Welcome to today’s blog post, where I’ll reveal the truth about Expert Advisors (EAs) and explain why I prefer trading with 50 EAs instead of relying on just one. In the world of trading, scams and false promises are rampant, making it difficult to find a reliable set-and-forget EA. To counter this, I dedicate myself to daily testing and experimentation with EAs. Further, in this post, I’ll share my journey, including how I create my own EAs and my strategy of trading with multiple bots to balance risks. As a bonus, I’ll provide you with all 50 EAs for free! Let’s get started.

Trading Bots: Unveiling the Scams and False Promises

The realm of Expert Advisors is filled with scams and deceptive marketing practices. Many individuals make hefty profits by selling EAs that fail to deliver on their promises. However, finding a trustworthy and profitable EA has become incredibly challenging. To combat this, I engage in thorough testing and analysis using EA Studio and FSB Pro.

Choosing the Right Platform and Broker

To begin your journey with trading bots, it is crucial to select a reliable trading platform and broker. MetaTrader 4 and MetaTrader 5 are the leading platforms for algorithmic trading. However, for our demonstration, we will focus on MetaTrader 4. Ensure you opt for a Hedging account, as it allows for different positions for each trade, providing better insights into the performance of individual Expert Advisors.

Trading Bots: The Quest for the Perfect Expert Advisor

Through my extensive experience, I’ve come to the realization that there is no single EA capable of consistently generating profits without occasional drawdown periods or stagnation. This understanding has led me to adopt a diversified approach by trading with multiple Expert Advisors concurrently.

Harnessing the Power of Diversification

By utilizing multiple EAs, I’ve discovered a powerful strategy to compensate for losses and maintain consistent profitability. When one EA experiences a drawdown, others step in to generate profits, effectively balancing the overall performance. This approach minimizes the impact of individual EA weaknesses and provides a smoother equity curve.

Trading Bots: Continuous Testing and Experimentation

In my relentless pursuit of success, I explore various EAs available on the marketplace and continuously scour the internet for potential gems. Despite my extensive search, I’ve yet to find an EA that meets my rigorous criteria for long-term trading. Consequently, I remain committed to ongoing testing and experimentation, enhancing my trading strategies and unearthing promising new EAs.

Sharing the Wealth of Knowledge

Now, let’s move on to the exciting part – I’ll provide you with the opportunity to access the 50 Expert Advisors I currently employ in my trading. I firmly believe in the power of knowledge sharing and creating a community of well-informed traders. Moreover, by offering these EAs to you for free, I hope to contribute to your trading journey and assist you in achieving better results.

Trading Bots: Utilizing the Expert Advisors

Once you download the EAs, you’ll need to install them on MetaTrader and conduct your own tests. This will enable you to identify the best-performing robots, which can then be separated into a secondary demo or your live account. I’ll guide you through this step-by-step process, ensuring you make the most of these EAs.

