Emotions in Trading

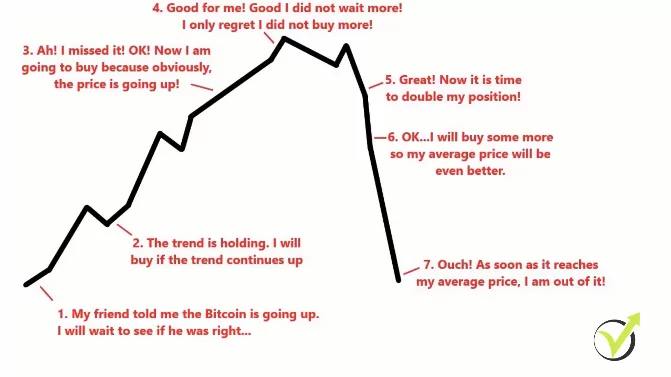

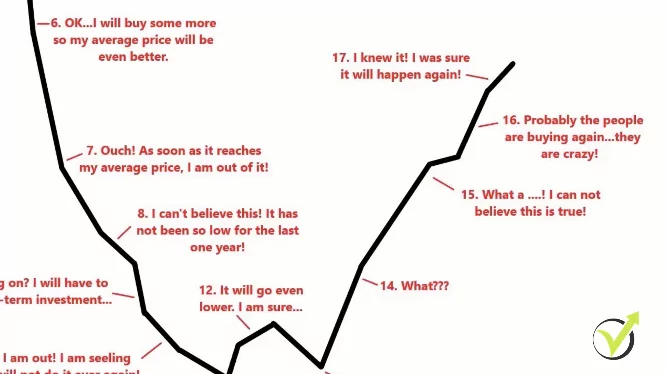

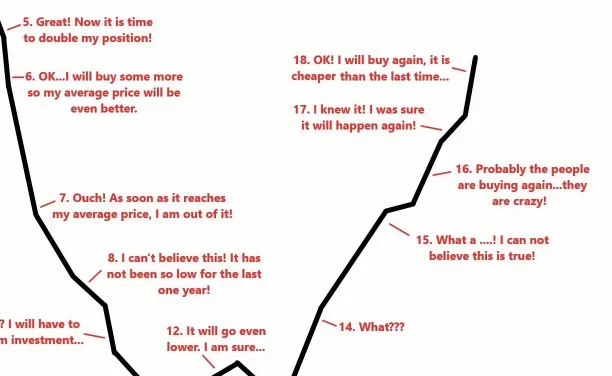

This article will cover what people think while investing, created by me, Petko Aleksandrov. There is one old theory of how people behave in the markets, especially the beginners. And I modified it last year when I was doing a seminar in Japan. I had 2 seminars – one in Tokyo and another one in Osaka. And I covered a lot about emotions in trading.

It shows very well how people invest in cryptocurrencies and especially in Bitcoin. So I’m pretty sure that you might see yourself somewhere in this lecture because I do see myself when I was starting and putting a lot of emotions in trading.

But you should not do that. Let’s get on it and I will attach the presentation as well to this lecture as a resource file. So how it all starts is that usually people receive information.

“My friend told me about Bitcoin and how it was going up. “

This is the first time when you hear about Bitcoin. In the beginning, you are very skeptical and you don’t know what Bitcoin is.

You start reading about it, researching, and you’re not ready to buy just because someone told you that the Bitcoin is going up, for example. So you’re waiting to see what will happen.

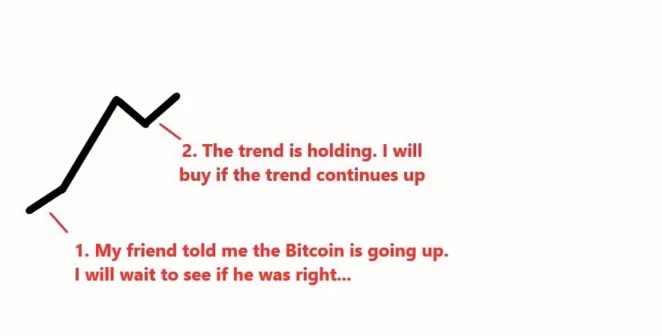

The first emotions in trading come when you miss the good price

Price goes up, you say, “OK, it’s holding. For sure I’m ready. I’m preparing my account now. If the trend continues higher, I will buy.” Price goes up, “Oh, I missed it. OK, now I will buy because obviously the price is going up. Everybody is buying, I should be buying as well.”

