Stochastic trading strategy is what I will teach you today!

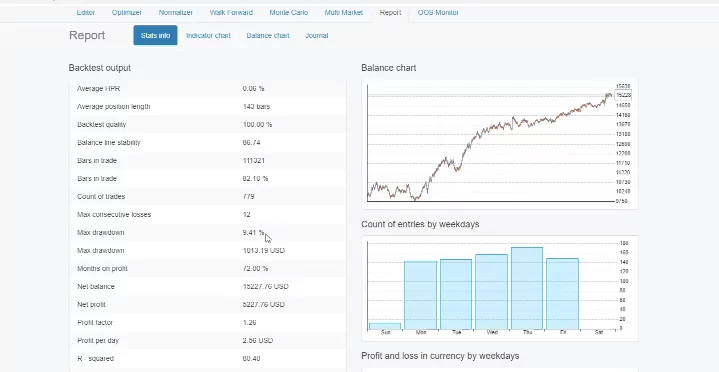

Hello traders, today I will share with you a stochastic trading strategy that I generated recently for one of my courses, The Automated Forex Trading course + 99 Expert Advisors. And I was very impressed by the results that EA Studio showed me. This is because you can see what a stable balance chart I have with small drawdowns.

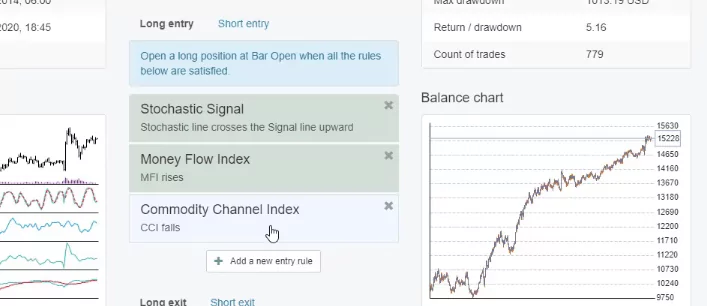

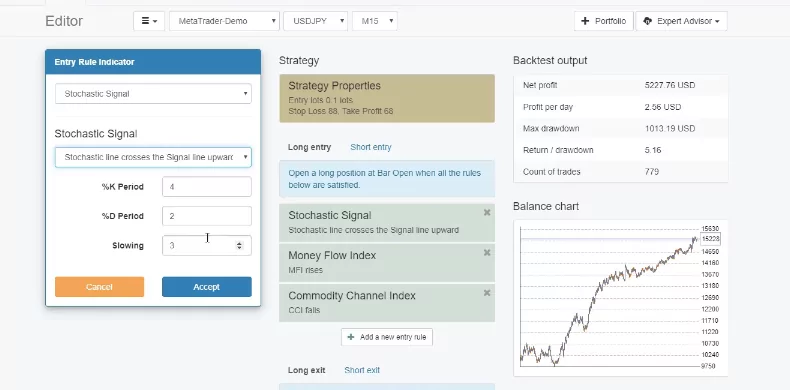

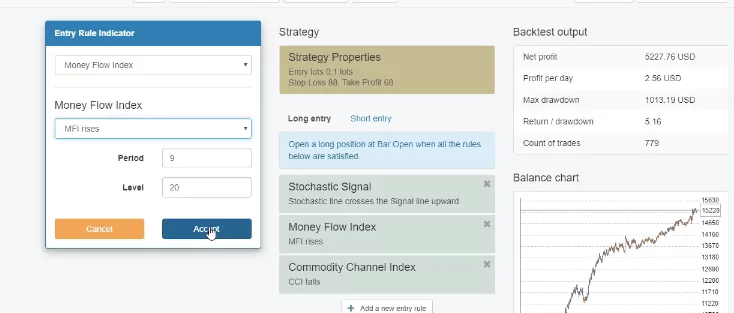

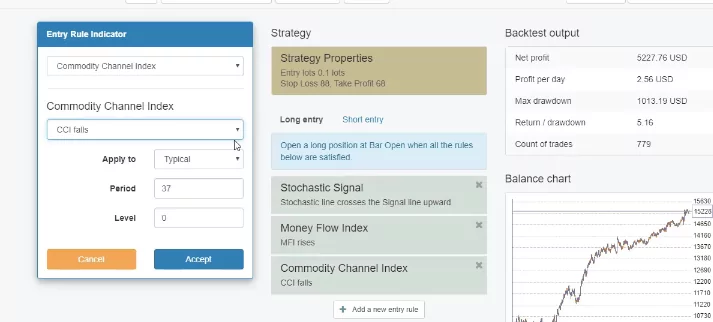

We will have a look at the statistics of this stochastic trading strategy later on. But you can see that this is not just a stochastic strategy. It’s much more because it combines the Money Flow Index and the Commodity Channel Index or as everyone knows it, the CCI indicator.

