Are you a trader wondering whether to trade a Scalping Forex Robot or Day Trading Robot? Today, we will answer this question by placing one of each on a thousand-dollar live account with BlackBull Markets and see which one will produce better results. But before we dive into the results, let’s first understand the difference between the Scalping Forex Robot and the Day Trading Robot.

Scalping Trading Strategy (Scalping Forex Robot)

Scalping trading involves trading for a very short interval of time. The strategy is to enter the market quickly, take quick profits, and get out without staying longer into the trade or position. In other words, scalping traders aim to make a profit within minutes or seconds.

Day Trading Strategy

When it comes to Forex trading, day trading is considered a little bit longer period than scalping but still within one day. Day traders buy and sell financial instruments within the same trading day. The goal is to open and close trades within the same trading day. Avoiding holding positions overnight is recommended, as it’s is risky due to potential gaps in the market at midnight.

While some traders say that scalping and day trading are the same thing, day trading is a little bit longer period trading compared to scalping trading. Now let’s take a closer look at the strategies behind the two robots.

Strategy Behind Scalping Forex Robot

The strategy behind the Scalping Forex Robot is to make quick profits. This robot uses a technical analysis tool that helps it identify profitable trades with a small spread. It analyzes price movements in real-time and uses an algorithm that allows it to enter and exit trades quickly, taking advantage of small price movements.

Strategy Behind Day Trading Robot

The Day Trading Robot, on the other hand, uses a strategy that aims to capture larger market moves during the trading day. It looks for opportunities to enter trades and holds them for longer periods, making bigger profits. This robot also uses technical analysis tools to identify potential market moves.

The Importance of Understanding the Strategy Behind the Robots

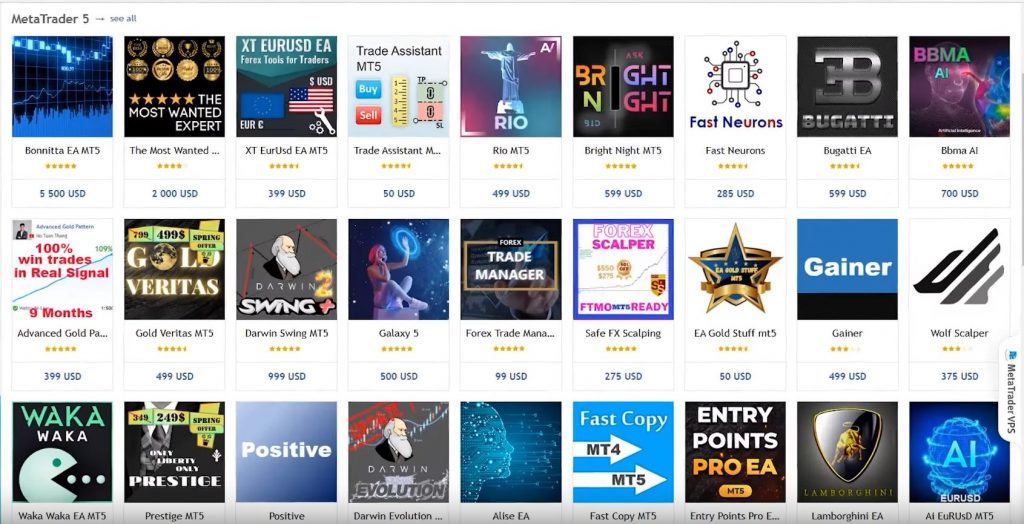

One of the major problems in algorithmic trading is that traders often buy Expert Advisors without knowing the strategy behind them. This lack of understanding can lead to blowing up accounts. When traders buy robots from the marketplace, they don’t know what indicators or conditions trigger the trades.

Simple EURUSD Day Trading Robot (EA)

Let’s start by looking at a simple EA for EURUSD (that is not a scalping Forex Robot). This particular robot uses just two indicators: Stochastic and Envelopes. When the Stochastic line crosses the Signal line downwards, the robot opens a short trade. Conversely, when the price goes above the upper band of the Envelopes, it closes the trade. It also has a Stop Loss of 100 pips and a Take Profit of 60 pips.

To test the profitability of this EA, you can easily backtest it using the Strategy Tester feature on MetaTrader 4 or 5. With the right settings, you can see how the robot would have performed on past data, giving you an idea of how it might perform in the future. Of course, past performance is not a guarantee of future success, so it’s important to exercise caution when using any trading robot.

GBPUSD Day Trading Robot

Moving on to a more complex EA for GBPUSD, this robot is designed for scalping and operates on the M1 timeframe. It uses three time frames and a combination of indicators to open and close trades. Without getting too technical, the robot looks for opportunities to enter trades when certain conditions are met, and it has a built-in algorithm for managing risk.

