Many people are interested in trading and making money, but they may not have the time or knowledge to do it. Following professional traders can be a good solution for those who want to make money with trading without having to spend all their time learning and analyzing charts. In this blog post, we will discuss the best way to follow professional traders, and that is through Copy Pro Traders, also known as copy trading.

Introduction to Copy Trading

Copy trading has changed drastically the way people invest, offering a pragmatic approach for those who don’t possess deep expertise but are keen on investing. It gives chance to novice traders to replicate the trades of experienced investors and copy professional traders. Therefore, the name copy trading. This innovative method provides an opportunity to earn at the same time when you learn as you observe the strategies and decisions of traders with vast knowledge and expertise.

One of the main advantages of copy trading is its accessibility. It opens the doors to those who might otherwise feel excluded due to lack of knowledge or confidence. You can select the best copy trading platform that fits your needs, ensuring that you have access to a user-friendly interface and reliable performance metrics. Copy trading platforms provide transparent insights into traders’ historical performances, which helps users make backed-up decisions about whom to follow. When you copy professional traders, you can potentially achieve better trading outcomes without extensive personal research and analysis.

Understanding Social Trading, Copy Trading, and Mirror Trading

Social trading has become popular in recent years, especially after the pandemic, when people spent a lot of time on social media. It has become common to follow traders on Twitter, Instagram, Discord groups, Telegram, and other platforms and apps where influencers post their trades and technical analysis. The bad thing here is that you have no track record or any proof of the traders’ success in trading. You cannot see their closed trades, and their strategies are not backtested.

Social Trading

Social trading is a form of investing where individuals can observe and learn from the trading behaviors of others within a community. It operates much like a social network for traders, where users can share ideas, discuss strategies, and follow market trends. On platforms offering social trading, users can follow professional traders and see their trades in real-time. However, executing trades remains manual; users make their own trading decisions based on the insights they gain from the community. Social trading provides educational value and creates a collaborative environment. This makes it perfect for those who want to expand their trading knowledge and skills through observation and interaction.

Copy Trading

Copy trading takes social trading a step further. This is because it allows users to automatically replicate the trades of experienced traders. When you engage in copy trading, you select one or more professional traders to follow, and your account will automatically execute the same trades that they make. This method is particularly beneficial for those who lack the time or expertise to trade independently. Platforms offering copy trading, often advertised as the best copy trading platforms, provide tools to manage risk and allocate funds proportionally. This form of trading is highly popular among beginners and those who prefer a hands-off approach while still utilizing the expertise of seasoned traders.

Mirror Trading

Mirror trading is similar to copy trading but with a slight difference in execution. In mirror trading, users replicate an entire trading strategy rather than individual trades. These strategies are often algorithmic and based on quantitative analysis, meaning they are tested against historical data to ensure their efficiency. When you engage in mirror trading, your account follows a predefined set of rules and executes trades according to the chosen strategy without manual intervention. This method is favorable for those who prefer a systematic, data-driven approach to trading and want to eliminate the emotional aspect of decision-making.

Key Differences

- Social Trading: Focuses on community interaction and learning. Users manually follow and replicate trades based on shared information and insights.

- Copy Trading: Automates the replication of trades from selected professional traders, providing a more hands-on experience.

- Mirror Trading: Replicates entire trading strategies, often algorithmic, based on predefined rules and quantitative analysis, ensuring a systematic approach to trading.

Each method offers unique benefits and caters to different types of investors, from those seeking educational engagement to those preferring automated, systematic trading approaches.

