Auto trading software: EA Studio Strategy Builder.

Hello, traders! In this article, I will teach you how to automate your trading strategy into Expert Advisor with the Auto trading software EA Studio. So if you are trading any strategy so far, you can go to strategy, and you can place here the entry rules and the exit rules.

This way, you will see if your manual strategy was profitable in the past or it was losing. As well, with EA Studio, you can export it as an Expert Advisor with one click and trade with it fully automatically.

Don’t worry it is not a rocket science to use the EA Studio auto trading software. We have recorded a Free Start-up course.

Now the benefits of trading with Expert Advisors compared to manual trading are many.

First of all, when we are trading with Expert Advisors, we trade all the time from Monday till Friday, 24 hours, and this is something impossible for manual trading.

As well with the manual trading, we skip many entries, sometimes we miss to enter the trade or we are late with the trade. And with the Expert Advisors, we are precisely on time with the trade.

The robots, they open the trade precisely at the moment when the entry rules are confirmed. And, as well, when we trade with Expert Advisors, we avoid emotions so we don’t get scared or we don’t get greedy with the trades, the Expert Advisors.

Simply follow the strategy in 100%, and no emotions are involved. And as you know, emotions are the reason that people lose in manual trading. So, now I will teach you how you can automate your strategy with EA Studio.

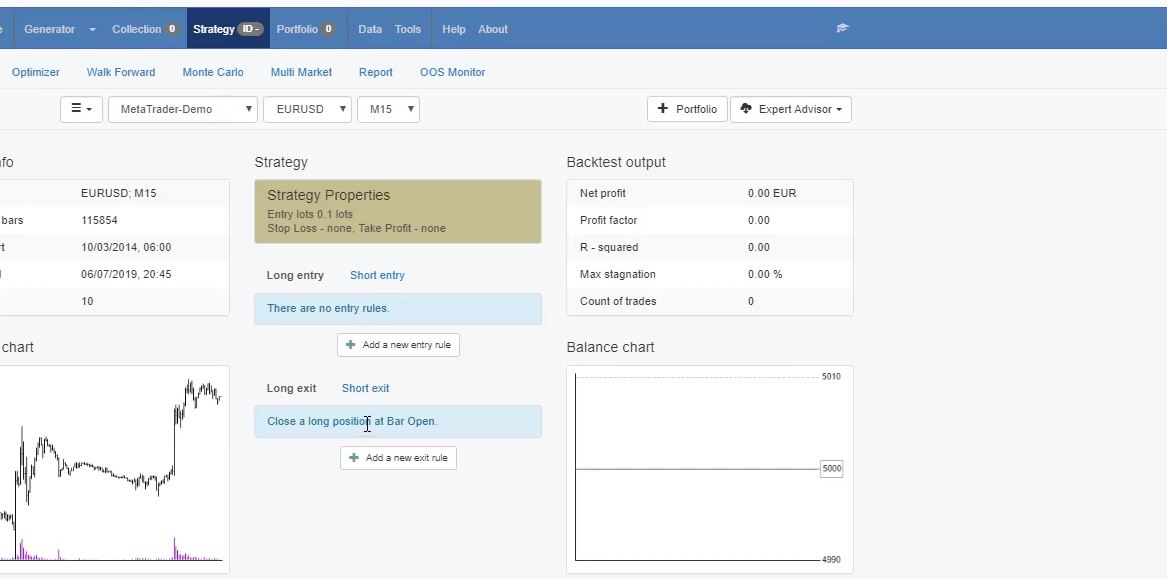

When you register for the 15–days free trial for the auto trading software EA Studio, you can click at the strategy editor is where you can use the historical data of your broker, the symbol that you want to trade, and the timeframe.

The backtest in Auto trading software.

