

InactiveHi Bence,

The reason the FTMO V6.0 robots don’t take trades as often as we would like is because the robots contain six indicators that all have to lineup to give a buy or sell signal. So it takes time for all these indicators to align themselves. The theory behind having so many indicators is that if it takes many indicators to line up and give a trade signal then the higher quality of signal it should be. Robots with fewer indicators would obviously take less time for the indicators to line up and give a trade signal. So I would not be disappointed the robots do not take trades as often as we would like, we should be pleased the signals from the FTMO V6.0 robots are providing high quality trades.

I might add that even though these robots provide high quality trades it is still possible for these indicators to close with a loss. Why is this? There are two types of indicators, indicators that provide profitable trades when the market is trending, and then there are those indicators that provide profit when the market is ranging. So there are trending type indicators and there are ranging indicators. Trending indicators will generally end up losing in ranging markets and ranging indicator will generally end up losing when the market is trending. Now beware that every trading day will provide trending periods and ranging periods. This is why we will get profitable trades and losing trades. Further sometimes ranging markets can last for several days or several months. This is why it is beneficial to demo trade as it will help us to understand if the markets are trending on a weekly basis so we can determine if the current market environment will allow our robots to generate profits. So with good quality robots there should be more profitable trades than losing trades which will then provide a profitable account.

Alan,

-

January 12, 2024 at 18:59 #226532

Anonymous

InactiveHi Alan,

Thanks again for the thorough response. Of course I agree with everything that you said.

The reason I asked is simply because when I watched a recent youtube video in which Petko showcased his last week’s trading results and there were up 9 trades per currency pair. So I was surprised to find only so few trades in my own trading. But of course I understand about trending and ranging markets. I also understand what you mean by having 6 indicators.

My only question is: Is the new V6.0 robots expected to have less trades than the previous versions or was this week a bit slow in fact?

Either way, please don’t take this as a complaint. I am just eager to understand what to expect.

Bence,

-

January 12, 2024 at 19:25 #226539

Anonymous

InactiveHi Bence,

I haven’t watched Petkos’ video but if the results were from last week and not this week I would expect somewhat different results.

As to whether this week was a slow week or not I cannot answer. I don’t know if you can call it a slow week or not but it could just be that the trending and ranging periods didn’t last long enough for all the indicators to line up during certain periods of this week. Maybe not a slow week but there could have been more trending and ranging periods than the previous week but they didn’t always last long enough for all the indicators to align. Just my thoughts.

Also, no worries. I don’t take your response as a complaint.

I am spending this week testing the robots. I am looking for a top performing robot with at least 3 to 5 closed trades before I will start trading it. It doesn’t look like this will happen this week so I may have to wait a few more days.

Alan,

-

-

January 13, 2024 at 10:26 #226630

Anonymous

InactiveHello all – just sharing my best pairs to trade.

For V6.0, my best pair of last week is – AUDCHF and USDCAD (Both at M30 timeframe).

This is for FTMO Trial.

What are your best pairs for last week and which broker?

-

January 13, 2024 at 14:04 #226646

Anonymous

InactiveHi Sammy,

When did you start the trial. I started testing the FTMO robots on 01/08/2024 on an FTMO Challenge instead of the demo account and my best two pairs are AUDUSD and USDCAD. So I would like to compare the difference between the demo account and the challenge. I find it interesting one of your best pairs is AUDCHF where mine is AUDUSD. Can you also provide the net pips for AUDCHF and USDCAD. Unfortunately as of this last week traders in the US can no longer use the FREE FTMO demo account so I am not able to compare the difference between the demo account and the challenge. Could you also show the results of all the robots for this last week?

Thanks,

Alan

-

-

January 13, 2024 at 16:06 #226658

Anonymous

InactiveHi Traders,

When sharing your FTMO robot results for the week please share the following:

1. prop firm / broker you are using

2. your account size

3. FTMO robots version (v5.0/v6.0/etc)

4. your risk o.o5%, 1.0% or 2.0%.

5. number of trading days

6. your trading resultsThis is necessary so when others are looking at your results and comparing them to their own results they will have a better understanding as to why their results may differ from yours.

Thanks,

Alan-

January 14, 2024 at 19:39 #226853

Anonymous

Inactive1. prop firm / broker you are using – FTMO Trial (not real challenge)

2. your account size – $10k

3. your risk o.o5%, 1.0% or 2.0%. – Medium 1%

4. number of trading days – 2 weeks

5. your trading results – Loss but two trades are still open so Equity is $10068.00 ; AUDCHF and USDCAD

-

-

January 14, 2024 at 17:44 #226833

Anonymous

InactiveI´ve been testing the 8 versions of FTMO 6.0 for the last week (Jan 8 to Jan 12 – 5 trading days) with 1% risk on a € 10K FTMO Demo … the results of the closed trades are:

– 5 trades, all negative, two losses of 1% (well in US$ anyway) and three small to very small losses

– 3 open trades

so no EA qualifies to be put on a live account for next week …

-

January 15, 2024 at 9:55 #226949

Anonymous

InactiveHi Rafael

Is your equity is negative as well apart from loss ? I am wondering if one can close open trades if the equity is positive and then risk those pairs for live challenge account.

-

-

January 14, 2024 at 17:52 #226834

Anonymous

InactiveI seem to have a very different outcome … I used the 8 EAs for the whole week on a FTMO Demo and got this results:

closed:

– AUDCHF none

– AUDUSD none

– EURAUD none

– EURUSD none

– GBPAUD one loss (1%)

– USDCAD none

– USDCHF two losses (one at 1%)

– XAUUSD two losses (both very small)

open

– same as original poster

I used the news filter … what could have been other differences?

-

January 14, 2024 at 18:08 #226837

Anonymous

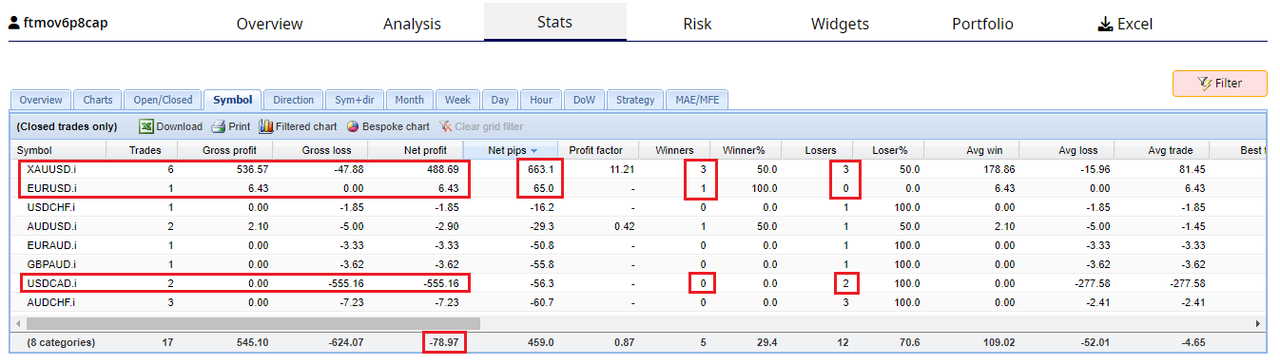

Inactivei tested the old startegy by running all 8 bots on an ftmo trial 25k account before V6 came out. I ran the trial from the 26th of Dec till 10th Jan. Here you can see the results. So for that period AUDCHF, EURAUD and USDCHF would have been the 3 to try on a challenge. I shall try version 6 now.

-

January 15, 2024 at 10:37 #226957

Anonymous

InactiveEURAUD is on fire, if it’s hot, it can be hot for quite a while.

