Forum Replies Created

-

AuthorPosts

-

Alan Northam

ModeratorAlso, add Stop Loss as a filter to generator, reactor, and validator.

Alan Northam

ModeratorAdd Stop Loss in percent to individual strategy Report and and Portfolio Stats. Risk management suggests that each asset traded should not be greater than 2% of account balance. In the case of a portfolio containing multiple strategies it would be nice to know what the total risk is in percent. Knowing what the risk (SL) is in percent is crucial to proper risk management and should be included in EA Studio.

Alan Northam

ModeratorI found the answer to my question!

Alan Northam

ModeratorDear Petko,

I started going through your “The Complete FTMO Challenge Course: Get Funded Quickly” course. In the first or second lecture you mention that you have already discussed your 4 setups. However, I don’t seem to be able to find your 4 setups. Where are they located?

Alan Northam

ModeratorHi Petko,

Good question! The max Daily loss is the max draw down during a trading session. When the daily draw down was getting close to the Daily loss limit I quite trading for the day so I wouldn’t go pass the max loss amount. On the next trading day the Daily loss is reset to zero so you again have a max daily drawdown limit of $500. Max Loss is the the max loss below the initial starting balance of the account. Hope this helps!

Alan Northam

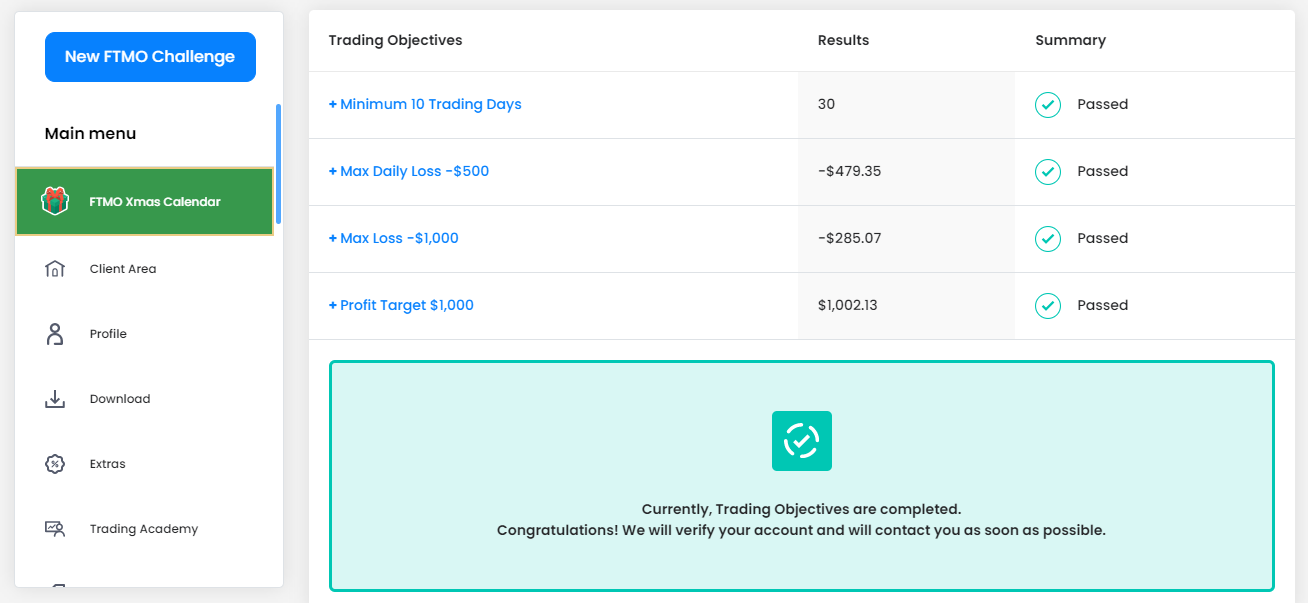

ModeratorFTMO Evaluation completed!

Alan Northam

ModeratorProblem solved!

Alan Northam

ModeratorHi Samuel,

Thanks for the encouragement! I found it interesting to hear that you are also close to passing the FTMO Challenge. My challenge also went through a two week stagnation period as a result of the U.S. dollar stagnating. The potential problem I see coming up this week that could destroy my challenge is NFP report coming out on Friday. I am considering closing all trades just before the report and holding off for a couple of hours until the market settles down. I know the report could help my challenge but at the same time it could destroy my challenge. Hopefully I will pass the challenge before Friday and I won’t have to worry about it. The thought has also come to mind is that perhaps the best time to begin an FTMO Challenge is the Monday following NFT report. That way I could go through the complete challenge without having to worry about this report.

