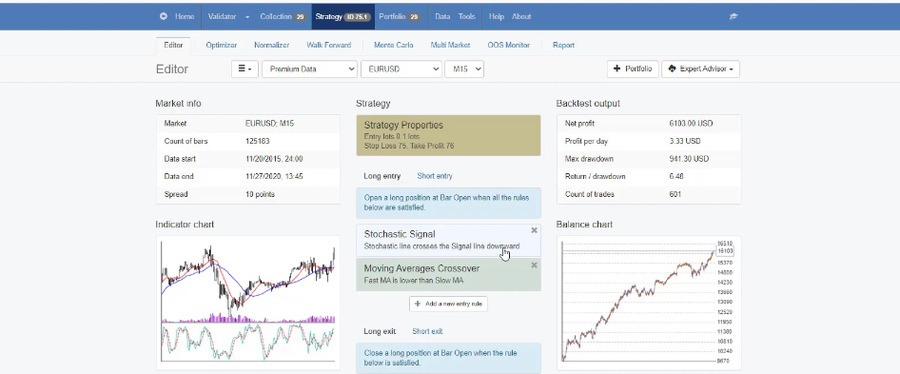

When trading with expert advisors, or so-called robots, we trade a strategy. Behind each expert advisor, there is a certain strategy that executes the trades: a strategy to open and close the trades. There are different types of strategies, and in this tutorial, we will have a deeper look at some of the main ones.

Table of Contents:

Grid Martingale Strategy

One of the most popular is the Grid Martingale strategy, which applies after the first trade is opened. The primary rule of this strategy is to enter long trades when the price touches the lower band and short trades when it reaches the upper band. However, it is important to note that while the Martingale strategy can be highly profitable, it carries substantial risks.

If we look at the above chart – we have a short trade, due to an indicator or a trading pattern. But once the price goes against the direction of the trade (green line), there are two options. One is to have a stop loss and to exit the trade with a certain amount of loss. Or two, to add to the position and improve the average price. In our case, it is more short trades, and the price keeps going upwards (red circles). The expert advisor is adding to the position, it is improving the average price.

But if the price keeps going upward, it might get risky for the account to run out of margin or to lose the account. In our case, the price went down (red line) and it was closed at a profit (green circle). This expert advisor on the chart is trading with 0.01 with every new order that is added to the position. So it’s not an aggressive grid trading expert advisor, which adds to the position a higher amount and a higher amount, which is riskier, but it brings more profits. There is also a Martingale expert advisor that is free but still risky, and it has actually brought a lot of profits to our accounts until the moment.

If you want to learn more about the grid trading expert advisor and the martingale strategy in depth, click here.

Scalping Strategy

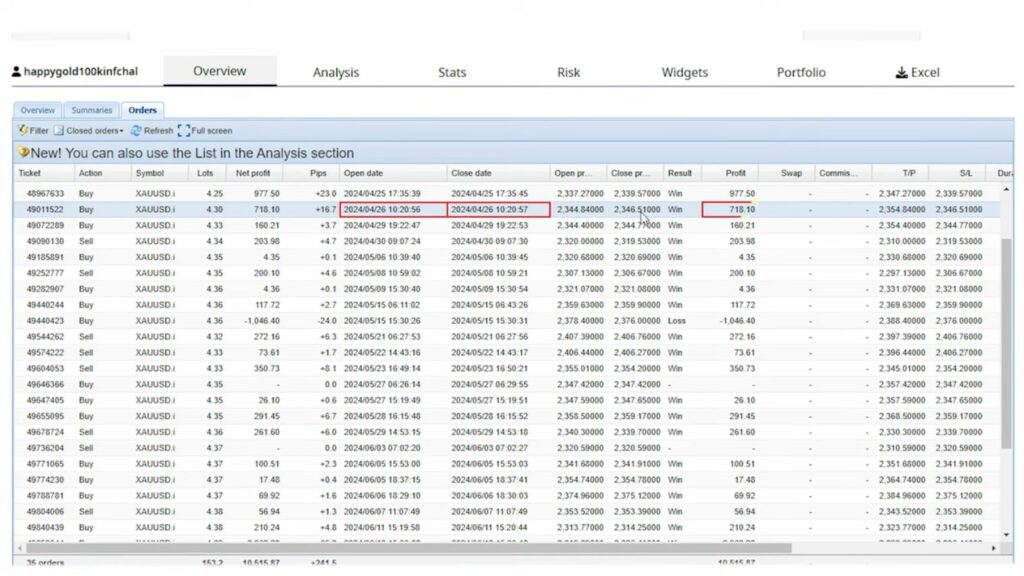

Strategy number two is scalping strategy. It is an expert advisor that is scalping the market. This is really easy to understand, but how to find a Scalping Robot that is profitable ? Let’s look at the Euro Dollar chart for example and switch to M1. This is where we have candlesticks for every one minute. Scalping EA usually would enter at one point, and would exit few minutes later, sometimes few seconds later. On our website, we have a section where we show our live accounts. We are showing our challenges, and we’ve been trading with one expert advisor called Happy Gold. This is probably one of the fastest robots. If you look at the closed orders, you will see the duration of the trades. It is mostly below 1 hour or even shorter.