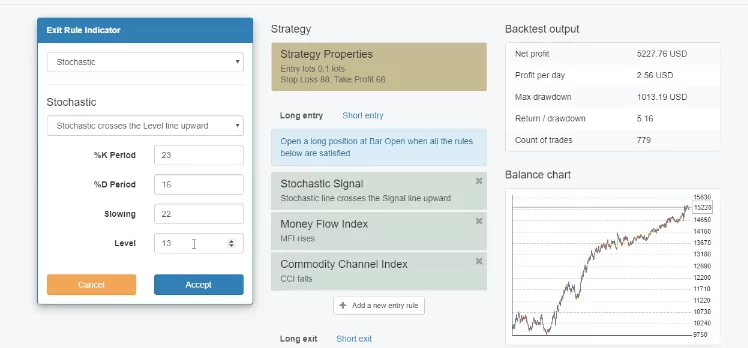

So these 3 indicators combined give the entry rule. All of them should confirm the trade before this strategy opens the trade. And we have as well the stochastic as an exit condition, we have a Stop Loss and a Take Profit with this stochastic trading strategy to protect the capital and to ensure better results.

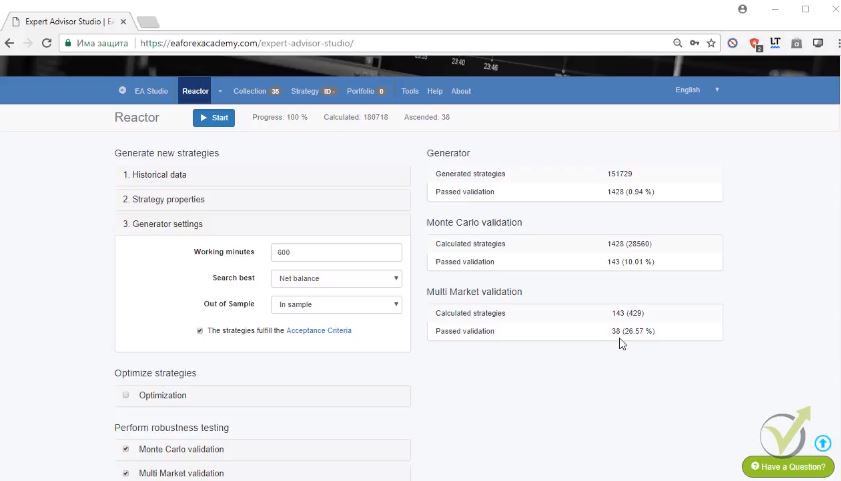

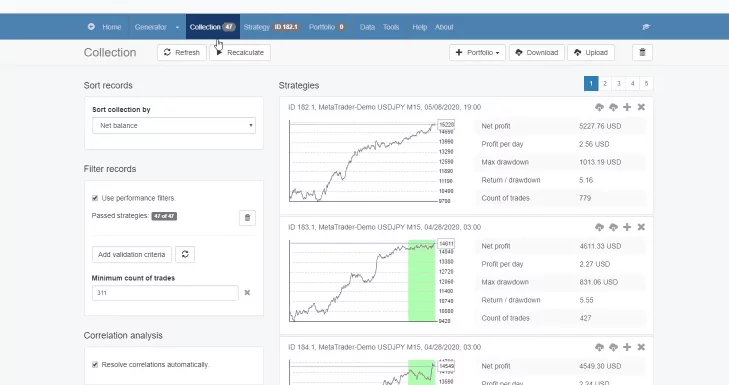

So this trading strategy is for the USDJPY. And for the recent update of the course, I have generated 47 strategies. I have used the Out of Sample tool in EA Studio as you can see in the strategies below. There is the In Sample part and the Out of Sample part which is marked in green.

