Best Forex strategies are what everyone is looking for while trading.

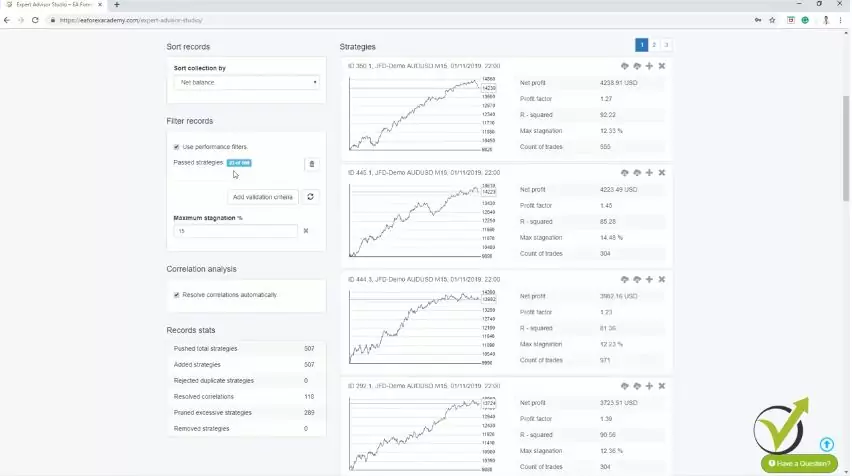

Best Forex strategies in 2019 are the subject of this lecture. Hello, dear traders, it’s Petko Aleksandrov and I continue now with the results that we got from the Generator that I started in the previous lecture. Over 600,000 strategies were generated for these 5 hours and in the collection, I see the best 100 strategies that I have over here. You can see some are having great Equity Lines, some are having some drawdown, some are losing recently.

So now, what I will do? I will use the filter records that we have in EA Studio right over here and using the performance filters we can add some validation criteria. So, we will filter these strategies. OK?

But all of these strategies, if you look at them, they have higher criteria. From what I have said in the previous lecture with the Acceptance criteria, we have Profit factor above 1.1, R-squared above 70 with those strategies and we have over 300 count of trades for every strategy that you see right here into the collection. Aren’t these the best Forex strategies you have seen?

What is stagnation and why it is important when selecting the Best Forex strategies?

I will add some more validation criteria and for example, I will add the Maximum stagnation in percentage because I don’t want to have huge stagnation and what is the stagnation for the very newbie traders? This is when the strategy does not make any more profits than it had previously.

So when it’s right here, it’s reaching to a point and then it’s going down it might go a little bit sideways and then it will go again on a profit and this period where we don’t have new profits higher than this top here, we call it stagnation. So we don’t want to have huge periods like that and you see by default comes 30% and 94 out of the 100 are with the stagnation that is below 30%. OK?

For example, if I go down to 25 you will see that I have 81 and I will go down to 20 and you will see that I will have 49 strategies and I will go down to 15 and you will see I have 23 strategies passing the validation criteria here. OK? So you see the strategies that are left don’t have huge stagnation and are basically not having these drawdown in the Equity Line.

This way you can filter the best Forex strategies that you have in the collection.

This one is a bit of stagnation here, but you see it’s 14.48%. OK? And from here, I can add more criteria but I want to have at least 20 strategies left into the collection and now you see that I have 23 left. So, I will leave it this way, if you want to test it out, you can add different criteria.

There are so many over here. There is the win/loss ratio which is great as well, return/drawdown ratio, months on profit in percentage and so many that I’m not going to explain in details but basically here you can filter the strategies that you have in the collection. Now, having this collection, first of all, I would download it because every time when I use the Generator, I download the collections. This way I save my best Forex strategies that I created.

So this way I’m not losing my work and my time for running the Generator and I will go to Tools and I will go to Data and then, I will go to Data Horizon and here, I will remove this tick. Use end date limit. So what this means is that now I will see what is the result with these 23 strategies left into the collection including the last one month from 12th of January 2019 till today, 12th of February 2019.

