Bitcoin investment strategy for every trader!

Hello investors! In this lecture, I will talk about the trend lines and the counter-trend lines. And this is exactly the thing I use when buying an asset, not just for this Bitcoin investment strategy but for many of my strategies that are based on counter trend lines.

This is a free lecture from the Bitcoin Investment Strategy course created by me Petko Aleksandrov.

The trend is upwards when we have a series of higher highs and higher lows and the opposite for the downtrend. Now, with such platforms, we have the opportunity to draw lines.

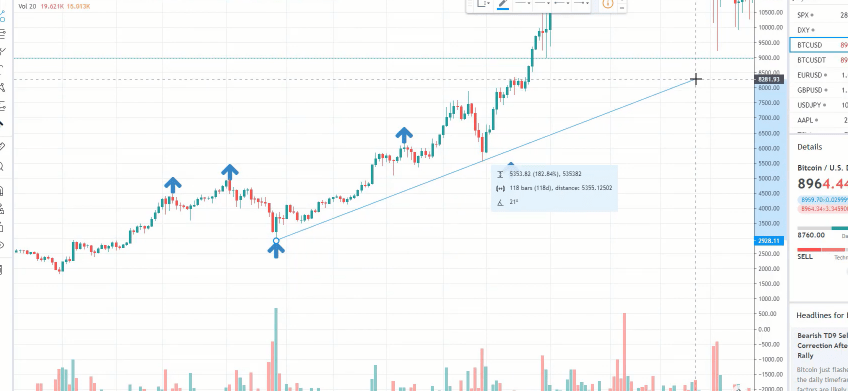

And, for example, I can draw a trend line that goes with the trend. This is why it’s called a trend line. If I draw it, it will look something like that.

Basically, to draw a line you need to have 2 points.

It shows that it’s an uptrend. And according to the line, when the trend is over, it should be when the price crosses the line. It’s not anymore an uptrend, it turns to a downtrend and actually it does in this case.

For this Bitcoin investment strategy I use counter trend lines

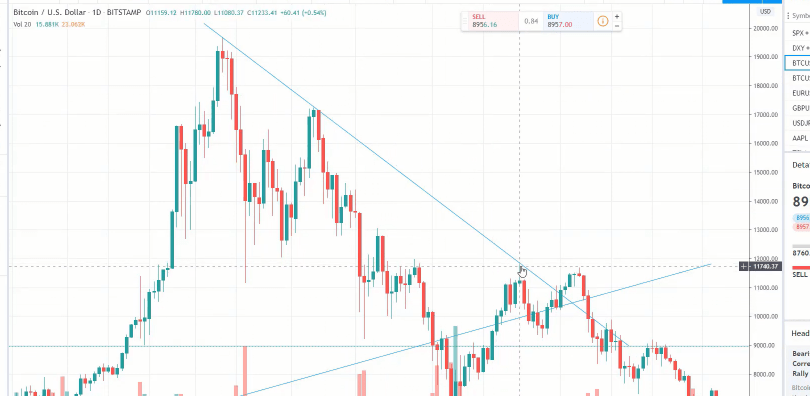

And it’s the very same thing for the downtrend. When we are in a downtrend, this is when we have a series of lower lows and lower highs or we can draw a trend line starting from the top, connecting the next lower high. I will try to make it a little bit more precise.

Try to do it very precisely if you are following a strategy with a trend line. There are a lot of strategies with trend lines.

So, for example, when the price touches the trend line, we can sell again. Or if we’re talking about an uptrend, we can buy if the price touches, and so on.

But in this strategy, I will be using counter trend lines. I usually don’t use trend lines in my trading, I use counter trend lines. What does that mean?

Drawing the counter trend line

The trend line is the one that goes together with the trend. So the counter trend line will be just the opposite thing. We will draw lines that are opposite to the major trend.

How do I draw it?

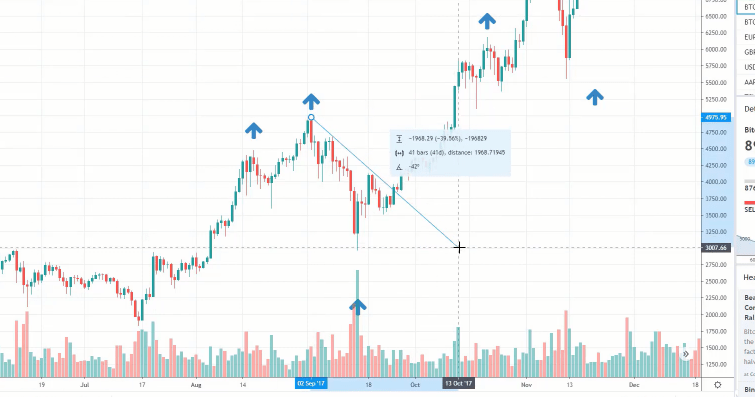

I take the recent high, let’s say the market forms 2 highs, one high and another lower high, and I take these 2 points to draw the counter trend line. And this is a strong one because the price nearly touches it, goes down again, and breaks it.

Exactly this break is the thing I use when I use the Bitcoin investment strategy.

This is where I buy and I remember actually this moment in September 2017, it was one of my entries because it matches perfectly with the strategy that I am following.

The trading view

But I will complete it step by step so you will understand me easier. So, one more time, the counter trend line is the opposite of the trend line and I draw it by connecting 2 highs. Just when I have a higher high than the previous one, I’m waiting for a lower high to draw the line.

When the price breaks, this is my trigger, this is the moment when I buy and the place where I buy on the chart. And you can see with trading view when you have a line, you have some more details about the lines which is very nice especially the angle.