Alan Northam

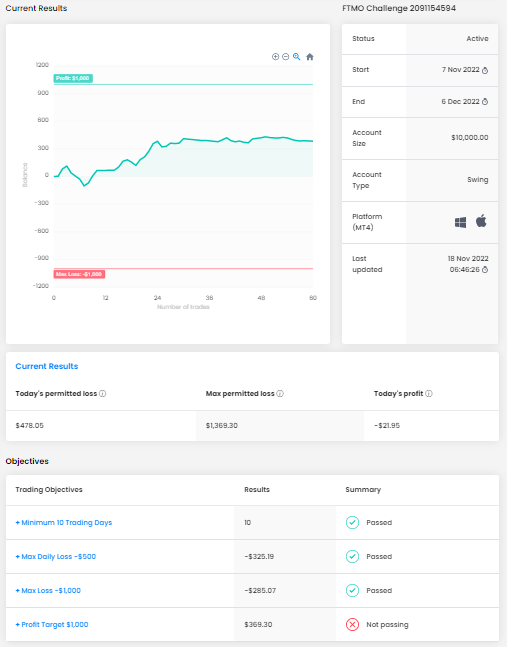

ModeratorI have $200 to go to reach my FTMO $10,000 challenge and 6 trading days to do it in. Up to this date I have been trading 9 strategies equally divided between, EURUSD, EURJPY, and USDJPY. At the beginning of week 11/20 through 11/26 I removed all EA’s and replaced with new EA’s. With only 6 trading days left I have now removed two weak strategies. I will not replace them as I am not 100% confident new strategies will perform well over the next 6 trading days. However, the remaining 7 strategies now have between one week and three weeks of history showing PF > 2 and have made more than $40.00 each to date. Hopefully, these 7 strategies will carry me above the $1000.00 challenge goal by 12/6/2022. May the force be with me!

Alan Northam

ModeratorMy plan for FTMO funding: I know that drawdowns/stagnations can last for a month or even two months before the trend will continue so my plan is to do a $10,000 challenge every month until I am funded. I will also use FXblue to monitor my daily, and projected weekly and monthly stats to help me decide if I need to increase position size in order to reach the $1000.00 goal. I am also thinking about not using any balanced portfolio containing the U.S. dollar as I am thinking drawdowns from news events could be larger. It should be possible to get funded after a few months of sticking to the plan and the first month or two of profits from a funded account should return my investment. Its like any business, you first have to make an investment to get the business up and running and then you can recover your investment from its profits. Once my investment has been recovered I can then start to use the profits to scale up to larger FTMO challenges. I am also thinking about diversifying my FTMO challenges and future funded accounts with different fx pairs in balanced portfolio configurations. I equate this plan as to starting a small business, growing the business and diversifying the product line. I will also move my profits to my own brokerage account so I am not fully dependent upon FTMO. I am just going to use FTMO to grow my own brokerage account, again to diversify.

Alan Northam

ModeratorThis week the currency markets have moved net zero. As a result so had my FTMO challenge balance chart. See below:

I have two left in the FTMO challenge. Hopefully, over this period the markets will be trending so that I can complete the challenge.Alan Northam

ModeratorHi Petko,

The big issue I find in using FPSM is that the strength of currencies according to the meter doesn’t change when you change the time frame. In reality the strength of currencies is different for differing time frames. I would think better success would come with a currency strength meter that measures the strength of currencies based upon the time frame being traded.

Alan Northam

ModeratorHi Samuel,

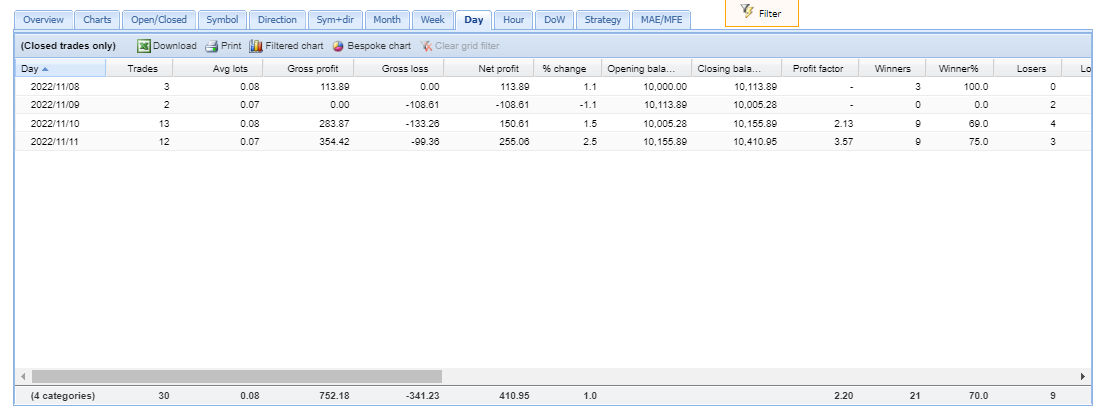

It is a live 30 day challenge! I have FXblue filtered for the first day and last day of the challenge. So far after 9 day it calculates a 12.2% monthly return and a Profit Factor of 2.1.

Alan Northam

ModeratorHi Samuel,

I went on Youtube and learned how to read the currency strength meter.

I know there are lots of currency strength indicators and websites. The problem I have with them is that there are so many how do I know which one is the correct one to use. One indicator will show one currency as being the strongest or weakest while another indicator will show a different currency as being the strongest or the weakest. I don’t trust them because they all indicate different currencies as being the strongest or weakest. The problem is that none of these indicators will explain how they determine the strength and weakness of a currency so its like trusting they are measuring the strength and weakness of a currency on blind faith. I can’t do that! I would have to know the math behind how an indicator determines the strength or weakness of an indicator before I could have faith that it is measuring the strength and weakness of an indicator correctly.

Alan Northam

ModeratorHere is the results of my live $10,000 FTMO account after the first 5 days. The account includes 3 EURUSD strategies, 3 EURJPY strategies, and 3 USDJPY strategies. The net loss of 1% on 11/10 was caused by important news events for the USD. I will be using new strategies this next week to include 2 EURUSD strategies, 2 EURJPY strategies, and 2 USDJPY strategies. I have decided to reduce the risk somewhat during this next week since the account is at 40% of the $1000 goal needed to be reached within approximately 20 trading days.

-

AuthorPosts