The key takeaway here is that EAs can be customized to suit your trading style and risk tolerance. They can help you automate your trading process, minimize human error, and potentially increase your profitability. However, it’s important to use caution and test your strategies thoroughly before relying on any robot.

If you’re interested in using EAs, you’ll need to find a reputable Forex broker that supports automated trading. One option to consider is BlackBull Markets, a regulated broker that offers low spreads and commissions, high leverage, and a variety of trading platforms. As always, make sure to do your own research and carefully evaluate any broker before opening an account.

How does the Scalping Robot work?

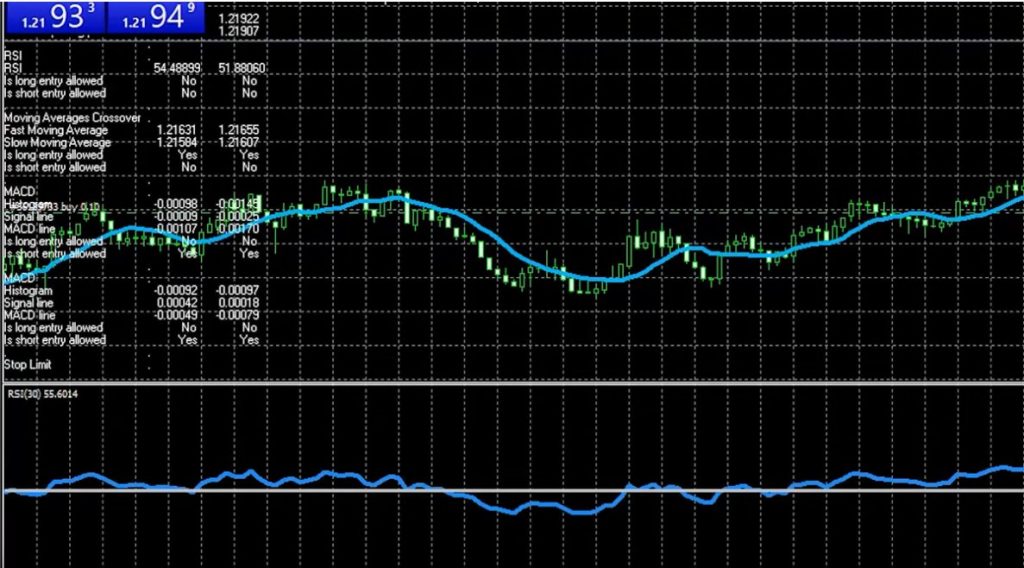

The Scalping Robot uses hard time frames like M30 and H1 to confirm the direction of the trade. The robot is monitoring these hard time frames to confirm the trade direction before opening the trade. The robot can trade inside the bar, not just at the opening. The Scalping Robot has one Moving Average with a period of 10 and the Relative Strength Index (RSI) with a period of 30.

To open a long trade, the RSI must cross the level line upward. The trade is opened when the price reaches the Moving Average. If you want to trade with this robot, you should place it on the M1 time frame. To ensure there are enough bars for the MACD, load historical data on H1 and M30. You don’t need to put any indicators on M1 or M15 for the EURUSD because the indicators, the values, the parameters are inside the code.

What indicators does a Scalping Forex Robot use?

The Scalping Robot uses one Moving Average with a period of 10 and the RSI with a period of 30. It also uses the Moving Average Crossover and the MACD on the higher time frames like M30 and H1. The Fast Moving Average has a period of 15, and the Slow Moving Average has a period of 50. If the Fast Moving Average is above the Slow Moving Average, we have confirmation to buy. The MACD line must also be higher than the signal line.

How to backtest a Scalping Forex Robot?

To backtest the Scalping Robot, you need to change the model to control points. This is because the robot can trade inside the bar, not just at the opening. You should load historical data on H1 and M30 to ensure there are enough bars for the MACD. You can place the robot on the M1 time frame, and it will automatically follow the rules and indicators on the higher time frames.

When backtesting the robot, you should look for the entry and exit conditions and the code. This way, you will know exactly what is inside the robot. You can also modify the code if you are an experienced MQL Developer. It is important to note that it is your personal responsibility if you decide to trade with any of the robots you backtest.

Day Trading and Scalping Forex Robot: Conclusion

In conclusion, the Scalping Forex Robot and the Day Trading Robot are two different robots that use different strategies. Scalping trading involves trading for a very short interval of time, aiming to make quick profits. Day trading, on the other hand, aims to capture larger market moves during the trading day. Understanding the strategy behind a robot is crucial when trading with algorithmic trading tools. After testing both robots on a live account, the Day Trading Robot produced better results.

You can download the 2 Robots from the Professional Trading Strategies Course with another 3 Robots attached as resource files. Test them yourself, and decide if day trading robots or scalping Forex Robots work better.