Robo Trading Software – the easiest way to do algorithmic trading without programming skills.

Robo Trading Software called EA Studio is what most of the algo traders are focused on during the last few years. It generates strategies, analyzes the results, and exports EAs with one click.

This makes it one of the most preferable Robo Trading Software nowadays. This Robo Trading Software comes with a 15-days free trial, and everyone can test it.

Hello traders! This is Petko Aleksandrov speaking from EA Forex Academy. In this article, I will talk about a recent update that we have in the Robo Trading Software EA Studio.

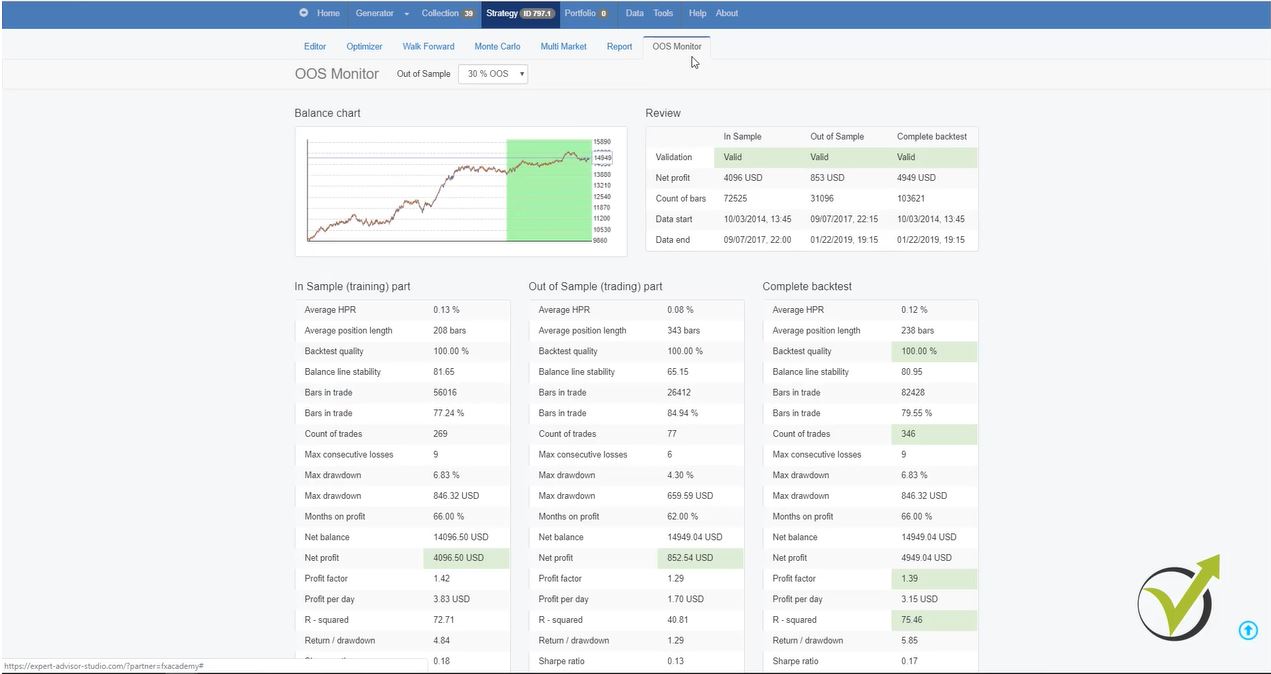

About the out of sample monitor. Which is available if I click on any of the strategies that I have in my collection:

You can see it right over here next to the report. It says “OOS monitor” and it stands for out of sample monitor. But before explaining all of that. I think I need to explains

What means actually out of sample?