-

January 15, 2024 at 11:54 #226967

Anonymous

Inactive@SammyTrader

the open trades have a positive balance but rather small … all in all they wouldnt amount to having a robot a profit factor of 1.2 or above … so I wouldnt use these robots for the live account …

-

January 15, 2024 at 16:34 #227016

Anonymous

InactiveThanks Rasa , my feelings are same. Only take the EA that has delivered the results after closing trade.

-

-

January 15, 2024 at 19:06 #227045

Anonymous

Inactivei am using euraud m15, gbpaud m30 and usdcad m30, since yesterday, i have the smiley face and no errors in the journal tabs. The bot hasnt taken any trades yet, so wanted to confirm if anyone has trades on the pairs i have listed?

These are the top 3 bots from the robot app

-

January 15, 2024 at 19:52 #227054

Anonymous

InactiveIf you say that you started yesterday, it means that today is the first day of trading.

I test the robots on two accounts with different brokers and today I have only one trade open, with each of them, on USDCHF, but several hours apart.-

January 15, 2024 at 22:06 #227083

Anonymous

InactiveDo you see much difference between the two brokers

-

January 15, 2024 at 22:16 #227087

Anonymous

InactiveYes, big differences.

Robots must be tested very well at your chosen broker. At different prop firms or brokers you will have different results.Anyone here can confirm for you. I have two challenge accounts on a VPS and I run robots continuously on both and that’s how I see the differences.

-

-

-

January 15, 2024 at 20:40 #227067

Anonymous

InactiveSmiley Face, Are you using V6.0 ?

-

January 15, 2024 at 22:04 #227081

Anonymous

InactiveYes version 6

-

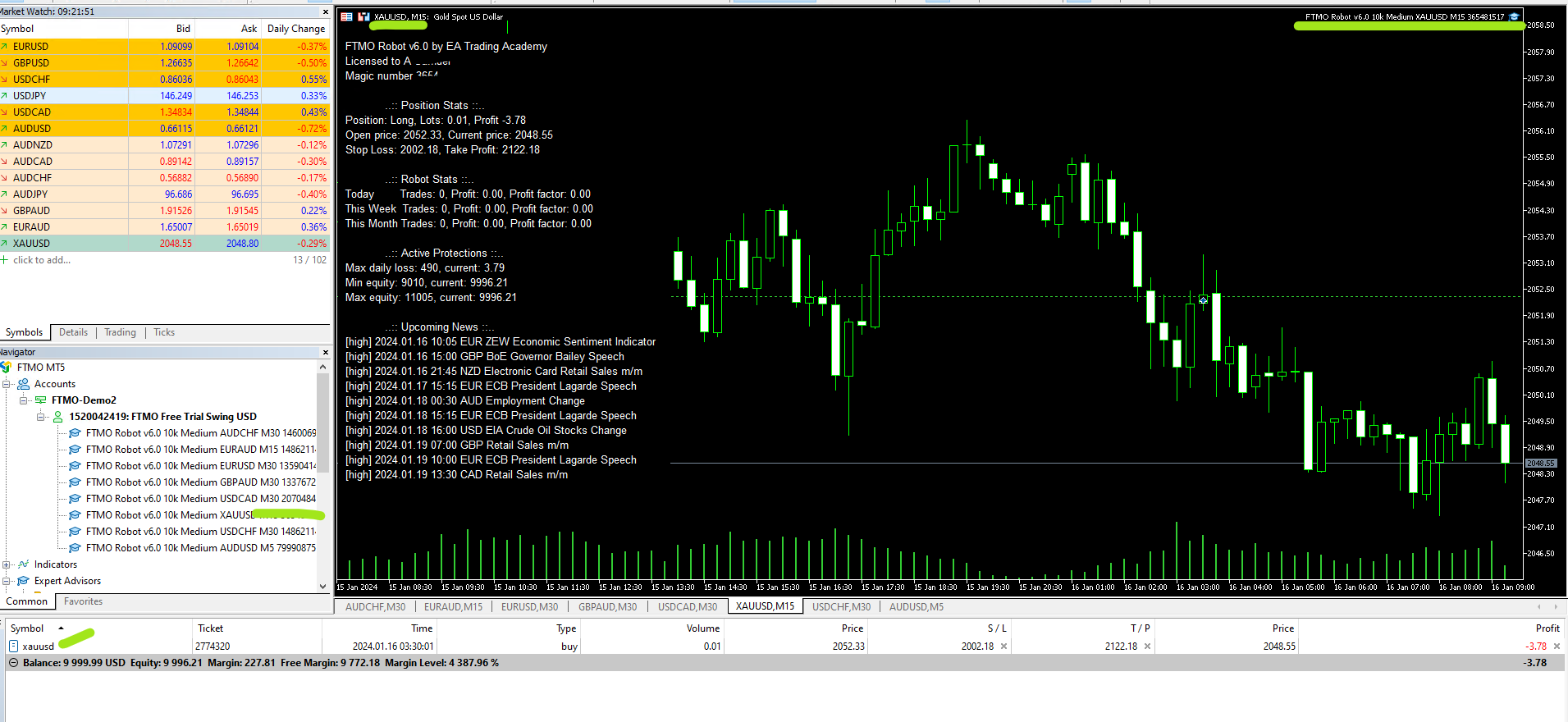

January 16, 2024 at 9:25 #227143

Anonymous

InactivePaul4x – not possible, it must be V5.

Here is the screenshot of my V6.0, a trade is already opened XAUUSD no Smiley Face.

-

January 16, 2024 at 10:11 #227153

Anonymous

Inactiveinteresting, i have smiley faces.

-

January 16, 2024 at 10:14 #227154

Anonymous

Inactivemaybe because i am using mt4 and you are using mt5?

-

January 16, 2024 at 10:43 #227162

Anonymous

InactiveOn MT5 there is no smiley face.

-

January 16, 2024 at 14:58 #227219

Anonymous

InactiveOh Yes, I am using MT5 , okay that is the reason then.

-

-

-

-

-

January 15, 2024 at 19:19 #227047

Anonymous

Inactive“Patient young jedi must be” (same goes for old ones ;-) )

my EA hasn´t got a trade on EURAUD and GBPAUD either today … on USDCAD I still have an open trade from last Wednesday …

-

January 15, 2024 at 22:04 #227082

Anonymous

InactiveOK that’s fine, just wanted to check all was in line

-

-

January 15, 2024 at 20:44 #227068

Anonymous

InactiveHow do I unsubscribe

-

January 16, 2024 at 23:14 #227296

Anonymous

Inactiveto unsubscribe contact [email protected]

-

-

January 16, 2024 at 18:27 #227255

Anonymous

InactiveI can confirm the bot has taken a trade today on usdcad

-

January 16, 2024 at 20:55 #227269

Anonymous

InactiveWhich broker is it ? In my FTMO Demo, it has taken a Sell trade for USDCAD, but this is my second trade. The first trade was for XAUUSD.

-

January 16, 2024 at 21:15 #227271

Anonymous

Inactiveyeh ftmo

-

January 16, 2024 at 22:33 #227284

Anonymous

Inactiveok cool, let’s compare our results at the end of the week

-

January 16, 2024 at 23:21 #227299

Anonymous

InactiveOver the last 5 trading days I have 2 profitable trades for USDCAD and 2 profitable trades for XAUUSD for FTMO V6.0 robots . The profits are small as the lot sizes are 0.01. I am just testing the robots. I am looking for a robot with 3 profitable trades to confirm the trend is profitable. Then I will adjust the lot size for medium risk.

Alan,

-

January 17, 2024 at 9:21 #227383

Anonymous

InactiveHi Alan

I prefer to test it through the default settings of Medium risk (downloaded from FTMO Robot App). At the moment, in loss due to USDCAD has gone down the hill.

