Are you a new trader hoping to make a profit in the market? It’s not just about having a profitable strategy to follow. It’s also about avoiding basic, yet common Trading Mistakes that can be easily avoided. In this blog post, we will discuss four of the most common trading mistakes that new traders often make and how to avoid them.

Trading Mistakes #1: Trading With Real Money From the Start

Test your strategy on a risk-free demo account before trading with real capital, regardless of where you get it from.

When trading with real capital, you risk losing some or all of your money due to market volatility or unexpected losses. Practicing on a demo account is best, especially for beginners who are likely to suffer losses. This way, you can test and implement the strategy, as if you were trading on a live account, but without the risk.

Emotional biases, such as fear, greed, and overconfidence, can lead to poor decision-making and financial losses. Practicing on a demo account can help you learn to trust the process and make informed decisions in a stress-free environment and avoid this trading mistake.

Trading with real capital immediately doesn’t give you enough time to understand the markets or the strategy before risking your capital. Practice on a demo account first to truly comprehend the markets and your strategy before trading with real money.

Mistake #2: Starting Without the Required Education

Many people show interest in trading, but often start trading without educating themselves. This is one of the common trading mistakes we see. It’s crucial to get educated in trading beforehand for several reasons:

- Understanding the market: Trading involves a complex market. Education can help you understand how it works, its trends, and the factors that influence it.

- Risk management: Trading involves a lot of risks, and it’s important to know how to manage them to minimize losses. Education can teach you about risk management strategies and techniques.

- Technical analysis: If you use manual trading techniques, it requires a deep understanding of technical analysis, including chart reading, candlestick patterns, and technical indicators. Education on these tools can help you make informed trading decisions.

- Avoiding scams: Trading is a highly unregulated market, and education can help you spot warning signs and avoid scams and fraudulent brokers.

- Developing a trading plan: Education can help you create a trading plan that fits your trading style and goals and keeps you disciplined and focused on your strategy.

You have no excuse to avoid getting educated today. There are countless free resources online, such as YouTube videos, blogs, articles, and professional opinion pieces. In summary, education in trading can help you make better decisions, minimize risks. You will avoid scams, leading to more profitable experiences.

Trading Mistakes #3: Trading unproven strategies

Let’s start with Social trading. It’s crucial to get educated before you start trading, but it’s even more important to learn from reliable sources. Many self-proclaimed experts make videos promising unrealistic profits with untested and unproven strategies. Don’t be fooled by fancy cars and luxury holidays; it’s all a lie.

Trading unproven strategies is risky, and is one of the more common trading mistakes beginners make. They haven’t been tested in real market conditions, and there’s no track record to rely on. Unproven strategies may seem promising on paper, but they may not work in the real market, leading to significant losses.

They may also lack risk management systems, increasing the chances of unexpected losses. Don’t forget, social media influencers are content creators, not traders.

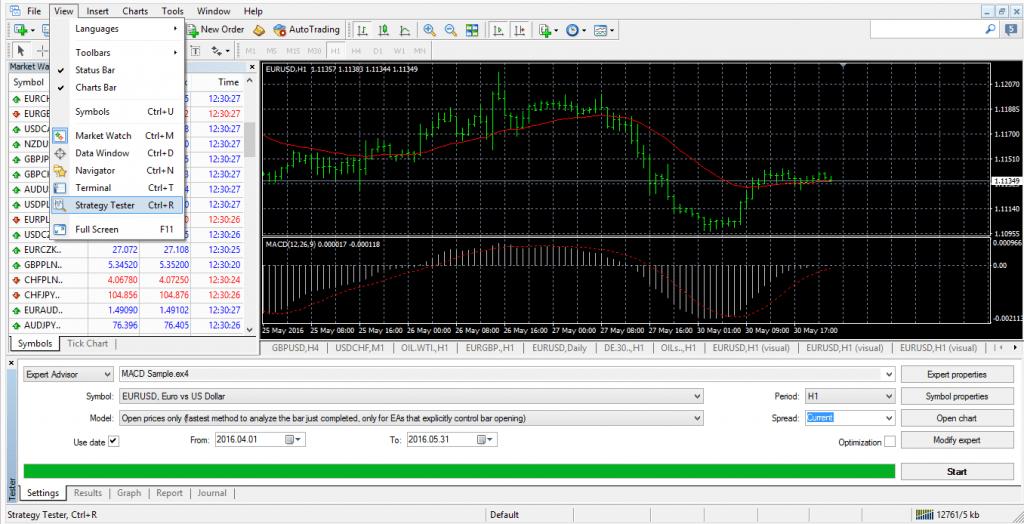

Backtesting a new strategy is essential. Backtesting is when you place a strategy over historical data. This shows us how it would have performed in the past, including during news events. Historical data is a record of an asset’s price over a specific period. Backtesting helps you make changes to your strategy and see how those changes affect its performance over time. This will you an idea of how it will perform in the future.

