Home › Forums › Prop Firms › FTMO Challenge › How to Pass FTMO Challenge

Tagged: Best Forex EA for Prop Firms

- This topic has 140 replies, 2 voices, and was last updated 1 year, 5 months ago by

Alan Northam.

-

AuthorPosts

-

-

September 14, 2022 at 23:09 #123448

Samuel Jackson

ModeratorHi,

I thought I’d share some results that might be useful. I trade my own live accounts but occasionally do an free trial with FTMO for a bit of fun (Also they have good metrix).

I just did my first one for a few months and the trading results can be viewed below:

https://trader.ftmo.com/metrix?share=437be753c284&lang=en

In a nutshell two weeks is nearly up but the account is up nicely currently sitting at 1700 equity on a 10k account. So 17% in two weeks.

These results are twice as aggressive in terms of position sizing that I would usually use but usually when doing a challenge I double up and then reduce my sizing afterwards.

For those unfamiliar FTMO offer a free trail which is exactly the same as the full evaluation but only lasts two weeks. It is however a great free way to test yourself and get some quick metrix.

-

September 15, 2022 at 10:02 #123483

Petko Aleksandrov

KeymasterHey Samuel,

Thanks for sharing your results with everyone.

I’ve heard much about the FTMO challenge but never got into details.

So what happens after the two weeks free trial if you fulfill their criteria?

PS: You did a great job! :)

-

April 28, 2023 at 9:44 #157322

Marin Stoyanov

KeymasterIt’s always great to see traders sharing their experiences and results with others. Thanks for sharing your experience with FTMO, and congratulations on your success so far! It’s important to remember to always trade with caution and adhere to risk management strategies, regardless of the platform or challenge you are participating in. Good luck with your future trading endeavors!

-

-

September 16, 2022 at 14:11 #123582

Samuel Jackson

ModeratorHey Petko,

Basically the FTMO challenge is that you can pay an entry free (depended on size of account but is about 150 dollars for a 10k account).

The to pass the challenge you must meet the profit target in 30 days while respecting the drawdown rules.

IF you pass the challenge then there is a verification phase that basically gives you twice the length of time to achieve the same target again.

At this point you are awarded the 10 account to trade on and will be able to withdraw real profits each month (20% of the profits go to FTMO though)

But they have a free trial that allows traders to try half the challenge period for free and provide the same metrix so it’s a really good free way of testing yourself :-).

I used to try the free trial loads and failed almost everytime when I was getting started, but now I just take it occasionally for a bit of fun and do pretty well most of the time :-)

It is certainly challenging to pass such targets while avoiding drawdowns for the full challenge and verification period though so gotta know what you are doing for sure. I prefer to just trade my own money without the rules although they are very good rules to follow but at least a small breach doesn’t result in losing an account.

-

September 16, 2022 at 16:03 #123585

Alan Northam

ParticipantHow often can you do the free trial?

-

September 16, 2022 at 19:20 #123593

Alan Northam

ParticipantDid you manual trade or did you use a portfolio of EA’s?

-

September 16, 2022 at 22:08 #123608

Samuel Jackson

ModeratorHey Alan, well that’s the great thing. You can do the free trial as many times as you want but can only do one at a time.

I don’t manual trade at all anymore, I just traded a portfolio of 10 EAs on various symbols

-

September 18, 2022 at 14:34 #123889

Petko Aleksandrov

KeymasterHey Samuel,

I got the point complitely. Thanks!

I guess it is suitable for traders that have no risk capital and would pay a small fee to get a bigger account.

Interesting. I will be looking for more information about it. We may create a course to help people pass such challanges. :)

-

September 19, 2022 at 8:46 #124282

Alan Northam

ParticipantHi Petko,

A course and an EA Studio portfolio could be a solution for traders in the States in order to get around the FIFO rule!

-

September 25, 2022 at 11:23 #125429

Petko Aleksandrov

KeymasterHey Alan,

But when you trade with Portfolio EA it would still open many trades, right? Isn’t that against the FIFO rule?

-

September 25, 2022 at 21:22 #125499

Alan Northam

ParticipantHi Petko,

I was referring to your comment on creating a course to pass FTMO challenge. This way traders in the States could use EA’s that contain multiple strategies as the FIFO rule would not apply. -

September 26, 2022 at 1:43 #125547

Samuel Jackson

ModeratorHi Petko,

I thought exactly the same when I read that comment as a portfolio EA trades the same symbol and timeframe so would not change anything with regards to FIFO.

I am guessing what Alan means isn’t a Portfolio EA but a portfolio OF EAs for different assets, right Alan?

Although this is pretty much what’s offered in the 12 expert advisor course. Although in this course there are 2 EAs per symbol which would affect the FIFO.

It sounds like what you are looking for is something like 12 strategies each on different symbols Alan?

Of course you could use 6 from the top 12 and put those together and supplement any others you have from different courses on symbols not included in the 12 expert advisor course too.

-

September 26, 2022 at 1:48 #125549

Samuel Jackson

ModeratorAlthough it does sound like you are getting confused maybe Alan?

If you think an EA containing multiple strategies would help with FIFO such as a portfolio EA, it won’t.

A portfolio EA can only open trades on a single asset and timeframe and so would try to open multiple positions and FIFO would apply in same way as if trading 10 separate EAs on same symbol and timeframe.

-

September 26, 2022 at 10:30 #125643

Alan Northam

ParticipantPetko and Samuel,

I think you are misunderstanding what I was saying. Petko made a comment about creating a course to help traders pass the FTMO challenge. I just thought it was a good idea especially to those traders in the States. The reason I said this is because if such a course were to include a portfolio of strategies it would help traders in the states to be able to use such a portfolio of strategies which we cannot do now because of the FIFO rule.

-

September 27, 2022 at 14:53 #126150

Samuel Jackson

ModeratorHey Alan,

Yeah I think I am a little confused. Can I ask what you would like this portfolio to look like that would be unaffected by the FIFO rules.

Presumably something like 10-20 separate EAs each for different Symbols so that they cannot interfere with each other? As opposed to many strategies that I myself trade that includes several different strategies for the same symbol that could be affected by FIFO rules (which I am lucky not to be affected by).

Is this correct?

I am sure many are affected by the FIFO rule and so clarify is useful. Pretty sure I understand your point now though.

-

September 27, 2022 at 14:59 #126154

Alan Northam

ParticipantHi Samuel,

A portfolio of strategies used in the FTMO challenge would be exempt from the FiFO rules for traders in the U.S. taking part in the challenge.

-

September 27, 2022 at 15:00 #126156

Samuel Jackson

ModeratorHey Alan,

I’ve not been affected by this rule but one way round it might be the following:

Let’s say you want to create a portfolio of 15 EAs on three different pairs. 5 on EURUSD, 5 on EURJPY and 5 on USDJPY.

You set each of the 5 EAs to trade a slightly different lot size (0.01 – 0.05) choosing what EA gets what lot size based on ranking suck as largest stop loss size, or largest nett profit for example.

That way you could all of these on the same account and they would trade together without affecting each other, and you have 0.15 lots assigned to each of the three symbols for balanced.

Like I say, I am not affected so never thought about it until now, but that’s what I would do if I was. Unless I am misunderstanding.

Also for incubation accounts would be easy enough to set different EAs with different lot sizes and then just organize at the FXBlue point and just use the profit factor to pick winners as that will be unaffected by lot size.

-

September 27, 2022 at 22:42 #126221

Samuel Jackson

ModeratorAh, that makes sense now Alan. FIFO doesn’t apply if you are trading with FTMO even if you are based in US. Got there in the end :-)

Have you tried one of their trials yet? Practicing is definitely the best way to get better at them.

I personally use the 10k swing account which has 1:30 leverage and allows news trading btw

-

September 28, 2022 at 13:56 #126286

Alan Northam

ParticipantHi Samuel,

Hurray!!! So, a course on how to pass the FTMO challenge, as mentioned by Petko, should be of interest to traders in the U.S. as it would allow these traders to use EA Studio Portfolio’s.

-

September 28, 2022 at 15:30 #126288

Alan Northam

ParticipantHi Samuel,

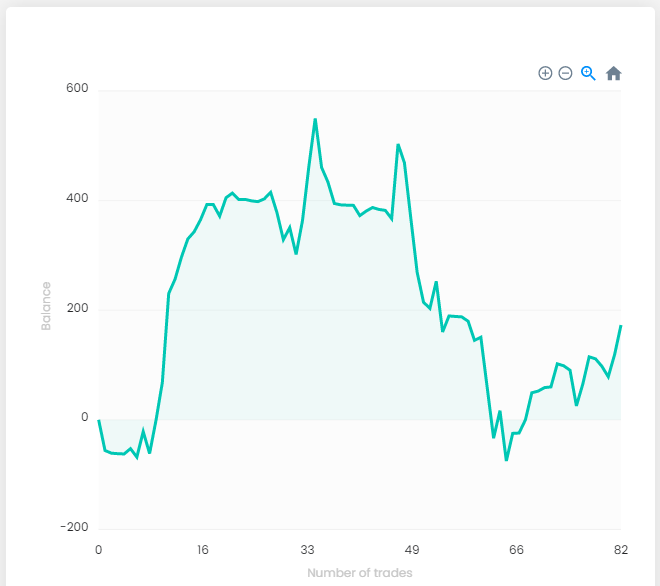

Yes I am doing the free FTMO Challenge. Notice at the peak of the chart above $500. At this point I had passed all the challenges. All trading before the peak was done by manual trading. Once I passed all the challenges I then switched to a Portfolio of EA Studio strategies. Actually it was a Portfolio of 3 EA’s of EURUSD strategies, 3 EA’s of GBPUSD strategies, and 3 EA’s of USDJPY strategies. All 3 portfolio’s were 15 minute time frames. So after the peak in the chart all trading was done with these 3 Portfolio’s. The challenge ends on October 2nd. I will show the complete results at the end of the challenge.