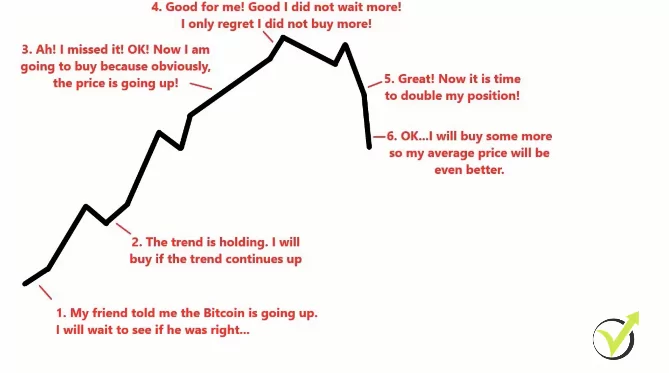

So let’s say you buy one Bitcoin. What happens is the price goes higher and you are happy. You already have some profits in your account. You’re experiencing positive emotions in trading.

But there is one feeling which is very normal but it’s kind of a strong feeling. You regret that you didn’t buy more when you see a profit.

Let’s say that you bought one Bitcoin at $15,000. The price goes up to $19,000 and you’re happy you have $4,000 of a quick profit. This is more than the average salary in most countries around the world.

And you just regret that you didn’t buy more. Regret is not a positive emotion in trading or investing.

Anyway, what happens is the price goes down and you say, “Great. Now I will double my position, I will buy another Bitcoin. So when the price goes back to $19,000, I will not have just $4,000 but I will have $8,000 of a profit and I will sell it then.”

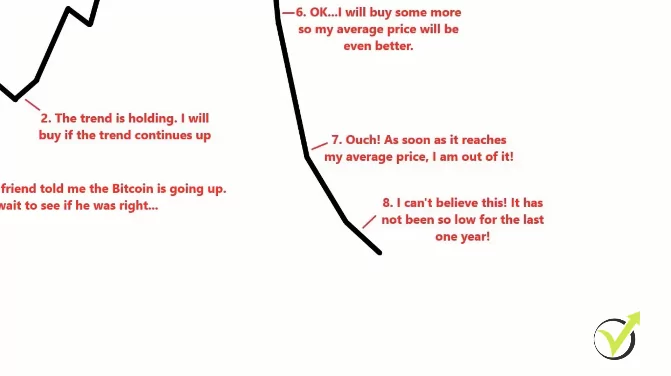

What drives people to invest all their savings

But what happens is the price goes down. You’re getting a little bit frustrated but this is where you start to calculate. You say, “If I buy more now, I will average my position and I will have more profits when the price recovers.” This is usually the point where people put all their money. All their savings.

Everything they had, they will just put it on the market because they want to have a better average price and they want to have more profit from all of that.

The emotions in trading and the emotions while investing will make you take the wrong decisions.

And let’s say you buy another Bitcoin at 12,000. You will have an average price of 14,000. One time 15,000, second time 15,000, one time at 12,042. Divided by 3, average price – 14,000.

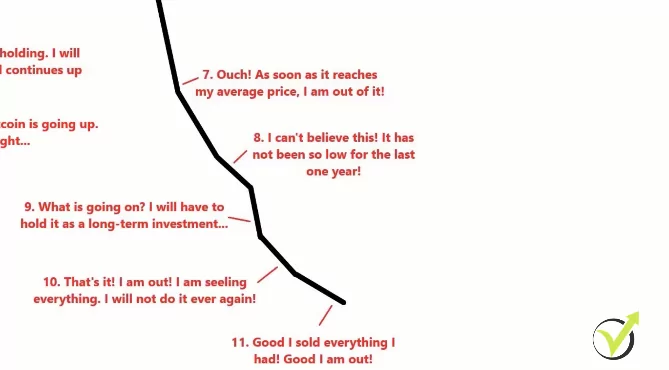

But what happens, price goes down.

And this is where the people feel pain and just regret it so much and they are afraid. Their only thought is about getting out of it. They don’t think any more about the 19,000. They think about their average price. We set an example of 14,000.

The only thing you will feel at this moment is that you want the price to get to 14,000 so you will sell everything and have 0 losses. You want to get rid of that weight you have on the shoulders, that loss that you see in your account. Because it’s your money, obviously it’s painful and you don’t think about profits anymore. You just want to get rid of it.

