Strategy Optimizer

Strategy Optimizer

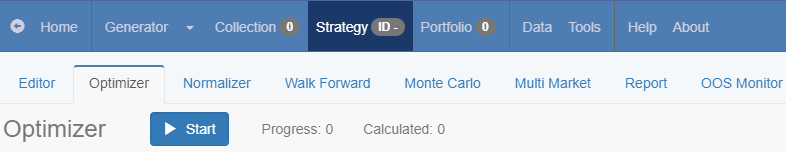

The role of the EA Studio as a Forex Strategy Optimizer is to improve an existing trading strategy. In order to get access to it, you need to click on Strategy from the main menu.

We strongly advise you to optimize only the strategies that are profitable.

There are various settings that you can use in the optimization process. You simply check the ones you want to use and uncheck the ones that will not take any part of it.

Let’s say that you use the Forex Strategy Optimizer to fix a losing strategy. It might make it trade less and in this way lose less money. However, this doesn’t mean that it will start making money.

Toolbar

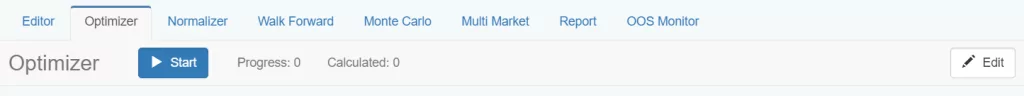

Start/Stop button – from here you start and end the work of the Optimizer. If you run it with its default settings, it completes the optimization in just a few seconds.

Progress – it indicates how far a strategy has been optimized at the current point in time.

Calculated – it shows you how many variations of the strategies have been calculated so far. The goal of the Forex Strategy Optimizer is to accomplish better backtest results by trying out various alternatives to the strategies.

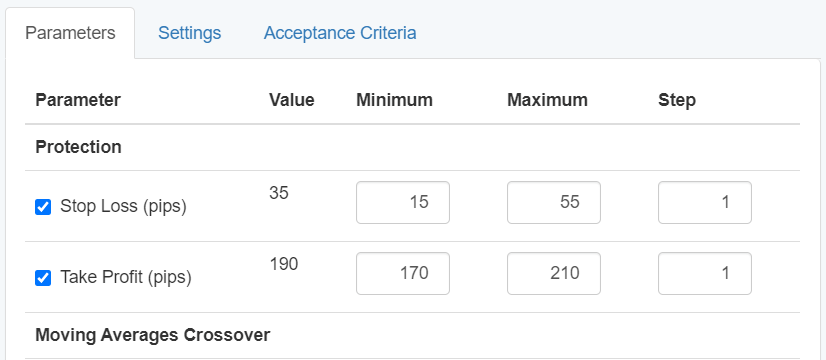

Strategy Parameters

In this tab, you set the values of the indicators that you are going to optimize by using the check boxes. There are minimal and maximal values, plus the step between them.

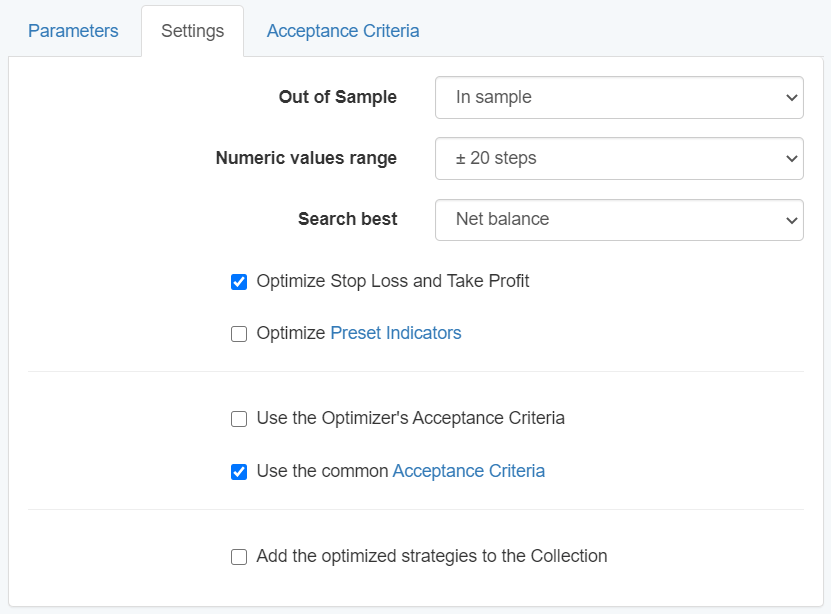

Optimizer Settings

Out of sample – the program runs an OOS test over the optimized variants of the strategies. The ones that pass the test are the ones we take into account.

