In the world of algorithmic trading, finding a reliable and adaptable expert advisor (EA) can be a challenge. Powerhouse EA stands out as a sophisticated trading bot that integrates six unique strategies, giving traders the flexibility to use them individually or in combination. Whether you’re a scalper, swing trader, or looking for steady, long-term profits, this EA offers customizable settings to align with different trading styles. And we hope that our Powerhouse EA Review will be exactly what you are looking for to familiarize yourself with this hot robot and how to use it.

What makes Powerhouse EA particularly appealing is its compliance with prop firm and FIFO (First-In-First-Out) regulations. This makes it a suitable choice for traders in the U.S. and those participating in proprietary trading firms (prop firms). We tested the bot extensively in live accounts, and it performed really well – steady gains with minimal drawdowns.

In this Powerhouse EA review, we will explore robot’s strategies, risk management features, live trading performance, and customization options. We’ll also discuss how it can be used alongside other trading bots to reduce correlation risk and maximize profits. If you’re considering an automated trading solution that combines versatility and compliance, Powerhouse EA may be worth a closer look.

Table of Contents:

Powerhouse EA Review – What is Powerhouse EA?

We start our Powerhouse EA Review with revealing what exactly is Powerhouse EA. And as you might have guessed already, it is a trading robot (expert advisor). But what kind of expert advisor? Powerhouse EA is a versatile trading bot designed to execute trades using six unique strategies. Or in other words, 6 expert advisors combined in 1. Unlike conventional expert advisors (EAs) that rely on a single trading method, Powerhouse EA allows users to select and combine strategies to match their personal trading style, risk appetite, and market preferences.

