Trading gold on MetaTrader 4 (MT4) is a straightforward process, especially with the platform’s user-friendly interface and robust features. Follow below 10 simple steps to start trading gold on MT4.

Table of Contents:

Why Gold and Why MT4

Trading gold has long been a popular investment choice due to its historical significance and stability. Understanding the dynamics of gold, also known as XAUUSD in the financial markets, as a precious metal and its significance in the global economy is crucial for effective trading. Gold is a unique financial instrument that blurs the lines between a commodity and a currency. In times of economic uncertainty, gold often serves as a safe haven, attracting investors seeking stability. Additionally, gold’s industrial applications in sectors like electronics and jewelry contribute to its demand.

On the other hand, the MT4 platform, also known as MetaTrader 4, is a widely used software for online trading. MetaTrader 4 (MT4) serves as a comprehensive trading platform. It is designed to provide traders with a user-friendly interface and a range of powerful tools for analyzing financial markets and executing trades. With its intuitive design and extensive features, MT4 has become the go-to platform for both novice and experienced traders alike. Its significance in online trading lies in its ability to offer real-time market data, advanced charting capabilities, automated trading through expert advisors (EAs), and access to a vast library of technical indicators. Moreover, MT4 supports multiple asset classes such as forex, stocks, commodities, and indices. This versatility makes it an indispensable tool for traders seeking efficiency and convenience in their trading activities.

This article aims to provide readers with a comprehensive guide on how to trade gold using MT4. With step-by-step instructions and detailed explanations, you will gain valuable insights into the process of trading gold on this popular platform. From understanding the basics of gold trading to advanced strategies, this article aims to equip you with the knowledge and skills necessary for successful trading. Whether you are a beginner or an experienced trader, this guide will serve as an invaluable resource in navigating the gold market using MT4.

Step-by-Step Guide How to Trade Gold on MT4

And now let’s move to our Step-by-Step Guide How to Trade Gold on MT4.

Step 1: Download and Install MT4

Ideally, you have already downloaded and Installed MetaTrader 4 platform from a trusted broker’s website. However, if you are a beginner, you can learn how to start from the scratch here. Also, you can check out our guide/tutorial about MT4.

Step 2: Open a Trading Account

After installing MT4, you’ll need to open a trading account with a broker that offers gold trading on the platform. Choose a reputable broker with competitive spreads, reliable execution, and regulatory compliance (check out our Brokers’ page for more information). You can create a demo or live account on MT4 for practicing or real money trading. Follow the broker’s account opening process and complete any necessary verification steps.

Step 3: Log In to MT4

Launch the MT4 platform and log in using the credentials provided by your broker. Once logged in, you’ll be greeted by the MT4 interface, which consists of various windows and panels, including the Market Watch, Chart, and Navigator.

Step 4: Add Gold Trading Instrument

How to add XAUUSD on MT4? To add the Gold trading instrument, also known as XAUUSD, on MT4, you can follow these steps. First, open your MT4 platform and go to the “Market Watch” window. Right-click within this window and select “Symbols.” A new window will pop up displaying all available trading instruments. Look for gold-related symbols, such as XAU/USD (spot gold) or GOLD (gold futures), and double-click on the chosen symbol. This will add the Gold trading instrument to your Market Watch window. You can now start trading Gold by simply dragging the XAUUSD symbol onto your chart or by right-clicking on it and selecting “Chart Window.” With XAUUSD added to your platform, you can now analyze its price movements and execute trades with ease.

Step 5: Analyze Gold Price Movements

Next, analyze the price movements of gold using the charting tools and technical indicators available on MT4. Customize the charts according to your preferences, such as timeframes, chart types, and drawing tools. Utilize technical analysis techniques to identify potential entry and exit points. Analyzing gold market trends is a crucial task for investors seeking to make informed decisions. To achieve this, experienced traders often rely on various predictive tools, such as Fibonacci retracement levels. These additional tools offer valuable insights into the potential future price movements of gold. Technical analysis tools are invaluable in this regard, offering valuable insights into the market’s behavior. Two popular technical indicators that can assist traders in identifying trends in the gold market are moving averages and the relative strength index (RSI).

