Are you looking for a reputable Forex broker to help you navigate the Forex market? Look no further than OANDA Broker, a multi-asset Forex broker that has been providing quality services since 1996. In this blog post, we’ll take a closer look at OANDA and what it has to offer in this OANDA Forex Broker Review.

The Company Background

OANDA was founded in 1996 and is headquartered in Toronto, Canada. It is a multi-asset Forex broker that offers a wide range of products, including Forex, indices, commodities, and bonds. OANDA is regulated by several financial authorities, including the National Futures Association (NFA) in the US and the Financial Conduct Authority (FCA) in the UK. This regulatory oversight ensures that the broker operates within the law and that clients are protected.

OANDA Forex Broker Review: Trading Platforms

OANDA offers several trading platforms to its clients. These include its proprietary OANDA Trade platform and the popular MetaTrader 4 (MT4) platform. The OANDA Trade platform is easy to use and offers advanced charting tools, automated trading options, and access to OANDA’s range of products. The MT4 platform is also popular among traders due to its advanced features and user-friendly interface. You can easily create EAs using EA Studio and trade with them on this platform.

Tools and Resources

OANDA provides its clients with various tools and resources to help them make informed trading decisions. The broker offers market analysis, including real-time news and market insights. Additionally, OANDA provides educational materials, including webinars, videos, and articles, to help clients improve their trading skills.

OANDA Forex Broker Review: Additional Services

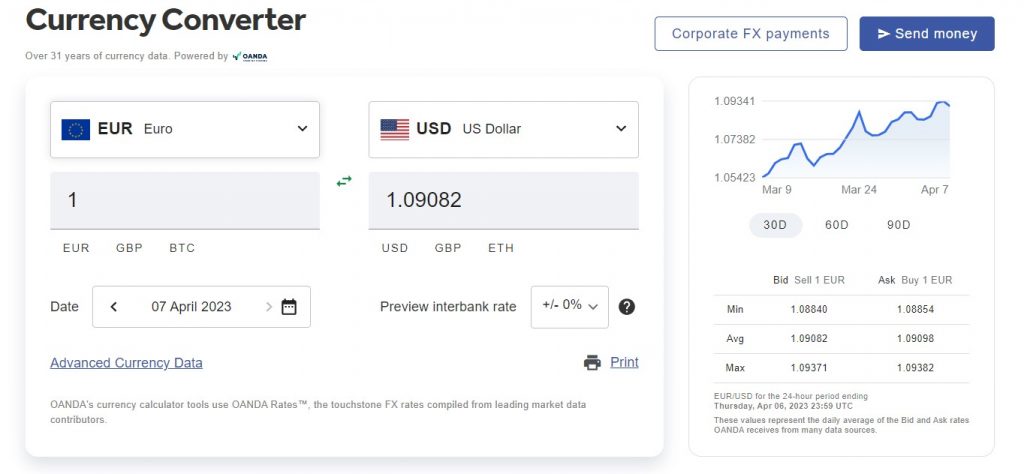

In addition to Forex trading, OANDA also offers other services. These include currency conversion and international money transfers. The broker’s currency conversion services are available for individuals and businesses, and it provides competitive exchange rates. OANDA’s international money transfer service allows clients to send money to over 170 countries and territories, with low fees and fast transfer times.

Industry Recognition

OANDA has received a number of industry awards over the years. In 2013, it was named Best Forex Broker at the Forex Magnates Summit. In 2016 and 2017, it was named Best Forex Provider at the UK Forex Awards. Especially relevant is that these awards recognize the broker’s commitment to providing quality services and its focus on innovation and technology.