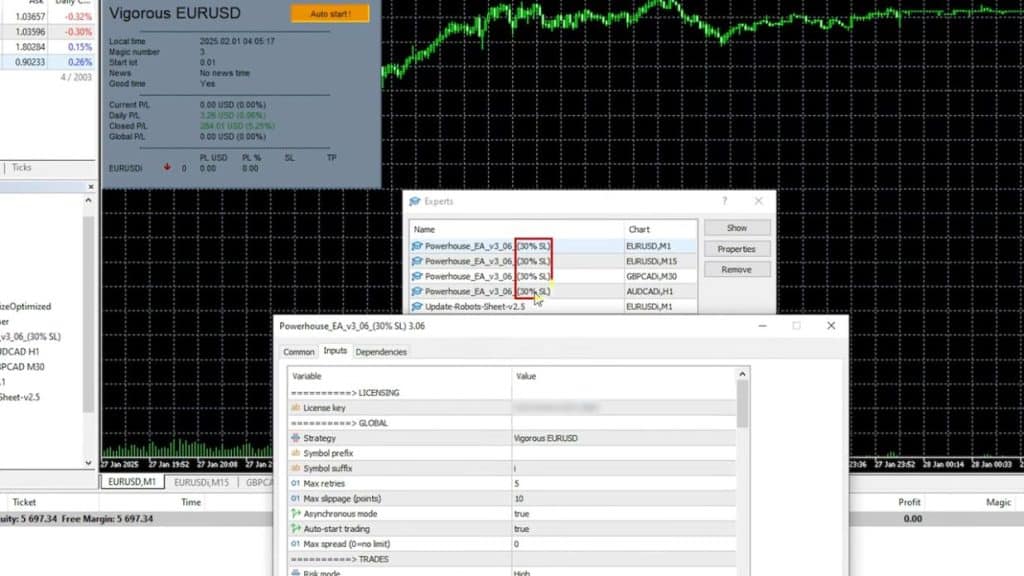

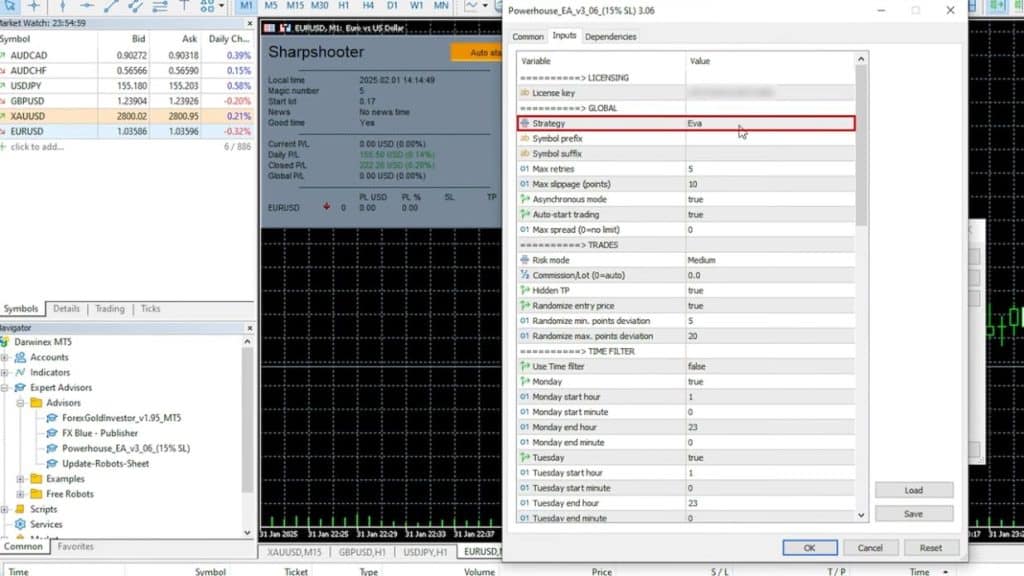

The six strategies embedded in Powerhouse EA include Vigorous EA, Sharpshooter, Eva, Ranger, Comeback Kid and Crackerjack. Each strategy operates with a different approach—some focus on high-frequency trading, while others are more selective and strategic. For example, Vigorous EA is highly active, executing hundreds of trades within a short period, while Ranger takes a more conservative approach with fewer but calculated trades.

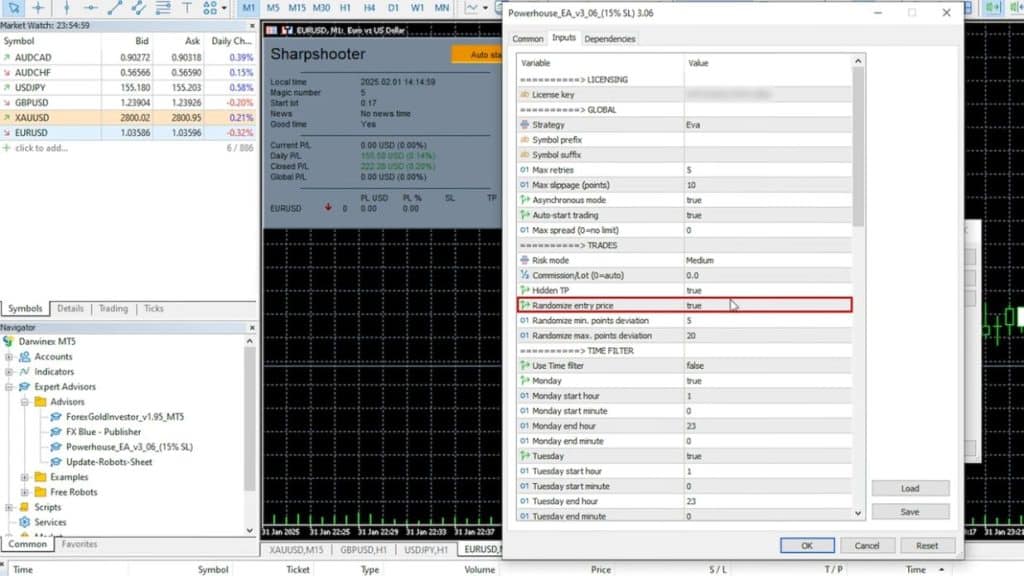

One of the key benefits of Powerhouse EA is customization. Traders can configure various parameters, such as risk management settings, entry conditions, and strategy selection. They also have the option to use randomized entry prices, which helps diversify trading signals and reduce predictability, a crucial advantage for automated trading in competitive markets.

And in this Powerhouse EA Review we will show how this flexibility makes Powerhouse EA an ideal solution for traders looking to optimize their automated trading approach, whether they prefer scalping, swing trading, or a hybrid strategy.

