If you’re looking for a low-cost broker that provides a versatile and affordable solution for Forex and CFD trading, FP Markets could be the perfect option for you. In this review, we’ll explore why FP Markets shines as a broker and what areas it could improve in.

FP Markets Review: Regulated Broker

FP Markets is a regulated broker that adheres to strict investor protection regulations. This is one of the most important aspects to look for when selecting your broker. The broker is authorized and regulated by the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority in South Africa as well as the Financial Services Authority in the Seychelles. By choosing FP Markets, clients can rest assured that they are trading with a broker that complies with the most stringent regulations for investor protection.

FP Markets Review: Low-Cost Solution for Forex and CFD Trading

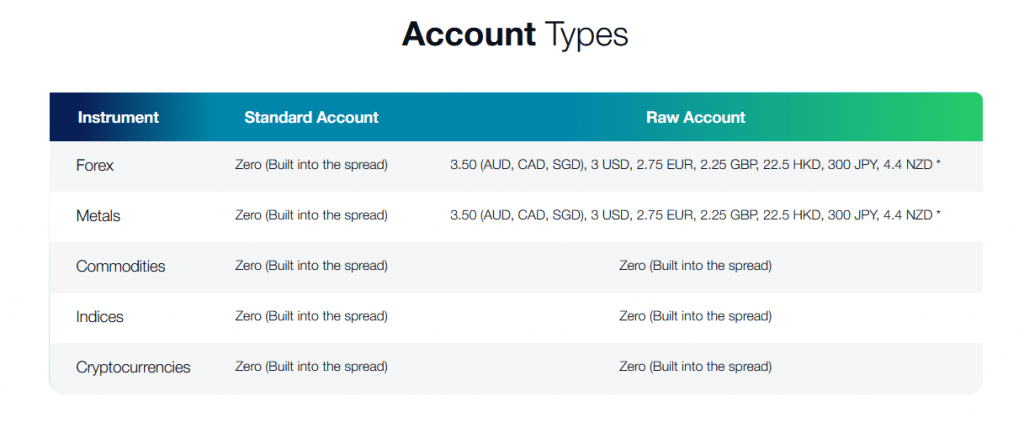

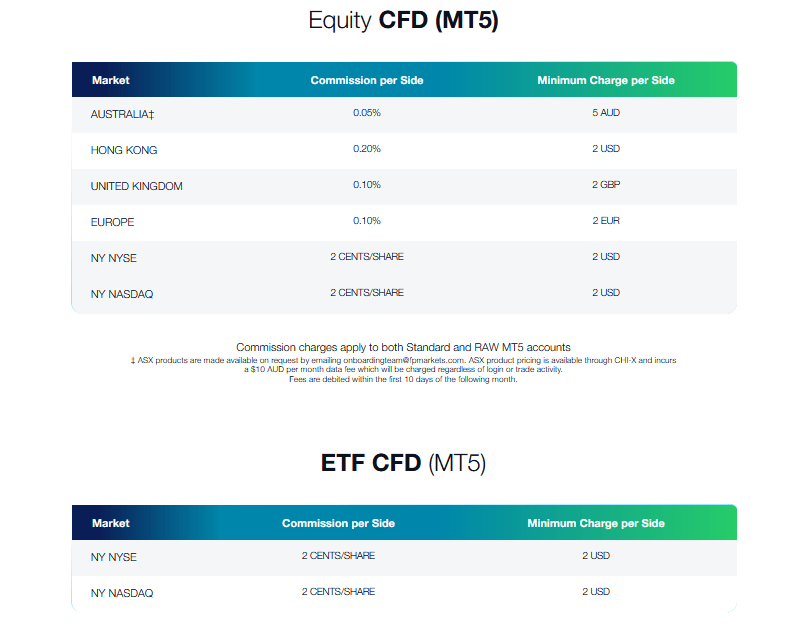

One of the most significant benefits of FP Markets is its low-cost offering for Forex and CFD trading. As long as you use the MetaTrader or cTrader platform, you’ll be able to take advantage of competitive pricing with no hidden markups or fees.

The spreads on major currency pairs start from as low as 0.0 pips on the MetaTrader platform.. Fees are also low, as can be seen below.

