-

General Questions

-

Robots

-

- What is the difference between EA Trading Academy's free and premium robots

- Which broker should I use to trade the Robots?

- Do I need a VPS to trade with Robots?

- Can I use Robots on cryptocurrency exchanges?

- How to trade with many EAs in the US? (FIFO solutions)

- I placed the EAs over the charts, but no trades are opening

- Is it possible to trade cryptocurrencies with Robots?

- Why do my trades not match on Demo and Live accounts with the same EAs?

- Why do some of the EAs in the courses not have SL and TP?

- Do the EAs have money management integrated?

- What returns should I expect from the robots

- Can I use Grid EA (like Waka Waka) on Prop Firms?

- Can you pass a challenge for me and manage my Funded account with the FTMO EA?

-

-

- Articles coming soon

-

- Articles coming soon

-

- Articles coming soon

-

- Articles coming soon

-

- Articles coming soon

-

- Articles coming soon

-

- Articles coming soon

-

-

- Articles coming soon

-

- Articles coming soon

-

- Articles coming soon

-

- Articles coming soon

-

-

-

- Articles coming soon

-

- Articles coming soon

-

-

Strategy Builders

- What are the main differences between EA Studio and FSB Pro?

- Is there a difference between the trial period and the license?

- Why is the backtest on EA Studio/FSB Pro different from the backtest in MetaTrader?

- Can I use Custom indicators on EA Studio or FSB Pro?

- What are the limitations of the EAs during the free trial?

-

-

- Articles coming soon

-

- Data Source Settings

- Fetch Settings

- Collection Settings

- Parameters and Settings

- Data Horizon

- Backtester Settings

- How to avoid overfitting?

-

- Articles coming soon

-

- Articles coming soon

-

- Articles coming soon

-

- Articles coming soon

-

- Articles coming soon

-

- Articles coming soon

-

- Articles coming soon

-

Courses

-

Indicators

Strategy Normalizer

5 out of 5 stars

1 rating

| 5 Stars | 100% | |

| 4 Stars | 0% | |

| 3 Stars | 0% | |

| 2 Stars | 0% | |

| 1 Stars | 0% |

Normalizer

The Strategy Normalizer tool in EA Studio ensures that your strategy is neat and its main task is to enhance its performance.

It is much better when a strategy consists of fewer components and the parameters of its indicators are intelligible.

In order to open the Normalizer, just click on Strategy from the main menu of the program.

Toolbar

The Strategy Normalizer has the same control buttons as the Optimizer. They have the same function as well.

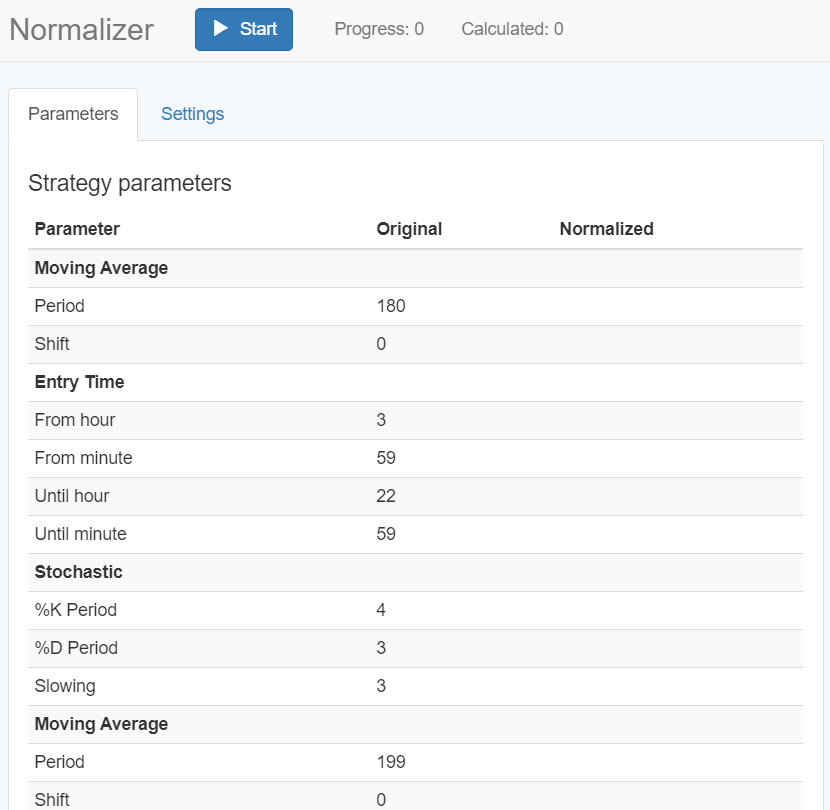

Strategy Parameters

In this tab, you can view the values of the indicators that you have set. After that, in the “Normalized” section you can see if there are any changes to them.

