Are you tired of relying on a single trading strategy that might fail in certain market conditions? Do you want to explore the potential of combining different Expert Advisors to create a more robust portfolio? In this post, I will show you The Best Expert Advisor Strategy: how I put five free Robots from my previous videos to the test by trading them together in one account.

The Best Expert Advisor Strategy: Why Trading Multiple Strategies Makes Sense

One of the key benefits of trading multiple strategies is that it allows you to diversify your risk and increase your chances of success. As I mentioned earlier, when one strategy fails in a particular market and time frame, another one might be profitable, which can offset the losses and keep your account balance stable.

Choosing the Best Expert Advisors for the Test

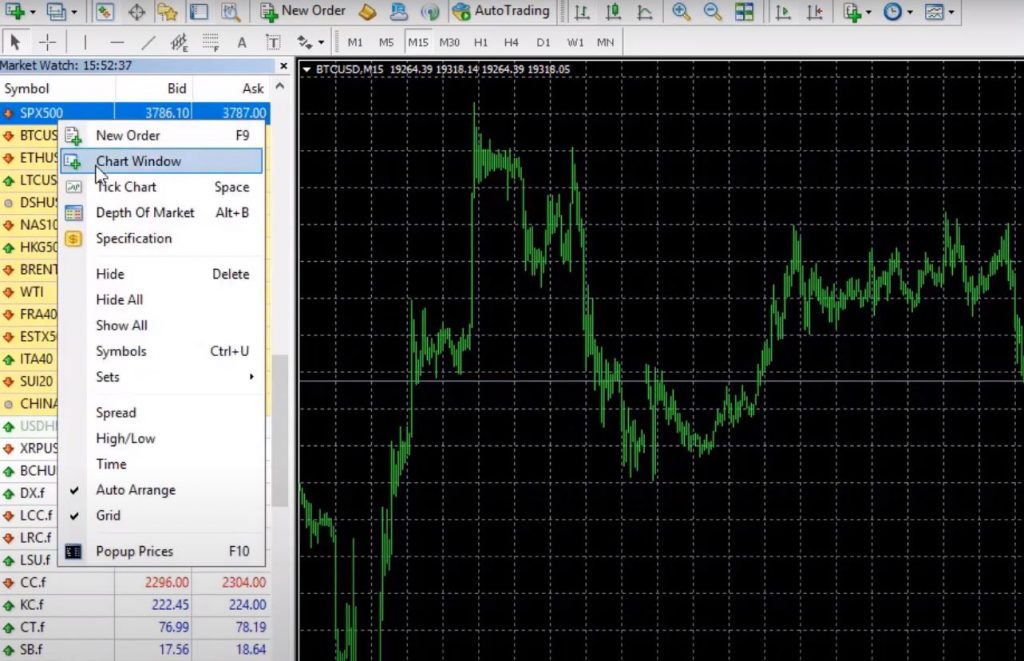

To make this test as realistic as possible, I selected five free Expert Advisors that I have previously shared in my videos. Two of them are for EURUSD, two for Bitcoin, and one for S&P 500. I installed them on a VPS to ensure uninterrupted trading, but you can also trade them on your desktop or laptop as long as you keep the MetaTrader platform connected to the broker’s server.