-

January 17, 2024 at 12:47 #227442

Anonymous

InactiveHi Sammy,

I am testing on an FTMO Challenge so I am using small lot size so any robots that are losing will not cause the account to draw down significantly. By testing on the FTMO Challenge I am avoiding the FREE FTMO demo account 14 day limit. It is my choice to test this way.

Alan,

-

January 17, 2024 at 15:57 #227469

Anonymous

InactiveHi Alan

Good luck with the real account then. Hope you pass the challenge soon.

-

January 18, 2024 at 12:31 #227640

Anonymous

InactiveHi Alan,

for this week V6.0 is on fire, has taken substantial no. of trades. Did you mean that you would see the 3 top Profits and then put them in your challenge account ? What adjustment in terms of lot size and risk you would be intending to do and what would you do with the open trades in the real challenge account from previous week?

For the current week, Broker FTMO, Medium risk for $10k – my top profitable Trade closed was for GBP AUD + 4 opened at the moment with3 in profits.

-

January 18, 2024 at 14:21 #227661

Anonymous

InactiveMy status of open trades from December 1, until now:

AUDCHF – no open trades.

AUDUSD – no open trades.

EURAUD – 5 trades – 18.12, 19.12, 21.12, 02.01, 03.01 – all win trades.

EURUSD – 1 trade – 17.01 – still open

GBPAUD – 2 trades – 09.01, 17.01 – 1 lose, 1 win

USDCAD – 3 trades – 08.01, 10.01, 16.01 – 1 win, 2 lose

USDCHF – 13 trades – 8 in december+5 in january – last 4 lost

XAUUSD – 15 trades – 9 in december+6 in january – of the last 6, 4 were lost

My conclusions:

– since I started testing, EURAUD has never lost a trade, so it is number one.– XAUUSD wins about as much as it loses, so it’s almost at zero.

– USDCHF loses more than it gains.

– USDCAD loses more than it gains – only 3 trades.

– GBPAUD – only 2 trades.

– EURUSD – only one trade.

– AUDCHF and AUDUSD – no trade.

So I can only work with EURAUD, and I would risk more because it rarely opens trades, but probably the vast majority will be wins.

I don’t know what else I could do.

-

January 18, 2024 at 14:48 #227666

Anonymous

Inactive@Gabiscriba – you results are completely different from mine. You mut be with a different broker.

-

January 18, 2024 at 14:52 #227668

Anonymous

Inactive@SammyTrader

Yes, my prop firm is FXIFY, I run all robots on a challenge account with 0.01 lotsize. I run all the robots on an FTMO demo account, too. The results are completely different.

-

January 18, 2024 at 14:31 #227663

Anonymous

InactiveHi Sammy,

I am looking for 3 winning trades.

Right now I have the lot size for all robots set to 0.01 lots. Once I find the top robot with 3 winning trades I will replace the robot with the one I downloaded from the FTMO app so it will have the correct lot size for an account risk of 1%.

Alan,

-

January 18, 2024 at 15:10 #227669

Anonymous

Inactive@Alan Thanks, I have read your previous posted reply too. That’s a lot of manual intervention that you are doing, but the theory behind it for Robot with Top 3 wining trade or trade with more profit than loss, is very safe to win the challenge.

I myself, will stick to the default lot size and top wining EAs to see how would that work.

-

January 18, 2024 at 23:07 #227782

Anonymous

Inactive@Alan – Omg omg omg , is this is for real ? I hope this is for FTMO Prop Firm

-

January 18, 2024 at 16:28 #227693

Anonymous

InactiveHey Sammy,

Are you running all the bots for v6? I am only running the top 3 that I downloaded

-

January 18, 2024 at 16:59 #227697

Anonymous

Inactive@Paul4x – I am running all EAs in a Demo acc for FTMO broker. The Demo only last for two weeks, so the idea is that to take the top 2 performers to the following demo account to see how will they behave for another two weeks. If all profitable then I can take this strategy into the real challenge account.

-

-

-

-

-

January 18, 2024 at 17:36 #227706

Anonymous

Inactiveyeh i only have the top 3 downloaded

so far 1 gbpaud in profit 132

usdcad loss 94

usd cad running at momnet with 62 profitonly running since last sunday

-

January 18, 2024 at 18:02 #227710

Anonymous

Inactiveok, keep us updated, is this is your Demo or real challenge ?

-

-

January 18, 2024 at 18:09 #227713

Anonymous

Inactivehow to choose the best pair do petko use data from a week or a month like for example i go to my history tab and just check the data for the week and choose the best performing pair 1 or 2 or maybe 3 from the profit and winning rate

-

January 18, 2024 at 20:15 #227734

Anonymous

InactiveHi Tanyeem,

Petko uses 1 week!

Alan,

-

January 18, 2024 at 21:33 #227755

Anonymous

InactiveI saw the new feature in the Robot App. It is a very helpful feature, but only for those who use FTMO prop firm.

For the rest of us, the results are very different and we cannot use this new feature.I wanted to specify this for those who still do not know that the results of robots are very different from one broker to another.

-

January 18, 2024 at 23:01 #227779

Anonymous

Inactiveand why cant you use FTMO prop firm ? Its the best, reputable, paying regularly for profit splits.

-

January 18, 2024 at 23:13 #227783

Anonymous

Inactiveftmo are expensive compared to other prop firms, trusted forex funds for instance, 10k accounts, one is 89 euros and the other is 155 euros.

-

January 18, 2024 at 23:26 #227787

Anonymous

Inactive@SammyTrader

Because I already have a challenge account with another prop firm. And even if it weren’t like that, we can’t all work with the same company. FTMO is the most expensive, it is an aspect that matters a lot.

Apart from that, the best tactic to make profit from Prop firms is to have accounts with several of them, for diversification and risk sharing. It may happen that you lose an account, you still have two or three.

And one more very important thing. Do you remember MFF? Until it closed it was the best and reputable too.I lost a 50K live account at MFF

-

January 18, 2024 at 23:35 #227793

Anonymous

Inactiveah ok! got your point now. I havent started my challenge yet, but frankly if new feature in The Robot App is for FTMO Prop Firm then I would go for this prop firm to see how would that work out.