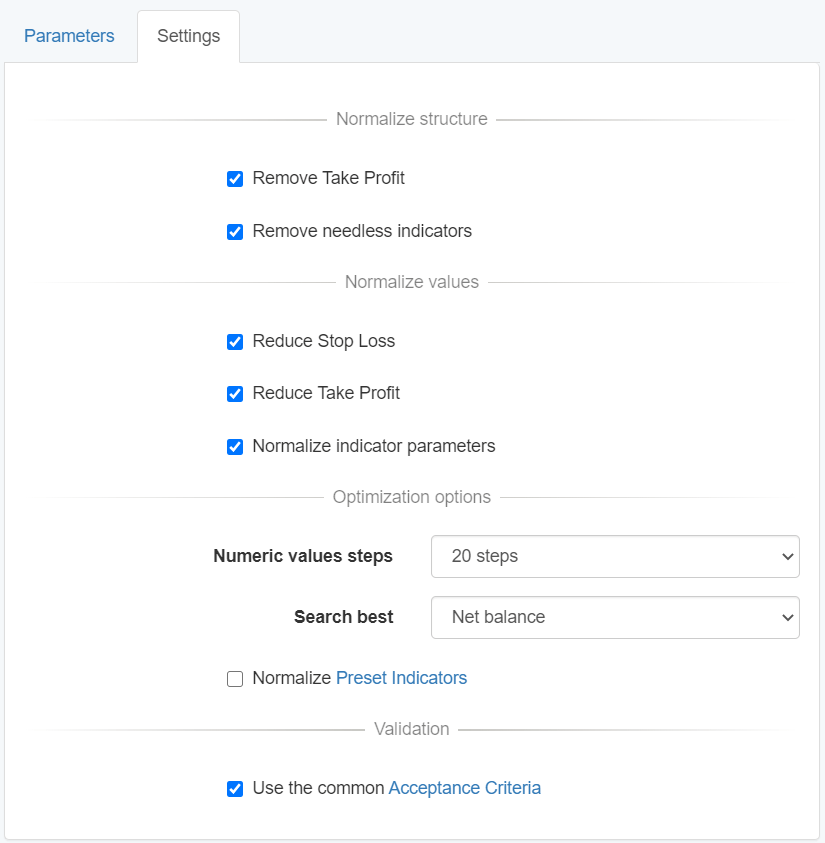

Normalizer Settings

Remove Take Profit – it tests if the strategy has a higher performance without using a Take Profit.

Remove needless indicators – if it detects that there are indicators that do not benefit the strategy in any way, it removes them. This makes the strategy faster and it prevents the over-optimization.

Reduce Stop Loss – as long as the strategy is still profitable, making the stop loss smaller creates a move favorable risk to reward ratio and decreases the maximum loss.

The creators of EA Studio have not added an option for stop loss removal in order to keep the strategy safe.

Reduce Take Profit – another way of improving the strategy’s performance is to decrease the take profit so that it is reached quicker and more often than the stop loss.

Normalize indicator parameters – most traders will advise you to use the default settings of the technical indicators. The creators of the technical indicators have put a lot of effort until they find their best workable values.

But EA Studio will give you the best parameters for the indicators based on the Historical data that you use.

How Does The Strategy Normalizer Work

Let us have a look at the following example where we have an AUDUSD strategy with a take profit of 2000 pips.

It is less probable for this profit to be hit, so the Normalizer removes it in order to calculate the strategy’s performance.

This is the process the Normalizer goes through:

- In case you select the “Remove Take Profit” option, the Strategy Normalizer modifies the strategy.

- Runs a backtest of the strategy.

- Performs a strategy validation against the Common Acceptance Criteria (in case they are enabled).

- Calculates the quality of the strategy in accordance with the “Search best” option.

- If the strategy passes the validation and has an equal or better performance than the original one, it applies the “Remove Take Profit” setting. If not, the Strategy Normalizer restores the old strategy.

5 out of 5 stars

1 rating

| 5 Stars | 100% | |

| 4 Stars | 0% | |

| 3 Stars | 0% | |

| 2 Stars | 0% | |

| 1 Stars | 0% |