FP Markets Review: Versatile Trading Platforms

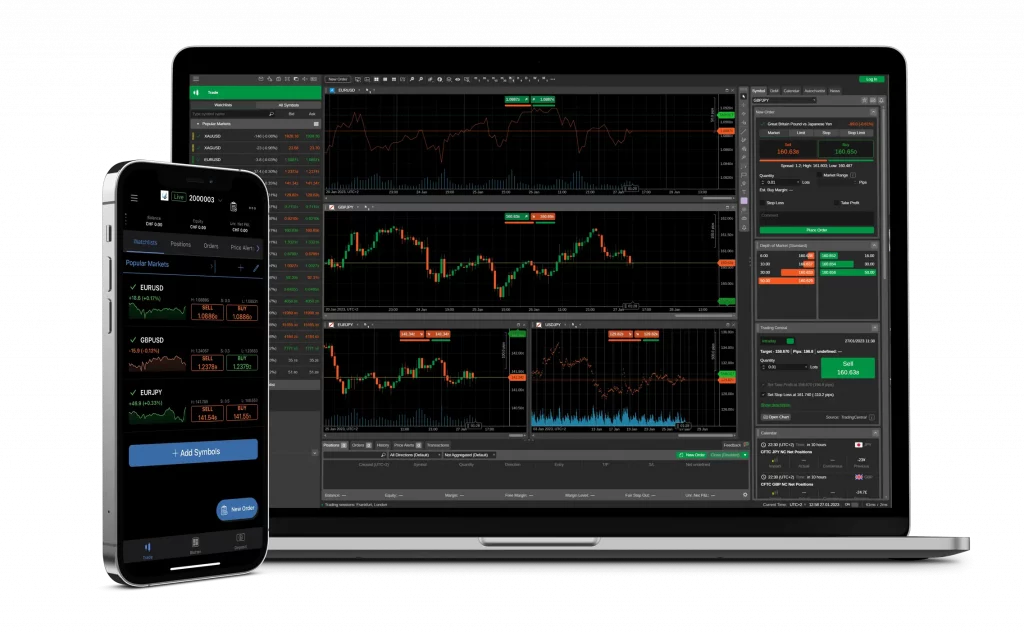

FP Markets provides a number of popular trading platforms for Forex and CFD trading: MT4, MT5, Iress, Webtrader, and Mobile App, as well as cTrader. These platforms offer a range of advanced features, such as automated trading, charting tools, and customization options.

MetaTrader

MetaTrader is a well-established platform in the Forex industry, providing access to over 60 currency pairs and a range of CFDs, including indices, commodities, and cryptocurrencies. One of the key benefits of MetaTrader is the availability of third-party plugins, such as trading signals and expert advisors, that can enhance your trading experience. You can purchase these on the MT4 and MT5 market place, or you could create your own using easy-to-use programs like EA Studio. It is also still the most widely used trading platform in the world, however, newer web-based platforms are catching up.

With the FP Markets MetaTrader 4 & MetaTrader 5 online WebTrader, trading becomes highly flexible. You can simply trade from a browser of your choice, on your preferred device with no OS preference (Windows or Mac), without the need to download additional software.

cTrader

Designed for Forex and CFDs (Contract for Differences), cTrader is a premium charting solution that offers a wide range of impressive features. With compatibility across several versions, it’s no surprise that cTrader has quickly become a go-to platform for traders around the world.

So, what makes cTrader stand out from the competition? Let’s take a closer look at some of its primary features:

- Custom Capabilities: With cTrader, you can customize the platform to suit your unique trading needs. Whether you’re an active day trader or a long-term investor, cTrader offers a range of customizable options to help you make the most of your trades.

- Rich Charting Applications: As a trader, you know that charts are an essential tool for analyzing market trends and making informed trading decisions. With cTrader, you’ll have access to a wide range of charting applications, including candlestick charts, bar charts, and more.

- Easy-to-Use Style: Despite its advanced features, cTrader is designed with simplicity in mind. The platform is easy to navigate, even for beginners, and offers a practical and intuitive interface.

