Welcome to my TradeGPT EA Review blog. Today, we will delve into the highly popular TradeGPT trading Bot that has been dominating the MQL5 Marketplace. If you have been keeping an eye on this website, you might have noticed the recent price increase from $590 to $780. This hike piqued my curiosity, leading me to question the motives behind the seller’s decision. In this review, we will explore three possible reasons for the price increase and unravel the strategy and workings of the TradeGPT Expert Advisor.

Reasons for the Price Increase:

- Demand and Profits: One possibility for the price surge is the high sales volume and profitability of the trading Bot. With a significant influx of interested buyers, the seller might have raised the price as a reflection of increased demand.

- Enhanced Performance: Another reason could be that the Robot has undergone significant upgrades, making it more profitable than before. If this is the case, the increase in price would align with the Bot’s improved capabilities.

- Inflation Adjustment: Lastly, it is possible that the seller raised the price to combat the effects of inflation. In a constantly changing market, adjusting prices can help maintain the Bot’s value in real terms.

TradeGPT EA Review: Analyzing the TradeGPT Expert Advisor

Now, let’s explore the intricacies of the TradeGPT Expert Advisor together. Before diving in, I want to emphasize the importance of researching thoroughly and reading reviews from satisfied traders before investing in any trading Robot. In recent times, ChatGPT has gained a great deal of popularity across various social media platforms and YouTube channels. It seems that content creators everywhere are eager to feature ChatGPT-related content, considering its large search appeal.

My Experience with ChatGPT

In my previous videos, I highlighted the limitations of ChatGPT when it comes to coding an Expert Advisor from scratch. I found it necessary to utilize more advanced tools such as EA Studio and FSB Pro to complete the code effectively. However, I also discovered that ChatGPT can be valuable in suggesting how to select an Expert Advisor from the Marketplace. In fact, one of my videos on this topic has garnered over 20,000 views, showcasing the widespread interest in ChatGPT.

TradeGPT EA Review:The Marketing Influence of ChatGPT

It is crucial to approach products related to ChatGPT with caution due to its substantial marketing presence. Some trading Bots in the market might exploit the name and logo of ChatGPT to attract sales. Therefore, skepticism and careful evaluation are vital to ensure you make informed decisions.

Examining the TradeGPT Robot

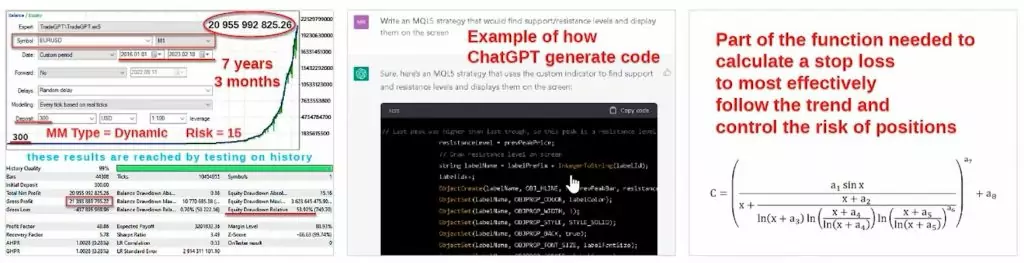

Before we dive into the details, let’s first examine three attached pictures shared by the seller. These images provide valuable insights into the TradeGPT Robot. The first picture showcases a backtest with a staggering profit of over $20 billion over a span of seven years and three months. While such impressive backtest results might raise skepticism among experienced Expert Advisor users, it’s important to keep an open mind and proceed with caution.

The second picture depicts an example of the code generated by ChatGPT. However, it is worth noting that relying solely on ChatGPT-generated code is unlikely to produce a functional Expert Advisor. Furthermore, the third picture showcases a part of the function used to calculate the Stop Loss, aiming to effectively follow the trend and control position risk. Although the formula might appear complex and advanced, it is not always the case that intricate strategies outperform simpler ones in the realm of Expert Advisors.

TradeGPT EA Review: Exploring the TradeGPT Robot Description

Now, let’s delve into the description provided by the TradeGPT Robot. According to the seller, they utilize ChatGPT to identify the best Market Entry strategy. This approach seems logical, considering ChatGPT’s capabilities. Additionally, the seller claims to incorporate their secret advanced mathematical model, which suggests that they have added extra knowledge and skills beyond ChatGPT’s capabilities. Such additional expertise is crucial when utilizing ChatGPT for trading purposes.

Key Details and Settings

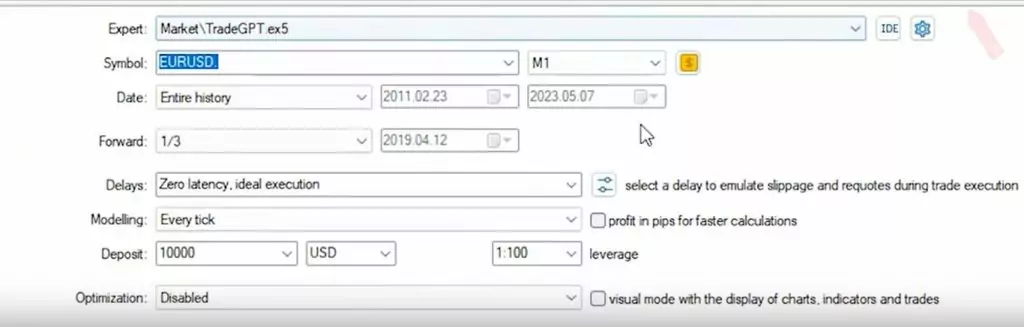

The TradeGPT Robot is optimized for trading on the EURUSD pair, using the M1 timeframe. The recommended minimum Trading Capital to start with is $300. It is important to note these specifications as we proceed to test the Robot.