The Best Expert Advisor Strategy: Testing the Expert Advisors on MetaTrader

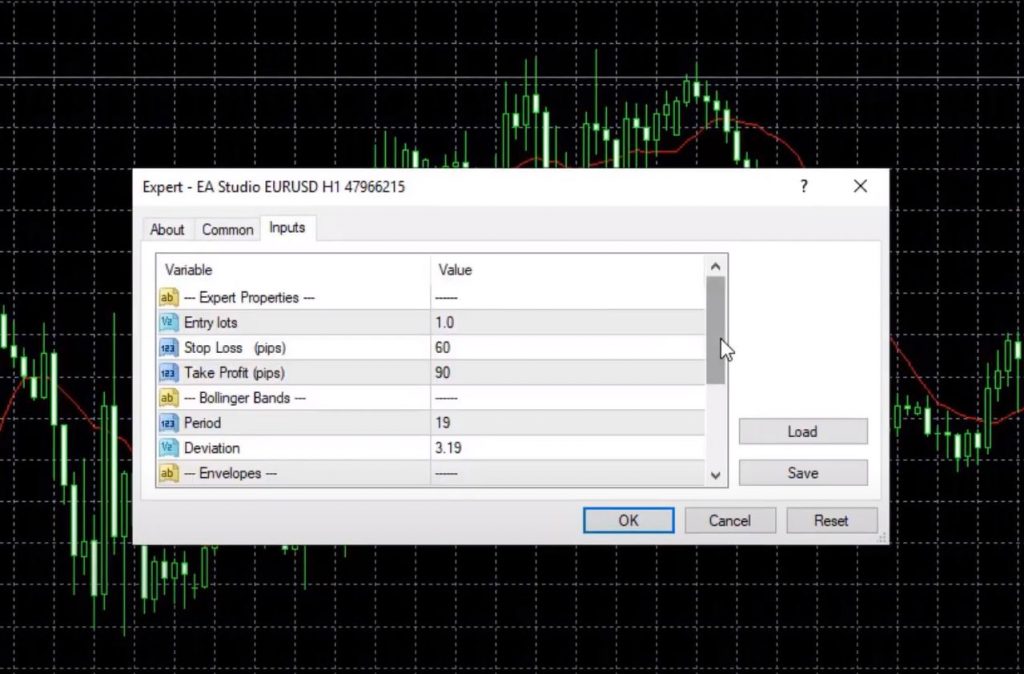

After compiling the Expert Advisors, I attached them to their respective charts by enabling the AutoTrading feature and double-clicking on each one in the Navigator. I made sure to choose different time frames for each market to cover a broader range of conditions. I also adjusted the inputs and indicators to suit my trading preferences and hit OK.

Managing Risk and Leverage

When trading multiple strategies, it’s crucial to determine how much you want to risk from your account and adjust your leverage accordingly. This will depend on your risk tolerance, account size, and trading goals. Make sure to use a position sizing calculator to determine the optimal lot size for each trade.

The Best Expert Advisor Strategy: Example

In this example, we’ll use the S&P expert advisor. To get started, simply press ‘S’ to find it. Once you’ve found it, right-click on the chart window, and double-click on the expert advisor. From here, you can change the trading lots according to your preferences. The lot size can range from 0.5 to 1.0 or even 0.001, depending on your broker’s requirements.

Trade Without Indicators

With the expert advisor, you don’t need to add any indicators to your charts. All the indicators, strategies, and trading conditions are embedded in the code. The expert advisor will open trades as soon as it identifies profitable signals. By using the expert advisor, you can easily keep track of all trades on your chart window.

Introducing BlackBull Markets

Before we show you some profitable results from the expert advisor, we want to introduce our sponsor, BlackBull Markets. Our team has reviewed BlackBull Markets as one of the best-regulated brokers on the market. You can test the broker yourself by opening a demo account and trading Forex, commodities, CFDs, cryptocurrencies, and stocks. You can choose from three different types of accounts depending on your trading needs. With an ECN standard account, you can trade with spreads below 1 pip and no commissions.