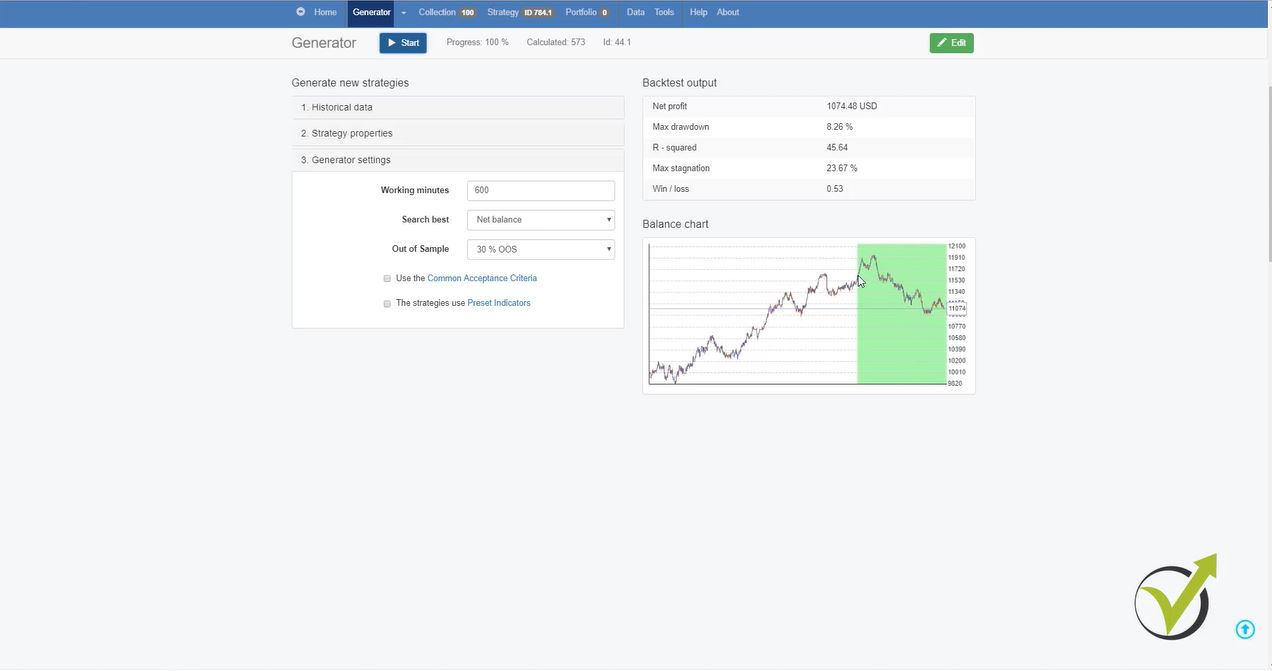

If I go to the generator and I want to generate strategies let’s say EURUSD on H1. I will just take this randomly. And then strategy properties as you know where you can enter the lot size, the minimum, and the maximum take profit and stop-loss.

And then in generator settings, we have out of sample. So in-sample, this is a statistical measure for all the data that we have in our statistics.

When it is in-sample it means it will use all the data we have in EA Studio Robo Trading Software. In this case on H1, these are 27 409 bars. So if I keep it in-sample this means that the generator will generate strategies based on all of that data.

But here the risk is that we will have over-optimized strategies. This means that the generated strategies will show such an equity line exactly for this period of time that I have been using for the generation.

And after that when I place them trading on the MetaTrader there is a chance that they will start losing.

One of the options is the method to place them on a demo account. So it will test the strategies on unknown data, okay, and we will see which one of those will continue profiting. And which one will start losing.

The second option is to use the out of sample.

If I click on the menu you’ll see ten percent, twenty percent, thirty-forty-fifty percent. So let’s go with the middle one of thirty percent. Now if I run the Robo Trading Software generator with thirty percent out of sample this means it will generate strategies by eliminating thirty percent of the historical data that I have for EURUSD on H1.

So if I have 27 thousand 409 bars times zero three it will eliminate eight thousand two hundred twenty-two bars. And it will generate strategies only on the rest historical data.

So the data before the last 8222 bars and after that it will show us the result that we are having at the last 8222 bars or the last thirty percent. So let me just demonstrate it to you.

