Trading stocks and indexes can be tricky, especially during times of rising interest rates and market crashes. That’s why many traders are looking for trading strategies that work despite the market conditions, such as scalping trading strategies for Dow Jones and SP. In this blog post, we’ll discuss a scalping trading strategy for Dow Jones that you can use to enter and exit the market quickly and profitably.

What is Scalping Trading Strategy?

Scalping is a short-term trading strategy that involves making quick trades for small profits. Traders who use this strategy hold positions for only a few seconds to a few minutes. Scalping focuses on making many small profits that can add up to a larger overall profit.

Scalping Trading Strategy for Dow Jones

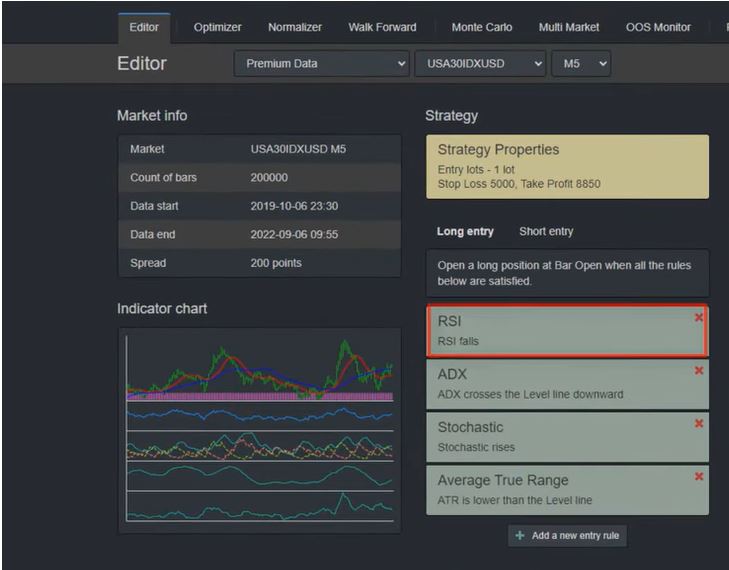

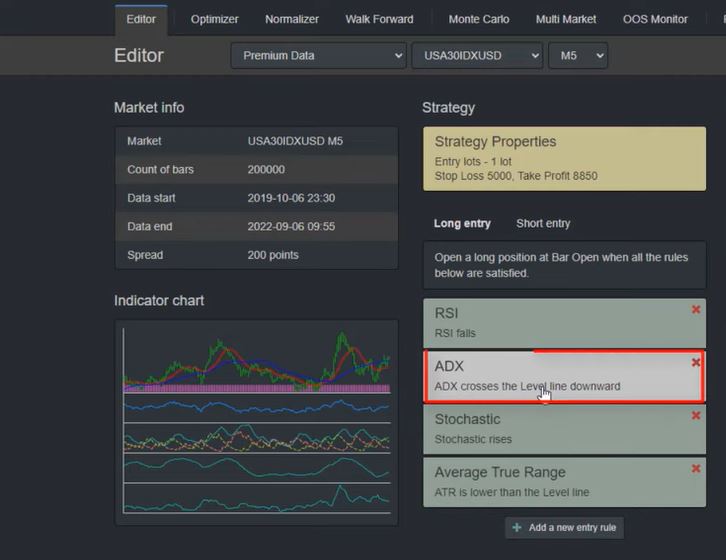

In this trading strategy, there are four entry rules, one exit rule, a stop loss, and a take profit. Here’s a brief overview of the rules:

- The price should be above the 50-period moving average.

- The RSI should be above 50.

- The MACD histogram should be above the signal line.

- The Stochastic oscillator should be oversold.

Exit Rule:

When the MACD histogram crosses below the signal line.

Stop Loss:

Place the stop loss 5000 points away or if the broker uses 2 digits it must be $50 away.

Take Profit:

Take Profit for that strategy is 8850 points.

The Benefits of Scalping Trading Strategy

Scalping allows traders to enter and exit the market quickly, making small profits along the way. This strategy does not rely on fundamental analysis, making it suitable for trading during times of market volatility.

Using a scalping trading strategy for Dow Jones offers traders the following benefits:

- It allows traders to make quick trades and generate small profits that add up to a larger overall profit.

- It does not rely on fundamental analysis, making it suitable for trading during times of market volatility.

- It allows traders to enter and exit the market quickly, reducing the risk of losing money due to sudden market movements.

Tips for Using Scalping Trading Strategy for Dow Jones

Here are a few tips to help you make the most of this scalping trading strategy:

- Use a reliable trading platform that offers real-time data and charts.

- Set your stop loss and take profit levels before entering a trade to reduce the risk of losing money.

- Use technical indicators to confirm the trend and identify potential entry and exit points.

- Practice with a demo account before using real money to get a feel for how the strategy works.

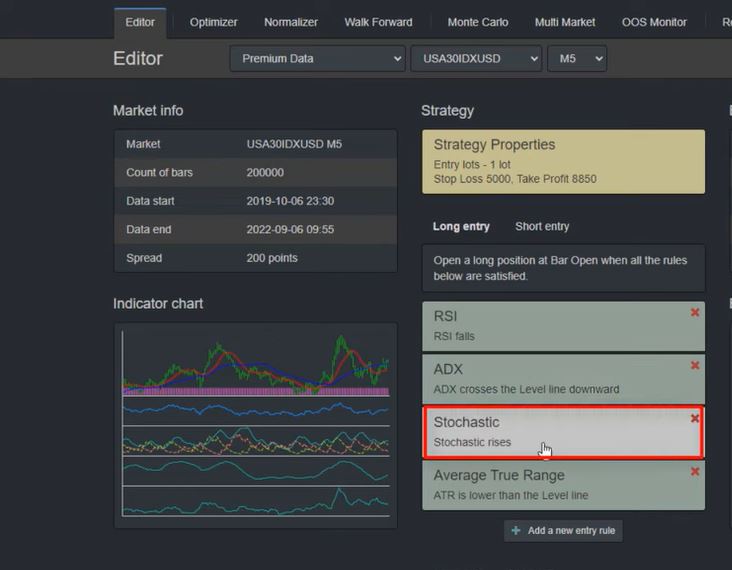

RSI Falls: The First Entry Indicator

The first entry indicator for this trading strategy is RSI Falls. We use a period of 15 and a level of 30 for this indicator. When RSI falls below the level line, it confirms the other rules.

IDX Crosses the Level Line Downward: The Second Entry Condition for Scalping Trading Strategy for Dow Jones

The second entry condition for this trading strategy is when IDX crosses the level line downward. We use a period of 14 and a level of 41 for this indicator. We need to look for the moment when IDX is going below the level line, and when it does, it confirms the other rules.

Stochastic Rises: The Third Entry Condition Scalping Trading Strategy for Dow Jones

The third entry condition for this trading strategy is when Stochastic rises. We use a K period of 20, D period of 1, Slow Wing of 15, and a level of 20 for this indicator. We need to see Stochastic rising at the same moment, which confirms the trade.

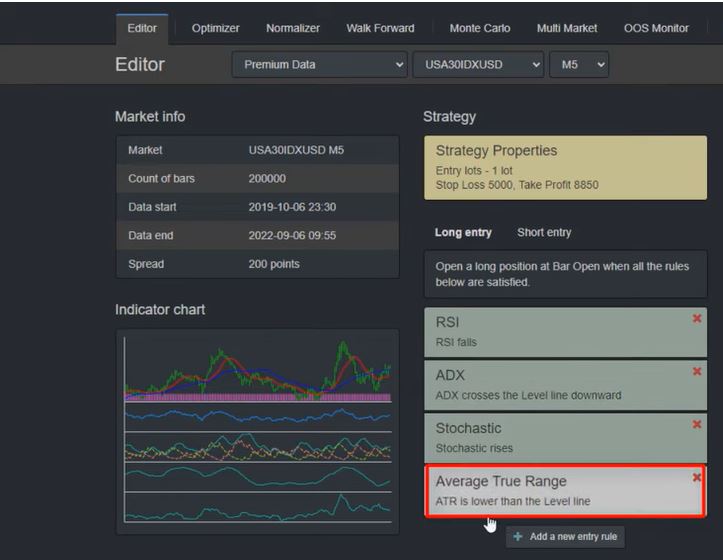

ATR of the Average True Range: The Fourth Entry Condition

The last entry condition for this trading strategy is the ATR of the Average True Range. We use a period of 5 and a level of 104 for this indicator. We need to see the ATR lower than the level line, which confirms the trade.

Long and Short Trades

For long trades, we use the above conditions to enter the market, and for short trades, we look for the opposite conditions. We set the Stop Loss at 5000 pips and the Take Profit at 8850 pips.

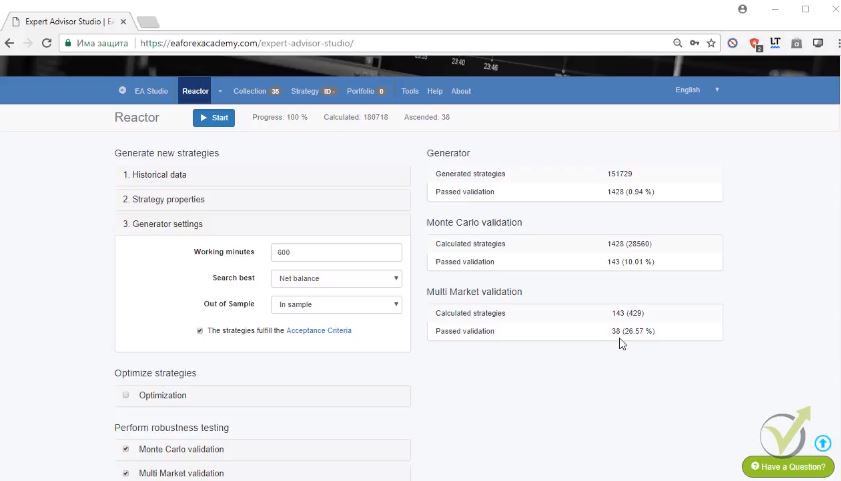

Max Drawdown: 10%

One of the most important statistics to consider when evaluating a trading strategy is the maximum drawdown. With EA Studio, you can see that the maximum drawdown is only 10%, which is a great result.

Profit Factor: 1.12

Another key statistic to consider is the Profit Factor. This is the ratio of all profits to all losses in a trading strategy. A Profit Factor above 1 indicates that the strategy is profitable. EA Studio has a Profit Factor of 1.12, which is a decent result.

Return Drawdown Ratio and Win Loss Ratio in Scalping Trading Strategy for Dow Jones

In addition to these key statistics, EA Studio provides information on other important factors such as Return Drawdown Ratio and Win Loss Ratio. These metrics help traders understand how a strategy performs over time and what to expect in terms of profitability.

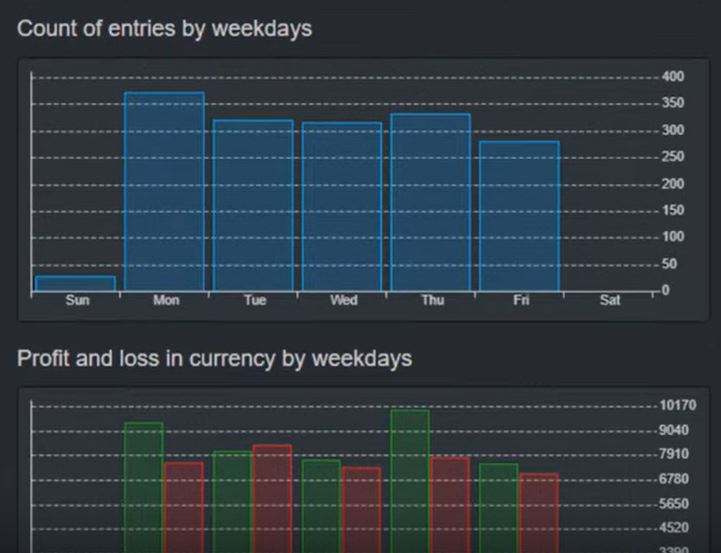

Day of the Week and Trading Hours Analysis

With EA Studio, you can also analyze how your trading strategy performs on different days of the week and during specific trading hours. This can help you optimize your trading plan and avoid losses during times when the market is less favorable.

Free Robot for Advanced Strategies

While some trading strategies can be challenging to implement manually, EA Studio provides a free robot for advanced strategies. This can help you maximize your profitability while minimizing your time investment.

Free Trial and Integration with EA Trading Academy

If you’re interested in trying out EA Studio for yourself, you can sign up for a free 15-day trial. And if you’re already a member of EA Trading Academy, you can benefit from the seamless integration of EA Studio and FSB Pro, the best strategy builders in the market.

Conclusion

EA Studio is an excellent tool for traders looking to optimize their strategies and maximize their profitability. With advanced statistics and a free robot for advanced strategies, it’s no wonder why so many traders trust EA Studio. So why not give it a try and see how it can help you succeed in the market?