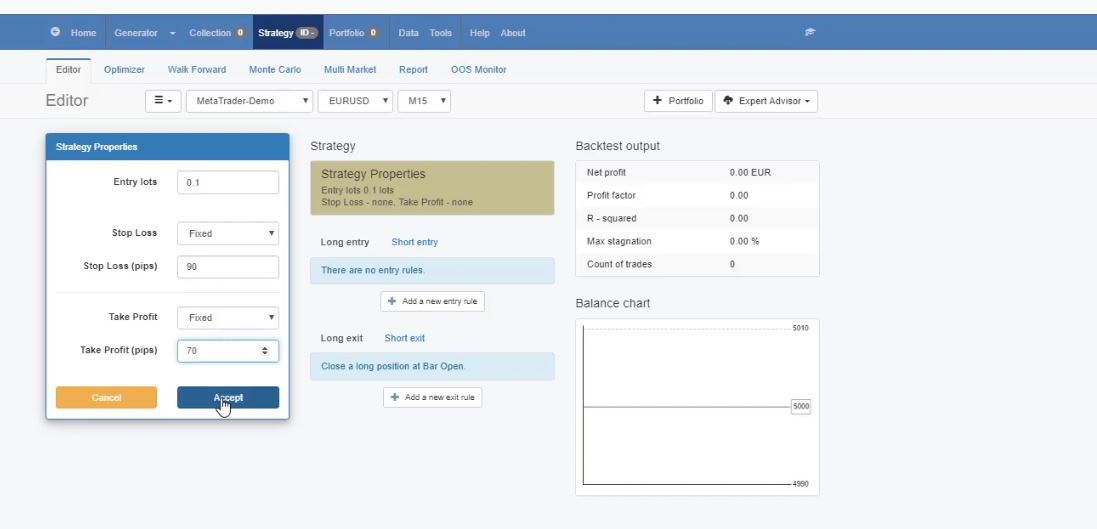

From strategy properties, you can set the entry lot and what are the Stop Loss and the Take Profit of your strategy. If you want to use one or not, if you’re going to use a fixed Stop Loss, you need to choose fixed.

If you’re going to go for trailing, you have this option. I will stay with fixed, and with Take Profit, I will remain with fixed as well.

So now, let’s say that we have Stop Loss of 90 pips and Take Profit of 70 pips. I click on accept, and I will add some rules.