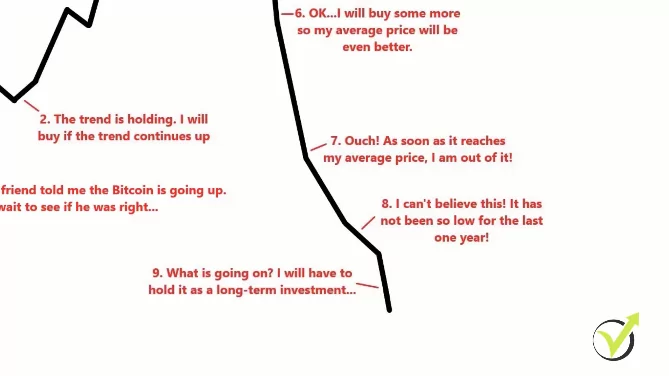

People tend to give up drivven by the emotions in trading

What happens? Price goes down. You cannot believe it, it’s never been so low.

The first time you heard about the Bitcoin the price was higher. You never saw the Bitcoin at this price. You never thought it is possible for the price to fall to these levels.

What happens, price goes lower. And you cannot believe it.

Like what’s going on? You cannot work properly, you cannot handle your daily activities and obligations. And all you’re thinking about is that you’re losing on the market.

And, of course, you’re thinking that probably the price will never recover and you will hold all the losses and you feel awful. This is a horrible moment for the people. The price goes down and you cannot handle it anymore.

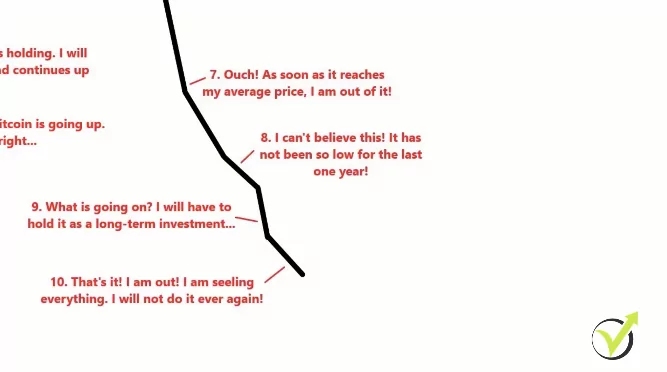

You say, “That’s it, I’m out. I have lost most of my money, I don’t want to lose everything. The price will crash. I am out of it because I cannot.” You are just selling. And all of that from point number 6, 7, 8, 9, and 10, all of these points are called in one word that makes the prices drop as a stone, panic. People panic.

Panic is one of the emotions in trading that drives the people crazy. They just sell and the price drops as a stone.

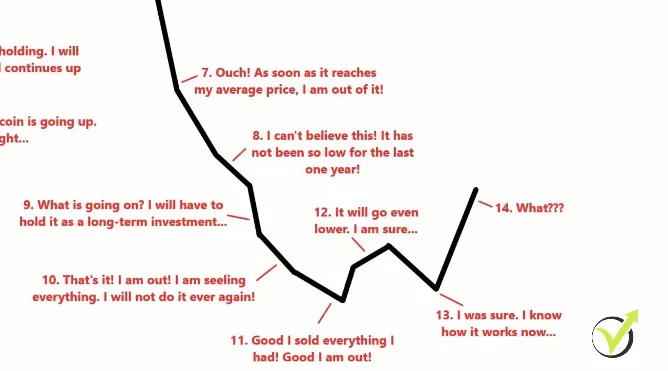

They sell everything and the price drops

The beginners, everyone that entered on the market for some reason, they want just to be out. They panic that they will lose their money. Nothing is important, they just want to get rid of it and they sell. And all of that selling makes the price drop.

So you are out. You say you will never do it again. You promise your wife and you promise yourself that you will never ever buy cryptocurrency again, whether Bitcoin or any other.

What happens is the price goes even lower and you feel relaxed.

“Good, I sold everything I had. It’s good that I’m out, I could have lost more. I would be at a bigger loss if I didn’t sell so good for me.” There is some recovery and you are sure that the price will drop because obviously it drops so much, it should drop lower.

Price might go sideways a little bit and you’re still sure. “I know I was sure. I know how it works now and I will never do that mistake again.”

What happens? Price goes up and you really cannot understand what’s going on.

How come? How come the price is going up after this big fall? Who is buying it? You are not on the market but the emotions while trading are still with you!