Numeric values range – the value you set here will be added to the current value of the indicator.

For instance, let’s say that the value of an indicator is 35. After that, you set the numeric value range to “± 20 Steps”, and the step to 1.

As a result, the minimum value of the parameter will change from 35 to 15, and the maximum value will go from 35 to 55.

Search best – it compares different variations of the current strategy. As soon as it finds a better version of the old one, the new modified strategy will replace it.

Forex Strategy Optimizer for Stop Loss and Take Profit

Optimize Stop Loss and Take Profit – the Forex Strategy Optimizer finds better values for the stop loss and the take profit.

Optimize Preset Indicators – if you enable this option, all the parameters can be used for the optimization. In case you disable them, they will no longer be included in the Strategy Parameters.

Use the Optimizer’s Acceptance Criteria – this is additional criteria that your strategies need to meet.

Use the common Acceptance Criteria – our recommendation to you is to keep this option checked for your optimized strategies so that they fulfill the Acceptance Criteria.

Add the optimized strategies to the Collection – the strategies that pass the optimization go to the Collection section where you can revise them at any time.

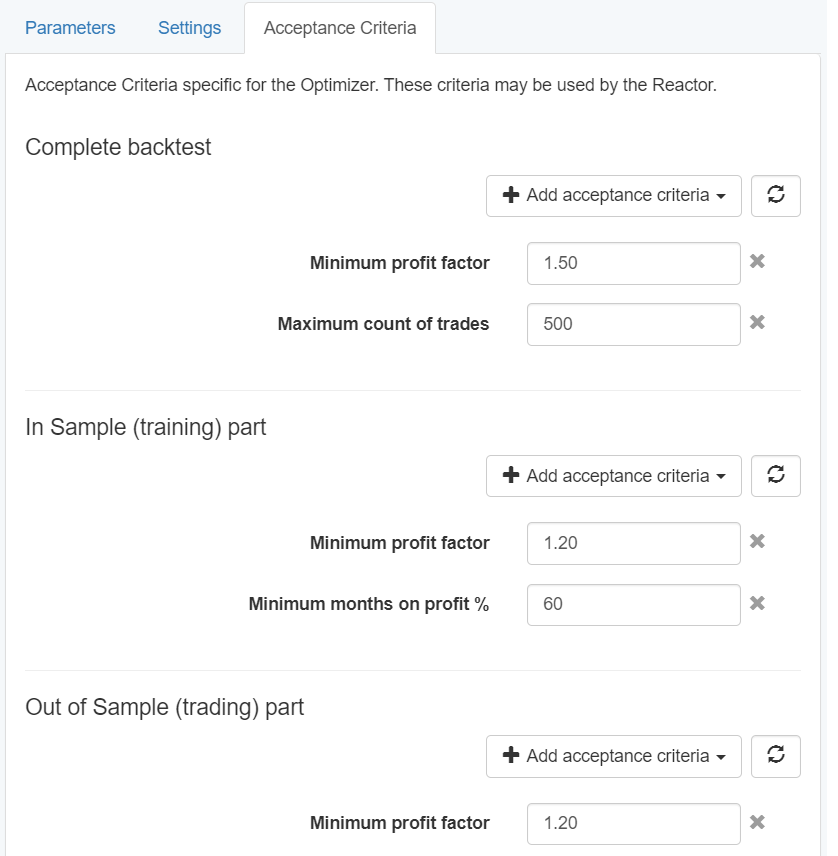

Optimizer Acceptance Criteria

This tab provides you the opportunity to add specific criteria for your overall backtest, or separately for the In sample and the Out of Sample parts.

In order to do this, just click on the “Add acceptance criteria” button and choose one or more options from the drop-down menu.