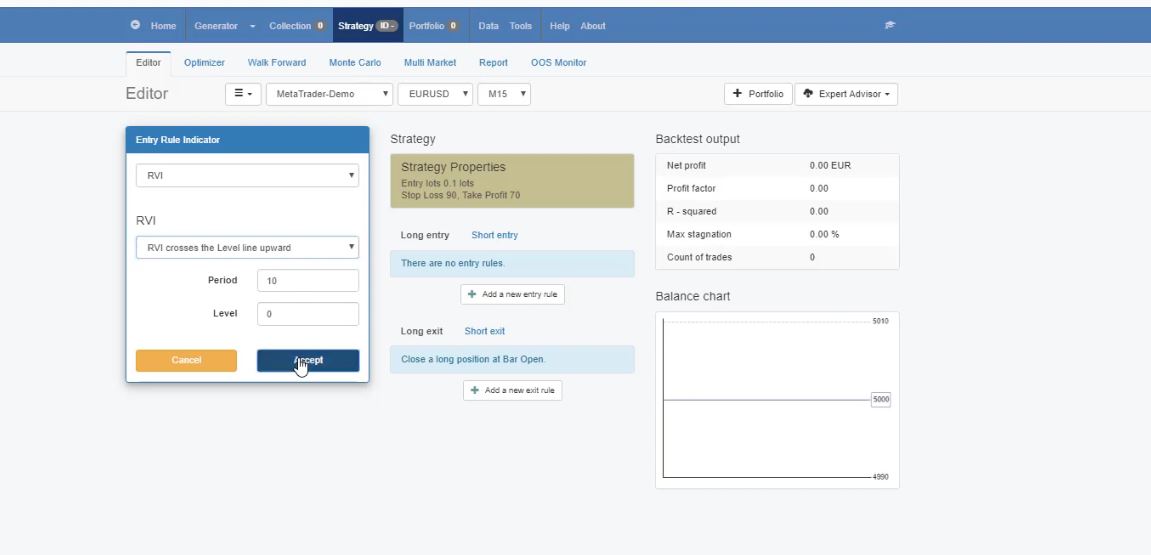

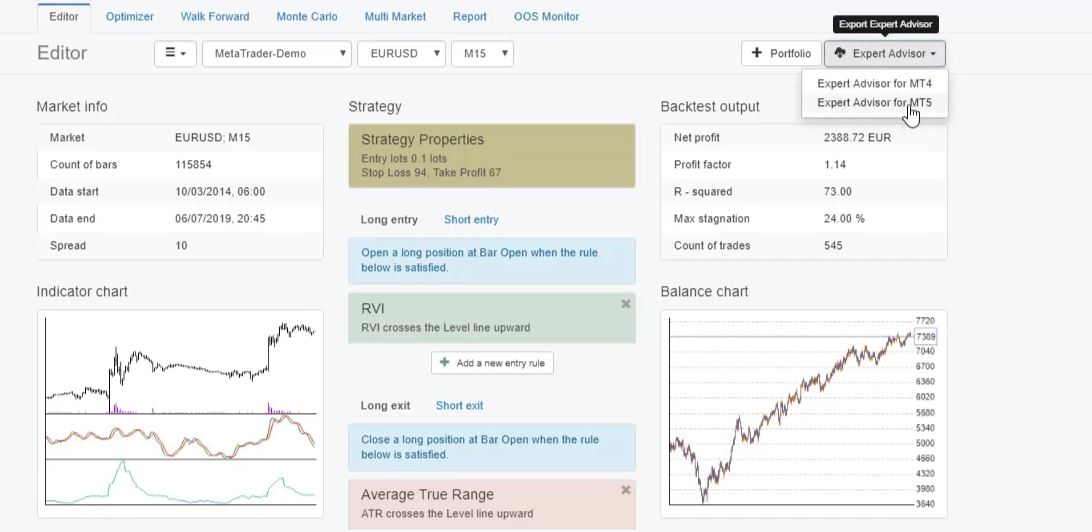

Now, these are the rules for a long entry. I can choose the indicators, and, for example, I will teach you a strategy with the RVI. And we have different parameters. RVI rises, falls, is higher than the level line, RVI is lower than the level line, crosses the level line upward, downward, changes its direction upward, or downward.

So we have different options. Now, let’s say we want the RVI to cross the level line upward. And I will teach you what is the difference when we use the default parameter. So 10 is the default with RVI. I click on accept, and I have a losing strategy.

This is the excellent thing that immediately when you make any change in the editor, you can see the balance chart, or this is the backtest.

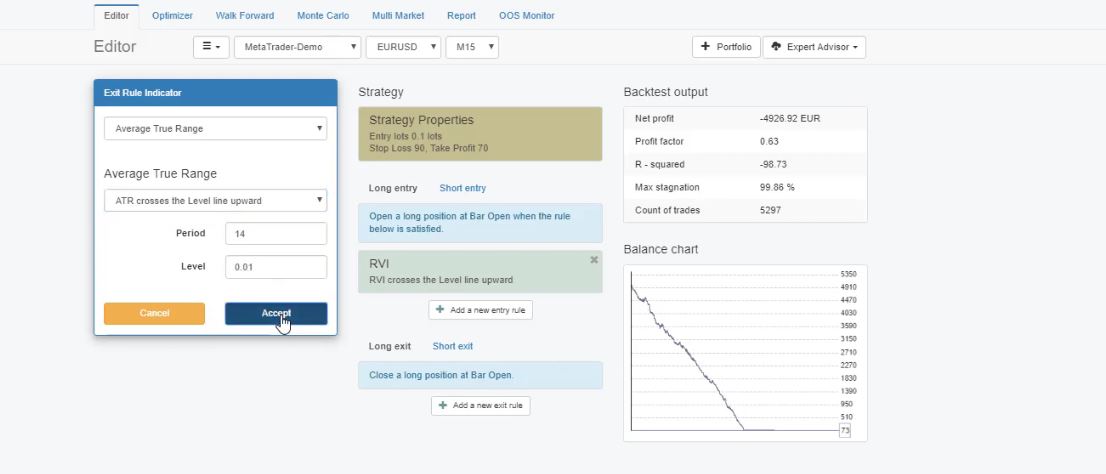

So any change will be applied here. As an exit rule, I will choose the Average True Range. And, as a rule, I will select Average True Range crosses the level line upward, and I will stay with the default parameters. I click on accept.

and already I have a much better backtest

Still losing, but at least I have some moments of profits, drawdowns, another period of Profit, then losing again.