Mistake #4: Blindly trusting others

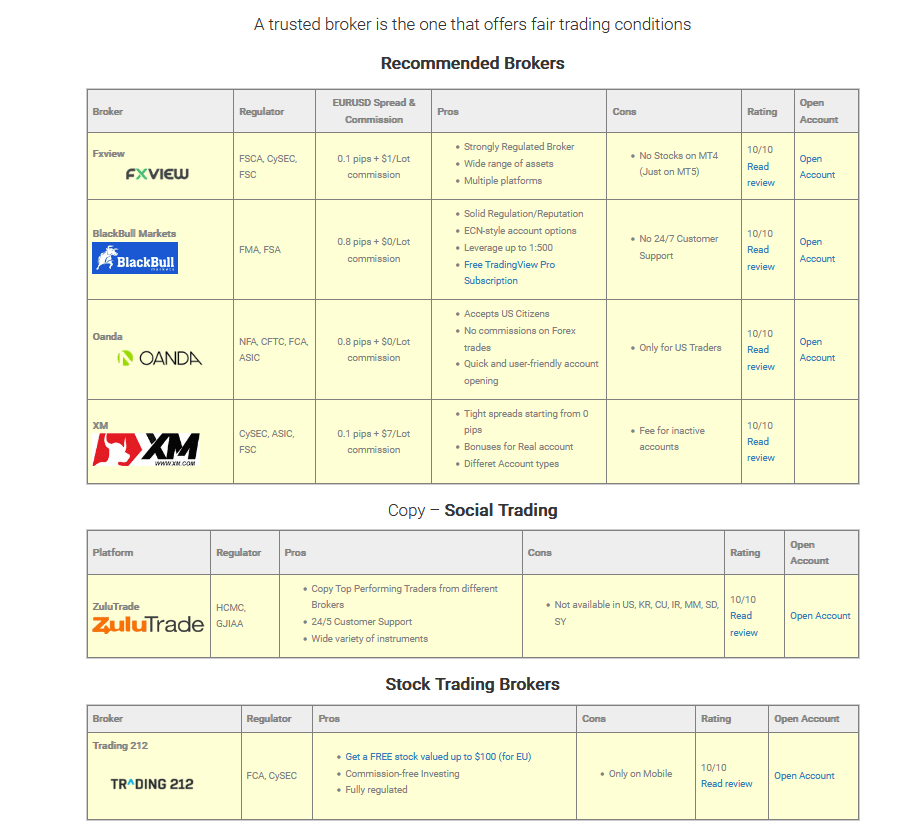

Trading can be risky, so it’s essential to select a regulated broker. Unregulated brokers are dangerous because many scammers and fraudulent ‘brokers’ are looking for victims. It’s important to be careful and research before investing in any trading opportunity.

Scam Forex brokers typically trick unsuspecting traders into depositing money with them by making false promises. These include high returns or other enticing offers. They often use aggressive sales tactics to pressure traders into making large deposits. They may also use false advertising and misleading claims to attract clients. This is one of the more costly trading mistakes new traders make. Find our list of trusted, regulated Brokers HERE.

Once the trader has deposited funds, the scam broker may refuse to allow them to withdraw their funds or charge high fees or commissions for trades. They may also offer poor trading conditions that make it difficult for traders to succeed.

Another tactic employed by scammers is to gain your trust with promises of trading on your behalf. However, they may allegedly lose your money or disappear once you invest more with them.

Unfortunately, some people have fallen victim to scammers more than once but continue to trust blindly without researching beforehand.

Overall, scam Forex brokers use a variety of tactics to take advantage of their clients. Therefore, it is crucial to research any broker you are considering working with and do your due diligence to avoid falling victim to these scams. At the Trading Academy, we research and work with legitimate brokers. Check out our brokers’ page in the description below for a list of trusted brokers and our honest reviews on each.

Trading Mistakes – Conclusion

New traders must choose a regulated and trustworthy broker, continuously educate themselves, and test strategies before implementing them in real trading. Practice on a risk-free demo account with your chosen broker for as long as needed before committing any real money to the highly competitive and volatile Forex Market. This exponentially increases the chances of success.