Step 6: Place a Trade

Once you’ve identified a trading opportunity, it’s time to place a trade. Right-click on the desired gold trading instrument in the Market Watch window and select “New Order” to open the order window. Specify the trade parameters, including the trade volume (lot size), stop-loss and take-profit levels, and order type (market or pending).

When placing trades on the MT4 platform, traders have two primary options: market orders and limit orders. Market orders allow traders to buy or sell assets at the current market price instantly, while limit orders enable them to set specific entry or exit points before executing trades. Effective risk management is vital in trading, and several strategies can help mitigate potential losses.

One such strategy is setting stop-loss orders, which automatically close positions at predetermined levels if the market moves against the trader’s expectations, limiting potential losses. Additionally, calculating position sizes based on risk tolerance levels helps traders ensure that they only risk a predetermined amount of their capital on each trade. These risk management techniques are essential for preserving capital and maximizing long-term trading success.

Step 7: Monitor Your Trade

Monitoring is fundamental aspect of successful trading, especially when it comes to trading gold on the MT4 platform. MT4 offers a range of tools to help traders stay informed about their gold trades. Utilizing price alerts and notifications allows traders to stay updated on market movements even when they’re not actively monitoring the platform.

After placing the trade, monitor its progress using the Terminal window, which displays your open positions, account balance, and trade history. Keep an eye on market developments and adjust your trade management strategy accordingly.

Step 8: Close the Trade

Closing the trade is a critical step that requires careful consideration and strategic decision-making. Once you have entered a position and achieved its desired profit or determined that the trade is no longer viable, it’s time to close the trade. When you’re ready to close the trade, right-click on the open position in the Terminal window and select “Close Order” to liquidate your position. Alternatively, you can set predefined take-profit or stop-loss levels to automatically close the trade when certain price levels are reached.

Step 9: Review Your Performance

After closing the trade, take some time to review your trading performance. Analyze the outcomes of your trades, identify any strengths or weaknesses in your strategy, and make adjustments as necessary to improve your future trading results.

Step 10: Continue Learning and Practicing

Trading gold on MT4 is a skill that takes time and practice to master. Continue learning about gold markets, refining your trading strategy, and honing your skills through education, research, and hands-on experience. With dedication and persistence, you can unlock the full potential of gold trading on MT4 and achieve your trading goals.

With our course Gold Trading Strategy for Beginners (including FREE MT4 Gold Trading Robot), you’ll learn when to buy and sell and how to trade gold on MT4.

BONUS: Trading Strategies for Gold on MT4 and Examples for Manual and Automated Trading

A.Short-term strategies:

1.Scalping technique – exploiting small price movements within short timeframes.

2.Intraday trading – taking advantage of daily fluctuations in gold prices.

B.Long-term strategies:

1.Swing trading – capitalizing on broader market trends over days or weeks.

2.Positional/long-term investing- holding onto positions for extended periods based on fundamental analysis.

