How to make money day trading with many Forex strategies.

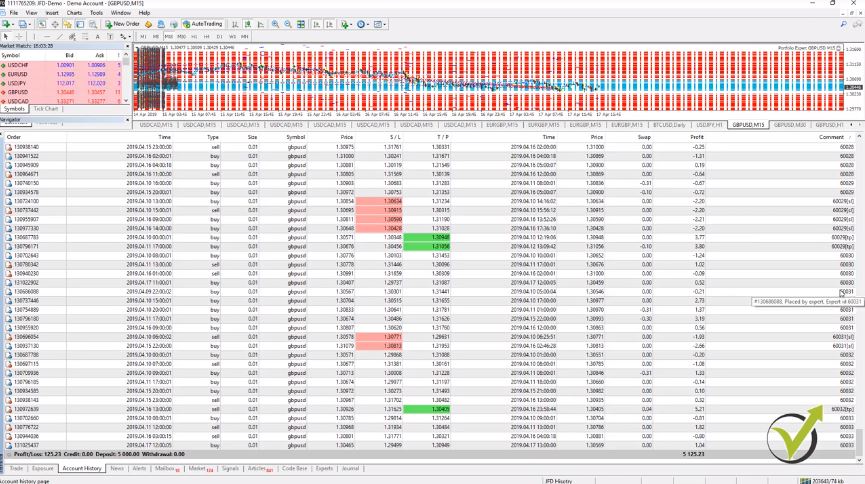

How to make money day trading is a question that every trader asks himself even unconsciously. Hello, dear traders, this is Petko Alexandrov from EA Forex Academy. In this article, I will share with you my experience in the account where I have left the 3 portfolio Expert Advisors. So you can see below how many trades are opened when I trade with Portfolio Experts. Really many.

Basically, with the blue lines, you see the open trades or the open price and with the red lines, you see the Stop Loss and Take Profit. If I just zoom out a little bit you will see the range is really big. Some of the strategies have bigger Stop Loss some have smaller Stop Loss and Take Profit.

So we are not really focusing on the opened trades, you can see them right over here. Currently, I have about the negative of 40 as a result and you can see too many trades are opened. But we are not looking at opened trades because the result changes.

As a trading result, we consider the closed trades.

But what we’re looking at is the account history where we have the closed trades. OK? The closed result. And you can see I have $125 with 0.01 lot.

So with the account history, it is really hard to follow the performance of the Expert Advisors. Let me make it a little bit bigger. On the right side, we have the comment where we can recognize which Expert Advisor opened the trade and closed it, and they are arranged now by the comment.

So, for example, the Expert Advisor with magic number 60030 which is an Expert Advisor on H1 because with 60, we start the magic numbers for H1 chart. And this is strategy number 30 and then we have one, two, three, four trades and it is easy to calculate it. Right? But if I look at it tomorrow, or after some time, there will be more trades.

Following the performance by looking at the results consumes time and calculations.

I will need to recalculate it again. And doing that for hundreds of strategies is very hard. And actually the strategies on M15, of course, they open a lot of trades.

It will take you a long time to calculate those. Alright? It is time-consuming to follow the performance by looking at the results in the account history. So what I do, and I have shown that in some of my courses, is I like to connect the account to a website called FX Blue.