Powerhouse EA Review – Live Testing and Performance Results

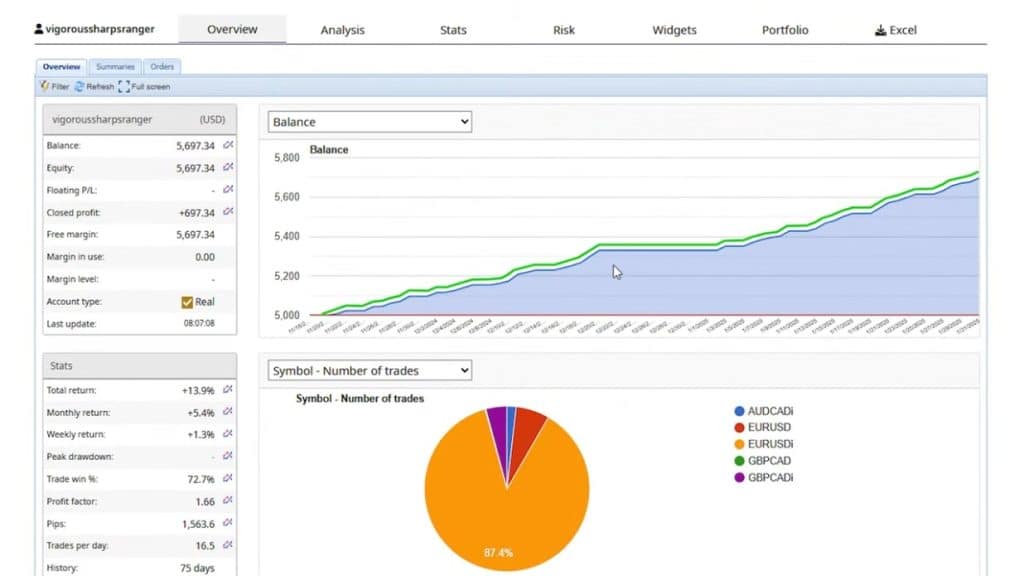

To assess the effectiveness and reliability of Powerhouse EA, we tested the bot on multiple live accounts, including a $5,000 personal account and a Darwinex account. The results were impressive – steady growth with minimal drawdowns, reinforcing the EA’s consistency in live market conditions.

$5,000 Live Account Testing

In a 75-day test period, the account achieved a 14% gain, demonstrating a stable equity curve with low exposure to drawdowns. We used a combination of three strategies—Vigorous, Sharpshooter, and Ranger—to optimize results. Among these, the Vigorous strategy was the most active, executing 877 trades, while Sharpshooter performed fewer trades (284) but generated similar profit levels. The Ranger strategy, although less active, also contributed to the account’s profitability.

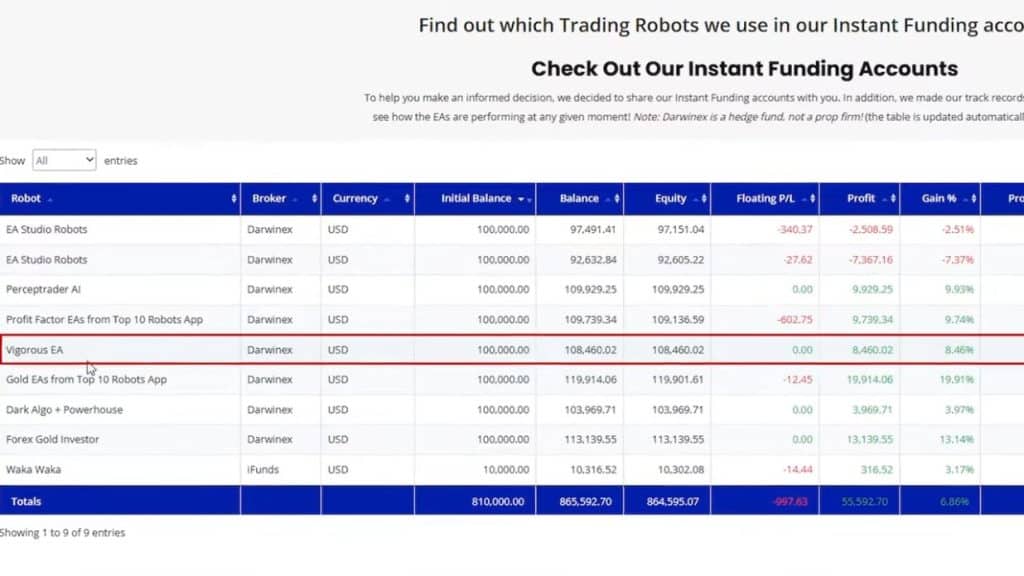

Performance on Funded Account

We also tested Powerhouse EA on a funded account, where Vigorous EA alone generated an 8.46% profit ($8,460). Due to its steady monthly returns, we received three consecutive funding allocations, growing our account to $90,000, with an additional potential allocation of $100,000 upon reaching a 15% profit threshold.

