Test trading strategies – learn how to avoid testing on Demo account

Test trading strategies could be much more useful than everyone thinks. It is not just a method to see how a trading strategy performed for a predefined period of time. It is much more! In this article, Petko Aleksandrov will teach you how to replace testing on Demo account with backtesting in 1 minute and have the same results. This is a free lecture from the course Ethereum trading course + 99 Algorithmic Trading Robots.

Hello dear traders, this is Petko Aleksandrov and today is the 7th of December 2017, the generator is ready and I have in the collection 100 strategies for H1 chart and as well I have 100 strategies for H4 chart.

What I will do now?

I will test trading strategies for the period of the last month.

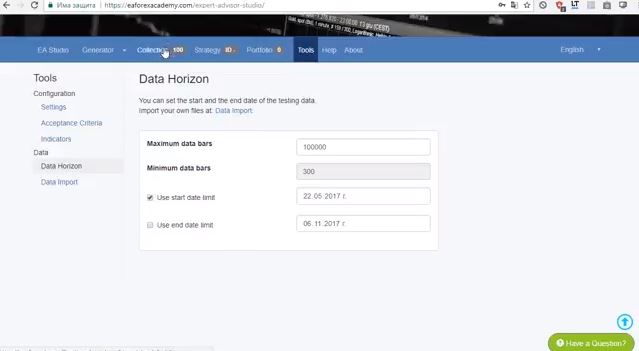

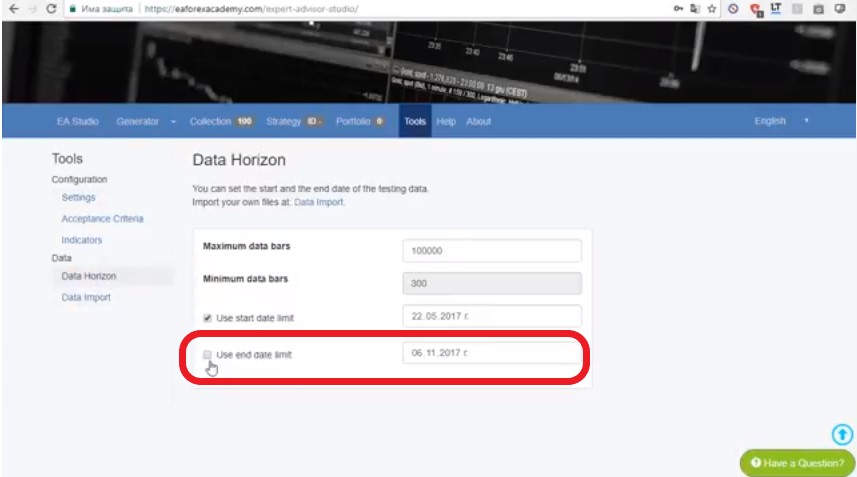

I will go to tools and from data horizon I will include the last one month. I will just remove the tick which disables to use the end date limit. And this will include the last one month. One more time, I have created the collection of strategies for the Ethereum on H1 and H4 but without using the last one month.

