What is Pip? The difference between Bitcoin pips and points

What is a Pip in crypto trading? This is one of the questions I get from the students very often.

Pip, short for percentage in point, is a unit of measure used in the trading of currencies, cryptocurrencies, and other financial instruments. In the context of Bitcoin trading, a pip is a unit of measurement that represents the smallest change in value that a Bitcoin can experience.

Hello dear traders, my name is Petko Aleksandrov from EA Trading Academy, and in this lecture, I will make it clear what is a pip and what is a point. But I will talk about Bitcoin pips and points.

I had many students asking me is what is pip, is this in points, how many points is the spread, the swap, and I want to make it clear for everybody.

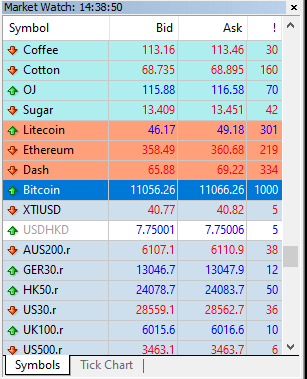

Therefore probably I will update some of the courses that I have ready, but the difficulty here comes with the cryptocurrencies mostly because these are the ones with a huge spread, and some brokers are having after the second or the third digit.

So most people do not understand what is a pip in cryptocurrency trading because they do not look at the price in detail. And Pip Bitcoin is harder because Bitcoin is expensive.

How to calculate Bitcoin pips?

One of the tools that traders use to calculate the value of a pip is a pip calculator. A Bitcoin pip calculator is a tool that allows traders to determine the value of a pip in terms of the currency that they are trading. For example, a trader who is trading Bitcoin against the US dollar would use a Bitcoin pip calculator to determine the value of a pip in terms of USD.

Calculating the value of a pip can be particularly important for traders who are using leverage to trade Bitcoin. Leverage allows traders to trade larger amounts of Bitcoin than they would be able to trade without it, but it also increases the risk of losses. By calculating the value of a pip, traders can determine the amount of profit or loss that they can expect from a trade and make informed decisions about whether or not to enter a trade.

In addition to calculating the value of a pip, traders may also need to calculate the value of a point. A point is a unit of measure that is similar to a pip, but it is used in the context of trading instruments that have a higher degree of price precision. For example, some Bitcoin exchanges quote the price of Bitcoin to five decimal places, in which case a point would be equal to 0.00001 BTC.

But I will explain that in detail below in the post.

- 2 digits after the crypto decimal comma that is a Bitcoin pip

- 3 digits, that is a point

Also, for the currencies, most of the brokers have five digits, some with four still, but anyway, I want to make it clear what is a crypto pip for everybody.

To make it clear what is crypto pip, we need to know what digit is?