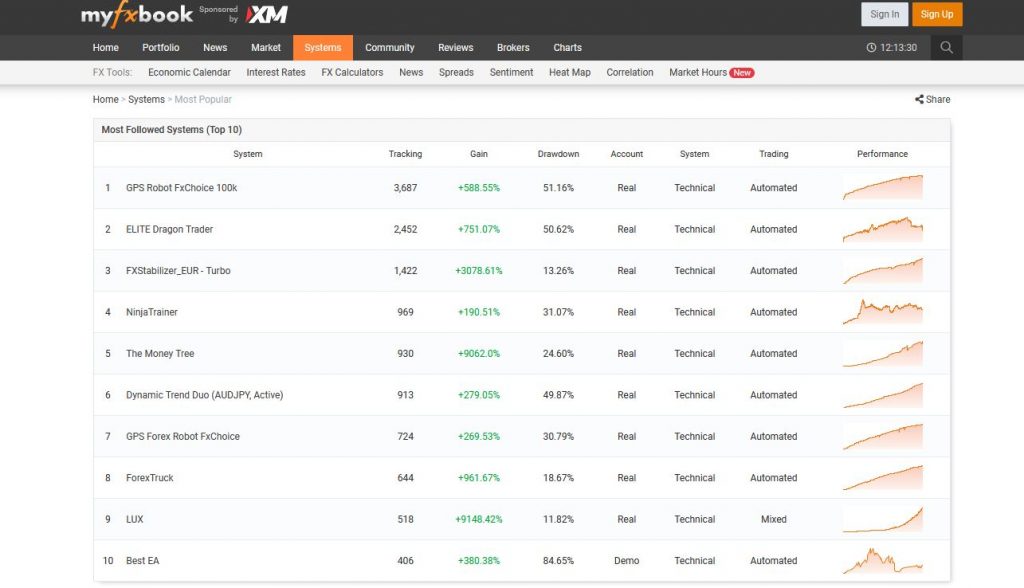

Copy Pro Traders Option 1: My FX Book and FX Blue

One way to follow professional traders and take part in social trading is through platforms like MyFXBook or FX Blue. Via comprehensive performance metrics, these tools offer detailed insights into traders’ activities. They allow you to see other traders’ profits or losses, drawdown statistics, and win/loss ratios. This detailed data allows you to assess the historical performance of traders and evaluate their consistency and reliability, and you can choose to copy their trading. Another essential component is real-time data and updates, which allow users to keep an eye on trading activity in real time and react quickly to changes in the market.

Additionally, copy trading platforms have active communities where users share reviews and feedback. If you are a beginner, you can use this social interaction to identify credible traders to follow. Personalized notifications for particular trading activities or performance thresholds are available through customizable alerts and settings, which further improve the user experience. Risk management tools are also a key feature. They offer stop-loss and take-profit settings to help users control their exposure. To understand how a trader’s strategy performs under various market conditions, the platforms are equipped with historical data and backtesting capabilities. They provide deeper analytical insights and help users who decide to copy pro traders.

Of course, there are also some drawbacks that you should consider before choosing to follow traders. One big concern is the potential for data manipulation. Traders could report their results selectively, which might present their performance in a more favorable light. Additionally, a profitable strategy in the past does not guarantee future success, as market conditions can change unpredictably. Another limitation is that following the strategy alone, rather than the trader’s comprehensive approach, might not yield the same results. Users should remain vigilant and conduct thorough due diligence before committing to copying professional traders on these platforms.

While data manipulation is a concern, the benefits of using MyFXBook and FX Blue for copy trading far outweigh the risks.

Check out also our Live trading accounts.

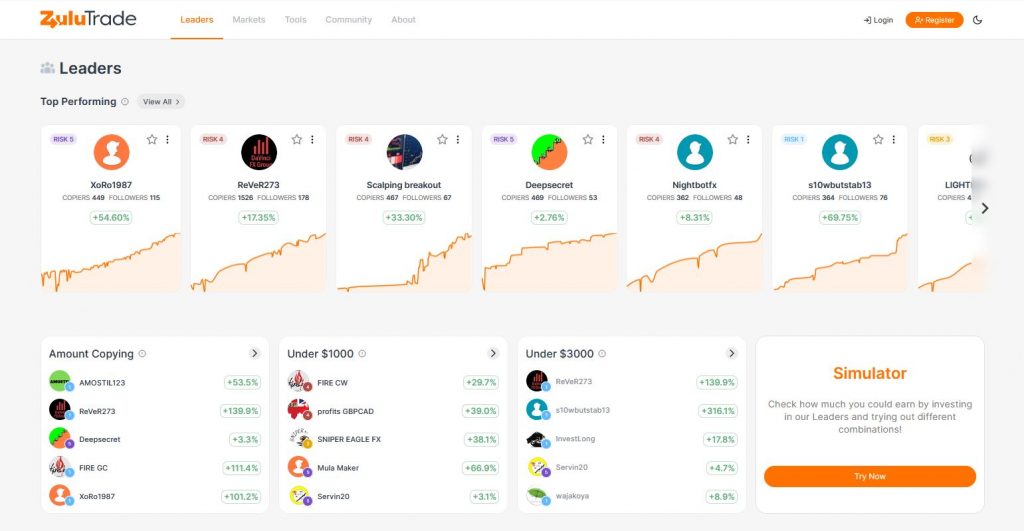

Copy Pro Traders Option 2: ZuluTrade

ZuluTrade stands out as one of the most transparent platforms to follow professional traders. As a leading platform in the copy trading field, ZuluTrade enables traders to share their strategies, which users can then replicate. It ranks traders based on performance metrics, which makes it easier for users to follow traders. The platform also supports connections to different accounts across various brokers, adding to its flexibility and user-friendliness.

