If you’re a trader, you’ve probably heard of RSI. It stands for Relative Strength Index, and it’s one of the most popular technical indicators used in trading. RSI can be used to identify overbought and oversold conditions in the market, which can help traders determine when to enter and exit trades. These days, you can use this powerful indicator to automatically open and close trades using the RSI Trading Robot.

However, despite its popularity, some traders fail to see positive results using RSI. This is because they’re not using it correctly. There are different strategies, parameters, and even RSI trading robots that can give different results. That’s why it’s essential to find the right one that works for you.

In this blog post, we’ll talk about RSI trading robots and how they can help you become a more profitable trader.

What is an RSI Trading Robot?

Essentially, it’s a computer program that uses the RSI indicator to generate trading signals. It’s designed to automate the trading process and eliminate the emotional aspect of trading. The robot can scan the market, identify potential trading opportunities, and execute trades on your behalf.

Creating the Best RSI Trading Robot

Petko Aleksandrov has created hundreds of RSI trading robots using different logic conditions and parameters. After testing them extensively, he narrowed the number down to 45. In his YouTube video, he shared the best RSI trading robot that brought him the most success, and he’s giving it away for free.

Using RSI as an Entry Rule

Using RSI alone as an entry rule can lead to losing trades. That’s why it’s essential to combine it with other indicators to get better entries and eliminate fake signals. As a beginner, it’s crucial to backtest the RSI trading robot to see if it works well for your trading broker. More on this a little later in this post.