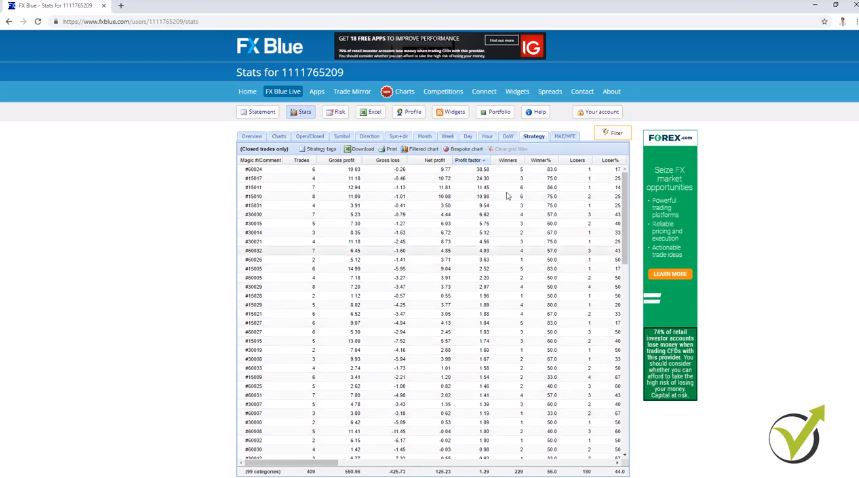

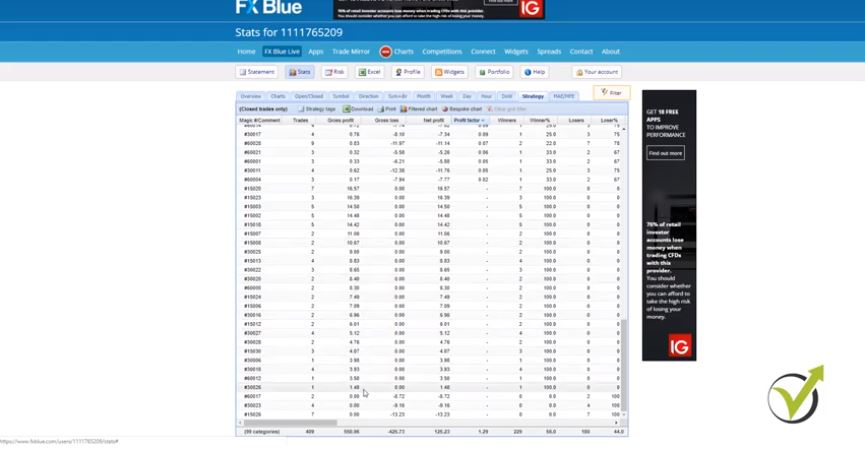

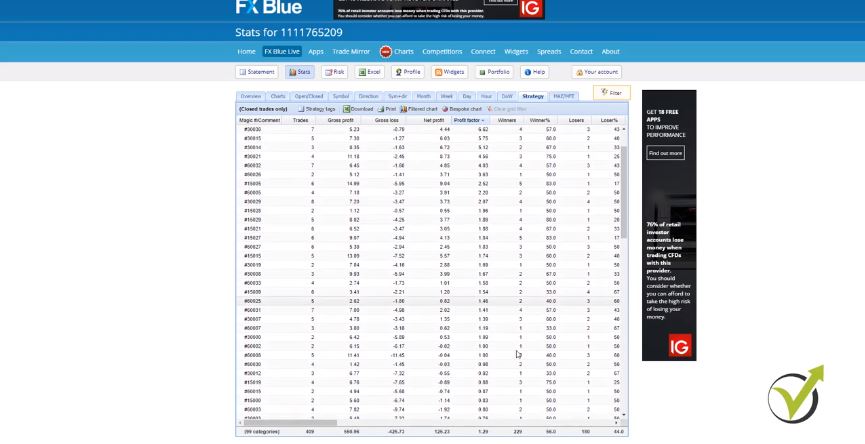

So please don’t take this website as a recommendation because we are not connected to this website. And I just use it to follow the results of the account. And you can see here, I have a detailed statistic for all of the strategies. You are not going to fine the answer of the question How to make money day trading but you will find a lot of statistics which is the key to success.

In the account history, we only see the results of all trades.

I have a number of trades that were open and closed, gross profit, gross loss, I have the net profit which is the most important, I have Profit factor, winners, losers. And if I scroll to the right you will see that I have too many trades like average win trade, average loss, average trade, best trade, worst trade, longest, shortest and many others.

You have net pips which are very interesting, something I like to look at as well, and many others. Now, this thing we don’t have it in Meta Trader. What we have in the account history is where the trade was opened, where was the Stop Loss, where was the Take Profit, with green you will see where the trade hit the Take Profit, and in red, you will see where the trade hit the Stop Loss.

And you see the time, and you see the price, and pretty much that’s it. We don’t see a lot. We just see the results there.

In order to understand How to make money day trading, you need to accept one thin – Every strategy has its losing phase and it has its winning phase.

Which makes it very hard to decide which strategies here are making profit currently and which strategies are losing. Because we said that every strategy has its losing phase and it has its winning phase. So we wanted to trade the strategies that are in their winning phase.

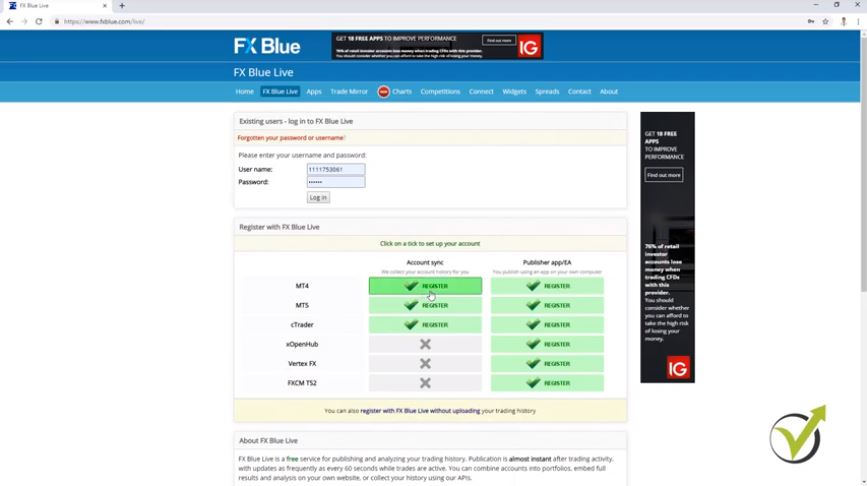

Here, I will concentrate on the Profit factor and on the number of trades that were opened and closed. Now for those of you who didn’t watch any of my other courses where I show how to connect the account to this website, I will show it very quickly. You need to go to FX Blue Live, where you come to the website.