These live testing results confirm Powerhouse EA’s ability to generate consistent profits, making it a suitable choice for traders seeking low-risk, high-reward automated trading solutions.

Powerhouse EA Review – Best-Performing Strategies in Powerhouse EA

Powerhouse EA integrates six different trading strategies, each designed to capture specific market movements. Among them, Vigorous, Sharpshooter, and Ranger stood out as the best-performing strategies in live testing. These three strategies demonstrated strong profitability, steady returns, and minimal drawdowns, making them the preferred choices for the trader.

Vigorous Strategy – High-Frequency Trading for Consistent Returns

The Vigorous strategy is the most active within Powerhouse EA. This strategy thrives on frequent market movements, generating small but consistent profits with each trade. The live trading results showed that Vigorous was the top performer, contributing the highest share of total profits.

Sharpshooter Strategy – Precision-Based Trading with High Profitability

Sharpshooter is a more selective trading strategy compared to Vigorous. Despite the lower trade frequency, it achieved almost the same profit levels as Vigorous. This indicates that Sharpshooter focuses on high-probability setups, allowing traders to benefit from fewer but more calculated trades.

Ranger Strategy – A Conservative, Low-Risk Approach

The Ranger strategy is designed for lower trade frequency and steadier gains. While not as active as Vigorous or Sharpshooter, it contributed positively to the account’s overall performance. It proved useful for diversification, helping to balance risk when combined with more aggressive strategies.

By combining these strategies, traders can tailor Powerhouse EA to their specific needs, optimizing both profitability and risk management. You can find the Powerhouse EA here.

Are you looking for optimized and tested Trading Robots ? Choose from our ready-to-use Prop Firm Robots or Top 10 Robots and start trading right away.

Powerhouse EA Review – Risk Management Features

One of the standout features of Powerhouse EA is its robust risk management system, which ensures that trading remains controlled and sustainable, even in volatile market conditions. Unlike many trading bots that rely solely on individual stop-loss settings, Powerhouse EA incorporates an account-wide stop-loss mechanism, offering an extra layer of protection against excessive drawdowns.

30% Stop-Loss Rule for the Entire Account

A key risk management feature within Powerhouse EA is the 30% total account stop-loss, which acts as a safeguard against severe losses. This means that if the total drawdown reaches 30% of the account balance, the EA will automatically close all open trades and halt further trading. This ensures that traders never risk losing their entire account due to extended market downturns or unexpected volatility.

This feature is particularly useful for traders who deploy multiple strategies simultaneously. If one or more strategies enter a losing streak, the global stop-loss prevents excessive capital depletion, allowing the trader to pause, reassess, and optimize their approach before re-entering the market.

Controlled Exposure Across Multiple Strategies

During the live testing, we observed that different strategies contributed to varying levels of exposure. For instance, the Vigorous and Sharpshooter strategies had the highest trading activity, especially on EUR/USD, whereas the Ranger strategy had a lower frequency. By analyzing trade data, it was evident that risk was well distributed, minimizing overexposure to any single asset or market condition.

Randomized Entry Prices to Reduce Predictability

To further optimize trade performance and reduce systematic risks, Powerhouse EA offers an option to randomize entry prices within a predefined range of 5 to 20 points. This feature helps traders avoid overly predictable trading patterns, which could be exploited in highly liquid markets. However, widening the randomization range too much, may interfere with scalping strategies and impact profitability.

By integrating multiple trading strategies, a global stop-loss, and entry randomization, Powerhouse EA creates a balanced approach between risk management and profit maximization. Traders can customize settings to match their risk tolerance, ensuring they can preserve capital while taking advantage of profitable trade opportunities.

Combining Powerhouse EA with Other EAs

One of the biggest advantages of Powerhouse EA is its ability to work alongside other expert advisors (EAs) to diversify trading strategies and reduce correlation risks. In live trading tests, we successfully integrated Powerhouse EA with Forex Gold Investor, a well-known gold trading EA, to create a more balanced and less correlated trading portfolio.