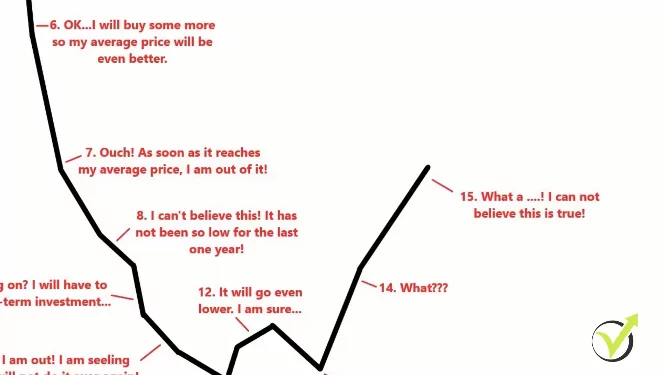

Price rises and they start regretting again

The price still goes up.

You cannot really believe that this is true. The price is higher from where you sold. And you cannot really understand how this is possible. “Really? Who is buying it now? Are the people stupid? Why are they buying it? We lost money.” Everyone lost money. This is what you will think.

Price goes higher and you say, “The people are crazy. I don’t understand why they are buying. For some reason, there are people buying. I don’t understand them. They’re absolutely crazy.”

The price goes higher and you say, “Oh my God. I knew that. I knew that this was going to happen. “

The price is almost at my average price, which I was waiting for for a long time. “Why didn’t I hold my positions? Why didn’t I wait a little bit longer? I sold it at such a bad price.”

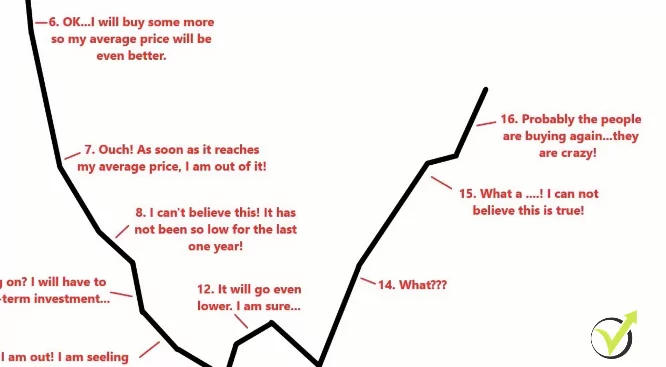

Price goes higher and you say, “OK, I will buy again. It is cheaper than the first time I bought and now I have the experience. I know how it’s working and I am again in the game.”

And usually people just buy with whatever they saved or with whatever they have left from the previous investments. And this happens all the time, every day.

Emotions in trading are the reason why traders lose

This is how the market works. The price goes up, it goes down, and it goes up again. We never know where it will be tomorrow. But this is how the average person invests in the market. And if you have followed me closely, you will notice that usually, people buy when the price is expensive.

They don’t have the strategy to take their profit. And they are greedy at point number 4 because they didn’t buy more. They are not happy with the profit but they are greedy. And they are awaiting the price to fall so they can buy again. The price falls and they cannot average the position anymore because they have bought with all of their capital.

Nothing is left there because it’s really painful. The only solution is to sell off at one moment. And after the price starts to recover, they don’t have the power, they don’t have the emotions and the mindset to buy again because they took a loss. And they wait until the emotions, the greed and the desire to profit comes again and they buy again when the price is expansive.

So this is how it’s working, guys. I have seen that so many times when I was working for brokers. People coming into the office, I saw their emotions. They were depositing money at the wrong time, they were withdrawing money at the wrong time. And this is what makes the people lose, the emotions. The greed at one moment and the fear on the next moment when you are already losing.

The smart investors do to not put emotions in trading

This gives the opportunity to the huge investors to profit. And they are called smart investors. They are not smarter than you are or than any other beginner trader. They have just more money to hold their positions longer, to average their price all the time, and to take their profit at the right moment.

When everyone else is just entering the market, they are getting out and they make the price drop. This is how it works.

And I will show in the course a precise strategy that I follow, which will protect you from emotions. I don’t put any emotions because I follow the strategies strictly. It doesn’t matter what I feel, if I see the buy signal I buy. If my target is reached, I sell off. It doesn’t matter if the price will go higher, I don’t care.

That was my target, I take my profit. This is how I do it.

And I will show you that in the Cryptocurrency Investment Strategy Without Losses course.

Download a PDF for the emotions in trading: