If you’re a trader looking to automate your trading strategies, then you’ve probably come across Expert Advisors (EAs). These are software programs that allow you to trade automatically based on predetermined rules and conditions. In this guide, we’ll take a closer look at the Bollinger Bands EA and how you can use it to improve your trading.

What are Bollinger Bands?

Bollinger Bands are a technical analysis tool that measures volatility in the market. Bollinger Bands are composed of three lines, which include a moving average typically set to 20 periods, and two standard deviations positioned above and below the moving average.. Equally important are the upper and lower bands that represent a range where prices are expected to stay within, providing potential entry and exit points for traders.

Using the Bollinger Bands EA

The Bollinger Bands EA is a trading robot that can help automate your trading based on Bollinger Bands. However, setting it up can be quite tricky. Here are a few steps to help you with the process.

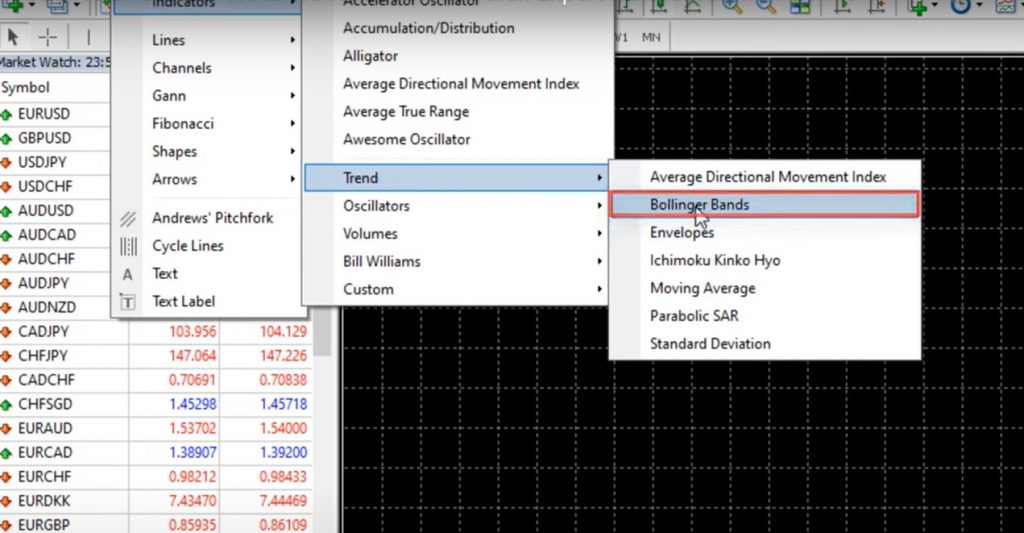

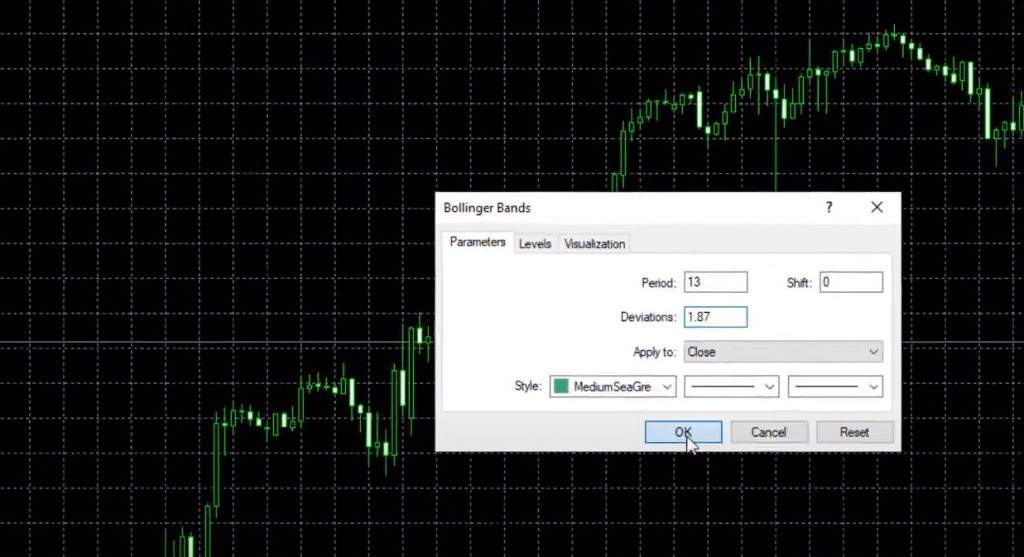

Step 1: Add the Bollinger Bands indicator to your chart.