Give the Stochastic trading strategy some time

For the beginner traders, the Out of Sample allows us to test the strategy on unknown historical data. This means that I have used 80% of the historical data to generate the strategies. As for the rest 20%, I have tested the strategies.

It is also possible now to filter the strategies that are in the Out of Sample part so I see as a result only the strategies that are profitable during the Out of Sample part. So is this stochastic trading strategy that combines the Money Flow Index and the CCI.

The statistics of this stochastic trading strategy are very promising because we see a maximum drawdown of 9.41% which is great.

My minimum is 20% and this is double less which is great for such a long period of time. I have been testing this strategy since 2014 and in numbers, this is $1,013 of a drawdown.

Many of the beginner traders that test the strategies from our courses say that there are some losses during the first week or during the first month. You need just to give it a little bit of time because as shown on the balance chart, there are periods when the strategy is losing.

Practice the Stochastic trading strategy on a Demo account

It is very normal, not just for this stochastic trading strategy but for any other strategies. Either on the Forex market, on the stock market, or the cryptocurrency market. The market changes every day.

We cannot expect to have strategies that are profitable every single day. This is why we test these strategies on a virtual account, Demo account, and we see which ones are profitable at the current moment to use in our live accounts.

More statistics from the stochastic trading strategy is Profit factor of 1.26. The Profit factor is the gross profits divided by the gross losses. As well, the return to drawdown ratio is 5.16, maximum consecutive losses is 12, and we have count of trades as 779. This means that for the whole period, this stochastic trading strategy executed 779 count of trades.

And the more count of trades we have, the more robust the strategy. We don’t depend our trading on a strategy that opened just a couple of trades. First, it’s not an active strategy, and second, the statistic is not reliable because it opened just a couple of trades.

The difference between stochastic & stochastic signal

But 779 is a good number so I can rely on this stochastic trading strategy. Now, let’s have a look at the details, the Stochastic Signal uses the rule – Stochastic line crosses the signal line upward. And we have K Period of 4, D

Period of 2, and Slowing is 3.

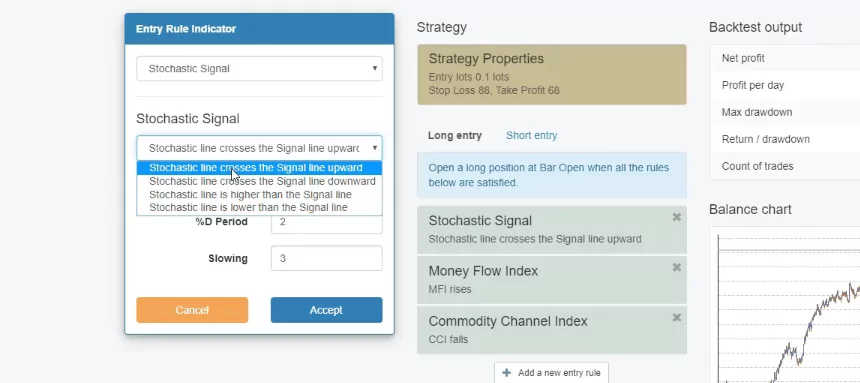

And you can notice that the exit rule is just stochastic and the entry rule is stochastic signal. What is the difference? The difference is that the stochastic signal uses signals that involve the signal line in the indicator.

You can see what are the 4 rules that are available – Stochastic line crosses the signal line upward, Stochastic line crosses the signal line downward, Stochastic line is higher than the signal line, and Stochastic line is lower than the signal line.

So all of these signals involve the signal line.

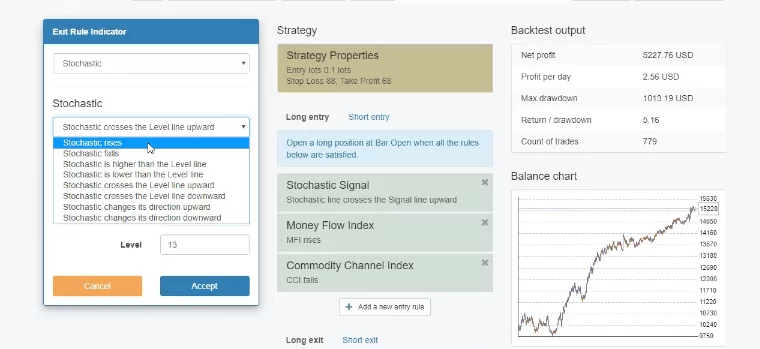

While in the stochastic exit rule, we have the following rules – Stochastic rises, Stochastic falls, Stochastic is higher than the level line, Stochastic is lower than the level line, Stochastic crosses the level line upwards, Stochastic crosses the level line downward, Stochastic changes its direction upward, Stochastic changes its direction downward.