I will leave it just this way and I will remove the acceptance criteria just to demonstrate to you what I mean. So you see immediately I have many strategies generated and they are being generated only on the first 70% of the historical data.

But you see what happens exactly after that. I will stop it because this is a very good example. The strategy was generated over 70% of the historical data and with the last 30 percent actually, the strategy started to lose. So this is exactly the over-optimization:

The Robo Trading Software Generator finds strategies that are profiting for the tested period.

Then when it is simulating real trading the strategy loses. And here I have selected search past by net balance. So the generator finds strategies with the best net balance.

And at this point exactly between at 70% it starts simulating real trading. So here is shown the result of unknown data. Meaning that the generator eliminates this 30% while generating the strategies.

And you see here this strategy starts to lose which means that the out of sample shows the strategy was over-optimized.

So let me run one more time the generator and it will generate hundreds of strategies immediately. Because I have removed the acceptance criteria but just because I wanted to show you exactly what I mean.

Now you see with this strategy that is shown at the moment actually after that the strategy shows a little bit of a negative but recently positive result.

And now you see even a little bit better strategy which continues to make some profit during this last 30% of the time. Let me stop now the generator. So one more time to make it clear:

What is the Out of Sample in Forex?

- the white period is in-sample

- the green period is out of sample

- generate strategies during in-sample

- simulate trading during out of sample

So here if we select in-sample this means it will use the whole period, the whole historical data we have. If we use 30% or any of the other choices the green one is out of sample. The white one is in-sample.

Now when we use out of sample we want to see the strategies that are actually profiting in the out of sample period.

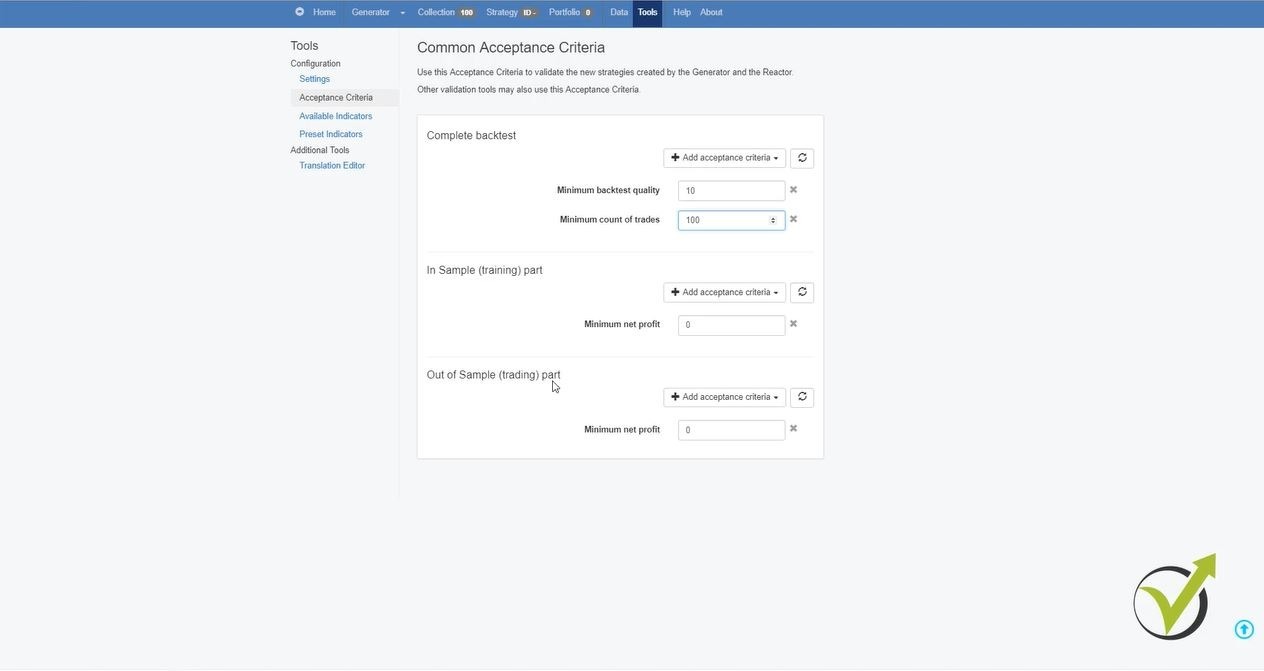

And this is another update now in EA Studio Robo Trading Software. If I use the common acceptance criteria you can see that there are few options.