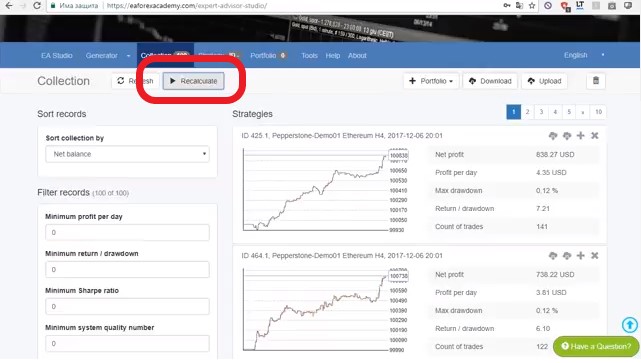

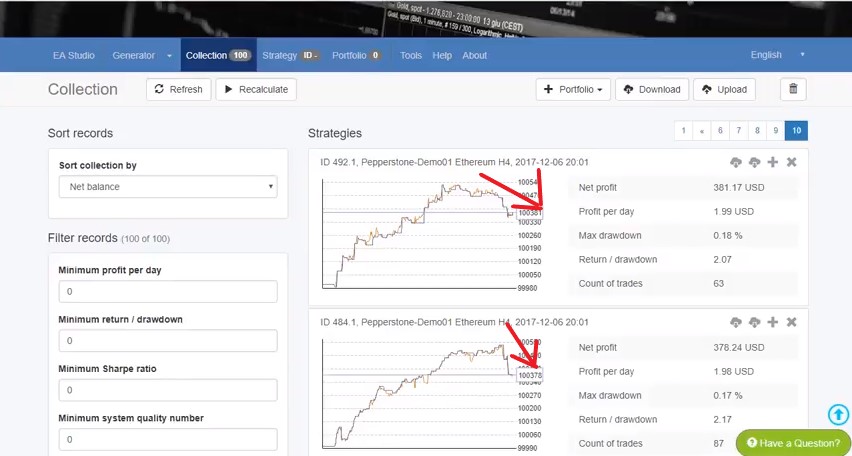

Now when I click on recalculate you can see here I have 10 strategies on each page and I have 10 pages. Watch carefully what will happen now. I click on recalculate and EA Studio recalculates how many of those strategies continue to be on the profitable side

And you can see something very interesting actually that some of the strategies have made a great profit during the last month.

This is the totally same thing, guys if I keep these 100 strategies on a demo account. Test trading strategies could not be easier!

You see I have done it just with one click or couple of clicks to add the last one month. But one click recalculates I am including the last one month. And you see how the date is yesterday. Basically now I have 99 strategies that were profitable as well during the last one month. And very important this shows how EA studio is creating actually robust strategies.

Simply, I will do the same thing for H4 chart, I’m going to tools, you can see the date here is 4th of November:

I’m going to tools and I will click on data import, actually data horizon. Here I as well remove this tick and this way I am including the last one month. And when I click on recalculate you will see what will happen. Let’s see how many strategies will pass the test, all of the strategies – this is just fantastic.

Normally, what I see is that 70, 60, sometimes 50, sometimes 30 really depends on the asset that we choose, how long time I have run the generator. But in this case, I have run it for a long time. Basically, I have many trading strategies that showed a great profit. And even including the last one-month history data they still show a profit.

What I’m doing now, guys?

I need to select from the two collections a total of 99 strategies. Probably I will choose like 50 from one and 49 from the other.

Why I can not test more than 100 trading strategies?

Because the maximum in Meta Trader is 99. And that’s why actually I choose to add in the course 99 strategies, just like my Bitcoin course. This is the maximum in Meta Trader. Obviously, I can provide you with hundreds of strategies. But you need to load it in two Meta Traders. Not really necessary to do 100, actually 99 is more than enough, guys, for you to choose the top performance out of the 99.

I went to the tenth page where are the strategies with less profit. And you can see that these strategies during the last month they remained profitable but they went on a loss. I will start removing these strategies. And I will just simply leave the ones that had a good profit as well during the last month. And not having this drawdown. Probably these strategies were a little bit over-optimized. EA Studio just found very good parameters while testing trading strategies:

When I just tested them now for the last one month they showed some losses. And we want to avoid having such strategies into our collection. You can see the test trading strategies has some drawdown here but not really huge. I can see like $80-$90 not really huge drawdown. You can see there is one here but then it recovered. And now again and now it starts to recover.

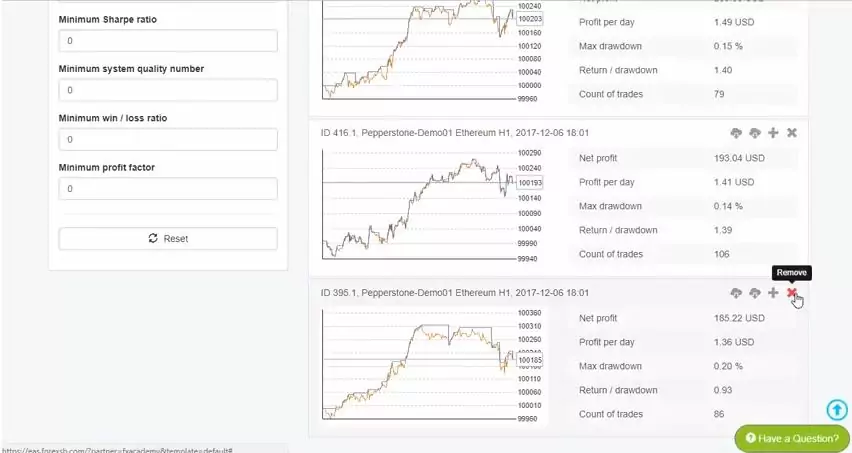

I will remove the others which are with worse profit lines at the end.