Recent statistics underscore ZuluTrade’s effectiveness and popularity. According to a 2023 report by Finance Magnates, ZuluTrade has over 2.5 million users worldwide, with an estimated $2.5 trillion in total trade volume executed through the platform annually. This highlights its position as one of the best copy trading platforms available.

ZuluTrade provides comprehensive statistics on traders’ accounts, including performance metrics and the number of followers each trader has. Users can view the total amount of funds invested by followers, analyze drawdown statistics, and assess overall performance. This level of detail helps users to choose when they decide to copy professional traders.

Check out our REVIEW for ZuluTrade.

Performance Evaluation

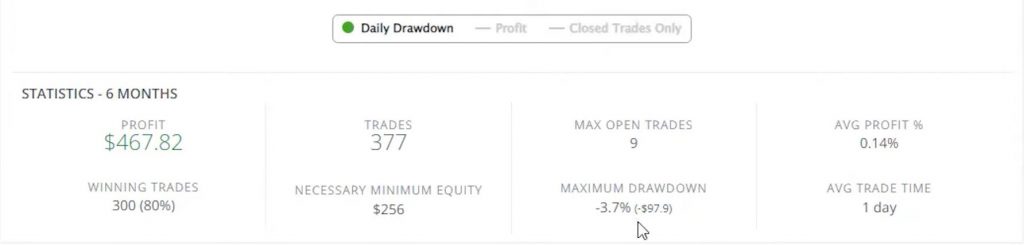

When it comes to copy trading, there are several factors to consider. One of the most crucial factors is the trader’s dedication to a particular asset, such as US Oil. If your preferred asset is US Oil, you may want to consider a trader who has a proven track record of success in that area. On the other hand, if you trade Forex and other assets, you may need to look for traders who are more versatile.

Drawdown Analysis

Another important factor to consider when evaluating professional traders is their drawdown. Drawdown is the measure of the maximum loss from a peak to the trough of a trading account. Avoid traders who have high drawdowns, especially if you’re not comfortable with taking significant risks. You can evaluate the drawdown of a trader by looking at their trading history and performance. You may prefer a trader with a low drawdown as a better fit for your needs.

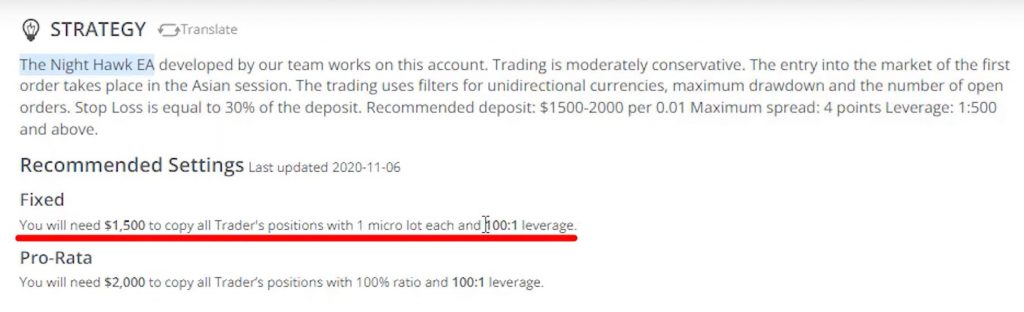

Follow Traders: Automated Trading Systems

Many copy-pro traders use automated trading systems (Expert Advisors) to manage their trades. These systems use algorithms to identify trading opportunities and execute trades automatically. If you’re considering a trader who uses an automated system, it’s critical to understand the system’s strategy and how it performs under different market conditions. Reviewing the trader’s performance, equity line, and trading history can provide this information.