What is the acceptance criteria in Forex?

- a complete backtest criteria

- in-sample which says “training part” criteria

- out of sample which says “trading part” criteria

So one more time the white part from the balance chart was in-sample where the generator was working. So it’s training, this is where the generator in Robo Trading Software builds the strategy.

And then out of the sample was the green period or the last 30% with the demonstration I did which is the trading part. So it’s simulated real trading on the unknown data. The data that was not used while generating.

Now you see here by default comes minimum net profit and minimum net profit.

So if I select, for example, to have minimum net profit one and then I select to have minimum net profit one as well in the out of sample. This will mean that in the currency my trading account is I will have at least $1 if it is in dollars or one of currency.

When I run the generator and in generator settings, I use the common acceptance criteria. So it will generate the strategies that will have at least one dollar of profit here and then one dollar of profit in the out of sample.

So let’s run now the generator and you will see it shows me strategies that are having no losses in the green zone, in the out of sample.

It could be just one dollar but it’s still a dollar profit. So it’s still a profitable strategy on the green period and this is what exactly I wanted to show you. That with the acceptance criteria, you can choose what acceptance criteria to have in the in-sample part and in the out of sample part.

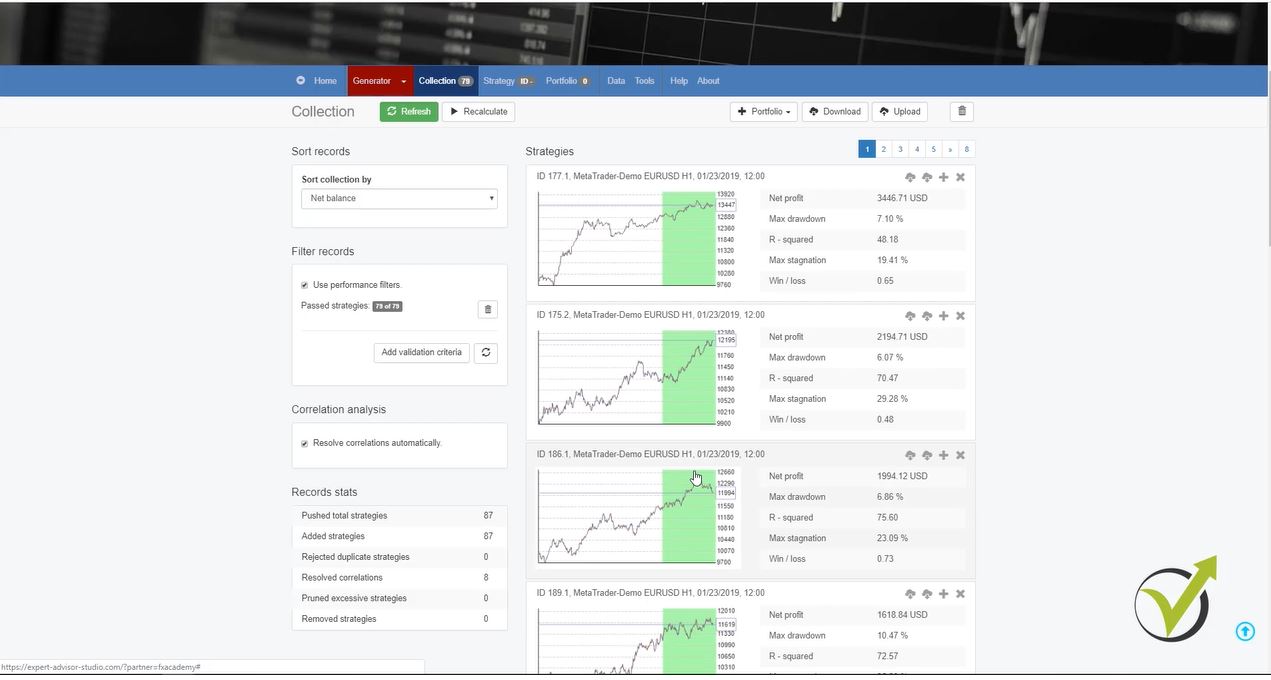

Going back to the generator you will see much better strategies over there.

And if I improve that so let me go back one more time to the acceptance criteria and I will actually delete all of these strategies. So going to the generator-generator settings-common acceptance criteria. So let’s say here I will go up to 100.

Alright, I want at least 100 of a profit on my out of sample period and an in-sample period. And I’m having a minimum count of trades 100 and minimum backtest quality 10. Alright so going back to the generator.

I will press Start and you will see how the strategies are having actually minimum 100 in the in-sample part and then a minimum of 100 in out of sample part. And if I click on the collection you will see that this is true for all strategies generated.

So here, for example, the strategy made some profit in the beginning. Then it went a little bit on a loss. But still at this point at the 70% of the historical data, it is above 100 of a profit.

And then during the out of sample period again it has much more than 100 of a profit. So this was a great update in EA Studio. That we have now the option to decide what acceptance criteria to have in the complete backtest. In the in-sample part and our sample part.

Now if I click on any of the strategies, for example, I will go to the first one you will see that with the balance chart in the editor. I don’t see the green zone. This is because the editor uses all the data that we have for this asset.

But here comes the update in the Robo Trading Software – out of sample monitor.