The recalculate button is what will do the magic.

Basically, I will do the very same thing if I have placed these strategies 1 month ago. OK? Instead of placing many strategies for testing on a Demo account, I have removed the last one month, I have generated the strategies using the historical data without the last one month and now, when I have the ready strategies into the collection, I am including again the last one month.

By removing the tick. This means it’s not using end date limit and I’m using all of the historical data that I have. All of the historical bars that I have imported here in the Strategy Builder and if I go to the collection, you will see that I have this recalculate button.

Now, if I click on it, it will recalculate the strategies including the last month but before I do that, I always visually delete some of the strategies that I have in the collection. Now, these strategies are having great Equity Lines. Their R-squared is big, they have low stagnation and Profit factor is good.

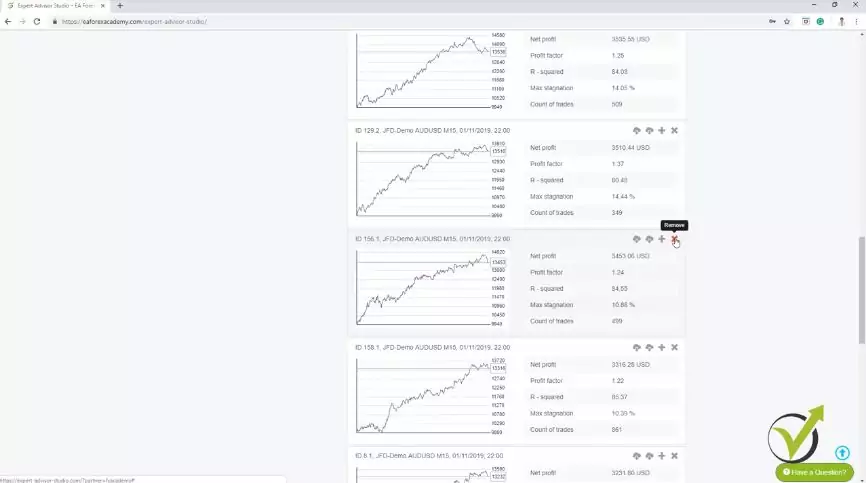

Remove strategies that have recently been losing.

Now, what I’m looking at is the most recent period. I don’t want to have strategies that are losing recently. So, you see the Equity Line has these curves up and down and it is normal to have such a move down on the Equity Line to have a losing period but I don’t want to have such a losing period just when I am placing the strategies for trading. OK?

I don’t want this losing period to be right now, to be at the moment when I will be testing or when I will be trading the strategies. So if I see strategies that are losing recently, I simply remove them from over here. OK? You see this one as well is losing recently, I will remove it and this one is losing a little bit more recently, also this one and let’s have a look at some of the others.

I will go to the second page; The first strategy is losing as well recently, I will remove it and I will go to the second page; You can see this strategy is losing recently, I will remove it as well, as well this one and this one, then, I am having this one; the last one and the others: this one, I think I will remove it as well and here is just fine.

Zoom the strategy if anything is visually unnoticeable.

Let’s go back to the first page. What we have here? We have a little bit of a loss.

I will remove it as well, and this one, I will remove and this one, I will remove. I think I have about 10 strategies left; exactly 10 strategies left and you see that their Equity Lines are fine, not really losing at the end. I don’t have the strategies that are losing recently.

So, now, what I will do? I will click on recalculate. This means that the software will recalculate the strategies, will backtest them again including this recent one month. From 12th of January till today, the 12th of February and I will click on the recalculate and you will see that all of the strategies will be actually recalculated that we had, even, we are having the filter criteria here and you will notice that this recent one month is colored in green and of course, one month is very small part of the whole trading period.

That’s why it is very hard to notice what happens visually and that is why I normally zoom it over here. I will zoom it a lot. I will make it more, I will go to 300 for example, and if I scroll down, I will see the strategies. OK? So this is the ending point which we used as end date limit for the generation and after that is the Equity Line where the strategy performed for the last one month.