Iress

A very interesting platofrm, Iress is an ingenious & award-winning co-pilot at your trading deck for a safer & enhanced Forex CFDs trading experience. Iress Essential is an advanced trading toolbox and an exclusive trading risk manager. The Iress platform suite offers well over 10,000 tradeable symbols.

FP Markets Review: Tradeable Symbols: MetaTrader vs. Iress

FP Markets offers a wide range of tradeable symbols on its platforms, including Forex, CFDs, shares, and commodities. However, the choices of tradeable symbols varies from platform to platform.

The MetaTrader platform provides access to over 60 currency pairs and a range of CFDs, including indices, commodities, and cryptocurrencies. It’s a versatile platform that caters to the needs of Forex and CFD traders.

The Iress platform suite, on the other hand, offers well over 10,000 tradeable symbols. However, it’s mostly a share trading platform, and the pricing is generally higher compared to the MetaTrader and cTrader platforms.

TradingView

FP Markets has further expanded its trading platform offerings by incorporating the TradingView Charting and Trading Platform. TradingView is recognized globally for its premium charting solutions, catering to millions of traders and investors worldwide. The platform offers advanced charting functionality accessible through desktop, web-based browsers, and mobile devices, allowing traders to explore and employ over 100,000 public indicators. With an intuitive interface, TradingView facilitates easy navigation and customization, enabling traders to create custom layouts, write, and share indicators and strategies using TradingView’s Pine Script.

TradingView stands out for its comprehensive coverage of global markets, including Stocks, Bonds, Forex, Digital Currencies, Commodities, and Indices, supported by a vast and active social trading community. It provides real-time data, various technical analysis tools, and a wealth of educational material through community-generated content. Traders can connect their FP Markets account to TradingView, enhancing their trading experience with sophisticated charting features and tapping into a large social trading community. This addition underscores FP Markets’ commitment to providing versatile and high-quality trading platforms to meet the diverse needs of its clients.

Leverage

One of the most common tools in the trading world, leverage allows a trader to invest much more in their trades, with relatively small deposit amounts. FP Markets offers leverage of up to 1:500 on positions in FX and precious metal CFDs, along with stop losses, so that traders can make the most of price movements while ensuring robust risk management measures.

By leveraging your investment with FP Markets, you can trade much larger lots and increase your exposure to the markets. This can be especially helpful when trading in more expensive assets with high liquidity. Even if you have only a small amount of capital to invest, FP Markets provides the opportunity to enter larger trades than what would have been possible with just your own capital.

However, it’s important to note that larger leverage not only magnifies your profit but also your loss potential. As such, it’s important to assess your risk tolerance before choosing a leverage ratio. While leveraging can increase your exposure to the markets and boost potential profits, it’s not without risk.

FP Markets offers a range of leveraged trading options and tools to help you trade on the markets with confidence. Along with stop losses, which help manage your downside risk, you’ll have access to a wide range of trading platforms, educational resources, and market analysis to support your trading decisions.

FP Markets Review: MAM/PAMM

FP Markets’ Forex offering includes both Multi-Account Manager (MAM) and Percent Allocation Management Model (PAMM) allocations. As one of the leading MAM/PAMM account brokers, FP Markets’ software is perfect for traders or money managers using Expert Advisors (EAs).

But what exactly are MAM and PAMM accounts, and how do they work?

MAM accounts allow money managers to manage multiple accounts through a single interface, providing a seamless trading experience. This makes it easier for money managers to monitor and execute trades on behalf of their clients. MAM accounts also offer flexibility in the way profits are allocated among the managed accounts. In this way, money managers can allocate profits generated from trades among managed accounts based on each account’s investment amount with MAM accounts. This provides flexibility.

On the other hand, PAMM accounts allow investors to allocate their funds to a money manager who trades on their behalf. Allocating funds is based on the percentage of each investor’s total investment amount which allows even those without the knowledge or expertise to trade on their own and get involved in Forex trading.

Both MAM and PAMM accounts offer order management monitoring. This provides transparency and visibility into the trades executed by the money manager. Investors who want to know where their money is being invested and how it is performing find this feature particularly appealing.

FP Markets’ have designed their MAM/PAMM accounts to provide money managers with the tools they need to manage their clients’ accounts efficiently and effectively. With FP Markets’ software, money managers can execute trades quickly and accurately, which can translate into higher returns for their clients.