Generate thousands of Expert Advisors with EA Studio

Minimum Investment and Track Record

Before you invest and copy professional traders, you need to consider their recommended minimum investment and track record. A particular trader’s recommended minimum investment can give you an idea of how much money you need to get started. The track record can tell you how successful the trader has been in the past and how long they’ve been trading. A trader with a more extended track record may be more experienced and reliable than a newer trader.

Follow Traders: Social Media Presence

In addition to evaluating the performance of pro traders, it is also important to check their social media presence. Many traders have YouTube channels, Instagram accounts, or telegram groups where you can learn more about the trader or the person behind the automated system. By reviewing their social media presence, you can get a better idea of the trader’s personality, trading style, and risk tolerance.

Diversify Your Risk with Multiple Brokers

It is always a good idea to diversify your risk by having multiple accounts with different brokers. This way, if one broker goes down or experiences technical difficulties, you will not lose all of your investments. However, it is important to choose reliable and regulated brokers. We recommend checking out ZuluTrade, a platform that allows you to follow some of the top traders in the market. You can even try it out on a demo account to see how it works.

Copy Professional Traders: Account Managers Warning

Avoid Account Managers: They Are Mostly Scammers

One way that scammers use to steal money from unsuspecting investors is by offering to manage their accounts. These scammers will promise unrealistic profits and show off fake traders with expensive cars to lure you in. They will then ask for your personal information and credit card details to fund a small account and start trading for you. However, they manipulate everything, including the platform, the results you see, and the quotes on the assets. They will even ask for more money, leaving you with nothing. Do not trust anyone to manage your funds.

Copy Professional Traders: Signal Providers Warning

Beware of Signal Providers: They Are Not Regulated

Signal providers claim to offer trading signals that can help you make profitable trades. Most of these providers are not regulated, and they often provide unreliable signals. The regulators do not allow brokers to send signals or suggest how to trade, what to trade, and when to trade. So, any company or website that is offering signals is not supposed to be in business at all. It is up to you to make your own trading decisions.

Advantages of Copy Trading

Using Copy Trading has several advantages. Firstly, it saves you time and effort, as you do not have to do the analysis yourself. Secondly, it reduces your risk as you are following experienced traders who have a proven track record. Thirdly, it allows you to learn from the professionals, as you can see how they make their trading decisions. Finally, it gives you control over your trades, as you can set your own risk parameters and stop-loss orders.

Copy Pro Traders: Conclusion

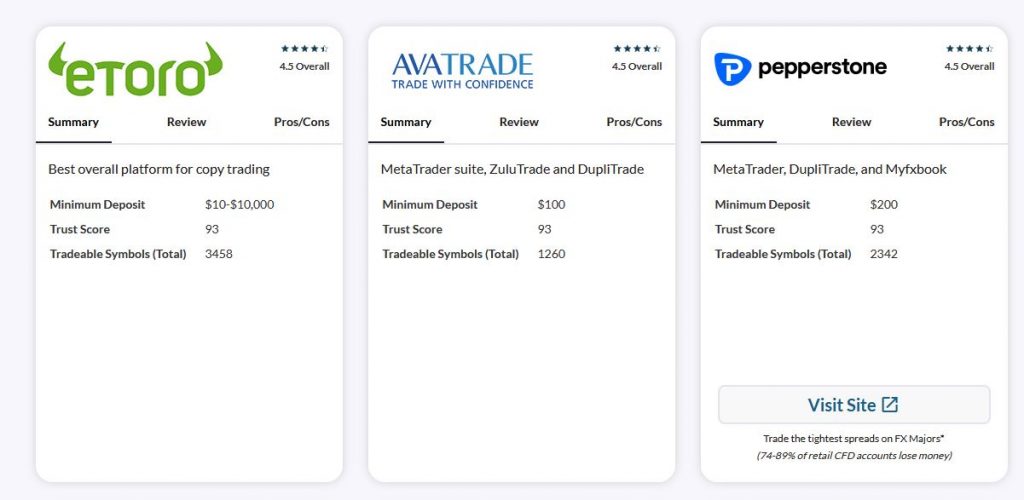

Following professional traders is a good solution for those who want to make money with trading without spending all their time learning and analyzing charts. There are several ways to follow professional traders. ZuluTrade is one of if not the best copy trading platform because it is transparent, easy to use, and allows users to connect accounts from different brokers. If you are interested in trading, consider following professional traders through ZuluTrade to maximize your profits.