But if we look closer, we will see that, for example, there is a trade opened at 9:07:24, and closed at 9:07:30. So the trade was open for just 6 seconds, and it brought $200 of a profit. There is another trade, again 6 seconds, with nearly $1,000 of a profit. Another one, pay attention to this one: 10:20:56, 10:20:57. It was a 1-second trade that brought in $718. Just one second; it enters the market, and it exits the market.

So for the good expert advisors, 1 minute is even a long time. And sometimes you won’t understand that the trade actually happened in your accounts because you won’t see it. It’s just so quick. The position opens and closes. But for this purpose, to trade such expert advisors, you need a very, very fast broker with super-fast execution speed because once the expert advisor places the order, it is a matter of speed that the broker will execute that order properly.

Trend-Following Strategy

Number three as a trading strategy is the trend-following expert advisors. Okay, so these types of expert advisors are trying to follow the big trends. So, if Bitcoin is going just upwards, this expert advisor will aim to enter a long trade and exit it, but not open short trades. It’s using a filter that is usually on a higher time frame. For example, if we check below TradingView analysis for Bitcoin since September 2023 until the failure of the recent high, which happened in March this year, Bitcoin was in a very aggressive uptrend.

Normally, in such cases you would be looking for selling opportunities at the end. So, along the way, you would be looking for buying opportunities, but when the trend is over, you would be looking for selling opportunities. For example when you notice such failure of the recent high, which was with the levels of the all-time highs, you would notice and you would recognize that this is the end of the trend. Of course it is never 100% guaranteed, but that is one trend-following strategy that we applied for Bitcoin. It’s manual; it’s investment, but when we are trading with expert advisors, the expert will filter the long-term trend and will execute the trades on a minor time frame.

So the trend following strategies are the type of strategies when we buy together with the direction of the trend.

Keep an eye on the new updates from us in our YouTube channel, because we will show you such strategy, and we will give it to you for free in one of our next educational videos. You will get the ready-to-use robot, and you will be able to test it.

Range Trading Strategy

Before we start exploring how Range Trading Strategy with EAs work, let’s try briefly to explain what is range trading in forex. Range trading in Forex is a strategy that involves identifying and capitalizing on price movements within a defined range, typically between a support level (the lower boundary) and a resistance level (the upper boundary). Support level is the level where the price tends to stop falling and may rebound upwards. And resistance level is the level where the price tends to stop rising and may reverse downwards. In a range-bound market, the price fluctuates between these two levels without breaking out in either direction.

Range trading is most effective in markets that lack a strong trend, where prices move sideways rather than trending up or down. This type of strategy is very, very appropriate when the market is in a range. Traders typically buy at the support level (expecting the price to rise) and sell at the resistance level (expecting the price to fall). Stop-loss orders are often placed just outside the range to protect against potential breakouts.

If you apply Range Trading, you would often use technical indicators like RSI (Relative Strength Index), Bollinger Bands, or stochastic oscillators to confirm overbought or oversold conditions within the range.

So with this type of strategy, the expert advisors will try to buy when the price is cheap and they will try to sell when the price is expensive.

News Trading Strategy

The next trading strategy and expert advisors are news trading, where we take advantage of the fundamental news, and we use those impulsive moves right before or after the news. But that’s risky. Like, that’s probably one of the riskiest approaches and strategies you can apply when trading.

There are plenty of websites where you can follow the fundamental news, for example here. Almost every week, there are plenty of red-hot news, and if the actual value is different from the forecast or from the previous value, it causes fluctuations in the market that we cannot really predict. Especially if we are trying to trade right at the news, there might be slippage, which means that the order might not be executed. This is why it is very risky to trade expert advisors on news. But we have a free robot which we are testing, and it works well so far. We will share it with you for free in one of our next videos as well.

Swing Trading Strategy

The next trading strategy that you can apply with expert advisors and the last one which we will explore today, is the Swing Trading strategy. Based on an article that we found, we can see that “swing traders aim to buy a security when they suspect that the market will rise. Otherwise, they can sell an asset when they suspect that the price will fall. Swing traders take advantage of the market’s oscillations as the price swings back and forth from an overbought to an oversold state”.

Or if we have to say it in very simple words, swing trading means that we want to buy the lows and sell the highs, buy the lows and sell the highs. In EA Trading Academy we have developed such a strategy, which again we will share with you as a free expert advisor in one of the next videos in our YouTube channel.

Selecting the Right Trading Strategy

Success in trading depends on selecting the right strategy. However, we cannot say that one strategy is better than the other. It is a complex question. Each strategy serves a unique purpose and caters to different trading styles and objectives. We recommend to consider few things when you select a trading strategy. Such as your personality type, level of discipline, available capital and risk tolerance. that aligns with your risk tolerance, market knowledge, and financial goals.

Final Thoughts

Understanding and applying various trading strategies is essential for navigating the financial markets effectively. Whether you prefer the quick decision-making of scalping or the longer-term approach of swing trading, a well-informed and disciplined strategy is key to achieving consistent results. By continuously refining your approach and adapting to market conditions, you can enhance your trading performance and achieve long-term success.