-

-

-

-

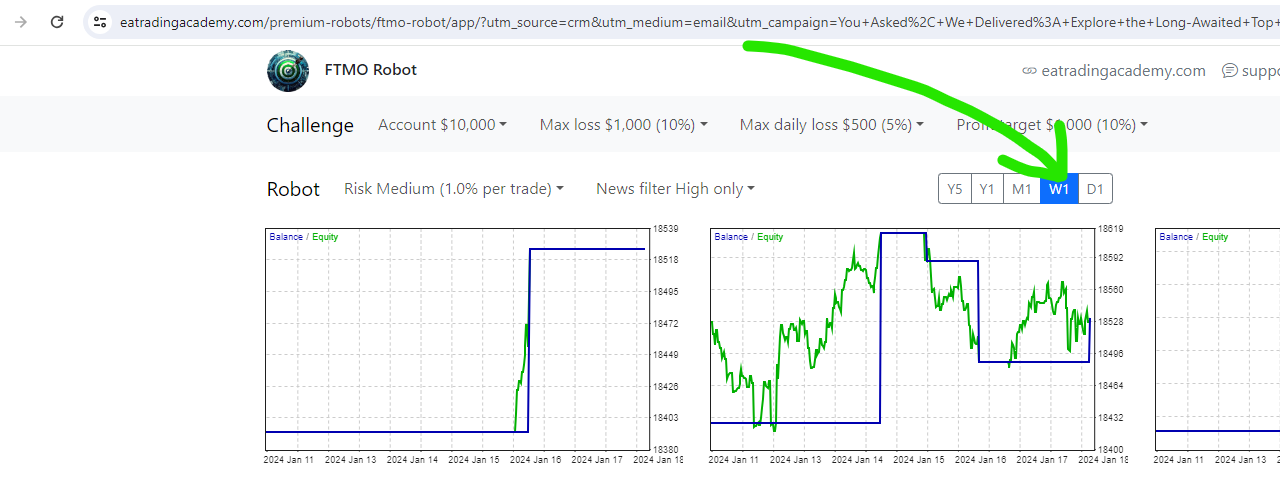

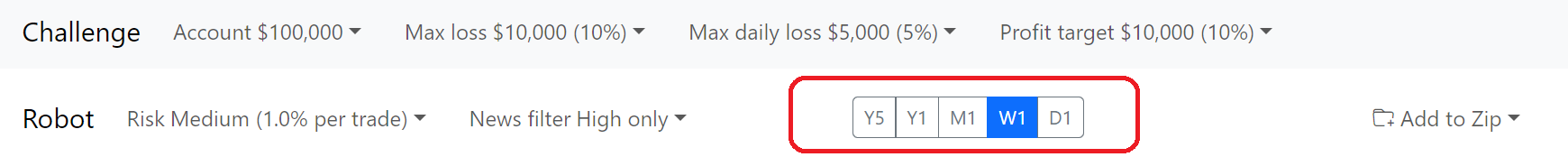

January 18, 2024 at 23:35 #227792

Anonymous

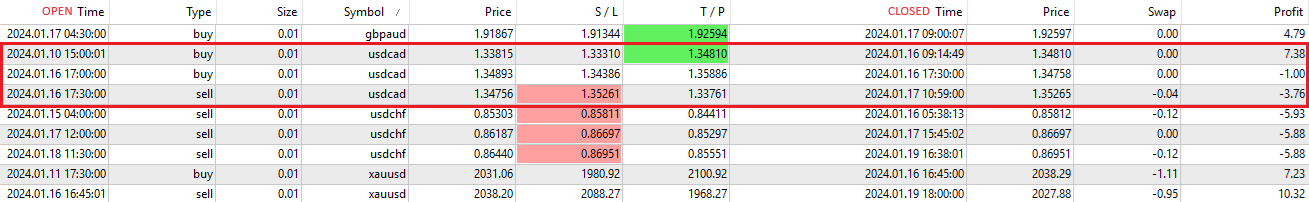

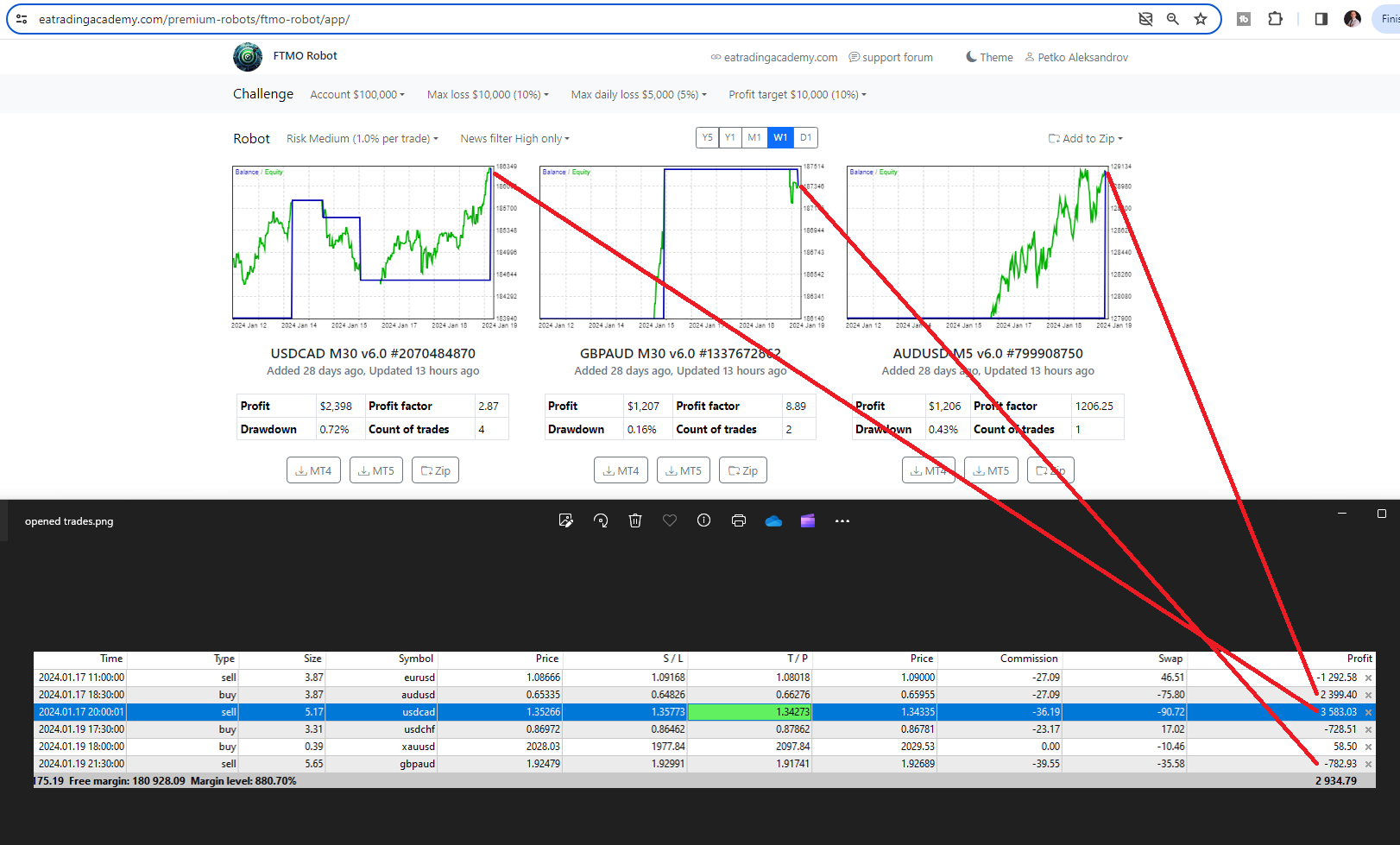

InactiveYes, it is real!

We have spent a lot of time figuring out the most useful and simple way for everyone to find the top performers from the FTMO Robots. And now the new feature is live on the app! You can see which assets are most profitable in the last 1 week or last 1 month. Even in the last 1 day!

There is no need for trial accounts and my Fxbook links. Whenever you get the FTMO Robots you can see the top performers with ONE click of the mouse:

Enjoy!

-

January 18, 2024 at 23:37 #227794

Anonymous

InactiveTHANK YOU ,, from the bottom of my heart.

-

January 18, 2024 at 23:43 #227795

Anonymous

Inactiveso which is better? the 1 trade pair that made the most profit or the pair that made 4 trades but less profit.

-

January 19, 2024 at 9:06 #227836

Anonymous

InactiveI would stick to the Top 3 , its all about testing with your broker now.

-

-

-

January 19, 2024 at 22:21 #228186

Anonymous

InactiveI’m a bit confused with this new feature. For this week, it shows USDCAD as the most profitable pair with 4 trades and a profit of 210$ (for a 10k account) but my results for this week are quite different (I’m using FTMO Demo account). I have, for USDCAD, only 2 trades, one SL and one closed in profit (no TP). The result for the week is positive for USDCAD but below GBPAUD which is my best pair of the week.

The only difference I can see is my account being in EUR. Do you think this can explain the different results?