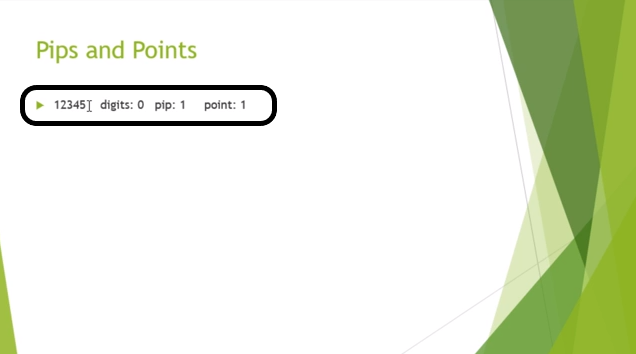

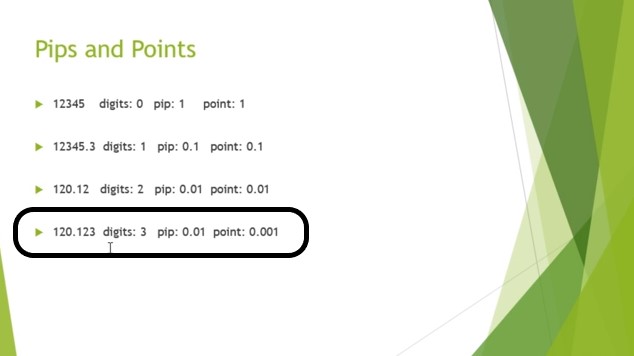

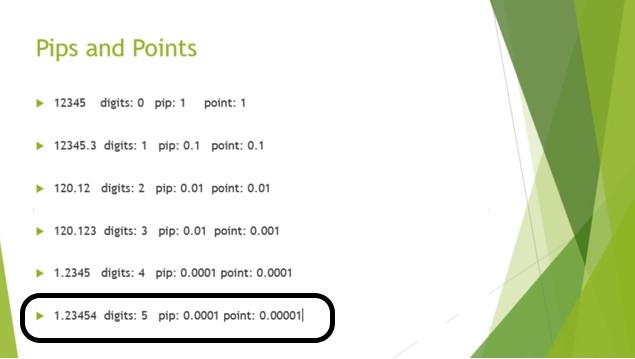

If you have a price of 12345, this means you have 0 digits. And we are talking about the digits after the decimal comma. So, let’s say this is stock. And the price is 12345, and there is nothing after that, there is no .05 or 0.5 nothing. It is a whole number, meaning digits are 0, pip is 1, the point is one as well.

When there is nothing after a point, so if there is no point at all, there are no digits. Said what it is after the point, after the comma or whatever you call it is called digit and in this case, the Bitcoin pips equal to the point.

The next example is when you have “.3”, for example, after the number. Usually, nowadays, you will not see such prices with currencies, with cryptocurrencies, or with stocks and commodities.

This is because, on the online trading platforms, we have a minimal difference between the bid and the ask prices (the buy and the sell prices). Not like in the bank, when we exchange currencies for a vocation, you pay a lot for that huge difference.

Try asking someone in the bank, “What is Pip?”. They do not know. They do not know that there could be such a small difference between the bid and the ask prices.

Now, if you have already trading experience, you know what I am talking about. But if you do not have, let’s have some more examples so you will have a better idea about it.

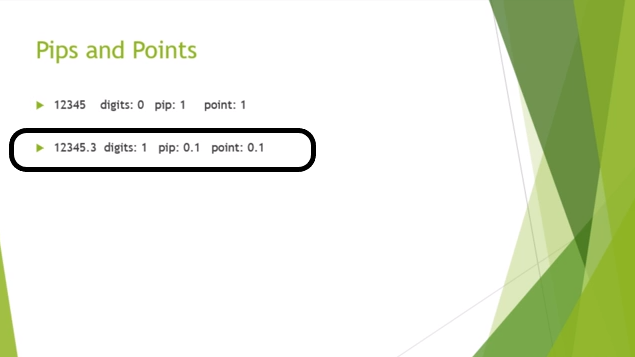

You already have one digit, so basically, this is your digit.

And in this case, you have pip 0.1, and you have point 0.1. So, when you have only one digit after the point this means that the pip and the point are equal.

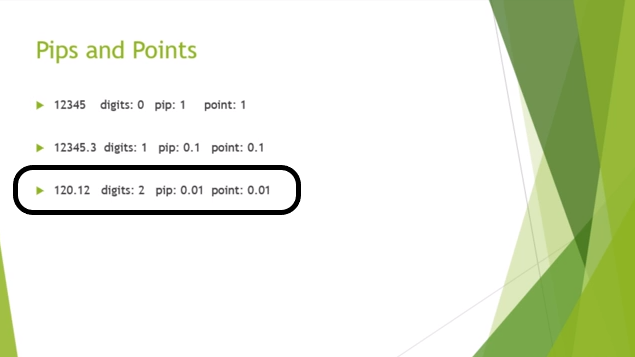

The next case is when you have two digits after the point, so 120.12,

Now the pip equals the point.

This is the most common case for Bitcoin pips:

As you can see the crypto Pip equals the points because there are just 2 digits after the decimal comma.

And the next case is when you have three digits after the point. This comes typically for the USDJPY at the moment or any of the JPY pairs. We have three digits, and here comes the difference between the pip and the point.

So, 12 pips and 3 points-this is how we say, we pronounce the price as 120.12, we usually do not mean the point, but this is the smallest change you can see on the price. Here already we have three digits, we have pip of 0.1, so 12 pips and the point is simply the last one.

Here already, what is pip? It is ten times bigger than the point.

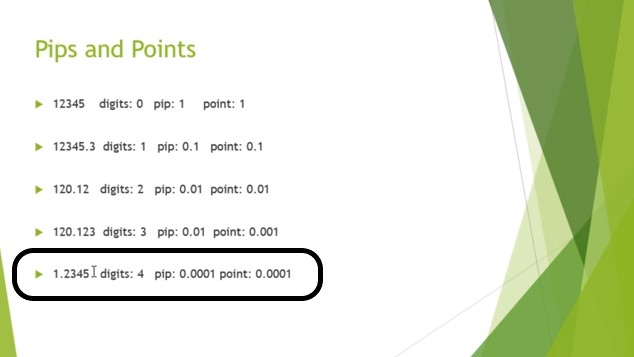

The next example what I will show you is when we have four digits, let’s say this is the price of EURUSD, it doesn’t matter what example I would take, but it is a currency. You will see four digits after the point and here basically, you do not have a point because the point is equal to the pip.