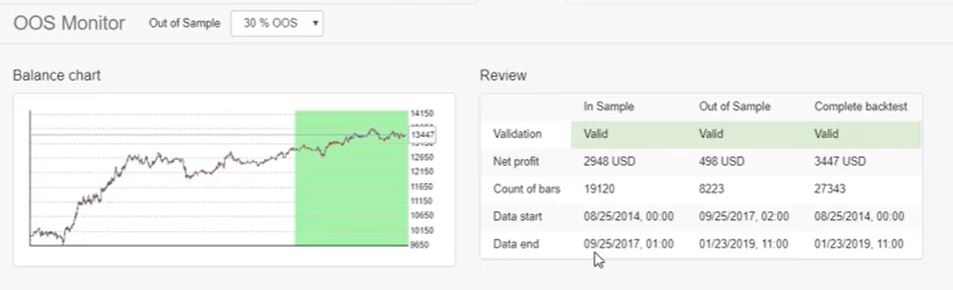

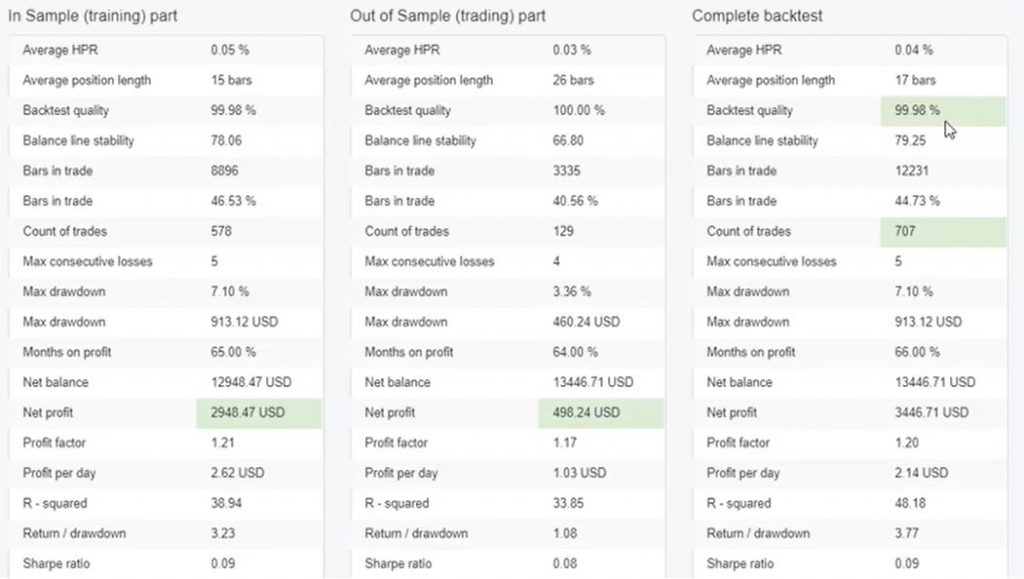

If I click on it you will see here that I have a lot of information for the in-sample part, for the out of sample part and for the complete backtest. As well you will see that it shows the net profit for each one, the count of bars for each one and then the start date and the end date.

So you can see the in-sample was from the 25th of August 2014 till the 25th of September 2017. And out of the sample was from the 25th of September 2017 till today. Which is 8223 bars just as I have calculated it with a calculator.

So here we see in details how many bars we are using. No need to use the calculator. And exactly from which date until which date. And in the end, we have the complete backtest.

Now what you notice is that we have in green the net profit for the in-sample, for out of sample, the count of trades and the backtest quality in complete backtest. This is because these are the criteria that we have in the acceptance criteria.

You see I have the minimum net profit for in sample and out of the sample.

And then I have the minimum backtest quality and a minimum count of traits. So if you use some other options here in the criteria you will see them in the out of sample monitor.

And they will be either in green or they will be in red. If they were not validated. So for example, if I change out of sample to twenty percent you see still all our validated. Let me go to ten percent.

Here you see that out of the sample was not validated because the net profit is just nineteen dollars. And in the acceptance criteria, I have selected to be a minimum of 100.

So one more time with ten percent of out of sample, it is just 19.98. Which means it’s not validated. If I put it back to thirty percent you will see that it’s just validated and it shows in green.

Alright, so here you can see a very detailed statistic about each period. About the in-sample period, about out of the sample period and about the complete backtest. So the complete backtest is in the sample plus out of the sample.

Alright, so this is the improvement that we have in the EA Studio Robo Trading Software with the out of sample.

Why the Out of Sample in Forex trading is useful?

- it gives a lot of opportunities to the trader to filter the strategies while they are being generated

- with the recent update, it is possible to predefine acceptance criteria for the in-sample part, for the out of sample part and for the complete backtest

- saves time for Demo testing which is very important

Аt the end I’ll give you some tips on how to set up the generator in this Robo Trading Software.