I have read somewhere in the forum that it is recommended to get US account but this is a bit late for this challenge

-

January 19, 2024 at 22:46 #228198

Anonymous

InactiveMaybe it depends on when thier week started? I am showing same results as you for usdCad, so confused as to why 4 trades showing also

-

January 20, 2024 at 9:15 #228308

Anonymous

InactiveIt’s not strictly meant for FTMO prop firm. Those 1 week results are for general, but the only way to find out is use those Top 3 EAs on Monday for FTMO Demo and see how close they are matching. That’s what my plan is, I am with FTMO demo too.

-

January 20, 2024 at 14:10 #228368

Anonymous

InactiveHi Rudy,

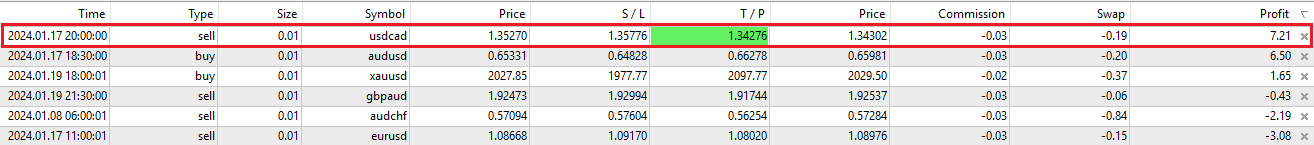

This first table shows the open trades from MT4 for the week of 01/14/2024 – 01/20/2024. Notice there is 1 open trade for USDCAD.

This second table shows the closed trades in the History tab of MT4. Notice there are 3 closed trades for USDCAD.

The FTMO app closes all open trades and adds them to the closed trades. This is why the FTMO app shows 4 trades.

Alan,

-

-

January 20, 2024 at 12:56 #228352

Anonymous

InactiveI have a confusion related to the last feature on the FTMO App.

I run all robots with 0.01 lotsize, both on an FTMO demo account and on a challenge account at another prop firm.

Referring strictly to the FTMO demo account, from what I have seen, I think that the trades that are running and have not yet closed also appear in the trade history. I selected D1 and in the App history the following appear: USDCAD – 1 trade – running, AUDUSD – 1 trade – running and XAUUSD – 2 trades – 1 closed and 1 running. At least this is the status of trades on my FTMO demo account.

But an extra trade is running on my account, which does not appear in D1 of the app history. GBPAUD sell, opened last night at 19.30.00, which is running at a loss at the moment.

My question is if the situation is the same for those of you who use FTMO account. -

January 20, 2024 at 15:47 #228392

Anonymous

InactiveThe FTMO app closes the opened trades just like the MetaTrader backtester does.

For example, currently, there are opened trades in my account, but those show as closed on the FTMO App.

This is why you will usually see more count of trades in the app compared to what you see in the account history.

But if you compare the opened trades, you will see they match.

-

January 20, 2024 at 16:56 #228406

Anonymous

InactiveThanks Petko, everything seems to be clear now.

I was misled by the fact that no trade appears on D1 for GBPAUD and I have one open. But in W1 two trades appear, which is correct.By the way, I run everything on VPS.

-

January 20, 2024 at 17:11 #228411

Anonymous

InactiveCan’t we change that then? So it keeps everyone results the same and not give a false stats?

-

January 20, 2024 at 17:13 #228412

Anonymous

InactiveIt seems that everyone using FTMO is getting the same results.

-

-

-

January 22, 2024 at 17:43 #228897

Anonymous

Inactiveinterestingly, if you switch the app to 1 year results then EURAUD comes out on top, monthly tab shows 3 trades and then nothing for a whole week, i downloaded this as part of the top 3.

So question is, what are members testing the best pair by what setting? yearly, month or weekly?

I was thinking of going weekly and downloading the past weeks top performers, the markets change and a top pair last year may not suit current market conditions.

-

January 22, 2024 at 18:06 #228903

Anonymous

InactiveHi Paul4x,

I downloaded the top 3 weekly robots, medium risk, to my 50K Challenge. So far today I have USDCAD open with a $250 profit so far today. The profit so far today doesn’t really mean anything. What counts is the profit or loss when the trade is closed out, but that is just where the trade stands at this moment.

Alan,

-

January 22, 2024 at 18:49 #228911

Anonymous

InactiveHi Alan.

Are you just sticking to the weekly top performers then, are you chopping and changing each week?

-

January 22, 2024 at 18:59 #228914

Anonymous

InactiveHi paul4x,

At the end of the week I will replace the weakest EA if the replacement is a different pair than my top 2 performers. That is my plan at the moment!

Alan,

-

-

January 23, 2024 at 9:25 #229018

Anonymous

InactiveHi Alan,

Is your trade is still opened for USDCAD ? Mine is still opened for a $10k challenge , it went all the way up to $100 in profit and this morning down back to $50. Looks as if it will take a while to close one trade. With this speed, I need to forecast that how long before one can pass the 1st phase of challenge ?

-

January 23, 2024 at 9:43 #229020

Anonymous

InactiveHi Sammy,

Yes I am still in. Backtest over the last month shows USDCAD placing 10 trades. So on average one trade every other day. This could indicate the current trade should close within the next day.

Alan,

-

January 23, 2024 at 10:42 #229025

Anonymous

InactiveThanks Alan

-

-

-

-

January 22, 2024 at 18:41 #228909

Anonymous

InactiveTop 3 from the last week with medium risk, testing it on a demo of $10k FTMO – 1 trade open- USDCAD – in profit of $54 but trade is not closed yet. All this week I will see how his Top 3 EA will perform form default settings.

-

January 22, 2024 at 18:50 #228912

Anonymous

InactiveHi Sammy,

Are you chopping and changing each week and using the top 3 from the previous week or sticking to the same pairs?

-

January 22, 2024 at 22:57 #228957

Anonymous

InactiveI would keep changing to the top 3 from last 3 weeks. So, every Sunday afternoon I would look the top performers from last 3 weeks and stop any pending trade, put the newly performers EA and see how it would go- only testing this for prop firm FTMO for next 3 days, if positive signs then use that in the real challenge.

-

January 22, 2024 at 22:59 #228958

Anonymous

InactiveHow has that been going for you? In profit overall by switching?

-

January 22, 2024 at 23:06 #228959

Anonymous

InactiveOnly did it for last two weeks but no losses so far, but then again FTMO demo acc only lasts for 2 weeks so I had to open a new one for this week. I am getting more confident to take it towards the challenge.

The thing that I am really stubborn about that I want to try passing the challenge with the default settings of EAs without scaling up in settings.

-

-

-

-

-

January 24, 2024 at 0:17 #229199

Anonymous

InactiveToday FTMO V6.0 50K Challenge had USDCAD close for a 1% profit. The trade took 24 hours from start to finish. I have open trades (GBPAUD,USDCAD) equating to 0.5% profit. My account risk is 1%.

Today My Infinityforexfund 100K Evaluation using FTMO V6.0 robots had USDCAD close for a 0.93% profit. The trade took 24 hours from start to finish. I have open trades (GBPAUD,USDCAD) equating to 0.28% profit. My account risk is 1%.

-

January 26, 2024 at 9:39 #229727

Anonymous

InactiveCiao Alan, perché dici che la tua posizione USDCAD si è chiusa con un guadagno dell’1% quando rischiando l’1% del conto dovrebbe chiudere con un guadagno del 2%? Hai chiuso manualmente la posizione?

-

January 26, 2024 at 9:59 #229741

Anonymous

InactivePlease use english!

Alan,

-

-

January 26, 2024 at 10:13 #229747

Anonymous

InactiveHi Alan, why do you say that your USDCAD position closed with 1% gain when risking 1% of the account should close at 2% gain? Did you manually close the position?

