Risk tolerance in trading is the amount of loss an investor is willing to accept when making an investment decision. Several variables decide the amount of risk an investor can tolerate. Knowing one’s risk tolerance level assists investors in planning their entire portfolio and influences their investment. For example, if a person’s risk tolerance is low, investments will be made cautiously, with more low-risk and fewer high-risk investments.

How Risk Tolerance Works

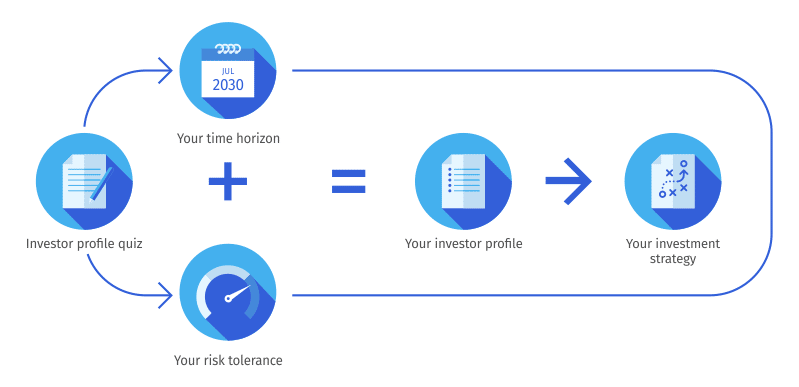

Using an online calculator or speaking with a financial planner, you can assess your own level of risk. Financial planners adapt their financial guidance to a person’s risk tolerance. Risk tolerance can also be used to classify their customers’ investing approaches as aggressive, average, or cautious. Firms use these three categories to describe asset options, recommend asset allocations, and offer strategies to their clients.

Risk tolerance also includes a trait known as “risk capacity,” which determines how much danger you can tolerate. It varies depending on how much risk you are prepared to accept. For example, you may be okay with an aggressive, high-risk portfolio, but if you only have a few years to reach your goal, a portfolio of 100% stocks is not in your best interests—they’re too volatile.

Assume you’ve just begun a new job and intend to retire in 40 years. Your income is low, and you have no savings, but your cost of living is low, and you’re young so those things will come in time. Assume it’s also natural to go big, roll the dice, and take risks when given the opportunity. (In other words, you are naturally risky.) Your tolerance for danger is strong.

Given all this information, taking a more aggressive strategy makes sense, but your income and savings are limited, so you may need help to withstand a significant decline in stock prices.

While you may have a high-risk tolerance, your risk potential is lesser. In that case, you may be better off with a more conservative portfolio than you prefer to preserve the assets you’ll need to retire.

Factors that Influence Risk Tolerance in trading

Timeline

Each investor will choose a different time horizon based on their investment plans. If there is more opportunity, more risk can typically be accepted. A person who needs a certain amount of money at the end of 15 years can take on more risk than someone who needs the amount by the end of five years. It is because the market has shown an upward trend over the years. In the short term, however, there are constant lows.

Goals

Financial goals differ from individual to individual. Many people’s primary goal in financial planning is to accumulate less money than possible. The amount needed to achieve specific goals is calculated, and an investment strategy to achieve such returns is typically pursued. As a result, depending on their goals, each person will have a different risk tolerance.

Age

Generally, young individuals should be able to take more risks than older individuals. Young people can earn more money while working and have more time to deal with market fluctuations.

Portfolio size

The more extensive the portfolio, the more tolerant of risk. An investor with a $50 million portfolio can take more trouble than one with a $5 million. If the portfolio’s value falls, the percentage loss is much lower in a more extensive portfolio than in a smaller one.

Same if you are trading with $100 000 or $100. With a more extensive trading account, you can handle more considerable losses and afford to keep a bigger Stop Loss, increasing your chances of having a profitable strategy.

More, if you wish to diversify the risk, you better use different strategies and not just one:

Investor comfort level

Each investor approaches risk uniquely. Some investors are inherently more comfortable with taking risks than others. On the other hand, for some investors, market fluctuations can be extremely worrisome. Risk tolerance is thus directly related to an investor’s comfort level when taking risks.

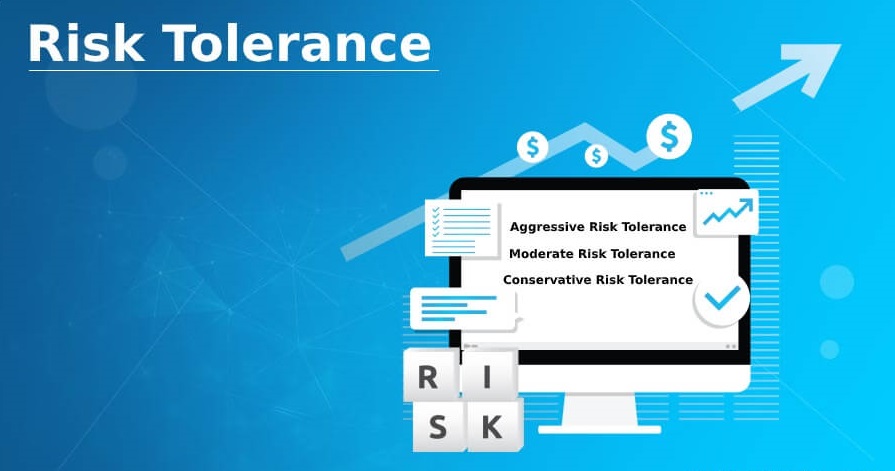

Types of Risk Tolerance

Investors are typically divided into three categories based on their risk tolerance. The categories are determined by various variables, only a few of which have been described above. The three divisions are as follows:

Aggressive

Aggressive risk speculators understand the market and are willing to take large chances. Such buyers are accustomed to significant upward and downward fluctuations in their portfolios. Aggressive investors are typically affluent, seasoned, and have a diverse inventory.

They prefer asset classes with volatile price movements, such as stocks. Because of the amount of risk they take, they benefit from better yields when the market is performing well but suffer massive losses when the market performs poorly. They do not, however, panic sell during market crises because they are used to daily fluctuations.

Moderate

Compared to aggressive risk investors, moderate risk investors are less risk tolerant. They accept some risk and typically designate a proportion of losses they can tolerate. They diversify their investments across risky and safe asset classes. When the market is doing well, they earn less than aggressive investors but do not suffer significant losses when it falls.

Such approach in Crypto Investing uses Petko Aleksandrov, and you can follow all of his investments with a spreadsheet.

Conservative

Conservative buyers are the ones who assume the least risk in the market. They avoid risky investments and instead choose the options they believe are the safest. Also, they value averting losses over earning profits. They only invest in a few asset classes, such as FDs and PPFs, where their capital is safe.

Ignoring Risk Tolerance

Investing without considering risk tolerance can be disastrous. When the worth of property declines, an investor must know how to respond. Many investors flee the market, selling at a loss. At the same time, a market downturn can be an excellent opportunity to purchase. As a result, determining risk tolerance aids in making informed decisions rather than hasty, erroneous ones.

Final Words

The quantity of market danger that an investor can tolerate is referred to as risk tolerance. Financial managers frequently classify risk profiles as cautious, average, or aggressive. Because they have more opportunity to recoup from market swings, younger buyers often take on more risk. Stocks dominate aggressive portfolios, while fixed-income assets dominate cautious portfolios.