-

October 9, 2022 at 17:12 #127389

Petko Aleksandrov

KeymasterHey Alan,

Yes, I am ver interested in recording such a course, and already invited Samuel to join a YouTube video where he will share more of his experience.

We will see how that goes and we might put a course together.

-

July 10, 2023 at 1:16 #181343

warrichief

ParticipantWhat is your average lots sizeyou used

-

-

October 9, 2022 at 23:37 #127410

Alan Northam

ParticipantHi Samuel,

Here is the results of my first free FTMO Challenge. Notice the peak price on the chart at about $500. At this point I had passed all the challenges. All trading before the peak was done by manual trading. Once I passed all the challenges I then switched to a Portfolio of EA Studio strategies. Actually it was a Portfolio of 3 EA’s of EURUSD strategies, 3 EA’s of GBPUSD strategies, and 3 EA’s of USDJPY strategies. All 3 portfolio’s were 15 minute time frames. So after the peak in the chart all trading was done with these 3 Portfolio’s. Notice that as soon as I switched to auto trading there was a large drawdown that caused the portfolio to fail the FTMO challenge as the drawdown exceeded the rules of the challenge. Further notice that after this big drawdown the auto trading strategies started to trend upwards. If the big drawdown had not happened I most likely would have passed the FTMO Challenge, unfortunately, the 15 day time frame came to an end.

-

October 9, 2022 at 23:45 #127435

Samuel Jackson

ModeratorHi Alan,

This is a great result. I’d advise signing straight up to your next one and keep doing what you are doing.

From the looks of the chart you have stayed within the drawdown limits though right? 500 per day and 1000 overall.

This indicates that you have set your risk to be appropriate which is excellent.

And you have finished the challenge period in profit. The result of this for the paid challenge is that you get another go for free :-)

This should be indicated by result : repeat in the client area.

Keep doing them, if you can repeat (OR pass) three in a row then its a pretty good indication that you have a chance of getting through the real thing.

Good work

-

October 10, 2022 at 2:03 #127441

Alan Northam

ParticipantHi Samuel,

I started new challenge today. Will report result when complete in 14 days.

-

-

October 23, 2022 at 6:45 #128246

Alan Northam

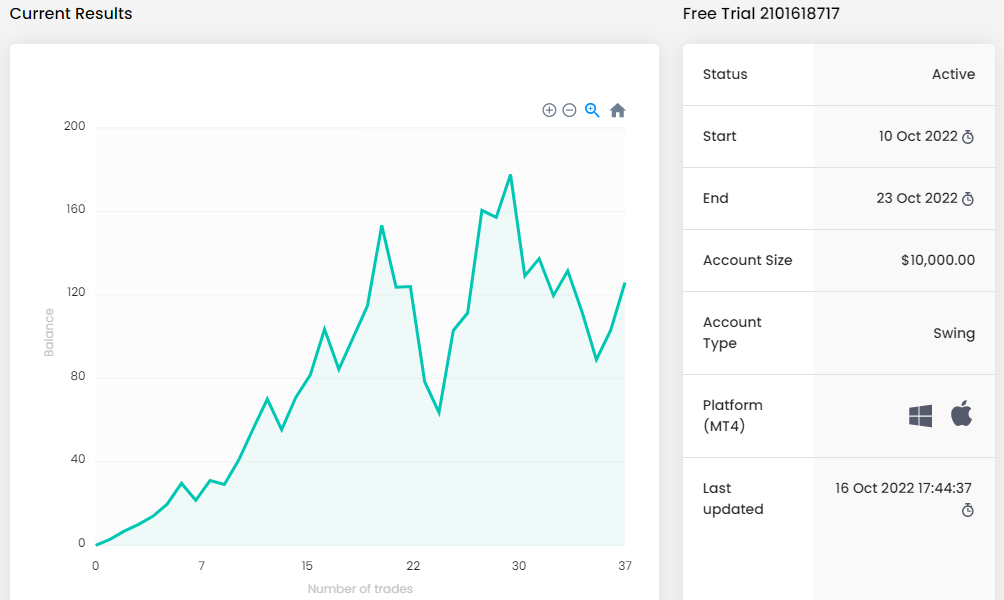

ParticipantI couldn’t wait until the end of the FTMO challenge to show the results so far for my second free challenge. The chart shows the volatility of the market over this first week of the challenge as a result of the U.S. economic data that came out. During the first week I used a strategy containing a EURUSD portfolio made up of 3 EA’s, a USDJPY portfolio made up of 3 EA’s, and a EURJPY portfolio made up of 3 EA’s. This weekend I created new strategies to be used during the second week of this challenge including a EURUSD portfolio made up of 3 EA’s, a USDJPY portfolio made up of 3 EA’s, and a EURJPY portfolio made up of 3 EA’s. So now I have to sit and wait to see how the second week goes.

-

October 23, 2022 at 6:45 #128524

Matthew Roberts

ParticipantYes!!! I’m actually looking for a course on this as well.

I’ve been using True Forex Funds. They only have an 8% profit target, and no minimum days traded.

The issue with them is there is no demo.

I have a 200k challenge and have completed 2 free retries in a row.

I have passed a challenge multiple times on FTMO’s demo using the same method.

I’m just waiting for the market to hit the right conditions and I should pass the real one soon :)

I’ve posted my results so far below.

I’m using only JPY currencies.

10 USDJPY

10 GBPJPY

10 AUDJPY

10 CADJPY

-

October 23, 2022 at 9:05 #128738

Samuel Jackson

ModeratorGreat Equity curve so far Alan.

Nice count of trades also, it is certainly a good feeling getting that first pass (or even just a retry with good curve and solid profit) on the challenge. Certainly looks like you are heading in the right direction. Well managed risk from last time and this time curve going up nicely. Your risk definitely looks about right which is the main thing. A few more challenges will give you a really good feel for how you need to adjust things in that department.

-

October 23, 2022 at 9:11 #128739

Samuel Jackson

ModeratorHey Matthew, that is REALLY good going to get two free repeats. Absolutely right just keep doing what you are doing an let the market choose when you will pass ;-)

MUCH easier to pass the validation and then keep the account that get through the initial challenge. I admire the boldness of going straight for the 200k account also.

Although for the less confident/more conservative I would definitely recommend passing a smaller challenge first haha, we all have to choose our own risk tolerance of course though!

Presumably you are sticking with only JPY for their safe haven status Matthew? Keep us updated, it would be great to see you pass this challenge, looks like you have a good shot if you don’t rush and keep doing what you are doing!

-

October 23, 2022 at 9:15 #128740

Samuel Jackson

ModeratorAlso I agree with your choice of MFF, I also have an account with them. FTMO is better for getting started as there is no free trail account with MFF. But the targets are a little easier to pass and also the fees are lower with MFF so its definitely worth consideration. Of course FTMO has been around much longer but MFF certainly becoming very well established (started July 2020 vs FTMO 2014)

-

June 22, 2023 at 19:30 #177569

David Hanlon

ParticipantI’m also thinking of using MFF. In your view is the Studio EA a good tool for this?

-

June 22, 2023 at 20:40 #177577

Alan Northam

ParticipantHi David,

Yes EA Studio is a great tool for creating EAs for MFF. After creating the EA carefully review the report and study the stats to make sure it doesn’t violate the daily drawdown. Also, check the stagnation to make sure it doesn’t consume too much of your evaluation phase. What I am saying is to review the EA Report in detail to make sure the EA has a good chance of passing the eval phase. Keep us up to date as to how it goes! I would be interested in how things go.

-

-

-

November 8, 2022 at 8:26 #130596

Petko Aleksandrov

KeymasterHey Samual,

Inspired by you, I took the trial of FTMO and passed it in 3 days:

Here are some of the stats:

I am new to this, but it was interesting to try it. I used bigger lots and a smaller number of trades.

And I know it is three days and they want 5, but I guess one can open a few trades with 0.01 just to maintain activity? :)

-

November 8, 2022 at 11:06 #130602

Samuel Jackson

ModeratorHey Petko,

Great results but they will definitely pick up on the inconsistency in trade size in a real challenge account and not accept it.

Variance is fine but a clear large lot size combined with small number of trades and then considerable reduction just to maintain activity would not work in passing the real challenge.

I am sure they mention this in the finer detail of their print. It could well pass the free trail challenge but not the actual challenge which will be reviewed at the end for these things.

-

November 8, 2022 at 11:09 #130603

Samuel Jackson

ModeratorI would think that passing a challenge this way would most likely just result in being warned against this and provided with a free retry but would not be passed through to verification stage.

It would be better to half your lot size and do it slower with consistent trade size.

-

November 13, 2022 at 16:27 #130983

Petko Aleksandrov

KeymasterI tried to record as much as possible from the trial period with FTMO Challenge, and I hope it is useful:

-

November 14, 2022 at 20:13 #131063

Alan Northam

ParticipantHi Petko,

How do I read the Forex Profit Supreme Meter? Is there instructions?