Auto trading software allows you find the best parameters for an Indicator.

So now, I have the strategies with the default parameters. Now let me change it. For example, the RVI, I will increase it to 18, I will click on accept. I have a much better strategy. It’s profitable because we start at 5,000.

And it made a considerable drawdown, then it went on a profit, then again goes down, and in the end, it’s more of a sideways, it is on Profit.

Now for the Average True Range, I will change the period to 42. And, as well, the level I will change it to 0.002. I click on accept, and there was no considerable difference in this case.

And let me change as well as the strategy properties. Let me increase a little bit the Stop Loss to 94, and the Take Profit I will decrease it to 67.

I click on accept. There’s a difference. I have a much better strategy here. There is a drawdown in the beginning, but in the recent period, it goes with a very stable line upwards.

And this is one of the strategies that I’ve created recently with the Auto trading software. So having the RVI 10, which is the default doesn’t work, but 18 is much better and as well the Stop Loss and the Take Profit.

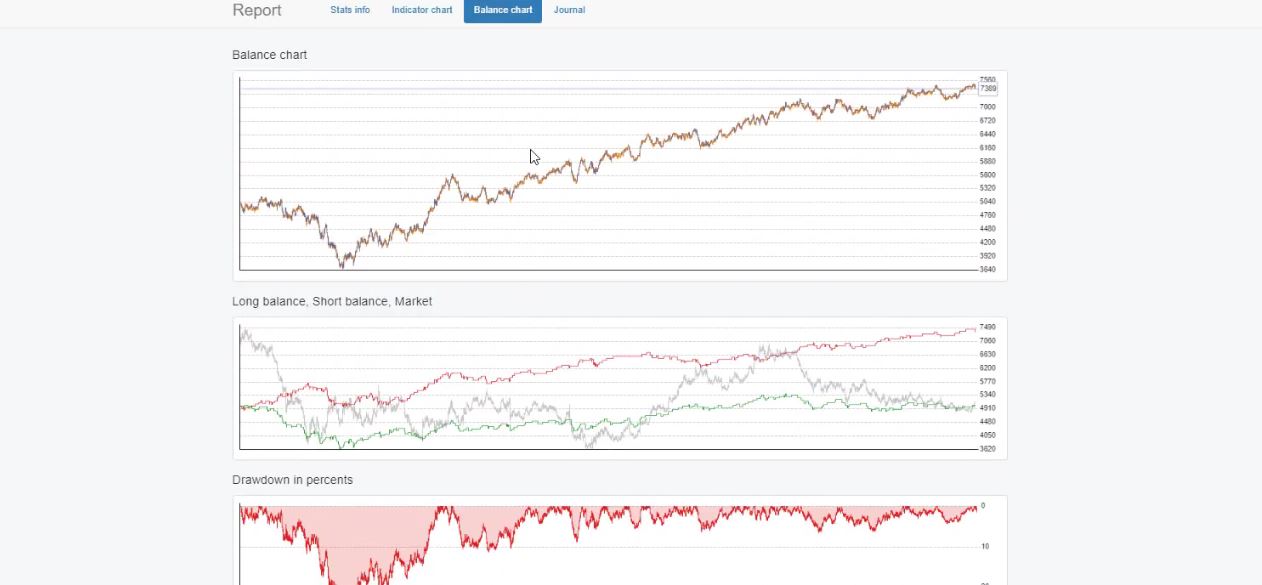

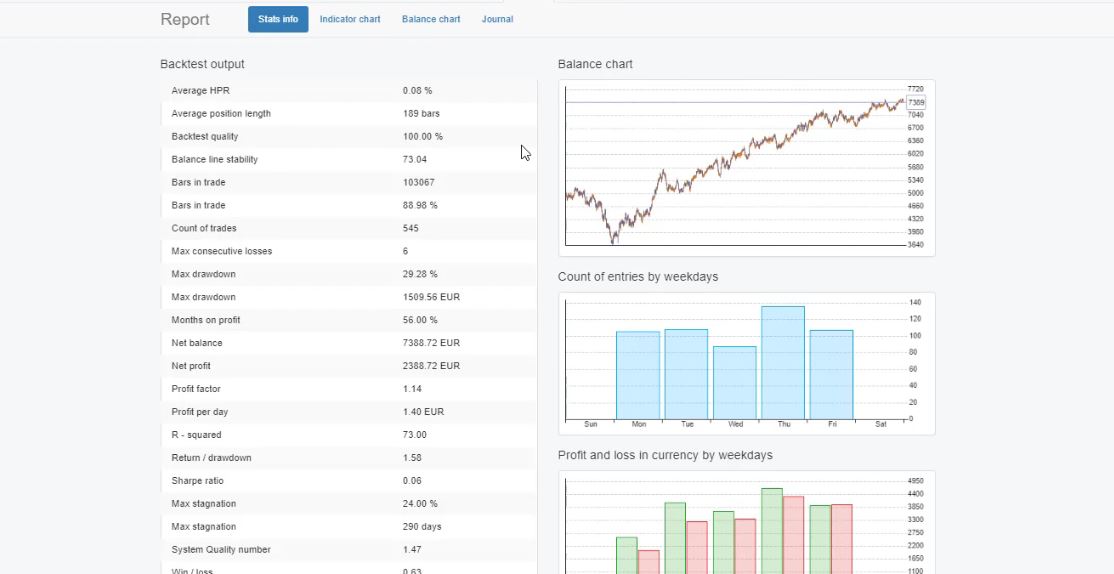

Now for this strategy, I have a very detailed statistic. If I click on the chart, I have the balance chart, long balance, short balance, and we have the drawdown in percentage, currencies, stagnation in days.

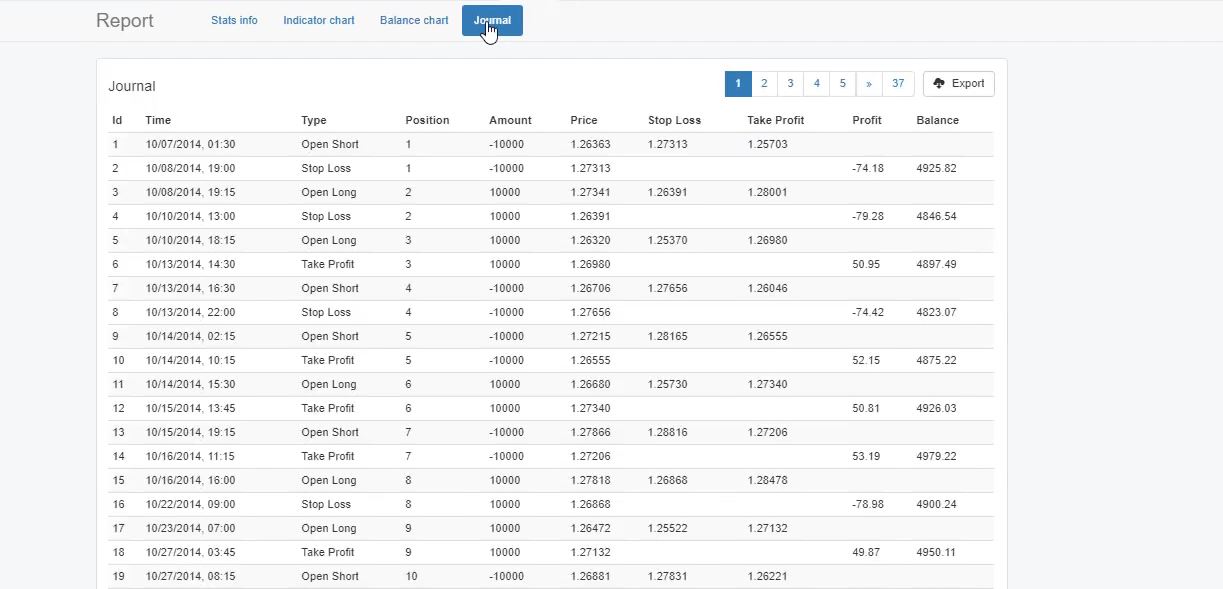

As well, we have the journal where we see when the trades were opened and closed, what was the price, what is the Profit or loss.