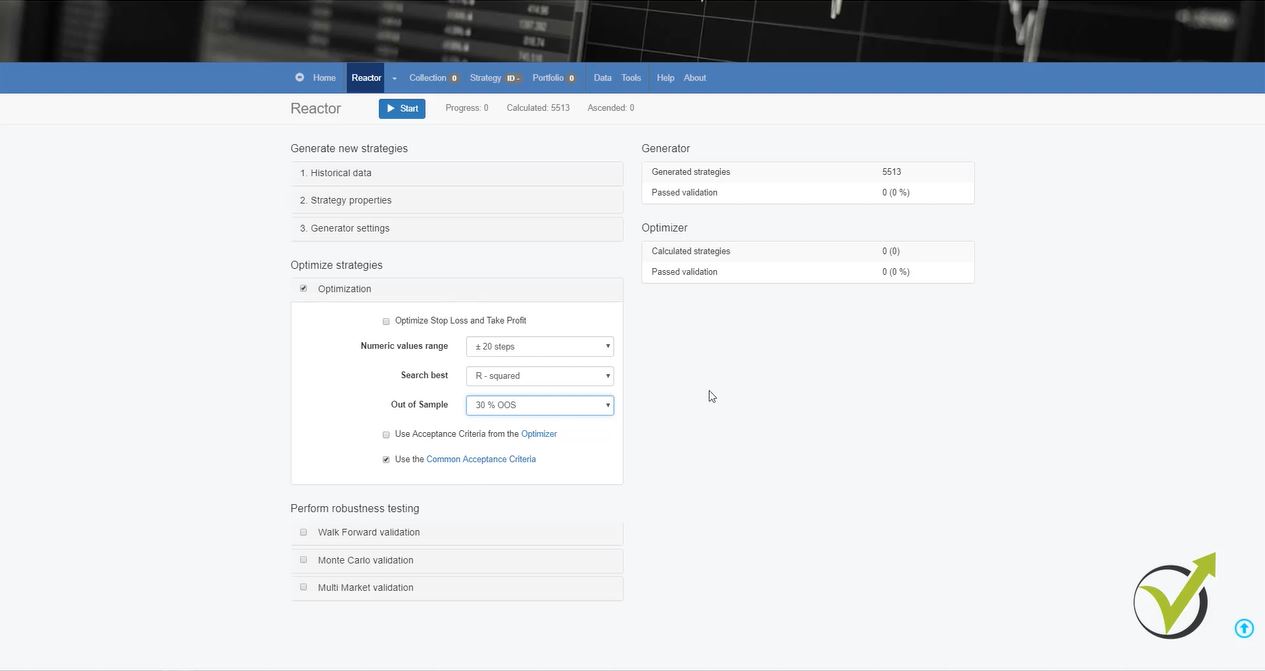

In order to use the optimizer with out of sample at the same time. So let me remove this collection now and I will switch to the reactor. Alright, so I will leave it the very same thing here EURUSD, H1, strategy properties. I will leave it between 10 and 100 pips. And then in the generator settings, I will remove the acceptance criteria and I will remove out of sample I will leave it to in sample. Some maximum number of strategies without any limitation. And then I would like to use the optimization.

In optimization, I have the option now search passed by net balance returned to drown down system quality number and so on. I can use here R-squared. And I will use here the out of the sample of 30%.

This means that the generator will generate my strategies. There will be optimized only for 70% of the time of the tested period. And then for the rest 30%, it will show me the result of these strategies. If I use common acceptance criteria I will leave it here the way it is minimum net profit 100. For in sample and out of sample.

And as well here I can add R-squared again if I am using these criteria. For example, here I will leave it 65. I will use the very same thing on the out of the sample and I will leave it here as well 65.

And then for the complete backtest, I want to have an R-squared minimum of 85. So this means that for the complete backtest I will have 85 for in-sample. I want to have at least 65 and out of sample, I want to have at least 65.

I will run now the reactor in the Robo Trading Software.