-

-

November 14, 2022 at 22:23 #130991

Alan Northam

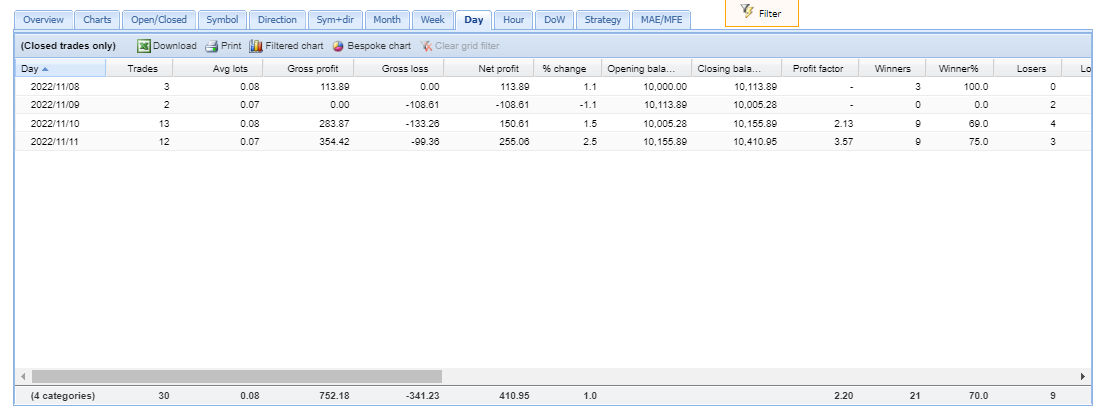

ParticipantHere is the results of my live $10,000 FTMO account after the first 5 days. The account includes 3 EURUSD strategies, 3 EURJPY strategies, and 3 USDJPY strategies. The net loss of 1% on 11/10 was caused by important news events for the USD. I will be using new strategies this next week to include 2 EURUSD strategies, 2 EURJPY strategies, and 2 USDJPY strategies. I have decided to reduce the risk somewhat during this next week since the account is at 40% of the $1000 goal needed to be reached within approximately 20 trading days.

-

November 14, 2022 at 22:24 #131066

Samuel Jackson

ModeratorHi Alan the indicator is provided and explained in the Forex trading course London, NY, and Tokyo.

-

November 15, 2022 at 3:34 #131075

Alan Northam

ParticipantHi Samuel,

I went on Youtube and learned how to read the currency strength meter.

I know there are lots of currency strength indicators and websites. The problem I have with them is that there are so many how do I know which one is the correct one to use. One indicator will show one currency as being the strongest or weakest while another indicator will show a different currency as being the strongest or the weakest. I don’t trust them because they all indicate different currencies as being the strongest or weakest. The problem is that none of these indicators will explain how they determine the strength and weakness of a currency so its like trusting they are measuring the strength and weakness of a currency on blind faith. I can’t do that! I would have to know the math behind how an indicator determines the strength or weakness of an indicator before I could have faith that it is measuring the strength and weakness of an indicator correctly.

-

-

November 14, 2022 at 22:30 #131067

Samuel Jackson

ModeratorIs that a full challenge account rather than the free trial time Alan?

I would try to be as consistent with your trade size as possible as otherwise it will likely not get through the account review but a small adjustment weekly shouldn’t be a problem as long as it is not a large reduction or increase in lot size.

Also just because it is at 40% this week doesn’t mean it will keep that trajectory abs it may have a drawdown for example for a week. I would advise being clear what your plan is before starting trading and then sticking to it throughout the challenge personally.

It would be good to see the equity curve also.

-

November 15, 2022 at 3:35 #131076

Alan Northam

ParticipantHi Samuel,

It is a live 30 day challenge! I have FXblue filtered for the first day and last day of the challenge. So far after 9 day it calculates a 12.2% monthly return and a Profit Factor of 2.1.

-

November 15, 2022 at 16:41 #131120

Petko Aleksandrov

KeymasterHey Alan,

I think you are doing pretty good job! To be honest with you, I am using FPSM for quite many years now and haven’t compared with others. But it works fine.

Anyway, I am working on a system to combine the Expert Advisors with the FPSM but it will be half-automaed.

The idea is to place on the charts Portfolio of EAs for the M1 time frame that will scalp the market.

For example, if after London opens the GBPAUD is very bullish, I would place a portfolio of GBPAUD EA that will go only long for a few hours.

But it will take me a few months to test it…

-

November 15, 2022 at 18:23 #131123

Alan Northam

ParticipantHi Petko,

The big issue I find in using FPSM is that the strength of currencies according to the meter doesn’t change when you change the time frame. In reality the strength of currencies is different for differing time frames. I would think better success would come with a currency strength meter that measures the strength of currencies based upon the time frame being traded.

-

November 16, 2022 at 12:13 #131176

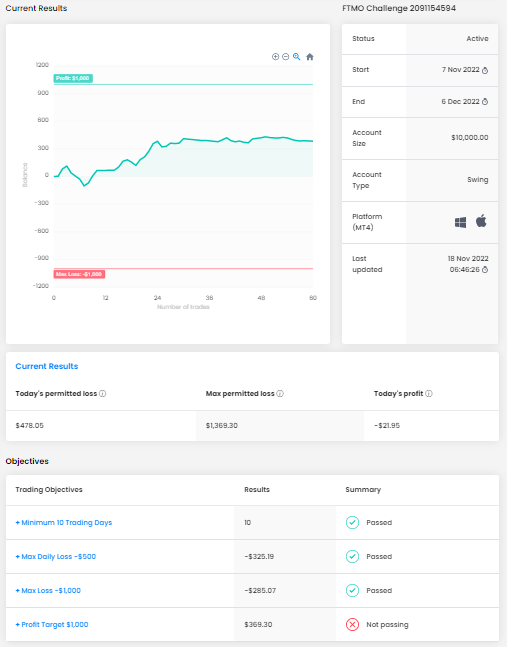

Samuel Jackson

ModeratorHey Alan,

So this sounds like it’s going brilliantly unless I am missing some something?

It sounds to me like you have passed everything except the minimum 10 tradings which could happen tomorrow? In which case you can close all your trades and let ftmo know you have passed right?

Curious to see a snip of you equity curve and also know how you went against the drawdown targets.

Thats a big achievement to trade consistently for minimum of 10 days and hit such targets while managing your drawdown. Well done :-)

Keep us posted, will be great to see how you go on the verification but it’s definitely looking really good at the moment.

You should Sedona post a snip of how you performed against a the targets and your ftmo stats btw, it’s a big achievement

-

November 17, 2022 at 0:40 #131223

Matthew Roberts

ParticipantSorry for the lengthy post and thank you to anyone who chooses to read it.

I have an update on my $200,000 challenge.

I was unsuccessful in creating enough profits to pass the challenge with my initial form of strategy generation. I was always ending in profit so that is good.

The profit was never enough to pass through, so I would get free retries. Excellent!!

I came really close one time, like within $3,000.00 close then I hit a drawdown phase that ate up all my profits and it put me straight into the negative.

The account got back into the positive with 4 days left on the challenge.

So, I took the bots off just in case another drawdown was coming.

This earned me another free retry.

Then I thought to myself, I’ve ended in profit twice and not created enough profits to pass why don’t I switch things up?

I couldn’t help myself and tried doing things differently… The different thing didn’t work and it failed lol.

I should have followed my initial instincts and kept it the same.

Anyways, it’s back to the demos for me.

I’d like to try switching up my strategy generation process to find strategies that perform better.

I’ll share what was “almost working” and how I was generating strategies that ended in profit but were not quite hitting the targets.

It was a process that I started trying a while ago and Samuel suggested a few things to help out in a previous forum post.

So, thanks Samuel for your input, I got a lot closer to passing an FTMO challenge because of you!

Maybe you or someone else has some more insight for me to adjust even further to get closer to that FTMO dream. The next post will have settings.

-

May 1, 2023 at 3:02 #159578

BrandonDavis88

ParticipantHow have you been doing with the bots now?

-

-

November 17, 2022 at 0:42 #131224

Matthew Roberts

ParticipantIn the reactor generate new strategies

1. Historical Data

Data Source: Premium

Symbols used: EURJPY, CADJPY, USDJPY, and GBPJPY.

Timeframe: H1

2. Strategy Propertiesentry lots: 0.60 (I’m using 200,000 USD settings 1:30 leverage)

Trade Direction: Long and Short

Opposite Entry Signal: Reverse

Stop Loss: Always Use

Stop Loss Type: Fixed

Stop Loss Min (pips): 20

Stop Loss Max (pips): 200

Take Profit: Always Use

Take Profit Min (pips): 20

Take Profit Max (pips): 200

3. Generator SettingsSearch Best: Net Balance

Out of Sample: 30% OOS

Max Entry Indicators: 4

Max exit indicators: 2

Generate strategies with Preset Indicators: Off

Use Common Acceptance Criteria: On

Common Acceptance CriteriaComplete backtest:

Minimum Profit Factor: 1.2

Minimum Count of trades: 300

In Sample (training) part:Minimum Profit Factor: 1.2

Out of Sample (trading) part:Minimum Profit Factor: 1.2

Continued into optimization on next post

-

November 17, 2022 at 0:43 #131225

Matthew Roberts

ParticipantOptimize Strategies

Full Data Optimization: Off

Walk Forward Optimization: Off

Normalization: OnNormalization:

Remove Take Profit: Off

Remove Needless Indicators: On

Reduce Stop Loss: On

Reduce Take Profit: On

Normalize Indicator Parameters: On

Out of Sample: 30%

Numeric Value Steps: 20

Search Best: Net Balance

Normalize Preset indicators: Off

Use Common Acceptance Criteria: On

Perform robustness testing in next post -

November 17, 2022 at 0:47 #131228

Matthew Roberts

ParticipantOther important notes

In tools:

Correlation analysis threshold 0.98

Detect balance lines correlation: on

Detect strategies with similar trading rules: on

Trading session: open to all hours of every day

Data Horizon:Maximum Data Bars: 200,000

Minimum Data Bars: 300

Use start date limit: 32 months ago from the day I generate

Use end date limit: 2 months ago from the day I generate

Validator 1:

I take all of the collections I just made and run them through these settings.