I will just go to eight-page and I will start removing strategies from here. Basically, what you see, is that I`m not going into each strategy to look into the indicators. I have done that many times and I have concluded that actually EA Studio works well, does its job. And I don’t need to analyze it and to change something in the strategies.

This is why I’m using this professional software to rely on it. And it proved to me obviously that it creates profitable strategies. And it does test trading strategies very well. I don’t need to spend time on each strategy to change somethings. But most important is that I will lose time, guys. And time recently in trading is very precious especially with the cryptocurrencies, we need to be very quick, we need to move fast, we need to create strategies very quickly if we don’t want to actually miss these volatile moves that are happening on the market.

I keep removing the strategies, simply one more time all I care about is the net profit. And this is the profit line of each strategy, and if it’s losing recently during the last one month that I have tested it over I am removing the strategy. And if you have any questions about how I’m selecting the strategies you’re welcome to ask me in our Trading Forum.

But one more time the most important thing we care about is the profit line shown while we test trading strategies.

We don’t want to have huge drawdowns. Huge drawdowns like huge stagnation, like for example here you see drawdown:

As you can see it is for a short period of time then it recovered. But if it was like that during the whole period and then it recovered I don’t want to have such strategy that it will stay a long time into stagnation.

This is called stagnation while we test trading strategies. The period when the strategy is not doing profit but it’s actually losing it`s called stagnation.

Let’s continue a lower, you can see here is such a great profit line, guys, very stable even including the last one month. You can see here drawdown and then the profit line just goes sideways. I will remove this one. Let me just have a look how many I have left 55. So, I will remove 5 more strategies. These ones are losing recently and this one as well. And I will do the same with H1 chart, and then I will remove one more strategy from the two.

Totally I will remain with 99 strategies. One more from here, let me just have a look this one. But not really losing too much recently, let me go back to the last page. I will remove this strategy that I left earlier. But obviously the others are having better profits.

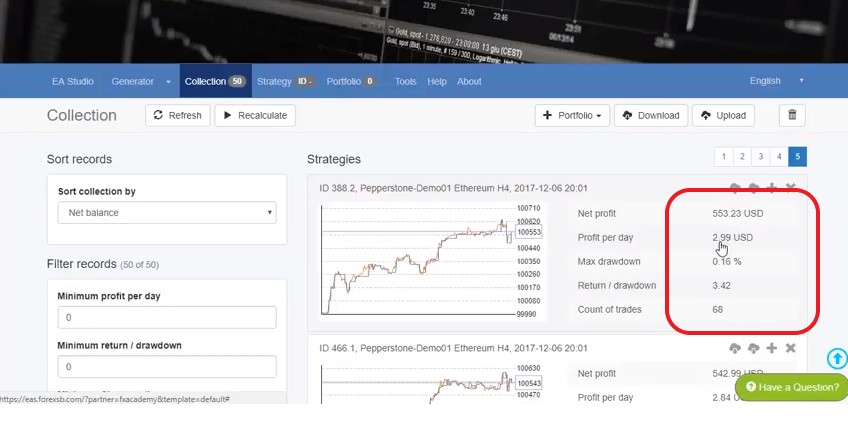

Now I have into the collection 50 strategies, that are having nice profit lines. They are having net profit more than $500 but actually I’m not looking really at the net profit and the profit per day. Because for the purpose of this course I have selected 1 trading lot while I test trading strategies.

Which with the Ethereum is a small amount.

Again I say in my courses I don’t want to suggest any trading volume. I don’t want to suggest any starting amount. It’s your choice. I have just opened a huge demo account and it’s really no matter how much. Obviously, if I put 10 trading lots here I will have $29 per day and I will have a net profit of $5530. And actually $32,30:

Really no matter here while we do test trading strategies, don’t look too much in the net profit and the profit per day because what we care about is a stable profit line and after that when you start trading on a demo, when you see the profits, the losses because some of the strategies will be profiting, some will be losing, you will decide for yourself with how much you want to start the trading.