-

January 26, 2024 at 10:23 #229749

Anonymous

InactiveHi Denis,

The FTMO V6.0 USDCAD robot was closed automatically by the robot with a 1% profit.

Alan,

-

-

January 26, 2024 at 10:28 #229752

Anonymous

InactiveI have the same EA who opened the same position but didn’t close it when he reached 1% gain…. What do you think could be the problem?

-

January 26, 2024 at 10:43 #229755

Anonymous

InactiveHi Denis,

Are you using the FTMO Free demo account?

Alan,

-

-

January 26, 2024 at 10:47 #229758

Anonymous

Inactiveno, TRUE FOREX FUNDS challenge

-

January 26, 2024 at 11:06 #229761

Anonymous

InactiveHi Denis,

USDCAD has opened and closed 2 trades this week and currently has 1 open trade. The trade I was referring to in the above reply was the one opened on 1/22/2024 and closed on 1/23/2024. The USDCAD that opened on 1/23/2024 and closed on 1/24/2024 ended in a loss. The current open trade is also in a losing position. Which of these 3 trades are you referring too?

Alan,

-

January 26, 2024 at 11:18 #229766

Anonymous

InactiveHi Denis,

The historical data for each broker or prop firm is somewhat different as there is no clearing house where all the brokers/prop firms get their historical data. So each broker / prop firm has to get the trading data directly from banks. Since not all brokers / prop firm gets their data from the same banks causes the historical data between various brokers / prop firms to be different. Also not all brokers / prop firms will use the same spreads. For these and other reasons Expert Advisors/robots will not all take trades or close trades at the same time.

Alan,

-

January 26, 2024 at 11:20 #229767

Anonymous

InactiveI thought you were referring to the trade of 01/23/2024 which also closed for me in a loss because I had no trades open on 01/22/2024. The trade opened on 01/24/2024 is currently in a losing position for me as well. I apologize for the misunderstanding and thank you for the clarification

-

January 26, 2024 at 19:10 #229865

Anonymous

InactiveHello everyone!

Today marks the end of two weeks since I carefully tested all 8 V6 robots on a live challenge account, with 0.01 lot, on a Vps.

My prop firm is FXIFY and I carefully monitored each individual trade of the 3 robots.

My problem is that I cannot choose a top performer because apart from one robot (which made two consecutive win trades), none of the others made more than one win trade.

AUDCHF – 1 lost trade + 1 open trade

AUDUSD – 1 win trade + 1 open trade

EURAUD – 1 win trade

EURUSD – 2 lost trades + 1 open trade

GBPAUD – 2 win trades + 1 lost trade

USDCAD – 2 win trades + 3 lost trades

USDCHF – 3 lost trades

XAUUSD – 3 lost trades + 2 win trades + 1 open trade

The point is that I don’t know what to do with these robots. I have been testing them since the V6 version appeared, and before that I also tested the V5 version for a long time. However, the only one that makes constant profit is EURAUD, which very rarely opens trades. This is the only one I can use.

I am very curious if the rest of you can share your experience with your brokers or your prop firms.

Who is successful with these robots? Who made some relatively steady profits?

Because I don’t know how much time it takes to be able to use these robots, how much patience I should have.

Thank you. -

January 27, 2024 at 11:04 #229950

Anonymous

InactiveHello,

This week has seen many economic announcements in favor of the dollar and to the detriment of gold and the euro. Or the results are just catastrophic: interest rates set by the ECB at 4.50, unchanged but at an all-time high.

Despite the market conditions, I’ve been trading with these robots since October and I’ve got two challanges FTMO and funded next and I still haven’t passed.

I’m very patient too but I’m starting to seriously wonder if I’ll ever get there and when.

I’ve decided to stop trading gold because with a lot of 0.01 we won’t get far. Despite the fact that the robot manages to get the best entry points, but otherwise for the other peers I remain suspicious. If anyone has managed to pass the challange this month or in December, I’m very curious to know how and with what.Regards

-

January 27, 2024 at 13:25 #229967

Anonymous

InactiveHi ayoub,

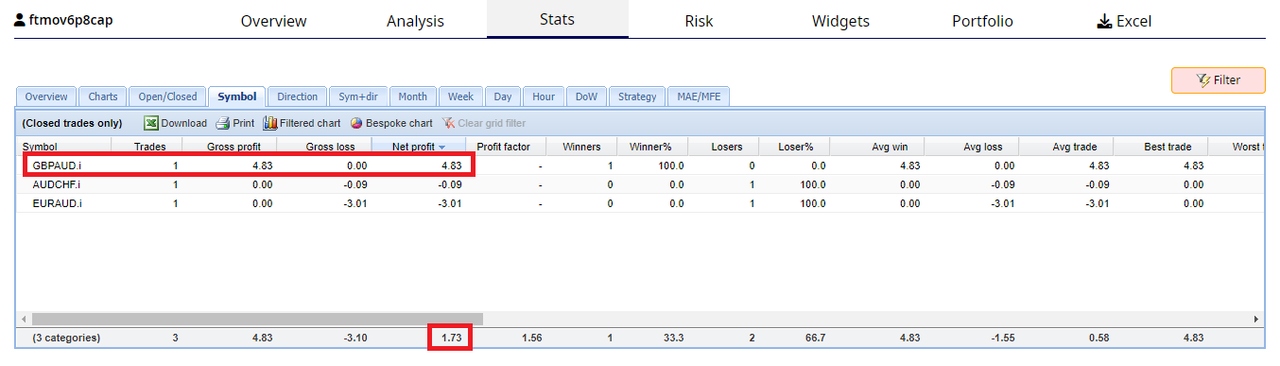

Here is the results of one trader pass a challenge in the beginning of January 2024.

Alan,

-

January 27, 2024 at 13:55 #229972

Anonymous

InactiveUnfortunately, this is not encouraging at all. Passing the challenge happened accidentally and with a special strategy, risking more on the top 1 performer. It is not something that can be applied in the long term, except by relying on luck. I am curious if on the funded live account he will be able to continue to obtain profit and make withdrawals.

-

January 27, 2024 at 14:25 #229976

Anonymous

InactiveHi gabiscriba,

Petko does a similar thing by increasing risk on his top performers. Petko has a scaling up plan he developed and uses to scale up with his top performers. He shows how to do this in his “The Complete FTMO Challenge” course. I think I can remember his sharing the scaling up plan in the 21 day course. Basically Petko will wait until he has 3% profit and then will double his risk from 1% to 2% such that if his account draws down it will only draw down a maximum of 2% leaving his top performer with a worst case of 1% profit. Petko has used his scaling up plan in some of the earlier FTMO robot versions. Petko uses his scaling up plan to pass the challenges more quickly and has passed challenges using the scaling up plan and has shared this on the forum in the past. So I think Pranav is following Petko’s scaling up strategy by doing a similar thing.

Alan,

-

January 28, 2024 at 5:16 #230087

Anonymous

InactiveTry EURAUD and usdchf and utilize Petko’s scaling strategy.

-

-

-

-

January 27, 2024 at 14:18 #229975

Anonymous

InactiveGood day EA Trading academy members

I am just interested to know if anyone is keen to join a Telegram group to share Experience with the FTMO Robot and discuss potential set files and success strories?

Cheers

-

January 27, 2024 at 14:47 #229977

Anonymous

InactiveYes, I know this strategy, I saw the video, it is a very good strategy.

But Pranav risked on the top 1 performer, not on the top 3 like Petko. Basically, his risk was 50-50, that’s why I say it’s a coincidence that he passed. And that this approach with top 1 is very risky.