Strategy Rules

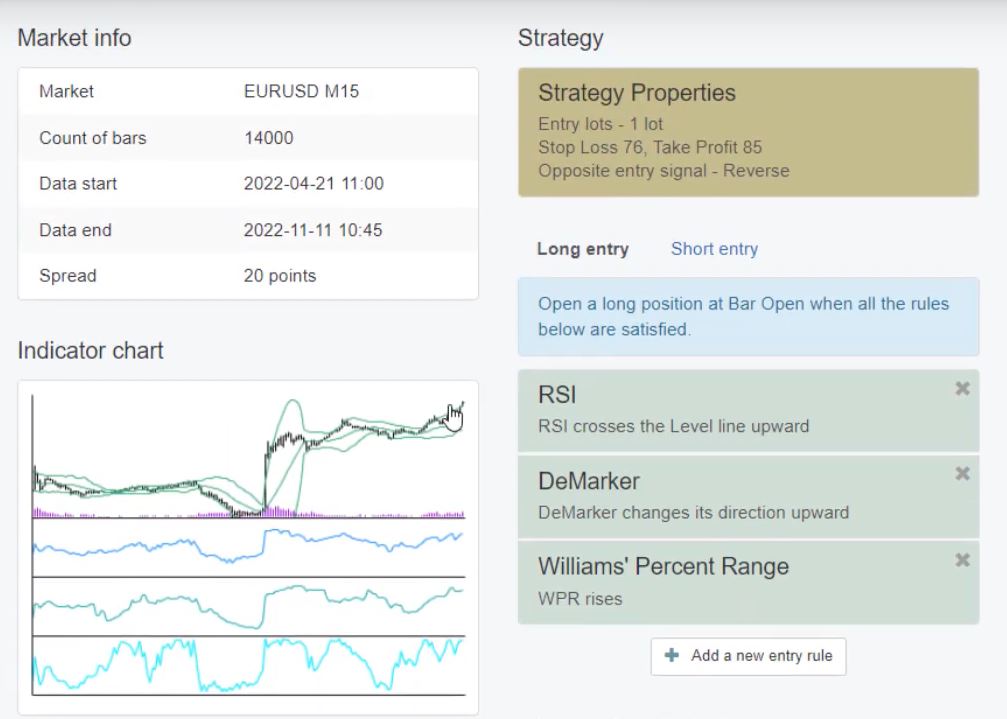

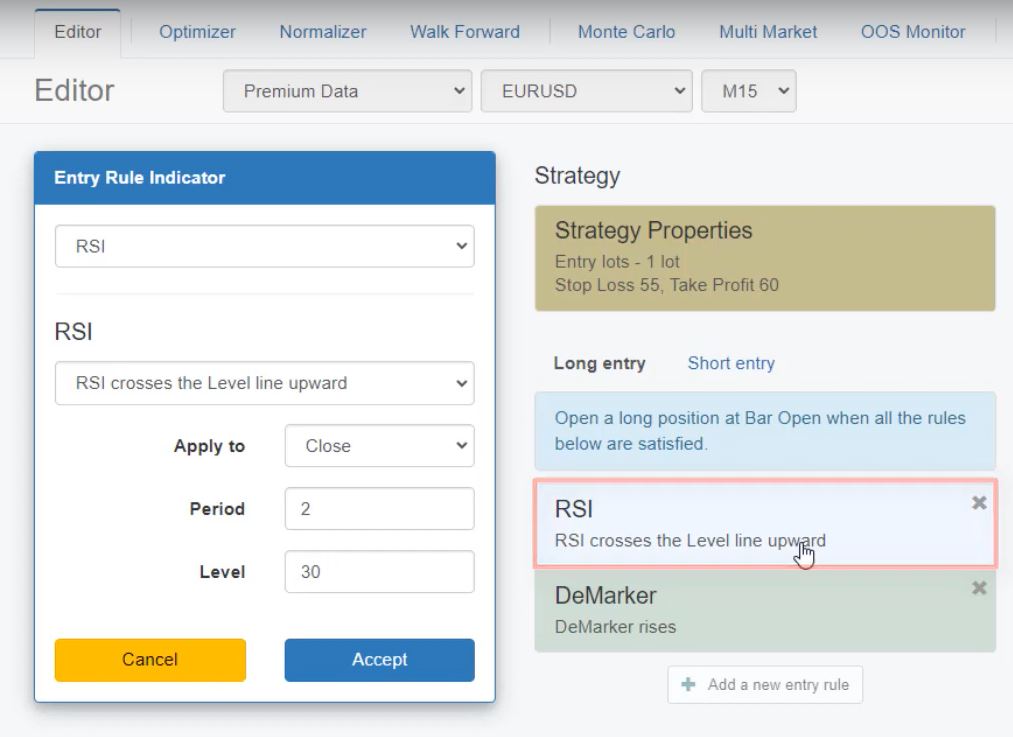

The RSI trading robot uses a set of rules to determine when to enter and exit trades. The first rule is to look for the RSI crossing the level line upward, with a period of 2 and level of 30. This indicator reacts very fast to market changes, making it a reliable signal for entering trades.

Once the price crosses the level line upward, the robot opens a long trade. However, it only does so if the Demarker rises at the same time with a period of 45. This provides a confirmation for the RSI indicator, ensuring that the robot is making a sound trade.

The robot uses a Take Profit of 60 pips and Stop Loss of 55 pips, ensuring that losses are kept to a minimum. The exit rule is provided by the Bollinger Bands, which have a period of 12 and deviation of 2.49. The robot exits a long trade when the bar opens below the lower band of the Bollinger Band, after opening above it.

Why is this strategy effective?

The RSI trading robot uses a combination of indicators to provide reliable signals for entering and exiting trades. By using the Demarker and Bollinger Bands in conjunction with the RSI indicator, the robot is able to filter out false signals and make better trading decisions.

Moreover, we designed this strategy to keep trading costs low. By reducing the number of trades, the robot minimizes the spread paid to the broker. This is a crucial consideration when trading, as trading costs can eat into profits.

When should you use RSI Trading Robot?

This robot is best suited for beginners who are looking to get started with trading. It is also ideal for traders who want to automate their trading process and remove emotions from trading decisions. The robot is designed to work on EURUSD on M15 time frame, but you can adjust the settings to work on other currency pairs and time frames.

How to backtest RSI Trading Robot?

Backtesting is a crucial step in testing any trading strategy or robot. You can backtest RSI Trading Robot using the MetaTrader platform. You can download the robot from the description, and then go to the Open data folder, click on Mql4, and then hit on Experts. Paste the Expert Advisor and close the tab. Then, right-click over Expert Advisors and hit on refresh. This will compile the Expert Advisor, and you will be able to drag it over the chart. From the inputs, you can change some of the parameters. Click on OK, and then right-click and go to Expert Advisors and hit on Strategy Tester. Keep it open prices only as a model and 15 time frame and then hit on Start. You will see the trades in Results tab, you will see the Graph as well, the Report and the Journal.

Why choose BlackBull Markets?

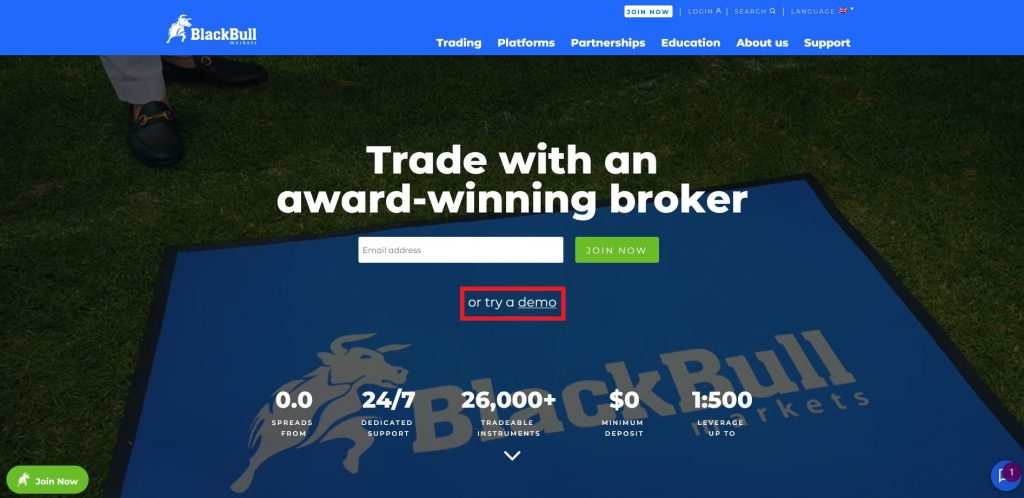

BlackBull Markets is a regulated Broker that offers leverage up to 1 to 500. If you’re a beginner trader and don’t know how to select a regulated Broker or have doubts with the one you are using currently, check out BlackBull Markets. They offer not just MetaTrader 4 and MetaTrader 5, but also TradingView, which is one of the most popular platforms for technical analysis and charts.

RSI Trading Robot: Conclusion

The RSI Trading Robot is a popular trading robot used by traders worldwide. It is best suited for beginners who are looking to get started with trading and want to automate their trading process. Backtesting is crucial when testing any trading robot, and you can backtest RSI Trading Robot using the MetaTrader platform.

If you’re looking for a regulated broker with high leverage, BlackBull Markets is a great choice. Remember, always test any trading robot on a demo account before trading with real money.