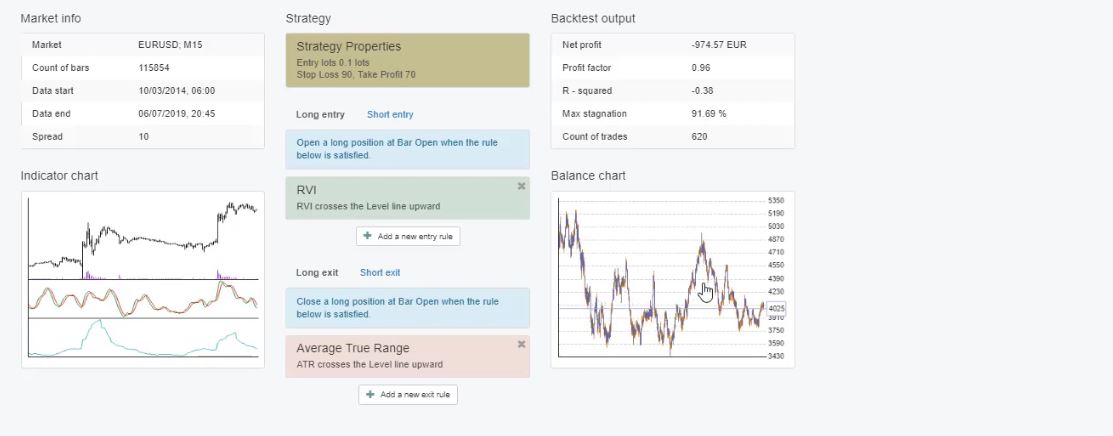

The indicator chart is what makes the Auto Trading Software precious.

We have an indicator chart, which is very interesting.

Here we can see where the trades were open, where they were closed. We can see precisely the moment of the entry. For example, we have a long trade because the RVI crosses the signal line, and when this is confirmed on the opening of the next bar, we have the trade. And we have a short trade, so it should be on the opposite side.

We have a sell because the RVI crossed the level line downwards. There’s a lot of statistical information, very detailed backtest output.

We have the count of entries by weekdays—Profit and loss in currency by weekdays, which is very interesting as well.

We have it by entry hour and exit hour, count of entries, profits, and losses by entry hour, and we have monthly performance in currency.

This is something exciting, so we can see which months this strategy was profitable when it was losing and so on. A lot of detailed statistics with this Auto Trading Software. Which are not available in Meta Trader if you perform a backtest there.