Acceptance criteria: Profit Factor 1.2

Out of Sample: In sample

No Normalization or Monte Carlo this time.

Use start date limit: 2 months ago from the day I generate

Use end date limit: 1 month ago from the day I generate

Validator 2:

I take all of the collections that passed Validator 1 and run them through these settings

Acceptance criteria: Profit Factor 1.2

Out of Sample: 50% OOS

No Normalization or Monte Carlo this time.

Use start date limit: 1 month ago from the day I generate

Use end date limit: the day I generate

Then I pick the top 10 strategies for each pair and export a portfolio.

I immediately place them onto the challenge account.The idea here is to create strategies that profited for long periods of time and are still profitable for the last 2 months and profitable bi-weekly last month.

The performance is never as good as the backtest but that’s the whole idea behind forex I think. As I’ve heard from a user in Popov’s forum “You can’t train algebra.”

Anyways I run these strategies for exactly 2 weeks. I delete them, then create new strategies using the same generation settings.

By the way, I’m now doing this through Express generator cuz I can do almost the entire process with a single click of a button.

It was very tedious to do this before hand.

-

March 13, 2023 at 14:14 #147558

SteveM2025

ParticipantHi Matthew and Samuel,

I recently read through this post and decided to try the strategy you outlined in your 17/11/22 00:42 post. I have been retrospectively testing it, that is to say I run the reactors and validations as if todays date were Saturday 6th August 2022. I then pick the best 10 strategies as per your post and using the validator i see how they perform over the following 2 weeks, ie between Monday 8th August to Friday 19th August. Then I repeat the process as if todays date were Saturday 20th August, and so on and so forth. That way I can build a picture over time as to how this strategy works over a period of a few months. I have had some partial success with this, the results have definitely been more encouraging than another system that I had been using til recently. I had some extra questions and wondered if you could help Matthew, or Samuel (as I know you had been providing advice to Matthew).

Do you only run one reactor with the 20 – 200 TP / SL settings?

If you run more than one reactor what other settings do you use?

How long do you leave the reactor(s) to run for?

What collection size do you set?

Your instructions state 30 months is the initial data horizon, then 2 months for validation 1 and an additional 1 month for validation 2. @Samuel I noticed in one of your replies you suggested to Matthew that validation 1 should be 3 months minimum, @Matthew have you done that and if so can you comment on whether 1 month or 3 months work better for validation 1?

Also re the initial 30 month data horizon, my broker (IC Markets) data only goes back to 1/8/2020 for 1HR, which means the earliest 30 month period I can input to generate strategies is 1/8/2020 to 31/1/2023. 1 months for Val 1 is 31/1/23 to 28/2/23 and add 1 more month for val 2 is 1/3/23 to 31/3/23. Which means I cant really try this strategy using my own broker data until the end of this month. I have experimented with a shorter initial data horizon of 15 and 18 months (and lowering the minimum trade count accordingly in acceptance criteria) but the results have been mixed. So do you both feel that the long initial data horizon is fairly critical to the success of this system?

Also Matthew in your post you mention you use the Premium data set to generate the strategies over the initial 30 month period, but then you must load the 10 successful strategies onto an MT4 or MT5 account which will use your broker data? I assume you find this still works fine? My instincts usually say I should only load strategies generated using IC Markets data on an IC markets account, because its the same data so you should be able to have confidence that strategies that perform on a backtest of IC Markets data should perform going forward on IC Markets data? But then I realised you generate strategies using the Premium data and must load them on an account using a different broker data set and you are still getting results so presumably you don’t see this as a problem? The Premium data set starts in 2007 so certainly I could do much longer range historical testing with this data set.

I should also check – do you do val 1 and val 2 using premium data or using your own broker’s data.

Thanks for your time and sorry about all the questions, but it really sounds like you are onto something so I am keen to exploring and running my own tests with this system.

Thanks,

Steve

-

-

November 17, 2022 at 15:04 #131269

Petko Aleksandrov

KeymasterHey Matthew,

Thanks for sharing your experience. You are doing a fantastic job. Imagine you were trading with your own capital. Who cares you missed 3k, right? You ended on a profit.

Anyway, Samuel will give you feedback on your settings, but one question from me: Why do you use a SL of 200 pips?

Is that based on some tests you did and you concluded that the range should be that big?

-

November 17, 2022 at 18:49 #131286

Matthew Roberts

ParticipantThanks for the reply, Petko!

Unfortunately, right after the EAs made that $13,000, it had a 7-day losing streak and created a -$3,000 loss from the initial balance on the account. Then it went back up to a measly $900.00 profit the next day and that’s when I pulled the plug for the free retry. ($16,000 is the profit target in this situation with true forex funds)

In a previous post on a different thread, I was doing a similar process with 10 – 100 pips SL and TP. I was struggling to find enough strategies that fit the acceptance criteria.

Samuel suggested I increase it to 20 – 200 SL and TP.

I was able to find enough strategies then and so I kept that criteria ever since.

This is a good point. If I cut my losers early it would be better.Assuming I’m able to get the criteria to generate enough.

Maybe a stop loss of 10 – 100 and a take profit of 101-200 or a take profit of 20 – 200 or something like that would be better.

Looking forward to Samuel’s reply as well if you have the time to do so. :)

-

November 18, 2022 at 13:38 #131348

Alan Northam

ParticipantThis week the currency markets have moved net zero. As a result so had my FTMO challenge balance chart. See below:

I have two left in the FTMO challenge. Hopefully, over this period the markets will be trending so that I can complete the challenge. -

November 18, 2022 at 13:39 #131364

Samuel Jackson

ModeratorHey Alan, yes I have had the exact same problem this week with stagnation on my accounts. But this is normal, it’s looking good just keep doing what you are doing.

-

November 18, 2022 at 13:46 #131365

Samuel Jackson

ModeratorHey Mathew, well done on the several retry’s and with your 200k account. This is no small achievement.

As soon as I saw you say you were going to switch things up I knew what was coming ;-)

Bummer to lose the entry cost but valuable experience, definitely do some demo for a bit before trying again.

Everything looks good to me regarding your reactor settings btw, I’d focus more on your 2 validations. However you were doing well so an overhaul isn’t what you are after but more some small variations.

I’ll take a closer look this weekend and make some suggestions for you to try (on demo ;-)

-

November 20, 2022 at 4:35 #131542

Samuel Jackson

ModeratorHey Mathew,

From reviewing your posts I have the following suggestions:

1 – I would personally be increasing your validation 1 to at least 3 months

2 – I would also suggest including demo incubation of at least some form in your system (Maybe even just replace the second validation period with using a demo account instead)

3 – Although I see the sense in the stability of you sticking to JPY pairs this could lead to over correlation so it may be an idea to try adding some other pairs or mixing this up a little, just a thought

Much more importantly though is to stick to your plan at all times:

I suggest the following outline:

1 – Create your system

2 – Test you system on demo for a sufficient period of time until you are confident in it

3 – Only when you feel ready should you try a challenge or prior to that I would even suggest a small money account and limit your risk to the cost of your prop firm fee (ie fund an account with a couple of grand and try a challenge on that but limit your overall drawdown to 500 dollars for example, then check out your stats using fxblue)

Saying that however what you were doing seemed to be working well, you cant really aim for a certain profit target each month but rather to just stay in the game as you were doing, who knows if you had kept doing what you were doing then next month just may have been your month where the market gave you what you were after. Periods of drawdown and stagnation occur in the best of systems, sometimes its a matter of just following your plan. IF it is a good plan then eventually things should come good.

-

November 20, 2022 at 4:38 #131543

Samuel Jackson

ModeratorMost people who get through the challenge wont be just starting it and passing it first time btw. Ideally there be several free retries before the market deliver on their system but even retakes are gonna be required on good strategies too. Also really getting through a challenge although great is nothing compared to consistently making small profit with managed drawdowns, its just a good month really.

-

November 20, 2022 at 10:49 #131552

Samuel Jackson

Moderator“thanks Samuel for your input, I got a lot closer to passing an FTMO challenge because of you!”

Thanks for the shout out btw Matthew, it’s all your hard work that’s getting it done of course. You did exactly as you should which is test any suggestions properly for yourself and then move forward with them if they are working for you. Great to see the improvement in results

-

November 20, 2022 at 14:54 #131564

Alan Northam

ParticipantMy plan for FTMO funding: I know that drawdowns/stagnations can last for a month or even two months before the trend will continue so my plan is to do a $10,000 challenge every month until I am funded. I will also use FXblue to monitor my daily, and projected weekly and monthly stats to help me decide if I need to increase position size in order to reach the $1000.00 goal. I am also thinking about not using any balanced portfolio containing the U.S. dollar as I am thinking drawdowns from news events could be larger. It should be possible to get funded after a few months of sticking to the plan and the first month or two of profits from a funded account should return my investment. Its like any business, you first have to make an investment to get the business up and running and then you can recover your investment from its profits. Once my investment has been recovered I can then start to use the profits to scale up to larger FTMO challenges. I am also thinking about diversifying my FTMO challenges and future funded accounts with different fx pairs in balanced portfolio configurations. I equate this plan as to starting a small business, growing the business and diversifying the product line. I will also move my profits to my own brokerage account so I am not fully dependent upon FTMO. I am just going to use FTMO to grow my own brokerage account, again to diversify.