Analyzing TradeGPT Settings

Let’s begin by examining the settings of the TradeGPT EA. Surprisingly, there are not many inputs to control. You have the ability to manage risk, determine the lot size, enable hedge mode, and set virtual Stop Loss and Take Profit levels. While the simplicity of the settings may raise questions about the strategy behind the Robot, we will have to rely on the trustworthiness of the seller as they do not provide detailed explanations.

TradeGPT EA Review: Conducting a Backtest

To gain insight into the performance of the TradeGPT EA, I will now conduct a backtest using the recommended settings. I will select the EURUSD pair and the M1 timeframe for the entire available historical data. By starting the backtest, we will observe the opening and closing of trades, as well as any drawdowns that occur. Drawdowns are particularly important to monitor, especially when trading with strict daily drawdown limits.

Interpreting the Backtest Results

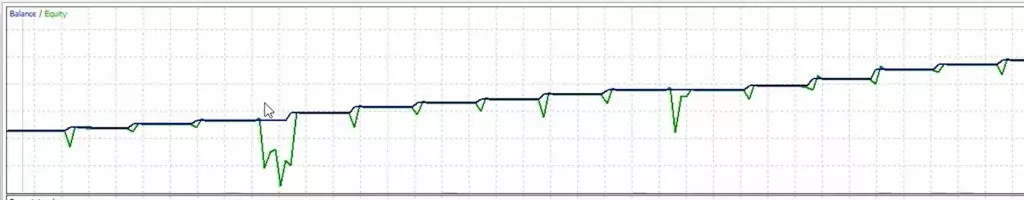

As the backtest continues, we can see trades being opened and closed, along with occasional drawdown periods. Although the account balance shows steady growth, it is worth noting that the backtest we are observing differs from the impressive screenshot boasting a $20 billion profit. Furthermore, the large portion of the profits occurred in the last two to three years of the backtest period. While the overall results appear promising, it is crucial to manage expectations and remain cautious.

TradeGPT EA Review: Visualizing the Trades

Next, let’s visualize the trades to gain a better understanding of how the TradeGPT EA operates. By running the visual mode, we can observe the opening and closing of trades on the chart. While analyzing the visual mode, I noticed that the graph does not display any indicators, trendlines, or horizontal lines. However, we can observe trades being opened and closed, with the presence of trailing stop-loss levels that move to lock in profits. It seems that the EA employs either a trailing stop-loss mechanism or utilizes specific indications to manage its positions.

Analyzing TradeGPT’s Trading Approach:

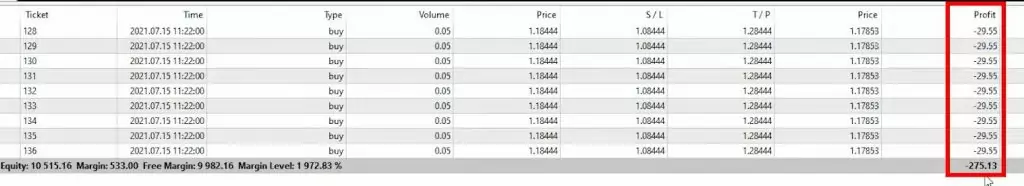

Upon investigating the TradeGPT EA, it became apparent that it opens multiple trades simultaneously. While this approach can be profitable, it also carries the risk of significant losses if the market moves against the trades. Surprisingly, there is no indication of a Martingale System to mitigate potential losses. Let’s take a closer look at the trades and their outcomes.

TradeGPT EA Review: Evaluating Trade Results

Upon reviewing the trade history, an intriguing pattern emerges. Regardless of whether the trades hit the Stop Loss or Take Profit levels, all of them appear to be positive. It is indeed impressive to see such a track record, where even losing trades eventually turn profitable. The EA seems to rely on Trailing Stop Loss levels to secure profits. While the positive trade results are encouraging, we must exercise caution when relying solely on backtest data.

Concerns and Considerations

In algorithmic trading, we typically encounter two scenarios with Expert Advisors. The first scenario involves EAs that generate both losing and profitable trades. Strategies falling into this category aim to achieve an overall profit by designing a strategy with more winning trades than losing trades. However, there is always a possibility of encountering losses along the way.

The second scenario involves EAs that utilize a Martingale System to manage losses and recover from drawdowns. While this approach can potentially yield consistent profits, it comes with the risk of substantial losses that could lead to account depletion. In the case of TradeGPT, we did not observe a Martingale System during our review.

The Lack of Transparency

One major concern with the TradeGPT EA is the lack of transparency regarding its indicators and underlying strategy. Without a clear understanding of the methodology employed, it becomes challenging to place trust in the EA’s performance. As an informed trader, it is crucial to thoroughly comprehend the mechanisms behind any trading system before deciding to use it.

TradeGPT EA Review: Final Thoughts

In conclusion, this honest review of the TradeGPT EA aimed to shed light on its strategy and performance. While the EA showcases an impressive backtest without losing trades or a Martingale System, it raises skepticism. As traders, it is vital to exercise caution when relying solely on backtest results. The lack of transparency regarding the strategy further adds to the doubts surrounding its reliability.

As always, this review is not financial advice but rather a means to provide insights and encourage critical thinking. It is essential to conduct thorough research, consider alternative opinions, and make informed decisions when selecting a trading tool. Thank you for joining me today, and be sure to check out our detailed review of the Waka Waka Expert Advisor on my YouTube Channel.

Disclaimer: The information provided in this review is based on personal experience and research. Trading involves risk, and past performance does not guarantee future results. Always exercise due diligence, seek professional advice, and trade responsibly.