The Bollinger Bands indicator can be found in your trading platform’s list of technical indicators. Once you add it to your chart, you can adjust the period and deviation settings. For this strategy, we’ll use a period of 13 and deviation of 1.87.

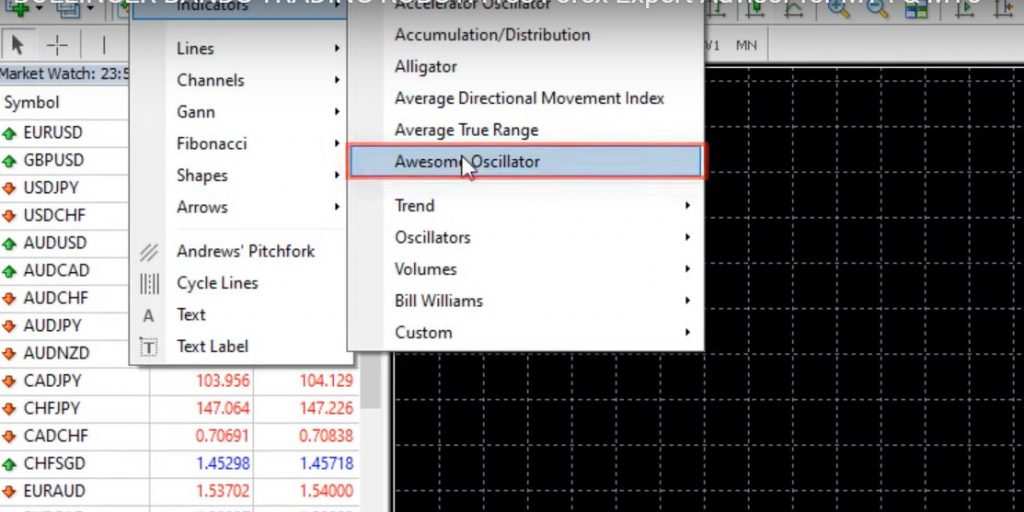

Step 2: Add the Awesome Oscillator to your Bollinger Bands EA.

The Awesome Oscillator is another technical indicator that can help confirm trades based on Bollinger Bands. It has a zero line, and the rule for entering a long trade is when a candlestick opens above the lower band after one opens below it. In order to initiate a short trade, it is essential to observe the price movement surpassing the upper band, trailed by a candlestick that starts below the band. It is advisable to verify that the Awesome Oscillator is ascending for long trades and descending for short trades.

Step 3: Use Stop Loss and Take Profit.

This strategy comes with a Stop Loss of 90 pips above the entry and a Take Profit of 100 pips below the entry price. Moreover, you can adjust these settings based on your trading style and risk tolerance.