-

November 22, 2022 at 23:39 #132141

Samuel Jackson

ModeratorHey Alan,

Your plan is sensible enough to me.

I am assuming that you have demo tested the system you will be using for this long enough to feel confident that over this period you have a high probability of passing and keeping the account?

I’d personally be testing on a small live account first to limit the cost and using fx blue to track how you would have done. But everyone has a different risk tolerance. I just don’t want anyone losing money unnecessarily, of course at least the losses are capped and if you are comfortable with the worst case scenario going in then either way I am sure a lot will be learned for the cost in the worst case and ideally you will land an account :-)

-

November 25, 2022 at 18:47 #132381

Alan Northam

ParticipantI have $200 to go to reach my FTMO $10,000 challenge and 6 trading days to do it in. Up to this date I have been trading 9 strategies equally divided between, EURUSD, EURJPY, and USDJPY. At the beginning of week 11/20 through 11/26 I removed all EA’s and replaced with new EA’s. With only 6 trading days left I have now removed two weak strategies. I will not replace them as I am not 100% confident new strategies will perform well over the next 6 trading days. However, the remaining 7 strategies now have between one week and three weeks of history showing PF > 2 and have made more than $40.00 each to date. Hopefully, these 7 strategies will carry me above the $1000.00 challenge goal by 12/6/2022. May the force be with me!

-

November 27, 2022 at 12:58 #132514

Samuel Jackson

ModeratorGreat work Alan, keep doing what you are doing and stick to your plan. You still have the verification to get through and then consistent trading after that so definitely smart to stick with the same methodology throughout and do not sway from this as you are doing.

I am in a similar position with not much left to hit a profit target on a prop form challenge but only a week left to go, had a couple of weeks stagnation so hoping the market delivers for both of us this week, if not we will both get free retries at the least. Can’t do much more that hope the market delivers at this point really.

-

November 27, 2022 at 15:59 #132522

Alan Northam

ParticipantHi Samuel,

Thanks for the encouragement! I found it interesting to hear that you are also close to passing the FTMO Challenge. My challenge also went through a two week stagnation period as a result of the U.S. dollar stagnating. The potential problem I see coming up this week that could destroy my challenge is NFP report coming out on Friday. I am considering closing all trades just before the report and holding off for a couple of hours until the market settles down. I know the report could help my challenge but at the same time it could destroy my challenge. Hopefully I will pass the challenge before Friday and I won’t have to worry about it. The thought has also come to mind is that perhaps the best time to begin an FTMO Challenge is the Monday following NFT report. That way I could go through the complete challenge without having to worry about this report.

-

November 29, 2022 at 4:42 #132672

Samuel Jackson

ModeratorHey Alan, yeah on my account I got a really great 1st week and then stagnation for weeks 2 and 3 and hoping for a boost over the finish line this week.

I just focus on trading my own accounts these days as I don’t like being so penalized for drawdowns that are actually fine, but I occasionally do a small prop challenge (or even just an ftmo free trial) for fun and bit of a challenge :-)

I did quite a few of them a while back and got through several challenges but back then I was changing things too much and didn’t have the legs to get through the validation phase. Hence why I recommend stick with whatever your plan is and definitely don’t mix things up mid way as it’s highly unlikely to work and you will just lose all the effort of passing the challenge.

They are a challenge to get through (right the way through) even if consistently profitable, can definitely be done of course though. Just got to stick to a good plan and be patient even if it takes several free retries.

-

December 17, 2022 at 17:03 #136375

Alan Northam

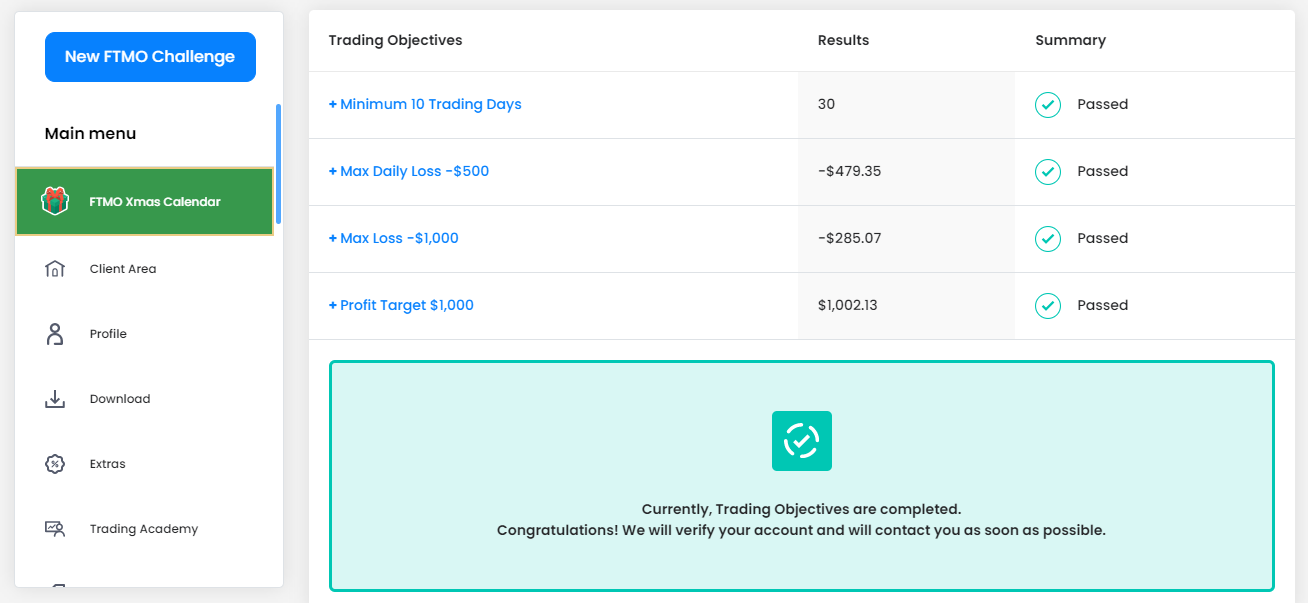

ParticipantFTMO Evaluation completed!

-

December 17, 2022 at 18:25 #136816

Petko Aleksandrov

KeymasterCongratulations, Alan!

Happy to see your results! Keep it up!

One question, how come the Max loss is smaller than the Daily loss you had? :)

-

December 18, 2022 at 3:28 #136847

Alan Northam

ParticipantHi Petko,

Good question! The max Daily loss is the max draw down during a trading session. When the daily draw down was getting close to the Daily loss limit I quite trading for the day so I wouldn’t go pass the max loss amount. On the next trading day the Daily loss is reset to zero so you again have a max daily drawdown limit of $500. Max Loss is the the max loss below the initial starting balance of the account. Hope this helps!

-

December 18, 2022 at 23:35 #137115

Petko Aleksandrov

KeymasterHey Alan,

Thanks for the clarification. :) I passed a challenge myself and did my best to record a few videos about it. I will publish one tomorrow, I hope it helps, but it is for manual trading. I am working now on algorithmic trading, and I will surprise you with something shortly.

-

December 20, 2022 at 9:04 #137332

Petko Aleksandrov

KeymasterHere is the first video for Youtube:

The course is live on the website as well:

The part for the algorithmic trading will be added later.

Cheers,

-

December 20, 2022 at 13:46 #137386

Samuel Jackson

ModeratorWell Done Alan, that’s a great achievement.

Stick to your plan for the evaluation and it’s looking like you have a really good chance of landing the account. Keep us posted

-

December 23, 2022 at 21:20 #137703

Alan Northam

ParticipantDear Petko,

I started going through your “The Complete FTMO Challenge Course: Get Funded Quickly” course. In the first or second lecture you mention that you have already discussed your 4 setups. However, I don’t seem to be able to find your 4 setups. Where are they located?

-

December 24, 2022 at 2:15 #137727

Alan Northam

ParticipantI found the answer to my question!

-

-

January 17, 2023 at 10:09 #140994

Samuel Jackson

ModeratorHey Alan, how is the verification stage going?

-

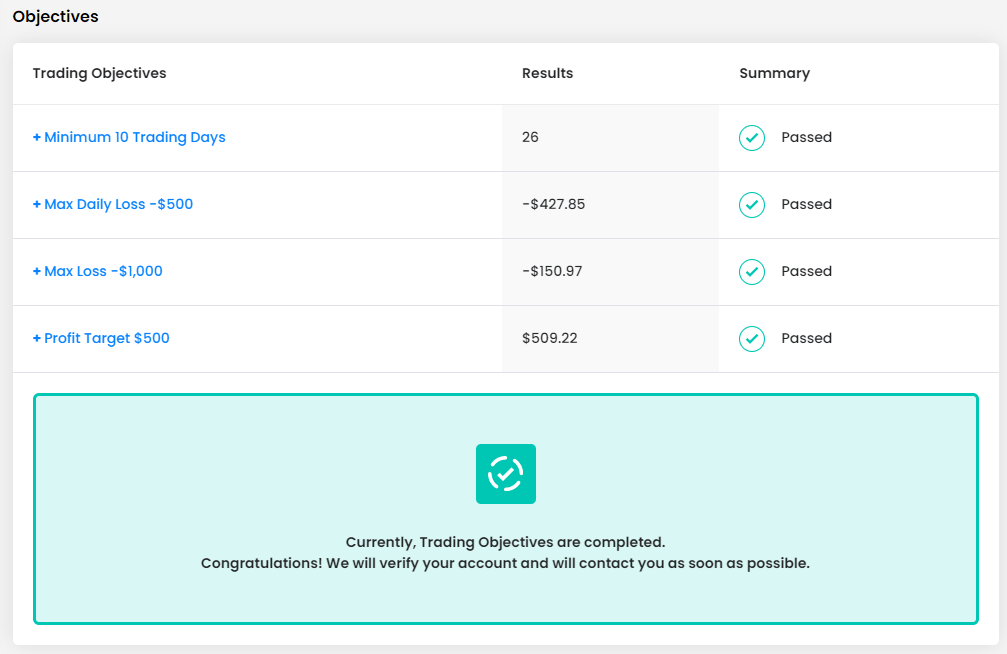

January 22, 2023 at 10:57 #141180

Alan Northam

Participant -

January 23, 2023 at 11:27 #141631

Samuel Jackson

ModeratorAwesome Alan, well done. You clearly have an edge and are practicing good risk management and consistency in what you are doing.