So let me log out and you will see that I have here account synchronization and I have the register option for Meta Trader 4, Meta Trader 5, depends on what you are using. It’s possible for cTrader as well, but at the moment I am using it for the purpose of this course Meta Trader 4 and account synchronization. So I click on register, and here I will need to enter the broker server that I have been using.

Account synchronization is actually what I do with this website.

After that, you enter your account number and the read-only password which normally comes when you register. They send it via the email or if they don’t you will need to ask them via the chat which is provided by the broker. Or write them an email anything they need to send you this read-only password it’s called investor password as well and it is needed to connect the website to your account.

Below you enter your email and you click on register, that’s it. Then you will have one account synchronization button which you need to click. Nothing really complicated.

You need to click on it and click on Save changes and it will be saved, and your account will be synchronized to the website. OK? So here you have the statistic, you can see that I am running the account for 10 days now and if I go to strategy, I see the statistic that I showed you.

Symbol + Direction is quite interesting one

You can look at the Symbol, obviously, I have only GBPUSD in this account, you can look at the direction. For example, at this time I have similar results to the long trades and the short trades. Symbol + Direction, month, still we are in the first month, week, you can see that the previous week was on positive and this week is still a little bit of a negative.

In this FX Blue website statistics, you can see the day performance, Hourly performance and so on. So going to strategy, as I said, I will concentrate on the trades and on the Profit factor.

So you can arrange the strategies according to the number of trades, according to the net profit, you will see the ones that have most losses on the top. Or if I click one more time I will see the strategies that have the most net profit at the moment, or you can arrange them by the Profit factor. And this is exactly what I want to do.

How to make money day trading using the Profit factor.

Now if you remember when I was generating the strategies, I selected in the Acceptance criteria to have strategies with Profit factor higher than 1.2. So one of the strategies is already 1.19 and the above one is 1.39. So all of these strategies, they have Profit factor higher than 1.2.

Below are strategies that are with lower Profit factor, and you will see that most of them are having losses. Now more if I scroll down, you will see that for some strategies there is no Profit factor. And this is because these strategies have only profits, for example, you can see as well three strategies at the bottom that had only losses.

So they don’t have a profit factor. A strategy needs to have profit and loss, so a Profit factor could be calculated. Now I want to remove from the account the strategies that have Profit factor lower than 1.2 but at the same time, to have more than 5 trades executed.

Remove the strategies that have consistent losses from your account.

So one of the answers to the question How to make money day trading is to remove the strategies that lose currently. Because obviously, if one strategy traded only two times, these are 2 consecutive trades and you can see the Profit factor here is 1.09. And 2 trades means one positive, one negative, it’s really hard to say if this strategy is in winning phase or it is in losing phase. But a strategy that has a lower Profit factor, and for example, let me find one.

For example, one of the strategies over here already had 8 trades and it has negative of two which is still a very small loss. But having 8 trades and having this small Profit factor, it gives me a sign that the strategy could be in it’s losing phase. OK? And especially 3 strategies below which have only losses, and especially the last one which already has 7 trades and $13 of a loss, this is the strategy I want to remove from the account, alright?

I don’t want it to continue trading. Could be the chance that the strategy now will switch and will start showing me profit. But I don’t want to hope on that, I don’t want to take this risk.

How to make money day trading: Test every system on a Demo account first with a small trading lot.

And below, you can see actually there the total Net profit is $125. But keep in mind that this is trading with 0.01 lot. If I have selected to trade with 0.1, that would be $1,252.

And of course if you trade with a complete lot, that would be $12,523 but you need a huge account to trade with one complete lot. And I prefer to show in the courses trading with 0.01. So this way I want to encourage you to test every system with a small trading lot. And of course on a Demo account first.

So this system is a system that I have been using recently and it works fine for me. That is why I decided to share it in this article. I keep the strategies that have Profit factor higher than 1.2 in my trading account.

FX Blue is really useful when we follow trading results

And the strategies that have Profit factor below 1.2 and have more than 5 trades, I will remove them from the account. And I will continue trading with the rest. OK? So this is how I filter the strategies with the FX Blue website.

It is very easy. And especially when you’re having 100 strategies or even more, it is not possible to do that from the account history of the Meta Trader. It will take you a long time and you will need to calculate Profit factor.

Calculating the Profit factor is too time-consuming if you do it from MetaTrader History.

For example, you need to sum the profits, you need to sum the losses and then you calculate the Profit factor. It’s really time-consuming which is much easier with this website. And this is why I have been using it and I share it in this course as well. Alright?

So thank you very much for reading. In the next lecture, I will show you how I remove the strategies that have Profit factor below 1.2 and already have 5 trades opened and closed or 5 executed orders. I will see you in the next lecture. If you have any question feel free to drop it in our forum and I will answer you.

To get the complete course, and the complete answer to the question How to make money day trading click the link ahead: How to trade Forex with 100 GBPUSD strategies in the account

Cheers.