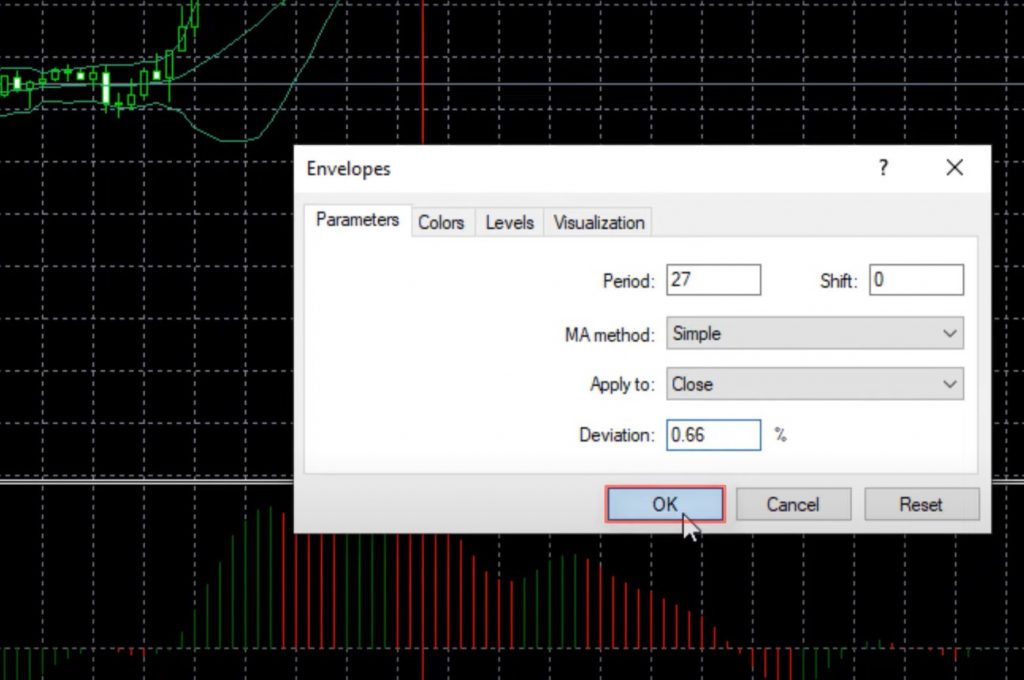

Step 4: Add the Envelopes indicator Bollinger Bands EA.

The Envelopes indicator is another technical analysis tool that can be used as an exit condition for trades. Located in the trend section of your trading platform’s indicators, the Bollinger Bands indicator is an essential tool that is particularly useful when using a period of 27 and deviation of 0.66, as we will do in this specific strategy.

Step 5: Test and optimize your strategy.

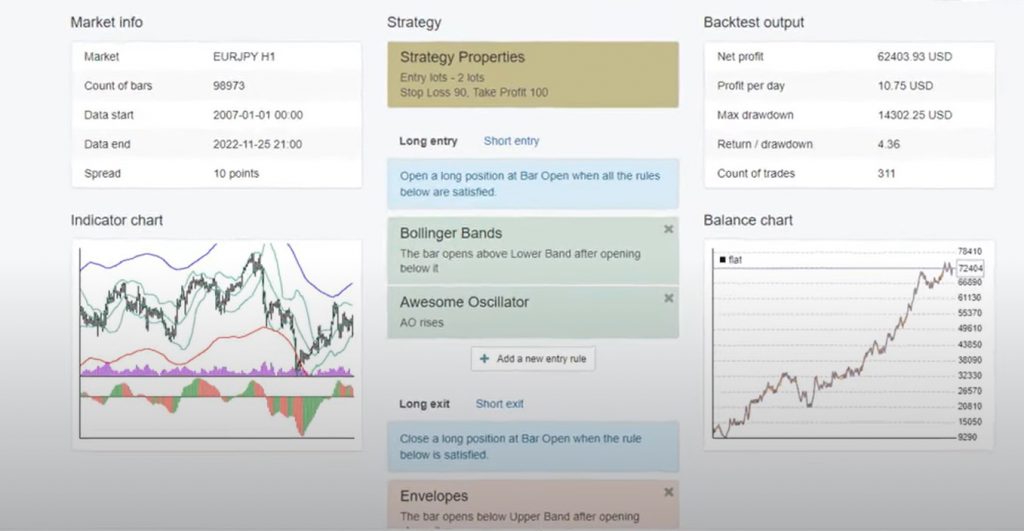

Once you’ve set up your Bollinger Bands EA, you can backtest it using your trading platform’s strategy tester. Make sure to set your timeframe, spread, and other parameters before hitting start. The strategy tester will provide you with detailed statistics and a visual representation of the Expert Advisor’s performance over time.

Tips for Using the Bollinger Bands EA

Here are some additional tips to help you get the most out of the Bollinger Bands EA:

- For both backtesting and live trading, it is crucial to choose a reliable broker. Therefore, we suggest that you check out our recommended brokers by clicking on this link.

- Optimize your settings based on past performance. Use your trading platform’s backtesting tool or a program like EA Studio to see how different settings perform over time despite varying market conditions.

- Set realistic expectations. No trading strategy can guarantee profits, so make sure to use proper risk management and only trade with money you can afford to lose.

- Monitor your trades. Even if you’re using an EA, it’s important to keep an eye on your trades and adjust your settings as needed.

Conclusion

The Bollinger Bands EA is a widely sought-after and efficient tool. It can be effective for traders who want to automate their trading using Bollinger Bands. Additionally, integrating technical analysis tools like the Awesome Oscillator and Envelopes can help create a strong and dependable trading strategy that has the potential to provide outstanding outcomes.. By utilizing these tools and techniques, traders can optimize their trading practices and enhance their overall trading experience.