The Money Flow Index

You can notice that all of these entry rules for the Stochastic trading strategy involve the stochastic itself, the level lines, and the direction, but not the signal.

And for the beginner traders, if I click on the chart, you can see below that for the stochastic indicator, we have the stochastic line and we have the signal line.

So this is why in EA Studio, sometimes you will see the stochastic signal as an entry or exit rule. And sometimes you will see just the stochastic indicator which, one more time, is the same indicator. They just use different entry and exit conditions.

Now, the Money Flow Index uses the rule – Money Flow Index rises which confirms the direction of the stochastic signal, we have Period of 9 and Level of 20.

And we have the Commodity Channel Index or the CCI with the entry condition to fall, period of 37.

And as an exit rule, we have – Stochastic crosses the level line upward, K Period of 23, D Period of 16, Slowing is 22, and Level of 13.

What more do we have with this stochastic trading strategy? A Stop Loss of 88 and Take Profit of 68.

Usually I round the numbers

What I usually do with the Stop Loss and Take Profit is to round the numbers if they don’t have a huge impact on the performance. Even this strategy improved a little bit. And then I increase the Take Profit to 70 and the balance chart improves even more.

Now, if I click on the indicator chart, I will show you some example trades that were executed with the stochastic trading strategy. All of the indicators are displayed below. Let’s have a look at some long trade first and then we will have a look at a short trade.

So at this candlestick, we have a long trade which means that the strategy executed a buy position.

This is because, in the previous bar, we have confirmation from all of the indicators. This is how this Stochastic trading strategy works.

On the opening of the next bar, the trade is opened. This trade was closed due to the exit rule, the stochastic line crossed the level line upward and the trade was closed. Let’s have a look at a short trade on the 28th of April, 2020.

Use the short exit button and short entry button

We have a short trade because we have confirmation from the Stochastic Signal, from the Money Flow Index, and the CCI index.

And as we said, the stochastic trading strategy follows the rules – Stochastic crosses the signal line downwards. This is for sell trade which is the opposite of the buy rule.

And as we said, this strategy follows the rules that we need to see the stochastic crossing the signal line upwards for a buy which will be the opposite for a sell. So it will be stochastic crossing the signal line downwards and this is exactly what happened.

We have the confirmation from the Money Flow Index which falls. As we said, for a long trade, the Money Flow Index should be rising and here it’s falling. And the third one, the CCI indicator rises and for the buy, it should be falling.

So we have just the opposite of the rules that are in a long trade and this trade goes to positive and we have our Take Profit reached just a couple of days later.

If you have difficulties with short and long, just use the short exit button and short entry button. This will convert the indicators or it will just show what are the rules to enter short or to sell.

You can register for the EA Studio free trial from our Home page

The easiest way to remember it is that we are looking for the opposite events. Trading with this strategy on the Meta Trader platform manually or algorithmically is up to you.

What I would suggest you do is to build this strategy with Expert Advisor Studio for your broker, for your historical data and just add the indicators one by one using the parameters that I have shared with you. You will see what the balance chart is with your broker.

And this is very logical to do because most of the brokers provide different quotes for the prices with a different spread. This results in different backtests.

With one click, you can export this stochastic trading strategy as Expert Advisor for Meta Trader 4 and for Meta Trader 5.

This is how this Stochastic indicator works.

You can test it on a Demo account. I always suggest for my students to test these strategies on a virtual account. If you like the performance, you can use it for your live trading account.

And if you haven’t used EA Studio, you can go to the Home page and register for a free trial.

You can build many similar Stochastic trading strategies with this software

During these 15 days, you can export as many Expert Advisors as you wish. You can also generate strategies or build strategies just as I show in my courses.

There is a free course on the Useful links tab. As well EA Studio is available on many different languages which might be useful to you if any of them is your native language.

Thank you very much for reading. Let me know if you find this Stochastic trading strategy useful.

Safe trading!