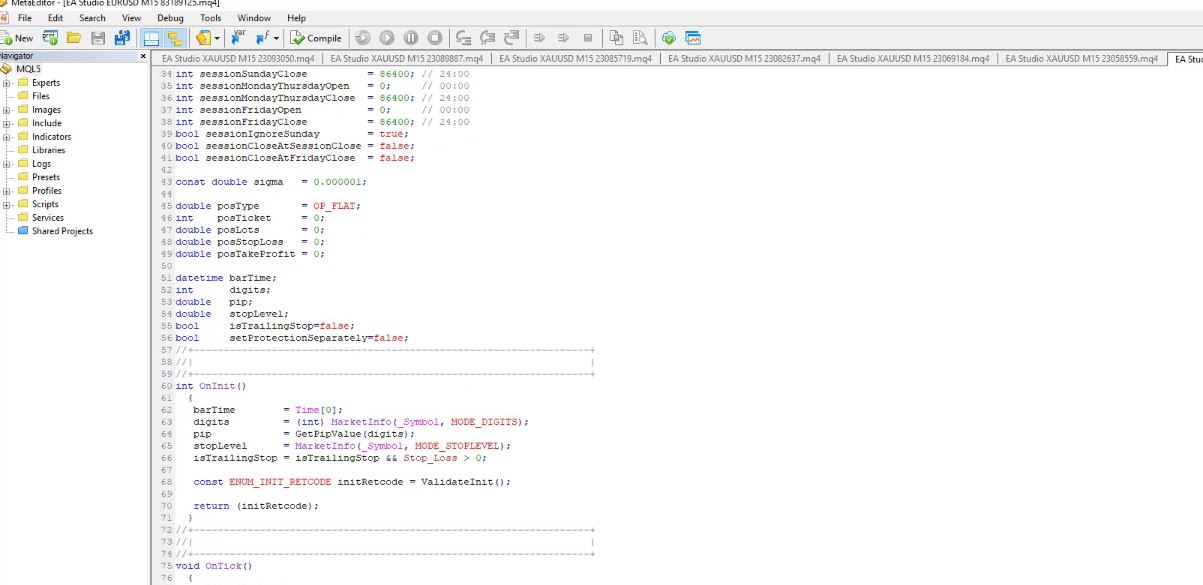

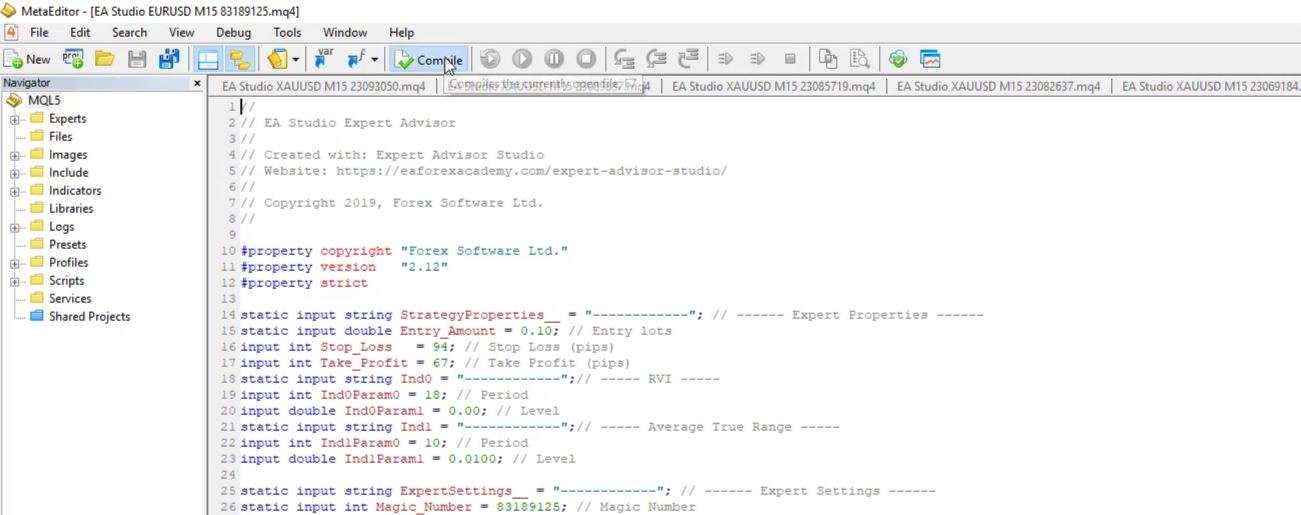

Now, the best thing with the EA Studio is that with one click, we can export it as an Expert Advisor for Meta Trader 4 and for Meta Trader 5.

And if I click on it, I will have the Meta editor opened, and I have the strategy code.

I have the complete code for the strategy. The parameters are on the top with the different indicators, the Stop Loss, the Take Profit, and all the rest below. Now, if you’re not an advanced developer, I will not suggest you touch anything in the code.

No programming skills required.

And you can compile the Expert Advisor, and it will be ready for the Meta Trader platform.

You can see there are 0 errors, 0 warnings, which means the code is just fine. So this is how you can build your strategies by entering the entry rules, the exit rules, Stop Loss, Take Profit, and you can export it as an Expert Advisor with one click.

You don’t need to have any programming skills. You don’t need to hire a developer to code the strategy for you. The Expert Advisor Studio just exports the ready code.

This is why many traders use this Auto trading software. It makes the trading so much easier and transperant.

Thank you for reading!

This was a free lecture from our Online Trading Course: Expert Advisor Studio Basics

Cheers.