That first paycheck is certainly going to feel great and be well deserved!

-

February 1, 2023 at 11:35 #142227

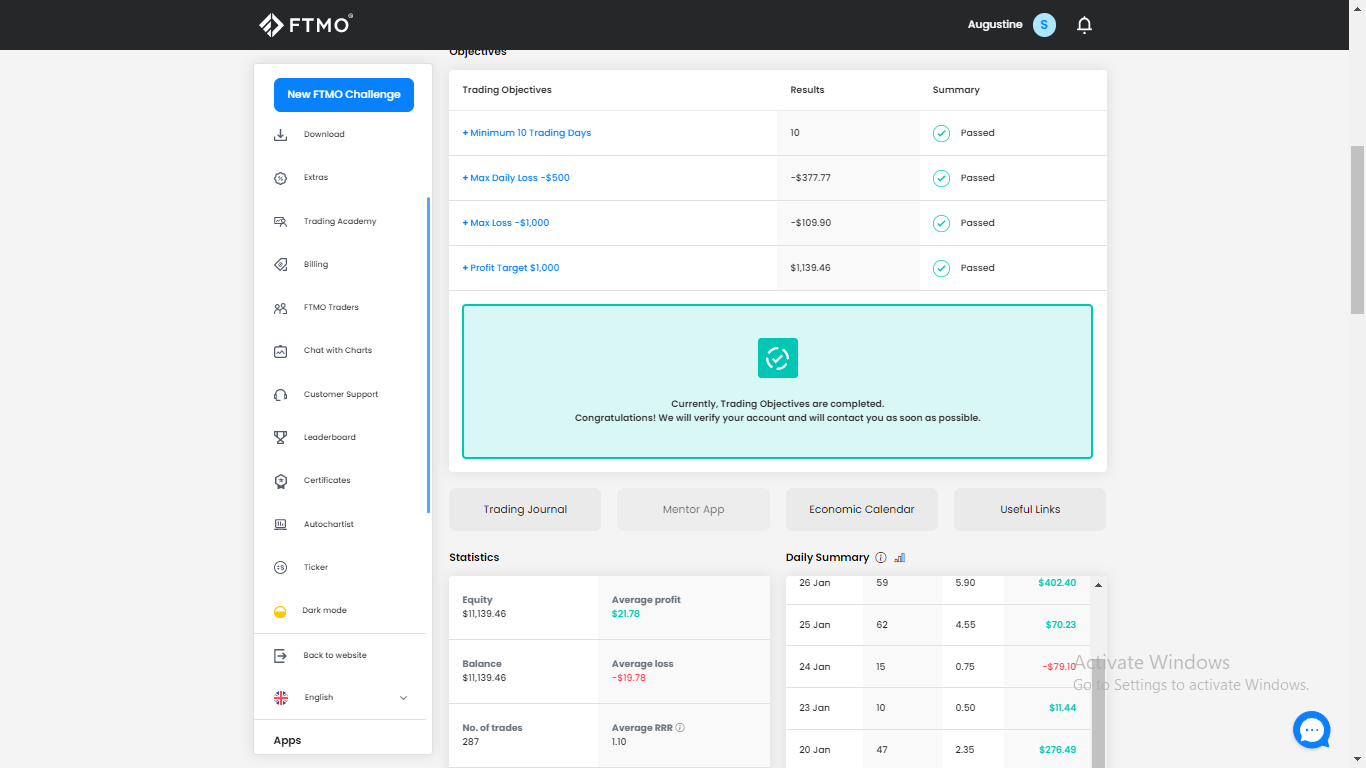

Augustine

ParticipantI passed my FTMO challenge, hopefully I will be able to pass the verification also.

-

February 5, 2023 at 10:56 #143315

Petko Aleksandrov

KeymasterThat is great! Can you share a bit more about the trading strategies you used? Like did you use EAs, or manual trading, what time frames and assets are you trading, etc.

It would be useful to everyone reading this Forum topic.

-

February 17, 2023 at 0:43 #144917

Augustine

ParticipantI used 10 M15 EURUSD EAs and 10 GPDUSD EAs, I failed the verification by a margin of Max Daily Loss. I will try again and definitely share my full strategies when I get funded.

-

February 20, 2023 at 15:25 #145293

Petko Aleksandrov

KeymasterHey Augustine,

Glad to hear from you. I guess you used too many EAs, and if a few it the SL on the same day, you would exceed the max loss permitted.

You better lower the number of EAs or the lots traded.

-

March 3, 2023 at 14:38 #146485

Alan Northam

ParticipantAugustine – This is exactly why I have been pressing Petko (see “EA Studio Updates” topic) to have the overall risk in percent and in dollars added to the Portfolio Stats. This way it would be possible to set the proper lot size so that the overall risk i.e. daily drawdown is not violated. Right now this has to be done manually looking at the SL of each of the 10 strategies within the Portfolio and calculating total risk and then set the lot size of the Portfolio so the daily drawdown risk is not violated.

-

May 2, 2023 at 16:09 #159905

John Noland

ParticipantGreat Job Alan! Any progress on the money management updates? Have you tried any of the Equity Management EAs that protect the equity by closing all trades at a predefined Equity or Profit level?

-

-

March 3, 2023 at 15:06 #146487

Alan Northam

ParticipantI am no longer using FTMO as it requires to pass target price in one month, its Swap fee’s are too high, it has a daily max loss requirement, and the scaling up requirements mean you have to have a profit for four consecutive months and it only scales up by 25 percent. These requirement are too restrictive for me. Even after having done all the hard work of becoming an FTMO Trader you can still lose your account if you happen to fail the maximum daily drawdown limit. In my opinion this daily drawdown limit is too restrictive for using EA’s. The reason for using EA’s is so you don’t have to sit and monitor the trades everyday. However, with this restrictive daily drawdown it is still necessary to interact with the daily trades so as not to violate this drawdown requirement. This is not something I want to do. So, until the EA’s can be programmed not to violate a specified daily drawdown requirement of a prop firm using EA’s with a prop firm is not realistic. I have moved on to trade my own account where I can use EA’s without all these restrictions and not have the constant worry of losing my account for violating a restrictive requiremnt. My opinion!

-

March 9, 2023 at 4:16 #147025

ARRR

ParticipantHi Petko,

May I ask these following questions?

Question 1: How you control the MDL with algorithmic trading once the bots trade against your desired direction ?

– FTMO MDL (Max Daily Loss) 5%

– Max Loss = 10%Question 2: How you generate Robots to trade for FTMO challenge due to little historical data for EA Studio Software ?

Question 3: When you are going to launch Algo Trading for Prop Firm Challenge ?

Regards,

ARRR

-

March 17, 2023 at 10:59 #146848

Ziawli Shah

ParticipantThank you very much for sharing such information, I am very grateful. That there are people like you who share their results. You are very good at helping to make a decision whether it is worthwhile to earn by such a system or not.

-

March 17, 2023 at 11:01 #148107

Petko Aleksandrov

KeymasterHello ARRR,

Today I am updating the current course with the EA and a complete section of how I use it.

You will see the whole thing.

And why do you consider the Historical data on EA Studio as small? You can increase it to 500 000 bars?

-

March 30, 2023 at 11:23 #149933

ARRR

ParticipantHi Petko,

Thanks for your reply, Do you think it’s a good idea to use “Forex Historical Data” ??? Because I cannot load enough data from their MT4’s terminals.

For all these prop firms (FTMO, MFF, TFF and etc.)

Regards,

ARRR

-

March 30, 2023 at 16:24 #149974

Alan Northam

ParticipantARRR,

Petko has demonstrated that the results of using candle data from your broker and using the premium data is the same as long as you update the Long Swap, Short Swap, and Commissions from your broker with the default Long Swap, Short Swap, and Commissions in EA Studio.

Alan,

-

-

-

March 17, 2023 at 15:30 #148180

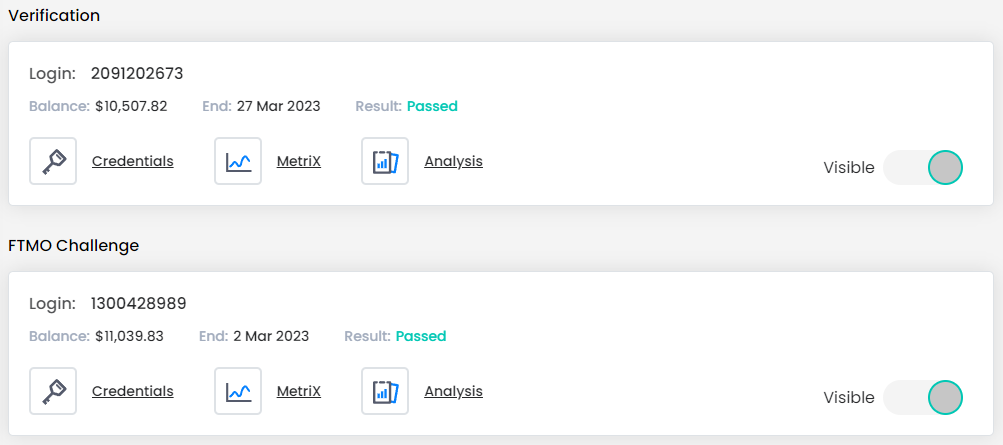

Petko Aleksandrov

KeymasterHey traders,

Here is a video from today that might be useful to all participants in this topic:

I also updated the FTMO course with the Semi-Automated System I was testing.