I would like to be able to use the strategy with the top 3 performers. But in my case, as I posted yesterday, I don’t have a top 3 performer in the last month. And that’s why I can only wait for this top to appear. The problem is that I don’t know how long I have to wait. At this rate, I can only trade with EURAUD, which opens a trade every two weeks (more or less).-

January 27, 2024 at 15:20 #229985

Anonymous

InactiveHi gabiscriba,

If the strategy of waiting for the top 3 performers to develop, which at this point I am thinking may not develop before Petko updates the robots again, maybe a different strategy is in order. Or, maybe just wait for the next update.

Alan,

-

January 28, 2024 at 5:21 #230088

Anonymous

InactiveTake prop firm challenges that has no time limits.

-

-

January 27, 2024 at 16:55 #229994

Anonymous

InactiveHi Richard,

Links to other websites are not allowed on the forum and was deleted in your post above. The forum was developed so traders could get together to discuss their trading, FTMO successes and failures, set files, and success stories. By using this forum allows ALL traders have the same opportunity to learn from others.

Alan,

-

January 28, 2024 at 13:55 #230142

Anonymous

Inactivehey everyone,

so my 2 week trial with FTMO ends tomorrow, i ahve been using the tope 3 robots that i downloaded on 14th Jan, at that point in time the 3 top pairs selected by the app were the following. I am using a 10k trial account.

EUR/AUD M15 – trades 1 this week with profit $160

GBP/AUD M30 – trades 2 this week with a negative $95

USD/CAD M30 – trades 4 this week profit of $174Current results showing a profit of $274, so 50% towards the profit target. I shall post the link below.

https://trader.ftmo.com/metrix?share=859246db0501&lang=en

The question i have now is according to Petro videos, do i increase lot size as account at 2% or was this old pass methods?

Looking at the app today, then GBPAUD is not part of the top 3 and so i would swap this out for perhaps the AUDUSD pairing.

Overall, i think passing the challenges is possible and will certainly try it on a full live challenge at some point, it will be a case of chopping and changing per week.

-

January 28, 2024 at 14:03 #230144

Anonymous

InactiveHi Paul,

Good job so far!

I would wait until the account has a profit of 3% before increasing risk to 2%. The reason for this is if your account has a drawdown of 2% you would still have a 1% profit.

Changing out GBPAUD for AUDUSD may be a good idea as it has larger profit last week. However, that does not mean AUDUSD will be more profitable than GBPAUD next week. It is your choice. Oh, the choices we traders have to make! :o(

Alan,

-

-

January 28, 2024 at 19:46 #230199

Anonymous

InactiveI have replaced all my FTMO V6.0 robots on my 50K FTMO Challenge with this weeks top 3 from the FTMO app.

Alan,

-

January 29, 2024 at 21:07 #230466

Anonymous

InactiveI am using the FTMO robot version 6.0. Should I check the top performance every day from the last week, or should I check it once a week, for example, on Sundays? Additionally, does version 6.0 of the robot allow for setting leverage?

-

January 29, 2024 at 21:50 #230472

Anonymous

InactiveHi Michal,

It is up to you as to how often you check the top performers. One way is to just check them once a week. Another way would be to check the monthly and the weekly to see which robots show up for both the monthly and weekly time frames. This would tell you which robots have been best performers for a longer period of time. So there are various ways to use the FTMO app.

As for leverage, leverage is set by the broker or prop firm and not by the robot.

Alan,

-

-

January 30, 2024 at 17:33 #230769

Anonymous

InactiveSo end of my 2 week trial with ftmo using the top 3 from a few weeks ago. Over halfway there, USDCAD was top performer with 6 trades, GBPAUD had 3 trades and EURAUD only had 1 btu it had the biggest profit of 160 from that trade. I currently have a challenge ongoing with another different bot just started yesterday, so will wait till next week and give these bots a chance on a challenge.

-

January 30, 2024 at 18:11 #230774

Anonymous

InactiveHi paul,

Congratulations, job well done!

Alan,

-

-

February 1, 2024 at 9:02 #231270

Anonymous

InactiveSo last weeks best pairs were usdcad audusd and euraud, and i was doing the single pair on the bot and i gave usdcad and euraud on my different accounts,usdcad lost so did euraud i didn’t manually do anything as it is an automated system.And so the thing is that for the next week if my account stays in drawdown i switch pairs again right by seeing what are the best performers this week

-

February 1, 2024 at 9:47 #231275

Anonymous

InactiveThat is what I am going to do!

Alan,

-

February 1, 2024 at 10:24 #231283

Anonymous

Inactivelast weeks best pairs were euraud usdcad and audusd

-

February 1, 2024 at 10:28 #231286

Anonymous

Inactiveand so i used euraud as my single pair and on one account ran two best pairs one is usdcad and euraud and another account i ran three of the robots of the three pairs euraud usdcad and audusd and all of them are in a loss of 1% so for the next week i again choose the best pairs right? and another question that is when i’m scaling if i loose the first trade to be a 3 percent do i keep running it on 3 percent so that it makes back 3 percent and profit or i scale it down i didn’t see petko scaling down on loosing trades

-

February 1, 2024 at 11:27 #231297

Anonymous

InactiveHi Tanyeem,

What I do is wait until I have 3% profit. Then I will increase risk by 1% so that I now have a total of 2% risk to my account. This way if my account draws down the trade will be closed leaving me with 1% profit in my account. Then I will start over with a 1% risk.

Alan,

-

February 1, 2024 at 11:46 #231304

Anonymous

InactiveOkay then i will do that too but once the account is back to 1 percent do you dial down the risk or still it is 2 percent

-

-

-

-

-

February 1, 2024 at 10:55 #231292

Anonymous

InactiveAlso do you manually interfere with the trades i see petko doesn’t but does he?

-

February 1, 2024 at 11:28 #231298

Anonymous

InactiveHi Tanyeem,

No I do not interfere with the trades.

The last few weeks has not been very profitable, but the profits will come!

Alan,

-

-

February 1, 2024 at 11:49 #231305

Anonymous

InactivePls do reply

-

February 1, 2024 at 11:53 #231307

Anonymous

InactiveOkay then whom should i follow petko or you

-

February 1, 2024 at 12:06 #231310

Anonymous

InactiveFollow Petko! I am just sharing how I scale up. Petko uses his own scaling plan and it works for him. Since these are Petko’s robots then I would suggest you follow his plan. Petko’s plan is based upon individual currency pairs where mine spreads the risk upon all traded pairs. My plan is less risky but will take longer to hit the price target to complete the challenge where Petko’s plan should hit the price target sooner.

Alan,

-

-

February 2, 2024 at 17:05 #231677

Anonymous

InactiveAlan, here’s another puzzling occurrence. This sell position was opened as per normal with a 50 pip stop loss and 100 pip TP. The NFP news just came out and were in our favour for us to maximise profit. The position closed too soon. It seems that the TP was moved to around 12 pips. I only made a profit of $120. The market is still moving as we speak in our favour so I’m missing out on profit. Why would the position have closed way before 100 pips? I’m very disappointed.

-

February 2, 2024 at 17:15 #231680

Anonymous

Inactiveso quick update for this week, even though my trial finished with FTMO on monday, i left the bots running.

no trades on GBPAUD or EURAUD, and nothing on USDCAD, however on the app it shows 6 trades but i also see the timeframe has changed from M30 to M5

-

February 6, 2024 at 9:39 #232495

Anonymous

Inactivehey so the last weeks best performers were AUDCHF,USDCAD,XAUUSD all v6.1 and now the USDCAD has dropped from the list but we do not change the robot right?As we are changing the robots based on the performance of an overall week and if we did change the robot then it would be a chase to changing and getting to the best robots so i don’t think we change like that

-

February 6, 2024 at 14:04 #232569

Anonymous

InactiveHi Tanyeem,

I would wait until the end of the week to make any changes.