This is a great method to find the best Forex strategies automatically.

So, one more time guys this period, the last 1 month was not used while I was generating the strategies. OK? Here we have basically tested the whole month very quickly just by adding the last one month to the historical data so this is how EA Studio will backtest it using the whole period. And just see the strategy went a little bit of a loss and then is on profit.

So, it is just fine. What we are looking for, is to remove strategies which are having a dramatic loss during the testing period during the 1 month. This means that the strategy was over-optimized by the software and what is over-optimization?

This is when we have the perfect parameters and indicators for this asset, for this timeframe, for this historical data and normally what we see when we test such over-optimized strategies is that we see a dramatic loss when we place it for real trading, or for Demo trading, or for testing which we said is absolutely the same with what we just did over here by including the last one month. OK?

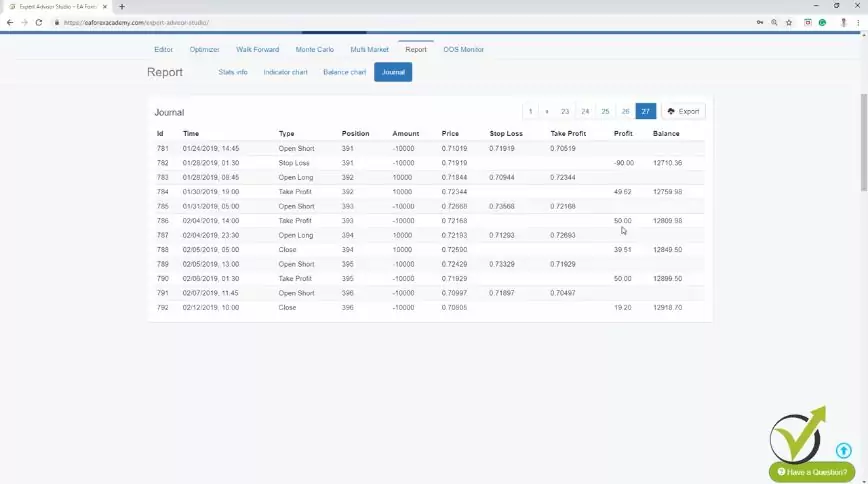

The Journal is where we see the details of the best Forex strategies.

And if you look at the next strategy it went on a profit, then a little bit of a loss, still fine. It’s not really a dramatic loss and here, is what I’m talking about. This is what I don’t want to see in my best Forex strategies.

At the moment of the test, the strategy is just losing. OK? So the whole time, it was just losing and if I click on this strategy, I will go to the report but let me zoom it out so I can see it better. I will go to the report of this strategy and I will go to the journal.

So, if I go to the last page of the journal, you can see that the last trades here are just losses; two trades but they are losses. I don’t want to have strategies that just did losses during the tested period. And I will go back to the collection and I will zoom it a little bit more again and here, I will go to this third strategy.

Don’t gamble whether you see a normal drawdown or an over-optimized strategy.

I do believe it was. OK? Here it is, and I will remove it. It could be that it is a normal drawdown in the Equity Line; Just what we are having here, what we have on many places but I don’t want to take this risk.

I don’t want to gamble if this is a normal drawdown in the strategy or it is an over-optimized strategy. It is hard to say that. I don’t want to find out this in my real account or in my real testing. Alright?

So that’s why I will just remove it. The next month you can see a little bit up, a little bit down. It is just fine and then, this one as well.

Go for strategies with profits that you can depend on.

A little bit down, a little bit up and I will go to the next one. What we have here, pretty much the same thing. And then you can see what a great test we had with this strategy right here. OK? It is just going on profit during this one month during the tested period and if I click on it and I will go to the report and I will see what the recent trades were. OK?

Right over here on the report and I’m going to the last page and you can see recently it had only profitable trades in February. OK? During the testing period; it had 1, 2, 3, 4 profitable trades in a roll, not even 1 loss. These are really the strategies that I like. That when I test them, I see profits and I can depend on these strategies. Alright?