Interestingly, I passed the Verification as well with the system. I wasn’t planning to include it in the course, but I will so it will be more beneficial for all having the course.

-

March 18, 2023 at 19:28 #148349

Alan Northam

ParticipantHi Petko,

Today I reviewed your updated course adding the semi-automatic trading strategy. However, I could not find the link to the EA you used. Also, the Conclusion video was not accessible as it says it is a private video.

Cheers,

Alan -

March 24, 2023 at 12:31 #149104

Petko Aleksandrov

KeymasterHey Alan,

Thanks, please check again, it is fixed now.

I will also update the course with the Verification process this week. The EA passed it quicker.

-

March 26, 2023 at 12:38 #149395

Samuel Jackson

ModeratorHi Alan,

Your opinion on the daily drawdown limit in FTMO is very valid. It is by far the most difficult requirement and I also trade my own accounts to avoid the restriction. However in doing the challenge your risk should be reduced as you progress through the process, by its very nature it is a challenge and to pass that phase your risk needs to be pretty high, however this should be reduced up to half for the verification and then definitely reduced by half again when trading ongoingly.

I did notice you were flying a little close to the sun in terms of the daily drawdown limit with the challenge results, but I assume that the intention was to reduce your risk considerably when trading ongoingly? In this case I don’t think there is any reason to be overly concerned with the daily drawdown limit right?

You did the hard work to get through (Which with these is also a case of the market aligning well for during the challenge), just set set your risk to a quarter of what you used for the challenge phase and keep running your system and that way the daily drawdown should be pretty far off really.

-

March 26, 2023 at 12:50 #149397

Samuel Jackson

ModeratorHi Steve,

For the first 4 question regarding the reactor. I personally develop settings by feel, I often start out pretty strict but if after an I notice that I am only really getting say 1 strategy every hour I will then ease up a bit. I usually run several reactors to make the most of whatever computing power I have. Collection size set to 300 but that’s rarely filled and to be honest I usually just leave mine running even for days sometimes.

As to your question regarding broker data, given the lack of data I would suggest the following:

1 – Use Premium Data for the reactor

2 – Run your collection through the validator on however much broker data you have (form 2020 is plenty)

It is completely okay to generate your strategies using the premium data as long as you validate on your broker data for what you have also. Make sure to also set the swaps to you broker data for the premium data when generating.

-

March 27, 2023 at 12:32 #149521

Petko Aleksandrov

KeymasterHey guys,

To keep you up-to-date, I have added one more Expert to the FTMO Course that worked better during the Verification:

I also added another four lectures to make it more transparent what is the difference between the two EAs more.

Trade safe!

-

April 8, 2023 at 16:44 #150795

Petko Aleksandrov

KeymasterCheck out this video:

-

April 30, 2023 at 17:44 #159015

BrandonDavis88

ParticipantI’ve only had the FTMO bot for a few weeks but its quite impressive but I do have a few Questions

Is the FTMO trading bot subject to continuous updates, and do users need to replace it on a monthly basis? Additionally, do you offer trading bots for different currency pairs or markets for FTMO or just EU?

-

May 2, 2023 at 15:17 #160863

Alan Northam

Participant“Is the FTMO trading bot subject to continuous updates, and do users need to replace it on a monthly basis?”

To determine if the FTMO Robot needs to be replaced I backtest it with EA Studio and look at its monthly profit. As long as the Robot continues to show good profit on a monthly basis there is no need to replace it. Lacking access to EA Studio you can also backtest the Robot using MT4 or MT5 Strategy Tester. The following is the results of my monthly backtesting using MT4 Strategy Tester:

11/01/2022 – 12/01/2022 769.50

12/01/2022 – 01/01/2023 -157.80

01/01/2023 – 02/01/2023 214.50

02/01/2023 – 03/01/2023 214.50

03/01/2023 – 04/01/2023 914.10

04/01/2023 – 05/01/2023 593.70 -

May 2, 2023 at 16:24 #160904

Alan Northam

ParticipantHi John,

Thanks for your kind comment!

I don’t use third party EA’s. For protecting the equity of my account I use Forex Strategy Builder Pro which is great for generating EA’s that will automatically close at predetermined equity levels and profit levels.

Also, I don’t have any news to report on the money management updates at this time.

-

May 2, 2023 at 19:38 #160998

John Noland

ParticipantThank you Alan..(-:

Have you found any EAs that are consistent enough to beat the Prop firm challenges or stay within the drawdown rules?

-

May 2, 2023 at 20:03 #161017

Alan Northam

ParticipantJohn: “Have you found any EAs that are consistent enough to beat the Prop firm challenges or stay within the drawdown rules?”

That’s the problem I had with using EA’s I had created with EA Studio was the drawdown. When using these EA’s in FTMO challenge I had to closely monitor the price chart. However, when creating EA’s with Forex Strategy Pro it has the ability to set the maximum account drawdown. For example a $10,000 FTMO challenge cannot fall below $9,000. So I can set the EA to close if it falls to say $9500. I have created a few EA’s now with FSB Pro and I am testing them now. Hopefully, this will allow me to set up an FTMO challenge and then walk away for a month. Also, the daily drawdown needs to stay less than 5% of account balance. FSB Pro can also do this. So, the only way I know to stay within the drawdown rules is to create them using FSB Pro.

-

May 5, 2023 at 22:44 #163059

John Noland

ParticipantThank you Alan! I really appreciate the help!!…(-:

1) How do you handle the news if the Eas have open positions?

2) What if the FTMO EA hits a winning trade at 1% when you are away from the computer or are sleeping? How do you handle the money management part then?

John

-

-

-

May 5, 2023 at 14:16 #162715

Petko Aleksandrov

KeymasterHey Alan,

Thanks for all of that! I am also working on a new and improved version of the FTMO Robot that I replaced with the FSB pro, I added a few additional indicators and I am also using the option to close trades if the account drops below $9500.

After the tests, I am planning to go for the 200k challenge with the robot. Will keep you updated!

-

May 5, 2023 at 22:55 #163068

John Noland

ParticipantPetko,

Thank you for the great courses! I have them all. They are informative, to the point, and very thorough with lots of examples. Your teaching style is great!!

If you need help testing the new FTMO EA, I would love to help! I am adding an equity management EA to the account I am using with your current Prop firm EA. It will turn off auto trading and close all open positions at any predefined loss limit and any predefined profit level.

Thanks Again…(-:

John

-

May 6, 2023 at 14:25 #163344

Petko Aleksandrov

KeymasterHey John,

Glad to hear from you.

I personally do not worry if I sleep and there are open traders or EAs trading during the news. We backtest the EAs with the complete Historical data (the news is included).

I am working on a new FTMO EA version with some extra inputs – max drawdown and max spread, which is better than a news filter in the first place. I will update the course as soon as I am ready with it.

-

May 22, 2023 at 21:59 #168534

John Noland

ParticipantThank You Petko! I am looking forward to the new robot for the FTMO course !!!

Will it also be able to handle the money management system in the course? ie…scale up the lot size after a winning trade?

-

-

May 6, 2023 at 16:46 #163406

Alan Northam

ParticipantJohn,

Answer to question 1: Like Petko says, when creating EA’s the backtesting includes all the news. Like Petko, I simply let the EA’s run 24/5.

Answer to question 2: Not sure I understand the question. Please rephrase the question for better understanding so I can properly answer.

Alann,

-

May 17, 2023 at 0:38 #168532

John Noland

ParticipantThank you Alan.

In question 2, I was asking about the money management portion of Petkos FTMO course on Udemy. It says to scale up after a win, letting your profits ride, needing 2 consecutive wins to beat the challenge. My question is what if the Ea closes out a winning trade and enters another while you are not watching the chart to scale the lot size after the winning trade.

Another question when you can please ….When trying to make the Dukascopy data match a broker….Where do I find the point value it ask for in EA Studio? I can not find it in the contract specifications on MT4 or any of the brokers websites.

Thanks again for all of the help!

-

-

May 17, 2023 at 0:46 #169243

Alan Northam

ParticipantHi John,

I think question 2 would be better answered by Petko as it pertains to his money management method for FTMO.

About your other question. Use the Data Export script. https://eatradingacademy.com/software/expert-advisor-studio/ Then you can open the appropriate data file at File>Open Data Folder>MQL4>Files. Then open a data file. For example: EURUSD15 with notepad. Then look for Point Value. For example: “pointValue”:1.00000.

You can also import the data files into EA Studio and all the data, point value, swaps long and short, etc, will be added to the symbol settings.

-

May 21, 2023 at 18:36 #171297

Thorsten G.

ParticipantHello, i like the FTMO-Robot and I’m about to test it in both versions (M15 and H1) in Demo with the scaling the inset.

Thanks for your work Petko and I’m already looking forward to the version you announced.

Thorsten

-

May 23, 2023 at 13:48 #172953

Petko Aleksandrov

KeymasterHey John,

I haven’t decided on that but it will definitely have the option to stop trading at a certain amount of drawdown.