But I’m not going into such details about degrees of the counter trend line and so on. And if I go back just a little bit, you will see that I have another counter trend line.

Actually this was the correct one I guess because it’s a little bit higher than the other one. So a high, a lower high, and then the price breaks. And, for example, there are places that I cannot draw such a line because I don’t have a lower high.

The coronavirus crash effect

The price just went up, it went down, and it went up again. And now let me go to the recent examples that we have in 2020 so you will see what counter trend lines I used.

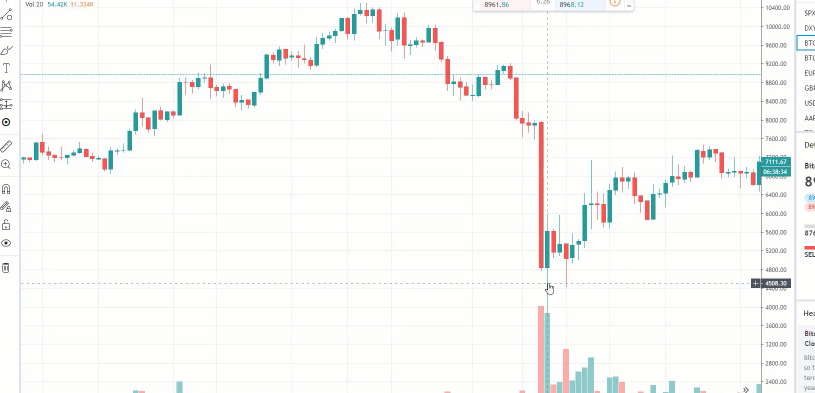

It is right here after the crash in March from the coronavirus that made not just the stocks but cryptocurrencies to crash.

But this gave me great opportunities and not only to me but to many investors and traders to buy at a cheaper price.

And I want to be more precise about this Bitcoin investment strategy in my drawings, this is why I will go to the hourly chart. So this is the current market that we have after the crash since March.

So what we have, first of all, the uptrend was back after these highs were broken.

So we have already a series of higher highs and higher lows. So after that moment, I started to look for buying opportunities. It was really uncertain if the price would go up or if it would crash lower so I stuck to my strategy and I was waiting to see an uptrend before buying any cryptos.

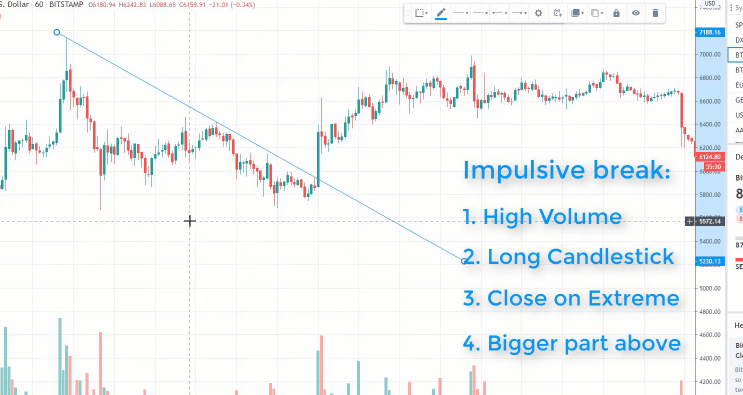

The impulsive break

And below is the first counter trend line that I used.

And we have an impulsive break. An impulsive break is defined when we have high volume, we have it below, we have a long candlestick, we have close on extreme which means that the candlestick will close near the top. It will not do a move like that.

And then the last thing for the extreme break is that the candlestick above the line should be a bigger part than below the line. So basically, where it breaks if it’s in the middle, half above and half below, this is ideal.

This is like the perfect example of the strategy. And later again I will show you examples where I’m executing the positions or actually when I’m buying the cryptocurrencies.

I can draw many different lines, but for this Bitcoin investment strategy you need the best ones

Next counter trend line, I draw only when I have a higher high than this one.

So I don’t draw lines everywhere. Why? Because if I do it this way, I will have hundreds of examples. If I zoom the chart, you will see that I can draw so many different lines. But I want to have a very clear counter trend line.

So I have the top, I have the lower high, and then I’m looking for a new higher high to draw the next counter trend line.

Price breaks, it goes down, sideways, and it continues higher. So we have a higher high and again we have the opportunity to draw a counter trend line.

What prevents me from buying from this strategy

So now it really depends when you catch it. For example, you can draw a counter trend line that is pretty strong if it has 1 to maybe 4 touches, and then the price breaks impulsively. Or if you just catch it a little bit early and a little bit faster, you can draw it like I did.

But there is something here that doesn’t allow me to buy from this strategy and this is the thing I will talk about in the next lecture. So there was the counter trend line which turned out to be a strong one because the price touched it a few times and then it broke.

And then the price retested it and it continued higher. Now, after that, we had a higher high. And then the price went aggressively higher in April.

Check out the Bitcoin investment strategy course

Now, these all were opportunities for me to buy and I use them and it takes really a lot of patience to wait for the counter trend line. And if you look at the whole thing, you will see that we’re in an uptrend. But I want to buy just when the price pulls back which is very normal on the market. Just before it starts to go up again, I will buy.

The price goes up and down, forms higher high, higher lows, then it fails to take the high. Then I draw the counter trend line, and when it breaks it, I buy again and again

So these are the different entries for me when I’m investing in cryptocurrencies and there is one tiny little thing that I use or that I look for before I buy and I will show you in the future updates in the course.