Alan,

-

February 6, 2024 at 14:25 #232576

Anonymous

Inactiveyes that’s what petko does seen in the videos

-

-

February 9, 2024 at 13:25 #233376

Anonymous

InactiveI have two FTMO robots with open trades, USDCAD M5 V6.1 and XAUUSD M5 V6.1. USDUSD is now in profit of $80 with increasing profits. XAUUSD in decreasing its loss but has not yet turned profitable. So far, so good!

Alan,

-

February 9, 2024 at 15:18 #233445

Anonymous

InactiveI have two FTMO robots with open trades, USDCAD M5 V6.1 and XAUUSD M5 V6.1. USDUSD is now in profit of $144 with increasing profits. XAUUSD is at $125 loss with decreasing loss. Right now my FTMO Challenge is in a $15 profit with profits increasing so far today.

Alan,

-

-

February 20, 2024 at 21:50 #236573

Anonymous

InactiveHi Traders,

I know there has been a lot of dissatisfaction with the FTMO app robots lately so I wanted to chime in here. At the beginning of this week I downloaded all 14 robots and installed them in my Infinity Forex Fund Algo Evaluation MT4 terminal. Sorry, I cannot use the FTMO Challenges anymore as in the United States FTMO no longer allows us to use MT4 or MT5. However, before this limitation was imposed upon us US traders I had installed the same FTMO robots on both the FTMO challenge and the IFF Algo Evaluation to compare their performance. The result was they very closely track each other. So based upon this past experiment I feel traders using the FTMO Free demo or Challenges should be able to achieve similar results to what I am getting. I also realize that these 14 robots have only been trading on my account for 2 days and my results are early I wanted to share what I am getting so far. When I installed all 14 robots I changed the lot size on each robot to 0.01 lots so their results would not affect my account balance significantly. Right now I have 3 closed trades. One profitable and two losing. However each of these closed trades where with one closed trade for each of the three robots. I will now continue to trade these 14 robots for the balance of the week and report my results this coming weekend and how I am going to address my trading for next week.

The following link will outline how I trade all my robots. The link was written based upon the FTMO robots v5.1 but the steps I follow is still the same for all robots.

Alan,

-

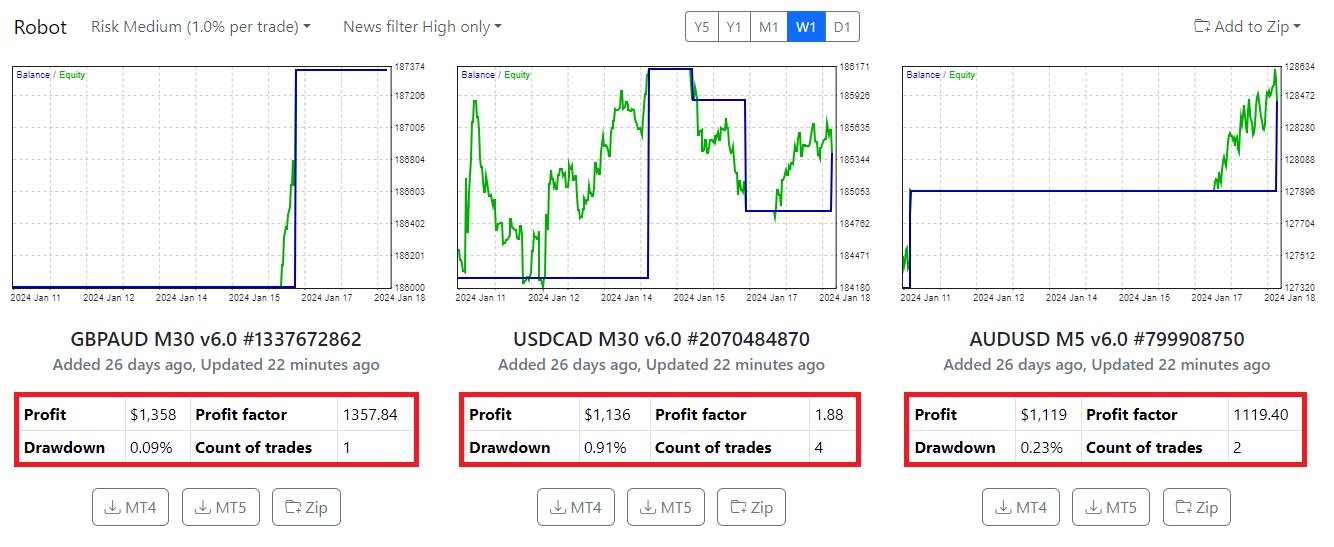

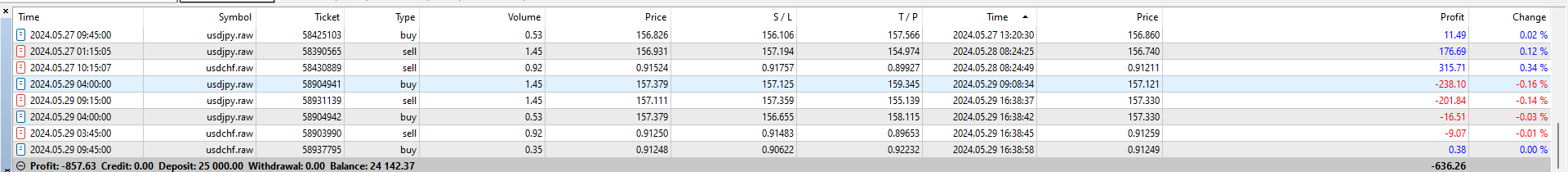

March 2, 2024 at 15:56 #239251

Anonymous

InactiveHi Traders,

On February 18, 2024 I downloaded all 14 of the FTMO app robots to my Infinity Forex Funds 100K Algo Evaluation account. I then reduced the lot size to 0.01 so I could monitor for one week how these robots would perform with a different prop firm other than FTMO. The following chart shows the results of that one week evaluation. I chose GBPAUD to trade the next week with normal lot size for a low risk account as determined by the FTMO app because it showed profit for the week and was the top performer. I also chose XAUUSD to trade the next week with a low risk account lot size even though it showed a small loss. My reason for including this robot to trade next week was because is had one winning trade and ONLY had one losing trade for the week and was also the second top performer. Since XAUUSD had one winning trade for the week I decided so trade it the following week as there was a good chance it could have a winning trade next week. If XAUUSD would have had two losing trades for the week I would not have made the decision to trade it the following week. Anyway, these are the types of decisions a trader must make.

The following chart shows the trade results for the following week, the week of February 25th. The results show XAUUSD with a nice profit for the week but also shows GBPAUD had no trades for the week. XAUUSD had 7 trades with 5 winning trades for a 2.5 to 1 ratio and also had a profit factor of 16.23 to 1. I also notice USDCAD came in second place this week with a winning trade. This tells me the current market environment is good for this robot so I will add it to my list of trading robots with a normal lot size for the low account risk robot I downloaded. My list of three trading robots now include XAUUSD, GBPAUD, and USDCAD.

My next update will be during the weekend of March 9.

Alan,

-

March 9, 2024 at 16:54 #240594

Anonymous

InactiveHi Traders,

Week of March 3, 2024 through March 9, 2024. The following are the third week results of trading the Prop Firm Robots on my Infinity Forex Fund (IFF) 100K Algo Evaluation account. The first week was used for testing all 14 robots with the IFF server. The second week was actually the first week of trading.

XAUUSD: XAUUSD has posted profits now for two weeks. I will continue trading this robot next week.