FP Markets Review: PROs and CONS

PROs

Low Forex Fees

Forex fees are one of the most critical factors when choosing a broker. FP Markets charges low commissions, which are among the lowest in the industry, and is known for its competitive fees. Traders can qualify for an active trader rebate to further reduce these commissions.

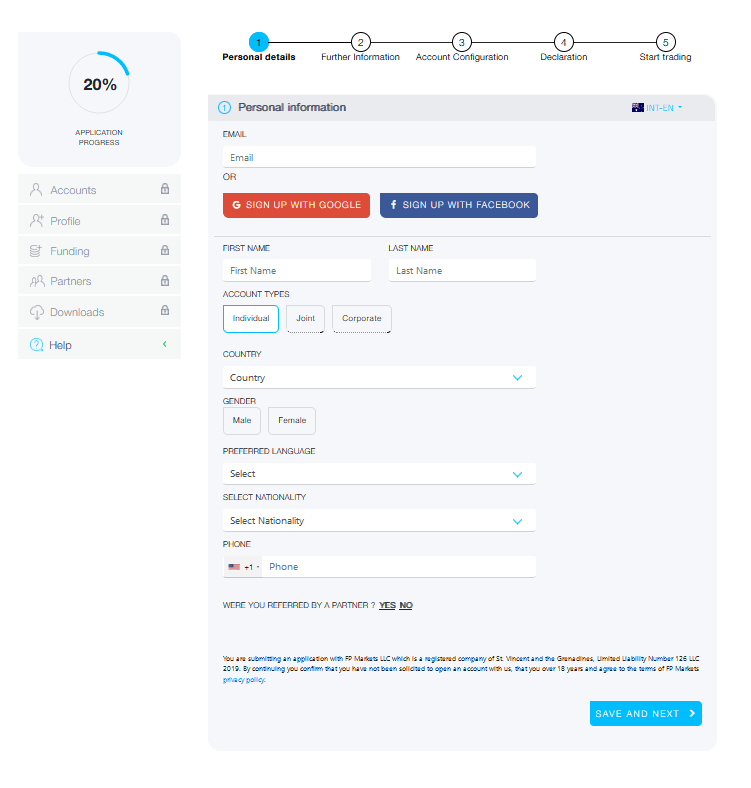

Fast and Easy Account Opening

Opening an account with FP Markets is easy and fast. The broker offers a very simple process that takes only a few minutes to complete. Once you’ve signed up, you can start trading right away.

FP Markets Review: Quick Deposit and Withdrawal Processes

FP Markets processes deposits and withdrawals quickly, which allows clients to fund their accounts or withdraw their funds quickly. Traders can make deposits using various payment methods, including credit or debit cards, bank transfers, and e-wallets. The broker also covers bank withdrawal fees, making the withdrawal process even easier.

Segregated Accounts and Annual Reports

FP Markets takes client fund protection seriously. The broker maintains segregated accounts for client funds, ensuring that clients’ money is safe and secure. Additionally, FP Markets provides annual reports that give clients an overview of the broker’s financial performance and stability.

Tighter Spreads from 0.0 pips

FP Markets offers consistently tighter spreads from 0.0 pips, which is a significant advantage for forex traders. The broker’s Raw ECN account provides access to the interbank market, ensuring the tightest spreads possible.

FP Markets Review: 24/5 Multilingual Support

FP Markets offers 24/7 support to its clients in several languages.. The broker’s customer service team is available to assist clients with any questions or concerns they may have. This is via live chat, email, or phone.

Educational Content

FP Markets have a wide range of educational resources available. These include trading courses, trading guides, podcasts, live webinars, platform tutorial and eBooks.

FP Markets Review: CONs

CFD fees on some stocks might be higher than other brokers out there.

FP Markets Review: Conclusion

In conclusion, FP Markets is an excellent choice for traders looking for a reliable and trustworthy broker. They are licensed and regulated with several well known regulators. With pricing that is better than average, a wide range of products, award-winning trading platforms, excellent customer service and a wide range of educational resources FP Markets has everything you need to achieve your financial goals. So why not open an account with FP Markets today and start trading?