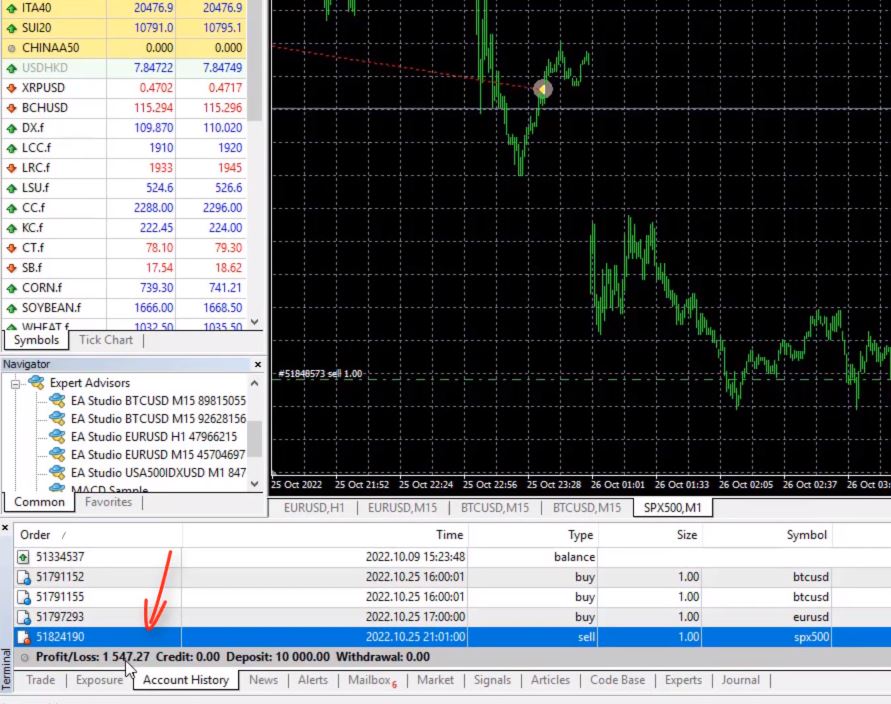

The Best Expert Advisor Strategy: Profitable Results

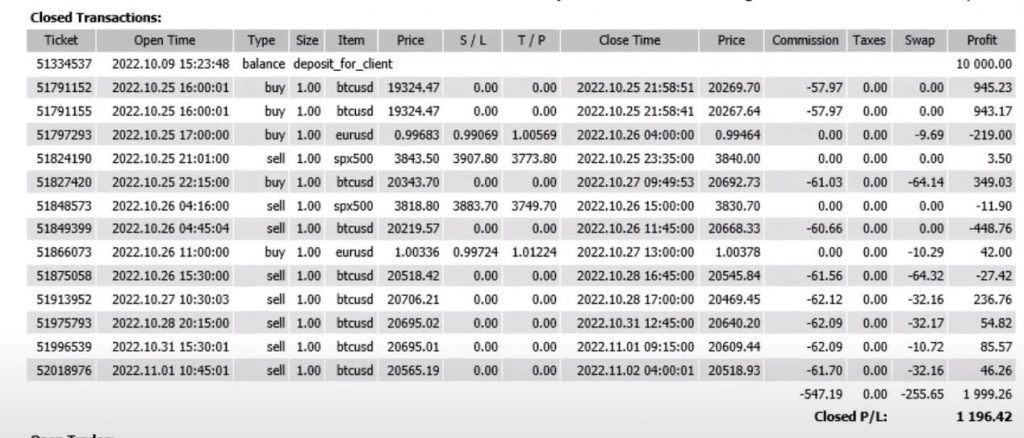

Now let’s take a look at some profitable results from the expert advisor. Within 24 hours, we made a profit of $1547.27, which is about 15% of the account. We had a small profit with S&P 500, and both expert advisors caught an awesome move with Bitcoin, bringing in about $945 each. However, we did have one losing trade with EURUSD.

Equal Exposure

It’s important to have equal exposure between assets and the account. To do this, we divided the current price of Bitcoin by the current price of S&P 500 and got 5.26. This is how much of S&P 500 we should be trading to have equal exposure. We increased the lots to 5.26, and now we have a bigger trading volume with S&P 500.

The Best Expert Advisor Strategy: Transparency

We want to be transparent with our trading results. If you look at our account history, you can see all the trades that opened and closed. With the help of the expert advisor, we were able to make profitable trades and increase our profits.

Profitable Trades with Bitcoin

Let’s start with some good news. With the Best Expert Advisor Strategy, we had profitable trades with Bitcoin. This cryptocurrency has been very active lately, making it an excellent asset to trade. By using the right Expert Advisor or robot, you can take advantage of its volatility and make good profits.

Losing Trades with EURUSD

Unfortunately, not all trades can be winners. You might encounter losing trades with EURUSD, like we had here for example. But that’s okay. With the Best Expert Advisor Strategy, you can minimize your losses and protect your account from huge drawdowns.

The Best Expert Advisor Strategy: Short Trades and Drawdowns

Sometimes, short trades can result in losses and drawdowns. But don’t panic. With the Best Expert Advisor Strategy, you can calculate your actual drawdown and keep it under control. By opening a detailed statement of your account history, you can see all the trades that opened and closed, and assess your overall performance.

Maximizing Profits and Minimizing Drawdowns

If you’re participating in a trading challenge, you need to achieve a certain level of profits while in turn, keeping your drawdowns low. The Best Expert Advisor Strategy can help you achieve this goal. By targeting a 10% profit and a maximum drawdown of 5%, you can pass the challenge and earn your reward. And if you reach your target in the first day, you can decide to stop trading and maintain your activity by opening 0.01 lots from time to time.

The Best Expert Advisor Strategy: Creating Your Own Portfolio

One of the best things about the Best Expert Advisor Strategy is that you can create your own portfolio of Expert Advisors and robots. By using the ones that suit your style and preferences, and by having equal exposure between different markets and time frames, you can minimize your risk and maximize your profits. This way, you can participate in the markets with confidence and peace of mind.

The Best Expert Advisor Strategy: Final Thoughts

Trading can be challenging, but it can also be rewarding. With the Best Expert Advisor Strategy, you can achieve consistent profits with low drawdowns. By using the right tools and techniques, and by following a disciplined approach, you can succeed in the markets and reach your financial goals.

Thank you for reading this post. If you found it useful, please like and share it with your friends. And don’t forget to check out the links in the description to grab some free stocks and crypto. Good luck and happy trading!