Probably you want to start first with a small trading account, with a couple of Expert Advisors. Because this is the idea from all the Expert Advisors:

- we create them;

- we test them;

- test them one more time for one month;

- and then we test them one more time on the demo and we place the top performer.

You will decide on how much you want to start and what trading lot you want to use.

Now I am going to H1 strategies and I will need to select another 50 out of the 99. Obviously I will not select, but I will exclude I will just remove these losing recent strategies. You can see the strategies, so they stay above 100 000 still profitable. But there were losses during the last month during I did test trading strategies.

And I want to remove these strategies. Because this is the test of the last one month that I’m doing. And you can see how nicely it shows the strategies that are losing recently. I better do this thing here instead of doing it into the demo account or worse to place these strategies on a live account. And they will just start losing according to the latest data.

Because, what you need to understand, is that these strategies doesn’t mean they are not profitable.

They are not profitable just simply with the recent historical data of the last one month. And this is very normal with cryptocurrencies. Because they are more and more volatile. And what I was saying is that we need to use the strategies that are showing profit recently.

And actually by placing the 99 on the demo account, what I will show you and selecting the top performers at the current moment is the only way that we can see while we test trading strategies are those that are making profit according to the latest history data.

According to the latest movements and market conditions. I keep removing here because you can see these strategies are simply having losses recently. Now here a little bit things are changing and improving. So, on the sixth page I see some strategies that are having not such huge loss recently but still losing, so I’ll just keep on removing these strategies:

Also, this one I don’t want to have it as well, this I will remove. And what we have here let’s go to the fifth page, actually this is at 50 strategies. You can see these strategies recently they’re just going up and down, up and some down but not really huge drawdowns at the end. There are some but this is actually very normal move and drawdown in a strategy.

Simply on H4 diversify the risk between H1 and H4.

If H4 continues doing better for you, for example as it shows on the profit lines here, simply the top performers will be on H4 and you will use H4, so I want to give you the choice here if you want to trade on H1 or on H4. And obviously, you will see a lot of movements there, you will see how the Expert Advisors are changing and how actually some are having more profits than they had during the test of the trading strategies, some are having losses more than they were having before.

So, our job will be to monitor.

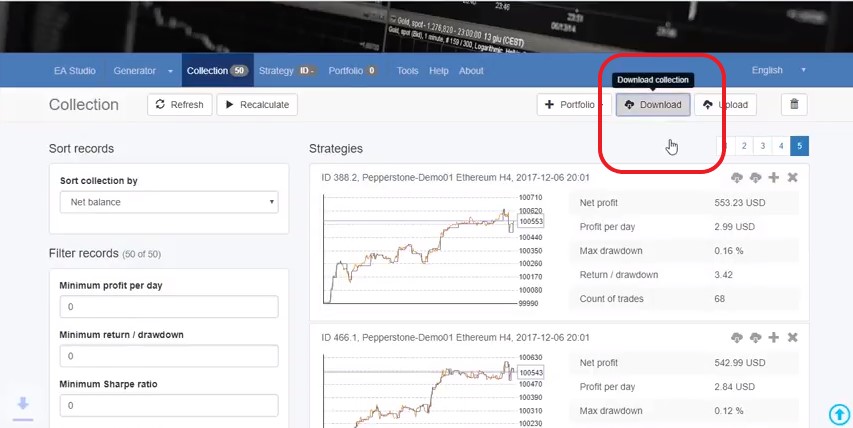

This one, you can see huge period of time is going down and I will remove it. I have here 49 strategies for the H1 chart I will download this collection to make sure not to lose it or to delete some strategy by mistake and as well I will download the collection for H4 charts:

Now, what I will do after I am done with the test trading strategies?

I will export the strategies and I will place them on the demo account but you can see it how I`m doing that in the Ethereum trading course + 99 Algorithmic trading robots, which you can find on our website!

Thank you very much for reading! If you have any questions you can always ask me in our FORUM, where we have a special topic about the Ethereum course which is called “The Ethereum trading course is live”

If you are interested in more cryptocurrency courses you can visit: https://eatradingacademy.com/tracks/cryptocurrency-trading/