For example, if you start with 10k, you will be able to set it to stop trading at 9600.

-

May 26, 2023 at 20:09 #173314

Chi Kong Yu

ParticipantAfter I downloaded your EA, why doesn’t it start tradin

-

May 26, 2023 at 20:09 #173320

John Noland

Participant@Petko. Question please …In one of your courses or videos you talk about another of your courses that includes all of your past and present collections for EA Studio. Which course is that?

Here is a great marketing idea..How about giving that course and the professional algorithmic trader course to any one that buys 15 or more of your courses, kind of like a VIP bonus. What do you think?Any ETA on the new FTMO robot?

Thank you…😁

-

May 26, 2023 at 20:11 #173480

Petko Aleksandrov

KeymasterHey Chi,

There could be two reasons – you haven’t placed the EA properly on the chart or there were no signals yet. Can you share some screenshots from your platform?

-

May 26, 2023 at 20:13 #173481

Petko Aleksandrov

KeymasterHey John,

The EA Studio Professional Course includes all the collections. However, that course is suitable for the EA studio licensed users.

-

May 27, 2023 at 12:18 #173582

Chi Kong Yu

ParticipantI want to ask if the company can’t get money after completing all the funds with EA

-

May 27, 2023 at 14:09 #173591

Chi Kong Yu

ParticipantI am using Best Forex EA for Prop Firms

-

-

May 27, 2023 at 15:09 #173533

Chi Kong Yu

ParticipantOriginally there was a pattern on the upper right

-

May 27, 2023 at 15:34 #173605

Alan Northam

ParticipantChi,

You have not properly installed the EA on MT4. Here is a video where Petko explains how to install an EA on MT4.

-

May 27, 2023 at 15:49 #173607

Chi Kong Yu

ParticipantI want to ask if the company can’t get money after completing all the funds with EA,I am using Best Forex EA for Prop Firms

-

May 27, 2023 at 17:36 #173618

Alan Northam

ParticipantChi,

After completing the FTMO Validation you will be given a live account to trade. If the FTMO live account you trade is profitable you will then be able to take profit.

-

May 29, 2023 at 10:06 #173914

Chi Kong Yu

ParticipantI want to ask if I need to use vps to maintain my ea?

-

May 29, 2023 at 11:48 #173930

Alan Northam

ParticipantYou do not need a VPS if you leave your MT4 open 24/5.

-

-

May 29, 2023 at 13:51 #173949

Chi Kong Yu

ParticipantI want to ask if this is working normally?

-

May 29, 2023 at 13:52 #173958

Petko Aleksandrov

KeymasterIt is hard to say…I see just the smiley face, which is good.

Do you see any errors in the journal or the terminal?

-

May 29, 2023 at 14:38 #173973

Alan Northam

ParticipantChi,

Be wise and test in a demo account until you know it is working correctly!

-

May 29, 2023 at 17:55 #174012

Chi Kong Yu

ParticipantI want to ask I want to set the entry price myself,I am using Best Forex EA for Prop Firms

-

May 29, 2023 at 19:39 #174027

Chi Kong Yu

ParticipantI would like to ask, do I need to change his setting according to the amount of each challenge? If so, how should I set it? or ea automatic setting

-

June 1, 2023 at 15:11 #174422

Petko Aleksandrov

KeymasterHey Chi,

I am not really sure if I understand you…you are using the EA but you want to set the entry price yourself?

In the course, and in my videos I show what amount I trade in the 10k challenge.

It is up to every trader what amount one would use in a challenge or trading account. But if you decide to follow my trading you can see what amount I use in the 10k challenge, I think it is very basic math to calculate with how much to trade in an account with a different size.

Kind regards,

-

June 1, 2023 at 22:34 #174472

John Noland

ParticipantThank You Petko,

I plan on purchasing EA Studio and FSB pro, but want to take the EA Studio Professional course sooner. Any discounts available? I have purchased 18 of your courses.

Any ETA on the new FTMO robot?

Thanks Again

John

-

June 1, 2023 at 22:39 #174473

John Noland

ParticipantHelp please..

I am in my trial of EAS and am downloading the collections once they are generated. The are down loaded as a zip File that contains the EAs.

When I try to upload the collection it says it needs to be a .json file

How do I download and upload the collection. I have watched the video tutorial and read the help section. It also says it should download as a .json file.

Thank you

-

June 2, 2023 at 0:03 #174482

Alan Northam

ParticipantJohn,

If you are trying to upload a zipped file containing EA’s back into EA Studio then do the following:

1. Go to Validator

2. Click on “1. Strategies”

3. Click on the box that says “Drop files here or click to upload”

4. Navigate to the zipped file, double click on the zipped file and the EA’s should be loaded. You can see the number of loaded files where it says “Loaded Strategies”

5. Click on “3. Validator settings”

6. Make sure ” Use the common Acceptance Criteria” box is unchecked

7. Make sure all the “Optimize strategies” boxes are unchecked.

8. Make sure all the “Perform robustness testing” boxes are unchecked

9. Click on START

10. All EA’s should now be in the “Collection”-

June 2, 2023 at 4:11 #174500

John Noland

ParticipantThank you Alan!!!

-

-

June 2, 2023 at 7:13 #174519

Petko Aleksandrov

KeymasterThanks for the support, Alan!

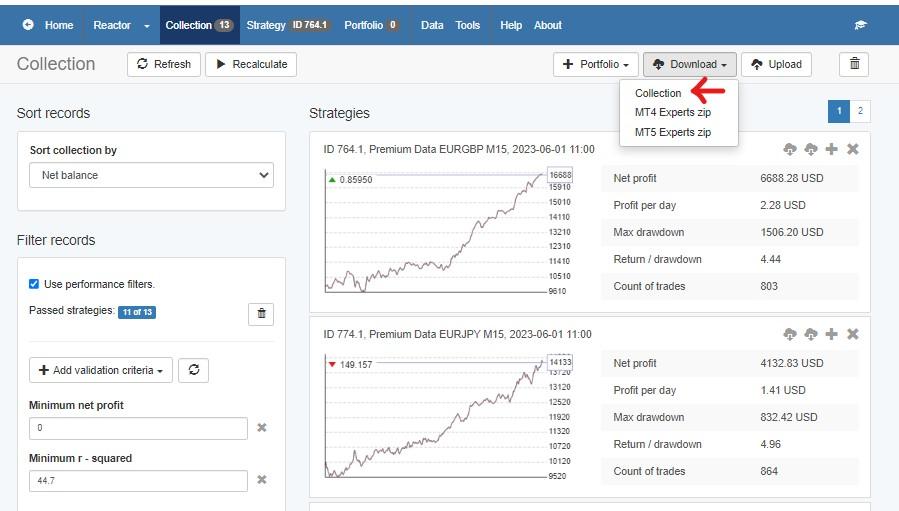

I think what John was doing is to download the EAs from the collection, not the collection itself.

So if you want to download the collection only, make sure to click the 3rd option in the dropdown manu:

-

June 2, 2023 at 11:33 #174541

Alan Northam

ParticipantPetko,

First option, not third option :o)

Saving a collection as a collection is the better option as it makes it easier to organize all your collections.

And, for Gareths’s knowledge the the Collection file is a json file.

-

December 17, 2023 at 19:06 #221195

SourabhRawal

ParticipantPetko ,

Please add Forex Profit Supreme Meter mt5 version

-

December 18, 2023 at 13:56 #221306

Petko Aleksandrov

KeymasterWe have it just for MT4.

-

-

January 6, 2024 at 10:22 #225051

Matthew Cupper

ParticipantPetko,

I just wanted to say how impressed I have been with your FTMO challenge course which I received the the FTMO EAs.

I placed the EA’s on a Trial account a few days ago and they started trading last night, so far I have three open trades going into the weekend but all are in profit, hopefully the market remains stable and they will come profitable next week.

After going through the training I have a few newbie questions for you, so sorry. I am sure many of you probably think I am stupid, but I would rather ask and understand than to remain ignorant!

While I understand the money management principles in the training what I don’t understand is how to quickly calculate my SL and TP based on account size and leverage?

Obviously I understand that 1% risk on £10K is £100 but how do you quickly calculate this to place SL and work out TP, is there a tool that you use?

Also how does leverage work with this? If I have two accounts at £10K and one with 100:1 leverage and another at 500:1 are my lot sizes the same or different?

I have tried to research this and find the explanations I found unclear and confusing.

I thank anyone in advance for providing a simplified explaination.

Thanks all and wishing you every success for 2024! :)

-

January 6, 2024 at 14:59 #225095

Alan Northam

ParticipantHi Matthew,

Here is the calculator I use to calculate SL. There are many others on the internet. You don’t calculate TP. Also don’t worry about the leverage. As long as you stick with 1 or 2% account risk the leverage will not affect your account.

https://www.forextime.com/trading-tools/trading-calculator/pip-calculator#pip-calculator

Alan,

-

-

January 6, 2024 at 16:03 #225107

Matthew Cupper

ParticipantAlan,

Once again thank you 🙏

One last question then is there a benefit in using a higher leverage over a lower leverage when setting up an account?

I currently have a small account funded and used 500:1 leverage which can be changed.

Appreciate your reply 👍

-

January 6, 2024 at 16:40 #225119

Alan Northam

ParticipantHi Mathew,

Higher leverage allows you to take on more risk than a lower leverage. However, with respect to FTMO, by limiting account risk from 1 to 3% it makes no difference as to whether your account has high or low leverage.

Alan,

-

-

-

AuthorPosts

- You must be logged in to reply to this topic.