Correlation risk occurs when multiple EAs or strategies trade in a similar pattern, leading to simultaneous losses in unfavorable market conditions. For example. in one of our accounts, we noted that Forex Gold Investor had already been used by many traders, which increased its correlation risk within the prop firm’s ecosystem.

To counter this, we added Powerhouse EA (Sharpshooter and Eva strategies), ensuring that different EAs were executing trades with unique logic and market conditions. This helped in:

- Spreading risk across different strategies and assets.

- Avoiding overexposure to a single market movement.

- Enhancing the stability of the account’s equity curve.

Integrating Powerhouse EA is straightforward—simply select which strategies to enable within the settings.

Powerhouse EA Review – FIFO Compliance for U.S. Traders

One of the significant challenges for traders using expert advisors (EAs) in the United States is compliance with FIFO (First-In-First-Out) regulations. These rules, enforced by the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC), require traders to close their oldest open positions first when dealing with the same currency pair. Many trading bots are not FIFO-compliant, which can lead to execution issues with U.S. brokers. However, for traders in the United States, Powerhouse EA includes an option to enable FIFO (First-In-First-Out) compliance.

Powerhouse EA Review – Demo Availability and Testing Recommendations

For traders interested in Powerhouse EA, the developer offers a 5-day free demo period to test its features and performance. While five days may seem like a short time for evaluating an expert advisor, Powerhouse EA’s high trade frequency allows traders to gather meaningful insights within this period.

What You Can Expect from the 5-Day Demo

Since Powerhouse EA includes highly active strategies like Vigorous, which can open 10 to 20 trades per day, a trader can expect to see 50 to 100 trades during the demo period. This provides enough data to analyze:

- Trade execution speed and order placement efficiency.

- Profitability of different strategies in real-time market conditions.

- Drawdown levels and overall risk exposure.

The Vigorous EA, in particular, is ideal for short-term testing since its high trade volume allows for quick evaluation. This makes the demo period useful even within a limited timeframe.

Best Practices for Testing Powerhouse EA

To maximize the demo and initial testing period, traders should:

- Start with default settings and observe performance before making adjustments.

- Test different strategies individually to see how they perform separately.

- Analyze key metrics like win rate, drawdowns, and profit factors over the test period.

Final Thoughts & Verdict

Powerhouse EA stands out as a versatile and well-optimized trading bot that offers traders six unique strategies, strong risk management features, and prop firm/FIFO compliance. Through extensive live testing, it has demonstrated steady profitability with low drawdowns, making it a suitable choice for traders looking to automate their trading while maintaining risk control.

Key Strengths of Powerhouse EA

- Multi-Strategy Flexibility – Traders can select and combine different strategies, including Vigorous EA, Sharpshooter EA, and Ranger, to match their trading style.

- Low Drawdowns & Consistent Returns – The live trading tests showed a 14% gain over 75 days, with minimal equity fluctuations.

- Prop Firm & FIFO Compliance – The built-in FIFO mode ensures U.S. traders can use the EA without regulatory concerns.

- Risk Management Features – A 30% global stop-loss protects accounts from excessive drawdowns.

- Integration with Other EAs – Works well alongside other bots to reduce correlation risks.

- Quick Testing & Scalability – The 5-day demo allows traders to test its performance, while funding accounts offer scalability opportunities.

Who Should Use Powerhouse EA?

- Scalpers and High-Frequency Traders – The Vigorous strategy is highly active, making it ideal for those who prefer frequent trade execution.

- Swing Traders & Risk-Conscious Users – Strategies like Ranger and Sharpshooter provide steady, controlled profits with lower trade frequency.

- Prop Firm & Darwinex Traders – Powerhouse EA has proven success in prop firm challenges, making it a strong contender for funded accounts.

- U.S. Traders Needing FIFO Compliance – With FIFO settings, the EA is compatible with U.S. brokers, unlike many other bots.

Final Recommendation

Based on real test results and verified performance, Powerhouse EA is a well-rounded trading bot suitable for both individual traders and prop firm-funded accounts. Its customization options, risk control mechanisms, and compatibility with multiple trading styles make it a strong choice for traders seeking a reliable, automated trading solution. For those interested, the Powerhouse EA can be found here.