How to Trade XAUUSD – The Strategy

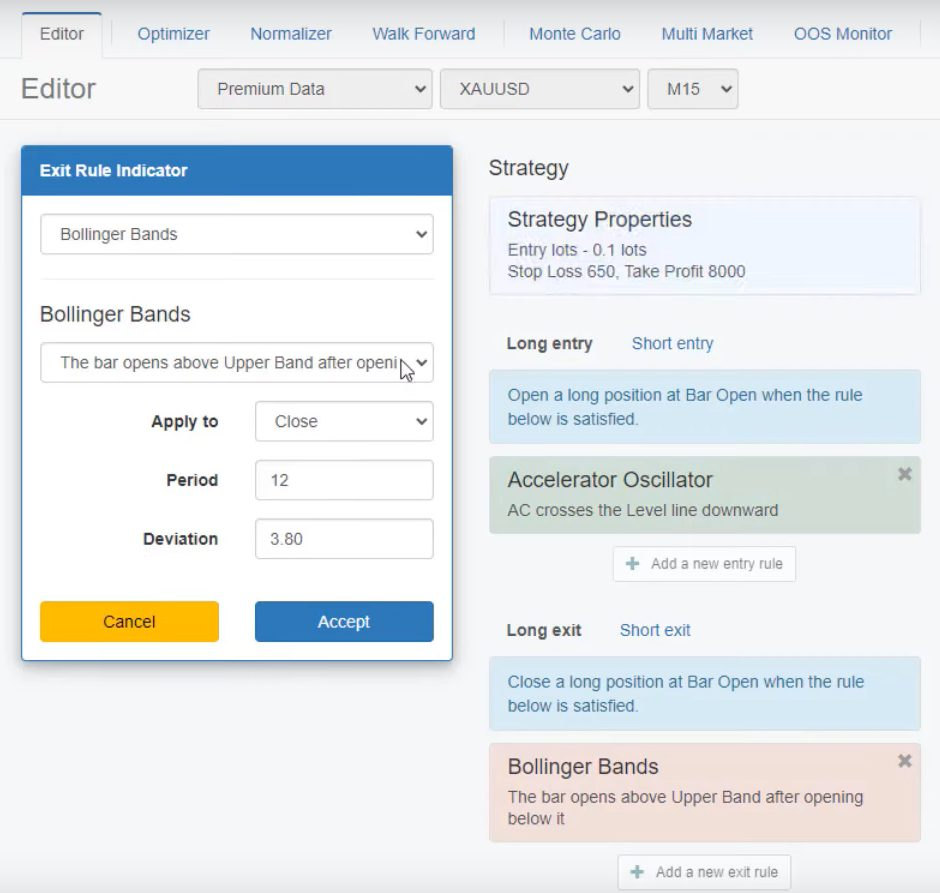

The first thing you should know is that this strategy only trades on the M15 chart. The first indicator we’ll use is the Accelerator Oscillator, for example the one from Everget, as it’s very visual and easy to read.

The Accelerator Oscillator

The Accelerator Oscillator is a histogram that shows the difference between the Awesome Oscillator and its 5-period moving average. When the AC is above the 0 line, it’s in green, and when it’s below the 0 line, it’s in red. For this strategy, we’ll use the 0 line as our only parameter.

When the Accelerator Oscillator crosses the 0 line downwards, we have a buy signal. This occurs when the AC is above the 0 line on one bar, and then below the 0 line on the next bar. The confirmation comes at the opening of the next bar. At this point, you can place a long position.

For a long position, the entry is at the opening price of the bar, which in this case is 1746. The Take Profit is $80 from the gold price, which would be 1826 in this example. The Stop Loss would be 1739.5, which is $6.50 below the entry price.

It’s important to note that we need to see one bar as confirmation before placing the trade. The risk-to-reward ratio for this strategy is 12.31, which is excellent.

Buy or sell with a single click

Bollinger Bands as an Exit Condition

However, we also have an exit condition from the Bollinger Bands. When using this indicator, we need to adjust the length to 12 and the deviation to 3.8. We should exit a long trade whenever we see a bar that opens above the upper band of the Bollinger Bands.

For short trades, we need to see the Accelerator Oscillator crossing the 0 line upwards. As an exit, we should see the price below the lower band of the Bollinger Bands.

It’s up to you whether you want to use only the stop loss and take profit or also include the Bollinger Bands as an exit condition.

Manual Trading

You can trade manually with the gold trading strategy. You can right-click and go to one-click trading.

When you decide it’s a good time to buy, you can buy from right there. When you decide to sell you can do it there.

Buy or sell with a single click.

Always look for brokers that have low spreads. For example, a spread of 35 pips is relatively tiny. That makes it suitable for algorithmic trading.

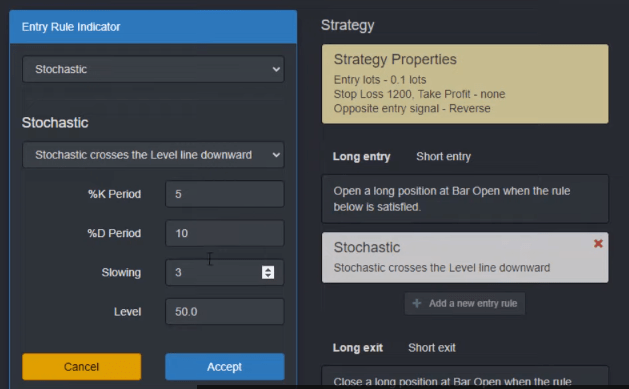

When the Stochastic crosses the 50-level line in the middle it’s time to buy. So, you would buy at the next bar.