Probably it will take me some longer time. You can see there are already generated strategies but they don’t pass the optimizer. Because it uses the acceptance criteria for minimum net profit. Аnd at the same time for R-squared 65 for in sample and out of sample and 85 for the complete backtest.

And you can see there is already one strategy that passed. I will click on it. And you will see what a great strategy I have with a complete R-squared of 87.51. And if I click on it and if I go out of sample monitor you can see what I have here in green. I have a net profit. Which in this case is 1471.49 and then I have R-squared of 77.88, the minimum here was 65.

Then with Out of Sample, this is the trading, this is the simulation. This is where the optimizer didn’t work. It optimized the strategy only for this period and not for this one and the net profit here is 1088.05 and here is 75 and R-squared is 75.74.

And here I have R-squared of 87.51 which is great for me. I have a huge count of trades and I have backtested quality of 99.99 percent.

So this is one of the ways that we found recently to be working really great. You can test it out and see how useful this update in EA Studio is. And it will take you some longer time to generate strategies.

But at the end of the day, we have very nice strategies with a very nice balanced line. Аnd we are protected from the over optimization. Because the optimizer worked only for 70% of the time. Аnd for the rest 30%, it was not optimizing the strategy.

Thank you very much for reading this article! If you have questions you can always write in our trading forum.

Also, you can test 15-days free trial EA Studio from our website.

Enjoy the trading!