OANDA Forex Broker Review: Competitive Spreads

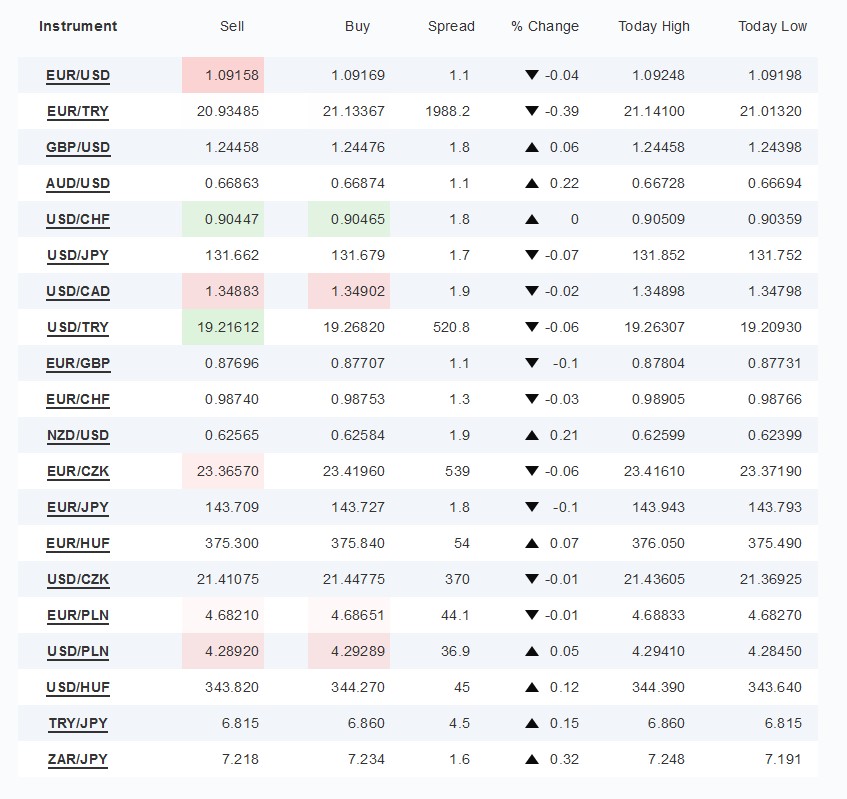

One of the standout features of OANDA is its competitive spreads. The broker offers some of the tightest spreads in the industry, which means that clients can trade with lower costs. Additionally, OANDA does not charge commissions on Forex trades, which further reduces trading costs.

Negative Balance Protection

OANDA offers negative balance protection to its clients. This means that clients cannot lose more than their account balance, even in cases of extreme market volatility. This protection provides clients peace of mind, knowing their losses are limited.

OANDA Forex Broker Review: Customer Support

OANDA offers customer support in several languages and has a reputation for providing high-quality assistance to traders. The broker’s customer support team is available 24/7 via phone, email, and live chat. Additionally, OANDA provides a comprehensive FAQ section on its website, which can help clients find answers to common questions.

Good customer service is essential when trading Forex. You want to choose a broker that offers quick and reliable support if you have any questions or technical issues. OANDA offers excellent customer service via phone, email, and live chat. The company’s representatives are knowledgeable, friendly, and responsive. OANDA also has a comprehensive online help center with articles, videos, and tutorials that can help you learn more about Forex trading and how to use its trading platforms.

OANDA Forex Broker Review: Pros and Cons

Pros of Oanda

- Low fees: OANDA’s fees are generally low with just a few exceptions. The company offers competitive spreads and does not charge commissions on Forex trades. Non-trading fees are also low, though the withdrawal fee is quite high for bank transfers.

- Easy-to-use trading platform: OANDA offers a great and easy-to-use MetaTrader 4 (MT4) trading platform, which includes MT4-web and MT4-Mobile versions. The platform is also available in a premium version with numerous technical indicators included.

- Quick and user-friendly account opening: OANDA’s account opening process is quick and digital. No minimum deposit is required to open an account, making it accessible to traders of all levels.

Cons of Oanda

- Limited product portfolio: One of the downsides of OANDA is its limited product portfolio. Currently, traders can only trade Forex and CFDs, which may not be suitable for those looking to diversify their investments.

- Poor customer service: OANDA’s customer support could be improved, as it is slow and not available 24/7. This could be a drawback for traders who require immediate assistance.

- High bank withdrawal fee: While Oanda’s non-trading fees are generally low, the withdrawal fee for bank transfers is quite high. This could be a drawback for traders who frequently need to withdraw their funds.

Oanda Forex Broker Review: Fees Comparison

To get a better idea of OANDA’s fee structure, we compared its fees with those of two similar brokers, Pepperstone and FXCM. Here is a breakdown of the most relevant fees for each asset class:

Forex trading fees:

OANDA charges low Forex fees, with the fees built into spread, which averages at 1.2 pips for EUR/USD and 1.6 pips for GBP/USD.

Stock index trading fees:

OANDA’s S&P 500 CFD fee level is low, with the fees built into the spread, averaging at 0.5.