Let me zoom a little bit again and here they are. I will scroll down again, I will go to this strategy which showed a nice profit. Here it is, and I will continue lower. Then we have a little bit of a sideways, that’s just fine. Another strategy that during the tested period showed only profit. Then here, we had a little bit of a loss, profit, small loss and then, here again, you see the strategy keeps on profiting and pretty much these are the best Forex strategies guys, OK?

How I came to prove the validity of this method?

I will zoom out. This is the method that I have been using for quite a long time and it worked just fine. And of course, how I have proved to myself that this method works. I have generated strategies using the whole historical data.

The whole period, I have been placing strategies for one month in Meta Trader to test them and after one month, what I was doing? I was adding the last one month, recalculating it and comparing the results that we have for each strategy with the history data in Meta Trader. And I saw that actually, these are the very same trades.

So one more time here, it is the very same thing If I would have placed these strategies one month ago and testing them on a Demo account for 1 month and then, comparing the result and decide which strategy to remove and which strategy to keep in my portfolio or to generate the strategies without using the last one month and after I select which strategies to use with the validation criteria over here, I recalculate including the last one month and I see which strategies are actually profitable and which ones are losing during this time. OK?

You can carry out a backtest for whatever duration you wish for these best Forex strategies.

And this is an example method for one month. You can test it for two months, for three months. Just don’t include the recent two, three months or five months. Or if you want half a year it is up to you. And when you recalculate it, you will see how the strategy performed during this period of time. Alright, guys?

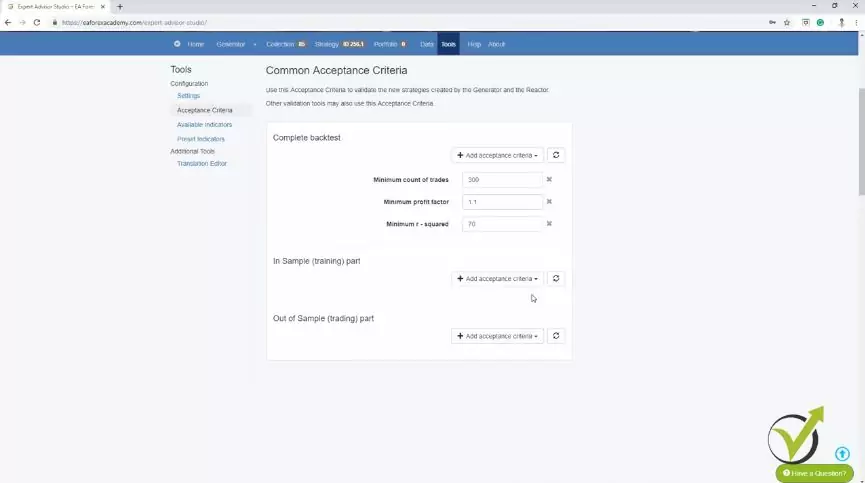

So this is the method I have been using for quite a long time. And in the next two lectures, I will show you the second method which is now possible because of the update in EA Studio which is in the Acceptance criteria. For me, it was a really huge update they did from the first software company. Because if I go to the Acceptance criteria and show you, they have improved the In Sample and Out of Sample testing with individual Acceptance criteria for each other.

And by using these two, I have improved my method and actually, this is a totally different method from what I have already shown you. And after that, I will leave it on you to decide which method you want to use. For me, the second method that I will show you is the better one. It is the easier one because it saves us even this recent thing that I did in this video.

If you have any question, we have the Forum for you.

It saves us the moment to eliminate the last month and then to include it again and to compare the results. And I will show you how it is possible. Because for me it is the better method, I will select again 10 strategies with the second method and I will include those in the course. OK? Not these ones but the ones that I will show you in the next lecture. And by providing you with the Expert Advisors, you will be able to test them as well. Alright, guys?

Thank you very much for reading and I will see you in the next lecture. If you have any question, feel free to drop it in our forum and I will answer you. Also, if you want to test 15-days trial with EA Studio, go ahead and do it.

Cheers.