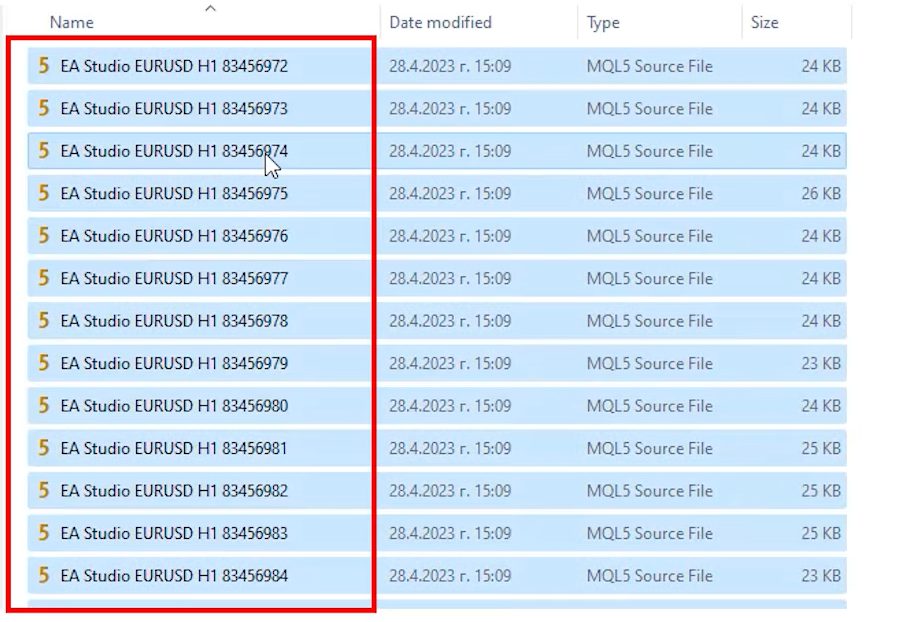

Accessing the Expert Advisors

To begin, open the folder provided in the video description. Inside, you’ll find two setup files – one for MetaTrader 5 and another for MetaTrader 4. For this tutorial, we’ll utilize MetaTrader 5. Open the MT5 Experts folder, select all the EAs (25 for H1 and 25 for M15), and copy them.

Trading Bots: Pasting EAs in MetaTrader 5

Navigate to File > Open Data Folder > MQL4 > Experts within MetaTrader 5. Click on Advisors and paste the copied Expert Advisors into this folder. Close the folder and right-click on Expert Advisors. Although the refresh trick doesn’t work in MetaTrader 5, you can still achieve the same result by closing and reopening MetaTrader 5.

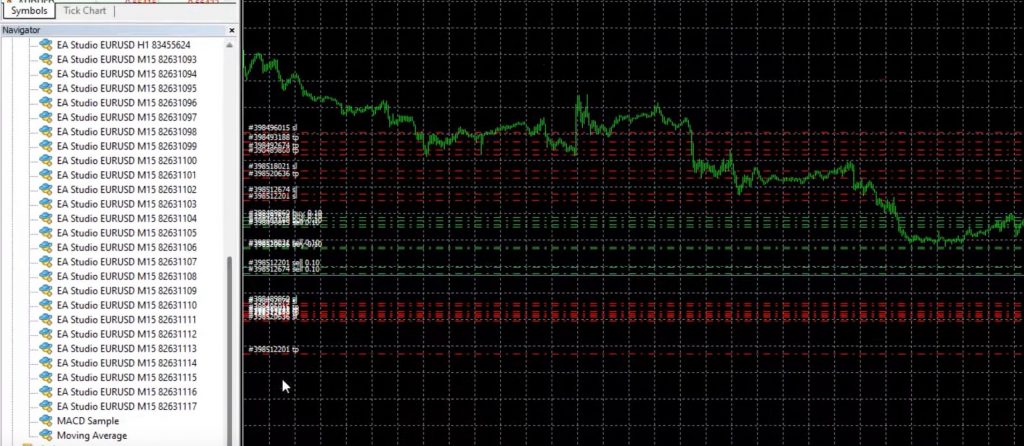

Attaching Expert Advisors to Charts

Upon reopening MetaTrader 5, you’ll find all the Expert Advisors in the Navigator tab. To attach them to charts, ensure that Algo trading is enabled. Begin by attaching the H1 robots, followed by the M15 robots. Set all your charts to the H1 timeframe. Despite the Auto Trading option being enabled, if you find your trading bots are not opening trades, check to ensure Auto Trading was enabled before placing the EAs on the charts. If you haven’t done this, you’ll need to remove the EAs, enable AutoTrading, and re-attach the EAs to your charts.

Attaching M15 Expert Advisors

Similarly, open 25 M15 charts and attach the corresponding M15 Expert Advisors to each chart. Follow the same steps as before to ensure proper configuration.