Here at 1.2345, you have your pip as 45, and point is as well 45.

The point is here, but it does not make any difference from what is a pip.

And the next line is now what you see with most of the brokers where we have pips, and the last one is the point.

In the old days, guys, all the brokers were till the fourth one, till the fourth digit, and the pip was equal to the point. Of course, at that time the crypto Pip was not there to confuse the traders.

And now because there are so many brokers on the market and because of the huge competition over there most of them started providing spread lower than one pip.

And because there was nothing before lower than one pip, they created the point.

Now often, you will see brokers providing you spread 12345 points. Which of course is good for everybody that is on the trading side, because you are paying less spread. Right here, when you have five digits, the price is 1.2345 pips and 4 points, but we usually do not say the 4 points when you pronounce the price. But the points are there and

The pip is ten times bigger than the points.

An easy way to remember it is when you have three digits and five digits are where you have the pip ten times bigger than the point and when you have two, and you have 4, you are having pip same as a point.

You can say there are no points, or you can say that pip is the same as the point. I hope it is clear.

And for the Bitcoin pips, if there are 3 digits behind the crypto price only then we will have a point. But if there are just 2, that is a Pip Bitcoin.

I do not think you will find a broker nowadays that will show you a one-digit price or without digit price, but I just made it this way, so it will be easier for you to understand me.

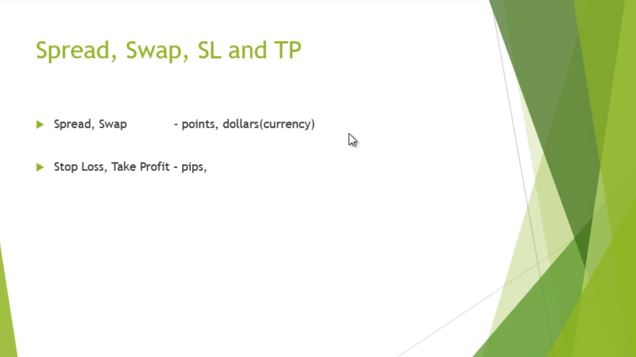

And the next question is about the spread, the swap, the Stop Loss, and the Take Profit.

If you have spread and swap, usually the spread and the swap are in points or USD or any other currency.

For example, you can see some of the brokers for the cryptocurrency trading provide swap negative of $25, and there are no points to calculate there, or you can see it as well in points, but the spread nowadays is mostly in points.

Of course, there are brokers with a considerable spread. Simply you can stay away from these brokers.

So what is the pip in cryptocurrency trading broker? It is the measurement of spread and swap

And the Stop Loss and the Take Profit it’s generally in pips, could be in points as well but especially the software that we are using, for example, EA Studio works with pips and FSB Pro works with points.

This is how you should work with such pieces of software if you are, and this is how the prices of the stocks, of the cryptocurrencies, of the regular currencies are basically structured.

I hope it is clear what is Pip in Cryptocurrency trading and you already know how to calculate Bitcoin pips, guys, thank you very much for reading.

If you are interested in the Cryptocurrency algorithmic trading course and you want to know more about cryptocurrencies, you can find it on our website. All our cryptocurrency courses you can find in the section cryptocurrency trading.

In summary, a pip is a unit of measure used in the trading of financial instruments, including Bitcoin, that represents the smallest change in value that the instrument can experience. A Bitcoin pip calculator is a tool that traders can use to calculate the value of a pip in terms of the currency that they are trading, and a point is a similar unit of measure that is used in the context of instruments with a higher degree of price precision.

Last but not least, check out our article about pips in forex trading if you are curious to learn a bit about this topic.

What is Pip?

Pip stands for a point in percentage. This is how traders measure the change of any asset or currency pair. A smaller movement than the pip is the point.

What is the difference between a point and a pip?

The currency prices normally are with 5 digits after the decimal comma. The 5th digit is the point and this is the smallest movement measured in the price. The Pips are the 3rd and the 4rt digits.

How the pip is different in cryptocurrency trading?

This depends on the broker or the exchange that offers the cryptocurrency. Most providers offer 3 digits after the decimal comma. The first 2 are the pips and the last one is the point.

How to calculate pips in Cryptocurrency trading?

If we divide the exchange rate by 0.0001 we will see what is the value of 1 pip in cryptocurrency trading. In other words, this is the smallest movement possible.