Example Long Trade

And here are the parameters for the Stochastic Indicator:

Stop Loss for the Gold Strategy

It would be best if you also used a Stop Loss with this strategy. We use a Stop Loss of 1,200 pips or $12 from the value of Gold.

We hardly ever reach the Stop Loss. However, a Stop Loss helps to protect our capital.

Trade GOLD on MT4 With This Exit Condition

Our exit condition uses the ADX. This gives us an indication of trend strength.

So, we look for the ADX to cross the level line upward. With this strategy, we use a K period of 5 and a period of 10.

How to Trade XAUUSD using Algorithmic (Automated) Trading

Benefits of Algorithmic Trading

Algorithmic trading has several benefits. Some of these benefits include:

- Faster Execution: With algorithmic trading, you can execute trades much faster than you could with manual trading. This is because the computer can execute trades in a matter of milliseconds, whereas it could take you much longer.

- Removes Emotions: Algorithmic trading removes emotions from trading. You might be tempted to make emotional decisions based on fear or greed when trading manually. With algorithmic trading, all decisions are based on pre-determined rules.

- Backtesting: With algorithmic trading, you can backtest your trading strategies using historical data. This allows you to see how your strategy would have performed in the past, which can help you make better decisions in the future.

Now that we’ve covered the benefits of algorithmic trading let’s take a look at how to trade gold using algorithmic trading on MetaTrader.

How to Trade XAUUSD on MetaTrader using EA

To trade gold on MetaTrader, you can create a trading robot on expert advisor (EA) using EA Studio. The strategy we’ll use is the Accelerator Oscillator as an entry rule, the Bollinger Bands as an exit rule, and Stop Loss and Take Profit in Pips.

Or you can try our Free M15 Gold Robot. Once you’ve installed the robot, you can set the parameters as described above and let it do the trading for you. More on that a little later.

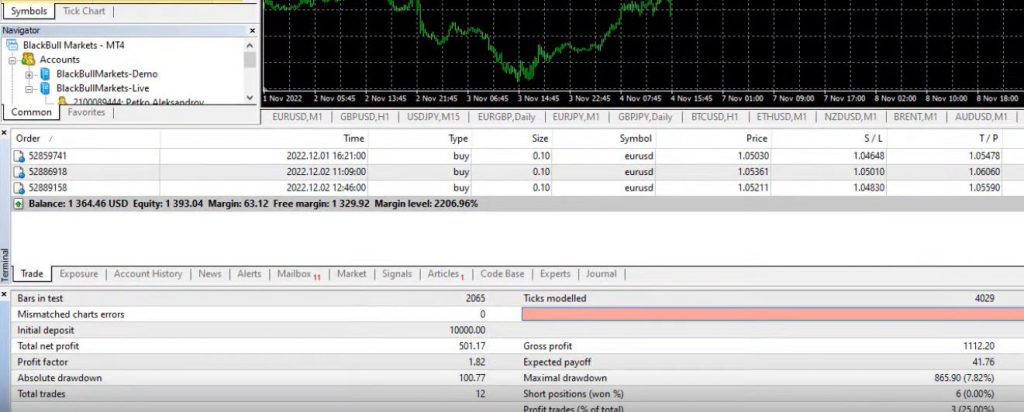

Backtesting XAUUSD Trading Strategy

Once you’ve created or downloaded the robot, you can backtest it using historical data. Backtesting allows you to see how your strategy would have performed in the past. If your backtesting results are satisfactory, you can then trade live using the robot.

The backtesting results for this strategy show that it performs well on Mondays and Tuesdays. However, there will be losing periods, so it’s important to perform regular backtesting to ensure the strategy is still performing well.

Conclusion

In conclusion, trading gold on MT4 can be a profitable endeavor if you have the right strategy. Remember to always practice proper risk management and wait for confirmation before entering a trade.