Brokers for US stock trading can help you to take advantage of opportunities during a recession. Some investors get excited about a recession because they can buy stocks for at least 20% or 30% of what their market price was just a few months before.

We’re not financial advisors. We don’t know if the price will reverse upwards or if prices will decrease even more. However, we do know that traders and investors should always choose regulated brokers that offer decent platforms.

Whether you want to trade US stocks daily or invest in them for the long term, you should look for a reputable platform to use. So, in today’s post, we’ll share details about the best brokers for US stock trading.

We personally use the brokers that we’ll discuss. However, you should do your due diligence before you open an account at any of these brokers.

Always decide for yourself whether a broker fits your needs. In this post, we’ll also share a strategy that we use for trading and investing in US stocks.

These Brokers for US Stock Trading Allow Manual and Algorithmic Trading

The brokers for US stock trading that we’ll discuss here allow traders to use manual or algorithmic trading. So, if you like to use Expert Advisors, you can do that.

You’ll also need to look for brokers that offer:

- Good conditions

- Low spreads

- Low commissions

- Low Swaps

If you visit our Brokers’ page at EAtradingacademy.com, you’ll find all of the brokers that we currently use. Darwin X is one of the brokers that we use, although we won’t discuss it in this post.

We keep the Brokers’ page up to date. We’ve also been very transparent in our reviews. You’ll see that each broker has pros and cons.

So, you’ll always need to assess each broker carefully and choose one that fits your needs. Regulation is critical.

CFD Brokers

These brokers for US stock trading do not offer real stock trading. So, you can speculate on price movements in any direction. So, you can go long or short with CFD trading. For example, if you wish you can trade indexes such as Dow Jones and the S&P 500.

Some traders like to trade the Dow because American markets are volatile. They use CFDs to do that without purchasing the stocks in the index.

What Is CFD Trading?

CFD trading is contract for difference trading. You profit from the difference in prices between when the trade opens and when it closes. So, for example, if the price goes up as you anticipated, you can close your position at the higher price and make a profit.

Popular Stocks at Best Brokers for US Stock Trading

Many traders look for brokers that make it easy for them to trade popular stocks like Apple. If you’re trading Apple, Amazon, or Google on a daily time frame, each candlestick would represent one day.

Using Trend Lines with the different platforms

If you’re using trend lines to find the direction of the trend, when the price breaks the trend line you would buy. To draw a precise trend line:

- Use a straight line to connect two lows during an uptrend

- Use a straight line to connect two highs during a downtrend

- Make your trend line valid by making sure that it connects at least three highs or three lows

Please read this post at EAtradingacademy.com to learn more about trends and trend lines.

Double Bottoms and Retracements

We can also trade by using double bottoms. However, traders should look for confirmation. So, look for the price to break through the midpoint (middle point). The price must break through the midpoint of the double bottom.

Some traders like to use retracements in their trading and investing at brokers for US stock trading. Some like to buy stocks such as Apple whenever the price drops.

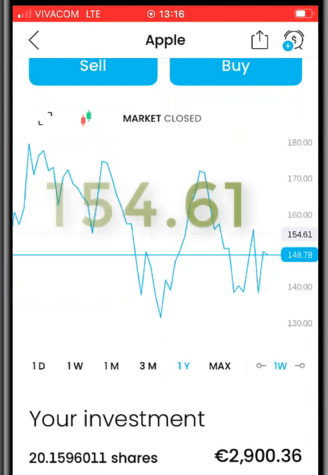

Trading212 App for Investments

We like to use the Trading212 mobile app for long-term investments. You can easily invest in real stocks by using the app.

For example, with Apple, you might be at a bit of a loss in the short term but hope to make a profit in the long term. The app is really easy to use because it shows you information like dividends.

You can get dividends from Apple. Some traders like Apple because they use a dividend strategy with their investments.

You can also use the app to find other investment options. These include Google, Amazon, PayPal, and Tesla. You can also find indexes like the S&P 500.

You can use the app to filter assets by top winners, top losers, and the most popular ones. However, apps like Trading212 don’t let you use leverage. So, if you want to buy a single Google stock, you have to pay the actual $98.

However with CFD trading, you can use leverage of 1:100 or 1:500. So, you can open positions 500 times bigger than the amount you have in your account. That’s risky. However, you can profit more quickly. When you trade real stocks you can’t use leverage.

You can get a free stick valued up to $100 from the Trading212 App if you use Promo Code PETKOA

Brokers for European and Indian Traders

European traders can use Trading212. However, American traders sometimes prefer RobinHood. If you want to compare a few brokers with respect to their transparency, speed of execution, and withdrawal process, you can check out TD Ameritrade and Interactive Brokers.

At EAtradingacademy.com, many of our subscribers use Forex.com and IG.

If you’re in India, you can compare Zerogha, Angel Broking, and Up Stocks. Wherever you are in the world, make sure that you use regulated brokers.

Remember what happened with FTX. We never know which broker, platform, exchange, or app will go bankrupt. Sometimes we won’t be able to withdraw any funds if that happens.

Diversify Your Assets at Best Brokers for US Stock Trading

Don’t invest all of your capital into one risky asset, such as crypto or even a single stock. Something can always happen on the market that will crash the market. Same thing with the brokers – make sure to put your money into a few baskets (brokers, apps and platform)

Final Thoughts

You should always be careful with even if you use the Best Brokers for US Stock Trading. Make sure they offer mobile access and make it easy to diversify your investments.

We personally don’t invest more than 10% of our capital into US stock trading. However, that’s not financial advice. That’s just how we do things.

Thanks for reading. Remember to visit us on YouTube.

Until next time, take care. Have a wonderful day!