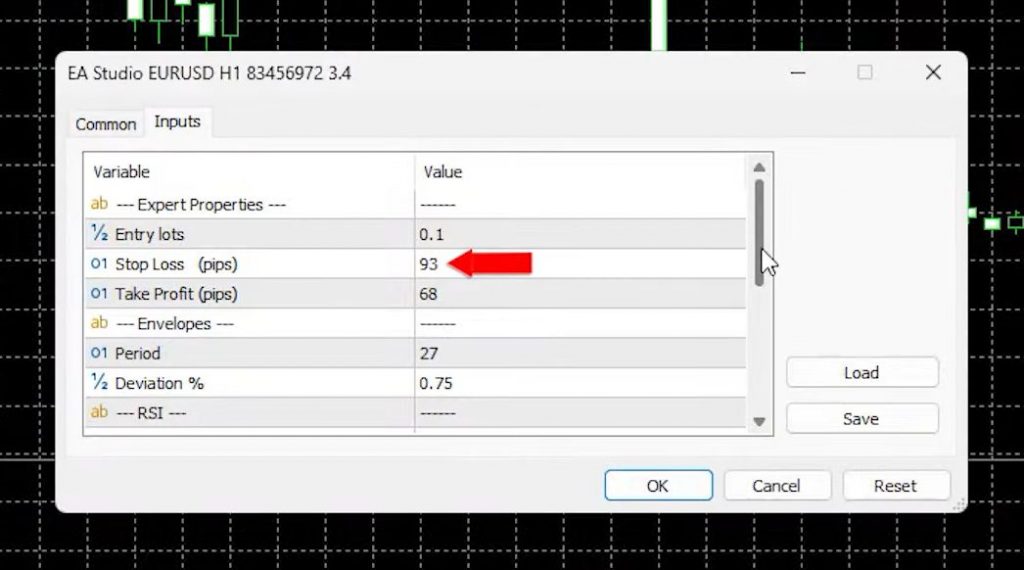

Trading Bots: Configuring Expert Advisor Settings

For each chart, drag and drop the desired Expert Advisor onto the chart. In the input settings, you’ll find options such as Lot size, Stop Loss, Take Profit, Envelopes, RSI, Stochastic, and the unique Magic Number. Feel free to adjust the Lot size according to your preference. The Magic Number helps track the performance of each Expert Advisor.

Observing Results and Performance

Once all the EAs are attached, you’ll notice that the indicators appear automatically on the chart. While trading with multiple EAs, the focus should be on overall results and performance, rather than individual indicators or trade execution timings. Assessing the top-performing EAs among the 25 H1 Expert Advisors is crucial for success.

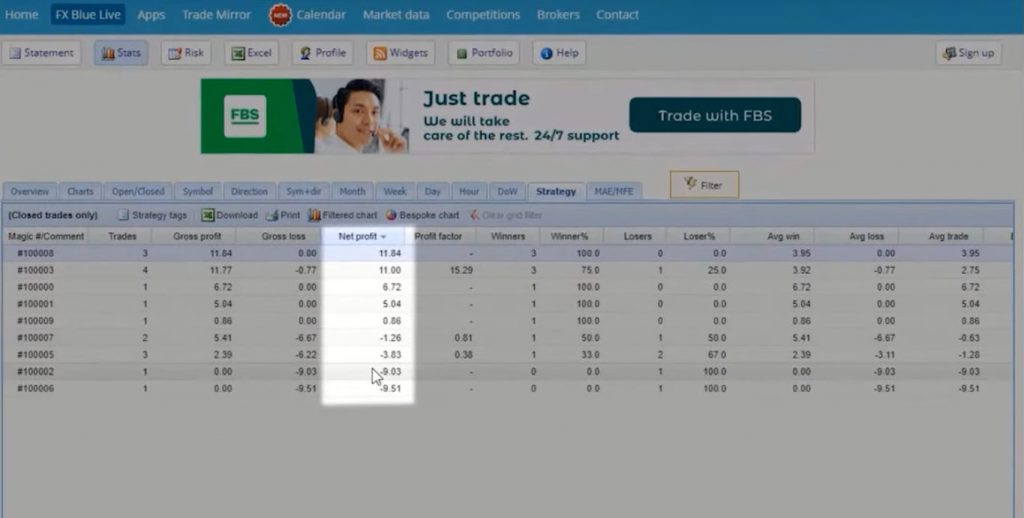

Trading Bots: Monitoring Expert Advisors

Equally important, is analyzing your trading bots. To analyze the results, you can connect your trading account with popular analysis websites like FX Blue or My FX Book. Above all, these platforms allow you to sort strategies based on Magic Numbers, enabling you to identify the top-performing Expert Advisors among the 50 attached. Select the ten most profitable ones, considering the current market conditions.

Testing Strategies in a Demo Account

To simulate live trading without risking real money, create a separate Demo account where you can test the top-performing Expert Advisors. Moreover, step allows you to refine your strategies and gain confidence in their profitability. Once you have mastered the process, you can proceed to use the most successful strategies in a live trading account.

Remember to exercise caution and consider using a second Demo account to further simulate live trading. This additional step minimizes the risk associated with real-money trading, ensuring you have thoroughly tested and validated your strategies.

Trading Bots: Conclusion

Trading bots, or Expert Advisors, offer immense potential for enhancing trading performance and efficiency. By carefully selecting the right platform and broker, attaching Expert Advisors to your charts, and analyzing their performance, you can identify the top-performing strategies. Through systematic testing in Demo accounts, you can refine your strategies and eventually transition to live trading with confidence.