Inactivity fee:

Oanda’s inactivity fee is low, at $10 per month after two years of inactivity.

Overall, OANDA’s fees are generally low, though the high withdrawal fee for bank transfers may be a drawback for some traders.

No Minimum Deposit Required

One of the most appealing aspects of OANDA is that there is no minimum deposit required to open an account. As a result, you can start trading with whatever amount you feel comfortable with, making it an attractive option for beginners or those who are just getting started in Forex trading.

OANDA Forex Broker Review: One Account Type with Multiple Sub-Accounts

At OANDA, there is only one type of trading account available, which is a Standard account. However, you can open up to 19 sub-accounts, which is a great feature if you want to have different base currencies under one account. For example, you can have a USD account with EUR and GBP sub-accounts.

The account opening process is quick and easy, and you can complete it in less than 10 minutes. While account approval can take multiple days, it’s still a relatively fast process, especially if you respond to their emails in time.

Four Steps to Complete the OANDA Account Opening Process

The Oanda account opening process involves four simple steps:

1: Contact Details – Set your username and password.

2: Personal Information – Submit basic personal information, such as your employment status or income estimate.

3: Appropriateness Test – Fill out a competence test with questions like “What are margins?”

4: Verify Your Identity – Upload a copy of your ID/passport to verify your identity and a bank statement/utility bill to verify your residency.

OANDA Forex Broker Review: Low Fees

Another significant advantage of OANDA is that its fees are generally low. The broker charges low CFD and Forex fees, and non-trading fees are also low. However, it’s worth noting that the withdrawal fee for bank transfers is quite high.

In terms of trading fees, OANDA’s fees are built into the spread. For example, the average spread cost for EUR/USD is 1.2 pips, while the average spread cost for GBP/USD is 1.6 pips. The average spread cost for S&P 500 CFD is 0.5.

Comparison with Similar Brokers

To get a better idea of how OANDA’s fees compare with those of other brokers, we compared them with two similar brokers – Pepperstone and FXCM. The selection of these brokers is based on objective factors such as products offered, client profile, fee structure, and more.

While Pepperstone offers a slightly lower spread cost for EUR/USD and GBP/USD, Oanda’s fees for S&P 500 CFD are lower. FXCM, on the other hand, has higher fees for all three instruments.

Regulation: A Safe and Secure Broker

One of the most important factors to consider when selecting a Forex broker is regulation. To protect its clients and ensure the integrity of the market, a regulated broker must follow strict guidelines. Multiple regulatory bodies, including the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and the Australian Securities and Investments Commission (ASIC) in Australia regulate OANDA.

These regulatory bodies ensure that OANDA follows strict guidelines to protect its clients’ funds and maintain transparency in its operations.

Fees: Low Trading Costs

Another critical factor to consider when choosing a Forex broker is fees. Fees can impact the profitability of trades, so it’s important to look for a broker with low trading costs. OANDA offers competitive spreads and charges low fees for most of its services. OANDA charges no commissions on trades and offers no account maintenance fees. The only significant fee that OANDA charges is for bank withdrawals, which can be quite high. However, this fee is only relevant if you choose to withdraw funds via bank transfer. OANDA offers several other withdrawal options with no fees, including debit cards and electronic wallets.

OANDA Forex Broker Review: Trading Platforms: Advanced and User-Friendly

When selecting a Forex broker, you should also consider the trading platforms and tools that the broker offers. A good trading platform should be user-friendly, reliable, and offer advanced features to help you analyze the market and make informed trading decisions. OANDA offers a wide range of trading platforms, including MT4, MT5, and its own proprietary trading platform. Oanda’s platforms are easy to use, and they offer advanced charting tools, technical indicators, and other features to help you analyze the market and execute trades quickly and efficiently.

OANDA Forex Broker Review: Summary

When it comes to Forex trading, selecting the right broker is essential. Choosing the wrong one can result in higher fees, slower trade execution, and poor customer support.

Conclusion

Overall, OANDA is an excellent choice for those who are looking for a Forex broker with a quick and easy account opening process, low fees, and no minimum deposit requirement. While its product portfolio is limited to Forex and CFDs only, the broker’s powerful research tools and easy-to-use MT4 trading platform make it a popular choice among traders. Additionally, the ability to open multiple sub-accounts is a great feature for those who want to have different base currencies under one account.